The crypto derivatives market is experiencing explosive growth in 2025. According to Coinglass data, the total value of open interest in global derivatives exceeded $100 billion in June, and the multi-day trading volume exceeded $300 billion, of which BTC and ETH contributed $67 billion and $28.5 billion in positions, respectively, approaching historical peaks. However, behind the prosperity, slippage risk has become a sword of Damocles hanging over the heads of traders - especially in leveraged scenarios, where a tiny slippage of 0.1% may be magnified to a huge loss of 5% under 50x leverage.

Slippage has become an invisible harvester in the highly volatile market.

BitMart is well aware of the significant impact of slippage risk on traders and always puts user asset security first. After successfully launching the industry's first slippage compensation plan (Phase I) and gaining wide recognition, the platform continues to innovate and launches the Slippage Protection Plan Phase II, achieving a disruptive upgrade on the original basis.

Slippage Protection Plan Upgraded: From "Risk Compensation" to "Ultimate Protection"

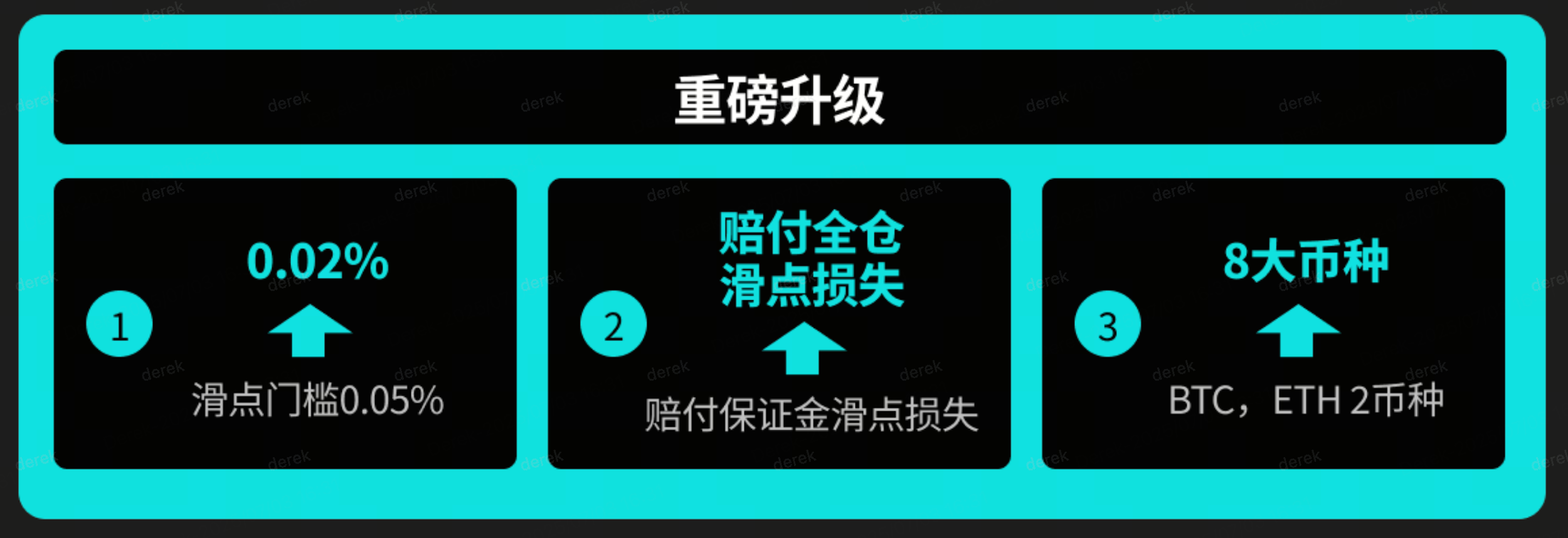

The upgrade logic of the second phase of the Slippage Protection Plan (July 7-31, 2025 UTC) directly hits the core demands of users and reconstructs the protection standards through three dimensions:

1. The compensation threshold has been reduced to the technical critical point

The slippage ratio requirement has been reduced from 0.05% to 0.02% in one period, which is close to the monitoring accuracy limit of the mainstream exchange risk control system. Take the BTC market order as an example: if the expected transaction price is $100,000, the actual execution price is $100,020 (the price difference is $20), which triggers the compensation rule, covering the previously ignored "micro-slippage" scenario. This move demonstrates the platform's confidence in the depth of liquidity and the stability of the engine - the millisecond-level matching capability of BitMart's new generation trading system has also become a key support.

2. Full loss coverage + tiered incentive system

Compensation scope: upgraded from "margin slippage loss" to "compensation for full position slippage loss;

New user privileges: enjoy "200% difference refund" for abnormal slippage in the first month of registration (up to 2,000 USDT per transaction);

BMX holders’ rights and interests: Users holding ≥ 1,000 BMX will receive an additional 10% compensation and priority review channel, thus completing the closed loop of token value capture.

3. Currency Expansion and Efficiency Revolution

Applicable contracts have been expanded from BTC and ETH to 8 major mainstream currencies: BTC, ETH, SOL, XRP, BNB, TRX, DOGE, and ADA, covering most mainstream currency contract trading needs; after the review is passed, USDT will be credited instantly, fulfilling the promise of "ultra-fast compensation", forming a generational advantage over the industry average processing efficiency.

Underlying logic: Facing the essence of slippage and reshaping transaction security standards with technical strength

When the market is unpredictable, the platform should become the only anchor of certainty for users.

In the cryptocurrency market, slippage has always been a major hidden risk faced by traders, especially in a market environment with high volatility and poor liquidity, where slippage is more common. The core of this is due to a variety of reasons: insufficient liquidity depth, instantaneous sharp fluctuations, and dispersed liquidity. For users, slippage directly erodes profits (increases in buying costs/shrinks in selling profits), and is magnified several times in high-leverage perpetual contracts (such as 50-200 times), and even triggers forced liquidation, becoming an "invisible killer" that exceeds handling fees. Therefore, building effective slippage protection, especially setting and reliably executing an extremely low compensation threshold, is a key infrastructure to protect the security of users' core assets and improve transaction certainty.

The second phase of BitMart's "Slippage Protection Plan" is a hard-core solution that directly addresses this pain point, reducing the compensation threshold from 0.05% to 0.02%, which is close to the industry limit. Its core essence is to transform the platform's liquidity depth, system stability, and risk control efficiency into a rigid bottom-line commitment that can be quantified and compensated immediately for user asset losses, anchoring certainty for users in volatility.

The strategic significance of BitMart's move goes beyond a single functional upgrade. By pushing the slippage protection standard to a technical critical point, it defines a "new watermark" for user asset security in the entire crypto derivatives market.

User Gene: Seven Years of Perseverance and Ecological Synergy

The secret to growing to tens of millions of users in seven years? Always engraving "user asset security and experience" into their genes.

Since its establishment, BitMart has always taken "reconstructing user experience through pain points" as its core concept, and is committed to providing the safest, most convenient and most professional digital asset trading services to users around the world. Whether in the continuous improvement of product functions or in the precise grasp of user needs, BitMart always takes the interests of users as the core, and strives to improve transaction efficiency and ensure transaction security through innovative technologies.

The Slippage Protection Program is not an isolated action. It forms a strategic triangle with the previously launched Ace Trader Program (50% copy trading profit sharing) and the Global Community Partner Program, which comprehensively upgrades the contract trading experience. At the same time, the BM Discovery Zone launched not long ago focuses on early on-chain assets, and provides users with full-link support for "discovery-participation-revenue" through dynamic risk control and 0 handling fee activities, continuing the logical main line of "reducing user trial and error costs". This gene is also confirmed in the data: the platform users have exceeded 10 million, and it has been continuously ranked among the top exchanges of CoinGecko.

When the industry is full of uncertainty and black swan events erode user confidence, BitMart announced with the second phase of the Slippage Protection Plan: The value scale of platform responsibility lies in converting uncontrollable risks into measurable protection. It is the strength and confidence from 0.05% to 0.02%, the sincerity of 200% return, and the ecological awakening of the BMX token economy. In this competition with trust as the bottom card, BitMart has thrown the most important chips - because the real industry leader never lets users face the abyss of the market alone. When protection becomes the new benchmark, BitMart is writing the next chapter of the rules of the derivatives market.

About BitMart

BitMart is a leading global digital asset trading platform with over 10 million users worldwide. BitMart is continuously ranked at the top of CoinGecko and offers over 1,700 trading pairs with competitive fees. BitMart is committed to providing a seamless trading experience for users around the world with the philosophy of continuous innovation and financial inclusion. To learn more about BitMart, visit the website , follow X on Twitter , or join Telegram for updates, news, and promotions. Download the BitMart App and trade anytime, anywhere.

Risk Warning:

The following information is provided for informational purposes only and should not be considered a recommendation to buy, sell or hold any financial asset. All information is provided in good faith. However, we make no representations or warranties, express or implied, as to the accuracy, adequacy, validity, reliability, availability or completeness of such information.

All cryptocurrency investments (including returns) are highly speculative in nature and carry a significant risk of loss. Past performance, hypothetical results or simulated data are not necessarily indicative of future results. The value of digital currencies may rise or fall, and buying, selling, holding or trading digital currencies may involve significant risks. Before trading or holding digital currencies, you should carefully evaluate whether you are suitable for participating in such investments based on your investment objectives, financial situation and risk tolerance. BitMart does not provide any investment, legal or tax advice.