2020 is the year when DeFi exploded.

Before 2020, the DeFi field has been caught in a negative feedback loop:

DApp needs liquidity to provide market services with low slippage and deep depth, but if there is no liquidity at the beginning, it will not be able to attract enough users and funds.

However, starting in 2020, many projects have explored ways to motivate users and attract funds—issuing platform governance tokens to distribute certain benefits to users who provide liquidity and use services, which also gave birth to the phenomenon of liquidity mining. upsurge.

Looking back at the liquidity mining boom, the synthetic asset protocol Synthetix can be called a pioneer; after that, the lending protocol Compound created a new milestone by distributing tokens through the "loan is mining" method. The rapid development of Compound has attracted the attention of the market. Since then, it feels like a new project will appear every other day. "Liquidity mining" has swept the entire industry, and the horns of "Uncle Farmer" plowing the fields are one after another. The DeFi field has also gradually entered positive feedback: liquidity generates liquidity.

secondary title

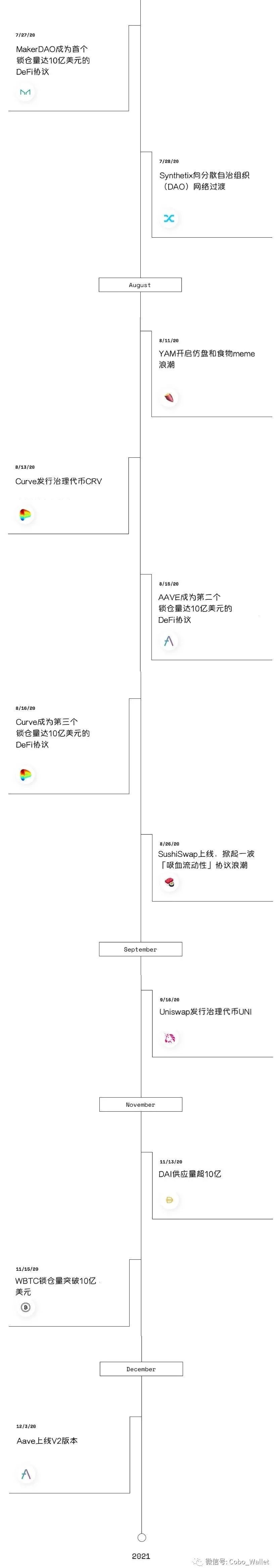

DeFi project development history

©️ THE BLOCK

DeFi protocols represented by Uniswap, Compound, Balancer, AAVE, Curve, Yearn, etc. will continue to have many big moves throughout 2020.

Various platforms have launched governance tokens and iterated new versions one after another. UNI first launched the airdrop money distribution model, which once made the entire currency circle jealous.

In July and August, the locked positions of MakerDAO, AAVE, and Curve reached 1 billion US dollars one after another.

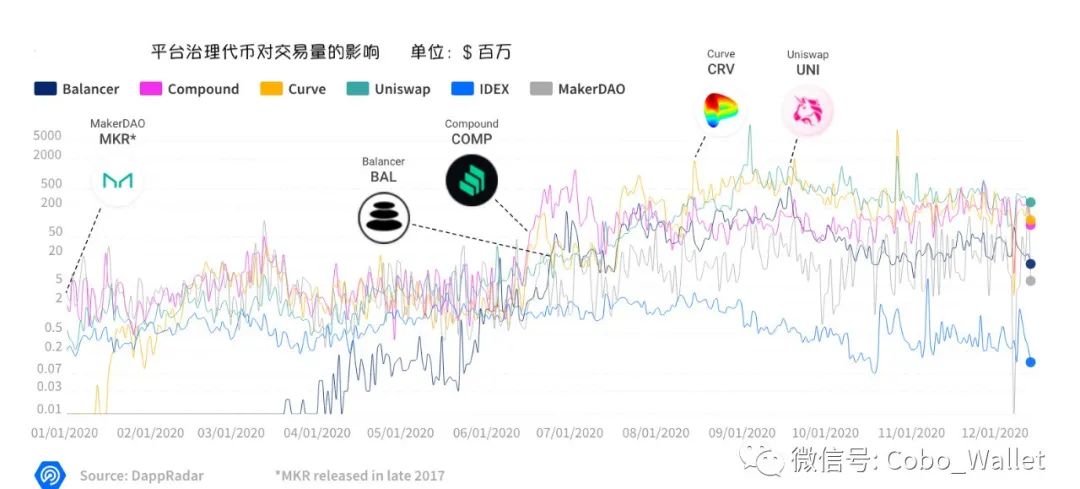

Impact of Platform Token Governance on Transaction Volume ©️ DappRadar

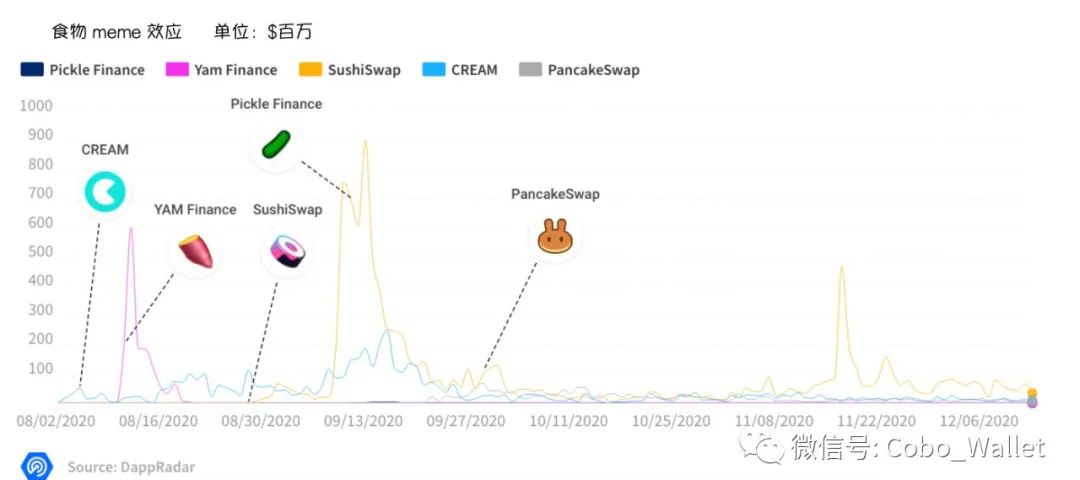

Food meme effect ©️ DappRadar

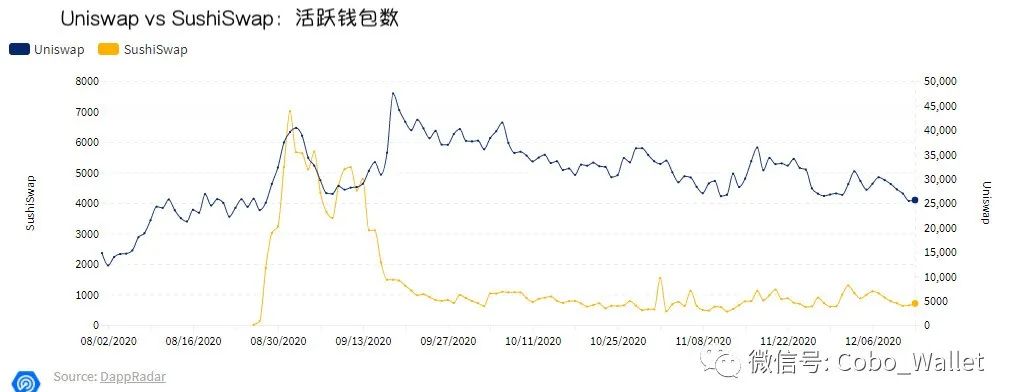

Uniswap vs Sushiswap active wallets ©️ DappRadar

secondary title

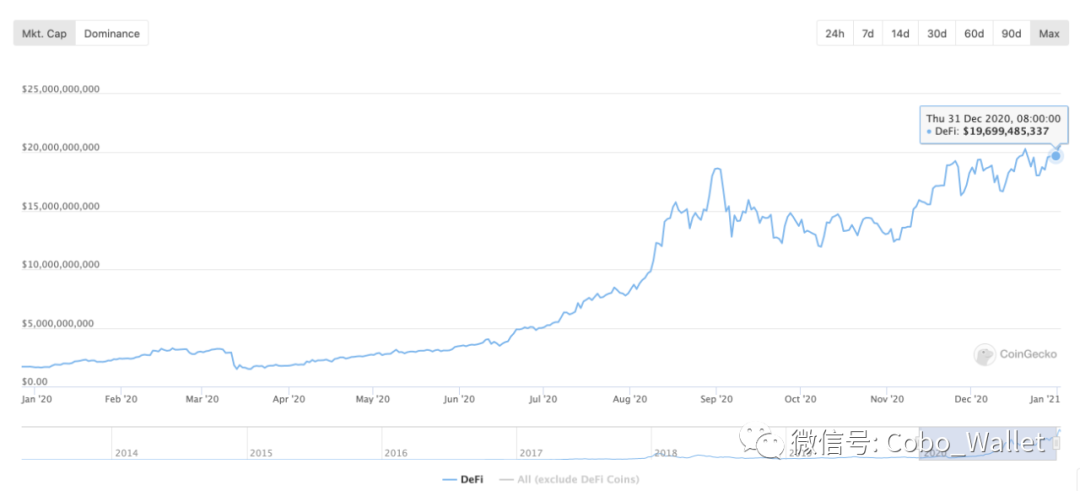

DeFi Market Cap

DeFi Market Value Changes Throughout 2020 ©️ CoinGecko

According to CoinGecko data, the total market value of DeFi at the end of 2020 will be nearly 20 billion US dollars, which is 12 times that of the beginning of the year. Judging from the overall trend of 2020, the first half of the year has been a small growth, and it began to climb gradually in July, and reached a new height in the second half of the year.

2020/01/01 Data: $1,639,289,656

2020/12/31 Data: $19,699,485,337

secondary title

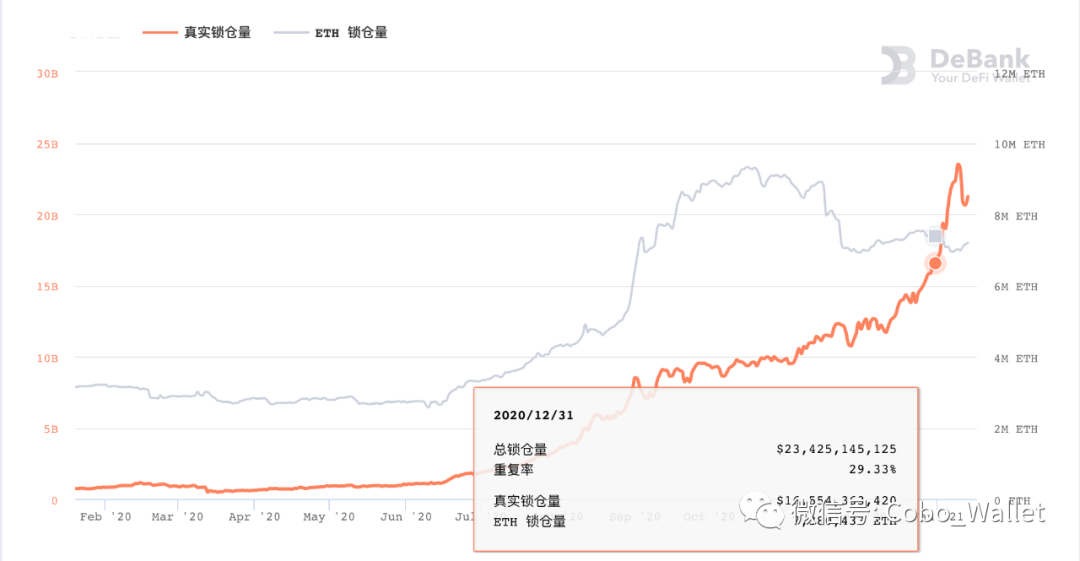

DeFi lockup volume

DeFi total lock-up volume & ETH lock-up volume changes in the past year ©️ DeBank

According to DeBank data, at the end of 2020, the total lock-up volume of DeFi was nearly 17 billion US dollars, which was nearly 28 times that of the beginning of the year; at the end of the year, the lock-up volume of ETH was more than 7.3 million ETH, which was nearly 2.5 times that of the beginning of the year.

Similar to the development trend of the market value, the lock-up volume also grew flat in the first half of the year, and began to grow by leaps and bounds in July. From the end of August to November, the growth rate of ETH lock-up volume was significantly greater than the total lock-up volume of DeFi; since November, ETH The locked-up volume began to decline, while the total locked-up volume of DeFi continued to rise. From this, it can be speculated that, in addition to Ethereum, there were also DeFi projects deployed on other chains that began to grow slowly, such as BSC.

2020/01/01 Data

DeFi total lockup: $ 591,946,087

ETH lockup amount: 2,954,042 ETH

2020/12/31 Data

DeFi total lockup: $ 16,554,363,420

secondary title

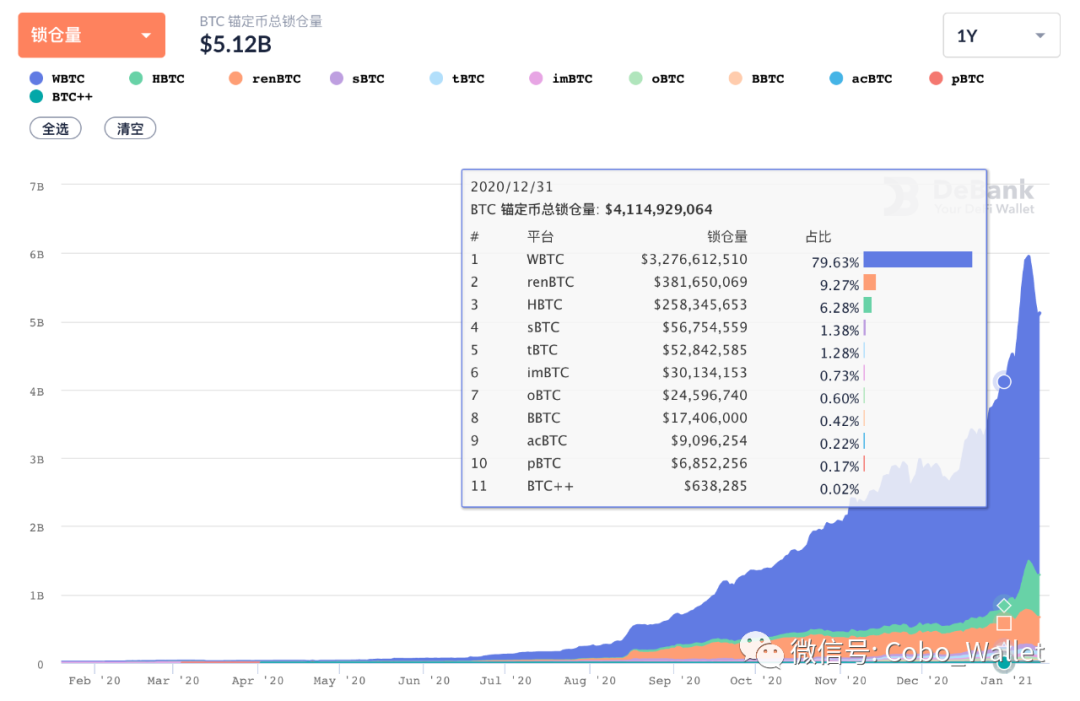

BTC anchor currency

Changes in the total lock-up volume of BTC-anchored coins in the past year ©️ DeBank

According to the data compiled by DeBank, at the end of 2020, there were 11 BTC-anchored coins, with a total lock-up volume of over 4 billion, 780 times that of the beginning of the year! oh my god...

The contrast between the first half of the year and the second half of the year in this picture is even more intense. In the first half of the year, there were almost none. At the beginning of the year, there were only two types of WBTC and sBTC.

2020/01/01 Data

Number of coins: 2

Total lockup: $ 5,273,256

2020/12/31 Data

Number of currencies: 11

secondary title

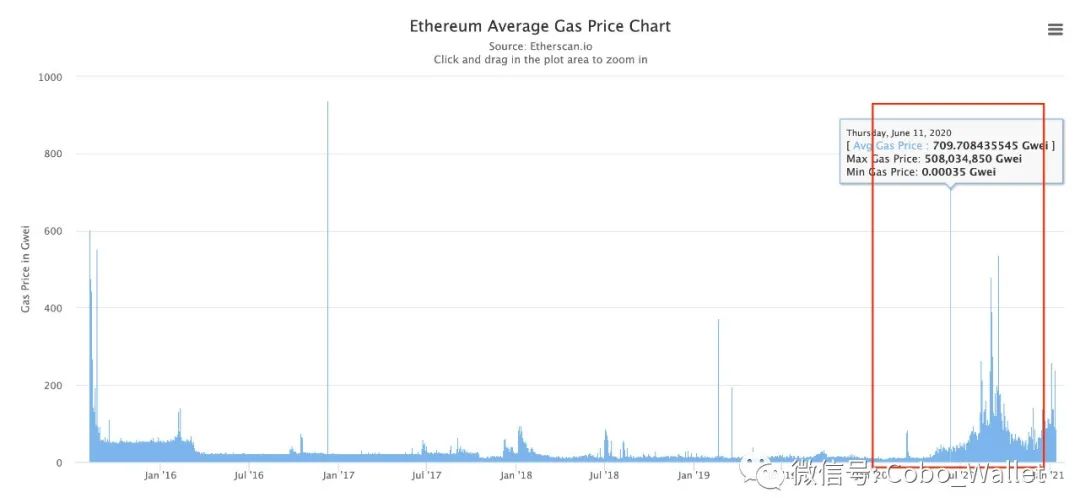

Ethereum gas fee

Talking about liquidity mining must not avoid the topic of ETH gas fees. For example, the price of ETH soared to more than 1,000 U two weeks ago. When the chain was congested, the handling fee for one operation was more than 100 U, let alone retail investors" The "peasants" have retreated, and even the "rich peasants" are trembling in their hearts.

The red line area is the average ETH Gas Price in 2020 ©️ etherscan.io

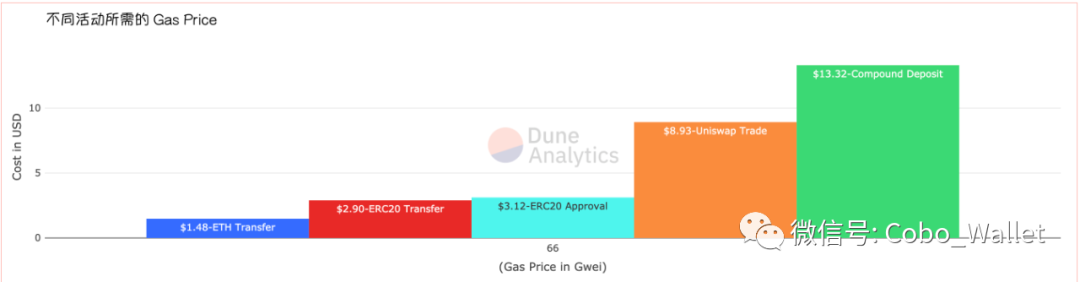

On the Ethereum chain, not all gas fees are the same standard. For example, look at the figure below, the deposit operation fee on the Compound protocol is the highest, followed by transactions on Uniswap, and the ordinary ETH transfer fee is the lowest of.

secondary title

DEX

The red line area is the ratio of DEX/CEX spot trading volume in 2020 ©️ THE BLOCK

In addition to the above detailed data, in the past year, DeFi has achieved considerable growth in various fields such as insurance, lending, NTF, privacy, and derivatives, and we will not list them here.

"DeFi is an important direction for the blockchain to land in the near future, and after several years of development, the feasibility of the product has been verified, and it has also created application scenarios with rigid demand at the bottom, such as lending, DEX, futures, options, insurance And other financial derivatives, as well as hierarchical management funds based on these products, and other more subversive gameplay. So basically DeFi is building various financial underlying open protocols, and then continuously and rapidly iterating and integrating on top of it , to build new financial products, the essence is to build application scenarios around better capital flow, and now DeFi is still in the initial stage of development.” —— Cobo Co-founder and CEO Shenyu