Key Takeaways

The total market value of global cryptocurrencies is $3.45 trillion, down 1.7% from $3.51 trillion last week. As of press time, the total net inflow of the US Bitcoin spot ETF is about $49.64 billion, with a net inflow of $770 million this week; the total net inflow of the US Ethereum spot ETF is about $4.4 billion, with a net inflow of $219 million this week.

The total market value of stablecoins is US$265 billion, of which USDT has a market value of US$158.7 billion, accounting for 59.89% of the total market value of stablecoins; followed by USDC with a market value of US$62.2 billion, accounting for 23.47% of the total market value of stablecoins; and DAI with a market value of US$5.36 billion, accounting for 2% of the total market value of stablecoins.

According to DeFiLlama data, the total TVL of DeFi this week is $116.4 billion, up 2.65% from $113.4 billion last week. By public chain, the three public chains with the highest TVL are Ethereum chain accounting for 56.29%; Solana chain accounting for 7.49%; and Bitcoin chain accounting for 5.46%.

From the chain data, except for Solana, the transaction volume of Layer 1 public chains has decreased this week. Among them, BNBChain has dropped the most, with a drop of 32.9% compared with last week. At the same time, Solana has increased by 16% compared with last week. In terms of transaction fees, Ethereum and Solana have changed the most significantly, with Ethereum falling by 50% and Solana falling by 75% compared with last week. From the perspective of daily active addresses, except for Ethereum, Toncoin and Aptos, the rest of the public chains have increased as a whole, among which Sui has increased the most significantly, with an increase of 71.87% compared with last week. At the same time, Solana has increased by 41.88% compared with last week.

● Innovative projects to watch: Keyring Network is committed to providing financial services institutions with licensing tools for on-chain compliance transactions. Its solutions emphasize institutional-level privacy protection capabilities and build a bridge between compliance and blockchain interaction; Strata is a perpetual yield tiering protocol designed specifically for Ethena's Delta-neutral synthetic stablecoin USDe, which aims to provide structured yield exposure; Derolas is a decentralized market-making system built by Olas Agents, which aims to solve the liquidity coordination problem that is prevalent in the DeFi ecosystem.

Table of contents

Key Takeaways

1. Total cryptocurrency market value/Bitcoin market value share

2. Fear Index

3. ETF inflow and outflow data

4. ETH/BTC and ETH/USD exchange ratio

5. Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin market value and issuance

2. Hot money trends this week

1. The top five VC coins and meme coins with the highest growth this week

2. New Project Insights

3. New trends in the industry

1. Major industry events this week

2. Big events coming up next week

3. Important investment and financing last week

1. Market Overview

1. Total cryptocurrency market value/Bitcoin market value share

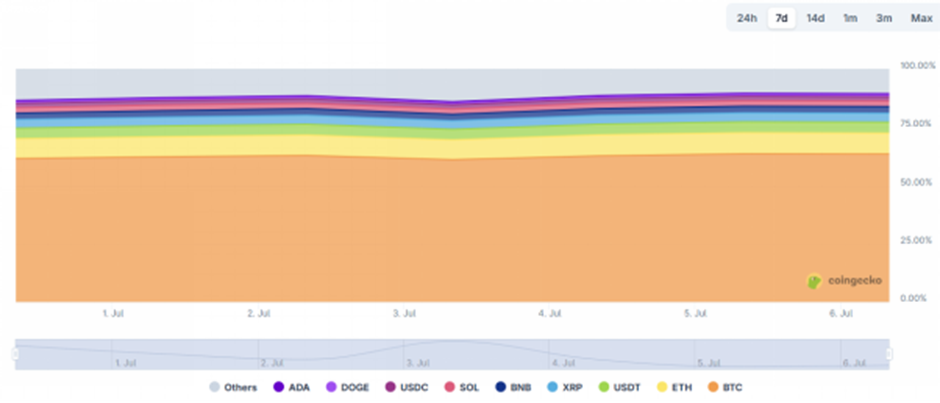

The total market value of global cryptocurrencies is $3.45 trillion, down 1.7% from $3.51 trillion last week.

Figure 1 Data source: cryptorank

As of press time, Bitcoin’s market cap is $2.17 trillion, accounting for 62.96% of the total cryptocurrency market cap. Meanwhile, stablecoins’ market cap is $265 billion, accounting for 7.68% of the total cryptocurrency market cap.

Figure 2 Data source: coingeck

2. Fear Index

The Crypto Fear Index is at 74, indicating greed.

Figure 3 Data source: coinglass

3. ETF inflow and outflow data

As of press time, the U.S. Bitcoin spot ETF has accumulated a total net inflow of approximately US$49.64 billion, with a net inflow of US$770 million this week; the U.S. Ethereum spot ETF has accumulated a total net inflow of approximately US$4.4 billion, with a net inflow of US$219 million this week.

Figure 4 Data source: sosovalue

4. ETH/BTC and ETH/USD exchange ratio

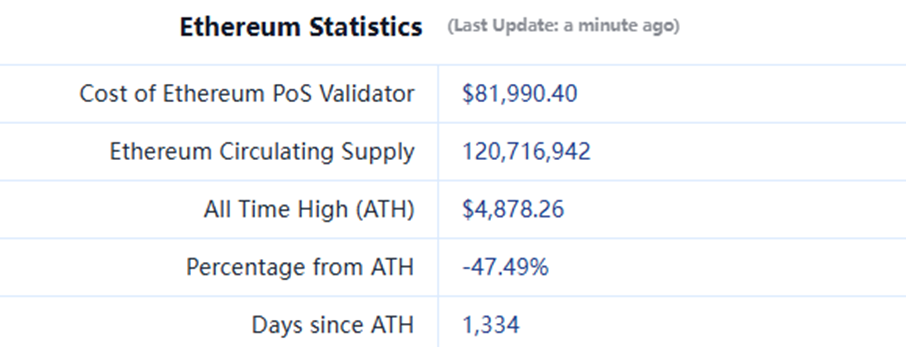

ETHUSD: Current price is $2,562, historical highest price is $4,878, a drop of about 47.49% from the highest price.

ETHBTC: Currently 0.023530, the historical high is 0.1238.

Figure 5 Data source: ratiogang

5. Decentralized Finance (DeFi)

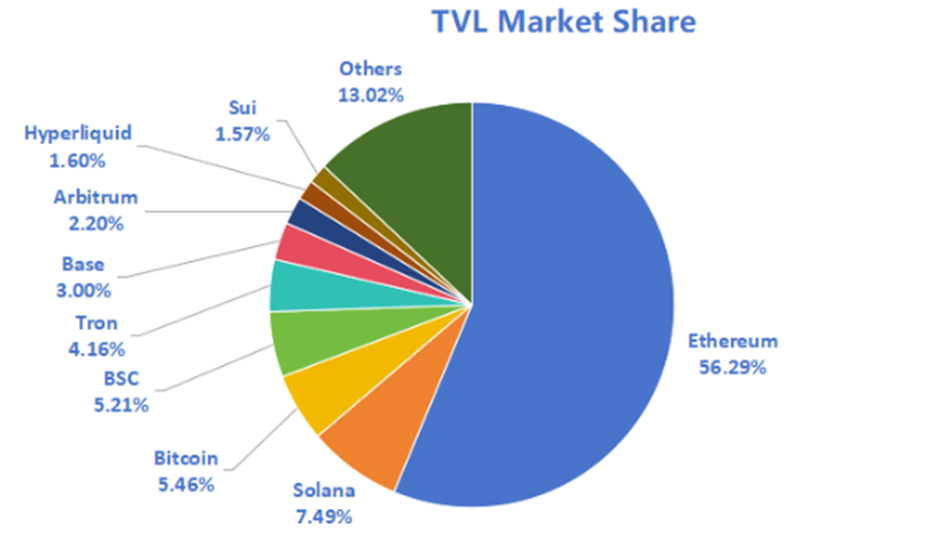

According to DeFiLlama, the total TVL of DeFi this week is $116.4 billion, up 2.65% from $113.4 billion last week.

Figure 6 Data source: defillama

Divided by public chains, the three public chains with the highest TVL are Ethereum chain accounting for 56.29%; Solana chain accounting for 7.49%; Bitcoin chain accounting for 5.46%.

Figure 7 Data source: CoinW Research Institute, defillama

Data as of July 6, 2025

6. On-chain data

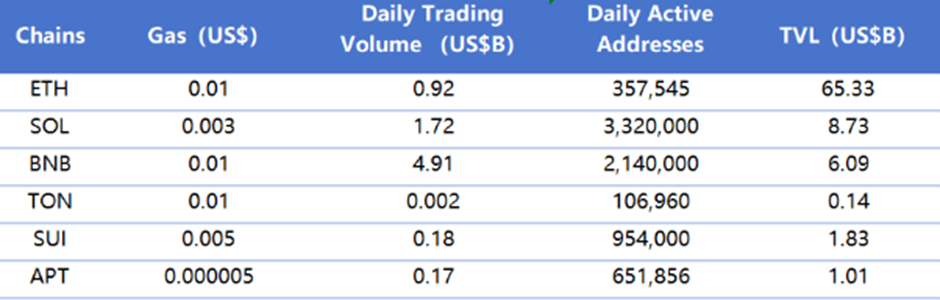

Layer 1 Data

The main data of Layer 1 including ETH, SOL, BNB, TON, SUI and APT are analyzed mainly from the perspective of daily transaction volume, daily active addresses and transaction fees.

Figure 8 Data source: CoinW Research Institute, defillama, Nansen

Data as of July 6, 2025

Daily trading volume and transaction fees: Daily trading volume and transaction fees are the core indicators for measuring the activity of public chains and user experience. This week, except for Solana, the daily trading volume of other public chains has decreased. Among them, BNBChain has dropped the most significantly, with a drop of 32.9% compared with last week. At the same time, Solana increased by 16% compared with last week; in terms of transaction fees, Ethereum and Solana have changed the most significantly, with Ethereum falling 50% and Solana falling 75% compared with last week.

Daily active addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of the public chain, and TVL reflects the user's trust in the platform. From the perspective of daily active addresses, except for Ethereum, Toncoin and Aptos, the rest of the public chains have increased overall, among which Sui has the most significant growth, an increase of 71.87% over last week. At the same time, Solana has increased by 41.88% over last week.

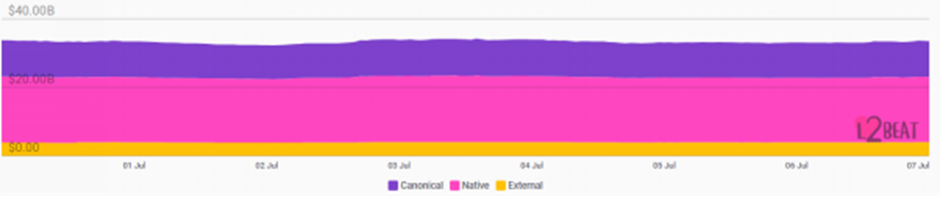

Layer 2 Data

According to L2B eat data, the total TVL of Ethereum Layer 2 is US$33.5 billion, an overall increase of 3.1% from US$32.49 billion last week.

Figure 9 Data source: L2Beat

Data as of July 6, 2025

Base and Arbitrum occupy the top row with market shares of 36.09% and 34.19% respectively. This week, Base still ranks first in the TVL of Ethereum Layer 2.

Figure 10 Data source: footprint

Data as of July 6, 2025

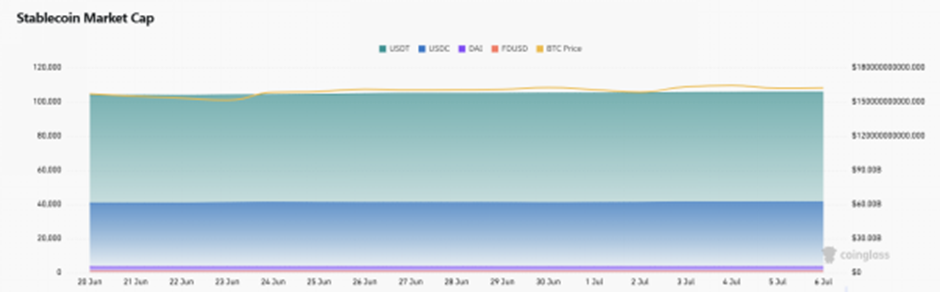

7. Stablecoin market value and issuance

According to Coinglass data, the total market value of stablecoins is $265 billion. Among them, the market value of USDT is $158.7 billion, accounting for 59.89% of the total market value of stablecoins; followed by USDC with a market value of $62.2 billion, accounting for 23.47% of the total market value of stablecoins; and DAI with a market value of $5.36 billion, accounting for 2% of the total market value of stablecoins.

Figure 11 Data source: CoinW Research Institute, Coinglass

Data as of July 6, 2025

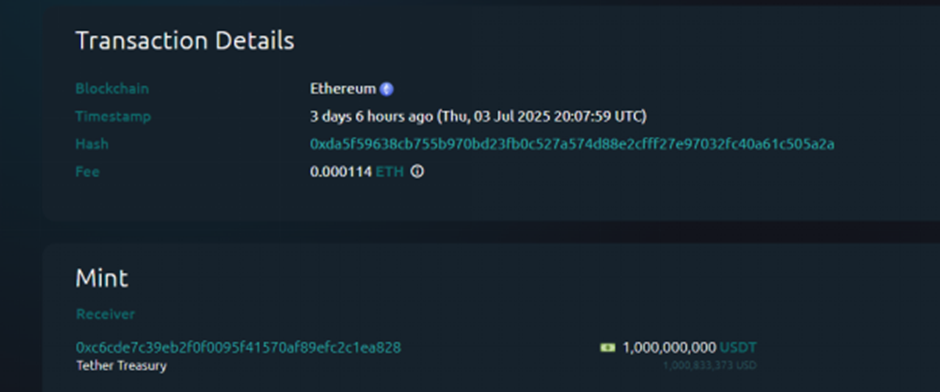

According to Whale Alert data, the USDC Treasury issued a total of 980 million USDC this week, and the Tether Treasury issued a total of 1.06 billion USDT. The total amount of stablecoins issued this week was 2.04 billion, an increase of about 320.62% from the total amount of stablecoins issued last week, which was 485 million.

Figure 12 Data source: Whale Alert

Data as of July 6, 2025

2. Hot money trends this week

1. The top five VC coins and meme coins with the highest growth this week

Top five VC coins with the highest growth in the past week

Figure 13 Data source: CoinW Research Institute, coinmarketcap

Data as of July 6, 2025

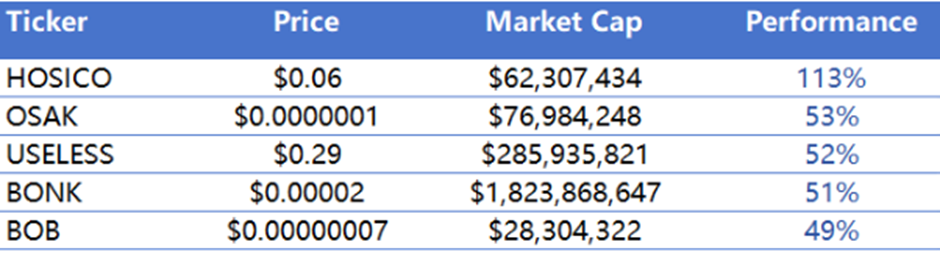

Top 5 Meme Coins That Gained in the Past Week

Figure 14 Data source: CoinW Research Institute, coinmarketcap

Data as of July 6, 2025

2. New Project Insights

Keyring Network: A technology company headquartered in London, UK, dedicated to providing financial services institutions with permissioned tools for on-chain compliant transactions. Since its establishment in 2022, Keyring has used zero-knowledge (ZK) privacy technology to help financial institutions achieve controllable connections with compliant counterparties while ensuring data privacy and security. Its solutions emphasize institutional-level privacy protection capabilities and build a bridge between compliance and blockchain interaction.

Strata: It is a perpetual yield tiered protocol designed for Ethena's neutral synthetic stablecoin USDe, aiming to provide structured yield exposure. The protocol is divided into two risk-level portfolios, senior and junior, allowing users to flexibly configure according to their own risk preferences and share the potential benefits brought by Ethena's arbitrage strategy.

Derolas: is a decentralized market-making system built by Olas Agents, which aims to solve the liquidity coordination problem that is prevalent in the DeFi ecosystem. The system is committed to realizing automated and coordinated market-making strategy deployment through a modular intelligent agent architecture, and improving liquidity efficiency and capital utilization between different DeFi protocols.

3. New trends in the industry

1. Major industry events this week

Lorenzo, an on-chain asset management platform, has launched its first OTF testnet product, USD1+ OTF, which is also its first U-standard income product with USD1 stablecoin as the settlement unit. It has been deployed on the BNB Chain testnet. The product is supported by the financial abstraction layer developed by Lorenzo, which will integrate RWA income, quantitative strategies and DeFi income. All income will be settled in USD1. Lorenzo has therefore become one of the earliest projects to build real income products around USD1, promoting the actual use of USD1 in the on-chain financial ecosystem. Users can participate in product testing by staking USDT, USDC or USD1, obtain s USD1 and tokens representing income rights, and experience a stable, diversified and real income structure.

The Ethereum SVM L2 network has launched the ES token airdrop inspection portal. ASC NFT holders will receive ES airdrops directly on the day of Eclipse TGE, without snapshots and without the need to claim. Eclipse Labs, the Eclipse ecosystem technology and research team, has stated that Eclipse Labs employees have signed documents prohibiting the claim of any ES airdrops and providing all addresses to exclude the possibility of participating in airdrops. All employee and investor allocations will be locked for one year after the token is publicly listed and gradually unlocked over three years.

Protocol Guild said it has distributed nearly $30 million to individuals working on Ethereum L1 research and development since 2022. At current funding levels, Protocol Guild expects to distribute another $37 million over the next four years. Protocol Guild said it still has a long way to go in balancing core development incentives and invites interested parties to participate.

Nexus, a company dedicated to enabling verifiable computation through cryptography and zero-knowledge proofs, said it has sent 10,000 reward points to contributors to the first week of Testnet III, which users can claim in the Nexus OS dashboard.

2. Big events coming up next week

Aethir Edge Token Economics 2.0 will be launched on July 13, introducing a staking-driven reward mechanism. Users need to stake ATH to participate in rewards, which are divided into Bronze, Silver and Gold levels, and can receive up to 240 ATH/day in rewards.

Resolv said it has set the total token distribution for the second quarter at 5.75% of the total supply, of which at least 4% will be used for the second quarter points program. The second quarter started on May 9 and will last until September 9, during which more integrations, opportunities and product improvements will be launched.

Modular RollApp network Dymension has announced the launch of the S 2 season, with the first wave of registration now open to long-term stakers. S 2 registration will be carried out in phases, with different registration bands having different participation conditions and time limits. Successfully registered users will receive DYMONDs, can obtain more through on-chain activities and invitations, and choose to exchange them for DYM tokens in a specific time window, or continue to participate for higher rewards.

3. Important investment and financing last week

Distinct Possibility Studios, with a financing amount of US$30.5 million, has investors including Bitkraft Ventures, BH Digital, Hashed, Shima Capital, North Island Ventures, etc. Distinct Possibility Studios is an independent game studio focusing on the Web3 field, dedicated to developing immersive large-scale MMO and FPS game experiences. Its first project, "Reaper Actual", combines blockchain technology with game mechanics, and has carried out innovative practices in digital assets, player economy and on-chain interaction, which has received widespread attention in the market. (July 4, 2025)

TWL Miner has completed its Series B financing with a financing amount of US$95 million. The investment institutions are not disclosed. TWL Miner is a platform company focusing on cloud mining services, committed to providing users with convenient and efficient cryptocurrency mining solutions. Users do not need to purchase expensive equipment themselves, but can participate in mining with the help of the platform's cloud computing capabilities, thereby obtaining stable passive income. (July 1, 2025)

Caleb & Brown announced that it was acquired on July 1, 2025 for $65.8 million. Investors include Australian trading platform Swyftx. Caleb & Brown is a cryptocurrency brokerage and custody service provider for individual and institutional clients, focusing on providing a secure and efficient digital asset trading experience. (July 1, 2025)

Reference Links:

1.KeyringNetwork https://x.com/KeyringNetwork

2.Strata https://x.com/strata_money

3.Derolas https://x.com/derolas_xyz

4.DistinctPossibilityStudios https://x.com/DPS_Studios

5.TWLMiner https://x.com/twl_miner

6.Caleb & Brown https://x.com/calebandbrown