As Bitcoin reached new highs, Ethereum also ushered in new breakthroughs.

As of 10:00 p.m. on January 19, the QKL123 market showed that the price of ETH peaked at US$1428.88 in 24H, an intraday increase of 11.93%, a record high, and an increase of more than 115% in the past month, far exceeding the increase of Bitcoin in the same period.

As the two most highly praised and most widely accepted cryptocurrencies in the encryption market, the bull market driven by Bitcoin and Ethereum is roaring. This is different from the turmoil caused by DEFI in the midsummer of 2020. This time conservative marginal investors Also eagerly waiting, waiting for the opportunity to enter.

Encrypted wealth with all eyes on

According to data, from January 1 to December 31, 2020, the annual increase of Bitcoin exceeded 300%, which was 10 times the increase of COMEX silver, the traditional asset with the highest increase in 2020. The high returns of encrypted assets represented by Bitcoin are increasingly attracting the attention of traditional investors. According to a Bitwise survey, in the past year, financial advisors have increased the number of cryptocurrencies allocated to client portfolios by 49%. 24% of advisors own bitcoin, ether or other crypto assets in their personal portfolios, up from 17% last time.

On January 8th, when Bitcoin hit an all-time high of nearly $42,000, did anyone around you murmur, "If I invested all my money in BTC in March 2020, my money would have multiplied 8 times !"

Will the encryption market be dominated by 10 times, 100 times, or even 1000 times the benefits again? Recalling the carnival in the currency circle in 2017, and the depression and silence after the carnival, the rise and fall of the encryption market seems to be a cycle with BTC as the core and ETH as the auxiliary. When the high point appears, the market will ebb and flow, and after the bull market is lively, there will be a period of "terrible loneliness", and the cycle will repeat.

secondary title

BTC and ETH, the value of the crypto market

Compared with the market bubble under the rampant air coins and garbage coins in the encryption market two or three years ago, the value consensus under this wave of bull market is more real. Some commentators believe that in the global low interest rate environment, investors seek higher returns, institutional investors and large companies enter the market, retail investors’ fear of missing out, and the limited supply of Bitcoin are all possible reasons for the four-fold increase in the price of Bitcoin in the past year. reason.

Investors seek higher returns in the so-called global low interest rate environment. The Fed’s additional issuance, the depreciation of the U.S. dollar, and the large-scale stimulus measures introduced by governments around the world have aggravated investors’ concerns about inflation. Buying cryptocurrencies represented by Bitcoin has become one of the better hedging strategies.

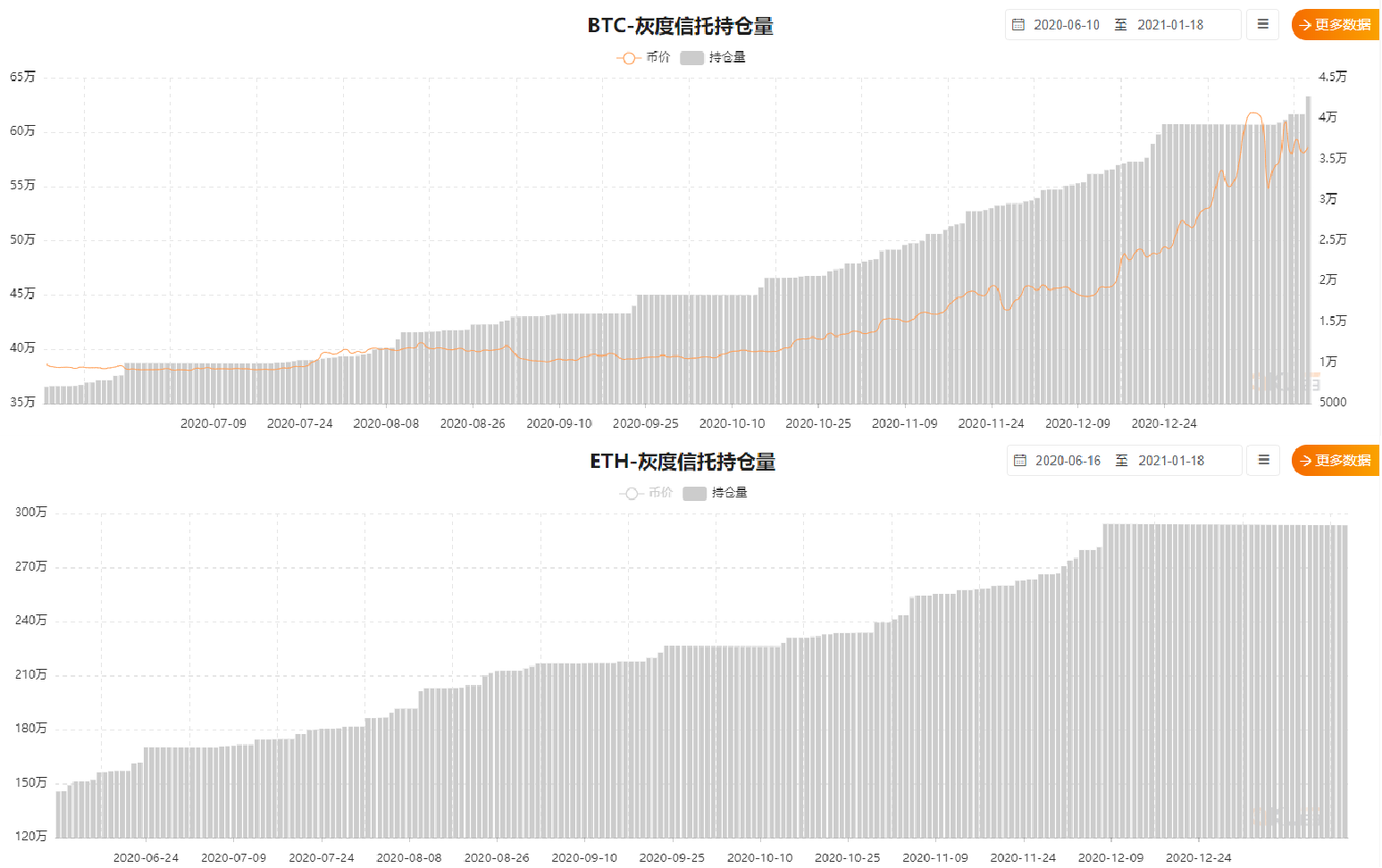

The so-called institutional investors and large enterprises entered the game. Compared with mature US stocks horizontally, institutionalization has always been a major feature of it. In 2020, institutions began to flock to the encryption market, which is also one of the signs that the encryption market is maturing. QKL123 data shows that BTC-Grayscale Trust holdings and ETH-Greyscale Trust holdings showed a stepwise growth in the second half of 2020. As of January 19, 2021, the total asset management scale of Grayscale has risen to US$28.1 billion.

According to media reports, Ruffer Investment Company, a U.S. dollar assets management company, allocated 2.5% of its investment portfolio to Bitcoin, explaining: negative interest rates, extreme monetary policy, increasing public debt, dissatisfaction with the government — All this has undoubtedly provided a strong impetus for Bitcoin's success when traditional safe-haven assets, especially government bonds, are extremely expensive.

The so-called fear of missing out among retail investors. The common means of speculation in the currency circle such as concept speculation and subject speculation also continue to exist. Retail traders are more obsessed with short-term transactions triggered by low prices. Set it? Where is the next wave of highs?

But this time is different from the situation in 2017. In 2017, the main investors were retail investors. The reason why Bitcoin climbed to $20,000 was related to speculation and market control. The power of retail investors at Bitcoin’s new high was replaced by institutions.

The so-called limited supply of bitcoins, the total number of bitcoins is 21 million, and the current circulation exceeds 18.6 million, accounting for more than 88% of which are mined. The scarcity of bitcoin is particularly prominent. According to the research of the stock-flow (S2F) model, around 2022, the S2F of Bitcoin will exceed that of gold (currently, the S2F of gold is 62), and it will become the most scarce value commodity in history.

secondary title

Who will be the chased?

Look at the trend in the short term and value in the long term. In the encrypted market, especially the value of Bitcoin and Ethereum has been verified and proven time and time again. At present, the greatest value of Bitcoin and Ethereum comes from social consensus, just like the earliest forms of currency are shells and salt, the society generally recognizes their circulation value.

After the value consensus is reached, what will new investors pursue?

The answer is likely to be DEFI, which is frequently mentioned in 2020.

From the data point of view, the performance of DEFI is far better than that of Bitcoin and Ethereum. QKL123 data shows that yearn finance (YFI), Chainlink (LINK), Uniswap (UNI) and Aave (Aave) have increased by 150.33%, 102.13%, 451.54% and 198.35% respectively in the past three months. It is worth mentioning that the price trend of YFI once surpassed BTC in recent days. The current 24H highest price YFI is higher than the highest price of BTC at US$38,089. On January 18, YFI broke through the 40,000 USDT mark for a short time.

Ethereum has been rising all the way, and it has a great relationship with DEFI. More and more participants in liquidity mining can bring higher returns to Ethereum holders. In fact, there is a binding relationship between Ethereum and DEFI. When the value and influence of Ethereum are sufficient, DEFI will become another winner.

The pledge of Ethereum affects the circulation of Ethereum. From the perspective of supply and demand, when ETH enters a state of deflation, it may generate a value that can compete with BTC. At present, Ethereum has become the largest encryption settlement layer surpassing Bitcoin. Perhaps it has something to do with the side effects of DEFI liquid mining.

Different from the carnival in 2017, in the new round of competition, DEFI participated in it with an attitude of doing my part, and DEFI tokens were given high hopes; while facing a single bitcoin with a price of more than 200,000 yuan, new investors are Waiting for its next sharp drop; Ethereum's daily trading volume for 6 consecutive months is much larger than Bitcoin's data proves that Ethereum is active.

The so-called "be fearful when others are greedy, and be greedy when others are fearful", whether it is traditional financial investment or the crypto market, this is the essence of the capital market. Fear and greed are two "contagious diseases" that can erupt at any time .

When others are greedy for the value of the bull market, when others panic and plummet, where do you focus your attention?

Note: This article does not constitute investment advice, investment needs to be cautious~