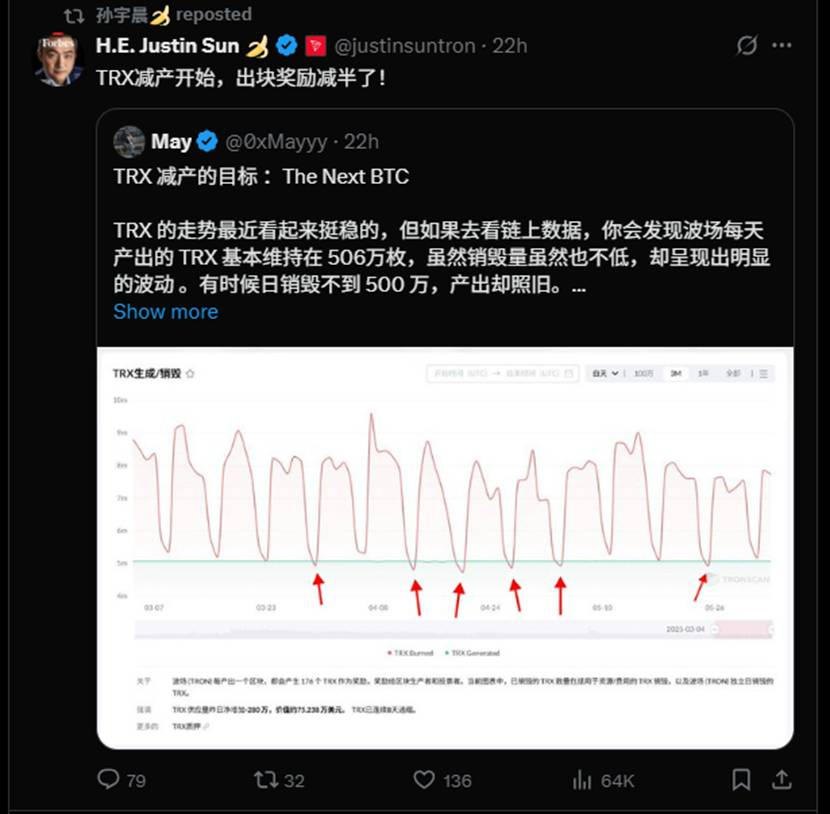

Recently, according to the latest data from TRONSCAN, the total revenue of the TRON protocol in May exceeded 343 million US dollars, setting a record high, with an average daily income of up to 11 million US dollars. Just yesterday (June 4), TRON officials stated that the "TRX production reduction" proposal will also be officially voted on on June 10. If the proposal is passed, the supply of TRX on the chain will be directly reduced.

In the past three months, the price of TRX has soared from $0.21 to $0.28, with an increase of more than 30%. In May, the US SEC officially accepted the application for Staked TRX ETF. If the application is successfully approved, the price of TRX is likely to usher in a big surge.

Now, more and more crypto community users have keenly captured this potential opportunity and have begun to take action, actively buying and firmly holding TRX tokens, quietly waiting for the ETF application to be approved to capture the potential for huge gains, and looking forward to getting a share of this wealth feast.

However, in the eyes of many investors, simply buying TRX and holding it seems to be a bit of a pity to "guard a gold mine but not know how to mine it", and fail to fully realize its potential value. How to maximize the income of TRX in hand? Finding reliable income channels and actively participating in a stable interest-earning strategy have become the top priority for the majority of TRX holders.

On the JustLend DAO platform, the native DeFi application of the TRON ecosystem, there is a combination of "sTRX + USDD" that can be called the "interest-generating artifact" of TRX. After actual testing and verification, by staking TRX to participate in this combination, the annualized return easily exceeded 20%, which undoubtedly provides an attractive wealth appreciation path for TRX holders. Moreover, the operation process is extremely simple. With just a few simple steps, investors can start the "lying and earning" mode on the JustLendDAO platform, so that the TRX in their hands can achieve "one fish, two kills", easily pocket multiple returns, and truly achieve steady growth of wealth.

JustLend DAO Gold Mine “sTRX+USDD”: Unlocking the TRX “One Fish, Two Meals” Wealth Code

In the world of cryptocurrency, the pursuit of high returns is always the unremitting goal of investors. The "sTRX + USDD" gold mine combination on the JustLendDAO platform provides TRX holders with an optimal path to achieve steady wealth appreciation, allowing TRX to "kill two birds with one stone" and bring multiple benefits.

TRX staking on the chain can obtain an annualized high yield of nearly 20%. This attractive return is mainly achieved through the two mining pools of "sTRX + USDD" on the JustLendDAO platform.

Before we delve into its specific operating process, let us first understand the main functions of the three key products, JustLend DAO, sTRX, and USDD, and the close connection between them.

·Justlend DAO was originally a decentralized lending protocol based on the TRON network, and has now grown into a vital DeFi ecosystem center in the TRON ecosystem. It is rich and diverse, covering mortgage lending, staking TRX (i.e. Staked TRX staking TRX in exchange for sTRX staking certificate tokens), energy rental, and supporting users to explore and use various DeFi applications. According to DeFiLlama data, as of June 5, the platform's locked crypto assets are worth as much as $3.4 billion, firmly sitting on the throne of the DeFi protocol with the highest TVL on the TRON network, and its strength and influence are evident.

·sTRX, also known as Staked TRX, is a TRX liquid staking product launched by JustLend DAO. Users only need to stake TRX to obtain sTRX staking certificate tokens. As an interest-bearing asset token, sTRX can automatically capture node voting rewards and energy leasing income on the TRON network. For this reason, sTRX is highly favored in the market and its popularity remains high. As of June 5, the number of TRX staked on JustLendDAO was about 8.1 billion, worth about US$2.19 billion, and the number of participating addresses was as high as 4,360, which shows its popularity.

USDD 2.0 is a decentralized stablecoin running on the TRON network, pegged at 1:1 with the US dollar. Users can over-collateralize and mint USDD by staking TRX, sTRX, USDT and other high-quality crypto assets. As of June 5, USDD issuance has exceeded 420 million US dollars, and its strength should not be underestimated.

So, how does the “sTRX + USDD” gold mine combination on JustLend DAO work?

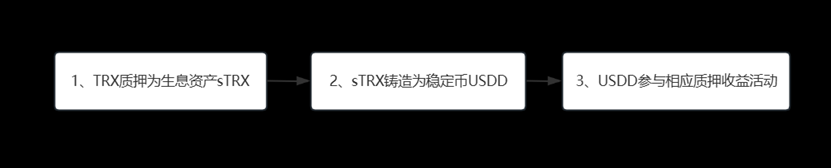

Specifically, users pledge TRX on the JustLend DAO platform to convert it into interest-bearing assets sTRX; then, use sTRX as collateral to mint the stablecoin USDD; after completing this series of minting operations, the USDD obtained by users can participate in the JustLend DAO platform staking or deposit to earn income activities, and they can enjoy the double generous returns of JustLend DAO sTRX staking income and USDD deposit income.

The whole process can be summarized concisely as follows: TRX is pledged as interest-bearing asset sTRX → sTRX is used to mint stablecoin USDD → USDD participates in JustLend DAO staking to earn interest.

Through such operations, TRX has achieved "killing two birds with one stone", and its income is mainly divided into two parts: one part is the underlying income brought by sTRX staking, including node voting rewards and energy leasing income; the other part is the income generated after sTRX mints USDD, covering the income from USDD staking or deposit and the income from participating in various DeFi activities.

In the current volatile cryptocurrency market, JustLendDAO's "sTRX + USDD" gold mine combination provides TRX holders with a stable and efficient way to increase their income, allowing investors to easily realize asset appreciation and preservation in a complex market environment.

TRX staking core gameplay revealed: Super simple 3 steps to easily earn 20% + income

Finding high-yield and easy-to-operate on-chain investment strategies has always been the core demand of crypto community users. The "sTRX + USDD" gold mine combination gameplay on the JustLendDAO platform allows TRX to "kill two birds with one stone" and reap multiple rich returns in just three steps.

Step 1: Stake TRX to get sTRX and start your journey to basic income

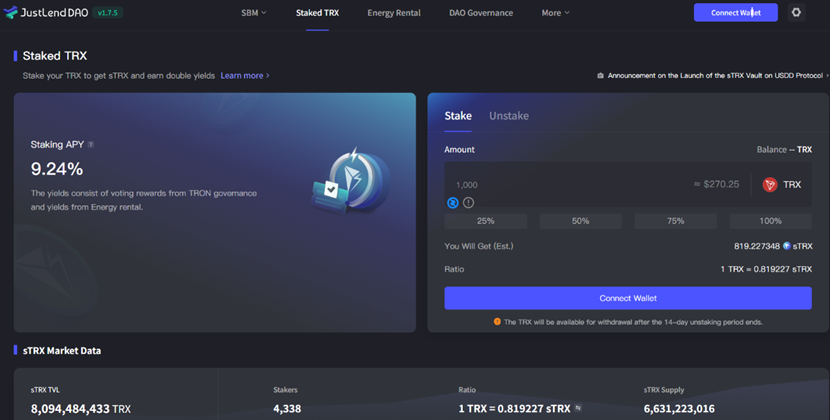

In the Staked TRX section of the JustLend DAO platform, users can easily obtain the liquid staking certificate token - sTRX by simply staking their TRX. sTRX is like a magic token that automatically "generates money" and can automatically earn staking income from the TRON network, including voting rewards and energy leasing income. However, the specific income of sTRX is not static, it will fluctuate dynamically with the amount of TRX staked on the network. The sTRX staking income in the past 7 days was 9.24%.

Website link (https://app.justlend.org/strx?lang=en-US)

Here is another tip to share with you: Regarding the transaction fees on the TRON chain, if investors have a high number of transactions, they may wish to rent energy from the Energy Rental Center on JustlendDAO. In this way, the on-chain transaction fee for each payment can be greatly reduced from a few dollars to a few tenths of a dollar, which can save a lot of costs.

Step 2: Use sTRX to mint stablecoin USDD and expand income channels

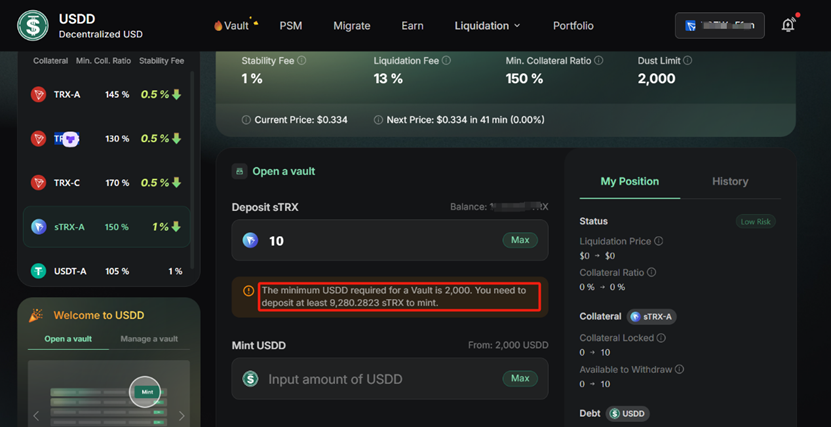

After obtaining sTRX, you can then use the sTRX fund pool to over-collateralize and mint USDD on the USDD platform.

(Website link: https://app.usdd.io/vault?token=STRX-A)

However, there are a few key points to note: The minimum minting amount of USDD is 2000 USDD each time, and it uses an over-collateralization model, with a current collateralization rate of about 150%. On June 5, it was shown that at least 9280 sTRX was required to collateralize every 2000 USDD minted. In order to avoid the situation where USDD cannot be generated due to insufficient sTRX, when staking TRX, it is best to pledge enough at one time. According to the current exchange rate of 1 TRX = 0.81 sTRX, it is safer to pledge about 12000 TRX each time.

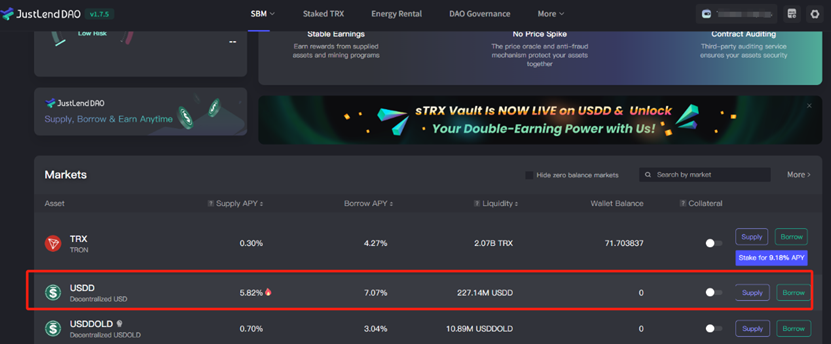

Step 3: Pledge USDD to earn high returns and realize wealth appreciation

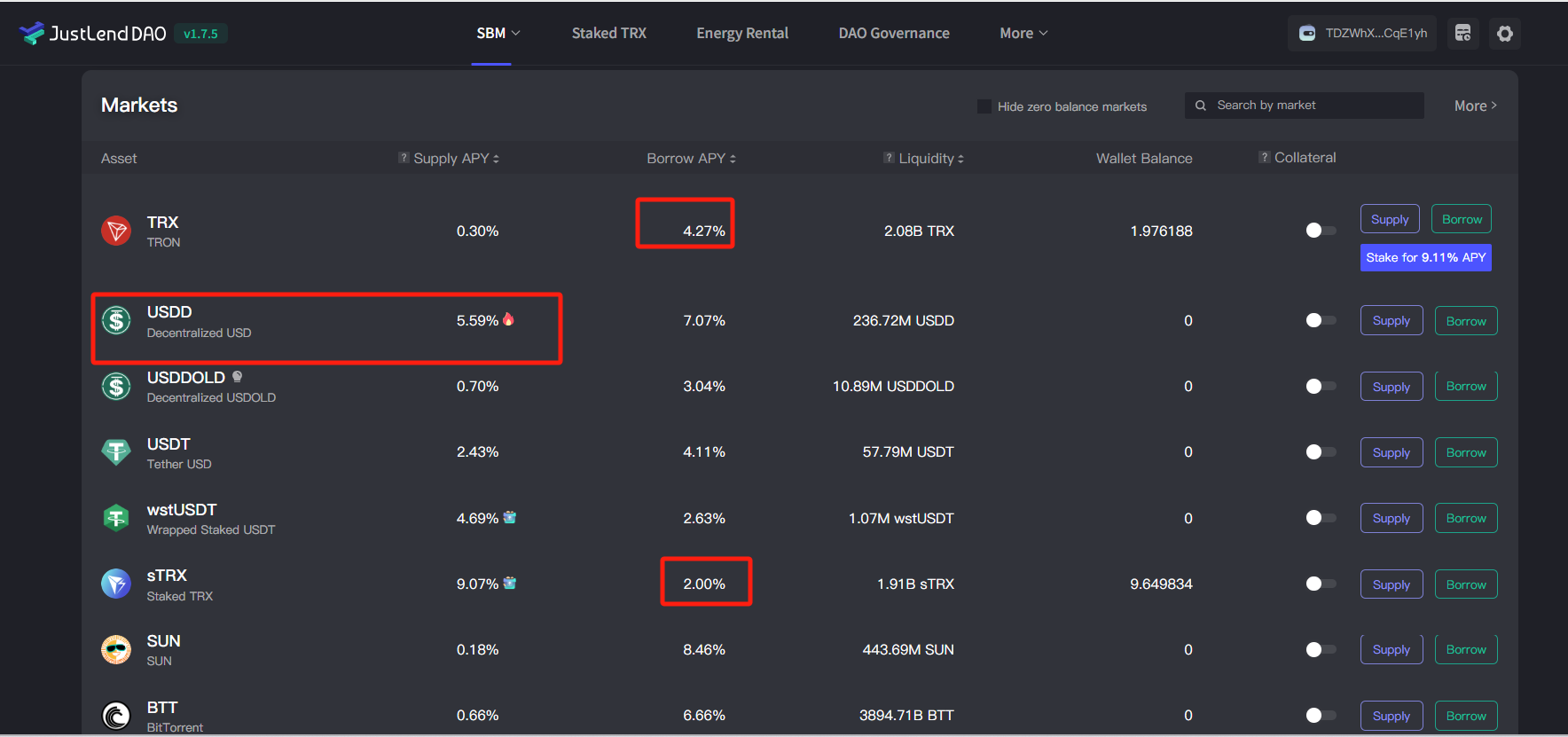

After successfully minting USDD, you can directly participate in the corresponding USDD high-yield deposit activity on JustLend DAO. Currently, the annualized return on USDD deposits in JustLend DAO is 5.8%, which is quite attractive in the field of stablecoin investment.

(Website link: https://app.justlend.org/homeNew)

Through the above three simple steps, TRX holders can easily obtain multiple benefits:

·Income 1: Stake TRX in JustLend DAO to obtain sTRX and earn basic staking income. The annualized staking income in the past 7 days is about 9.24%, which lays a solid foundation for investors' asset appreciation.

·Income 2: The sTRX you hold can be over-collateralized and minted into USDD on the USDD official website, and the USDD you obtain can then be used to participate in the staking activities of the JustLend DAO platform. On June 5, JustLend DAO platform deposited USDD to enjoy an annualized return of 5.82%, further broadening the income channels.

The two incomes of "TRX staking income (income 1) + USDD staking or deposit income (income 2)" are generated simultaneously and independently without interfering with each other.

The measured data on June 5 showed that the comprehensive annualized rate of staking TRX currency standard easily reached 15% + (TRX staking income 9.24% + USDD deposit income 5.82%). Moreover, the sTRX staking rate of return and the USDD fund pool interest rate are not fixed, but in a floating state, and will be adjusted at any time according to the amount of pledged or deposited assets. During the active market period, the sTRX staking rate of return can be as high as 30%. In this way, the comprehensive annualized rate of return will also fluctuate accordingly, and most of the time the comprehensive annualized rate of return is far more than 20% +, which brings investors a very considerable opportunity for wealth growth.

Tips for advanced players: Capture excess returns from “sTRX+USDD” through circular lending operations

Through the "sTRX+USDD" gold mine combination on the JustLend DAO platform, novice players can easily earn double returns of sTRX staking income and USDD deposit interest using only TRX underlying assets. However, for those experienced high-level on-chain players, the profit potential of this combination is far more than that, and there is a broader space for gold mining, and the possibility of capturing higher returns.

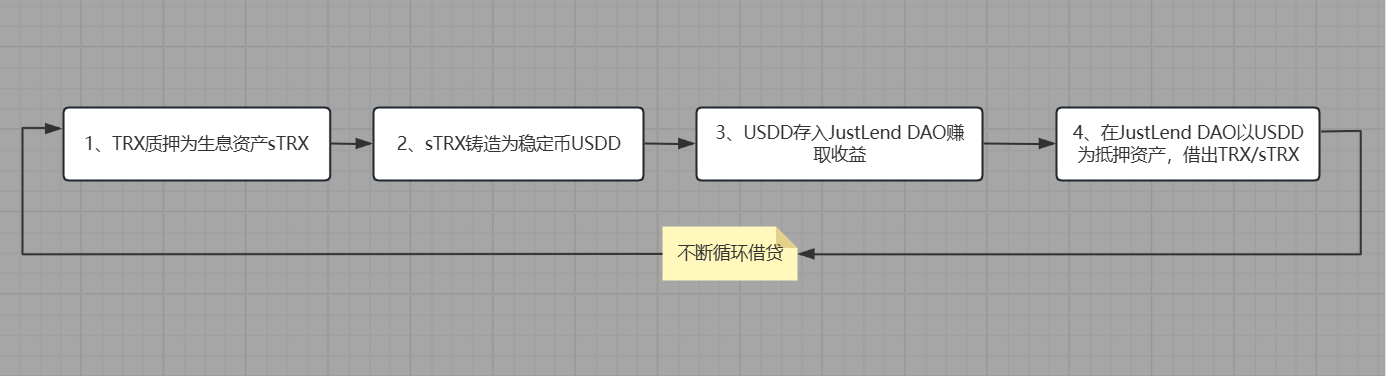

Advanced players can cleverly and efficiently use the JustLend DAO lending pool function, deposit USDD to borrow TRX and sTRX, and unlock the golden key to high-yield circular nesting dolls. Depositing USDD into the JustLend DAO platform can be used as collateral to directly borrow TRX or sTRX, and then continue to mint USDD. This step seems simple, but it actually contains huge profit potential.

After borrowing TRX, players will quickly pledge it to obtain sTRX pledge certificate tokens. Then, they will use the sTRX in their hands for over-collateralization to mint more USDD. The newly minted USDD is deposited into the interest-bearing platform again, waiting for interest to accumulate. When the funds accumulate to a certain level, the above operation can be repeated, and TRX/sTRX can be borrowed again, starting a new round of cycles, and so on.

This circular lending operation mode is like a rolling snowball. With each cycle, the income is constantly accumulating and amplifying. Compared with the basic "sTRX pledge income + USDD deposit interest income", the comprehensive income can show a geometric growth, easily far exceeding the conventional annualized income level of 20%.

“Golden Shovel” TRX continues to benefit

The "sTRX + USDD" gold mining combination of the JustLend DAO platform is like a precision-operated automatic money-making machine, opening up a new value-added channel for TRX from staking, minting stablecoins to stablecoin interest, and opening up a clear income chain: TRX→sTRX→USDD→and then to TRX/sTRX, truly realizing the wealth appreciation model of "money makes money, and money makes money again", making TRX a well-deserved "golden shovel" asset.

For users holding TRX, they can not only enjoy the benefits brought by the increase in the TRX coin base, but also capture excess on-chain returns through the combination of "sTRX + USDD".

For TRX hoarders, this model has unique advantages. Without affecting asset liquidity, users can maximize their returns and maximize the appreciation of their assets. There is no lock-up period requirement for sTRX and USDD. Users can redeem sTRX or USDD assets at any time, or exchange them for other assets they need on the DEX platform at any time, which provides great convenience and flexibility for users' fund management. The sTRX+USDD revenue model is also very clear and sustainable. The sTRX staking revenue comes from governance voting rewards and energy leasing revenue; the USDD revenue comes from official system subsidies.

In addition, the underlying asset TRX has received continuous positive news. First, in May, the TRX ETF application was accepted by the US SEC; then in May, TRON network protocol revenue hit a new high of US$343 million; however, just yesterday (June 4), TRON officials said: The TRX production reduction proposal (TIP-738) is expected to start the voting process on June 10, 2025, Singapore time, which once again attracted widespread attention and discussion in the crypto community.

The "TRX Production Reduction Proposal" aims to reduce TRX block rewards. The proposal proposes to cut the block reward from 16 TRX in half to 8 TRX, and reduce the voting reward from 160 TRX to 128 TRX. If the proposal is passed, the reduction in rewards means that the daily on-chain TRX output will be greatly reduced, which will directly compress the new supply on the TRX chain and significantly reduce the inflation rate of TRX, which can increase the scarcity of TRX and help increase the long-term price of TRX.

From this point of view, the underlying asset TRX may become one of the most promising crypto assets in the crypto asset field, driven by multiple favorable factors such as the potential expectations of the RX ETF narrative, the continuous record of protocol revenue, and the recent TRX production reduction proposal. At the same time, with the help of JustLend DAO's "sTRX + USDD" multiple income strategy, TRX can be used as a golden shovel, not only to enjoy the benefits brought by the future rise in the currency standard, but also to start the journey of wealth appreciation with one click, and achieve steady growth of assets and accumulation of wealth.