Editor's Note: This article comes fromBabbitt Information (ID: bitcoin8btc), Author: Qiu Xiangyu, released with authorization.

Editor's Note: This article comes from

Babbitt Information (ID: bitcoin8btc)

, Author: Qiu Xiangyu, released with authorization.QKL123)

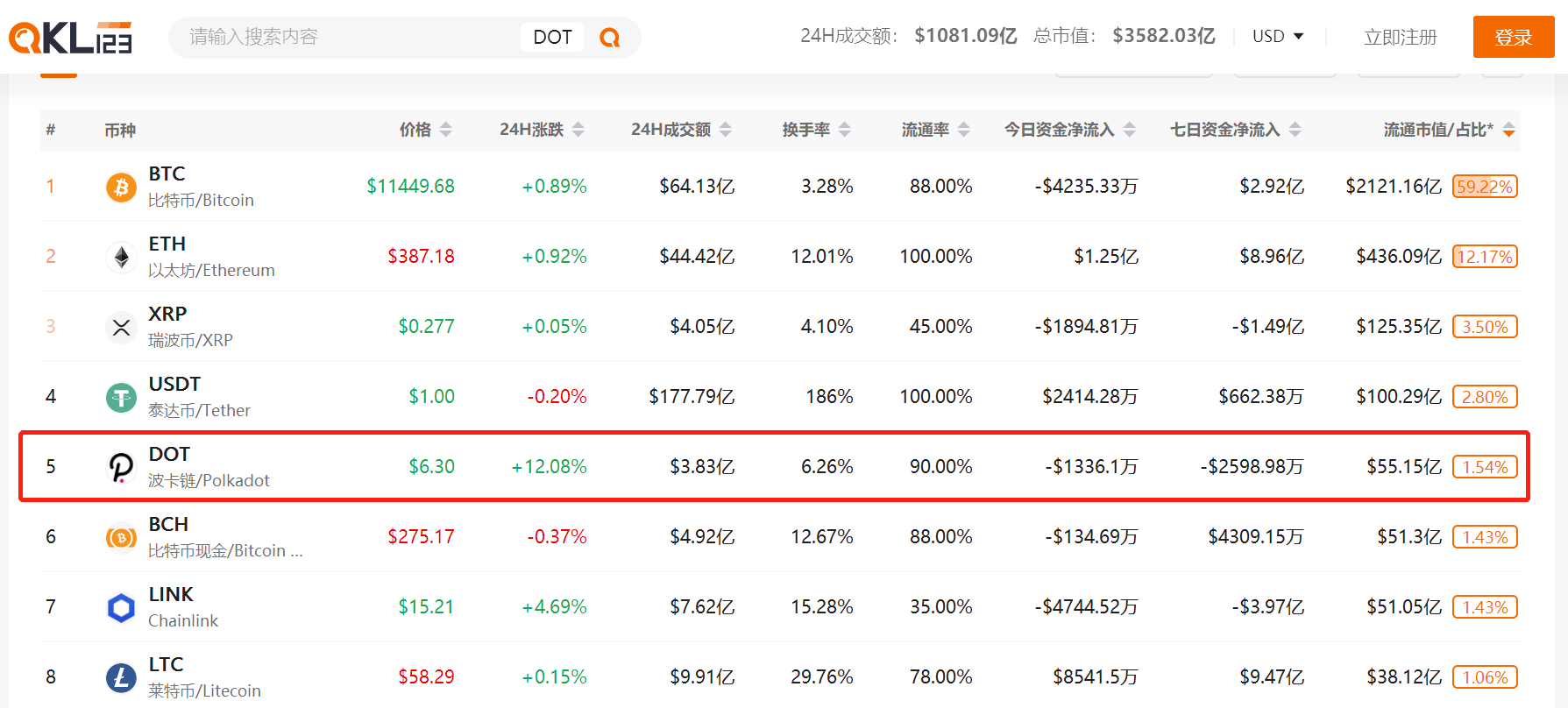

In the early morning of the 26th, a big positive line of DOT broke through the $5 mark and then did not come down. As of press time, the latest price of DOT is $6.3, which is a 110% increase from the post-split price of $3. The market value of Polkadot has also risen to US$5.5 billion, ranking fifth in the market value of cryptocurrencies.

image description

(Data Sources:

With the surge of Polkadot, some people have easily made millions or even "a small goal". Of course, there are also people who regret it because they sold the aircraft.

secondary title

Why did the market fall, but Polkadot rose against the trend?

In this regard, William, the chief researcher of OKEx Research, told Babbitt that there are two main reasons:

Secondly, on August 22, Polkadot completed a 100-fold split plan. In the traditional financial market, stock splits mean good, and the same is true for DOT in the cryptocurrency market. The 100-fold dilution can reduce the price of DOT without compromising the total value of user assets, which is conducive to expanding the investor base, stimulating investors' desire to buy, and attracting more investors to participate, so we can find that it has risen again since the 22nd It has doubled or so, which is the benefit of dilution.

Blockchain investor Ni Kaihao told Babbitt that although the market value of Polkadot has exceeded 5 billion US dollars, the amount of pledges is now very large, and the split and auction are both good. Several large institutions have not sold, so the actual circulation is relatively small. Small.

image description

(70% of DOT is locked)

secondary title

In the past two months, Polkadot's market value ranking has been growing, and its market value has surpassed BCH to rank fifth. William said that there are some irrational factors in the market. But it is more because the market has not seen a high-quality project with a technical tendency for a long time, and it will naturally be sought after. However, William failed to give a specific valuation model.

Ni Kaihao believes that project valuation can only be well valued in a stable period. Polkadot just came out not long ago, and dreams have a greater addition to valuation. For example, eth is like a general motor, valued according to active addresses and gas. Then, dot is Tesla. The volume is small now but everyone has high expectations in the future.

ChainX CMO Kristen gave a valuation model of "equivalence principle". She believes that Polkadot's future prospects are completely immeasurable. Simply put, DOT=ADA+XTZ+ETH2.0+EOS+ATOM.

The biggest highlight of ADA is the true random number consensus; XTZ is governance; ETH2.0 sharding; EOS is the Wasm contract; The front end of the block chain, not to mention the future.

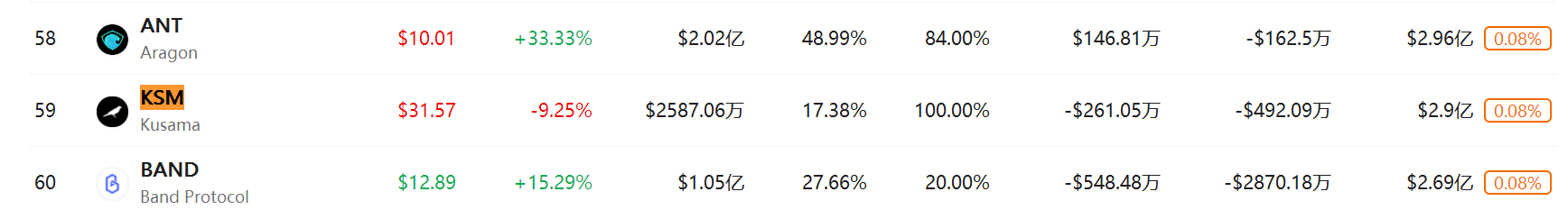

As Polkadot's test network, why does KSM also skyrocket?

It is worth noting that, as Polkadot’s testnet Kusama token, KSM is also rising sharply.

KSM's market capitalization is now nearly 300 million US dollars, ranking 59th.

secondary title

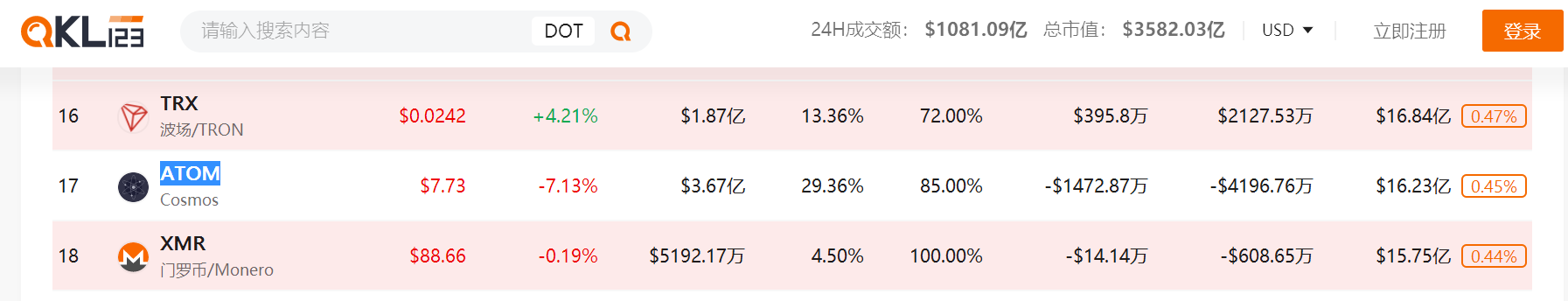

ATOM, one of the "cross-chain duo", has a market value of only $1.6 billion, is it undervalued?

Together with Polkadot, Cosmos is known as the "cross-chain duo", and the mainnet was successfully launched in March 2019. However, in February of this year, there were problems within the Cosmos team, and the project founders left Cosmos to start a new project. At present, Cosmos is still stuck in the core cross-chain protocol IBC 1.0 stage. Although the progress has been accelerated after the team reorganization, it is still unknown when it will be completed.

Compared with Cosmos, William is more optimistic about Polkadot, because Polkadot is bigger than Cosoms in terms of team background and technical strength. The team background is not mentioned for the time being. In terms of model design, Cosmos adopts the Hub-and-Zone (central hub-partition) model, while Polkadot adopts the Relay Chain/Parachain (relay chain/parallel chain) model. The former is mainly used to realize the mutual transfer of Token between the network and the network, while Polkadot can realize unlimited types of information transfer, not just the transfer of Token. In addition, the main network of Polkadot has not yet been officially launched, and it has attracted more attention from the market. There are optimistic expectations, and the market benefits have not yet been exhausted. This is also an important reason why its market value is higher than that of ATOM.

secondary title

Will DOT be the same as EOS back then, after the Three Waves fight?

Since the total amount of Polkadot is 1 billion after the split, it is equal to the total amount of EOS. At the same time, Gavin Wood, the founder of Polkadot, is the co-founder of Ethereum and has a high reputation. The founder of EOS, BM, also became famous because he successfully created two projects, BTS and Steem, before launching EOS. Moreover, both are TOP20 projects in terms of market capitalization, so some people in the circle compare the two projects.

EOS is regarded as blockchain 3.0, and first-line exchanges and various big Vs are running for EOS nodes. In April 2018, before the EOS mainnet went live, the enthusiasm for EOS in the market reached its climax. Driven by various funds, EOS rose to about $22, with a market value of $17.6 billion. At that time, it coincided with a bear market, and Bitcoin fell from a low of about US$20,000 in 2017 to US$8,000. Therefore, the performance of EOS is very eye-catching.

At that time, many big V predicted that the price of EOS would be "500 (yuan) after the three waves". However, after the mainnet launch of EOS in June of that year, it began to fall all the way. The current price is only 3 US dollars, and the market value is only 3 billion US dollars, ranked 13th.

Today's DOT is no less popular than EOS. Exchanges have made small plans for DOT, and Matcha announced that it has recently established a special Polkadot ecological fund to support the development of Polkadot ecological projects. Almost at the same time, Huobi also opened the Polkadot ecological zone, and currently launched two currencies, DOT and KSM.

In order to catch up with Polkadot's popularity, the small exchanges at the bottom of the ranking have stepped up to grab Polkadot ecological projects. For example, Jubi’s first Polkadot token KLP, Tiger Talisman, Gate, etc. have recently launched PCX.

As DOT continued to skyrocket, funds began to flee. According to QKL123 data, in the past 7 days, more than 40 million U.S. dollars have flowed out, and more than 19 million U.S. dollars have flowed out in the past 1 day.

As for whether DOT in the market outlook will be as bad as EOS, it is difficult to judge for the time being. The managing director of the Digital Renaissance Foundation has always been an evangelist of DOT. He said, "Most of the reason why eos is like this is because of bm."

The current Polkadot, whether it is the founder or the ecological community, is working very hard. Gavin Wood has always maintained active communication with the community, almost every key node of Polkadot has his imprint. Faced with some exchanges launching DOT before the agreed time, on August 20, gavin Wood also tweeted that some centralized exchanges were "immoral".

The ecological progress is also very rapid. Cao Yin introduced that although the Polkadot mainnet has just been launched, after two years of precipitation, there are already a number of high-quality high-quality projects in the Polkadot ecosystem, such as Polkadot, which was developed very early. Parallel chain Chainx, Polkadot mobile client wallet Polkawallet. In the field of defi: Polkadot’s DeFi infrastructure Acala, Polkadot’s synthetic asset and mirror asset protocol Laminar, Polkadot’s pledged asset liquidity protocol Bifrost and Stafi, Polkadot’s cross-chain DEX protocol Zenlink, Polkadot’s off-chain asset mapping Protocol Centrifuge, Polkadot defi+nft's important infrastructure Darwinia, etc. In addition, there are a number of defi projects that are about to migrate from Ethereum. For example, REN Protocol has deployed RenVM on acala, which can directly map and issue BTC on acala.

The skyrocketing price of Polkadot has increased the value of investors who participated in the early stage.

In October 2017, Polkadot sold 5 million DOTs. At that time, the cost of each DOT was between $30 and $35. In June 2019, 500,000 DOTs were sold at a cost of around $120 per DOT. On July 24, 2020, the third public offering of Polkadot DOT was held, selling 300,000 DOT quotas at a price of $120. On August 22, 2020, Polkadot completed the DOT split, and the DOT in the Genesis block increased from 10 million to 1 billion. The proportion of DOT owned by token holders in the total supply will not change, nor will it affect Total value of tokens held.

It is understood that someone participated in the sale of Polkadot in the first round, and invested 2 million US dollars at that time. According to the current price of 6.3 US dollars, it is worth at least 36 million US dollars.

There is also an investor who participated in private placement three years ago and currently has a total of 4 million DOTs with a value of 25 million US dollars.

In just 3 years, he earned hundreds of millions, and the rate of return exceeded 10 times. As Jiang Zhuoer, the founder of Leibit Mining Pool, said: In the currency circle, making money is as simple as breathing.