Source of this article: Pantera Capital

Translator: Odaily Azuma

Editors note: From last night to this morning, the crypto market once again experienced a sudden change. BTC once exceeded US$57,000, rising 10% in a single day. At this critical moment, many investors are trying to find various bullish signals and trying to find answers to the sudden rise of BTC, but Odaily found that Pantera Capital provided an answer in a recently released report The Absence of Bad Things A very unique idea - the biggest feature of the current market is that there are no negative events, which in itself is the biggest benefit.

The following is part of the summary of the Pantera Capital report, compiled by Odaily.

Last June, I discussed the banking crisis, macro markets, and blockchain with former SEC Chairman Jay Clayton at the Bloomberg Invest Conference.

At the end of the discussion, the moderator asked me a question: “What potential black swan events should we be aware of?”

My answer at the time was: Before a black swan happens, everyone will choose to ignore it. Once it happens, everyone will think about discussing what will be the next (black swan). In my opinion,The best news right now is that we’ve seen all the potential black swans come to fruition over the past year, and nothing crazier will happen again.… If you had to ask me to say something, I would just say that the regulatory attitude was something that no one expected, and it could lead to several different outcomes.

A very important theme regarding current market conditions is the absence of bad news.

Throughout 2022 and much of 2023, there has been a steady stream of bad news that is as rare as it is crazy.

Global macro markets have experienced unprecedented volatility. Edward McQuarrie, an emeritus professor at Santa Clara University who specializes in research on historical investment returns, once said that 2022 is the worst year that U.S. bond investors have ever experienced - Even if you go back 250 years, you cant find a better year than 2022. Bad year.

2022 is also the worst year for the classic 60/40 stock-bond portfolio since the Great Recession.

Private markets have suffered even more, which has a direct impact on our venture capital business. Compared to the previous year, total IPO proceeds were down 95% and deal volume was down 85%.

The cryptocurrency market is also not immune. The FTX thunder and the absurd leverage operations of six lending institutions caused the total market value of cryptocurrency to shrink by more than 70%.

In my opinion, these are crazy events that only happen once in a generation.In the next 10 or 15 years, no one will lend money to cryptocurrency hedge funds, especially those with no collateral and opaque operations, but in the next generation, I have more than 25 years of experience observing cycles. Someone will definitely do it again.

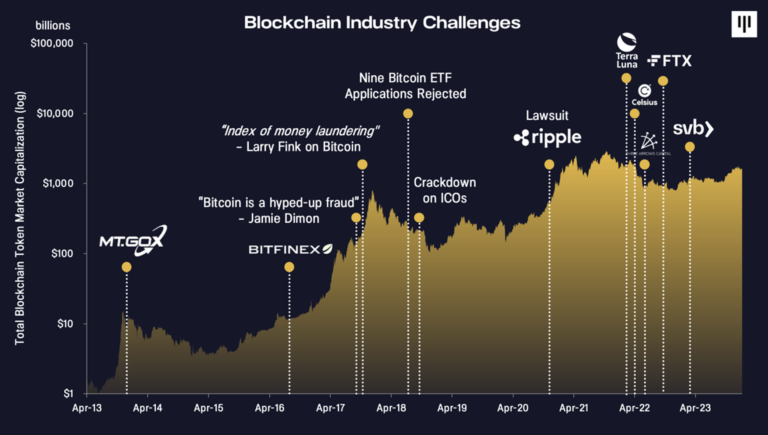

Below is a visual representation of the catastrophic events in blockchain history.

These black swans are not killing cryptocurrencies,Their absence, in turn, has become a huge benefit for the new cycle.

There’s another huge plus, some of the regulatory hurdles the cryptocurrency industry previously faced have been removed, especially for financial institutions looking to build on this emerging asset class.

In the past year, Ripple and Grayscale’s victories in lawsuits and the approval of ETFs indicate that the regulatory environment in the blockchain field may be becoming clearer.

Institutional adoption appears to have accelerated since the Bitcoin spot ETF was approved in January.

Given that Bitcoin will also usher in its halving at the end of April 2024, we believe these positive interactions will drive BTC towards the next bull market.

also,The blockchain industry may be experiencing a transition from the dial-up Internet to the broadband era.We can witness this jump through the growth of Ethereum Layer 2 and other high-performance Layer 1, which will be the main content of our investor communication in March and will be the focus of our next thematic seminar.

Pantera Capital has probably been focused on the cryptocurrency industry longer than any company - more than a decade and has witnessed multiple bull and bear cycles. We have gone through three full cycles and seen multiple pumps and dumps. We believe that the market is now at the beginning of the fourth major cycle.

The stock market crash of 2022 took a huge toll on institutional investors, and many institutions have withdrawn from private markets. Now, with stocks back at all-time highs, theyre going to come back to private markets again, so I think its very likely that the cryptocurrency market will have a strong bull run over the next 18 to 24 months.

This is a turning moment. The trauma of the past few years in the financial market and blockchain field has become a thing of the past. At the same time, positive factors such as halving and regulatory slowdown are also happening at the same time, all of which indicate the direction of future development.