After the new U.S. administration sent friendly signals to the crypto industry, leading compliant companies have accelerated their embrace of regulation and improved their global compliance layout, hoping to leverage the opportunity to enhance their industry status and promote global user benefits and ecological development.

Veteran players who are highly sensitive to industry regulatory trends have recently observed an unusual piece of news: in addition to TRX BTT USDT-TRC 20 that has already been launched on Kraken, Kraken has recently launched 5 tokens in the TRON ecosystem: NFT, JST, USDD, SUN, and WIN.

As a benchmark for compliant exchanges in the United States, Kraken has won the trust of the market with strict compliance audits. The inclusion of TRON assets in its token list means that they have passed the "high-quality token selection". Correspondingly, TRON's recent compliance construction has achieved remarkable results: it has jointly established T3 FCU with Tether and TRM Labs to freeze more than $150 million in assets involved in the case and assist in tracking money laundering fraud funds; the US SEC even suspended charges against three TRON companies at the end of February, showing that its compliance efforts have made significant progress and the ecological prospects are positive.

1. A two-way rush under the Web3 regulatory compliance wave, TRON and Kraken achieve mutual benefit and win-win situation

As we all know, Trump has always made a high-profile promise to "make the United States the global crypto capital" before and after taking office, and the US compliant trading platforms that are happy to see the good news naturally responded in droves. Under the favorable wind, US trading platforms are more inclined to list assets that can directly bring them strategic synergy effects.

According to the [2024 Public Chain Stablecoin Transfer Volume Ranking] released by Cryptorank, TRON ranks third, second only to Solana and ETH. According to the latest data from TRONSCAN, the issuance of USDT-TRC 20 has exceeded 66.7 billion, a record high, accounting for nearly 50% of the total issuance of USDT on the entire network. Obviously, the listing of native assets on the TRON chain on exchanges can directly bring them considerable business growth.

Kraken is a top trading platform that ranks sixth in market share (Coingecko data), ranked second in independent security assessment, and obtained a US cryptocurrency bank license. Naturally, it is more motivated to list high-quality assets in the TRON ecosystem and more efficiently achieve the benign goals of safe growth and compliant expansion. From an analytical perspective, there are three core benefits of TRON's five major assets landing on Kraken:

1. Increase the user scale: Kraken is a top compliant exchange in the United States, known for its security, and its daily average trading volume ranks among the top. It has a huge influence in the European and American markets. TRON can use this to directly reach the US market;

2. Strengthen brand potential: TRON ecosystem tokens have performed outstandingly in many aspects. After being listed on Kraken, it will undoubtedly be another long-term brand exposure opportunity, indirectly enhancing global influence.

3. Enriching capital accumulation: Kraken supports direct deposits and withdrawals in fiat currencies such as the US dollar and the euro, making deposits and withdrawals more convenient for users, and has a higher penetration in the European and American markets. After listing on Kraken, the trading volume of TRON assets can be increased in the short term, and in the long term it will attract more capital to flow into the TRON ecosystem.

2. The five assets cover multiple fields of NFT and DeFi, implying Kraken’s far-reaching layout for the TRON ecosystem

There are many TRON ecological tokens. Six major assets such as NFT and JST were selected by Kraken this time, which naturally has inherent highlights. To summarize briefly, their common advantages are:

1. It covers the mainstream tracks and is the representative of TRON ecosystem;

2. It has survived multiple bull and bear cycles with zero safety incidents and is sustainable;

3. It has been listed on mainstream exchanges such as Binance, OKX and Upbit, and has high recognition across the entire network.

In detail, the five assets have their own advantages, which can be summarized as follows:

1. NFT: Launched by the APENFT Foundation, it is committed to promoting the development of the NFT ecosystem of artworks through the high throughput and low cost characteristics of the TRON network. As of April this year, the market value of NFT exceeded US$410 million, and the number of currency holding addresses exceeded 2.16 million;

2. JST: The decentralized financial system JUST platform token. All transactions, mortgages and governance on the platform are completely transparent and run on the chain. The lending TVL ranks second on DeFiLlama. As the most important infrastructure on the chain, with the increase of TRON's global influence, the potential of JUST will be continuously stimulated;

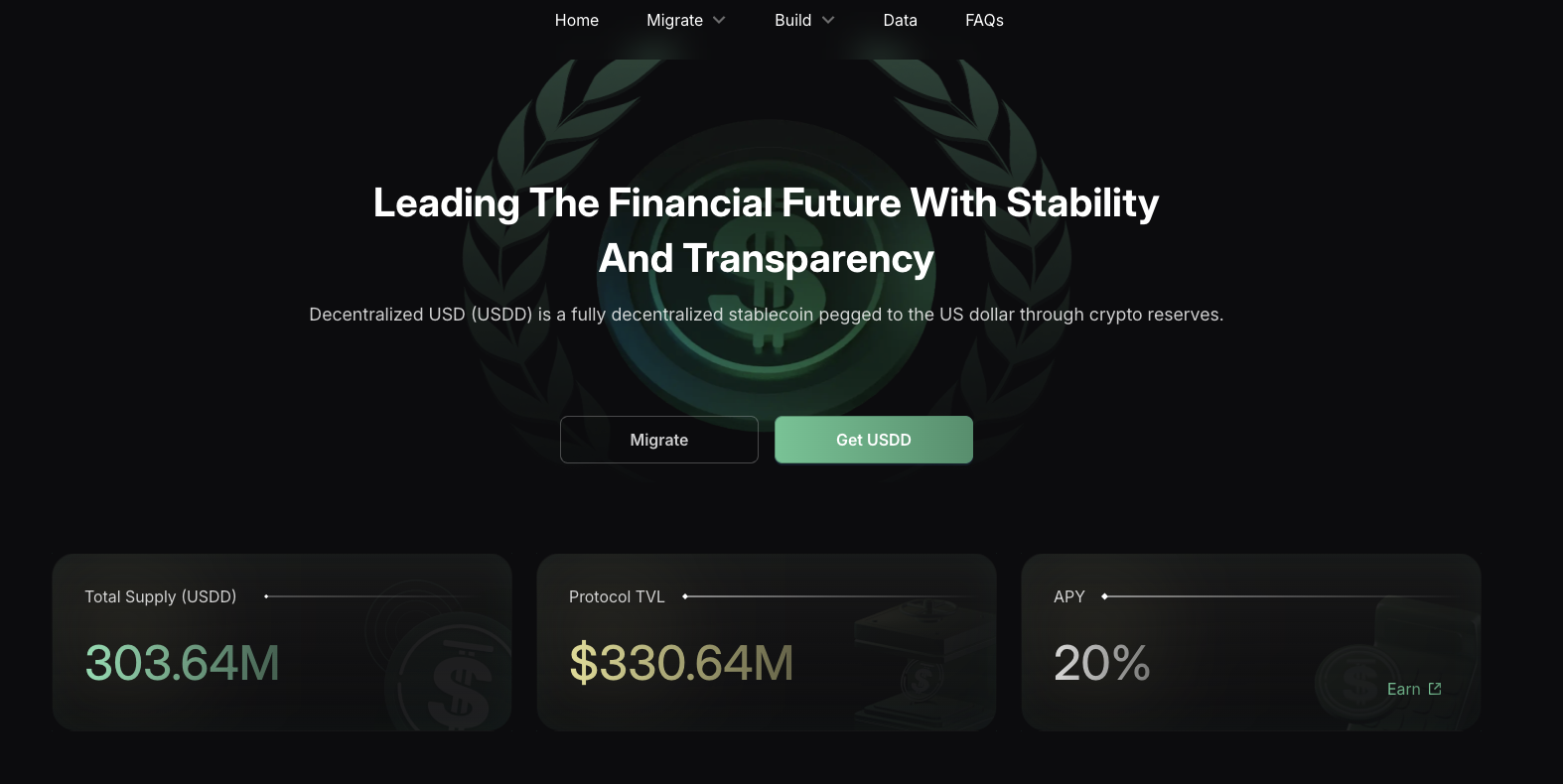

3. USDD: USDD is a super-collateralized stablecoin issued by TRON DAO Reserve. It has a stable price and diverse use cases. It is a leader among decentralized stablecoins with an APY of up to 20%. The circulation of the upgraded USDD 2.0 exceeded 100 million just 12 days after its launch, and now exceeds 300 million.

4. SUN: SUN.io’s governance token is initiated, led, and developed by the community, with zero VC investment, zero pre-mining, and zero team reservation. It relies entirely on the community and open source smart contracts, and functions are developed through smart contracts. All contract codes are completely open source.

Since the launch of SunPump, the Meme fair launch and trading platform under SUN.io, the TRON chain has added nearly 15 million transactions, more than 10 million contract calls, and an 8.02% increase in wallet addresses in 30 days. The SUN token ecosystem is firmly committed to promoting sustainability, and has destroyed a total of 494 million tokens to date, with continued deflation and value to be expected.

5. WIN: The token of WINklink, a decentralized oracle project on the TRON chain. The project aims to provide reliable data streams to enable smart contract execution. In January 2025, Winklink officially launched the Any API Data-Feeds feature on the TRON network mainnet, marking another milestone in its development. This feature supports the direct integration of real-world data from any API into smart contracts, ushering in a new era of more responsive, adaptable and interconnected DApps;

The above five assets cover the entire ecosystem, including NFT art, DeFi, community governance tokens, decentralized stablecoins, and SocialFi. They have strong ecological linkage properties and continue to strengthen the ecological prosperity of the TRON chain in the process of interaction. The most intuitive example is that in the second phase of the USDD 2.0 staking activity launched on March 1, users can earn up to 20% annualized APY by staking USDD on the DeFi project JustLend DAO, and this part of the income can in turn be invested in other sectors to benefit, which not only strengthens the value cycle properties of the USDD stablecoin, but also injects more sufficient liquidity into various projects in the ecosystem.

The launch of these five assets indicates that Kraken has fully accessed the entire ecosystem of the TRON public chain, thus seamlessly connecting to the latter's value circulation network. In this way, Kraken can achieve a breakthrough from a single point and leverage the vast value and traffic in the TRON ecosystem. Furthermore, the launch of TRON's high-quality assets may also bring about a significant "catfish effect", which in turn stimulates the motivation of other high-quality asset projects to make markets on the Kraken platform, bringing multiple dividends to Kraken.

It is foreseeable that with the steady progress of TRON's compliance work, more compliant trading platforms will actively launch high-quality assets or potential tokens on the TRON chain in the future.

3. With the support of the fruitful results of compliance construction, TRON will comprehensively expand its global influence in this cycle

In the new cycle, why does TRON have more potential to take the lead and expand its global influence? Because TRON's own super value foundation is still accumulating, and the masterstroke of compliance construction can further stimulate the potential of its ecology. The huge value generated during this period will spill over to the global Web3 financial field.

The latest data shows that the total number of TRON accounts has exceeded 299 million, the number of transactions has exceeded 10 billion, the total locked value (TVL) has exceeded 18.4 billion US dollars, and the issuance of USDT-TRC 20 is close to half of the total circulation. It has become an important global payment network. Based on this, TRON can better meet the demands of encryption infrastructure construction in many countries, and its global influence continues to surge.

With the accumulation of the above favorable factors, multiple disruptive applications in the TRON ecosystem are more noteworthy. For example, will USDD compete with mainstream stablecoins? Will the Sun.io ecosystem give birth to more phenomenal Dapps or assets? Will the DeFi platform JUST iterate with more long-term value potential? Let's look forward to it and wait.