*This article only represents the author's personal opinion and does not constitute investment advice

2021 As a new turning point in the decade of the mobile Internet, the blockchain has also gone through eleven years.

first level title

Under the trend of market differentiation, where should we go?

Use history as a guide to know the rise and fall.

As early as 2017, the Bank of China Institute of International Finance mentioned in the macro observation that the income distribution in the United States has fallen into two levels of differentiation, changing the original spindle-shaped or olive-shaped social structure to an hourglass of unstable polarization between the rich and the poor The subprime mortgage crisis in 2008 and the epidemic in 2020 made this social transformation a global trend, and the assets of the middle class, which were struggling to survive, could only be supported by debt.

One of the sources of extreme differentiation comes from technological progress. The development of the mobile Internet has allowed us to enjoy unprecedented convenience. However, under this evolutionary trend, the new middle class is being replaced by personnel in emerging technology industries such as artificial intelligence and blockchain. The labor market This kind of differentiation first appeared in China and the capital market. The original industry and light industry are constantly being impacted by the transformation of the Internet. Platform-oriented services revolve around everyone's clothing, food, housing, and transportation.

While overall asset growth in global wealth never seems to stop, what exactly is the value of an asset? The answer given by economists is the sum of the discounted present value of all future cash flows. In the era of negative interest rates, the lower the denominator, the higher the asset value (FV=PV/(1-DR)). Therefore, in a wave of growth, Accumulated wealth is increasingly concentrated in a small number of leading enterprises and individuals, and the differentiation is more intense.

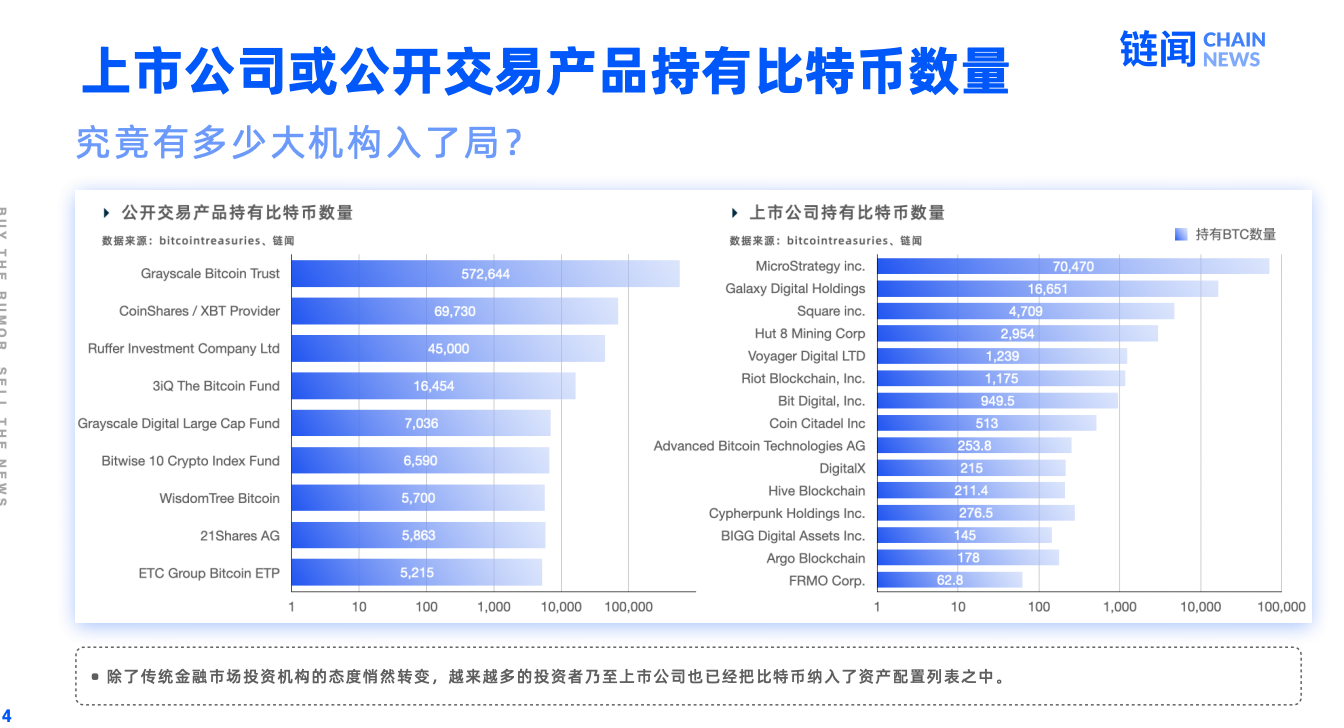

The key to asset differentiation is that growth is differentiated, that is, not all assets are rising. If you want to really make money in the differentiated market, you must make a choice. And this kind of growth differentiation and negative interest rates are concentrated in Bitcoin in the blockchain market. As a story of rebelling against the traditional currency system and pursuing freedom and democracy, Bitcoin breaks through multiple integer digits and uses the power of the market to tell Choosing the right path will become even more important. In 2020, more and more large institutions began to deploy, and the larger the blockchain market, the greater the negative interest rate dividend, so it became bigger and stronger.

On the other hand, the DeFi blockchain market has also begun to show a trend of differentiation due to the large-scale entry of capital, and the ecology is constantly stratified. But as far as the DeFi track is concerned, according to DeBank data, the total lock-up amount of DeFi exceeded 30 billion US dollars for the first time , but the number of ETH locked positions has decreased by more than 25% compared with 3 months ago, so that the cruel and drastic changes in the market make it possible for projects with moats to become the top of the differentiated track.

text

first level title

Polkadot's ecological paradigm has been established, how to maximize the benefits?

After talking about trends and choices, the question I am asked most by my friends is: Since 2021 is the first year of Polkadot, what method can maximize the utilization rate of investment funds? Do you want to participate in the parachain auction?

Of course, there are no standard answers to these questions. I can only say that under the trend of differentiation, high-quality Polkadot ecological projects will become important core assets in the future, because access to parachains is just the beginning for high-quality projects.

The return of Polkadot and traditional investment targets can be compared horizontally. The most extensive and popular investment method in the Polkadot ecosystem is staking. As of now, the annualized return of the currency standard is generally around 13%. Compared with other investment targets in 2020 According to the statistics of Tradingview, in 2020, gold will increase by 13%, stock funds will increase by an average of 37%, index funds will be slightly lower by 28%, and pure bond funds will only increase by an average of 2.6%, which is the most popular investment target for Chinese people. Real estate has only risen by 4% on average, and the laziest way to put it in the bank is only 1.75%, so you should be able to see that 2021 has obviously put forward higher requirements for asset allocation.

As shown below:

As shown below:

Graphic:

X-axis: the proportion of DOTs that have participated in Staking

Y axis: Inflation rate (fixed at 10%)

Blue line: Inflation rewards for stakers

Green line: staker’s rate of return

image description

source:Math Wallet

first level title

How to better actively participate in the Polkadot parachain slot auction?

The number of Polkadot parallel chain slots is limited. When resources become scarce, market supply and demand will have certain price support. It can be predicted that in 2021, the Polkadot parachain slot auction will enter a fierce competition once it starts. At that time, more gameplay will be born, but the differentiation effect will always exist, so for high-net-worth investors , high-quality project assets will always become the assets at the bottom of the box to improve the rate of return in the era of negative interest rates.

Investors in the current market can be roughly classified as:

The first is short-term investment in the secondary market, but it is often difficult for individual investors to attract liquidity in the market in the short term by using cash-out and quantification like professional hedge fund Ark Capital institutions.

In addition, there are allocation investments, whether it is individuals or institutions that focus on allocation, they can often hold them for a long time and obtain excellent investment returns. Paul Tudor Jones, a famous Wall Street fund manager, said in an interview with CBNC in May that he has invested in his personal 1% of assets, the scale is about tens of millions of dollars or more.

And in the interview, Jones believes that the best strategy for maximizing revenue is to own the fastest horse. So, if you want to obtain such considerable benefits in the Polkadot ecological DeFi project, what factors can help you measure the pros and cons of participating in the Polkadot parachain project?

Fundamentals may help you find the answer. It can be considered from the latitude of community, market, and institutional background:

Is the community data showing steady growth?

Are the communities geographically and nationally diverse?

Does it have unique competitiveness in the core track?

Is it working hard to deliver products on time?

Is the security code audit completed before the product is connected to the parachain?

Is the background lineup of investment institutions good and the amount of funds sufficient?

How is the expansion of market partners?

Is the model of the project itself sustainable?

Is the design of the parachain slot auction reward model reasonable?

Is Marketing Excessive, Form Over Substance?

……

Of course, there are still many fundamental measurement dimensions that will help you choose the best. Here is just a basic idea to help you capture value at an early stage.

In each round of parachain slot auction mechanism, only one project can win and be qualified to access the parachain. DOT/KSM will be returned to the user after other bids fail. For individual users, if they choose the wrong project, they will face no income from Polkadot assets for a month. Therefore, users need to be more cautious, choose better fundamentals, and reduce opportunity cost losses.

In 2021, I wish everyone can follow the Jones investment rules and find the fastest "horse" in the Polkadot ecosystem.

Reference news:

"Hollowing the Middle Income Class, Where Does the American Dream Go?"

"Happy New Year 2021: 2020 in the Snapshot Crypto World"

《Paul Tudor Jones calls bitcoin a ‘great speculation,’ says he has almost 2% of his assets in it》