Recently, a seemingly routine on-chain transaction has attracted widespread attention in the industry. A user with a wallet ending in 721 suffered severe losses when executing a KOGE/USDT buy operation. According to the on-chain monitoring @ai_ 9684 xtpa report, the user's order was split and routed to multiple liquidity pools by the system and suffered a MEV attack. He spent 47,000 USDT and received only 0.009 KOGE, which is equivalent to a unit price of up to 5,181,958 US dollars, and suffered heavy losses.

Although similar incidents are common in the decentralized trading ecosystem, the large amount of money involved this time and the typical process have sounded the alarm for crypto users about the risks of on-chain operations. Multiple accounts on the social platform X also issued warnings about this incident, emphasizing not to set too high slippage and not to turn off MEV protection.

High slippage and lack of MEV protection increase the risk of on-chain transactions

There are two key mistakes behind this tragic event:

Setting too high slippage: High slippage leaves a huge profit margin for MEV attacks, becoming a bait for attackers to squeeze positions;

MEV protection is not enabled: After giving up key transaction protection, users are directly exposed to the risk of being squeezed.

The most common attack method is the "sandwich attack", which manipulates the transaction order and price slippage range. The attacker buys at a low price before the target transaction and quickly sells it for profit after the target transaction raises the price. The complexity of on-chain transactions makes variables such as slippage settings, asset split paths, and pool liquidity common "mines". For ordinary users, risk identification and transaction configuration capabilities themselves constitute a threshold.

BM Discovery: Reconstructing the on-chain asset participation experience with the advantages of centralization

MEV attacks, high slippage, routing splits... these potential risks brought by the complexity of on-chain transactions continue to emerge. A simple mistake in one operation may lead to capital loss. For ordinary users, the lack of professional tools and on-chain practical experience makes the risks more invisible and more threatening.

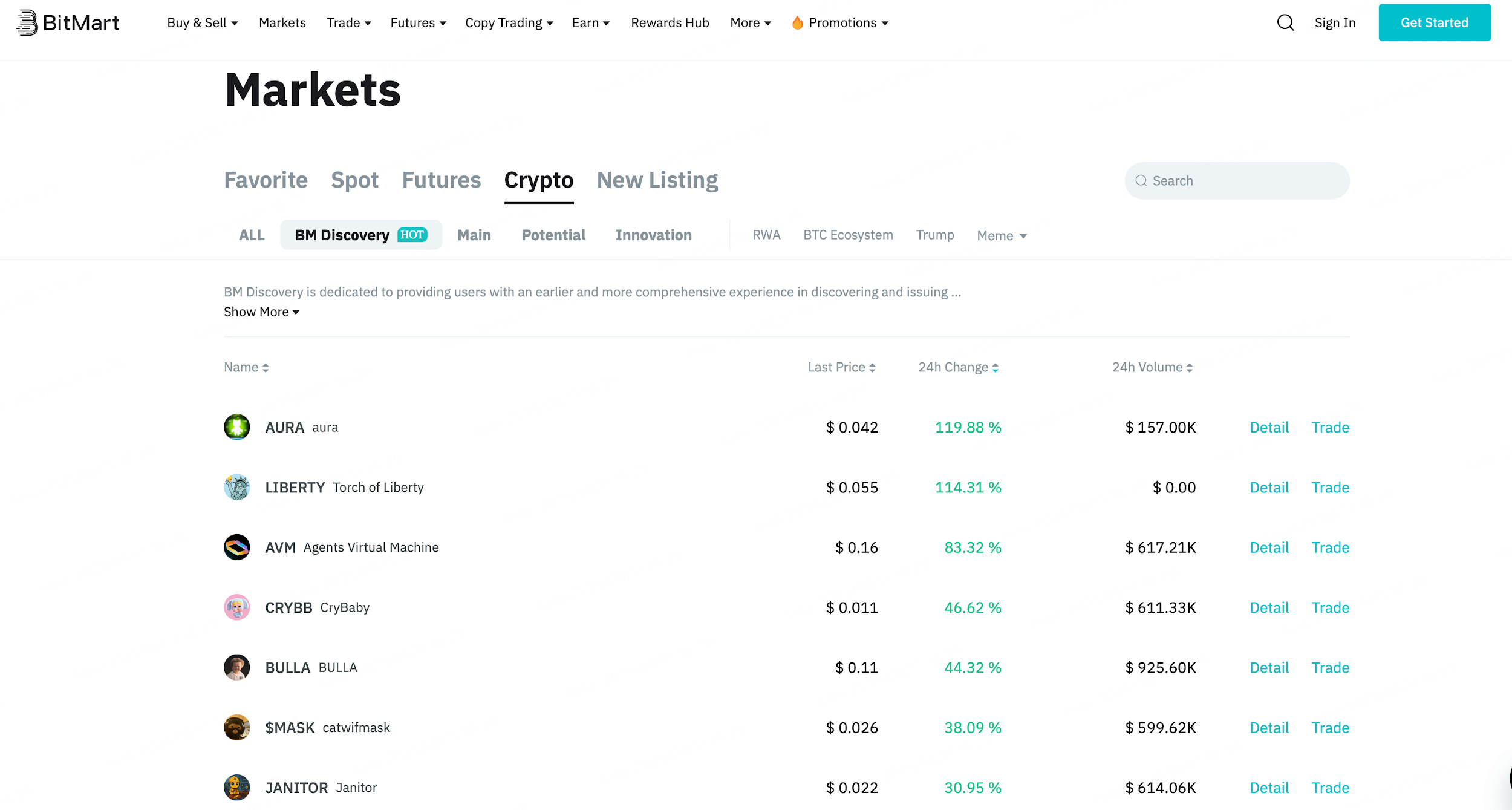

In the context of such frequent risks, the BM Discovery zone launched by BitMart is becoming a solution that attracts more attention from users. This zone focuses on the discovery of high-quality assets on the early chain, and through the mechanism advantages of centralized exchanges, it creates an asset participation portal for users that is both convenient and risk-controlled.

BM Discovery mainly builds new paths for on-chain asset exploration around three aspects:

Professionalize the screening mechanism to reduce blind participation of users

BitMart relies on its internal research team and on-chain data tracking system to cross-examine candidate assets from the perspectives of fundamentals, on-chain activity, community consensus, etc., screen out risky projects, and pre-bury potential assets to help users obtain early Alpha at a lower cognitive cost. Many assets have also performed well in the market after going online, with significant increases.

Centralized experience, solving the threshold of operation and on-chain interaction

Compared with using DEX directly, BM Discovery saves users from having to manually set slippage, routing paths, wallet signatures and other complex operations. All transactions are completed within the platform without paying gas, greatly reducing the possibility of users being trapped due to misoperation or encountering other risks.

Dynamic response to risks to improve user safety margin

BM Discovery has established a risk control system that integrates on-chain and off-chain. The platform will continuously monitor the market performance and potential anomalies of listed assets, dynamically remove risky assets, and ensure that the trading environment remains controllable.

In addition, in order to encourage more users to use Discovery to participate in on-chain asset mining, BitMart is launching a limited-time 0 fee discount for spot transactions in the Discovery zone, providing users with a lower-cost trial space.

Risk revelation: from free trade to trusted participation

As the decentralized ecosystem flourishes, more and more users realize that there are still certain thresholds and risks in completely relying on individual users to complete on-chain strategies and risk control deployment. Mechanisms such as high slippage and MEV vulnerabilities are highly professional in themselves, and BM Discovery represents a new idea: using a more friendly transaction structure and platform screening mechanism to reduce the spillover of technical risks, allowing more users to participate in early asset dividends more safely.

The launch of BM Discovery is not only a strategic deepening of BitMart's on-chain asset layout, but also reflects its proactive construction capabilities as a trading platform in the entire process of "asset screening-user participation-security assurance". Faced with the complex and ever-changing on-chain asset ecology, BitMart is opening a new path for investors to avoid reefs and discover value in a more controllable, more credible, and more professional way.