The Polkadot mainnet will be truly "available" with the auction of the parachain. Judging from the current development progress, it will not be too long, and then the Polkadot ecology will usher in a period of rapid development.

secondary title

1. Acala

Acala is a relatively powerful DeFi protocol in the Polkadot ecosystem. It is widely sought after by institutions, and its community building is also very good.

Acala defines itself as: "a decentralized financial center and stable currency platform that provides support for cross-blockchain liquidity and applications."

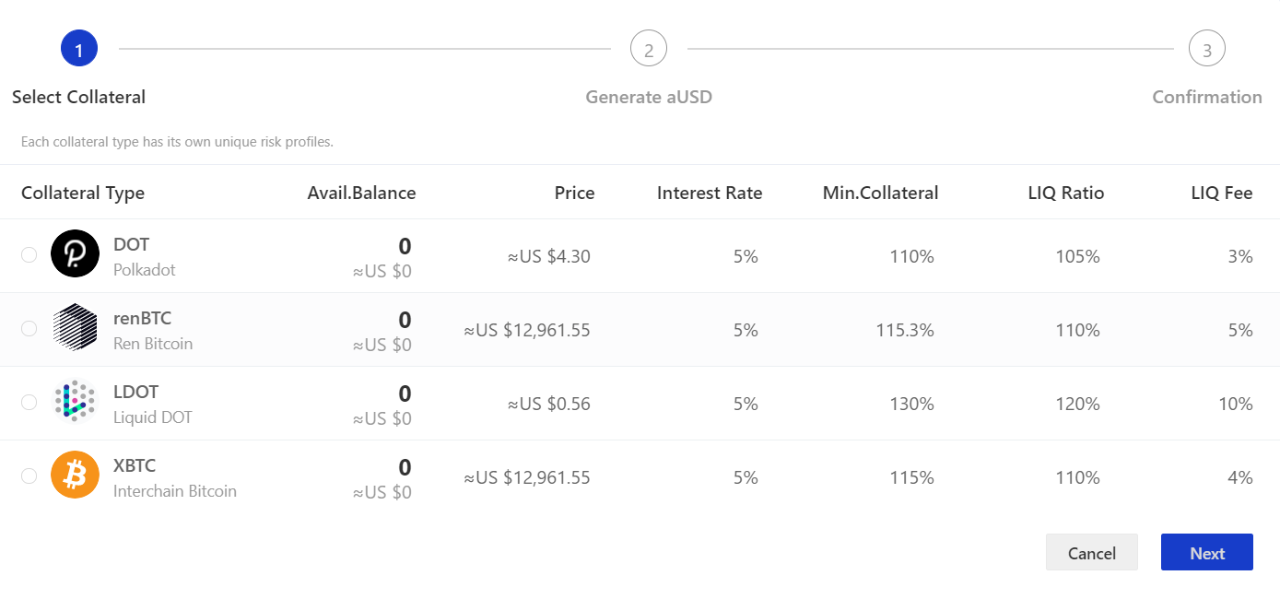

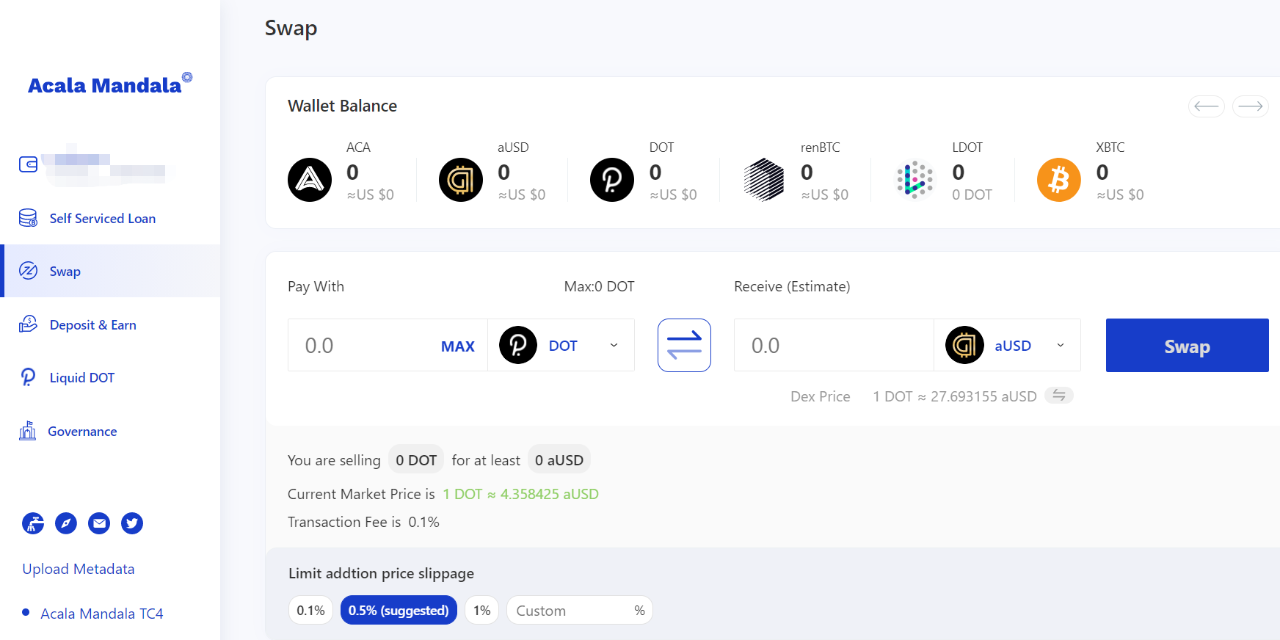

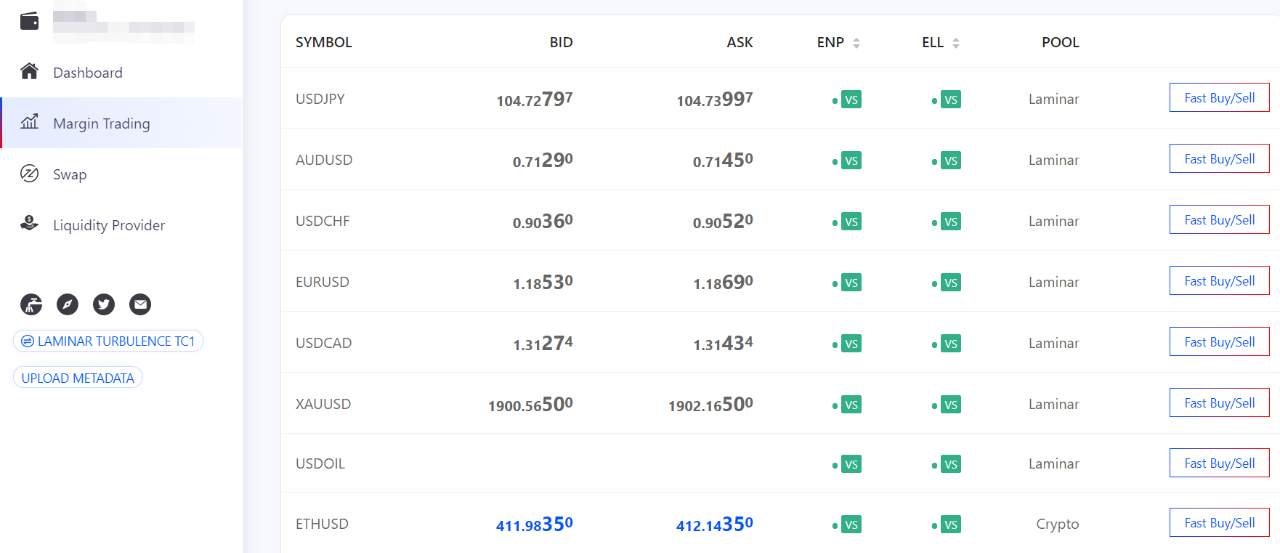

Acala has three main business segments:Stable currency generation platform, liquidity release protocol and DEX trading platform.The three cooperate with each other and help each other develop. Foremost among these are stablecoin generation platforms.

image description

Source: https://apps.acala.network, Acala Testnet

Acala, Maker, etc. all use the over-collateralized model to generate stable coins. When the price of the mortgaged assets falls, the mortgaged assets may be liquidated.Compared with Maker, Kava, etc., the liquidation mechanism of Acala uses robots to participate, and it combines liquidation and DEX in an original way.

Users can inject liquidity into DEX, and the funds injected into DEX will automatically participate in the liquidation of collateral, and the liquidation proceeds will be distributed to liquidity providers (of course, robots can also participate in liquidation, which is different from Maker, etc. different). Liquidity providers can obtain DEX transaction fee dividends and liquidation income. However, it is uncertain whether comprehensive income can cover the impermanent losses of liquidity providers without additional subsidies.

Another key innovation of Acala is the dSWF fund. Most of the income of the Acala network will be injected into the dSWF fund. When the black swan comes, after the DEX is liquidated, the dSWF fund will be used as the risk taker.This mechanism will be combined with the governance token auction mechanism used by Maker and others to bear the risk of stablecoin liquidation. Compared with the single auction mode, Acala combined with dSWF funds strengthens the ability to resist risks.

The dSWF Foundation uses system surplus to purchase other valuable, value-added and market-demanding assets inside and outside the ecosystem to enrich the platform’s revenue structure and reserve asset types. The reason for this is to strengthen the risk-taking ability on the one hand, and on the other hand, it is also to be able to lease parachain slots relying on its own reserves.

As we can see above, the clearing mechanisms of DEX and stablecoins are combined, and clearing participants can also directly withdraw funds in DEX to improve clearing efficiency, which will increase the transaction volume of DEX.

Through the DOT of Acala Staking, the Staking certificate LDOT can be obtained. LDOT is negotiable and tradable. While obtaining Staking income, it can also have liquidity. LDOT can be directly traded in DEX, or can be directly mortgaged to generate stable coins, which provides a wealth of application scenarios for LDOT, and also increases the source of assets for stable coin casting.

To sum up, we can see that Acala's business design is interlocking, with long-term consideration and originality. At present, Acala has launched several rounds of testnets and is in the audit stage. After obtaining the parachain slot, it will be able to go online as soon as possible.

image description

source:

source:text

For a detailed introduction to the Acala stablecoin model, please refer to the previous articles of the Institutesecondary title。

2. Laminar

Laminar and Acala have a close relationship, and many of their team members overlap.Laminar's CTO, Chen Xiliang, who often speaks out to the outside world, is also a director of the Acala Foundation.

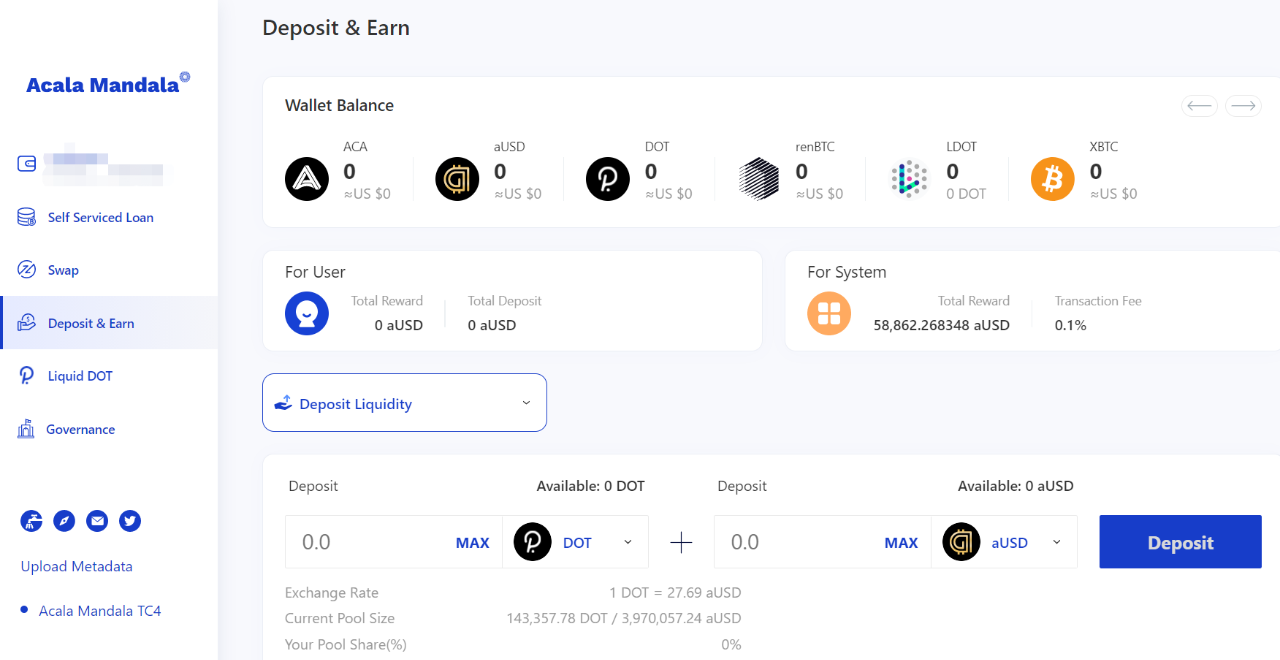

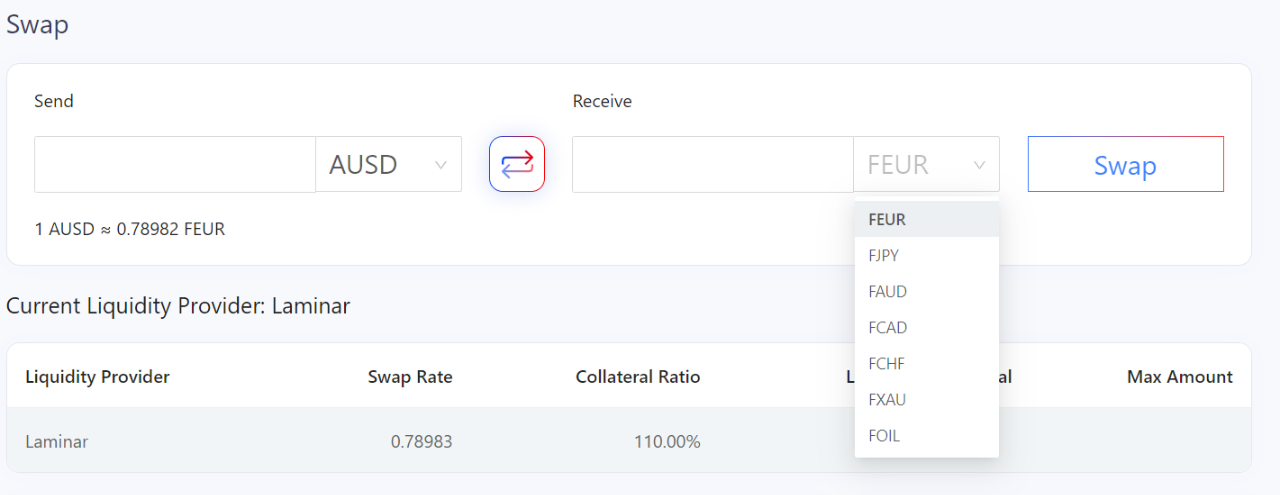

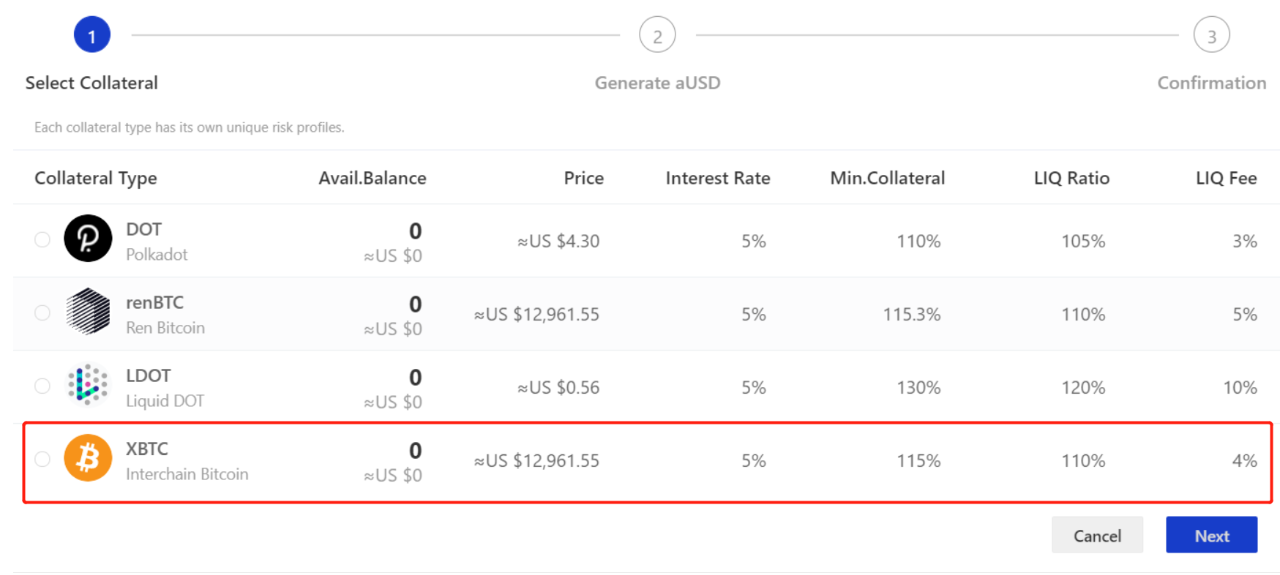

Laminar is a synthetic asset and margin trading platform. The synthetic asset here refers to foreign exchange assets. Users can use stablecoins to exchange various anchored foreign exchange assetsimage description

text

image description

Source: https://flow.laminar.one, Laminar testnet

Various foreign exchange assets, stocks and other assets can be synthesized on Laminar, and margin transactions of up to 50 times are provided at the same time. Laminar wants to use blockchain technology to solve the problems of opaque pricing and price manipulation in current foreign exchange transactions, and provide users with an open and transparent foreign exchange trading platform.

Of course, from the above testnet screenshots, we can also see that it also provides BTC, ETH and other margin transactions. The screenshot above is from the Turbulence testnet, which was released in July this year.

secondary title

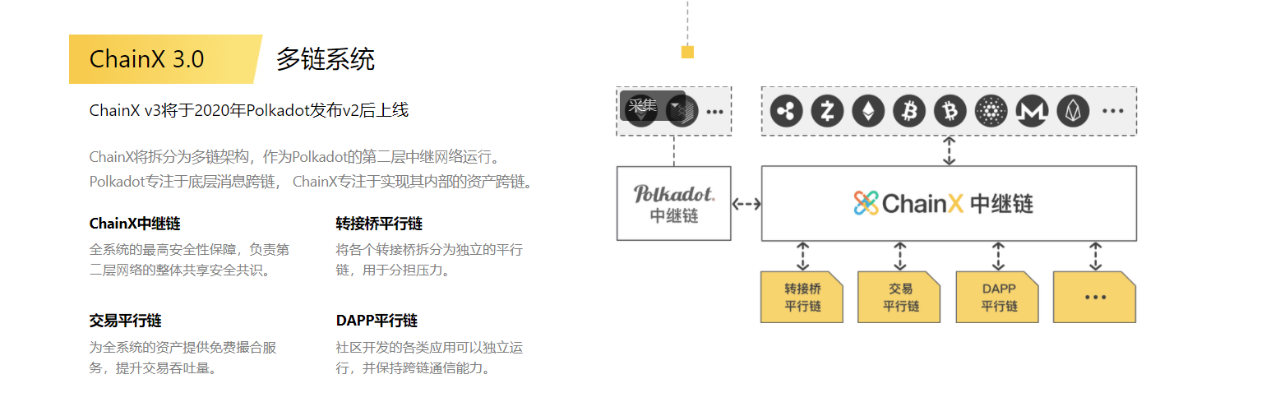

ChainX is the earliest Substrate chain in China. The mainnet was launched very early. When it was launched, it started the recharge BTC mining activity, which also caused a big wave of enthusiasm at that time. ChainX wants to become a cross-chain hub for digital assets. As stated in the vision of a cross-chain hub, ChainX has been working on cross-chain digital assets.

ChainX is the earliest Substrate chain in China. The mainnet was launched very early. When it was launched, it started the recharge BTC mining activity, which also caused a big wave of enthusiasm at that time. ChainX wants to become a cross-chain hub for digital assets. As stated in the vision of a cross-chain hub, ChainX has been working on cross-chain digital assets.

Currently, there are 348 BTCs stored on the ChainX network. Currently, there are no application scenarios in the Polkadot ecosystem. Cross-chain BTCs can only be traded in its DEX and participate in ChainX's own mining activities.

In the screenshot above about Acala generating stablecoins, it can be seen that the Acala testnet supports two types of BTC as collateral, among which XBTC is BTC cross-chain through ChaiX.

In the process of BTC cross-chain, the preservation of assets on the original BTC chain is a very important issue. At present, most of them use multi-signature for storage, and ChainX is currently using this mode. ChainX believes that this storage mode is not decentralized enough, and will solve this problem after the auction slot is connected to the Polkadot mainnet, and will also realize cross-chain cross-chain of all currencies.

At the same time, ChainX has opened up new businesses outside the cross-chain and has become a smart contract platform. It wants to become the secondary relay of the Polkadot ecosystem and attract applications that do not want to bid for slots alone to develop on the ChainX network.

text

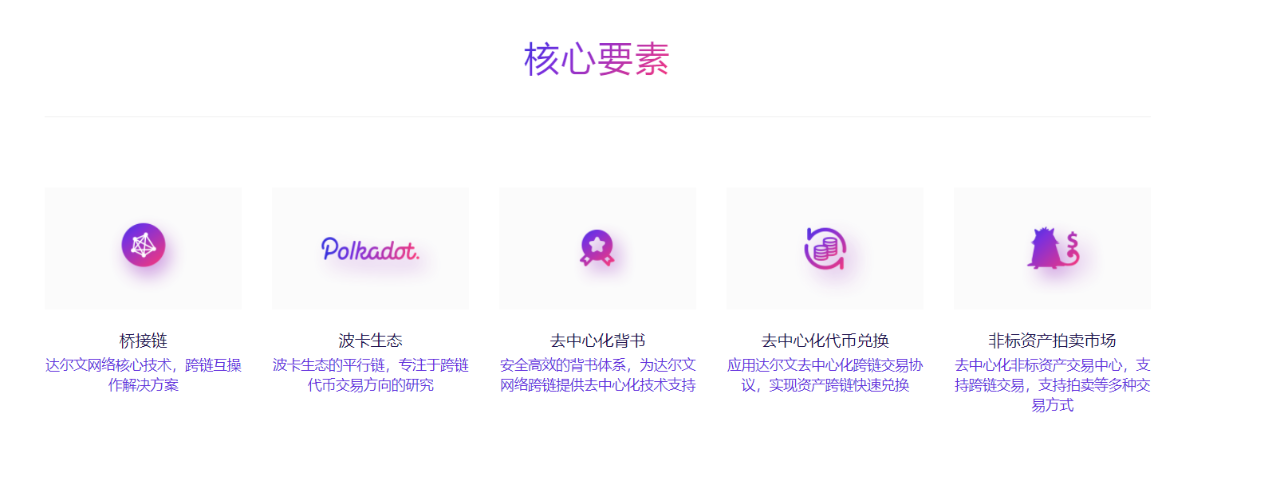

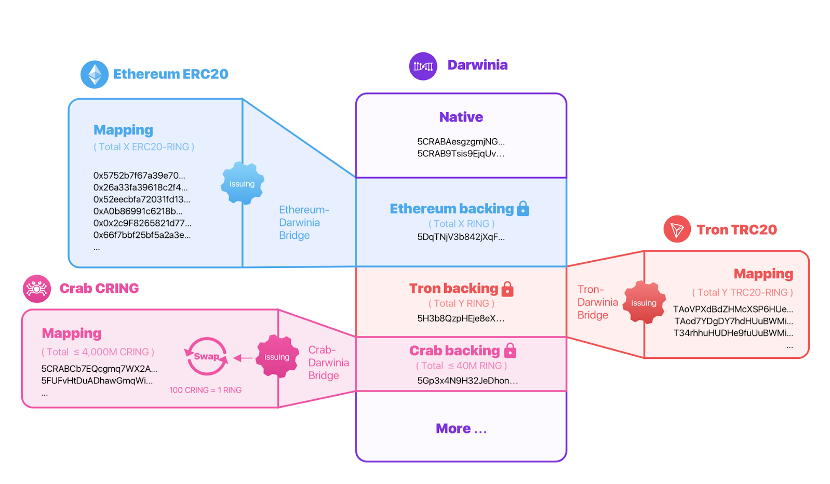

Darwinia is similar to ChainX, both of which focus on cross-chain projects, but Darwinia's cross-chain direction covers a wider range, including not only the cross-chain assets such as ETH we often say, but also the cross-chain of game assets and non-standard assets , application chain cross-chain and other services.

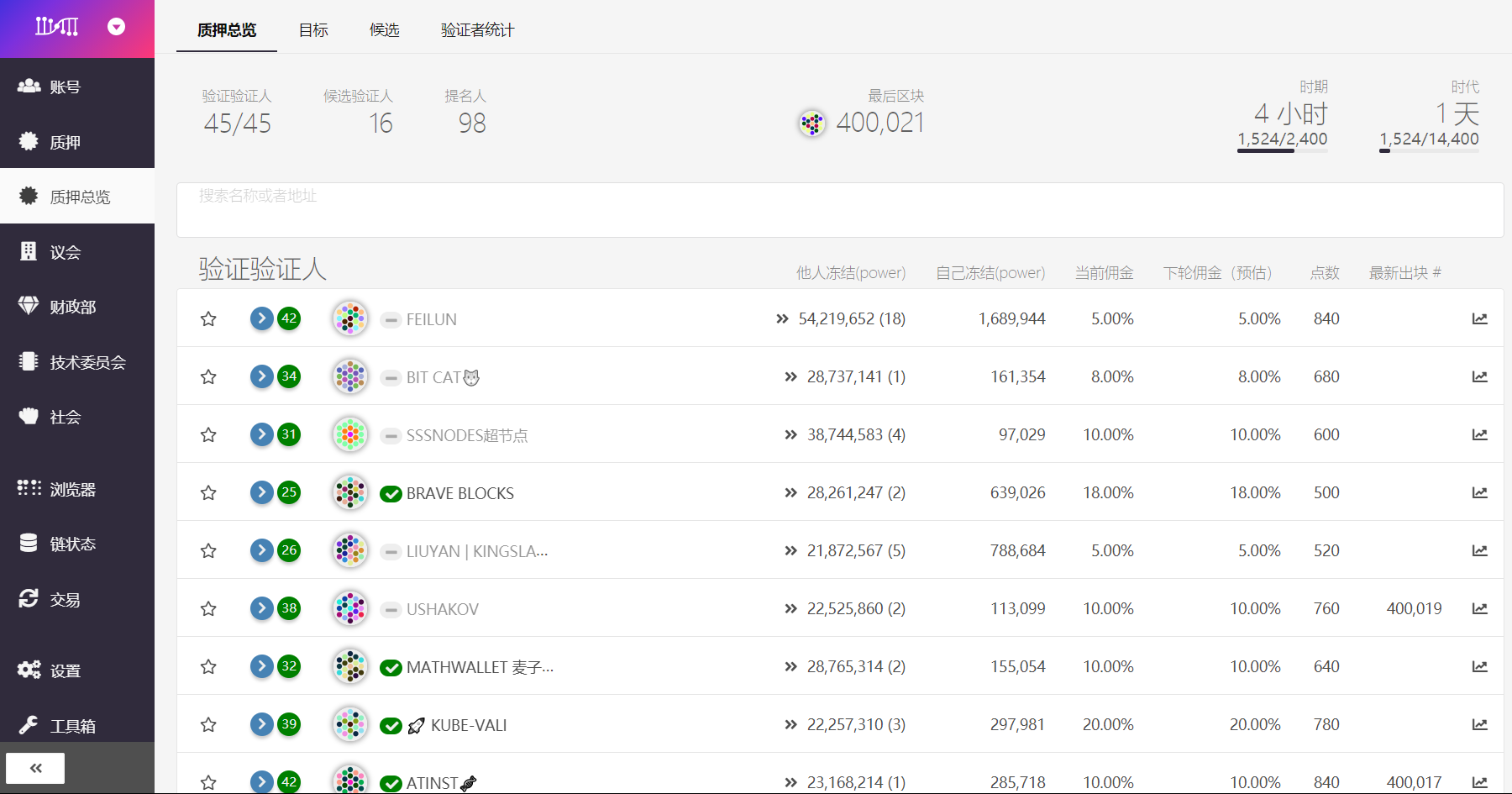

Darwinia's main network has been launched, but its main network adopts "gradual launch" and has been completed in 4 stages. The first stage has been launched on September 26. The main network in the first stage can only provide simple staking functions, and complex functions such as cross-chain will be opened in the next three stages.

Darwinia itself has also developed a blockchain management game "Evolution Odaily", which predates the Darwinia network. Before the Darwinia mainnet went live, Evolution Odaily assumed the Staking function in disguise.

The native token of the Darwinia network is RING, which is also the circulating token in "Evolution Odaily". RING can bid for land, purchase apostles, and lock up KTON in "Evolution Odaily".

secondary title

5. Akropolis

Akro wants to give people the tools to save, grow, and be self-sufficient securely in a future-proof manner, without being constrained by geographic, centralized counterparties, or falling prey to predatory financial operations by various intermediaries.

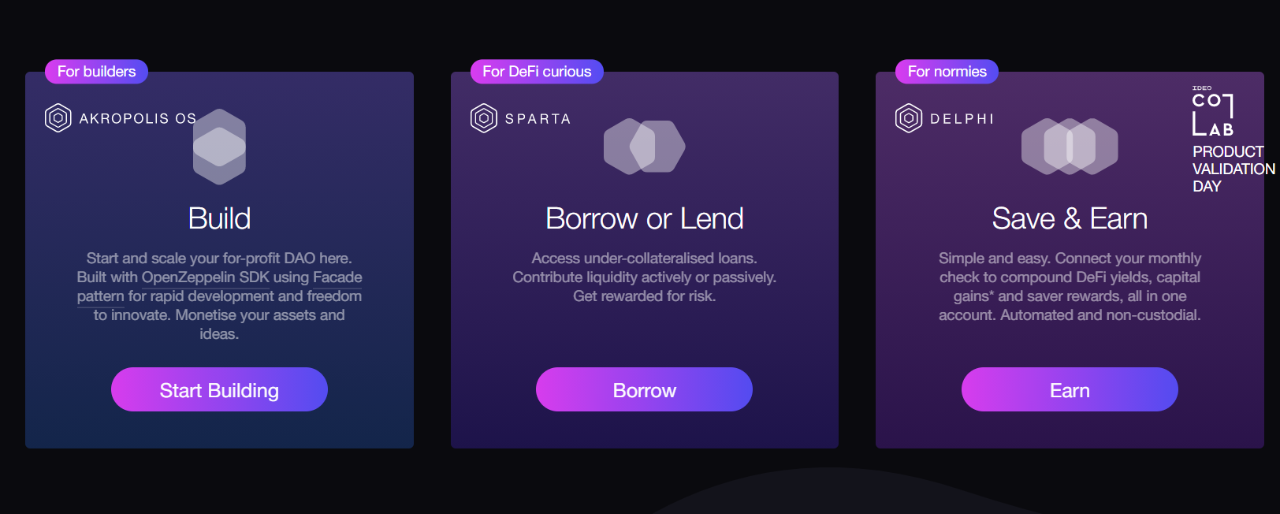

The above awkward introduction comes from the official document. Judging from the content displayed on the current official website,,As follows:,As follows:

The first piece of business is based on the fact that it is a lightweight modular framework that can be used to create profitable DAOs, with customizable user incentives, automated liquidity configuration empowered by the bonding curve mechanism, and Programmatic liquidity and fund pool management and other functions. This part is not the focus of this article, so I won't say much.

The module in the middle of the picture above is SPATA. Its most famous slogan is to allow users to carry out "under-mortgage loans". Users only need to mortgage 50% of their assets to obtain loans. Compared with the current over-collateralization in DeFi lending, it is a A slogan that is very easy to remember.

SPATA follows the "informal savings bank model" that is still popular in many places.The "informal savings bank model" is generally a voluntary organization through which members can save and obtain loans, and the savings funds are loaned to members of the organization to earn interest.This model is a typical acquaintance community model. The organization can operate normally, and there are generally some preconditions, such as: members in the organization know each other's detailed information, family situation, work situation, etc.; meet and talk regularly; new members must join There are introductions and guarantees from old members.

And Akro wants to implement a similar model through the blockchain. Akro's vision is that users mortgage 50% of their assets, and the other part of assets is jointly guaranteed by members' votes. Just like NXM's insurance mechanism, voting users share risks and enjoy benefits . But for the judgment of risk, this will be a difficult problem. For online borrowing, even if KYC is used and the social information of the borrower is obtained, or the credit information of the user is further obtained, it is still very difficult to judge the risk .

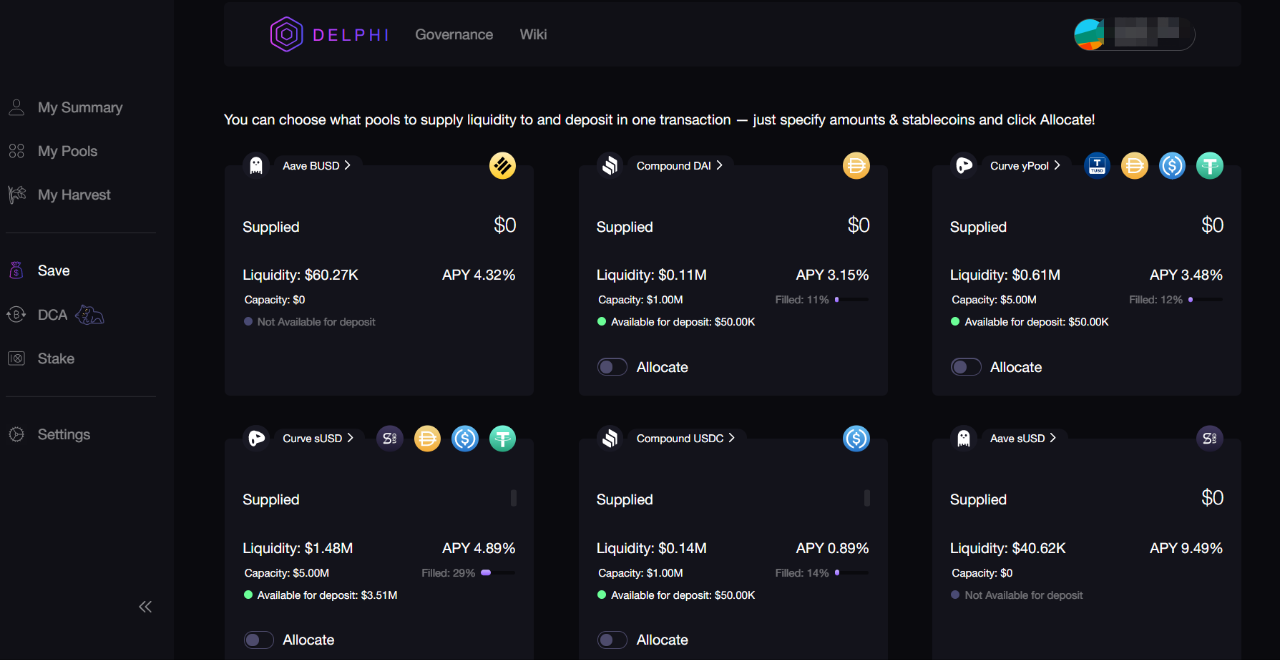

DELPHI on the far right of the picture above is a wealth management platform, which can help users disperse funds to multiple platforms to obtain income, and can also help users realize regular and fixed investment functions, and the income is not very high.

secondary title

According to statistics on September 27, the total market value of PoS assets displayed on the Stakingrewards platform is 32 billion US dollars, the market value of Staking assets is 16.8 billion US dollars, and the average mortgage ratio is 52%. This does not include the future PoS leader Ethereum, as well as other PoS public chains that are not online.

Stafi and Bifrost generally do similar businesses, both want to release the liquidity of Staking assets.

Users who staking through their network can obtain corresponding staking certificates. For example, users who staking DOT will be able to obtain rDOT, rDOT can be circulated and traded, and can also obtain staking income. Acala's LDOT is also a similar model.

According to statistics on September 27, the total market value of PoS assets displayed on the Stakingrewards platform is 32 billion US dollars, the market value of Staking assets is 16.8 billion US dollars, and the average mortgage ratio is 52%. This does not include the future PoS leader Ethereum, as well as other PoS public chains that are not online.

Staking assets are 16.8 billion US dollars. Assuming this model is a great success, 50% of users re-mortgage through Stafi and obtain liquidity, which will release 8.4 billion US dollars of liquidity. If this model allows users who originally wanted to staking but are worried about liquidity to also start staking, and increase the industry's average mortgage rate to 80%, this additional 30% is about 9.6 billion US dollars. What will happen at this time?

Since many public chains have not developed an ecology, the system tokens are useless except for staking. After rToken is converted into rToken by releasing liquidity, it will be able to circulate, trade, and even borrow, financial management.

While obtaining Staking income, you can also obtain liquidity to participate in DeFi to obtain additional income. What will users do? As long as DeFi applications add support for these rTokens, they can obtain users and assets corresponding to the ecology. What will DeFi applications do?

Even if only 50% of users re-staking through Stafi, a liquidity of 8.4 billion US dollars can be released, and many users who do not want to lose liquidity because of staking will also actively staking. These Tokens can only be placed in the exchange After becoming rToken, it will flow to the DeFi ecosystem with a high probability, which is nearly 18 billion US dollars of new assets.

Regarding Stafi and Bifrost, this article will not go into details, you can refer to the previous articles of the Institutesecondary title。

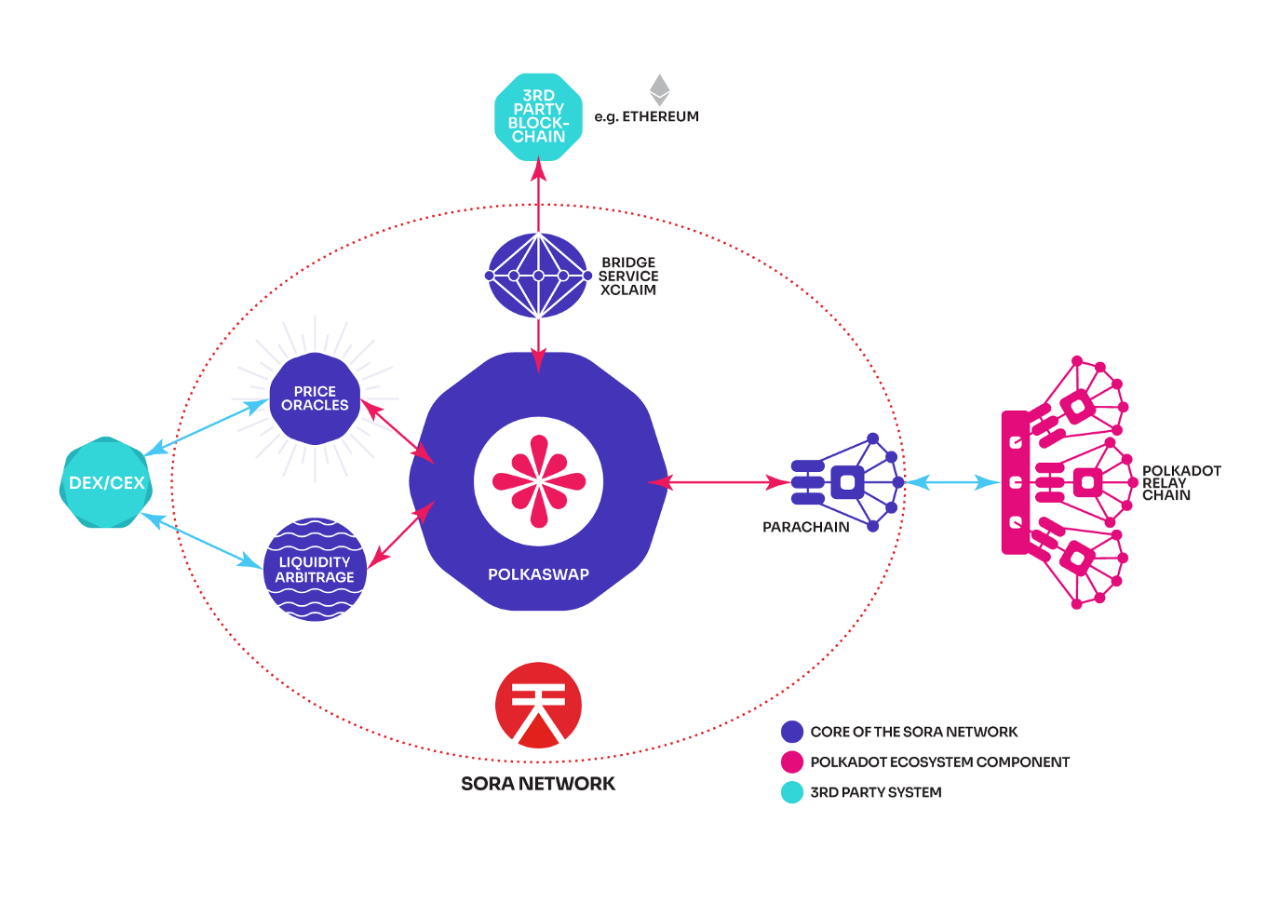

7. Polkaswap

Polkaswap is a DEX on Polkadot, built on the SORA network.

Polkaswap is a DEX, but it is not just a DEX. Polkaswap can set multiple liquidity sources according to the liquidity aggregation algorithm. When trading, the liquidity aggregation algorithm will use the best quotation provided by the liquidity source to execute the order. Liquidity sources can be AMMs, order books or other algorithms.

secondary title

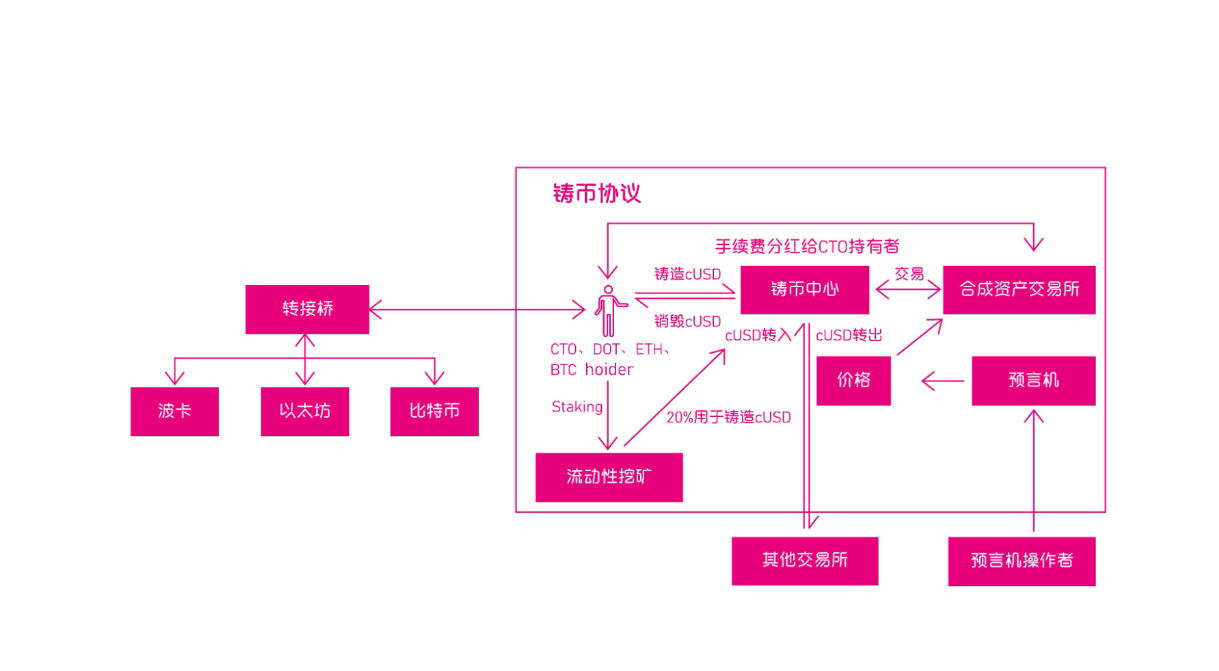

8. Coinversation

Coinversation is a synthetic asset platform, currently in its infancy. In Coinversation, assets such as CTO and DOT can be minted to generate stable currency cUSD, and the collateral ratios are 800% and 500% respectively. cUSD can be converted into various synthetic assets, such as cBTC, CETH, CDOT and even stocks, gold, etc., and supports short buying and short selling.

"Synthetix, the DeFi leader that doubles a hundred times a year, don't you know yet? ""Synthetix, the DeFi leader that doubles a hundred times a year, don't you know yet? "。

But compared with Synthetix, one big difference is multi-asset mortgage. Synthetix can only use its own token SNX to mint stable coins. Coinversation supports multi-asset mortgage, and the system is more complicated and scalable.

Disclaimer: This article is the author's independent opinion, does not represent the position of the Blockchain Institute (public account), and does not constitute any investment opinion or suggestion.

References

https://medium.com/@polkaswap/introducing-polkaswap-6f1db4003747

https://medium.com/@polkaswap/sora-network-parachain-for-polkaswap-intro-859558753f48

https://www.chainnews.com/news/684595249397.htm

https://mp.weixin.qq.com/s/nk2ah6U-z0kZW7MGGPSmCA

https://mp.weixin.qq.com/s/qWKPQVf9k38U7Nc-YcCXJA

https://mp.weixin.qq.com/s/9uoF9HIXB7fdy898HLUQ7w

https://mp.weixin.qq.com/s/duGHW12koeDCL0YReHeVXg

https://mp.weixin.qq.com/s/CpvR5iJeGi7k6tIgqjzLYg

https://www.jinse.com/blockchain/610603.html#top

https://businesstoday.co.ke/6-steps-to-creating-a-successful-chama/

https://www.chainnews.com/articles/886101140361.htm#

http://coinversation.cn/#partners

https://medium.com/@polkaswap/sora-network-parachain-for-polkaswap-intro-859558753f48

-END-

Disclaimer: This article is the author's independent opinion, does not represent the position of the Blockchain Institute (public account), and does not constitute any investment opinion or suggestion.