first level title

text

Polkadot is a project that started in 2016. After a long period of research and development, it was not until the end of May this year that the mainnet launch process was officially launched. So far, the main network still has not achieved the "available" state, that is, the state that people often say can run applications.

The founder of Polkadot, Gavin Wood, is well-known in the industry. He has a series of auras such as the co-founder of Ethereum, the former chief technology officer of Ethereum, and the author of the "Ethereum Yellow Paper". He is a top developer with the same reputation as V God. The development strength of the Polkadot team is undoubtedly the top team in the industry.

first level title

text

Polkadot is a scalable heterogeneous multi-chain system. The Polkadot network can be divided into three parts: relay chain, parachain and transfer bridge.

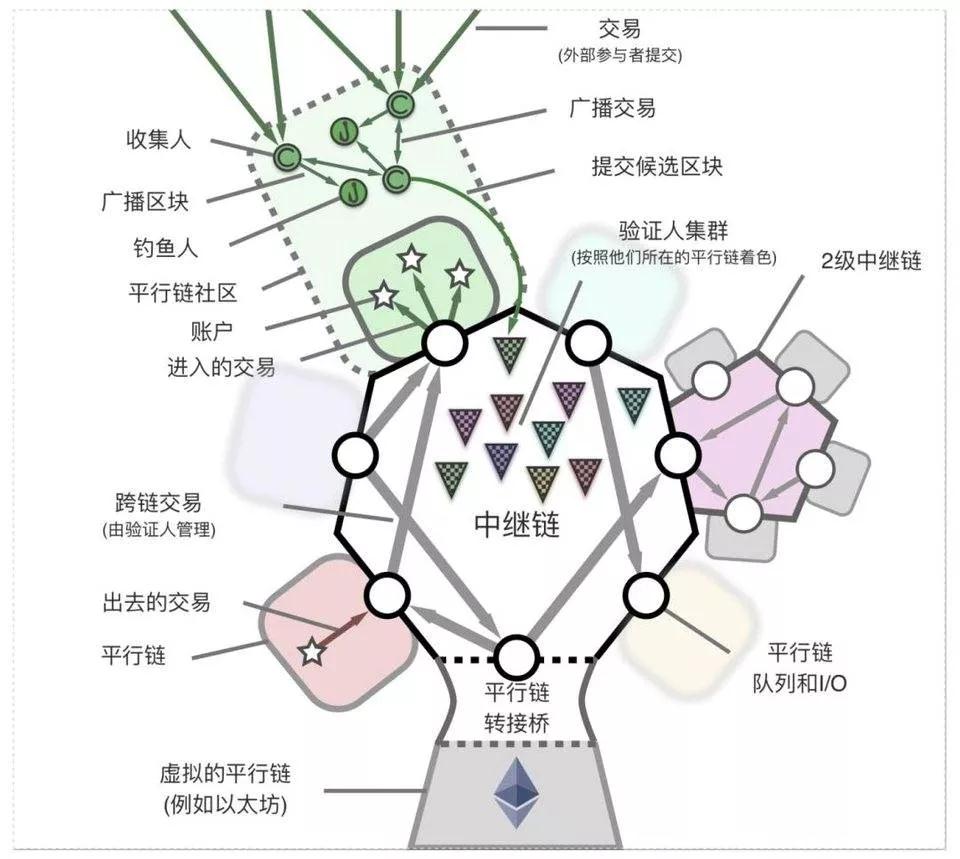

First look at a very classic Polkadot graph

The central part in the above figure is the relay chain, and its core is the verifier cluster. The relay chain only provides simple services that satisfy the functions of the relay chain. It is not like the public chain we usually know. Developers can build applications based on the main chain. This is to ensure that the design of the relay chain is simple enough ,robust. Because we all know that the simpler the design, the less chance of problems.

The relay chain is very important in the Polkadot system. The security of all parallel chains is taken care of by the relay chain. This is also a major feature of Polkadot - shared security.

The top part of the picture above is the parachain, and the parachain can independently design various mechanisms on its own chain, which has a high degree of autonomy.

The parachain has its own nodes, these nodes are called collators, and the task of the collator is to collect and execute transactions, create an "unsealed" block and submit it to the validator. The verifier checks, verifies whether the transaction submitted by the collector is legal, and approves it. This is why the validator is responsible for the security of all parachains, because all transactions are approved by the validator of the relay chain, and if the validator is ok, all the parachains will be fine.

first level title

text

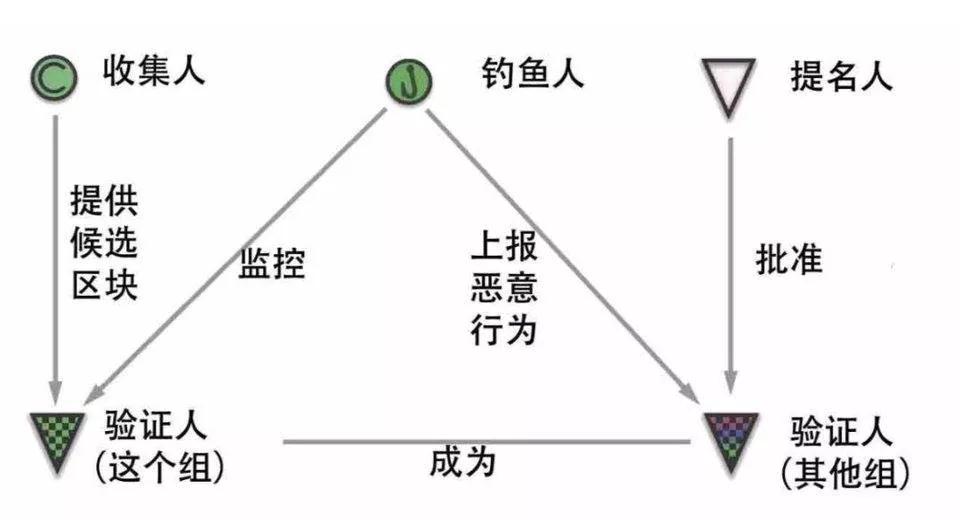

The Polkadot network can be understood as being maintained by four roles in a short answer, namelyCollector (collator), validator (validator), fisherman (fisherman), nominator (nominator).

Collectors belong to parachains, and each parachain will have its own collectors, the number of which may vary. For example, Stafi currently has 120 collectors, and Darwinia has 47 collectors. As mentioned above, the collector is mainly responsible for collecting and executing the transactions corresponding to the parallel chain, and then submitting the block to the verifier for approval.

Validators are elected by nominators, who are token holders.Verifiers will be randomly assigned to the parachains to verify and approve the blocks submitted by the parachain collectors.Validators who are malicious or do not fulfill their tasks well will be punished, and the nominators who voted for them will also suffer losses.

Validators are very important in the Polkadot system, so the supervision of validators actually has a relatively complicated design. At the same time, the decentralization of verifiers is also very important. Polkadot currently has 222 verifiers, and it is expected that the number of verifiers will expand to 1,000 in the future.

Fisherman is the node responsible for supervision in Polkadot, which is used to supervise validators and collectors. The interaction diagram of the four roles in the Polkadot white paper is as follows. Phishers are responsible for monitoring malicious behavior in the system and can get rewards. The requirements for running the Angler node are not high, and the income of the Angler will gradually increase with the increase of the number of successful reports. This is used to prevent excessive incentives in the initial stage, causing the Angler and its role to collude with intentional violations to obtain rewards.

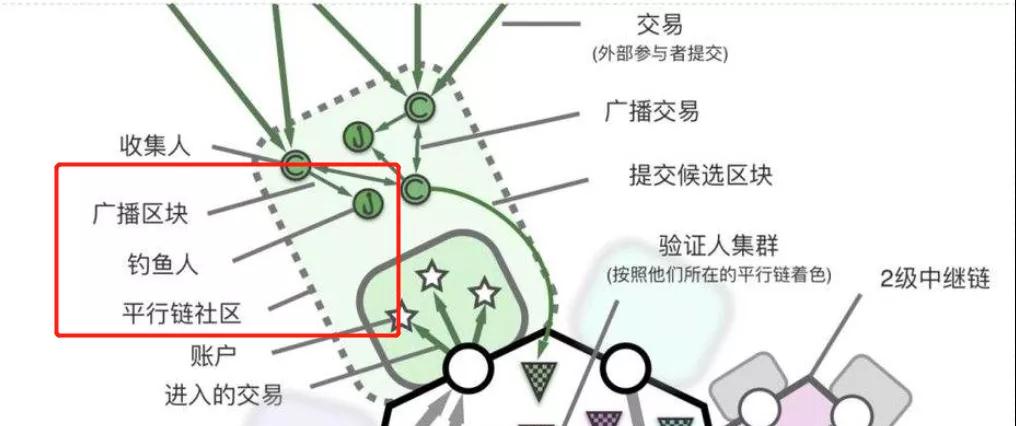

But if we look at the picture below, we can see that the fisherman in the picture belongs to the parachain community. From the picture, we would think that the fisherman supervises the collector instead of the verifier, which seems to be in conflict with the picture above .

first level title

text

The Polkadot system provides unified security for parachains through relay chains. Parachains can save a lot of cost in maintaining network security and concentrate on business development.

But the resources of any public chain are limited, and the same is true for Polkadot. Therefore, if you want to access the relay chain to enjoy the security of the entire Polkadot network, you need to rent a parachain slot to share the security of the entire network.

Parachain slots have limited slots, and slot demanders need to participate in the auction to obtain them. The rental slot needs to lock the Polkadot token DOT, because the amount of locked funds will be relatively large, and it is difficult for the project party to take out enough tokens for leasing alone.

Therefore, there is an IPO mechanism in the Polkadot system, and the project party can mobilize community users to bid for slots together. Users need to lock their DOTs for a certain period of time to participate in the auction, and users will have opportunity costs and loss of Staking income, so the project party will give out its own tokens to reward community users participating in the auction.

The slot duration is capped at 2 years, and each phase is divided into 6 months, after which a new lease is required. Therefore, how to obtain sustainable funds for slot leasing through development is something that the project party needs to consider. Because it is always leased by distributing tokens, it is not a long-term solution.

Parachain slots will not be auctioned a lot at once, but will be auctioned every once in a while. There is no definite time for the specific interval. Judging from the relevant introduction, it is generally said that the auction is once every few weeks.

Regarding the number of slots, Polkadot currently sets a target of supporting up to 100 parachains. Speaking of this, I can mention the TPS of the Polkadot network. According to a tweet by Polkadot founder Gavin Wood on June 9, all Substrate-based chains can reach 1,500 TPS. The goal that the Polkadot network wants to achieve is to support 100 parallel chains, so theoretically the maximum TPS of the entire network can reach 150,000.

first level title

text

Slot auctions will start on Polkadot's permanent network Kusama first. Judging from the current news, although it will take a while, it will not be too long.

Kusama is Polkadot's permanent first network, using basically the same code as Polkadot, but any new features will be launched on Kusama first to verify the feasibility. If there is no problem after verification and all parties respond well, it will be added to the Polkadot network.

Kusama is an independent network with independent tokens and communities, not a testnet in the traditional sense. Because the testnet can be operated at will, but the operation on Kusama is also real money, which will be a completely real test environment for Polkadot.

first level title

text

When it comes to the characteristics of Polkadot, many people may think of cross-chain. Indeed, a major feature of Polkadot is cross-chain. The Polkadot network can achieve heterogeneous cross-chain through the relay chain. Heterogeneous means cross-chain between two different chains.

Polkadot mainly transmits messages through the cross-chain message passing scheme (XCMP). Let's briefly understand the specific principles. Parallel chain A and parachain B need to communicate across chains, referred to as A and B.

A initiates a cross-chain, and enters 1 token A into B's contract on the A chain.

The transaction propagates to B through the relay chain.

B confirms that A has performed the relevant operation through the relay chain, B performs the corresponding operation, and generates the corresponding amount of A' tokens on B.

The same is true for reverse cross-chain.

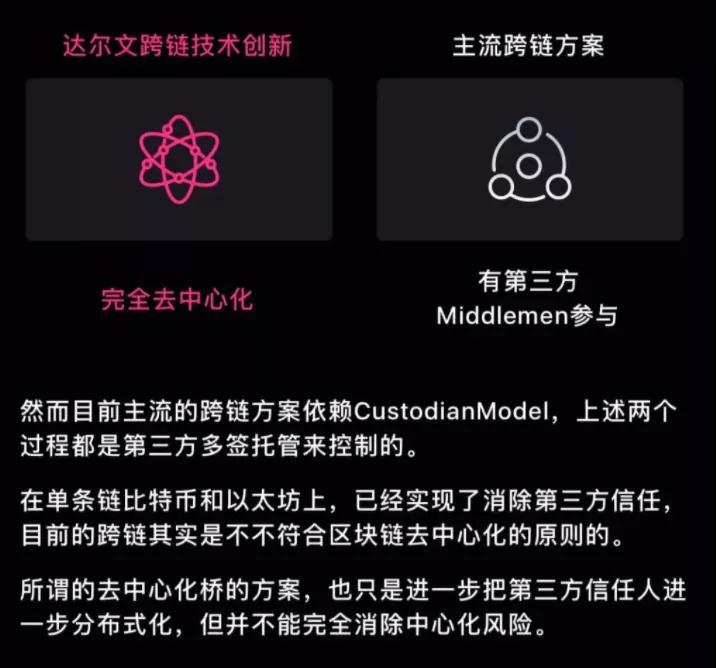

The key here is the decentralization of the whole process, not the cross-chain of trusting a third party as we often say。The approval of Polkadot network transactions is carried out by random validators, so the deposit and withdrawal of mortgage assets are all responsible for security by the decentralized validator cluster. Its cross-chain security is equivalent to that of the entire Polkadot network.

But for a network like Bitcoin without smart contracts, cross-chain will be more complicated. Bitcoin is cross-chain. At present, the custody of Bitcoin generally uses a multi-signature method. In fact, it still trusts a third party.

first level title

text

The largest number of projects in the Polkadot ecosystem are infrastructure, which are far away from ordinary users, so I won’t introduce them much. DeFi is a field that is closer to users, and it is also highly anticipated. Here is a brief introduction.

Polkadot’s DeFi ecological zone brother is still looking forward to it, but we can see very few projects so far, and hope to see more in the future.

1)Acala

Acala is a relatively powerful DeFi protocol in the Polkadot ecosystem. It is widely sought after by institutions, and its community building is also very good. Acala defines itself as: "a decentralized financial center and stable currency platform that provides support for cross-blockchain liquidity and applications."

Acala has three main businesses: a stablecoin generation platform, a liquidity release protocol, and a DEX trading platform. The three cooperate with each other and help each other develop. Foremost among these are stablecoin generation platforms. Therefore, Acala is a multi-protocol comprehensive DeFi platform, and if successful, it will have a deep moat.

Official website: https://acala.network/

2)ChainX

ChainX is the earliest Substrate chain in China. The mainnet was launched very early. When it was launched, it started the recharge BTC mining activity, which also caused a big wave of enthusiasm at that time. ChainX wants to become a cross-chain hub for digital assets. As stated in the vision of a cross-chain hub, ChainX has been working on cross-chain digital assets.

In the BTC cross-chain, most of the current multi-signature methods are used to keep Bitcoin. ChainX believes that this storage mode is not decentralized enough, and will solve this problem after the auction slot is connected to the Polkadot mainnet, and will also realize cross-chain cross-chain of all currencies.

At the same time, in addition to the cross-chain, ChainX wants to become the secondary relay of the Polkadot ecosystem, attracting applications that do not want to rent slots alone to develop on the ChainX network.

Official website: https://chainx.org/

3)Darwinia

Darwinia is similar to ChainX, both of which focus on cross-chain projects, but Darwinia's cross-chain direction covers a wider range, including not only the cross-chain assets such as ETH we often say, but also the cross-chain of game assets and non-standard assets , application chain cross-chain and other services.

The Darwinia main network is divided into four stages. The second stage "Ethereum-Darwin one-way cross-chain bridge" has been completed. The third stage will open the "Ethereum-Darwin two-way cross-chain bridge/transfer". The fourth stage Turn on "multi-directional cross-chain", and the subsequent cross-chain will expand to CRAB Network, TRON, BSC, EOS, etc.

According to the latest official information, the Darwinia network has realized a decentralized bridging technology, which can realize the fully decentralized cross-chain of Bitcoin.

Darwinia itself has also developed a blockchain management game "Evolution Odaily", which predates the Darwinia network. Before the Darwinia mainnet went live, Evolution Odaily assumed the Staking function in disguise.

Official website: https://darwinia.network/

4) Stafi and Bifrost

Stafi and Bifrost generally do similar businesses, both want to release the liquidity of Staking assets.

Users who staking through their network can obtain corresponding staking certificates. For example, users who staking DOT will be able to obtain rDOT, rDOT can be circulated and traded, and can also obtain staking income. Acala's LDOT is also a similar model.

According to statistics on September 27, the total market value of PoS assets displayed on the Stakingrewards platform is 32 billion US dollars, the market value of Staking assets is 16.8 billion US dollars, and the average mortgage ratio is 52%. This does not include the future PoS leader Ethereum, as well as other PoS public chains that are not online.

Staking assets are 16.8 billion US dollars. Assuming this model is a great success, 50% of users re-mortgage through Stafi and obtain liquidity, which will release 8.4 billion US dollars of liquidity. If this model allows users who originally wanted to staking but are worried about liquidity to also start staking, and increase the industry's average mortgage rate to 80%, this additional 30% is about 9.6 billion US dollars. This will be a big market.

According to Bifrost official news, Bifrost will provide liquidity release services for users participating in parachain slot auctions, that is, users who participate in bidding through Bifrost can maintain liquidity while obtaining bidding rewards.

Official website: https://bifrost.finance/

Official website: https://www.stafi.io/

More information about Polkadot DeFi can be clickedfirst level title。

wallet:

Official website:

https://polkadot.network/

wallet:

Domestic Math Wallet and imToken all support the Polkadot network, which is more in line with the usage habits of Chinese people

Encyclopedia:

https://wiki.polkadot.network/en/latest/

Project Encyclopedia:

https://www.polkaproject.com/

Chinese community (official/community account):

Polkadot_China、PolkaWorld

Navigate the site:

https://www.polkaworld.org/explore/

browser:

https://www.polkaworld.org/articles/polkadot-white-paper-in-chinese

browser:

https://polkadot.subscan.io/

https://polkadot.js.org/apps/#/explorer/

https://polkascan.io/

This is the end of Polkadot’s introductory guide. The level is limited. If you make any mistakes, please correct me.

If you have any ideas, welcome to leave a message to discuss.

More Polkadot articles:

1. "Overview of Polkadot's 9 Popular DeFi, Who Has More Potential?" Who could be the pit? "

2. "Four years of waiting, the Polkadot mainnet is finally online, the first step of an era!" "

3. "Ethereum, Polkadot, and Cosmos, the three major ecological stablecoins have a big bottom!" "

Disclaimer: This article is the author's independent opinion, does not represent the position of the Blockchain Institute (public account), and does not constitute any investment opinion or suggestion.

References

https://mp.weixin.qq.com/s/KmDUPHPEZiszh_Rm7wjuVw

https://mp.weixin.qq.com/s/bjZhBeoyIcwaTy4Ga0ZQbw

https://doter.io/show/renzhi10/

https://mp.weixin.qq.com/s/oplLdSYOqFba42PnjUpL3A

https://mp.weixin.qq.com/s/F5Ki2if5MGWJkj8Q78yBOg

https://mp.weixin.qq.com/s/_A24DFGet9dB8lNdbo4YwQ

-END-

Disclaimer: This article is the author's independent opinion, does not represent the position of the Blockchain Institute (public account), and does not constitute any investment opinion or suggestion.