At 7:00 p.m. on August 28th, Math Wallet held the 11th session of the Math Show, and was honored to invite 6 heavyweight guests from the Polkadot Ecosystem: Liam Stafi Co-Founder, Marvin Phala Co-Founder, and Yue Lipeng, the founder of the chain cooperation laboratory , Fuyao Acala council member, Denny Wang Darwinia Co-Founder, Lurpis Bifrost Co-Founder, invited host Polkadot Ambassador Wheat Wallet Xiao Qing, will take you to reveal the secrets of "Polca and its parachains", the following is Great write up for the night.

Lord Qing:

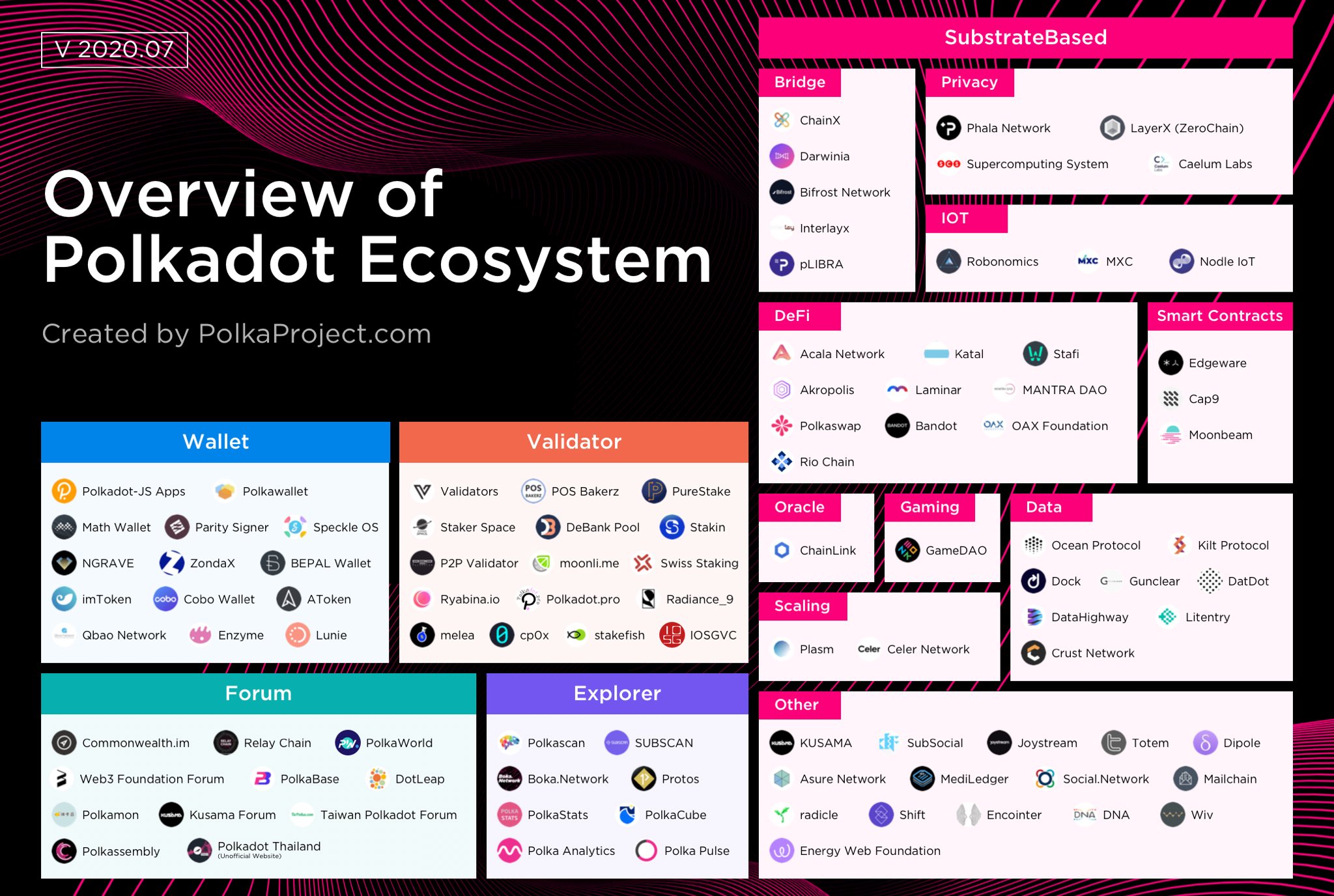

With the opening of the Polkadot ecology for transfers and denomination splits, more and more projects with Polkadot parachains are added, and the topic is getting higher and higher. As of tonight, Polkadot’s market value ranks fifth. Let’s take a look first a picture.

It can be seen that Polkadot's ecological blueprint is growing day by day, and everyone has begun to pay more and more attention to the development of Polkadot's ecological projects. So this is also the purpose of our Math Show in this issue. I hope to talk about the Polkadot ecology with 6 guests tonight.

Liam:

I'm Liam, good evening everyone, I'm glad to come to the wheat community to share the progress of Stafi.

Tong Lin Marvin:

I am the founder and CEO of Phala network. Been here a time or two before. After I graduated, I have been working as a product manager in Tencent, Didi and other companies, commonly known as product dogs. I was brainwashed by the blockchain by accident, and then I couldn't hold on to the impulsive idea, so I came out with a few computer classmates in high school and founded Phala, a team and project that wants to calculate Rebuld Internet through privacy. My partner Yin Hang was an expert in Google search ML related fields before, and Wang Zhe was an expert in Huake Computer Hardware Laboratory. They were both recommended by the University through the Olympiad.

The Phala team was established in the middle of 2018. At that time, we discovered that although the smart contracts of the Web3.0 ecosystem can be trusted, the price paid is that all data must be open and transparent. This is obviously a big obstacle, and many applications have no The method is "decentralization". We want to solve this problem, which is what the Phala team was created for.

Yue Lipeng:

Yue Lipeng:

Patract Labs provides solutions for Polkadot's parachain smart contract ecology, supporting smart contract parachains within Polkadot's public chain network, as well as smart contract alliance chains based on Polkadot technology. Lianhe Lab operates in the form of an offshore company and will not issue any new cryptocurrencies. All solutions will revolve around the use and value of DOT.

Polkadot is a heterogeneous cross-chain network built by Web3 Foundation and Parity. In Polkadot's design, only very complex applications or innovative technologies need to develop independent parachains, and almost all common DApps only need to deploy a simple smart contract. In the Polkadot network, the Web3 Foundation will officially deploy a general-purpose parachain purely for smart contract applications, and other community members will also deploy dedicated parachains with smart contract functions. Developers can choose the optimal parachain Deploy the contract. Compared with independent parachains, smart contracts provide developers with a simpler, faster and more economical development method, which greatly reduces the barriers to entry for developers.

The Polkadot network itself only provides the underlying chain operating environment for smart contracts. Developers also need a lot of upper-level development kits and service support outside the chain to quickly develop qualified smart contracts. In contrast, although the contract technology of Ethereum is simple, after 5 years of development, the development ecology has been very prosperous. For example, ConsenSys provides many solutions for the smart contract ecology of Ethereum, forming a mature development kit, and also provides data interface, security audit, industry consulting, application incubation and other services. At the same time, other members of the Ethereum community also provided some source code libraries, token standards and development specifications. Projects that Ethereum developers are very familiar with include Truffle Suite, Infura, Metamask, Remix, ERC, OpenZeppellin Contracts, Enterprise Ethereum Alliance, etc., which are all developed by community members.

Fuyao:

I am an open contributor to Fuyao, Polkawallet and Acala Network, an early community member of Polkadot, and I have been following up for more than 10,000 hours.

I started to pay attention to Polkadaot in 2017 and helped the Polkadaot Chinese community to build up slowly, so it was also recognized by many developers and community members in the community. It was later discovered that community users especially need a mobile wallet to operate anytime, anywhere. For example, mortgage, check at any time whether it has been cut, nominated, and governed, so the initial model framework was drawn, which is the Polkawallet that everyone sees now. Later, this product was strongly supported and funded by the Web3 Foundation.

After developing Polkawallet, I found that it is particularly suitable to develop a stable currency system based on Substrate. The heterogeneous cross-chain attributes can greatly empower the DeFi ecosystem and fundamentally solve the current technical bottlenecks of DeFi, such as solving multi-asset mortgages and pledges. long-term liquidity issues. Therefore, Acala's development team has studied two sets of protocols, the stablecoin Honzon protocol that supports cross-chain multi-asset mortgages and the Homa protocol that releases the liquidity of pledged assets. Acala aims to bring stability and liquidity to global encrypted assets. Moreover, Acala, as the world's first decentralized open financial alliance, aims to create an open financial framework in conjunction with the Polkadot ecosystem. At present, Acala has received official financial support from the Web3 Foundation, and our test network Mandala has also been launched.

As the Polkadot financial center, Acala will also be the Polkadot DeFi "Financial Special Zone" chain. Acala provides the underlying financial infrastructure of DeFi, allowing DeFi to thrive on Polkadot. As the bottom layer of DeFi, Acala provides 3 basic protocols: decentralized stable currency, decentralized AMM transaction and decentralized pledge liquidity protocol.

Denny:

Darwin Network is a decentralized heterogeneous chain cross-chain bridge network developed based on Substrate, focusing on building future asset interconnection networks, including non-standard asset auction markets, stable currency cross-chain, asset exchange and other fields. The sub-linear super light client is used to realize the perception of the state of the external chain, to replace the current more centralized or semi-decentralized cross-chain solutions, and to achieve decentralization and trustlessness.

The BTCRelay project based on the light client was unsuccessful, because the classic light client is a linear relay block, that is, each block needs to be relayed, which makes the maintenance cost high and economically unsustainable. And Darwin's Chain Relay is a novel cross-chain verification Relay, which implements a sub-linear super light client, uses Merkle Mountain Range (MMR) block chain header commitment, optimistic game mechanism Optimistic Verification Game, Relayer incentive model and other technologies , can achieve only logarithmic number of block headers and their derived data need to be submitted, that is, sub-linear performance, which greatly improves efficiency and economic availability, and can even realize the ability to relay block headers and verify them on demand.

With the support of efficient and economical ChainRelay, we can safely build a two-way bridge, build smart contracts and mutual ChainRelay on two heterogeneous chains in a two-way peer-to-peer manner, and the smart contracts control asset locking, redemption and other operations, and the verification is passed Bridgehead Darwin ChainRelay implementation. And Darwin, as a bridge network center, only needs to build a bridge to Darwin from the external chain, so that each linked chain can be interconnected, without the need to build bridges between the two. On this basis, we hope to see that many single-chain protocols can be upgraded to multi-chain versions.

We have released the experimental network Darwinia Crab Network. Many developers and users have participated in testing and experiments on it. Recently, we have successfully connected the test parachain Darwinia PC1 to the Rococo network.

More information can visit our official websitehttps://darwinia.network/or Github:https://github.com/darwinia-network

Lurpis:

Hello everyone, I am Lurpis from Bifrost. I am very happy to participate in today's sharing, chatting about the current situation of Bifrost and some personal insights on Polkadot.

I was engaged in development on Sina Weibo before, and entered the blockchain industry in 2017. I tried several Dapps in various contract chains. I think that the direction of DeFi should be the scene with the highest degree of fit with the blockchain and the fastest landing speed. Later, I found out that since Staking is locked, it seems that we have a problem with issuing derivatives, so we made an MVP verification requirement based on the contract.https://pool.liebi.com, is still running.

After finding that users are willing to pay the bill, they want to support multiple currencies. However, due to contract restrictions, it is difficult to completely decentralize the business. Therefore, after comparing Substrate and Cosmos SDK in 2019, they chose Substrate for development. Various business scenarios are very suitable, and it solves the problem of multi-currency support while also meeting the needs of cross-chains. Only then did Bifrost come into being.

Bifrost, as the basic DeFi protocol of the Polkadot ecosystem, is a cross-chain network designed for the liquidity of pledged assets. Currently starting from Staking liquidity, users can exchange PoS currency into vToken through Bifrost protocol at any time to obtain Staking income and liquidity.

Lord Qing:

Below, I would like to invite 6 guests to share with you Polkadot and its parachains.

Liam:

Seeing the excellent introduction, Polkadot ecological projects should have survived from last year to the present, and it is not easy. I also briefly introduced myself, also a product dog, who has been on the road of starting a business, doing O2O, the Internet, and then came to the blockchain. I started staking in 2018. Many people may have seen articles written by Wetez or me. I even wrote a book about PoS, which is open sourced on Github. Since 2018, I have been walking on the Staking track, doing many things right, and seeing many peaks and valleys. In short, this circle is very interesting, much more interesting than the traditional blockchain. Of course, we are still on the track of Staking, sailing towards a bigger world, so we have come to the direction of Staking Derivative.

Today I will mainly share with you the current development of Stafi, including StakingDrop, which is nearing completion, Stafi's two-stage test network, community development, and cooperation progress.

Let me introduce Stafi first. Many people are still relatively unfamiliar with what Stafi is doing. Staking Derivative is still a new concept, which is difficult to understand. Stafi is the first DeFi protocol that provides liquidity for Staking assets, aiming to improve the liquidity of locked assets in the PoS chain while also improving the security of the PoS chain. rToken is the general term for assets such as Staking Derivative on Stafi. rToken is a one-to-one anchoring derivative of Staking assets locked in Stafi, such as rXTZ, rAtom, rONE, etc. Staking Contracts are smart contracts that manage these assets. For example, when DOT does staking through Stafi's Staking contract, it will get rDot. Holding rDot can get Staking rewards and the right to trade mortgage assets. We have reached rToken trading cooperation with some exchanges, and we will provide these mortgage assets in the future. Provide liquidity.

We launched Stafi’s StakingDrop event in early August, mainly for pledge users of Tezos, Cosmos, Polkadot and other projects to airdrop FIS Token ranging from 100,000 to 400,000. At present, most of the projects supported by Stafi have been distributed. MATIC The project airdrop is still in progress, if you are interested, you can find out in this link:https://www.stafi.io/stakingDrop

About 600 million project tokens (worth close to 200 million U.S. dollars) have received FIS airdrops through Staking,

Participating projects include DOT, KSM, KAVA, ATOM, etc.

In addition, in the past two months, Stafi has successively launched the public test network Seiya and the incentive test network Sitara. Seiya is the basic network of the Stafi protocol. It mainly tests basic functions such as identity registration, transfer, validator registration, and nomination. A total of more than 150 validators participated in the test of the Seiya network. In the Sitara incentivized testnet, we received about 650+ validator applications, and finally screened nearly 400 high-quality validators to participate in the incentivized testnet. We have fully tested the Stafi protocol from different angles. Except for a short 20-minute block generation pause (Halt), the Stafi protocol ran smoothly throughout the test period, with fewer functional bugs. Participants' recognition of the entire consensus Knowledge is also improving, which we are very willing to see.

At the same time, the Stafi community is also thriving. At present, there are more than 600 developers in Stafi's Discord developer community, and the number of Twitter followers has increased by more than 3,000 in the past month. The number of 3-digit numbers is increasing, and there are more discussions in foreign communities.

Community developers are also helping novices. What is exciting is that some validators have helped Stafi create Docker. Newly added validators only need a few simple steps to complete the configuration of the node and start running, which greatly reduces the development cost. Difficulty and development time. Validators are also helping each other. Before we have time to answer your questions, some active validators will actively help nodes in difficulty to find and solve problems. To this end, in the Sitara incentivized testnet, we have set up Mentor mentor rewards to incentivize their contributions to the Stafi community, which gives us great confidence to build a prosperous community.

Stafi aims to provide more cooperation for PoS projects. In terms of cooperation, it has reached cooperation with multiple PoS projects, such as Matic, Kava, Harmony, Elrond and so on. The cooperation is mainly divided into two forms. One is that Stafi launches StakingDrop for the above projects, and airdrops FIS to entrusted users of the above projects. In the second phase, Stafi will develop and deploy the Staking Contract pledge contract, which will liberate the liquidity of the original chain assets and improve the security of the original chain without affecting the pledge rate. Through cooperation with other projects, Stafi will provide the community with high-quality DeFi products and services. At the same time, we will also exchange technologies and resources for common development, such as:

In addition, we are now in contact with excellent blockchain projects such as Oasis, Chainlink, and Qtum to communicate and cooperate. In terms of cooperation with exchanges, we hope to provide Token liquidity services for centralized and decentralized exchanges. Many exchanges are willing to provide trading pairs and liquidity support for Stafi’s Staking derivative rToken. For specific cooperation, we will also It will be announced later, and everyone is welcome to continue to pay attention to Stafi.

Yue Lipeng:

Yue Lipeng:

The first step plan of Lianhe Patract Labs is to develop the peripheral development tools and services of the contract chain, the second step plan is to serve all parachains that include contract functions, and the third step plan is to lead the underlying improvement of a general contract parachain, Do differentiation at the chain level.

Now Parity has made the underlying WASM contract module and EVM contract module. There is only the underlying chain, and there is no complete upper-level tool, so most projects now use the runtime to write parallel chains. However, the development and operation costs of parachains are high, and the iteration is relatively low. Everyone is paying attention to shooting slots, and there will not be many slots by then. Contract development does not need to be a slot, just write a contract on a certain parachain like Ethereum. It is expected that half of the parachains will be general contract chains in the future.

Fuyao:

The Acala network is a cross-chain open financial platform developed based on Substate, aiming to create the lowest financial infrastructure of the Polkadot ecosystem.

The first core protocol of the Acala network is the Honzon stablecoin protocol. The stablecoin in the Acala network is named aUSD, which supports different blockchain network assets such as BTC, ETH and DOT as collateral, and generates stablecoins through over-collateralization aUSD.

Another core protocol is the Homa protocol, which supports assets in the PoS network in the Staking state to generate on-chain certificates to enhance the liquidity of user assets. At present, we have completed the liquidity release of DOT, the pledged asset of Polkadot Network. Users can obtain LDOT with their DOT through the Homa protocol, and can also mortgage LDOT as collateral to the Honzon stablecoin protocol to lend aUSD, allowing themselves to enjoy Polkadot network income can also obtain a certain amount of liquidity for secondary investment.

The last core module is Acala's built-in decentralized exchange and currency deposit and interest-generating services, which allow users in the Acala network to use the services of automatic and fast currency exchange transactions, and users can obtain liquidity very simply by injecting liquidity. Transaction fee income and liquidation income in the Honzon stablecoin protocol.

The current technical bottlenecks in DeFi lie in four points:

The first point is the high Gas Fee and network congestion on the Ethereum network;

The second point is the problem of liquidity shortage;

The third point is that the failure of the oracle machine to feed the price leads to price manipulation;

The fourth point is that assets are "created out of nothing" due to asset standard issues;

In response to the above problems, the Acala network has made many improvements.

https://mp.weixin.qq.com/s/gy9Py1R-M0TvZ2Mr0X6p9A

When Acala faces a black swan risk similar to March 12 this year, thanks to Polkadot’s heterogeneous sharding architecture, about 20% of the space in each block will be reserved as a priority channel for important system transactions (such as : Quotation oracle, risk parameter adjustment, automatic liquidation), to ensure the integrity and security of the entire network.

In terms of liquidation, Acala will liquidate risky positions through a hybrid mechanism of [auction + built-in exchange]. The Honzon stablecoin protocol will first try to sell collateral through the built-in exchange to pay outstanding debts, and if that fails, start an auction to ensure that collateral is sold at the best liquidation price to protect the interests of borrowers.

In addition, Acala makes full use of the Off-Chain Workers mechanism of the Substrate framework, which will automatically trigger the liquidation of all dangerous positions to ensure timely liquidation and system debt repayment.

The large-scale implementation of DeFi is not only a technical problem, but also a problem of users' awareness of DeFi. So at this point, in addition to constantly updating product science, we at Acala have launched 4 versions of the test network alone, and recently connected to the Polkadot Rococo parachain test network. It is expected that there will be new tricks.

In addition, let me reveal that there will be explosive news in the foreign Polkadot ecology in the early hours of tonight.

Denny:

We have shared the introduction of Darwinia before, and I would like to talk about some of our experience in Polkadot and Substrate engineering practice.

We decided to join the Polkadot ecosystem because we were concerned about Ethereum at first, so we have always been interested in the work of Dr. Gavin Wood and Parity. I have had many exchanges with Dr. Gavin Wood in the past. The original intention of Polkadot was to let each chain perform its duties, focus on its own business characteristics, set various parameters, and realize its own personality, but at the same time maintain a certain commonality , so that security and interoperability are guaranteed, and value can flow freely in links. Following this line of thought, there will be business logic that allows everyone to quickly develop the chain, without having to reinvent the wheel, so that they can have more energy to focus on the business functions they want to solve. This is the reason why the substrate suite of tools was born. Polkadot itself serves as a relay chain to connect these application chains, allowing them to share a security pool and exchange messages.

We have also participated in the development and use of some other blockchain open source frameworks, such as the Graphene framework used by Bitshares. In contrast, I found that the design of the framework of Substrate is very forward-looking in many aspects, including modular design, runtime environment and so on. The Substrate framework is highly compatible with our team and is suitable for rapid iteration.

Our team Itering has been committed to the large-scale implementation of blockchain applications, so the technical solutions researched and developed are mainly aimed at the direction of application implementation, including cross-chain technology Darwinia Relay, distributed key management service DKMS, random numbers on the chain, NFT recognizability and more.

After more than two years of use and study, we believe that Substrate is a very good blockchain framework core. We not only choose Substrate as the blockchain development framework for Darwinia, but also develop a Substrate-based multi-chain Explorer Subscan (https://www.subscan.io/), hoping to provide a better infrastructure for the Polkadot and Substrate communities.

With the construction of the cross-chain transfer bridge and the access of more cross-chain assets, we believe that the application ecology on Darwinia will flourish.

Lurpis:

Let me briefly talk about what problems Bifrost has solved.

Friends who have done staking know that sometimes the income generated by staking for a year is less than 10%, but it is very likely that it will be lost in a sharp drop. Users suffer huge losses due to locked positions, and the opportunity cost of staking is huge, and Bifrost allows users to trade while doing staking, avoiding the loss of funds caused by staking locked positions. For example, when DOT is mortgaged directly, DOT will be locked. If the price of DOT plummets during the lock-up period, users cannot quickly unlock and sell DOT, and can only passively bear the loss (just like the oolong of DOT unlocking today).

However, in Bifrost, the user only needs to exchange the DOT in your hand into vDOT through Bifrost, and holding vDOT can obtain the Staking income and liquidity of DOT (sell at any time), which also achieves the risk hedging of Staking. Of course, you can also use vDOT to recycle stablecoins, realize Staking leverage, enlarge the principal and increase Staking income, etc.

In addition, drawing big pies can also solve key issues such as revenue competition for DeFi applications built on PoS networks, PoS network security and liquidity balance, and Staking revenue acquisition in cross-chain scenarios.

Tong Lin Marvin:

In addition to DeFi applications, Polkadot also has "weird" projects like Phala. The purpose of Phala is to provide privacy services for application protocol parachains such as Acala, Stafi, Bifrost, and Darwin. Phala Network is a private computing parachain on Polkadot. Based on a POW-like economic incentive model, Phala releases the privacy computing power of countless CPUs and applies it to the Polkadot parachain, thereby serving other applications such as DeFi and data services on Polkadot.

Phala, as a batch of Polkadot parachains in 19 years, has a good network maturity. It will launch the main network in September-October this year and participate in the slot auctions of Polkadot and Kusama. Phala-based applications pLibra and Web3 Analytics have already Get the Web3 Foundation grant.

The core value is: we hope to expand the concept of "privacy protection" into "confidential protection". Privacy not only refers to the transaction privacy of users, but also protects any confidential data in smart contracts from being leaked. In the current smart contract technology, all data must be fully disclosed, and we hope that the "Confidential Smart Contract" (Confidential Smart Contract) can perform general-purpose calculations like Ethereum's Turing-complete smart contract, but without exposing confidential data .

In March of this year, Phala was the first to invent and use the concept and economic design of "StakeDrop" in the Polkadot ecosystem. From May 15th to August 15th, a total of 1.913 million KSM participated in the Stakedrop activity, which is equivalent to approximately 200 million RMB. But now it’s over, and students with KSM and other tokens can participate in similar activities of Stafi, Bifrost, and Acala.

In addition, Phala has ended its Rorschach testnet activity for more than a month. In the Rorschach test network, the number of nodes in the Phala test network exceeded 20 days, and it ranked first in the Polkadot ecosystem. It took only 16 days for the number of nodes to break through 1,000, and finally stabilized around 1,400.

https://mp.weixin.qq.com/s/_4FY7P8gwrtCNQIhkeANTA

Lord Qing:

Your project chooses the Polkadot ecology. What do you think is the biggest advantage of Polkadot compared to other public chains?

Tong Lin Marvin:

In my opinion, Substrate, as a blockchain framework, implements most of the common functions encountered in the field of blockchain development, such as peer-to-peer network connections, configurable consensus algorithms, common encryption algorithms, database storage, transaction management, etc. By using Substrate, we can pay more attention to Phala's special ability, and can be liberated from the underlying complex technology! For example, during the development of Phala, we found that in fact, 1 year and 4 R&Ds are almost enough. The same type of chains, such as XX chain and XX chain, have melted 400 to 500 million US dollars, and the main network has not yet launched, which really saves developers effort.

The other is the soul question: who uses your chain?

The goal of Phala is to become a parachain in the Polkadot ecosystem, because we not only implement confidential smart contracts on our own chain, but also hope to provide the ability of confidential contracts to other chains. Polkadot can just bring our capabilities to the extreme. Otherwise, it will be 2020, who will come to an unknown public chain to develop things.

The last point is very important for small teams: shared security - without shared security, the value of cross-chain will be greatly reduced. Based on the Phala Network developed by Substrate, it can be easily connected to cross-chain protocols of Kusama and Polkadot.

Denny:

As mentioned earlier, some advantages of the Substrate framework are important reasons for us to choose Polkadot and Substrate ecology. In addition, we also analyzed and compared some design differences of different public chain networks.

Compared with Ethereum, in terms of network scalability, Polkadot has indeed adopted sharding technology, and there are indeed similar technologies, but the difference from Ethereum is that Polkadot uses heterogeneous sharding technology.

The shards on Polkadot are also called parachains. Each parachain has its own business rules and governance sovereignty. Polkadot uses shared security and shared runtime (Shared Protected Runtime Execution Enclaves), on-chain governance to organize and protect For these shards, each parachain can also choose to apply to join and exit the Polkadot network independently, which is a bit like the European Union from this point of view. Each fragment of Ethereum 2.0 is more consistent and unified, and uses the same business rules and language, and the entire system is governed in a unified manner. Compared with Polkadot's EU model, it is more like the United States.

In addition, many people compare Polkadot with Cosmos. From the perspective of specific technical solutions, there are also many differences. Polkadot uses XCMP to solve the problem of cross-chain message communication. Many people may compare XCMP and Cosmos. IBC for comparison. But in addition to XCMP, Polkadot has many other cross-chain technologies to help parallel chains interoperate, such as shared security, Spree (also known as trust wormholes), which can provide more complete cross-chain applications for cross-chain applications. Chain technology solutions and network facilities.

In addition, Polkadot's support for ecological projects is also very strong, such as Grant, Substrate Builder, BootCamp, Ministry of Finance budget, etc., which are also very helpful for the growth of Polkadot ecological projects.

Lurpis:

I would like to add that I personally think that the biggest advantages of Polkadot over other public chains are mainly three aspects: shared security, heterogeneous cross-chain and no fork upgrade. This is also what Gavin Wood has accumulated from the process of designing the technical framework of Ethereum The valuable experience of Polkadot has made Polkadot a network with strong scalability, high security, and heterogeneous cross-chain.

The parachains developed based on Polkadot or Substrate also inherit these characteristics. The moat built with the development of the ecology is difficult for other projects to surpass in a short time, so choosing the Polkadot ecology is worse than choosing the Substrate framework. , not only reduces the development cost, but also comes with many features that other chains cannot have.

Fuyao:

Leaving aside these mechanisms of on-chain governance, let’s just talk about the tip of the iceberg among Polkadot’s many technologies: the expansion plan.

Polkadot expands through multiple parallel chains. Nodes only need to verify transactions on parallel chains, allowing independent transactions on different parallel chains, thereby increasing transaction throughput and expanding the transaction capacity of each additional parallel chain. This structure is actually like a plug-in strip in life. Polkadot is equivalent to an electrical plug-in strip, which can be connected to various electrical appliances: refrigerators, computers, washing machines, electric fans, and so on. They can handle different business logic and tasks. If the power strip is full, then another power strip can be connected, and then various electrical appliances can be connected. This is equivalent to the secondary relay chain, which is simply Polkadot to Polkadot.

Why is Polkadot an expansion solution? For example, for a household electric fan, the wind power is equivalent to the transaction throughput TPS. It is troublesome to break through its upper limit of wind power, and various improvements are required. Then it is better to directly plug several fans on the plug strip. When one plug strip is full, you can connect another plug strip and then plug in many electric fans. In this way, you can connect many electric fans, and the wind will blow, so Expansion is the core idea of Polkadot.

Everyone wants to hear the truth that has been kept relatively low-key and hidden, and you are not ashamed to say it?

In addition to the collection value of Bitcoin and the long-term accumulated ecology of Ethereum, these two things (note that they do not represent two chains), open CMC or non-small accounts, and look from the top to the bottom, there is no one that can compete with Polkadot .

Liam:

Because Stafi mainly focuses on staking derivatives, and the technical solution is mainly to solve problems on the second-layer network. Choosing a stable underlying public chain is one of the important reasons we consider. There are not many options in the market, and ETH cannot satisfy We need to customize validator behavior. The ecology of the Cosmos SDK is relatively fragmented, and the IBC solution has not made progress. Substrate has become an important choice for us.

In the process of implementation, the Substrate framework has become more and more perfect driven by the Polkadot project, and at the same time has more and richer module choices, which is not available in other ecology. In addition, the design of Parachain can play a very important role as an umbrella for new projects or small market value projects, lowering the threshold for use.

Yue Lipeng:

Yue Lipeng:

The DOT community passed an equation relationship

DOT = ADA + XTZ + ETH2.0 + EOS + ATOM, there is a basis.

ADA's VRF random number is the soul of PoS. The white paper written by XTZ 4 years ago is the beginning of governance. ETH2.0 requires pos+sharding. EOS pioneered the WASM contract. ATOM is also a cross-chain concept. There are no new concepts in the blockchain industry, and everyone knows the good things. The key is that only the Parity team has this engineering capability, and the core logic is simple and rude.

Lord Qing:

Will you choose parachain slots, or parachain threads? Do you have any special plans? How can ordinary users participate in the slot auction (IPO) of your parachain?

Liam:

Stafi's plan has not been fully determined, but participation in the parachain auction is certain. Currently, it is an independent chain but compatible with parachain slots. A large number of Tokens in Stafi's Tokenomic are reserved for the community. Previously, 2% of Tokens passed The StakingDrop method has airdropped users, including DOT and KSM holders. Stafi will combine the development of Staking derivatives to carry out more incentive activities, so that holders of PoS projects can participate in the growth of Stafi.

Yue Lipeng:

Yue Lipeng:

Slots will be expensive, and the thread user experience is very poor, which is equivalent to several chains crowded together, waiting in line to produce blocks. IPO has now become the logic of flexing muscles, which is divorced from Polkadot's positioning. Most projects will write contracts on the parachain, but everyone is not paying attention to this now.

Denny:

Darwinia is currently participating in the access of the parachain test network Rococo.

Darwinia is a Polkadot ecological cross-chain transfer bridge project. Because it meets the requirements of Public Good, on the one hand, it will consider applying to Polkadot for the sponsorship of parachain slots. On the other hand, we are also waiting for the specific details of the parachain slot auction. Details, at that time Darwinia may pass a governance proposal to take part of the budget from the Treasury for the IPO.

If the incentive is not enough, a part of the subsidy will also be considered to motivate DOT holders to participate. At present, the liquidity of RING is still good, and we will be helpful for parachain slot auctions.

In addition, before the Polkadot slot auction, we also plan to allow the Darwinia Crab experimental network to participate in Kusama’s parachain slot auction, so as to better participate in and be familiar with the mechanism of the parachain slot auction. Through the open auction mode officially designed by Polkadot, ordinary DOT holders will be able to obtain RING token incentives by helping Darwinia bid.

Lurpis:

Our specific plan depends on the protocol rules and quantity of Polkadot parachain slots and threads. We will disclose the specific IPO plan before the auction of the parachain slots begins.

Of course, we have also reserved a considerable Token share for the cost of the parachain to give back to the DOT holders who helped us bid for the parachain. Welcome friends who are interested in Bifrost, hold the DOT in your hand and participate in our parachain crowd Come to plan.

Fuyao:

The auction of parachain slots uses a candle auction, which was originally used to sell ships in the 16th century. When the flame is about to go out, you don't know when it will "snap" and go out. The candle auction of parachain slot bidding simulates the process of randomly extinguishing candles on the chain, and the person with the highest bid at the moment when the candle is extinguished wins the auction.

What is the use of getting this parachain slot?

The first advantage is that you don't need to supply your own power supply, and you have a shared consensus mechanism. The consensus is processed by Polkadot, giving you security. Then there is cross-chain intercommunication, communication and business calls between parallel chains.

Parallel chain auction is a new concept proposed by Polkadot. In our opinion, parachain auction is a new way of participating in the network launch without risk. The previous set of CO in Ethereum was to give up the valuable Token. It is likely to be replaced with a bunch of shit coins, but IPO is different. Mortgage DOT, will not give up DOT, and the project party will generally subsidize the cost of staking and time cost, such as Acala.

DOT/KSM holders can obtain Acala's native token ACA/KAR through Staking DOT/KSM. The DOT/KSM participating in the auction does not belong to the project party, but only supports the project party to obtain a parachain slot. Using this method to participate in the project is safer and more convenient, and it also allows DOT/KSM holders and the project party to have a common development goal: to build the Acala parachain well.

In fact, IPO is very similar to the liquidity mining that has been popular now. We will soon launch a special event website for IPO. Please follow the Acala official account to get more details about IPO in the future.

Tong Lin Marvin:

I like the passage of the card boss, so I will fill in the blank.

Phala’s plan has not been fully determined, but it is certain to participate in the [Kusama & Polkadot] parachain auction. At present, Phala is an independent chain but compatible with parallel chain slots [we have completed the local testing of the parachain technology part], Phala’s Tokenomic has [a large number of Tokens] reserved for slot auctions, and [2.7%] of Tokens passed The method of StakingDrop has been airdropped to KSM holders. Phala will cooperate with other parallel chain protocols [to achieve IPO liquidity] to carry out more incentive activities, so that holders of PoS projects can participate in the growth of Phala.

Think of the slots and parallel threads as mobile, China Unicom [monthly 5G packages] and [pay-as-you-go packages]. If you want to spend a lot of traffic, monthly subscriptions are cost-effective; if you use less traffic, it’s appropriate to use a per-traffic package. There is no such thing as [Awesome] [Not Awesome], [Official] [Unofficial], it’s just decided according to the actual production situation business strategy.

In addition, I very much agree with what Mr. Yue said, the current IPO has changed. But as far as I know, from the perspective of some officials, they still hope that high-quality projects will get slots first. Therefore, there will be no logic that "if you have money and can catch hot spots", you will definitely be able to shoot slots, so that you can cheat more money.

Lord Qing:

Thank you very much to the "show" friends who participated in the Math Show #011 event tonight. We wish the Polkadot ecological blueprint stronger and stronger! If you want to know more about Polkadot ecological projects, you can go to:http://polkaproject.com/Understand and pay attention to the Polkadot ecological project.