Original author: HunterGo (X:@HunterDogKing)

The current market value of Wormhole in Whales is estimated to be around US$20 billion, and there are even rumors of a market value of up to 50 billion. Compared with Wormhole, the value of Axelar, which was just launched on Binance, is still greatly underestimated due to the lack of attention from hair-raising studios. Another consensus that is underestimated in the Chinese-speaking area is that currently some Western secondary funds and research institutions on the cross-chain interoperability track basically believe that from a technical perspective, Axelar (AXL) will be far better than Wormhole, which has become popular. /LayerZero also has long-term competitive advantages.

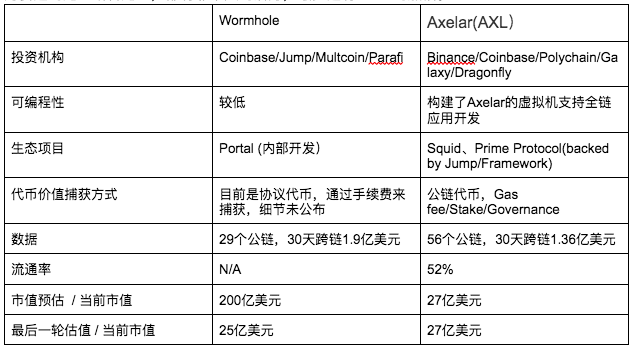

Let’s look at a simple table first. As the two leaders in cross-chain interoperability, Axelar has higher competitive advantages than Wormhole in terms of programmability, ecological projects, and token value capture methods. Since there is no consensus on the cross-chain interoperability track, the markets opening market value for Wormhole ranges from US$20 billion to US$100 billion. From this perspective, once Wormhole issues coins, Axelar, as the first or second player on the track, has great potential, with at least a 5-10x increase.

FDV is not important in the bull market, what is important is consensus and popularity. The market is speculating on the new rather than the old, and the new AI track has directly given birth to TAO/WLD, two projects with a market value of 100 billion U.S. dollars; as the track rotates, Wormhole/LayerZero successively issues coins, and major North American VCs join forces to implement cross-chain interoperability The sexual track is very likely to generate projects with a market value of hundreds of billions of dollars.

Well-known secondary funds Progrmd Capital and Theblockcrunch have analyzed Axelars market value expectations from a revenue perspective based on the Axelar networks transaction volume, fee income, and Relayer development [1][2]:

As a guarantee, assuming Axelars market share is 25% and gas/txns revenue is 0.2 AXL, then Axelar will achieve revenue of 309 B (Billion). If the PE (price-to-earnings ratio) is 30 times, Axelars guaranteed market value is US$9.3 billion (far from the market value). Lower than Wormhole market capitalization)

Optimistic estimates, based on the same 30 times PE, Axelars market share is 50%, Axelars market value will reach $114 billion (100x the current price)

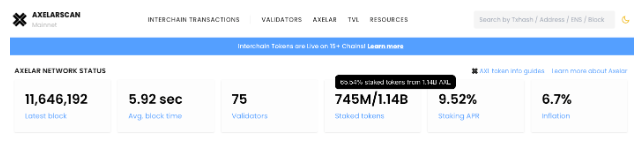

Although AXL has increased 2-3 times, it can be held longer in the bull market and at the same time participate more deeply in the staking and governance of the Axelar network. The current pledge rate of the Axelar mainnet is 65.54%, and the APR is 9.52% [5]. If this price continues to double and the gas fee income is added, the passive APR of the stake can have very considerable income. A recent proposal by Axelar is to use a Gas burning mechanism. Axelar will continue to destroy AXL. Assuming that there are 10 million transactions per day and network handling fees of 730 million AXL, in this case AXL will begin to deflate to -63.75% [ 4], then Axelar will be similar to the combustion model of ETH at this time.

For developers, the recently announced virtual machine (AVM) by Axelar marks Axelars important layout on the cross-chain interoperability track - creating a programmable full-chain Layer 1, and developers can write smart contracts based on AVM to implement The final chain abstraction layer was developed to simplify the user experience [3]. Before the launch of AVM, Axelars core technical barrier was General Messaging (GMP). Axelar is not a simple cross-chain bridge concept. GMP transcends the original concept of asset cross-chain bridge and enables developers to build native cross-chain applications. In crypto, assets are issued based on applications, and serving the application itself will be more fundamental than serving assets. This also lays the technical framework for Axelars subsequent gas burning mechanism and public chain governance.

Summarize:

Axelar (AXL) has solid fundamentals and has technical barriers on the cross-chain interoperability track. It is well timed to lay out its plans on the eve of the issuance of Wormhole and LayerZero coins.

From the perspective of the track, funds have not yet rotated into this sector. At the same time, large funds in North America are doing the work, with development space of hundreds of billions of dollars in projects. At the same time, Axelar is also in the big track of cosmos. Axelar is the cosmos ecology and EVM chain. The liquidity portal will directly benefit from the explosion of the cosmos ecosystem.

From a project comparison point of view, Axelar (AXL) has significant advantages in technology, ecological applications, and token value capture methods. It is currently the cross-chain protocol and development solution that best meets market needs.

From the perspective of layout timing, Axelar (AXL) has just been listed on Binance and completed a round of market wash. At the same time, the consensus has not been fully established. On the eve of Wormhole/LayerZero’s currency issuance, it is a very good position opening range.

The exit strategy can be based on the market or Wormholes coin issuance, taking profits in batches; or based on the gas burning indicator of Axelar (AXL) as one of the basis for the trading strategy.

Reference:

[1] Progrmd Capital’s Market Cap Estimates for Axelar’s P/E Ratio

[2] The Block Crunch’s competitive analysis of Axelar

[3] Axelar publishes virtual machines

[4] Axelar’s gas burning mechanism proposal and deflation forecast