After the market rebounded and new institutions entered the stage, the new coin market surged in seconds, becoming the focus of hot money. In particular, a large number of projects have recently issued airdrops through TGE and have been listed on exchanges one after another, sparking widespread discussion on the new coin strategy in the crypto market. In the current environment, is it necessary to continue the short-term thinking of "selling at the opening"? Or is there a need for more long-term gaming value?

In order to analyze this problem, this article focuses on the price performance of new CEX coins after they are launched, providing crypto market traders with a more comprehensive and realistic reference for judgment. We hope to provide the market with a set of guiding quantitative observation frameworks for new coins through data cross-comparison.

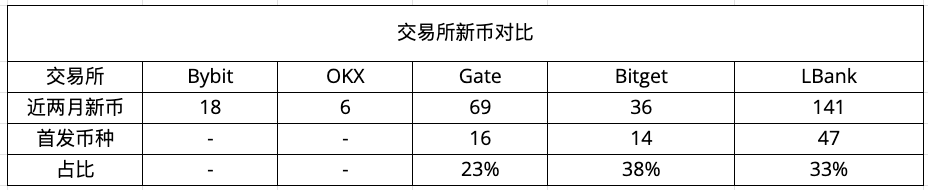

Overview of recent major CEX coin launches

We selected a nearly six-week window from May 1 to June 12, 2025, to conduct a horizontal comparison of the first-time tokens of five exchanges, namely Bybit, OKX, Bitget, Gate and LBank. By counting the number of first-time tokens on each platform, the price performance and transaction depth in different periods after listing (5 minutes, 1 hour, 24 hours, 7 days),

Bybit, OKX - traditional "first-tier" platforms, with strict project screening and a restrained pace of listing;

Bitget and Gate — The number of emerging users and liquidity have leapt to the forefront of the industry and can be regarded as the “new first-tier”;

LBank——A second-tier representative of “latecomers” that has emerged in recent years with its high-frequency debuts.

From May to June this year, the crypto market once again set off a wave of new coin listings, and major centralized exchanges (CEXs) showed obvious differentiation in the pace of new coin launches.

According to our analysis of the coin listing announcements, official Twitter and community dynamics released by various platforms, the new coin listings of the five exchanges between May and June 2025 are as follows:

LBank - 141 new coins were listed in a "machine gun" style, with great opportunities but mixed quality; 90% of the projects showed strong differentiation within 7 days.

Gate - 69 new coins, continuing to maintain the rhythm of "daily update", with large fluctuations and varying depths; there is ample room for short speculation, but also accompanied by the risk of liquidity fault.

Bitget - 36 new coins, driven by both spot and contract, fierce long-short hedging on the first day; individual theme coins can double against the trend, but beware of leverage backlash.

Bybit──18 new coins, strictly controlling the number of coins listed, and an obvious "stopwatch market"; if you miss the opening sprint, the subsequent profit window will narrow quickly.

OKX - 6 new coins, rather have nothing than have something of poor quality, with the strictest standards; the volatility is controlled but the money-making effect is highly concentrated, and you need to be precise in order to reap the dividends.

In general, LBank and Gate create a large number of trial and error opportunities through high-frequency coin listings; Bybit and OKX use a strict selection model to compress the risk range; Bitget is in the middle, using derivative tools to expand short-term gaming space.

From the rhythm point of view, the new coins launched on platforms such as LBank are high-frequency and scattered - an average of 2-3 new coins are launched every day, continuously supplying "new blood" to the market. This machine-gun-style coin listing strategy makes LBank the leader in the richness of new projects. At the same time, some platforms choose to release them in a centralized manner: for example, some exchanges launch multiple tokens at the same time on a single day to create market attention. In contrast, mainstream exchanges such as OKX launched only a handful of new coins in May and June, and tend to carefully select high-quality projects and slow down the pace of coin listing. Although Bybit and Bitget do not have as many new coins as LBank, they also maintain a frequency of new tokens being launched every week and actively follow up on market hotspots.

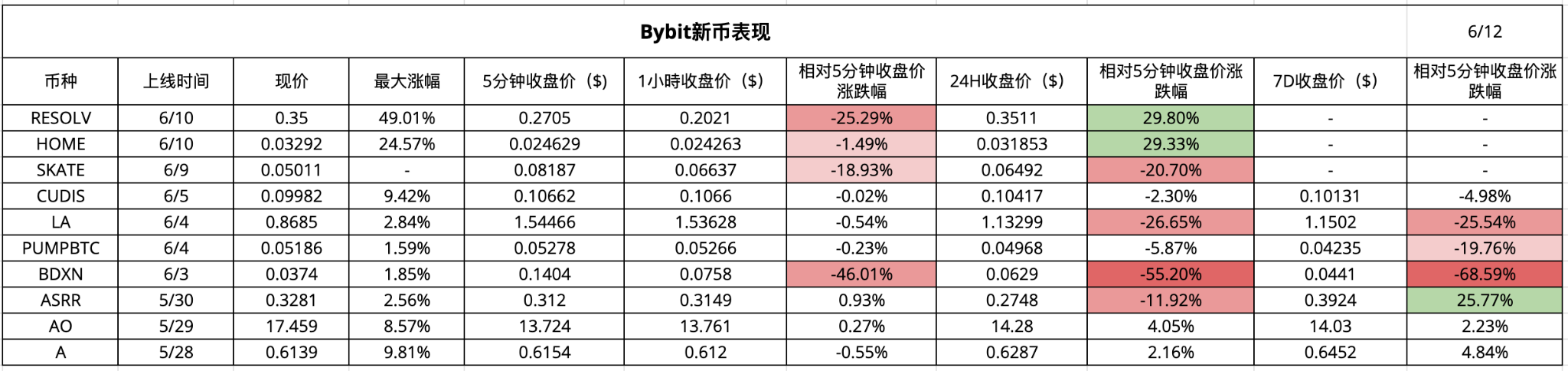

Bybit: Opening high and closing low, the volatility on the first day conceals the subsequent weakness

In the six-week window from May 1 to June 12, 2025, Bybit launched a total of 18 new tokens globally or simultaneously, with an average of about 1 token every 2-3 days. The categories are mostly Meme and new public chain ecological tokens, accounting for nearly 70%. In this round of samples, Bybit's new coins still continue the "stopwatch market" characteristics: RESOLV and HOME rebounded nearly 30% relative to the 5-minute closing price within 24 hours, but the pull-up was mostly concentrated in a few K-lines after the opening; once the buying tide receded, the price quickly fell back. BDXN is a typical "roller coaster"-the 5-minute price is $0.1404, and only $0.0441 is left on the 7th, a drop of 68.6%. Except for ASRR (+25.8%) and AO (+2.2%), the performance of other currencies turned negative in the 7th day, indicating that Bybit's new coin enthusiasm is more inclined to ultra-short-term speculation; if the profit is not realized in the first hour, the value of the position will often inevitably decline in a step-by-step manner.

OKX: The pace of listing fewer but better coins does not guarantee profits

OKX only listed 6 new coins from May to June, continuing its prudent style, but from the perspective of returns, "better to have nothing than to have something bad" does not mean "guaranteed dividends". RESOLV, with the help of the platform depth, pulled out a 48.8% rebound in 24 hours, which is the only bright spot; SOPH, KMNO, and HUMA fell within 24 hours, and retreated 14-45% in 7 days, showing that even the selected projects are difficult to completely resist the liquidity retreat. JITOSOL, as a high-priced asset, fluctuated in a narrow range, and only rose 1.4% in 7 days relative to 5 minutes. Overall, the volatility of OKX's new coins is lower than that of other platforms, but the concentration of the money-making effect is extremely high; if you miss the strong target on the first day, the subsequent opportunities are relatively limited.

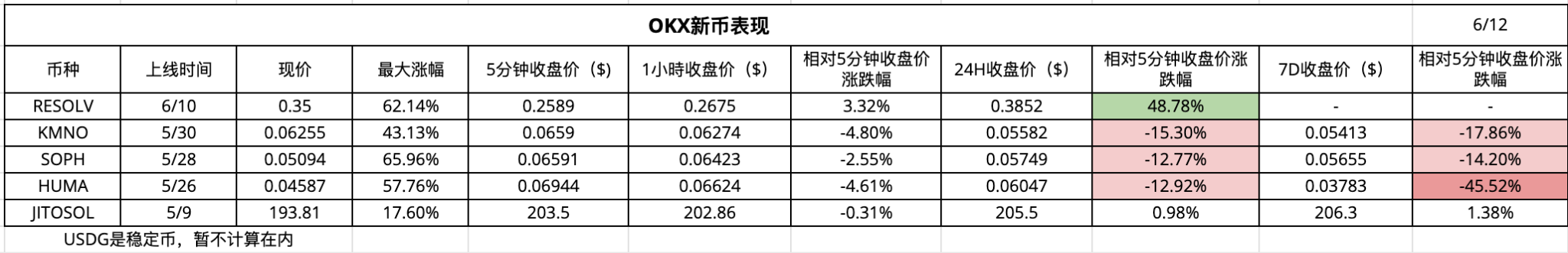

Gate: The frequency of listing coins is the highest, and the decline is wider

Gate has been in the high-frequency queue of 69 first-time listings in the past two months, but the sample shows that its "aftereffects" are also prominent: TQ and SUIRWAPIN's 7-day relative 5-minute closing prices were halved by 92% and 82% respectively, BDXN and BOXCAT also fell by more than 50%, and only STB recorded a slight positive return (+ 3.7%). Although there are occasional short-term "red envelopes" such as YBDBD (+ 29.8%) in the 24-hour dimension, the prices of most coins quickly lost key support after the first day of highs. Gate's market-making depth is relatively weak, and the rise and fall are often magnified by single-point funds-high frequency listings have brought about extremely dramatic short-term pull-ups, and also magnified the waterfall risk in the liquidity vacuum the next day.

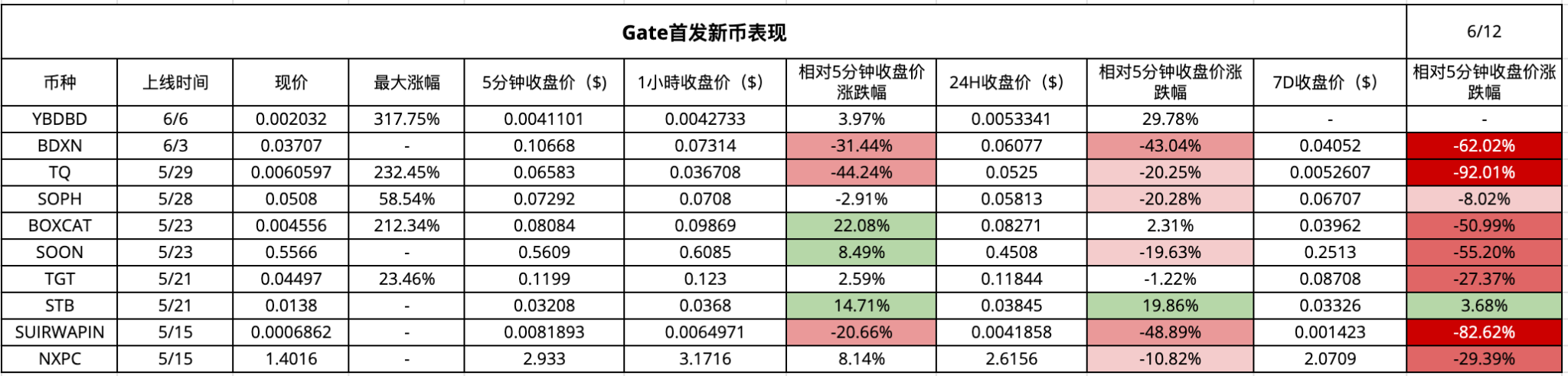

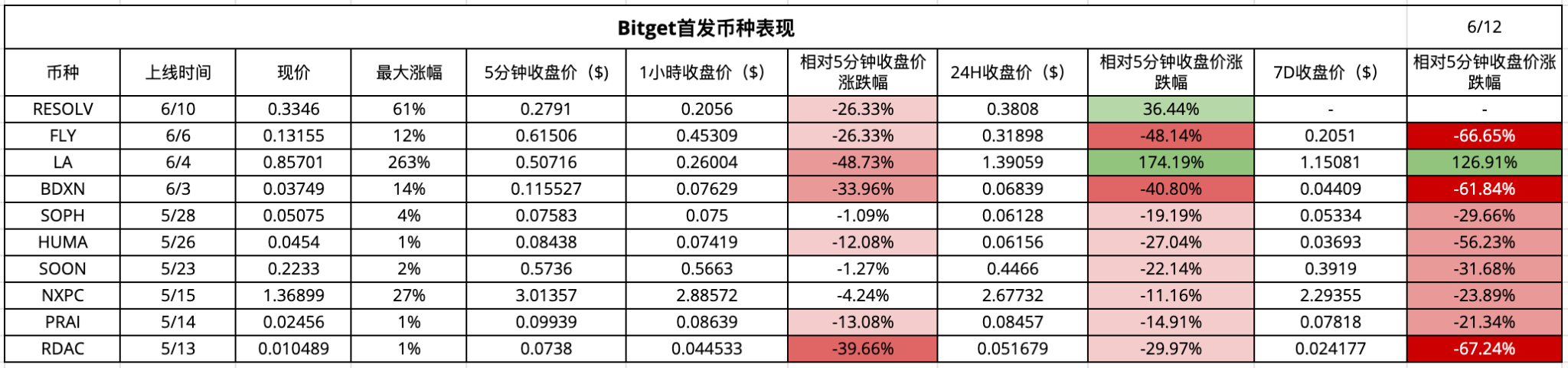

Bitget: "Ice and Fire" under the filter of derivatives

Overall, Bitget's 36 new coins in May and June showed a clear right-skewed return distribution: only LA maintained an increase of about 1.3 times in the 7-day period, barely making it into the "double club"; a few others (about 15% of the total sample) recorded a small increase of 0%-30%; about a quarter of the tokens fell in the range of -10% to -30%, which was a mild performance; and more than half of the projects suffered a deep retracement of -30% to -70% in the first week, including FLY, BDXN, RDAC and other typical cases. Comprehensively estimated, the average 7-day decline of Bitget's new coins was about -28%, the median decline was about -31%, and the probability of a seven-day "red plate" was less than a quarter. This means that the overall profit effect of the platform is concentrated on a very small number of popular targets, and the vast majority of new coins quickly sank under the double attack of contract shorts and a sharp drop in liquidity, completing the "elimination round" in the first week.

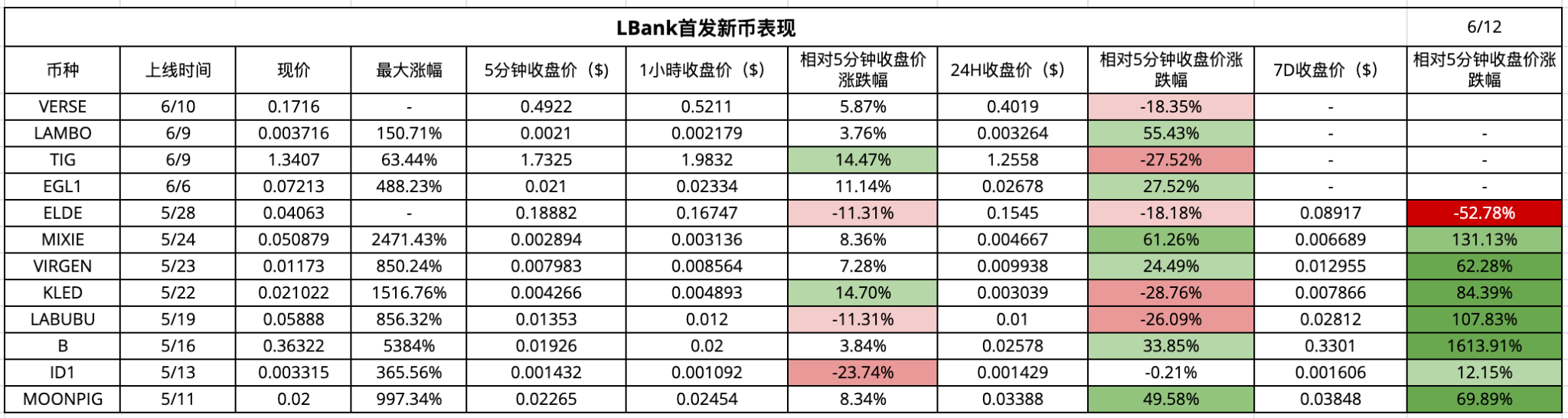

LBank: Extreme differentiation, high-multiple winners and deep drawdowns coexist

LBank leads the industry with 141 first issuances. In the sample, LAMBO (+ 55.4%) and MIXIE (+ 61.3%) rose rapidly within 24 hours. After calming down, most currencies showed a "dumbbell" distribution in 7 days - on one end, there were multiple dark horses such as B (+ 1 613.9%), LABUBU (+ 107.8%), and KLED (+ 84.4%), and on the other end, there were deep decline tails such as ELDE (-52.8%). After calculation, the arithmetic average decline of the sample in seven days was about - 24%, the median decline was close to - 27%, and the "doubling rate" was only 3%. In other words, the loose listing gate does increase the probability of hitting an extreme dark horse, but it also causes most tokens to quickly fall into silence: if there is a lack of agile profit-taking strategies, investors are more likely to be "eaten away" by continuous negative returns in the vast number of choices, and only a very small number of lucky positions can realize the 100-fold myth.

Horizontal comparison

The four platforms show completely different risk-return curves: Bybit's "flash sale" requires extreme entry and exit speed; OKX uses project screening to exchange for smaller fluctuations, but sacrifices overall gains; Gate amplifies the depth of retracement in high-frequency listings; LBank uses its quantity advantage to create dark horses, but with a higher rate of stepping on thunder. When choosing a platform, investors need to choose the right one according to their own trading cycle and risk tolerance: those who pursue short-term arbitrage can pay attention to the high volatility windows of Bybit and Gate; those who prefer stability can wait for OKX's low-Beta new coins; and if you are willing to "pan for gold" in the vast ocean, LBank's huge pool is still the first choice to improve the hit rate, but the premise is to do a good job of position and risk control.

Short, medium and long-term performance of new coins after listing

The listing of new coins is often accompanied by violent fluctuations, and the returns of different holding periods vary greatly. Based on recent data, we selected three representative new coins, B (BUILDon), LABUBU, and LAUNCHCOIN, and analyzed their price trajectories after listing to compare the advantages and disadvantages of short-term speculation and medium- and long-term holding.

B (BUILDon) – “Long-term winner”: The coin was first launched on LBank on May 16. The opening price (5-minute closing price) was about $0.019. The price rose slightly to $0.020 (+~4%) in the first hour, and rose to $0.0257 (about +34% from the opening price) in 24 hours. What is more remarkable is that B coin has been rising since then: it climbed to about $0.330 a week after listing (equivalent to 17 times the opening price), and is currently about $0.363, a nearly 18-fold increase from the opening price. In other words, although short-term trading also makes a profit, it is those who really eat the “big meat” on this coin. It is worth noting that the intraday peak of B coin once reached 53 times the opening price, showing that if early participants can successfully sell at a high price, the single-day profit is also quite amazing. However, such an extreme instantaneous surge is difficult for most people to grasp. Instead, a strategy of patiently holding for several weeks allows investors to share in the dividends of subsequent continued increases.

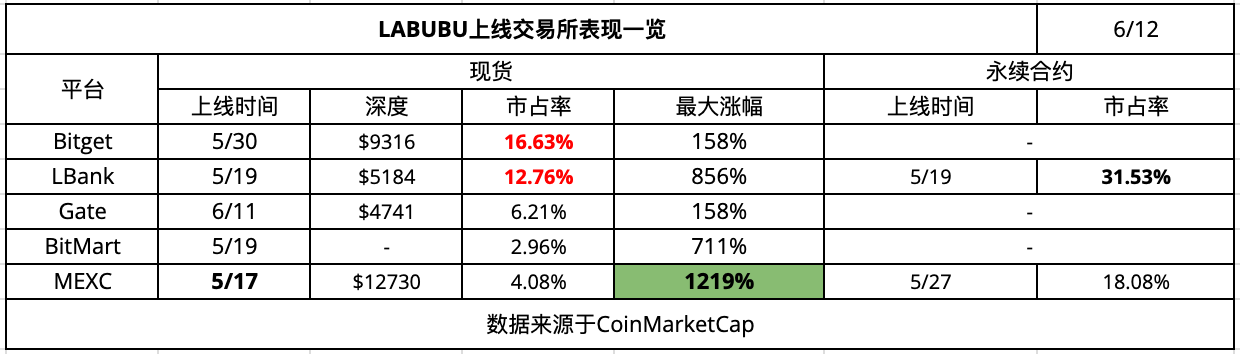

LABUBU – “A new high after a roller coaster ride”: LABUBU was launched on May 19 (LBank and other companies were launched at the same time). The opening price of the coin was about $ 0.0135. Similar to most new coins, LABUBU experienced a sharp rise and fall as soon as it was launched: according to statistics, the highest intraday increase on the day of its launch reached 8.56 times (probably occurred at the moment of opening), but it quickly gave up most of the gains, and the 5-minute closing price fell back to around $ 0.0135. After that, it continued to fall to about $ 0.012 in the next hour (about 11% below the opening price), and closed at around $ 0.0100 in 24 hours (about 26% lower than the opening price). It can be seen that most investors who chased high prices on the first day suffered floating losses. However, LABUBU rebounded in the next few days: one week after its launch, the price rebounded to $ 0.0281, rising back to more than twice the opening price. Entering June, LABUBU continued its strong performance, and as of now, it is about $ 0.0589, which is about 3.4 times higher than the opening price. This trend shows that although short-term trading (selling on the first day) can avoid the risk of intraday retracement, it also misses the opportunity to rise several times thereafter; while medium- and long-term holders get higher returns after surviving the initial shock. Of course, this kind of new currency that first suppresses and then rises is not a common phenomenon, but the case of LABUBU reveals the possible path of "deep trap on the first day, and then double the untrap".

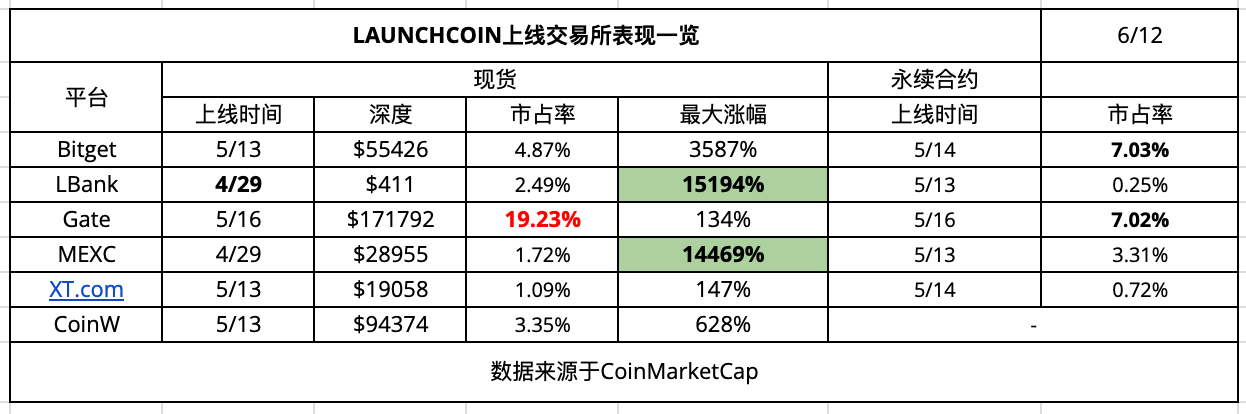

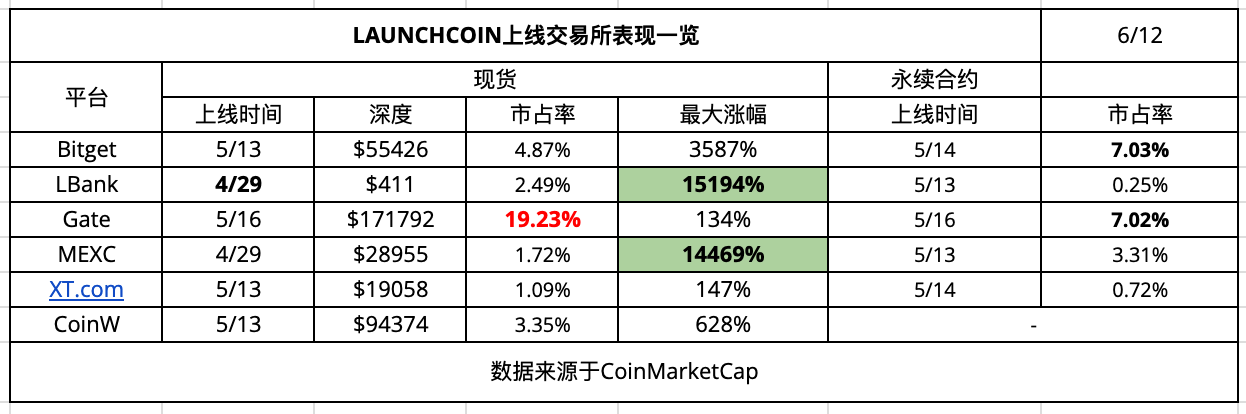

LAUNCHCOIN – “A 100-fold Miracle in an Instant”: As one of the most anticipated new meme tokens in May, LAUNCHCOIN has skyrocketed after its launch on April 29 (LBank, MEXC, etc. were the first to go online). Official data shows that LAUNCHCOIN has accumulated a 15,194% increase (about 152 times) in the first month, becoming the champion of the May increase list. This means that if the opening price is about $ 0.001, it will rise to around $ 0.15 in just a few days. In the actual market, the coin soared on the first day of its launch, and although it has been adjusted back afterwards, it has generally maintained a price far higher than the opening price. As of mid-June, LAUNCHCOIN is still fluctuating around $ 0.20, maintaining an increase of more than 100 times compared to the initial price. For this extreme case, short-term speculators may get a hundredfold return if they close the position in time at the beginning of the surge; and long-term holders may still have huge floating profits even if they miss the peak sell-off. However, it should be emphasized that such "hundred-fold coins" are rare, and the success of LAUNCHCOIN depends more on catching up with the market's craze for meme themes. For most new coins, it is normal to continue to fall after the first day of high. For example, the BDXN coin launched on Bybit at the same time, the price of which was halved from the opening price within less than 1 hour after the opening, nearly -50%; it has been falling all the way since then, and only about 30% of the opening price remains after 7 days, and it has now fallen to less than 27%. In contrast, only a few projects such as AO have risen steadily after listing, rising by more than 20% from the opening price within a week, and currently maintaining an increase of about 27%. It can be seen that in new coin investment, "there are few winners and many losers", and the choice of investment cycle is crucial.

Combining the above three examples and other new coin data, we can see that the holding period has a significant impact on returns:

Short-term (T+ 0 ~ 1 day): Many new coins fluctuate violently in the first few hours after listing, with both the opportunity of a few dozen times increase in an instant and the risk of a deep retracement. The advantage of fast arbitrage is that you can lock in the skyrocketing gains or stop loss in time to avoid overnight uncertainty. For example, for coins like LAUNCHCOIN, only short-term participants can capture the intraday increase of nearly 100 times. However, short-term operations have extremely high requirements for timing. If you are not careful, you may be trapped if you chase high prices. Just like LABUBU’s first day of high rise and fall, the chasers suffered a floating loss of 20% + on the same day.

Mid-term (several days to 1 week): After the first day of trading, many new coins will experience a trend reversal or continue to fall. Mid-term holding can avoid intraday noise and bet on value return on a larger time scale. Some new coins found their lows a few days after listing and then rebounded (such as LABUBU, which rebounded significantly on the 5th to 7th day); but there are also many new coins that once the heat subsides, the price continues to fall for a week, and the holders' losses are increased (such as BDXN, which lost more than 70% in one week). Therefore, the effect of the mid-term strategy varies from coin to coin, and it tests investors' judgment on the project's stamina.

Long-term (several weeks or more): For very few high-growth projects, long-term holding can bring accumulated returns far beyond imagination. For example, B and LAUNCHCOIN can easily bring returns of dozens of times after holding for a few weeks. However, the popularity of most new coins is difficult to last for several months, and in the long run, it may gradually return to zero or become silent. Therefore, holding a newly listed token for a long time is essentially a bet on whether it can stand out and become a "dark horse". There are very few winners, but once the bet is successful, the return is amazing.

In general, the typical trajectory of new coins after listing is a short-term surge and plunge, and then a gradual return to rationality. The vast majority of tokens fell shortly after reaching their highs on the first day, and many never even returned to their opening prices. This means that short-term arbitrage strategies can often lock in unique gains in the early stages of listing and avoid losses from subsequent deep corrections; while long-term holdings are only valuable in individual projects with fundamental support or continued topicality, which may mean shrinking assets for more new coins. For this reason, for new coin investors, "quick in and out" or "long-term holding" has always been a dilemma.

Focus: Differences in cross-platform trading performance of new coins

Different trading platforms often have very different prices and transaction data for the same new coin, which includes both spot market performance and contract trading dynamics. Taking B, LABUBU, and LAUNCHCOIN as examples, we compare their spot and perpetual contract trading performance on multiple exchanges (such as LBank, Gate, Bitget, etc.) to explore the differences in platforms and the possible reasons behind them.

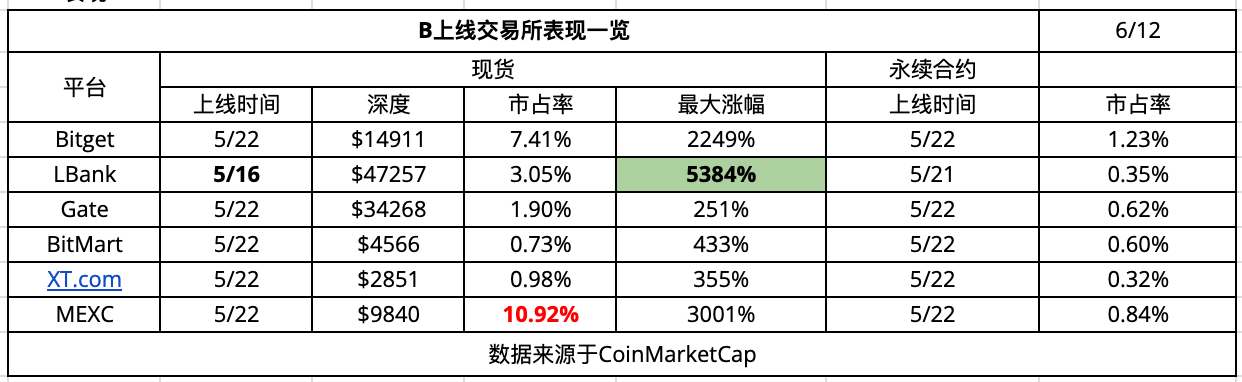

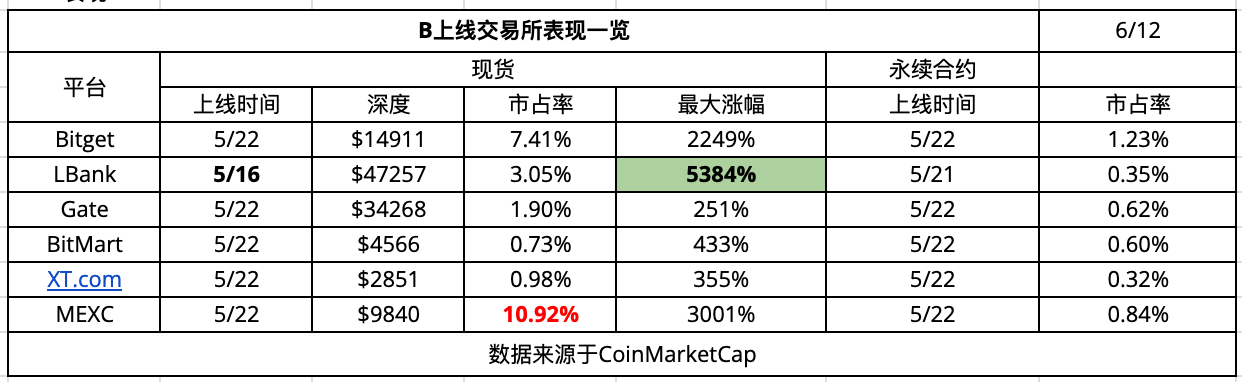

B (BUILDon) cross-platform performance: B coin was first launched globally by LBank on May 16, and then Gate, Bitget, MEXC and other exchanges were launched one after another within a week. On the day of LBank's launch, B coin experienced an astonishing instantaneous pull-up-the maximum increase was as high as 53.8 times (corresponding to LBank's intraday peak). Since LBank was listed the earliest and gathered a large number of speculative funds that poured in at the beginning, the transaction activity and volatility of B coin on this platform were significantly higher than those of later entrants. The order book depth of LBank reached a pending order scale of about $47,257 when B coin was first launched, which was significantly higher than other platforms launched at the same time (for example, Gate was about $34,268 and Bitget was about $14,911). Deeper liquidity means that LBank also provided relatively more takeover orders during the explosive pull, which may have caused B coin to surge rapidly on LBank but not show an extremely out-of-control unilateral market. In contrast, platforms such as Gate, which launched B-coin only on May 22, had already been in the spotlight at that time, and the price was relatively rational: the highest price of B-coin on Gate on the first day only rose to about 2.5 times the opening price. This shows that the launch timing directly affects the price performance of each platform - the earlier the platform is launched, the greater the increase bonus, and the later launches often face a market where prices have already been discovered.

In terms of contract trading, the performance of different platforms is also differentiated. Bitget launched the perpetual contract of B coin on May 22, and quickly attracted a high degree of leverage trading enthusiasm. Its B coin contract trading volume and position interest ranked first among all platforms. Data shows that Bitget has taken about 1.23% of the total network contract market share of B coin, slightly higher than Gate's about 0.62%, while LBank's contract share is only about 0.35%. This abnormal phenomenon (the first launch platform LBank has a lower contract share) may be due to: on the one hand, LBank users are more involved in spot trading and more choose to directly trade spot for profit; on the other hand, users of platforms such as Bitget prefer to use leverage tools to gamble on price fluctuations, thereby gaining greater advantages in the contract market. In addition, it is not ruled out that LBank's B coin contract was launched later (May 21) and the leverage multiple/mechanism is different, causing some high-risk preferences to switch to other platforms. In general, the differences across B-coin platforms are as follows: LBank leads the market and provides deep liquidity in the spot stage, while Bitget and others come from behind in derivatives to attract speculative funds.

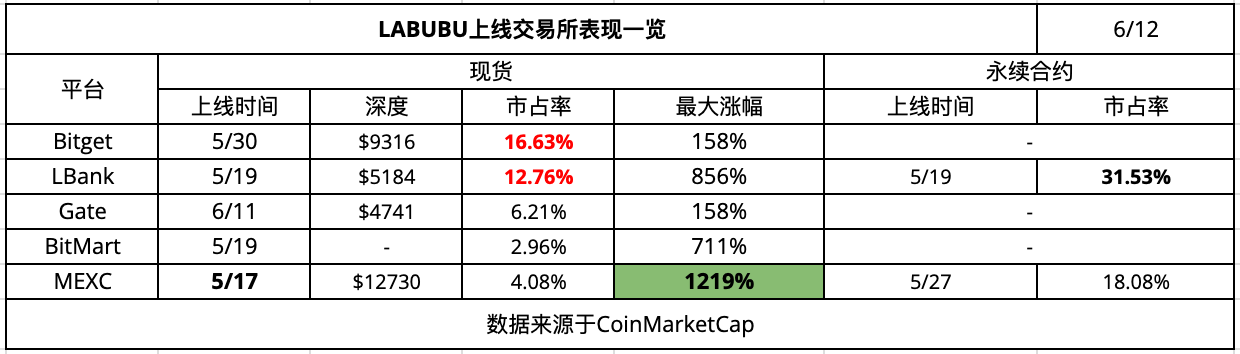

LABUBU cross-platform performance: LABUBU was launched on multiple exchanges almost simultaneously in mid-to-late May, but the trading conditions on each platform were very different. MEXC was one of the earliest platforms to launch LABUBU on May 17, and it saw a first-day increase of up to 12.19 times. Two days later, on May 19, LBank and BitMart also launched the coin simultaneously: LBank, with its experienced user base and liquidity support, raised LABUBU's first-day maximum to about 8.56 times the opening price; while BitMart, due to its small size and limited depth, stimulated a higher increase of 11.11 times - this suggests that on platforms with weak liquidity, small funds can also push prices to fluctuate significantly. It was not until May 30 that Bitget launched LABUBU, when the market heat had weakened. The high point of the coin on Bitget increased by only about 1.58 times, and the market was quite flat. The later Gate (launched on June 11) also had a small fluctuation of about 1.58 times. The time difference of launch plays a key role again here: the later you enter, the smaller the increase.

In terms of spot transactions, the contribution of each platform to LABUBU is different. As of mid-June, Bitget (about 16.63%) and LBank (12.76%) had the highest market share in terms of trading volume, followed by MEXC (4.08%). Although Bitget was launched later, it has achieved considerable trading volume in a short period of time with its user base, even surpassing the pioneer LBank. This may be because Bitget users concentrated on trading when the currency was officially launched, which increased the market share. On the other hand, part of LBank users' trading enthusiasm on LABUBU has shifted to the contract market. LBank is one of the first platforms to provide LABUBU perpetual contracts (the contract was launched on May 19), and as a result, its LABUBU contract trading volume accounted for 31.53% of the entire network, far exceeding other platforms. This means that a large number of speculators choose to open leveraged positions in LBank, whether going long to gain greater returns or going short to hedge spot risks, which makes LBank a leader in the field of derivatives of the currency. In contrast, until the LABUBU popularity subsided, platforms such as Gate and BitMart did not provide contract trading. It can be inferred that LBank provides traders with more strategic options by launching spot and contracts simultaneously, which helps it attract high-frequency trading and hedging needs, thereby consolidating its dominant position in the currency trading.

LAUNCHCOIN cross-platform performance: LAUNCHCOIN's cross-platform transactions show an extreme contrast of "first come, second come" and "second come" being dull. As a star in the meme craze, LAUNCHCOIN was first launched on LBank, MEXC and other platforms on April 29, setting off a 100-fold myth (the maximum increase on LBank was about 151.94 times; MEXC was also as high as 144.69 times). The early platforms that were launched gathered the initial market enthusiasm, and the prices soared. However, this market situation was not generally replicated to later exchanges: Bitget joined the transaction on May 13, and LAUNCHCOIN's highest increase was about 35.9 times - although not as exaggerated as the first launch platform, it was still a huge increase relative to most new coins. It was not until May 16 that Gate began trading the coin. Thanks to the fact that all platforms have completed price discovery, LAUNCHCOIN on Gate opened at a relatively reasonable price. The highest increase on the first day was only 34% (1.34 times) before it stabilized, and there was almost no speculative wave. This difference is also related to the user composition and risk control of each platform: LBank and MEXC users are known for chasing hot spots and dare to buy at high prices to drive the market; Gate user groups and market makers tend to provide deep liquidity (the order depth of Gate was as high as $171,792 when it went online, the highest among all platforms), which suppressed the possibility of a surge.

In terms of perpetual contracts, the launch rhythm of each platform also affects the trading landscape of LAUNCHCOIN. LBank and Bitget opened contract trading the day after the currency was launched (around May 14), and Gate also synchronized the contract on the day of its launch. This means that since the mid-term stage, most mainstream platforms have provided short-selling mechanisms. As rational traders use contracts for hedging, the price of LAUNCHCOIN has not reproduced the outrageous rise in the early days. Data shows that Gate and Bitget occupy a relatively high share in the LAUNCHCOIN contract market (about 7% each), reflecting the participation of their professional trading users; while LBank attracted most of the speculative funds in the spot stage, but the contract market share was divided by latecomers, only about 0.25%. This may reflect the differences in user preferences on different platforms: LBank users are more inclined to spot game surges, and Gate/Bitget users are more active in trading with contract tools. In addition, since top platforms (such as Binance and OKX) have not yet launched these currencies, each exchange has basically digested market sentiment in its own ecosystem, forming a misalignment with each other: some are responsible for "initial speculation" and some focus on "later stage". Overall, the cross-platform experience of LAUNCHCOIN shows that the more mature and stable the platform, the later it is launched and the smaller the initial volatility. On the contrary, emerging platforms dare to be the first to try, in exchange for huge volatility and trading volume. Such differences reflect the different strategies of exchanges: some focus on seizing the market heat and attracting trading volume through a large number of first-time new coins; others focus on project quality and risk control, and would rather have nothing than something bad. This difference in strategy directly affects the number of new coin opportunities that users of each platform can participate in. For example, LBank users have had more than a hundred "tasting" opportunities in the past two months, while users on OKX can only see a few new projects. This also lays the groundwork for subsequent analysis-the differences in the quantity and rhythm of the new coin effects of different platforms may lead to differences in price performance and investment strategies.

In this wave of new coins, some platforms have achieved outstanding results with aggressive coin listing strategies. According to official data, LBank led the world in the performance of new coins in May: the average first-day increase of its new tokens was about 90% higher than that of other exchanges. At the same time, Coingecko's report also showed that LBank ranked first in the number of 100-fold coins. This shows that the active coin listing strategy has brought high returns to platform users and attracted the attention of investors who prefer high risks and high returns.

In summary, the three cases of B, LABUBU, and LAUNCHCOIN reflect the significant differences in the performance of new coins among trading platforms. Factors affecting these differences include:

Timing of listing: The first-launch platform often enjoys the highest increase and trading popularity, while the price trend of subsequent platforms tends to be milder due to improved information transparency.

User composition: Platforms where emerging market users who prefer speculation gather are more likely to experience extreme market conditions; while platforms where institutions and rational traders account for a high proportion have more stable prices.

Liquidity depth: Higher order depth helps buffer price fluctuations (for example, when Gate launched LAUNCHCOIN, its depth was much deeper than that of early platforms, so its increase was limited).

Derivatives supply: The earlier the contract is launched, the more hedging means it can provide to the market, thereby suppressing the bubble component (for example, LBank/MEXC did not launch the LAUNCHCOIN contract in time, causing the spot price to surge first; Gate launched the contract simultaneously, and the price was much more rational).

Project popularity: As project popularity increases over time, buyers and sellers will be more rational when a new platform is launched, making it less likely for blind speculation to occur.

For investors, this means that participating in new coin transactions on different exchanges will face different market ecosystems and risk-return characteristics. Choosing the first launch platform means facing the greatest opportunities but also the highest risks, while waiting to trade on a larger platform may miss out on huge profits but the volatility is controllable.

Conclusion and strategic recommendations

From the above analysis, we can see that the "new currency effect" not only breeds the myth of getting rich quickly, but also contains huge risks. Under the current market sentiment, whether investors should choose to quickly arbitrage or hold for a long time to endure fluctuations depends on their own risk preferences and confidence in the project.

Short-term strategy (T+0 fast in and fast out): From the data point of view, short-term trading can more effectively seize the unique bonus of the first issuance of new coins. For example, the average increase of new coins on platforms such as LBank on the first day far exceeds the industry average, and many tokens have achieved several times or even dozens of times increase in a few hours. However, it should be noted that the fleeting market requires traders to have superb execution: including watching the market, fast in and fast out, and strict stop-profit and stop-loss discipline. Once the judgment is wrong and the position is trapped, the short-term position should also be decisively stopped to prevent small mistakes from turning into big losses. In the current market conditions (hot spots come and go but the sustainability is questionable), this small and fast operation idea can avoid long-term exposure of funds to high-volatility targets and reduce the risk of black swans. Especially for investors who are not familiar with the fundamentals of the project, it may be a wise move to stop when they see good results. As the saying goes: "No matter how much it rises, you won't make money if you don't sell it." The core of the short-term strategy is to realize the benefits in time.

Long-term strategy (HODL): In contrast, long-term holding of newly listed tokens is a high-risk, high-return gamble. A few projects with real substance or hitting the right jackpot (such as the above-mentioned LAUNCHCOIN, B, etc.) will continue to rise after listing, and long-term holders will receive cumulative returns far exceeding short-term gains. At the same time, long-term holding avoids the transaction costs of back-and-forth turnover and the pressure of frequent monitoring. However, it must be emphasized that most new coins will not rise all the way to new highs, but will slowly decline or even return to zero after the heat subsides. Therefore, the HODL strategy for new coins should be carefully screened. It is best to select a few trustworthy coins based on fundamental judgment or medium- and long-term theme logic (such as project technology innovation, community consensus, etc.). At the same time, be prepared to withstand a large retracement. In the current context of volatile market sentiment, blindly holding new coins for a long time is not the most cost-effective option unless you have a deep understanding and confidence in the project.

Balanced view: For most investors, a combination strategy may be adopted: divide the new currency investment into "two-layer positions" - one part is used for short-term fighting, fast in and out to lock in the profits in the early stage of listing; the other part (a small proportion) is retained in the bottom position to gain the potential for subsequent growth of the project. This approach is equivalent to using profits to gamble on possible long-term critical returns without losing the principal. In addition, the rational use of tools provided by the platform is also part of the strategy. For example, the rich and liquid new currency features on platforms such as LBank give investors the opportunity to diversify their layout of multiple projects to increase the probability of hitting the "dark horse", while also hedging some risks through the contract market that is launched simultaneously (for example, shorting the perpetual contract to hedge the spot position after the surge). This strategy of combining diversification and hedging can take into account both returns and risk control to a certain extent.

Conclusion: The recent craze for new coins reminds us again that high returns are always accompanied by high risks. Whether it is intraday arbitrage or long-term lurking, it must be based on a clear understanding of one's own trading ability and risk tolerance. Faced with the tempting "first-time effect", rational investors should maintain a calm data-oriented analysis and choose the right platform and time to intervene. For those who are good at short-term operations, platforms such as LBank, which are rich in currencies and active in trading, provide a stage for them to show their talents; and for those who believe in value investment, they should choose new projects with long-term value and hold them patiently, and be alert to the turning point of market sentiment. In short, in the current market atmosphere, it is a more prudent strategy to prefer short-term gambling to obtain certain returns, but it is also possible to keep a long-term expectation for high-quality projects - the key is to find your own balance between gambling and perseverance.