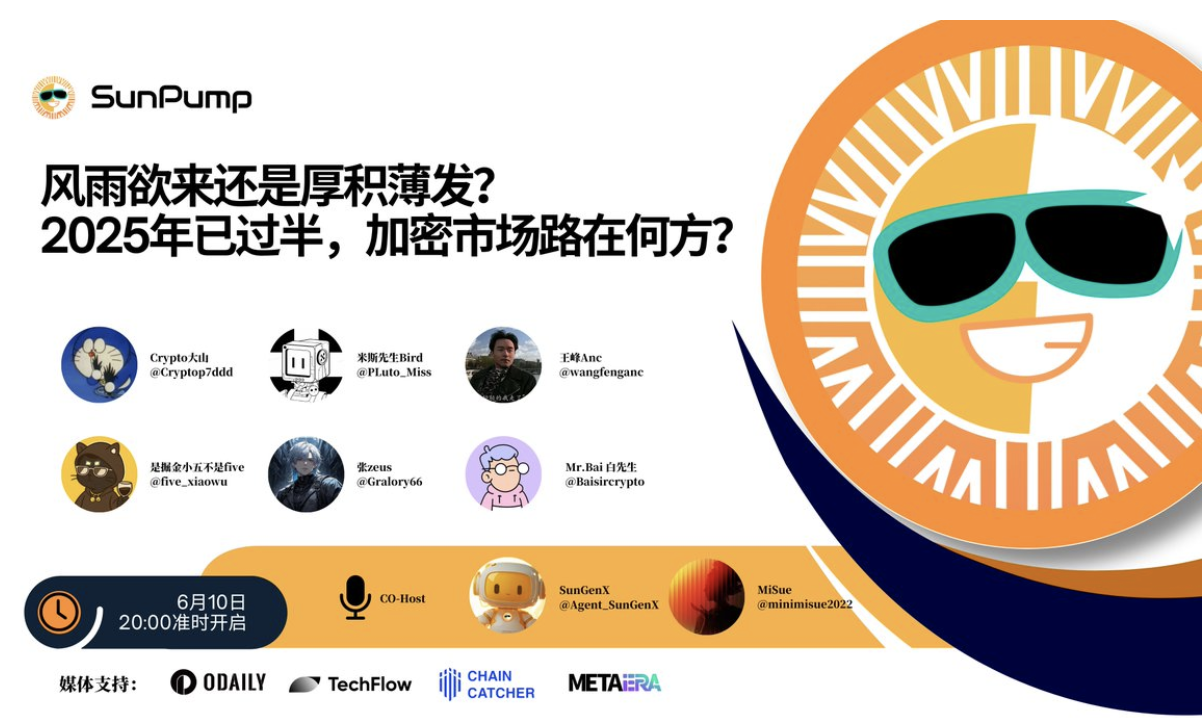

Halfway through 2025, the crypto market stands at a critical turning point where uncertainty and opportunity intersect. At 8 pm on June 10, the #SunFlash roundtable opened an in-depth dialogue on the theme of "Is the storm coming or is it a long-term accumulation? Where is the crypto market going?" in X Space. This issue of Space brought together many senior industry KOLs to face the core anxiety of the market, explore the survival logic of mainstream currencies and new narratives, and clarify the rational path in the fog for investors.

The crypto market in 2025 is full of twists and turns, presenting a complex scene of dual game. First, Bitcoin (BTC) repeatedly hits the $110,000 mark, institutional funds continue to pour in through ETFs, and trading volume hits new highs. This should be a strong sound of the bull market, but it is shrouded in a heavy cloud of doubts against the backdrop of geopolitical friction and uncertain global inflation expectations. At the same time, new narratives such as AI, Meme, and RWA are sweeping across the market, further exacerbating market differentiation.

It is in this context that the differentiated survival logic of mainstream coins and the prosperity of their respective ecosystems are becoming key dimensions for judging the true health of the market. This article will focus on the core insights of the roundtable, sort out the subsequent trends of the market, and the core strategic positioning and development momentum of the TRON ecosystem at the turning point of the industry.

1. BTC breaks through $110,000: Three major engines drive a new bull market cycle

In June 2025, BTC broke through the $110,000 mark. The market faced a critical decision amid the hustle and bustle: Is this round of rise the starting point of a new bull market or the end of a bubble? The guests of this issue of Space reached a consensus based on on-chain data and historical laws: the increase in holdings by institutions and whales, the law of the BTC halving cycle, and the influx of compliant funds into BTC spot ETFs. The three ironclad evidences interweave and confirm that the crypto market is entering a new round of growth cycle.

Institutional hoarding dominates the market landscape

Nuggets Xiaowu saw deep changes from the on-chain data. He pointed out: "Institutions are becoming the cornerstone of the market - they do not make noise, but accumulate strength in the dark. The on-chain data reveals that institutions are accelerating their layout and whales continue to absorb funds, which shows that everyone has not wavered in the long-term value of BTC. " In addition, the data given by Wang Feng Anc also confirms this trend: Since November 2024, there have been more and more addresses with more than 1,000 BTC. The "cornerstone" role played by institutions and whale users supports BTC to a new wave of peaks.

Halving cycle points to new all-time highs

"Macroeconomic disturbances are just ripples, and the halving cycle is the tide that dominates prices." Based on BTC's historical cycle data, Mr. Bai pointed out that the rule that BTC reaches its peak about 518 days after halving has not failed for ten years. He added: "According to the halving time in April 2024, BTC will form a cycle peak from August to December this year, with a target of $150,000."

Fundamental changes in market structure

The passage of the BTC spot ETF is changing the structure of players. Mr. Bird pointed out: "This is no longer a carnival for retail investors . After the passage of the BTC spot ETF, BlackRock and others are frantically sucking in liquidity, and the regular army is rewriting the bull market script. " He emphasized: "This shift means that the market will shift from being driven by emotions to being dominated by compliant funds."

II. The differentiation of the altcoin market and the logic of TRON’s value revaluation

As industry attention continues to rise, many KOLs predict that funds may gradually overflow into the altcoin market, but they all emphasize that the grand occasion of "universal rise in all coins" is difficult to reproduce, and only a few protocols with technical barriers, real income and user stickiness can attract capital inflows.

Structural opportunities under market differentiation

Crypto Dashan pointed out the structural changes in the current altcoin market in Space: "This round of altcoins has experienced sharp fluctuations and a downward trend, with market sentiment becoming the dominant factor." He observed that only a few projects with solid technology and practical application scenarios, such as TRON, can develop independent trends in the BTC-dominated market.

Reconstructing investment strategies: from chasing popularity to waiting for value

Faced with the core issue of "how to discover undervalued projects", Mr. Bird proposed a cognitive change: "Altcoin investment needs to abandon the past thinking of 'sector rotation and betting on the rise' and turn to potential projects with 'solid infrastructure'." Crypto Dashan further added screening criteria: technology is the foundation of survival, actual application scenarios determine demand sustainability, protocol revenue capacity verifies business logic, and user activity reflects the vitality of the ecosystem. Only "head-down builders" who meet these four elements have the potential for revaluation.

The TRON ecosystem is a perfect example of this concept:

1. Developer-friendly architecture: TRON has built a global inclusive financial infrastructure based on its underlying advantages of 2500 TPS high throughput performance and near zero friction cost. Through a virtual machine architecture that is fully compatible with EVM, it supports Solidity developers to seamlessly migrate smart contracts.

2. Rigid application scenarios: TRON has built a global financial application matrix through a three-level architecture of stablecoin payment network, DeFi liquidity engine and Meme economic infrastructure. As of June 2025, its core ecological data has achieved multi-dimensional breakthroughs: TRC-20 USDT circulation accounts for 51% of the world; JustLendDAO TVL exceeds 6.4 billion US dollars, ranking first in the lending market; DeFi protocol JUST TVL exceeds 9.7 billion US dollars; decentralized trading platform Sun.io TVL is as high as 740 million US dollars; more than 98,000 tokens have been created on the Meme coin fair issuance platform SunPump; the cross-chain protocol BTTC network has processed more than 290 million transactions in total, and the total number of smart contract deployments has exceeded 7.6 million .

3. Protocol revenue capacity: In May, the total revenue of the TRON protocol exceeded US$343 million, setting a record high, with an average daily income of up to US$11 million.

4. User retention barriers: The DeFi TVL on the TRON chain exceeds US$5 billion (ranked fifth in the entire chain), with 24-hour active addresses of 2.48 million.

3. TRON’s solution to the Meme sector: How SunPump reshapes structural opportunities

At the Space roundtable, Mr. Bai was the first to point out the role of Meme coin as an ecological engine: "Meme is the core catalyst of the bull market and a thermometer of market sentiment. Whether it is the 'Zoo Carnival' led by Dogecoin (DOGE) in 2021 or the new cycle in 2024, Meme has always been the entry point for incremental funds ." Mr. Bird further deconstructed its deep value chain: "Meme has built an entry with the lowest threshold for the crypto world. Newcomers may complete their first on-chain interaction with the dog head emoji token and eventually become long-term holders of Bitcoin." This conversion funnel of 'entertainment entry-on-chain practice-value precipitation' will convert onlookers outside the circle into crypto market participants in batches.

When the market verified the commercial value of emotional consensus, mainstream public chains have built Meme economic closed loops. Among them, SunPump has performed a textbook case in the TRON ecosystem. First, SunPump has reduced the threshold for Meme creation to the extreme with its AI Agent that "issues tokens with one click" and its AI tool SunGenX that "issues tokens by tweeting", attracting users to create more than 98,000 tokens, driving SunPump to achieve 37 million TRX revenue .

With the influx of traffic, SunPump has promoted the prosperity of the entire TRON ecosystem . SUN.io's trading volume increased significantly after SunPump went online, and other DeFi projects such as SunSwap and JustLend also grew due to the traffic dividend brought by SunPump. After the launch of the SunPump platform, TRON's DEX activity reached its highest level since 2022.

SunPump has become a converter connecting incremental users with underlying facilities. This just proves Mr. Bird’s point of view: high-quality Meme protocols can feed back to the fundamentals of the public chain, rather than the traditional “vampire effect”.

IV. Conclusion

As BTC rushes to the next high point, the crypto market is moving from the hustle and bustle to deep reconstruction. TRON has demonstrated its ecological resilience in this transformation. The TRON ecosystem is building a "workable crypto financial closed loop" with stablecoins as the foundation, Meme as the traffic, and ecological internal circulation as the driving force. The "infrastructure faction" represented by TRON is building the foundation of digital finance with a lower cost, higher efficiency, and wider coverage ecological network. When technology returns to its service essence, the market will crown its value with real money.