1. Introduction

In Q2 2025, the crypto market experienced a transition from a high-heat market to a short-term adjustment. Although tracks such as Meme, AI, and RWA have been rotating and repeatedly guiding emotions, the ceiling of macro suppression has gradually emerged. The turbulent global trade situation, the repeated swings in US economic data, and the constant bargaining of expectations for the Fed's interest rate cuts have put the market into a critical window of "waiting for the reconstruction of pricing logic." At the same time, marginal changes in policy games began to emerge: the Trump camp's positive attitude towards cryptocurrencies triggered investors to pre-price the logic of "Bitcoin as a national strategic reserve asset." We believe that the current cycle is still in the "mid-term bull market retracement period," but structural opportunities are quietly emerging, and pricing anchors are shifting at the macro level.

2. Macro variables: the old logic is disintegrating, and the new anchor point is not determined

In May 2025, the crypto market is in a critical period of macro-logical reconstruction. The traditional pricing framework is rapidly disintegrating, and the new valuation anchor has not yet been established, leaving the market in a "fuzzy and anxious" macro environment. From macroeconomic data, central bank policy orientation, to marginal changes in global geopolitical and trade relations, they are all affecting the behavior pattern of the entire crypto market in a "new order in instability" posture.

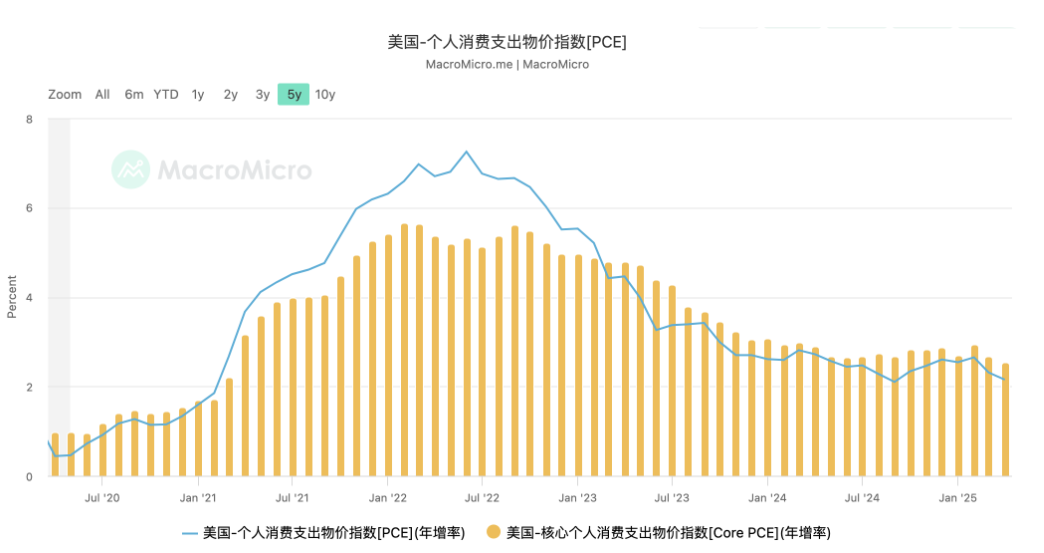

First, the Fed's monetary policy is moving from "data dependence" to a new stage of "political and stagflationary pressure game". The CPI and PCE data released in April and May showed that although the inflationary pressure in the United States has eased, the overall stickiness remains, especially the rigidity of service industry prices is still high, which is intertwined with the structural shortage in the labor market, making it difficult for inflation to fall back quickly. Although the unemployment rate has risen marginally, it is far from triggering the lower limit of the Fed's policy reversal, which has led to the market's expectations for the timing of interest rate cuts being postponed from the original June to Q4 or even further. Although Fed Chairman Powell did not rule out the possibility of a rate cut this year in his public speech, his language emphasized "cautious wait-and-see" and "persistence in long-term inflation targets", which made the vision of liquidity easing even more distant in the face of reality.

This uncertain macro environment directly affects the pricing basis of crypto assets. In the past three years, crypto assets have enjoyed a valuation premium under the background of "zero interest rate + general liquidity easing", but now in the second half of the cycle of high interest rates, traditional valuation models are facing systemic failure. Although Bitcoin has maintained an upward trend driven by structural funds, it has never been able to form the momentum to cross the next important threshold, reflecting that its "alignment path" with traditional macro assets is disintegrating. The market has begun to no longer simply apply the old linkage logic of "Nasdaq rise = BTC rise", but has gradually realized that crypto assets need independent policy anchors and role anchors.

At the same time, the geopolitical variables that have affected the market since the beginning of the year are undergoing important changes. The issue of the Sino-US trade war, which had previously heated up, has cooled down significantly. The recent shift in the focus of the Trump team on the issue of "manufacturing repatriation" shows that China and the United States will not further intensify the conflict in the short term. This has temporarily receded the logic of "geopolitical hedging + Bitcoin anti-risk assets", and the market no longer gives a premium to the "safe haven anchor" of crypto assets, but instead looks for new policy support and narrative momentum. This is also an important background for the crypto market to shift from a structural rebound to high-level fluctuations since mid-May, and even the continued outflow of funds from some on-chain assets.

At a deeper level, the entire global financial system is facing a systematic process of "anchor reconstruction". The US dollar index is trading sideways at a high level, and the linkage between gold, treasury bonds, and US stocks has been disrupted. Crypto assets are caught in the middle. They are neither backed by the central bank like traditional safe-haven assets, nor have they been thoroughly incorporated into the risk control framework by mainstream financial institutions. This intermediate state of "neither risk nor safe-haven" puts the market pricing of main assets such as BTC and ETH in a "relatively vague area". This vague macro anchor is further transmitted to the downstream ecology, resulting in the outbreak of branch narratives such as Meme, RWA, and AI, but they are difficult to sustain. Without the support of macro incremental funds, the local prosperity on the chain is very likely to fall into the rotation trap of "quick ignition-quick flameout".

We are entering a turning point of "de-financialization" dominated by macro variables. At this stage, the liquidity and trend of the market are no longer driven by simple correlations between assets, but depend on the redistribution of policy pricing power and institutional roles. If the crypto market wants to usher in the next round of systematic revaluation, it must wait for a new macro anchor - it may be the official establishment of "Bitcoin national strategic reserve assets", or it may be "the start of the Fed's clear interest rate cut cycle", or "the acceptance of on-chain financial infrastructure by many governments around the world". Only when these macro-level anchors are truly implemented, will there be a comprehensive return of risk appetite and a resonant upward movement of asset prices.

At present, the crypto market needs to no longer cling to the continuation of the old logic, but to calmly identify the clues of the emergence of new anchor points. Those funds and projects that can first understand the changes in the macro structure and make early arrangements for the new anchor points will take the initiative in the next round of real main uptrend.

3. Policy variables: The GENIUS Act was approved, and the state-level Bitcoin strategic reserve was implemented, triggering structural expectations

In May 2025, the U.S. Senate officially passed the GENIUS Act (Guaranteed Electronic Network for Uniform and Interoperable Stablecoins Act), becoming one of the most institutionally influential stablecoin legislation programs in the world since MiCA. The passage of this bill not only marks the establishment of a regulatory framework for U.S. dollar stablecoins, but also sends a clear signal: stablecoins are no longer a technical experiment or a gray financial instrument, but have entered the core of the sovereign financial system and become an organic extension of the influence of the digital dollar.

The core content of the GENIUS Act focuses on three aspects: first, it establishes the Federal Reserve and financial regulatory agencies' authority to manage licenses for stablecoin issuers, and sets capital, reserve, and transparency requirements equivalent to those for banks; second, it provides a legal basis and standard interface for the interoperability of stablecoins with commercial banks and payment institutions, and promotes their widespread application in retail payments, cross-border settlements, financial interoperability and other fields; third, it establishes a "technical sandbox" exemption mechanism for decentralized stablecoins (such as DAI, crvUSD, etc.), retaining innovation space for open finance under a compliant and controllable framework.

From a macro perspective, the passage of the bill has triggered a triple structural shift in expectations for the crypto market. First, a new paradigm of "on-chain anchoring" has emerged in the international extension path of the US dollar system. As the "federal check" of the digital age, the on-chain circulation ability of stablecoins not only serves Web3 internal payments, but is also likely to serve as part of the US dollar policy transmission mechanism to strengthen its competitive advantage in emerging markets. This also means that the United States no longer simply suppresses crypto assets, but chooses to incorporate some "channel rights" into the national fiscal system, which not only justifies the name of stablecoins, but also takes a position for the US dollar in the future digital financial war.

Secondly, the legalization of stablecoins will lead to a reassessment of the on-chain financial structure. The ecosystem of compliant stablecoins such as USDC and PYUSD will usher in a period of liquidity explosion, and the logic of on-chain payment, on-chain credit, and on-chain ledger reconstruction will further activate the demand for DeFi and RWAs asset bridging. Especially in the context of high interest rates, high inflation, and regional currency fluctuations in the traditional financial environment, the attribute of stablecoins as "cross-institutional arbitrage tools" will further attract emerging market users and on-chain asset management institutions. Less than two weeks after the passage of the GENIUS Act, the daily trading volume of stablecoins on platforms such as Coinbase hit a new high since 2023, and the on-chain USDC circulation market value increased by nearly 12% month-on-month, and the focus of liquidity began to shift from Tether to compliant assets.

Of more structural significance is that several state governments followed suit and released Bitcoin strategic reserve plans after the bill was passed. As of late May, New Hampshire has passed the Bitcoin Strategic Reserve Act, and Texas, Florida, Wyoming and other states have announced that part of their fiscal surpluses will be allocated as Bitcoin reserve assets, with reasons including inflation hedging, fiscal structure diversification, and support for the local blockchain industry. In a sense, this behavior marks that Bitcoin has been included in the "local fiscal asset table" from a "civilian consensus asset", which is a digital reconstruction of the logic of the state reserves in the golden age. Although the scale is still small and the mechanism is still unstable, the political signal released behind it is far more important than the size of the asset: Bitcoin has begun to become a "government-level choice."

These policy dynamics have jointly contributed to a new structural picture: stablecoins have become "on-chain dollars" and Bitcoin has become "local gold". The two are one standard and one wild, and they coexist and hedge with the traditional monetary system from the perspectives of payment and reserve. This situation provides another security anchor logic in 2025, when geo-financial divisions and institutional trust are declining. This also explains why the crypto market still maintained high volatility despite poor macro data in mid-May (high interest rates continued, CPI rebounded) - because the structural turning point at the policy level has established long-term deterministic support for the market bottoming out.

After the passage of the GENIUS Act, the market's reassessment of the "U.S. Treasury interest rate-stablecoin yield" model will also accelerate the stablecoin product to move closer to the "on-chain T-Bill" and "on-chain money fund". In a sense, the future digital debt structure of the U.S. Treasury may be partially completed by stablecoin custody. The expectation of U.S. Treasury on-chain is gradually emerging through the window of stablecoin institutionalization.

IV. Market structure: Track rotation is fierce, and the main line remains to be confirmed

The crypto market in the second quarter of 2025 presents a highly tense structural contradiction: macro-level policy expectations are warming up, and stablecoins and Bitcoin are moving towards "institutional embedding"; but at the micro-structural level, there is always a lack of a "main line track" that truly has market consensus. This has led to the overall market showing obvious characteristics of frequent rotation, weak sustainability, and short-term "idle" liquidity. In other words, the speed of capital circulation on the chain is still there, but the sense of direction and certainty have not yet been reconstructed, which is in sharp contrast to some "single track main upswing" cycles in 2021 or 2023 (such as DeFi Summer, AI narrative outbreak, Meme Season).

First, from the perspective of sector performance, the crypto market showed an extremely differentiated structure in May 2025. Solana Meme, AI+Crypto, RWA, DeFi, etc. took turns to strengthen in a "pass the parcel" style, and each sub-track continued to explode for less than two weeks, and the subsequent follow-up funds quickly collapsed. For example, Solana Meme once triggered a new round of FOMO frenzy, but due to the weak foundation of community consensus and overdrawn market sentiment, the market quickly pulled back from a high level; AI tracks such as $FET, $RNDR, $TAO and other head projects showed the characteristics of "high Beta and high volatility", which were greatly affected by the sentiment of US AI heavyweight stocks and lacked spontaneous narrative continuity within the chain; and the RWA sector represented by ONDO was certain, but because the airdrop expectations had been partially fulfilled, it entered a "price and value divergence" consolidation period.

Data on fund flows show that this rotation phenomenon essentially reflects the flood of structural liquidity rather than the start of a structural bull market. Since mid-May, the growth of USDT market value has stagnated, while USDC and DAI have rebounded slightly. The average daily trading volume of on-chain DEXs has remained in the range of US$2.5 billion to US$3 billion, which is nearly 40% less than the high point in March. There is no obvious influx of new funds into the market, but the existing stock of funds is looking for short-term trading opportunities of "local high volatility + high sentiment". In this case, even if the track switches frequently, it is difficult to form a strong main line market. Instead, it further amplifies the "pass the parcel" speculation rhythm, resulting in a decrease in the willingness of retail investors to participate and an increase in the disconnection between trading enthusiasm and social enthusiasm.

On the other hand, the valuation stratification phenomenon has intensified. The valuation premium of first-tier blue-chip projects is significant. Head assets such as ETH, SOL, and TON continue to be favored by large funds, while long-tail projects are in an embarrassing situation where "fundamentals cannot be priced and expectations cannot be fulfilled." Data shows that in May 2025, the top 20 market capitalization currencies accounted for nearly 71% of the total market capitalization, the highest value since 2022, showing characteristics similar to the "concentration reflux" of the traditional capital market. In the absence of a "broad-spectrum market", the market's liquidity and attention are concentrated on a few core assets, further compressing the living space of new projects and new narratives.

At the same time, on-chain behaviors are also changing. Ethereum active addresses have remained stable at around 400,000 for several months, but the overall TVL of the DeFi protocol has not increased synchronously, reflecting the rising trend of "fragmentation" and "non-financialization" of on-chain interactions. Non-financial interactions such as meme transactions, airdrops, domain name registrations, and social networks have gradually become mainstream, indicating that the user structure is migrating to "light interaction + heavy emotions". Although this type of behavior has driven short-term popularity, for protocol builders, the pressure of monetization and retention has become increasingly obvious, resulting in limited willingness to innovate.

From an industrial perspective, the market is still at a critical point where multiple main lines coexist but lack a main upward trend: RWA still has long-term logic, but it needs to wait for regulatory compliance to be implemented and the ecosystem to grow spontaneously; Meme can stimulate emotions, but lacks leaders like DOGE and PEPE that have the ability of "cultural symbols + community mobilization"; AI+Crypto has huge imagination space, but the technology landing and Token incentive mechanism have not yet reached the consensus standard; The Bitcoin ecosystem has begun to take shape, but the infrastructure has not yet been perfected, and it is still in the early "trial and error + positioning" stage.

In short, the current market structure can be summarized in four key words: rotation, differentiation, concentration, and testing. Rotation increases the difficulty of trading; differentiation compresses the space for medium and long-term layout; concentration means that valuation flows back to the head, leaving the long tail with mud and sand; and the essence of all hot spots is still that the market is testing whether the new paradigm and new main line can gain the dual recognition of "consensus + funds".

Whether the main line can take shape in the future depends to a large extent on whether three factors can resonate: first, whether there will be innovations in on-chain native explosive mechanisms similar to DeFi in 2020 and Meme in 2021; second, whether the implementation of policy supervision will continue to release institutional benefits that are conducive to the long-term pricing logic of Crypto assets (such as tokenized treasury bonds, federal-level BTC reserves, etc.); third, whether the secondary market will replenish mainstream funds and re-promote primary track financing and ecological construction.

The current stage is more like a "test pressure" in deep waters: the sentiment is not bad, the system is slightly warm, but the main line is missing. The market needs a new core narrative to gather people's hearts, funds, and computing power. And this may become the decisive variable in the evolution of the market in the second half of 2025.

V. Future Outlook and Strategic Recommendations

Looking back from the mid-2025 time point, we have gradually stepped out of the bonus zone of "halving + election + interest rate cut", but the market has not yet established a long-term anchor point that can truly stabilize the confidence of participants. From the historical rhythm, if Q3 still fails to form a strong main line consensus, the overall market is likely to enter a medium-intensity structural consolidation period, during which hot spots will be more fragmented, trading difficulty will continue to rise, and risk preferences will be significantly stratified, forming a "low volatility window during the policy uptrend period."

From a medium-term perspective, the variables that determine the trend in the second half of the year have gradually shifted from "macro interest rates" to "institutional implementation process + structural narrative". The US PCE and CPI continued to decline, and there was a preliminary consensus within the Federal Reserve to cut interest rates twice this year. The negative factors are easing marginally, but there has not been a large-scale inflow into the crypto market, indicating that the current market is more concerned about long-term institutional support rather than short-term monetary stimulus. We believe that this means that crypto assets have transitioned from "highly elastic risk assets" to "institutional game-type equity assets", and the market pricing system has undergone a bottom-level transformation.

The implementation of the GENIUS Act and the state-level Bitcoin strategic reserve pilot may be the starting point of this institutional support. Once more states begin to include BTC in their fiscal strategic reserves, crypto assets will truly enter the era of "quasi-sovereign endorsement." Combined with the expected reconstruction of federal policies after the November election, this will constitute a more penetrating structural catalyst than halving. However, it should be noted that this kind of process is not achieved overnight. If the policy rhythm is sluggish or the election situation is reversed, crypto assets may also experience drastic adjustments caused by the correction of institutional expectations.

From a strategic perspective, the current environment is not suitable for "all-out attack" but more suitable for "patient defense and waiting for an opportunity to strike quickly". We recommend adopting a "three-tier structure strategy":

Sovereign anchor assets are deployed in the bottom warehouse: "Emerging institutional assets" represented by BTC and ETH will continue to be favored by large funds. It is recommended to use them as the core of the bottom warehouse configuration, giving priority to assets with low supply elasticity, low institutional risks, and clear valuation models;

Participate in structural hot spots during high volatility windows: For sectors such as RWA, AI, and Meme, a tactical allocation strategy can be adopted to control risks in the time dimension and determine the rhythm of entry and exit based on liquidity intensity, paying special attention to whether there are on-chain behavior breakthroughs or capital injection signals;

Watching for native innovation in the primary market: All the waves that can truly change the structure of encryption are driven by the dual-wheel drive of "on-chain mechanism innovation + community consensus". It is recommended to gradually shift the focus to the primary market, capture new paradigms that may explode (such as chain abstraction, MCP protocol group, native user layer protocol, etc.), and form long-term holding advantages in the early stage of the ecosystem.

In addition, we remind the community to pay attention to the following three potential turning points, which may dominate the structural market in the second half of the year:

Will the Trump administration subsequently release systemic policy benefits such as BTC strategic reserves, tokenized treasury bonds, ETF expansion, and regulatory exemptions?

Will the Ethereum ecosystem bring real user growth after the Petra upgrade? Will the L2/LRT mechanism complete the paradigm shift? Will listed companies continue to raise funds to buy ETH like Strategy buys BTC?

In short, the second half of 2025 will be a transition window from "policy vacuum to policy game". Although the market lacks a main line, it has not stalled, and is generally in a state of "squatting and accumulating power before an upward breakthrough". Assets that truly have the ability to penetrate cycles will not rush to the top in the surface heat, but will lay the foundation in chaos and usher in a certain rise when policies and structures resonate.

In this process, we suggest that community members give up the fantasy of getting rich overnight by "hitting the jackpot" and instead build a self-consistent, multi-cycle investment and research system to find the real "penetration point" from project logic, on-chain behavior, liquidity distribution and policy context. Because the real bull market in the future is not the rise of a certain sector, but a paradigm shift in which Crypto is widely accepted as an institutional asset, supported by sovereignty, and users truly migrate.

VI. Conclusion: Winners waiting for the “turning point”

The current crypto market is in a period of ambiguity: the macro logic is uncertain, policy variables are in game, market hot spots are rotating rapidly, and liquidity has not yet completely shifted to risky assets. However, an institutional reassessment and valuation anchoring under the game of sovereign states are taking shape. We judge that the real market's main uptrend will no longer be driven by a simple bull-bear cycle, but a comprehensive reassessment triggered by the "establishment of the political role of crypto assets." The turning point is coming, and the winner will eventually belong to those who understand the macro and patiently plan.