headlines

Filecoin mainnet officially launched

headlines

Filecoin mainnet officially launched

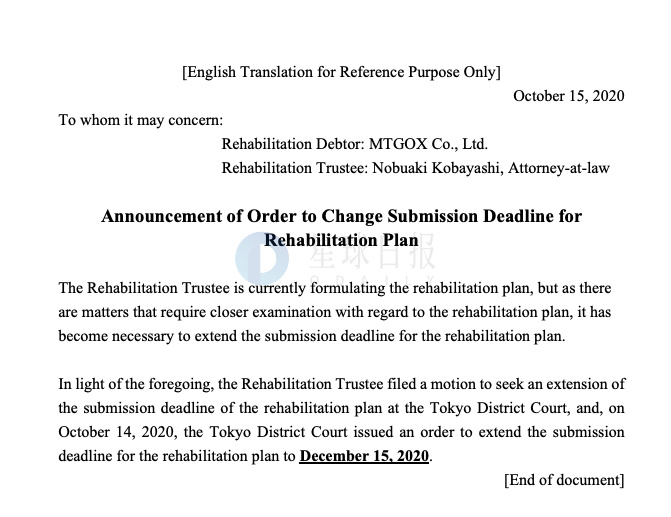

According to the official announcement, the Mt.Gox liquidation compensation plan originally planned to be submitted on October 15 has been postponed again, and the latest submission date is December 15, 2020.

digital currency

Privacy infrastructure NuCypher has launched its mainnet

digital currency

Privacy infrastructure NuCypher has launched its mainnet

Privacy infrastructure NuCypher (NU) has launched its mainnet. Earlier news, NuCypher CEO MacLane Wilkison said that after the mainnet is officially activated on October 15, users can receive pledge rewards for the network’s native token NU, or bind NU to a working node.

Algorand Foundation Announces Launch of New European Accelerator Program

The Algorand Foundation is launching a new accelerator program in Europe. The Algorand European Accelerator aims to support European developers and entrepreneurs who want to build applications on the Algorand platform. The new program will be launched in partnership with Eterna Capital and Borderless Capital. As part of the initiative, Borderless Capital will distribute $15,000 in upfront seed funding to ten selected projects. Successful projects will be eligible to receive up to $500,000 in follow-on investment from Borderless Capital and Eterna Capital. (Cointelegraph)

S.finance released a statement about the contract vulnerability on the Curve chain

The Taproot/Schnorr upgrade proposal has been officially implemented on Bitcoin Core

According to the code submitted by Bitcoin core developer Pieter Wuille on GitHub, the Taproot/Schnorr soft fork upgrade proposal (BIP340-342) was officially implemented on Bitcoin Core on the morning of October 15. After the proposal is activated, it will bring better transaction capabilities to Bitcoin while increasing the privacy features of the network. The activation mechanisms of the three BiPs have not been identified. Depending on the mechanism chosen, it may take some time (perhaps a year) before the code is activated.

Schnorr signatures are a technical extension that Pieter Wuille has been advocating for introducing into the Bitcoin protocol. Pieter Wuille proposed the Taproot/Schnorr soft fork upgrade proposal in May 2019, and the proposal was subsequently released as a Bitcoin Improvement Proposal (BIP), with the relevant proposal numbers BIP340, 341, and 342, respectively. (Decrypt)

Blockchain startup OffchainLabs has announced a major update to its Ethereum scaling solution, the Arbitrum Rollup testnet, on the Ethereum Kovan testnet, running on the newly upgraded Arbitrum software stack and making it open source for anyone use.

Interlay will release the Polkadot BTC Parachain Alpha Testnet in November

Blockchain technology developer Interlay will complete the BTC parachain in the first quarter of 2021 through subsequent funding from the Web3 Foundation. The first Alpha testnet of the parachain is scheduled to be released in November 2020, and the Beta version will be released in January 2021. Once deployed, users will be able to create 1:1 Bitcoin-backed assets on Polkadot, called PolkaBTC, and use these assets in a wide range of applications, including decentralized exchanges, stablecoins and lending protocols.

Interlay will release the Polkadot BTC Parachain Alpha Testnet in November

Blockchain technology developer Interlay will complete the BTC parachain in the first quarter of 2021 through subsequent funding from the Web3 Foundation. The first Alpha testnet of the parachain is scheduled to be released in November 2020, and the Beta version will be released in January 2021. Once deployed, users will be able to create 1:1 Bitcoin-backed assets on Polkadot, called PolkaBTC, and use these assets in a wide range of applications, including decentralized exchanges, stablecoins and lending protocols.

Stellar to Add Support for USDC in Q1 2021

Stellar announced on Thursday that USDC will be launched on the Stellar blockchain in the first quarter of 2021, strengthening Stellar's position as a cross-border payment network. (CoinDesk)

On October 15th, Huobi Global released the September HT Operation Monthly Report. In September, Huobi destroyed a total of 3.9406 million HT, about 18.6159 million USDT. The average price of HT burned this time was 4.724 USDT. The deflation rate of HT circulation in that month was about 1.3%. The number of HT holding users increased by about 3.47% from August.

Blockchain industry

In the third quarter, Huobi burned a total of 11.5816 million HT, about 53.7449 million USDT, an increase of 26.9% from the second quarter. As of October 15, the total amount of HT in existence was 276.889 million, and the total circulation was 216.982 million.

Blockchain industry

Fujitsu, JCB and Mizuho Bank test digital identity interoperability

On October 15, Fujitsu, JCB, Japan's largest credit card issuer, and Mizuho Bank jointly tested a system based on Fujitsu's blockchain solution, the self-sovereign and decentralized digital identity exchange technology that enables companies and Secure transactions between industries regarding sensitive user ID information. JCB and Fujitsu have been conducting a joint research project on digital identity since 2019. (Events News Asia)

ICBC successfully directly connects to the cross-border financial blockchain service platform

Recently, the Industrial and Commercial Bank of China has successfully connected directly with the cross-border financial blockchain service platform of the State Administration of Foreign Exchange. In the next step, ICBC will also make in-depth use of export customs declaration, financing application, loan repayment, corporate credit and other platforms to directly link and reverse information to improve the efficiency of trade financing business, further enhance the level of cross-border trade facilitation, and promote the stability of foreign trade and stability. foreign investment. (People's Daily Online)

Ebang International intends to acquire a licensed financial company in New Zealand

Regax UK-based crypto asset firm Archax announced it has raised $8 million in seed funding, with participation from Alameda Research, Amnis Ventures and Hudson Capital, among others.

Investment and Financing

Encrypted asset company Archax raises $8 million, Alameda Research participates in investment

Regax UK-based crypto asset firm Archax announced it has raised $8 million in seed funding, with participation from Alameda Research, Amnis Ventures and Hudson Capital, among others.

According to previous reports in August, British regulators granted a license to crypto asset company Archax, making it the first crypto asset company registered with the FCA. (Decrypt)

global policy

global policy

U.S. National Security Council Adds DLT to Key Technology Candidate List

The Trump administration has included distributed ledger technology (DLT), the technology behind cryptocurrencies and blockchain, in its strategy to protect America's technological edge. DLT is reportedly one of 20 focus areas on the National Security Council's shortlist of "critical and emerging technologies" released on Thursday. The shortlist also includes artificial intelligence, data science, quantum computing and "space technology," among others. Trump's strategy calls for investing in, developing, adopting, and scaling these priority technologies, it is reported. (CoinDesk)

New York Department of Financial Services plans to roll out financial reporting digitization initiative

The department will launch the initiative in partnership with the Conference of State Bank Regulators, a group of state financial regulators, and the Coalition for Innovative Regulation. Design workshops are scheduled for the fiscal fourth quarter of this year, and a "technical sprint" program is expected to take place in early 2021. (CoinDesk)

Nigeria is developing a national blockchain adoption strategy

According to news on October 16, the Nigerian federal government is developing a plan to promote the adoption of a national cryptocurrency with the vision of creating a "digital Nigeria." The country’s Federal Ministry of Communications and Digital Economy and the National Information Technology Development Agency (NITDA) have collaborated on a blueprint for blockchain adoption in the country. (CoinDesk)

Isle of Man Financial Services Authority Publishes Blockchain Regulations

The Isle of Man Financial Services Authority (FSA) has released blockchain and cryptocurrency regulations. The specific regulatory treatment will depend on the nature of the token, with regulators considering “substance rather than form,” the FSA said. The regulations state:

1. Although cryptocurrencies such as BTC and ETH are not regulated by the FSA, companies that own such assets must register with the FSA as designated businesses and comply with anti-money laundering and combating terrorist financing requirements.

2. Those institutions that use tokens that "have the characteristics of securities or electronic currency" to conduct transactions will be regulated by the FSA.

3. Tokens that provide profit, income or capital growth will be regulated as securities investments and require a financial services license.

4. If invested through other means such as shares, these tokens will be subject to the same rules.

On October 15, the General Office of the Hainan Provincial Committee of the Communist Party of China and the General Office of the Hainan Provincial People's Government issued the "Hainan Province Action Plan for Creating a First-Class Business Environment (2020-2021)". The action plan pointed out that the "one network" tax handling system should be promoted, and more than 90% of the main tax-related service items should be processed online, and the application of blockchain technology in taxation management should be explored and promoted. (Shanghai Securities News)

Character·Voice

Character·Voice

Xinhuanet: The 10 million digital renminbi test is an important step in deepening the reform of the economic system

Fed Governor: The Fed is committed to studying digital currencies but it is too early to set a timetable

Bank of Japan official: The Bank of Japan may set a cap on the issuance and holdings of digital yen

Federal Reserve Governor Quarles said that the Federal Reserve is specifically committed to researching digital currencies, and it is too early to set a timetable for the Federal Reserve's digital currency work. (Golden Ten)

Bank of Japan official: The Bank of Japan may set a cap on the issuance and holdings of digital yen

Bank of Japan officials said that if the digital yen is issued, the Bank of Japan may set a cap on the issuance and holdings of the digital yen. It hopes to start the first phase of the trial next April and move to the second phase in fiscal year 2021. In addition, the Bank of Japan sees the central bank digital currency as a tool to strengthen the settlement system, rather than a monetary policy tool. (Golden Ten)