When 80,000 bitcoins (about $8.69 billion) that had been dormant for 14 years were suddenly transferred recently, speculation about the true identity of this ancient giant whale sparked speculation in the community, and there were many different opinions. The market was violently shaken by the speculation of "Satoshi Nakamoto's return" and the panic of black swan selling pressure.

This shock reflects the deep uncertainty faced by the protection of user rights in the crypto ecosystem: Faced with the market impact that may be brought about by the secret operations of whales, users' core assets and legitimate rights and interests always seem to be hanging on elusive variables - the intentions of whales, the "goodwill" of the platform or the changing compliance boundaries, rather than a solid, transparent and predictable rule cornerstone.

This general anxiety about the weak foundation of rights protection naturally extends to one of the key scenarios for users to interact with the platform - the airdrop mechanism. Once regarded as a tool for inclusive growth, the operation mode of airdrops has caused more and more controversy in 2025:

The "Yap-to-Earn" model promoted by some projects has been questioned for alienating social interactions into mechanical labor of chasing points. User behavior is deeply constrained by the weight distribution of the algorithm black box, and the correlation between their "contribution" value and the final return is unclear.

Some exchanges have set extremely high airdrop entry thresholds, such as "millions of trading volumes", which directly tilts the balance of resource allocation towards large capital holders, triggering widespread discussion about whether inclusiveness is already dead in name only, and retail investors are essentially excluded from core benefits.

As the threshold for participating in airdrops is increasingly tilted from "technical screening" to "capital screening", the fair access opportunities represented by "fleecing" are shrinking. User dissatisfaction and loss have forced the industry to face a key issue: In the absence of a reliable rights protection mechanism, has the design logic of airdrops, as an important means of user incentives, deviated from its original intention, and may even exacerbate injustice? Exploring a new paradigm of airdrops that is more transparent, verifiable, and truly based on user contributions has become an urgent issue to maintain user trust and ecological health.

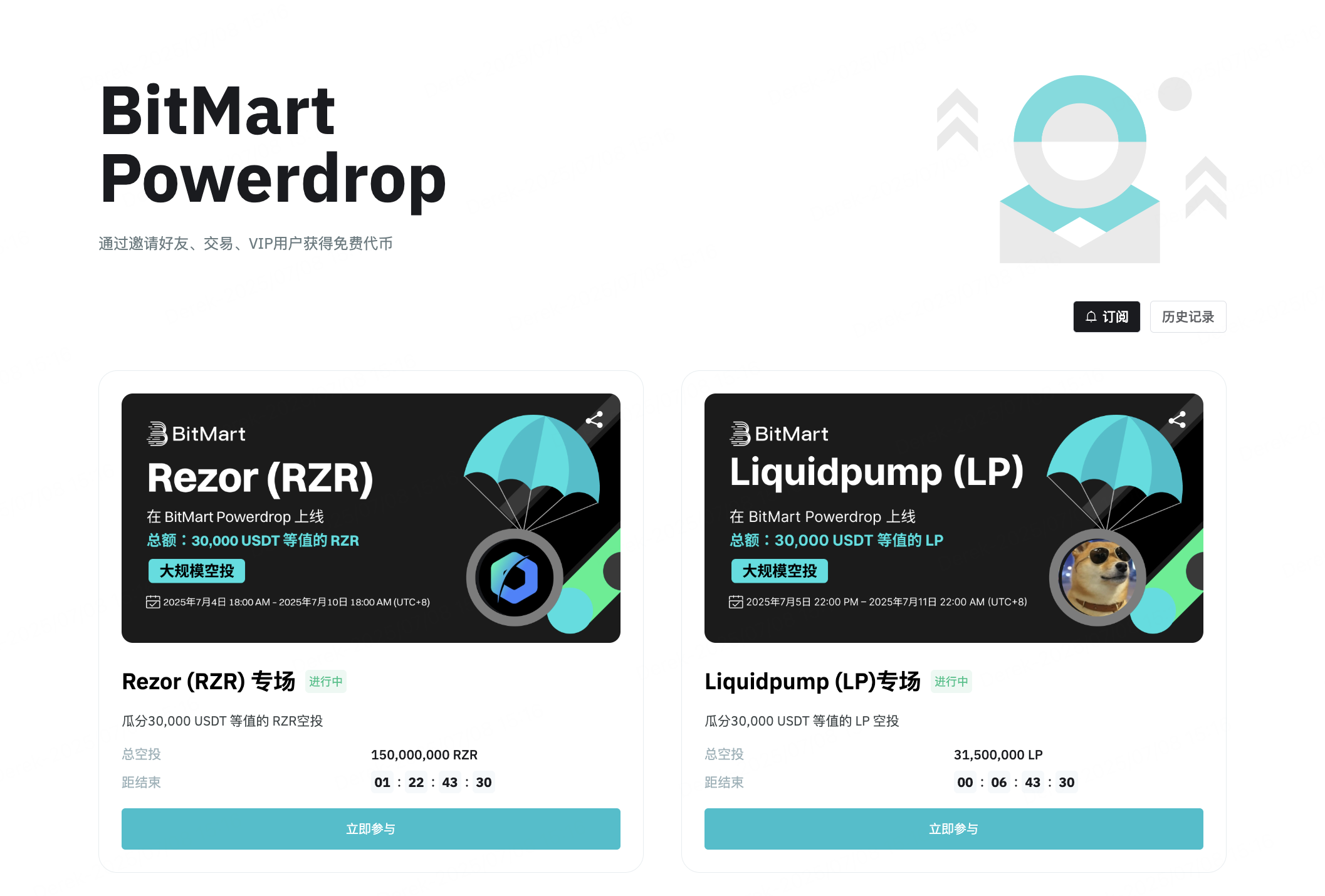

PowerDrop, BitMart’s attempt to break out

In this context, the market has also begun to see some practical explorations aimed at improving the fairness and accessibility of airdrops. For example, some trading platforms have tried to lower the threshold for participation and improve transparency through mechanism design. The PowerDrop mechanism recently launched by BitMart is an attempt:

Reduce access and liquidity risks: The core of PowerDrop is to simplify the participation process. Users only need to complete the basic KYC 1 certification to obtain participation qualifications, which significantly reduces the initial threshold. More importantly, it does not require users to pledge assets or pre-deposit margin, which directly avoids the common liquidity freezing risks in traditional models, especially protecting the capital flexibility of ordinary users.

Contribution-oriented diversified paths: PowerDrop has designed three paths for accumulating “signatures” (participation weights):

Trading behavior: A signature number can be obtained for every cumulative spot trading volume of 500 USDT. This respects the user's trading contribution, and the amount threshold is relatively reasonable, avoiding the barrier of "sky-high trading volume".

Community expansion: Invite friends to complete KYC and deposit more than 10 USDT to get additional signatures. This encourages the natural growth of the community.

VIP level: provides additional channels for senior platform users. The key is that these three paths coexist, and the basic participation threshold (KYC 1) is extremely low, ensuring a starting point of inclusiveness. This design attempts to find a balance between encouraging activity and contribution and ensuring basic accessibility.

Strengthening fairness and anti-monopoly mechanisms:

Algorithmic fairness: PowerDrop randomly shuffles the lottery numbers during the draw to ensure that the probability of winning for each lottery number is relatively equal, reducing the advantage of those who concentrate large lottery numbers.

Anti-whale control: The platform sets a maximum number of signatures per user (5%). Once the number of user signatures exceeds this ratio, manual review will be triggered, effectively preventing whales from monopolizing airdrop rewards by concentrating resources. This is a direct restriction on the excessive expansion of capital advantages.

Transparency and initial practice: According to official disclosure, two PowerDrop airdrop events are currently underway, with a total airdrop amount of 60,000 USDT.

However, although PowerDrop has indeed made positive attempts to optimize the airdrop participation rules and ensure fairness, it remains to be seen whether this innovation can truly subvert the traditional airdrop model in the long run. First of all, although BitMart has solved the equality problem of users participating in airdrops to a certain extent by lowering the threshold and improving transparency, it still cannot completely prevent some "high-level users" from getting more rewards through continuous active behavior. More importantly, whether all crypto platforms can emulate this model or maintain the existing "capital-led" airdrop method is also a question that needs to be observed.

Conclusion: Reconstructing the trust equation in the crypto world

From the awakening of dormant Bitcoin to the gradual improvement of the airdrop mechanism, the industry has finally realized that the real rights of users are not only the distribution of benefits, but also the power to participate in rule-making. From the "sugar-coated bullets" of airdrops to the "threshold traps" to the fairness and transparency brought to users by innovative airdrop mechanisms such as PowerDrop, every change in this process is reconstructing the trust system in the crypto world.

Today, the crypto market is no longer a place for speculation, but an ecosystem full of opportunities and challenges. The protection of user rights no longer depends on the "generosity" or promises of the platform, but is achieved through fair rules and transparent mechanisms. In this transformation, trading platforms have tried their best to provide us with a new possibility, which makes the reconstruction of trust in the crypto market more feasible.

The trust equation of the crypto world may be quietly reconstructed in this process.