Original author: BitMEX

Quick Facts

The U.S. stock market continued to be under pressure this week, falling back to previous lows after each rebound. The cryptocurrency market is in sync with the stock market and faces downside risks.

The much-anticipated announcement of the Bitcoin Strategic Reserve disappointed the market: the U.S. government only plans to hold seized assets and has no plans to increase its holdings.

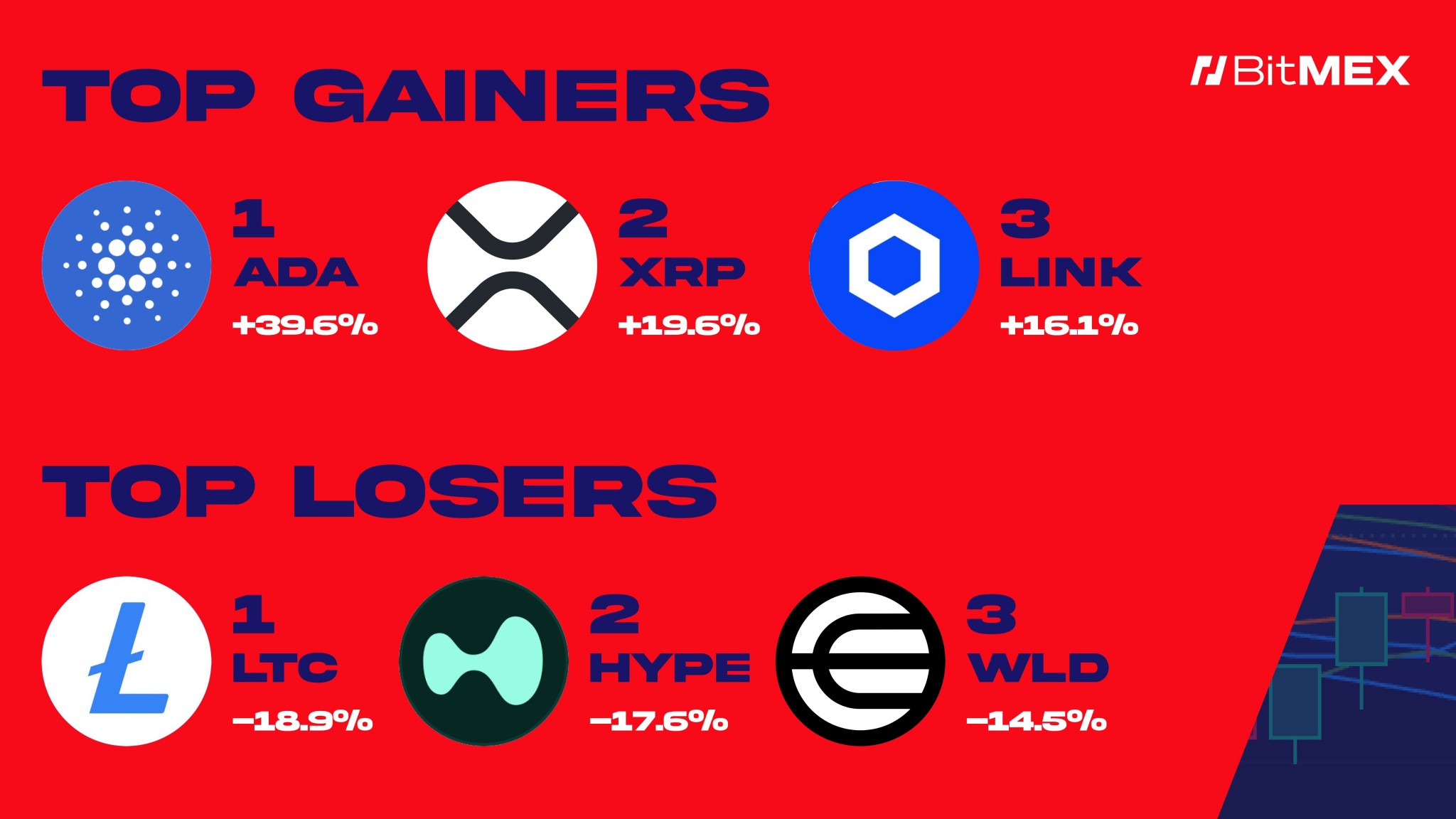

ADA, XRP, and LINK performed the best, with increases of 39.6%, 19.6%, and 16.1%, respectively; while LTC, HYPE, and WLD performed the worst, with declines ranging from -18.9% to -14.5%.

In the trading analysis section, we will take a deep dive into Trump’s Bitcoin strategic reserve executive order: how bullish is this policy? Will the US government sell gold to buy Bitcoin?

Data at a Glance

Best Performer

$ADA (+39.6%): ADA surged as it was included in the US cryptocurrency reserve program, sparking strong interest from institutional investors.

$XRP (+19.6%): Ripple also gained after being selected for the U.S. crypto reserve program and its prospects for cross-border payment applications also brought positive news - although some analysts believe this wave of gains may not be sustainable.

$LINK (+16.1%): Chain Oracle has gained an advantage over competitor $PYTH, which has frequently experienced downtime and user experience issues, further consolidating LINK’s position as the industry’s core data oracle.

Worst performance

$LTC (-18.9%): Litecoin fell sharply after a rally driven by ETF expectations.

$HYPE (-17.6%): HYPE lost market enthusiasm due to its overhyped EVM ecosystem promises, and trader interest quickly faded.

$WLD (-14.5%): WorldCoin plunged on the upcoming massive token unlock, and inflation concerns triggered a wave of investor selling.

Market Dynamics

Macroeconomics

ETH ETF outflows last week: -$60.8 million ( source )

BTC ETF outflows last week: -$279.3 million ( source )

Trump signs executive order to establish US strategic Bitcoin reserve ( source )

Trump suspends tariffs on goods from Canada and Mexico under trade agreement ( source )

Trump: Don’t pay attention to stock market performance, tariffs will make the United States "stronger" ( Source )

China sets 2025 economic growth target of "around 5%", launches stimulus measures to address trade concerns ( Source )

US Senate Banking Chairman Pushes Forward on Anti-Banking Discrimination Bill Following Cryptocurrency Controversy ( Source )

Texas leads the race among US states to invest in cryptocurrency ( source )

Project Progress

ADA, SOL, and XRP are expected to be included in the US cryptocurrency reserve plan ( source )

Solana community discusses drastically reducing SOL inflation rate ( source )

Lombard Finance will launch LBTC, a Bitcoin liquidity staking token, on Sui ( Source )

Sam Altman's World Network launches new chat feature to connect real people ( source )

Trump's cryptocurrency project adds Solana competitor SUI to its portfolio, and SUI price surges ( source )

Kava releases the largest decentralized AI model, ushering in a new era of crypto x artificial intelligence ( source )

AAVE token buyback proposal progresses, price rises in response ( source )

SBF's pardon lobbying journey continues, guest appearance on Tucker Carlson podcast ( source )

Trading Insights

Disclaimer: The following content is for reference only and does not constitute investment advice. This is a summary of market news and it is recommended that you always do your own research before making any trades. The following content does not represent any guarantee of returns and BitMEX is not responsible for your trading performance.

Trump’s Bitcoin Reserve Plan: Buy Rumors and Sell Facts?

Jabin Botsford | The Washington Post | Getty Images

Trump signed the "Bitcoin Strategic Reserve" executive order, which shocked the crypto market. On the surface, this policy seems to be good for Bitcoin - after all, it includes Bitcoin in the US reserve asset system for the first time. However, when we look into the details of the policy, we find a key point: this is a budget-neutral policy. In other words, the government does not intend to inject new funds to increase its holdings of Bitcoin, but to acquire BTC by allocating or selling existing assets. For traders, this has triggered a typical "buy the rumor and sell the fact" market. Let's take a deeper look at how this affects your trading strategy.

Market reaction: the collision between expectations and reality

Before the executive order was signed, cryptocurrency traders had high expectations. Rumors of direct government purchases of Bitcoin had driven the market higher since Trump took office, with many expecting a fresh injection of demand. However, when the executive order was announced, prices took a sharp turn for the worse. Bitcoin fell about 6% in a matter of hours as market participants realized that the government was not injecting new money. The order confirmed that the reserve increase would only be achieved through existing assets or confiscated assets, disappointing traders who were expecting large-scale government purchases.

Budget Neutrality: An In-depth Look

Budget neutrality is at the heart of Trump’s executive order. This means that any acquisition of Bitcoin cannot increase the federal budget or deficit. In practice, this limits the government’s ability to increase its BTC holdings through new spending. Within this constraint, the government can take the following avenues:

Asset Forfeiture: The government will use Bitcoin obtained through criminal and civil asset forfeiture. While this approach could remove approximately 200,000 Bitcoins (worth over $17 billion) from circulation, such forfeitures are unpredictable and do not provide a steady source of Bitcoin.

Asset Replacement - Selling Gold: Selling part of the US gold reserves to buy Bitcoin is one of the most popular options. The United States has a huge gold reserve, and even converting a small part can bring considerable funds. But this may disrupt the gold market and undermine confidence in traditional reserves.

Reallocating existing assets or tariff revenues: While there has been discussion about shifting tariff revenues or other federal assets, no direct reallocation plans have been confirmed.

Government Mining: The idea of using idle government computing power to mine Bitcoin has been proposed, but this option is limited given Bitcoin's supply cap and fierce mining competition.

In short, while the policy confirms that the United States views Bitcoin as a strategic asset, its short-term positive impact is limited because it does not increase new market demand.

Historical Lessons: The "Selling News" Phenomenon in the Cryptocurrency Market

This is not the first time that the crypto market has seen a “buy the rumor, sell the news” situation:

Ethereum Merger (2022): Ether surged ahead of the upgrade but fell more than 10% once the change was finalized.

El Salvador Bitcoin Legalization (2021): Bitcoin rose strongly ahead of El Salvador’s official adoption, but fell sharply on the day of the announcement.

CME Bitcoin futures launch (2017): Hype for regulated futures drove Bitcoin to an all-time high, but the market immediately pulled back after the launch.

In each case, traders who bought into the rumor early made short-term gains and then sold when the news came out. Trump’s Bitcoin reserve order appears to be repeating this pattern.

Trading inspiration: Short-term caution, long-term opportunities

short term:

The immediate market reaction was bearish, with Bitcoin falling as traders closed their positions after their expectations were dashed. Short-term traders may consider cautious shorting or hedging strategies on weak rallies, while keeping a close eye on key support levels in the mid-$80,000 region.

long:

For long-term investors, this policy sends a strong signal that Bitcoin is being recognized as a strategic reserve asset. This could ultimately drive institutional confidence and global adoption, pushing up BTC prices over time. Any short-term pullback—especially below $90,000—could be an excellent buying opportunity for investors who believe in the long-term value of Bitcoin.

Balanced strategy:

Medium-term traders should remain flexible. Expect choppy consolidation as the market digests this news. Look for support signals and adjust positions as the broader trend develops - especially if the government follows up with more aggressive measures (such as asset swaps involving gold) to increase reserves.

Final Thoughts: Sell the News, But Remain Bullish

Trump's executive order on the strategic Bitcoin reserve is a classic example of short-term disappointment versus long-term potential. While the market reacted negatively immediately after the announcement - triggering a "sell the news" rally - the underlying message was clearly positive: the United States has now officially recognized Bitcoin as a reserve asset. This recognition, even without an immediate infusion of new money, has the potential to transform Bitcoin from a speculative asset to a cornerstone of national reserves.

Our Position:

Short term: Stay cautious. The market has already digested the news and any weak rebound may bring short-selling opportunities.

Long term: Maintain long positions in Bitcoin Core. Use any break below key support to enter positions as strategic reserves are a slow-burning positive signal, but a meaningful one.

Timing is crucial in trading. While initial reactions may be characterized as "sell the news," remember that once short-term noise subsides, Bitcoin's long-term fundamentals as a national reserve may still pave the way for a significant uptrend. Happy trading, and don't forget to be ready to buy the dips when the market frenzy subsides!