The global economy has changed suddenly. The United States has imposed a new round of tariff policies on many countries, which has stimulated investors' risk aversion. The prices of risky assets have weakened, and where capital flows have become a hot topic in the market. In this wave of uncertainty, the decentralized stablecoin USDD launched by TRON has risen strongly. With its stable properties anchored to the US dollar and high-yield financial management potential, it has quickly become popular. As a core financial asset supported by TRON DAO Reserve, USDD not only builds a security barrier for users to resist market storms, but also lights up the road to wealth growth beyond traditional finance through a diversified DeFi ecological layout.

USDD: Value support behind stable anchoring

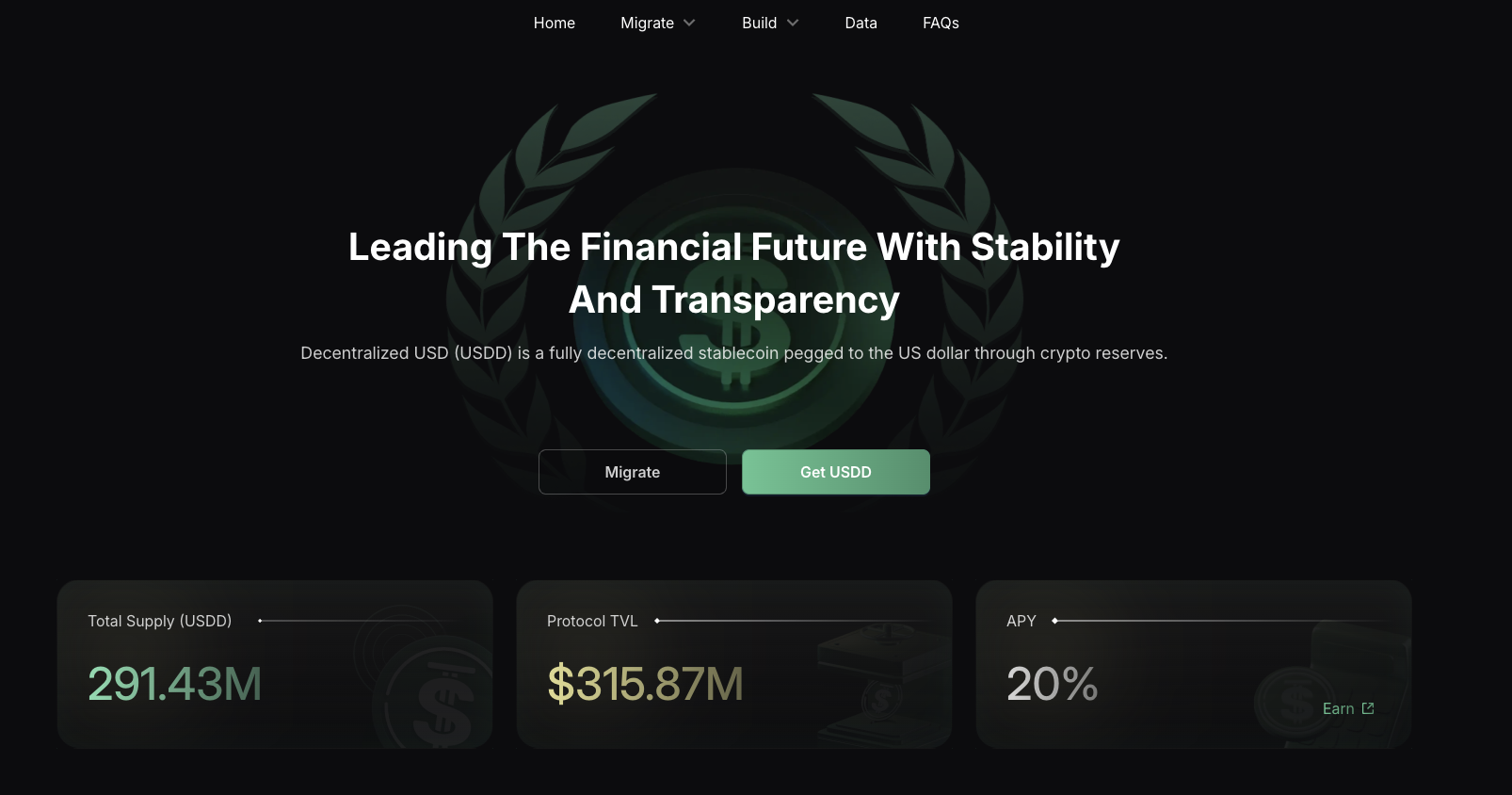

When the prices of risky assets around the world are in turmoil, USDD becomes a bright spot with its decentralized design and solid value support. As a stablecoin pegged to the US dollar at a 1:1 ratio, USDD ensures price stability through over-collateralized cryptocurrency assets and can be operated autonomously by the community without the intervention of a central agency. This completely decentralized feature gives it the advantages of being tamper-proof and unfreezable, allowing users to truly take control of their assets and completely say goodbye to centralized risks.

USDD's mission does not stop there. It aims to inject safe and transparent trading blood into the decentralized finance (DeFi) ecosystem and narrow the distance between traditional finance and the DeFi world. Whether it is daily payment or long-term investment, USDD has become the cornerstone of digital assets trusted by users with its stable value and open ecosystem. Across multiple public chains such as TRON, Ethereum, BNB Chain and BTTC, USDD's application landscape continues to expand, consolidating its leading position in the global blockchain market.

It is worth mentioning that the upgraded version of USDD 2.0 has shown amazing growth momentum since its launch. Its circulation exceeded 100 million in just 12 days after its launch, and is now close to 300 million, highlighting the market's high recognition and strong demand for it.

How good is USDD for financial management? The perfect combination of high returns and flexibility

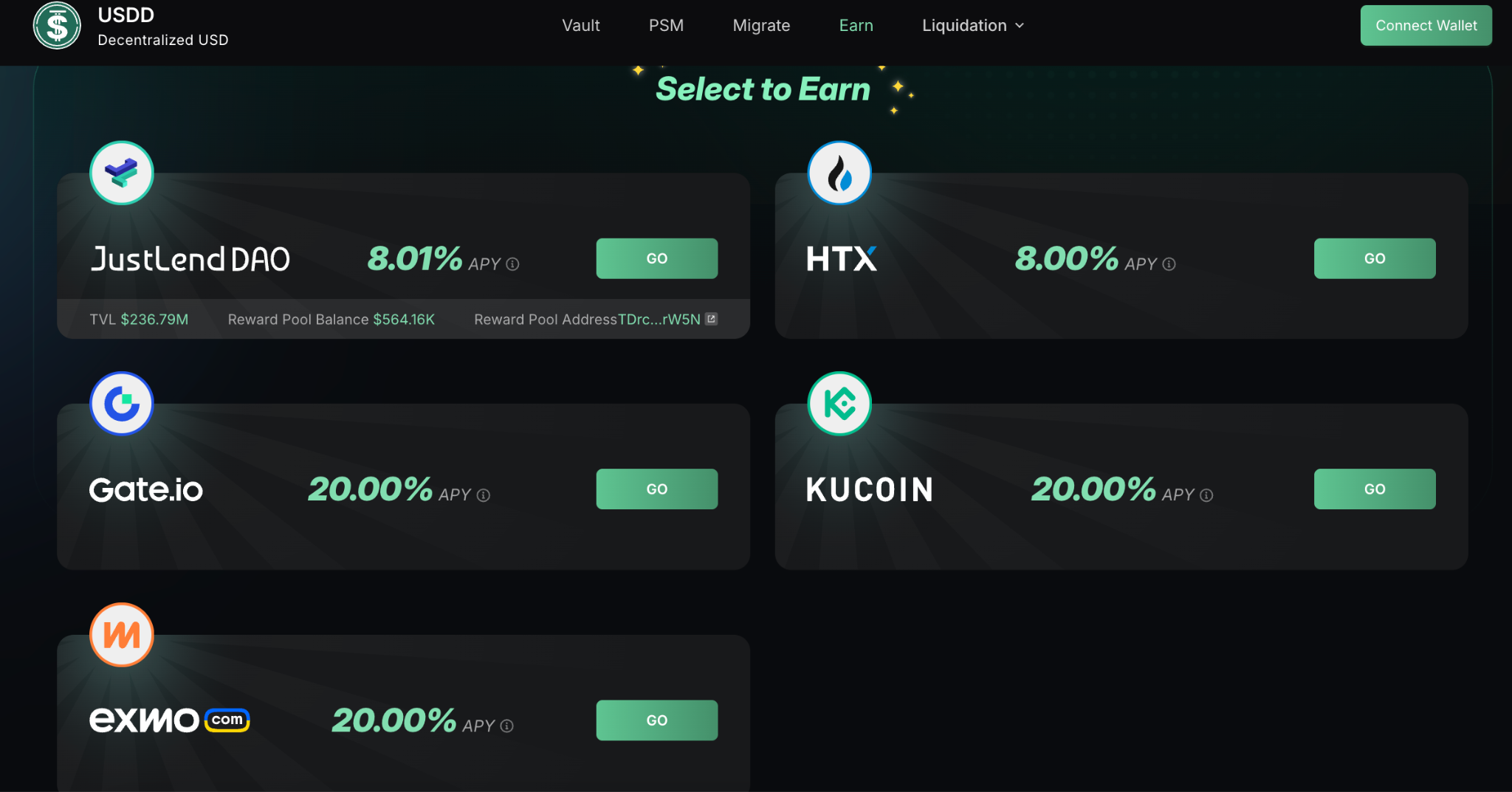

The new US tariff policy has caused market turmoil, and global capital has accelerated its flight from high-volatility assets and turned to a direction that takes into account both stability and returns. The financial products launched by USDD are like a shot in the arm, with an annualized rate of return of up to 8% to 20%, far exceeding the imagination of traditional financial management, bringing exciting return prospects to investors.

In addition to high returns, USDD financial management also captures people's hearts with its flexibility and inclusiveness. Users can deposit and withdraw funds at any time without lock-up constraints, and can easily cope with market changes. What's more surprising is that it supports small-scale participation, and novices do not need a high threshold, and can operate with one click through the mobile terminal. At present, USDD has seamlessly connected to DeFi platforms such as JustLend DAO and SUN.io, as well as compliant exchanges such as Kraken, HTX, Bybit, Gate.io, and Poloniex. Users can reap high returns by staking USDD.

How to participate in USDD financial management

The participation method is simple and convenient: users only need to purchase USDD through centralized exchanges (such as HTX, Gate.io), or exchange it on the chain, and then choose platforms such as JustLendDAO, connect to supported wallets, and deposit with one click to enjoy the benefits. The operation is simple and efficient, and the experience is smooth and smooth. Currently, wallet applications that support USDD include TronLink, TokenPocket, imToken, Gate Web3 Wallet, etc., providing users with a variety of choices to ensure the convenience and security of asset management.

Stable income is the core logic of crossing the cycle

Against the backdrop of increasing global economic uncertainty, investors are increasingly seeking a balance between stability and profitability. USDD relies on a decentralized mechanism to ensure price stability, while relying on TRON's mature DeFi ecosystem to provide high-yield financial management options. Whether it is short-term risk hedging or long-term investment, USDD provides users with a solid support point in market fluctuations.

The value of USDD is not only reflected in the technical level, but also in its fit with the trend of changes in the global financial landscape. When the traditional market is shaken by policy adjustments, DeFi's transparency and community governance mechanism provide users with a new basis for trust. As a link between traditional finance and DeFi, USDD not only meets the market's demand for stability, but also enhances user participation through high-yield design. As the integration of DeFi and traditional finance deepens, USDD is expected to play an important role in it and open up broader opportunities for investors. Participating in the USDD ecosystem and using stable returns to cope with cyclical fluctuations may be one of the wisest financial choices at the moment.