Produced by Odaily

Editor | Hao Fangzhou

Produced by Odaily

Derivatives tools are becoming more and more abundant;

Exchange Weekly Trends

Exchange Weekly Trends

Crypto derivatives exchange FTX is launching a token that tracks bitcoin’s volatility, April 18.

On April 18, Alpha5, an encrypted derivatives exchange backed by Polychain Capital, will launch in June.

On April 18, Binance completed the 11th quarterly burning of BNB, and the value of burning BNB was about 52.46 million US dollars.

On April 18, Renaissance Technologies, a $75 billion hedge fund, will enter the bitcoin futures market.

On April 17, data: more than $3 billion in stablecoins were stored on trading platforms, and Binance accounted for more than 45%.

On April 17, the Binance peer-to-peer trading platform supported Venezuelan fiat currency.

On April 17, data: The daily trading volume of Bitcoin options rose to a one-month high, and Deribit's trading volume accounted for more than 85%.

On April 16, TokenInsight Q1 Spot Exchange Industry Report: Traders have become more rational, but the digital asset industry remains hot.

On April 16, opinion: BTC halving may make most investors keep their assets away from exchanges.

On April 16, OKEx CEO: The value transferred to stablecoins is catching up with Bitcoin, and US dollar thinking is still the mainstream.

On April 15, Huobi Public Chain completed the underlying development and will launch the mainnet in the middle and late 2020.

On April 15, Huobi burned 4,835,500 HT in March, and the amount burned in Q1 increased by 102.4% year-on-year.

On April 14, due to high compliance costs, the encryption exchange Blackmoon announced its closure.

Exchange data statistics

Exchange data statistics

source:

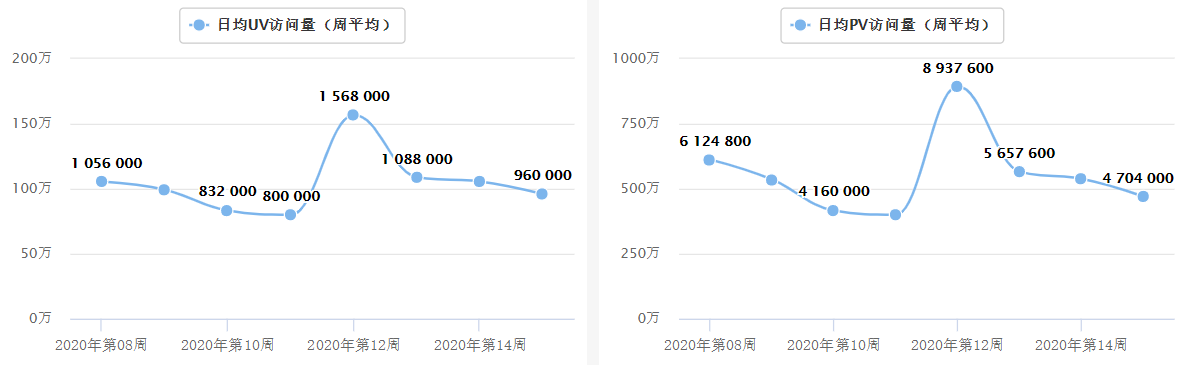

source:Alexa

According to Alexa statistics, the Binance website UV (unique visitors) this week was 960,000/day, a decrease of 9.1% from last week; at the same time, PV (page views) was 4.704 million/day, a decrease of 12.7% from last week. Binance, as the leading exchange in the encryption world, occupies most of the market traffic, which shows that the overall market traffic has declined recently.

source:

source:Dapptotal

Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, and the number of users of Dex reached a peak of 9340; in April and May of 2018, the price of BTC rebounded again, and the number of active users of DEX also rebounded again; therefore, the number of users of DEX can be used as a judgment A reference indicator of market trends, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend is not as highly correlated as the number of users and the price of BTC, so the number of users is intercepted as a reference indicator.

Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, and the number of users of Dex reached a peak of 9340; in April and May of 2018, the price of BTC rebounded again, and the number of active users of DEX also rebounded again; therefore, the number of users of DEX can be used as a judgment A reference indicator of market trends, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend is not as highly correlated as the number of users and the price of BTC, so the number of users is intercepted as a reference indicator.

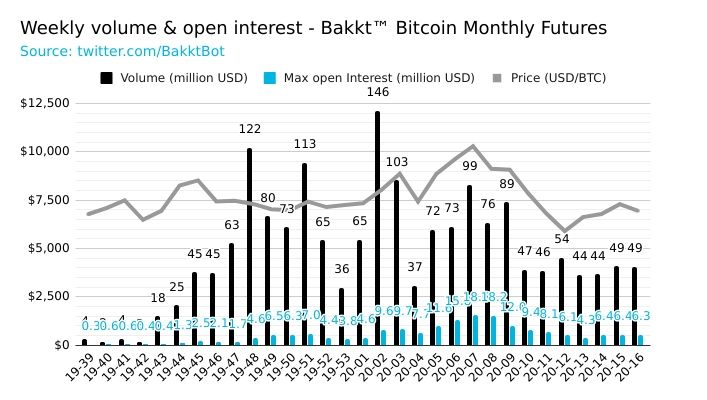

source:

source:Bakkt Volume Bot

secondary title

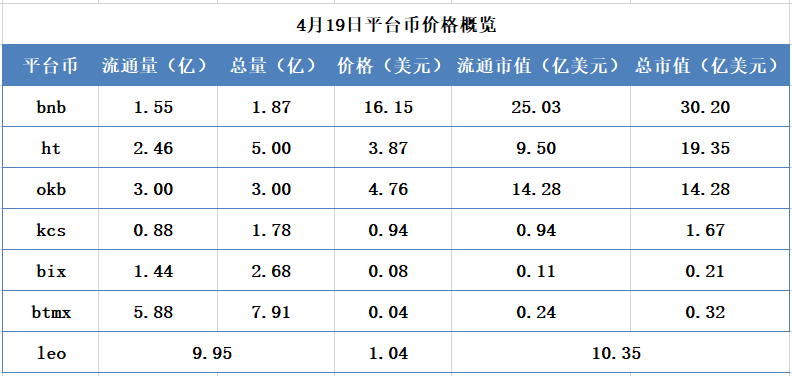

source:

source:tradingview

The blue line is the price trend of BTC, the green line is the price trend of BNB, and the orange line is the price trend of HT.

This week, Bitcoin fluctuated in a wide range, among which BNB performed well. Binance announced a new phase of IEO project, and announced that the burning volume in Q1 of 2020 was 52.46 million US dollars.

source:

source:aicoin

analyst point of view

analyst point of view

Serving professional traders may be one of the directions of future exchanges

This week, Renaissance Technologies, a well-known American hedge fund, announced its entry into the virtual currency market and obtained a license to trade bitcoin futures on the CME Chicago Mercantile Exchange.

The rise of exchanges such as FTX, Bybit, and Deribit that provide traders with more professional trading products and hedging tools since last year has already explained the problem. There is a certain gap, which makes some professional traders unable to find suitable trading tools and effective information, thus avoiding them. Therefore, the next direction of the exchange is not only to gain more market share on the market, but also to extend to the market outside the market. Professional tools for traders.