Original Author:@auggest_crypto

Mentor:@CryptoScott_ETH

TL;DR

Metis, as the first Layer 2 network focusing on LSD (Layered Staking Distribution), has overcome the limitations that other Layer 2 networks cannot reach. Its unique decentralized sequencer pool technology has created staking demands, making LSD the most convenient and high-yielding channel for community participation in decentralized development.

LSD, as an important component of Ethereum's POS mechanism network, lowers the network staking threshold, enhances network security, maintains token value, and stimulates asset liquidity, leading to the development of the DeFi ecosystem.

To promote liquidity staking, Metis has launched various ecosystem incentive programs such as MetisLSB, offering a 20% annual mining yield for the LSD protocol, far exceeding Ethereum and other networks, which only have a 4.25% yield.

Emerging protocols like ENKI, Artemis have initiated community proposals. Their token economics and upcoming ecosystem activities will be important criteria for early airdrops, deserving attention.

1. Metis LSD

1.1 Why LSD?

1) Reducing the high threshold of traditional staking

LSD, also known as Liquid Staking Derivatives, is a type of derivative that involves staking liquidity. After the Ethereum Paris upgrade shifted the blockchain's consensus mechanism from PoW to PoS, on-chain nodes are required to stake a certain amount of tokens to participate in the network and receive block rewards and staking incentives. However, for ordinary users, participating in on-chain staking is not easy.

Generally, the amount required for on-chain staking is high. For example, Ethereum nodes require a minimum of 32 $ETH, which raises the entry barrier. Staking also has a long time commitment, which can result in capital lock-up and low efficiency for retail investors. Staking also requires some technical and hardware requirements, which is not user-friendly.

With the upgrade of Shapella in Ethereum Shanghai, the era of LSDfi begins. LSD opens up new avenues for ordinary users to earn token rewards and unlocks the liquidity of staked assets. It has also led to the development of various protocols such as LSDfi and Restaking, promoting the rapid growth and widespread participation of the DeFi ecosystem.

As a Layer 2 solution, Metis introduces the POS mechanism into the sequencer pool, generating staking demand for $METIS. By decentralizing consensus security from node staking to the sequencer, the development of LSD is a crucial step towards decentralization.

Metis is a Layer 2 network on Ethereum that truly focuses on achieving decentralization. It is the first network to prioritize decentralized sequencers and redistributes gray income such as MEV back to the community, making it a transparent and user-friendly network. In this article, we provide a detailed introduction to Metis' decentralized technology, with a focus on the decentralized sequencer pool for node staking.

Metis becomes a sorting pool by introducing multiple sorters, and any sorter pledged into it has the right to view the transaction pool content and process transactions, preventing a single sorter from malicious manipulation. Nodes must pledge the network token $METIS to participate in the network, and becoming a sorter node requires a minimum pledge of 20,000 $METIS (worth about $2.4 million). However, once the sorter participates in transaction block production, it can simultaneously receive gas income from processing transactions and additional $METIS pledge incentives. Block proposers are randomly selected based on their stake in the network.

In addition, being a Metis sorter not only allows one to enjoy network and pledge rewards, but also in the EDF Program launched by Metis, 3 million $METIS out of the 4.6 million $METIS will be allocated to achieve the decentralization of sorters. This demonstrates the importance Metis attaches to decentralized sorters. However, ordinary users who want to participate are discouraged by the high pledge threshold of $2.4 million.

LSD provides a channel for users to participate in pledge with a small amount of investment, greatly lowering the participation barrier.

2) Enhance network security and maintain token price

Why is pledge directed towards the community? For public chains using POS mechanism, the security of the network depends to a large extent on the decentralization of node pledges.

If the pledged assets are concentrated in the hands of a few nodes, they will have enough power to manipulate the network, leading to centralization risks. On the contrary, if there are many and dispersed pledge participants in the network, the influence of a single node on the network will be reduced, increasing the cost of any potential malicious behavior, as attacking the network would require controlling more nodes.

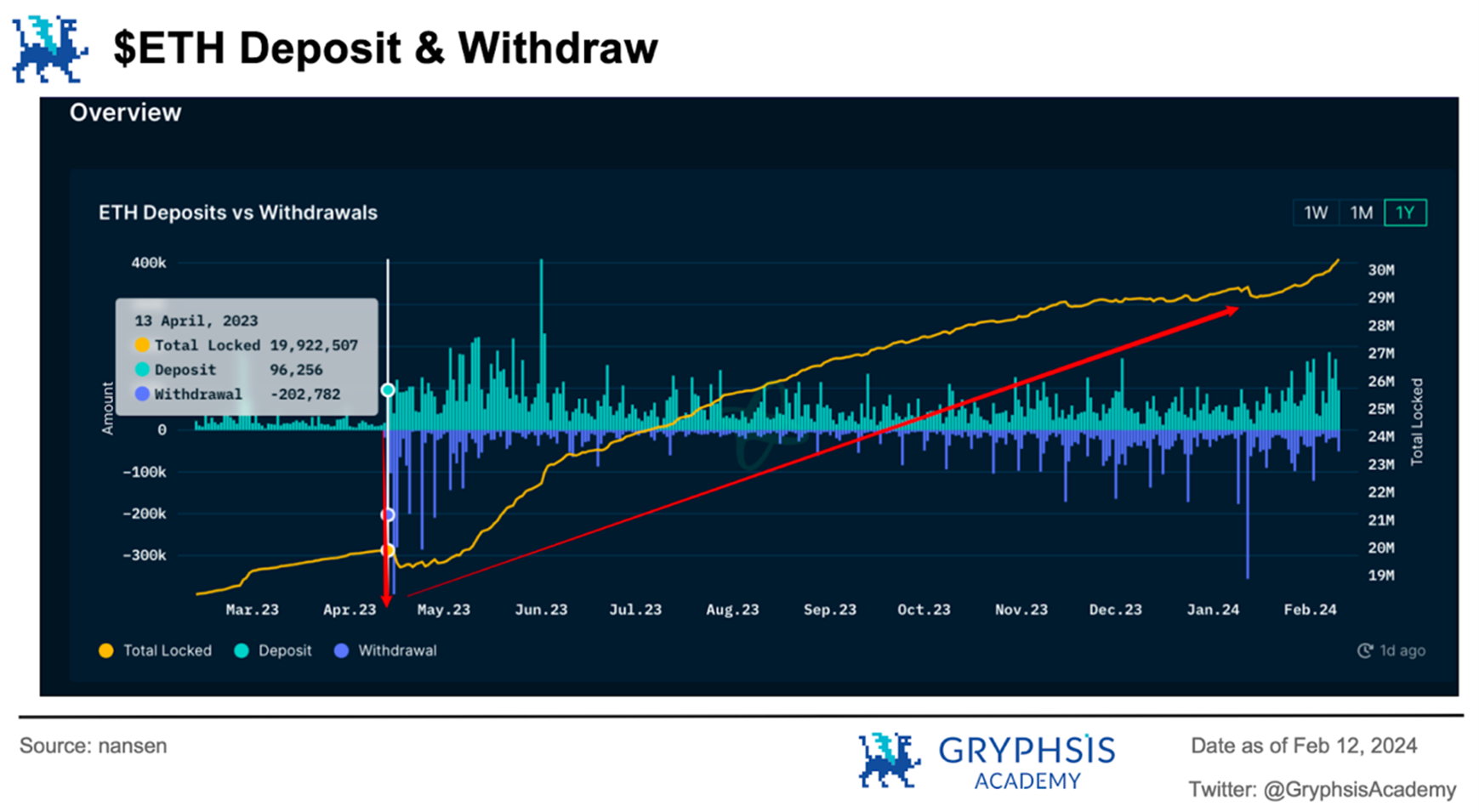

Although there was a temporary significant withdrawal of pledged $ETH after the Ethereum Shanghai upgrade, the total amount of ETH locked has achieved substantial growth in the long term. Users move the withdrawn funds to the LSD protocol, allowing pledge and asset liquidity and flexibility to coexist, also realizing an increase in Ethereum's pledge rate, maintaining network consensus and thereby improving network security and stability.

It can be seen that the launch of LSD makes Ethereum's network pledge more accessible to retail investors, making the Ethereum network safer as more tokens participate in pledge. At the same time, pledge reduces the market liquidity of $ETH, controlling supply to maintain/increase token value.

3) Improve capital efficiency and promote the DeFi ecosystem

LSD, as an important component of Ethereum, currently has a TVL of 37.96 B, accounting for 35% of the total TVL of Ethereum. Head protocols like Lido and Rocketpool provide high-quality and versatile liquidity staking, driving the development of other sub-tracks like LSDFi, Re-Staking, and DVT.

The well-developed liquidity staking ecosystem makes $ETH assets more divisible and stimulates new gameplay in the DeFi ecosystem. For example, users can further utilize the tokens obtained from staking in lending, market-making, farming, and other scenarios, greatly enhancing the efficiency of originally locked capital.

LSD attracts more users and capital to enter the DeFi ecosystem by providing liquidity and innovative financial products, thereby stimulating the economic growth of the entire ecosystem.

Therefore, the development of LSD is crucial for the network of the POS mechanism, as it is an important step in maintaining network consensus and promoting the circulation of ecological capital. Metis also provides a rich and comprehensive incentive plan to encourage liquidity staking in this ecosystem.

1.2 Ecological Incentive Plan

1.2.1 MetisLSB

On February 8, Metis launched the LSB plan (Liquid Staking Blitz), which focuses on helping Metis become the first Rollup with a decentralized sequencer and sharing sequencer revenue with the community.

Officially, 3M $METIS will be extracted from the 4.6 million ecosystem development fund (MetisEDF) to accelerate the deployment and development of the LSD protocol. The selected protocols will have the right to pair with Sequencer nodes and provide a 20% MRR (Mining Reward Rate) mining incentive for the first year.

As mentioned earlier, becoming Metis' sequencer allows participants to receive gas income from processing transactions and additional $METIS staking incentives. The LSD protocol also has the right to pair with sequencer nodes as individual entities and receive a 20% mining reward rate.

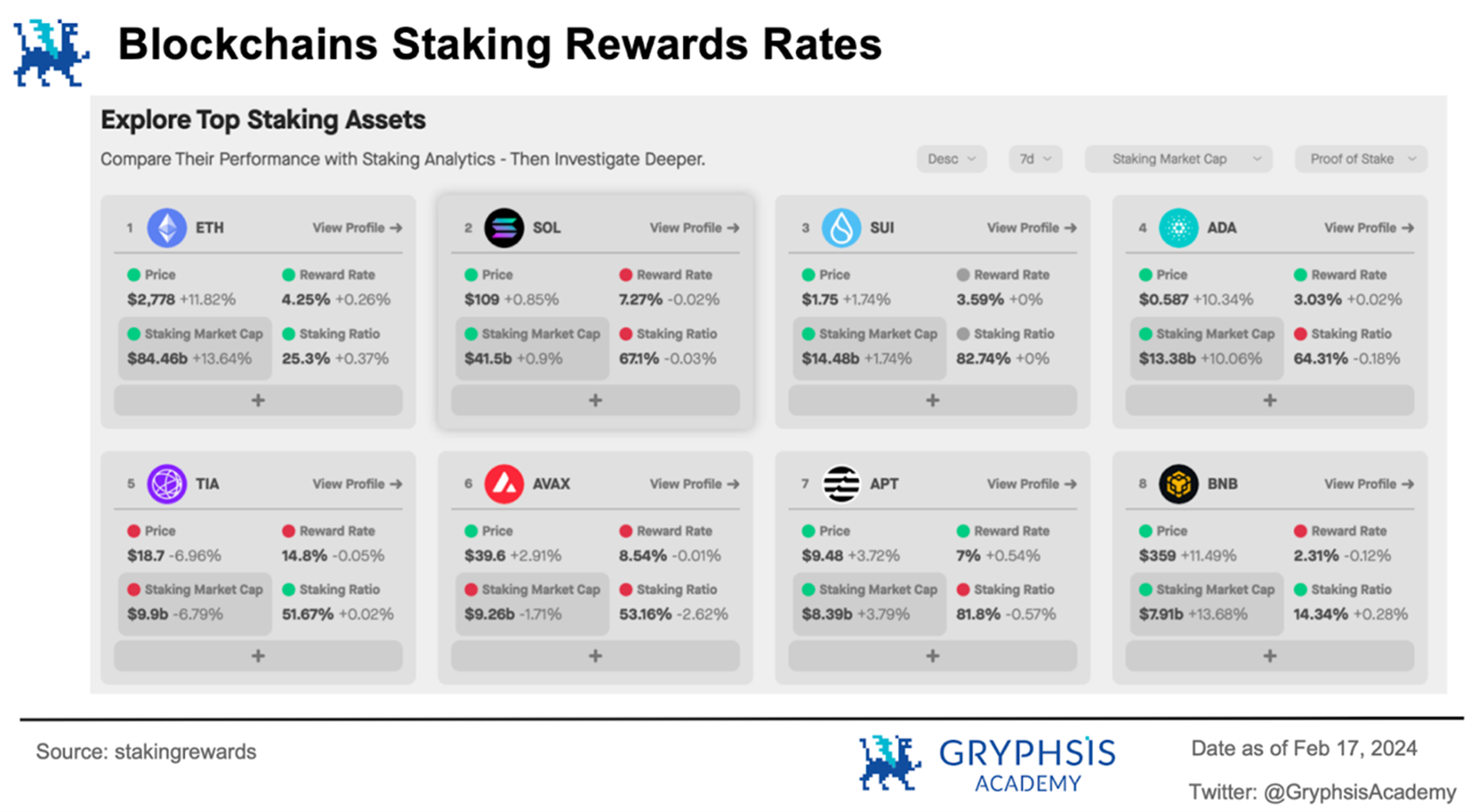

Compared to other POS network staking rates, Ethereum only has 4.25%, Solana has 7.25%, and Celestia has 14.8%. If we only consider the Ethereum ecosystem, apart from the recent popular API 3, only Metis has the highest reward rate, while the rest are below 10%.

Metis LSB provides revenue incentives for LSD products by integrating sorter mining and ecological funds, amplifying the income from liquidity staking. It not only attracts more users to participate in decentralized implementation but also expands the development of derivative products related to staking, including re-staking, and activates asset circulation while achieving network expansion.

1.2.2 MetisEDF & Journey

On December 6th, Metis offered a $5 million incentive program #MetisJourney to incentivize and attract more relevant Dapps deployments in the Defi category.

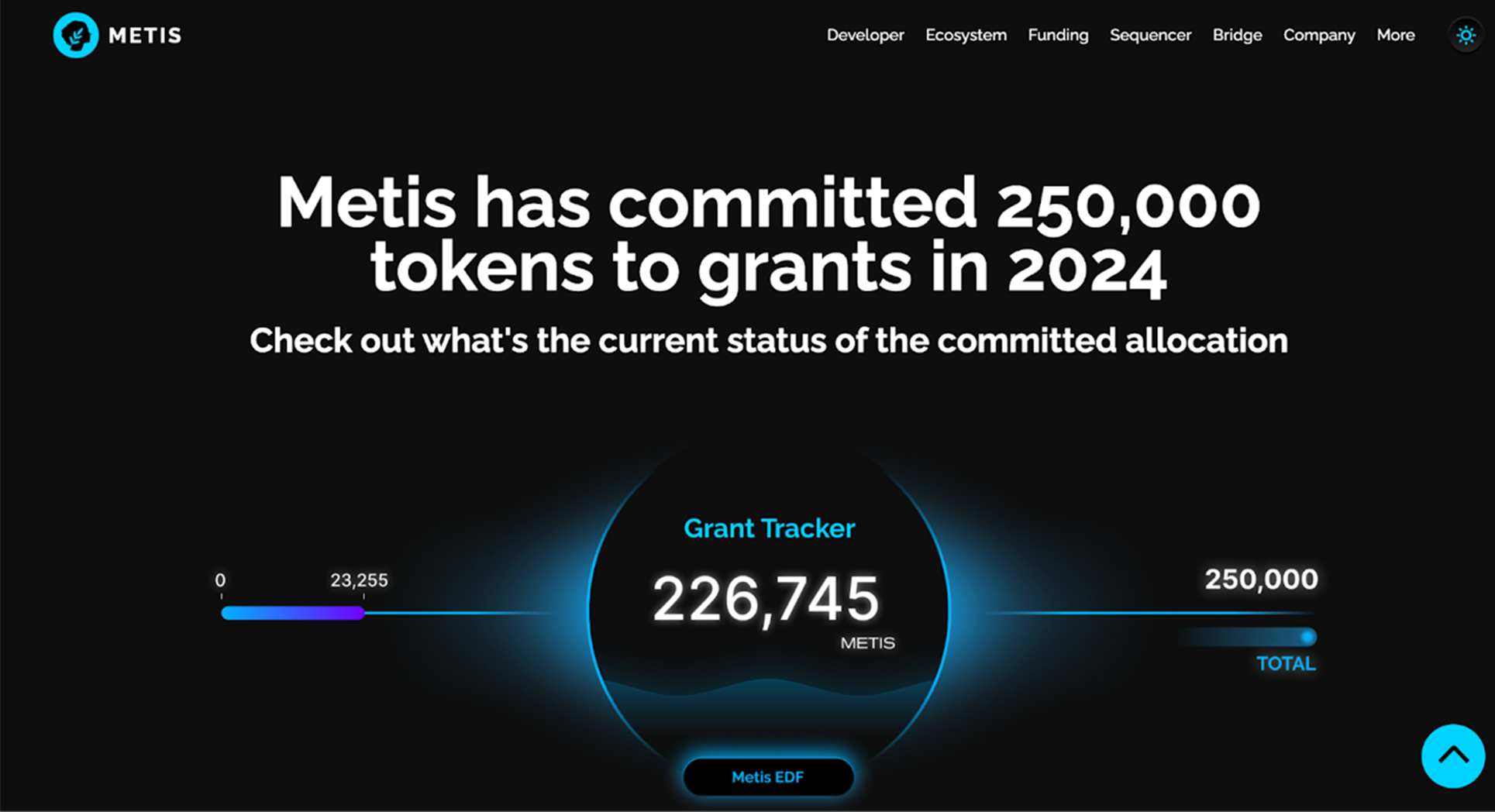

On December 18th, Metis launched the #MetisEDF (Ecosystem Development Fund) plan, distributing 4.6 million $METIS (valued at 5.5 billion USD) of ecological funds to implement decentralized Sequencers, Grants for Dapps, Dapp Building incentives, liquidity incentives, and other ecosystem development activities.

It specifically allocated 3 million from the EDF for sorter mining to ensure network functionality and decentralization. The remaining 1.6 million $METIS is used to attract more LSD protocol deployments, including lending, stablecoins, and CDP, and other ecological development.

On February 16th, it was determined that 250,000 $METIS would be drawn from the EDF as the 2024 Grant Pool, and currently, 23K has been claimed.

Source: https://www.metis.io/grants

As of now, Metis has provided billions of dollars as incentives, offering new momentum that combines new assets, products, and platforms, providing strong support for the decentralized development of the network and asset liquidity.

Community proposal voting for the LSD protocol is now open, and in conjunction with the LSB plan, we can anticipate participating in these elected protocols and enjoying high mining rewards. What exactly are they?

2. Alpha Protocol

2.1 ENKI

2.1.1 Basic Introduction

ENKI is the first LSD project deployed on Metis, aiming to simplify participation in the Metis Sequencer Node Staking process. It allows users to earn rewards without the technical complexity of running a Sequencer node themselves. ENKI can be seen as a bridge that connects ordinary users to the Metis Sequencer Node and provides multiple benefits.

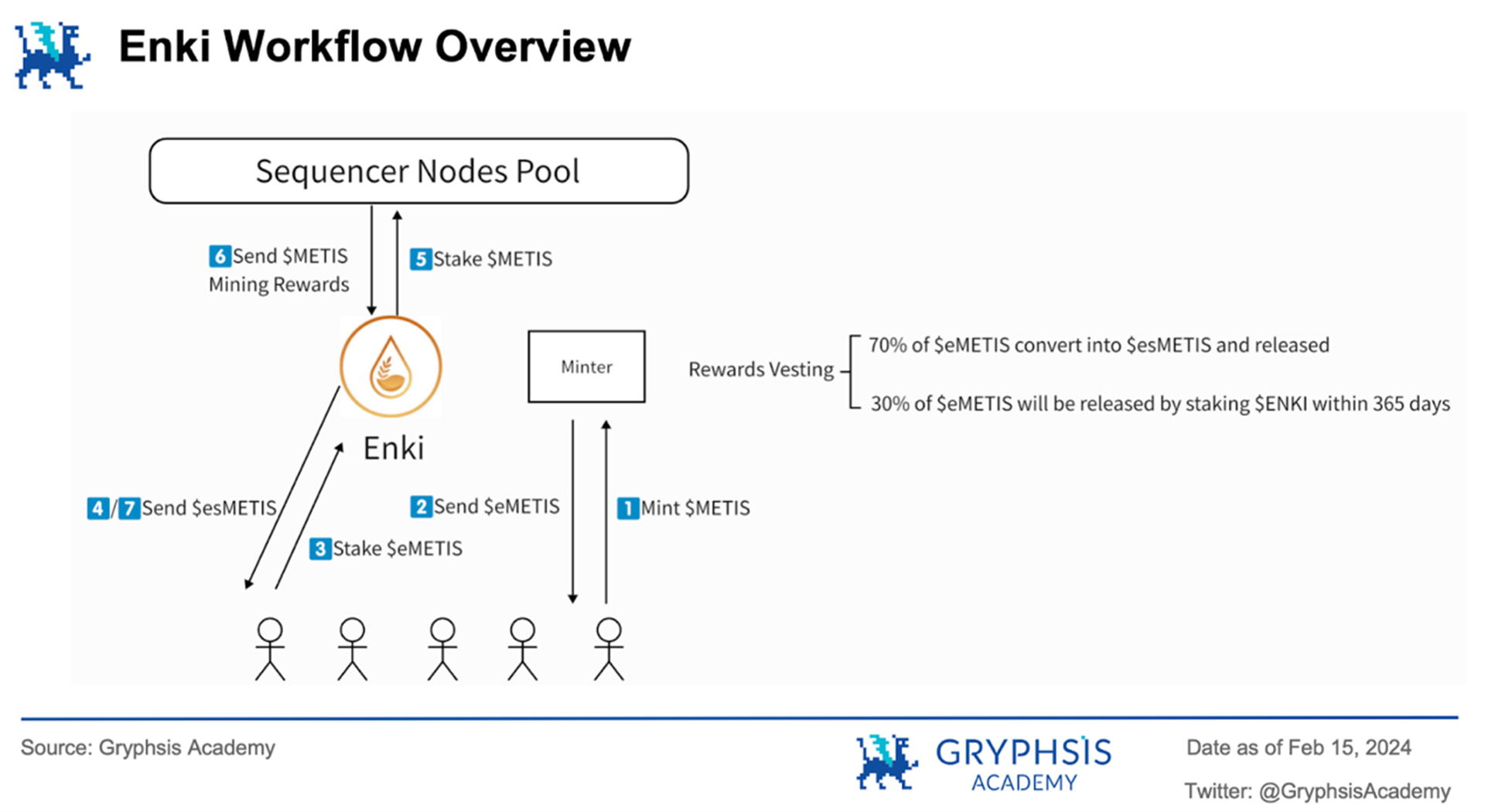

The following is the workflow:

Step 1: Convert to $eMETIS - Users convert their holdings of $METIS into $eMETIS in Enki (via Minter).

Step 2: Stake $eMETIS - Earn $seMETIS as a certificate to actively participate in the profit generation process.

Step 3: Accumulate Rewards - The held $seMETIS accumulates rewards over time, reflecting the performance of the Metis Sequencer Node ecosystem.

Step 4: Get rewards, rewards are distributed every 7 days, where 70% of $eMETIS earnings are immediately released as $seMETIS, and the remaining 30% enters the vesting period. To unlock this part of the earnings within a year, users need to stake $ENKI.

Step 5: Claim rewards, you can convert $seMETIS to $eMETIS in ENKI, and then convert $eMETIS to $METIS in secondary markets like Netswap.

Even users with a small amount of $METIS can participate in staking, eliminating the need for technical knowledge and large initial setups, providing more users with the opportunity to participate in staking and earn profits.

2.1.2 Token Economics

1) Allocation Mechanism

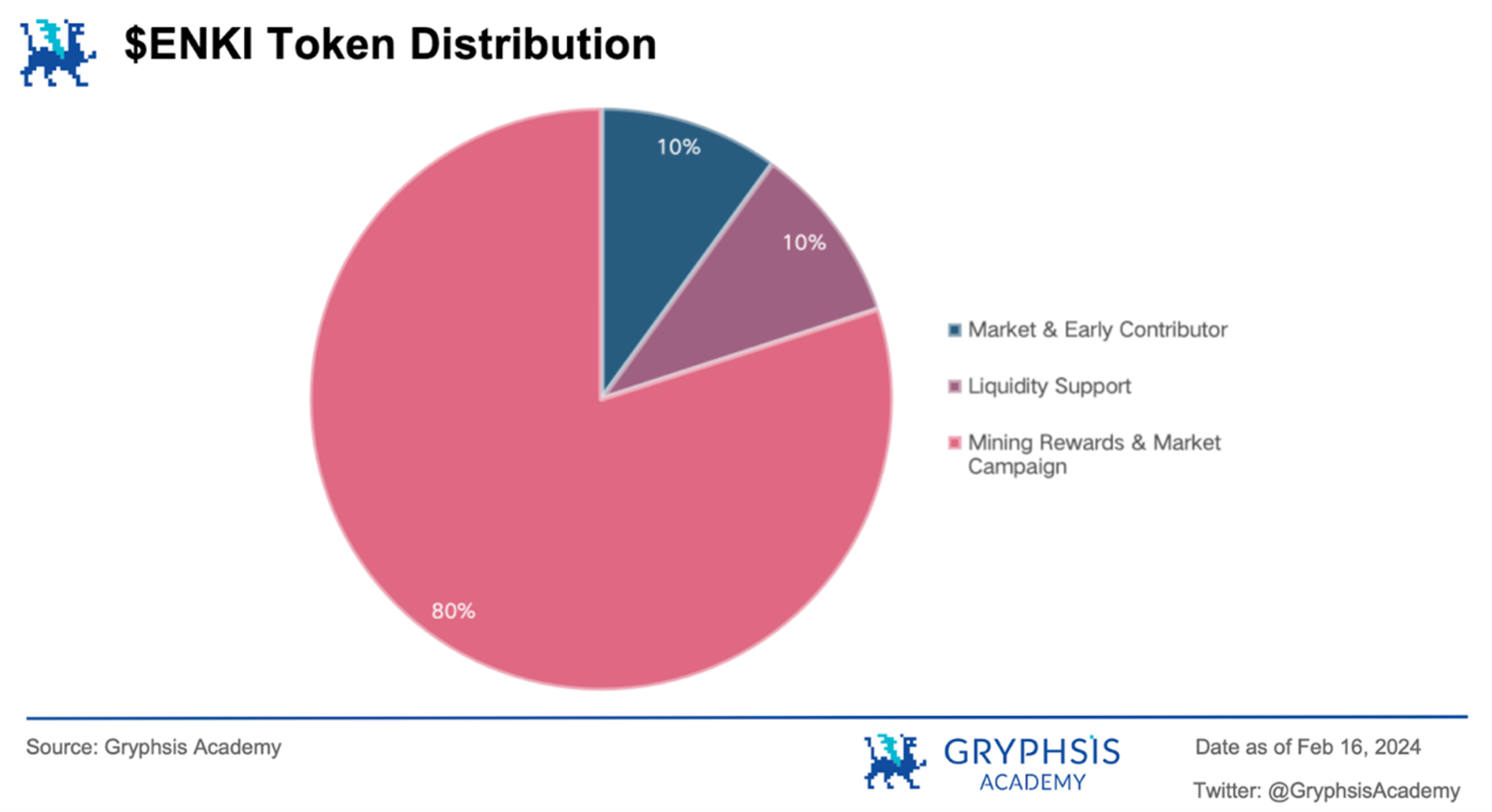

The native token of the ENKI protocol is $ENKI, with an expected total supply of 10 M. Holding $ENKI tokens allows for participation in locking and potential governance rights and other benefits within the ecosystem.

The initial allocation plan for $ENKI is as follows:

Market, partners, and early community supporters: 10% of the total supply, i.e., 1 M $ENKI.

Protocol liquidity support: 10% of the total supply, i.e., 1 M $ENKI, added in batches based on market demand and protocol revenue.

Future mining incentives and some market activities: 80% of the total supply, i.e., 8 M $ENKI, released gradually in various forms.

The ENKI team itself does not hold any token allocation shares and does not conduct fundraising. Token releases in all stages are done through a Fair Launch approach.

2) Dual token model

$eMETIS: A token similar to a stablecoin, pegged to the value of $METIS at a ratio of 1:1, converted by the Minter in ENKI. It facilitates user participation in the ENKI system and serves as a ticket to enter the Metis Sequencer Node Staking world.

$esMETIS represents the proof of pledging $eMetis, allowing users to effectively pledge $eMetis and earn more pledging rewards tokens while maintaining liquidity and interacting with other Defi ecosystems.

3) Value Capture

Governance Rights: Holders are an important part of the decentralized governance model, with a majority of $ENKI tokens being used as mining incentives. Holders can vote to influence incentive content, fee structure, protocol upgrades, and overall ecosystem development.

Unlocking Rights: As mentioned above, 30% of the mining incentives of the ENKI protocol require users to lock $ENKI for a period of 365 days to unlock them.

The $ENKI token is crucial for the locking process and is a requirement for $esMETIS holders to earn part of the $eMetis rewards. This locking mechanism, combined with the $ENKI token, encourages users to continuously participate and invest in the ecosystem, effectively binding incentives with the long-term development of ENKI.

2.1.3 Recent Developments

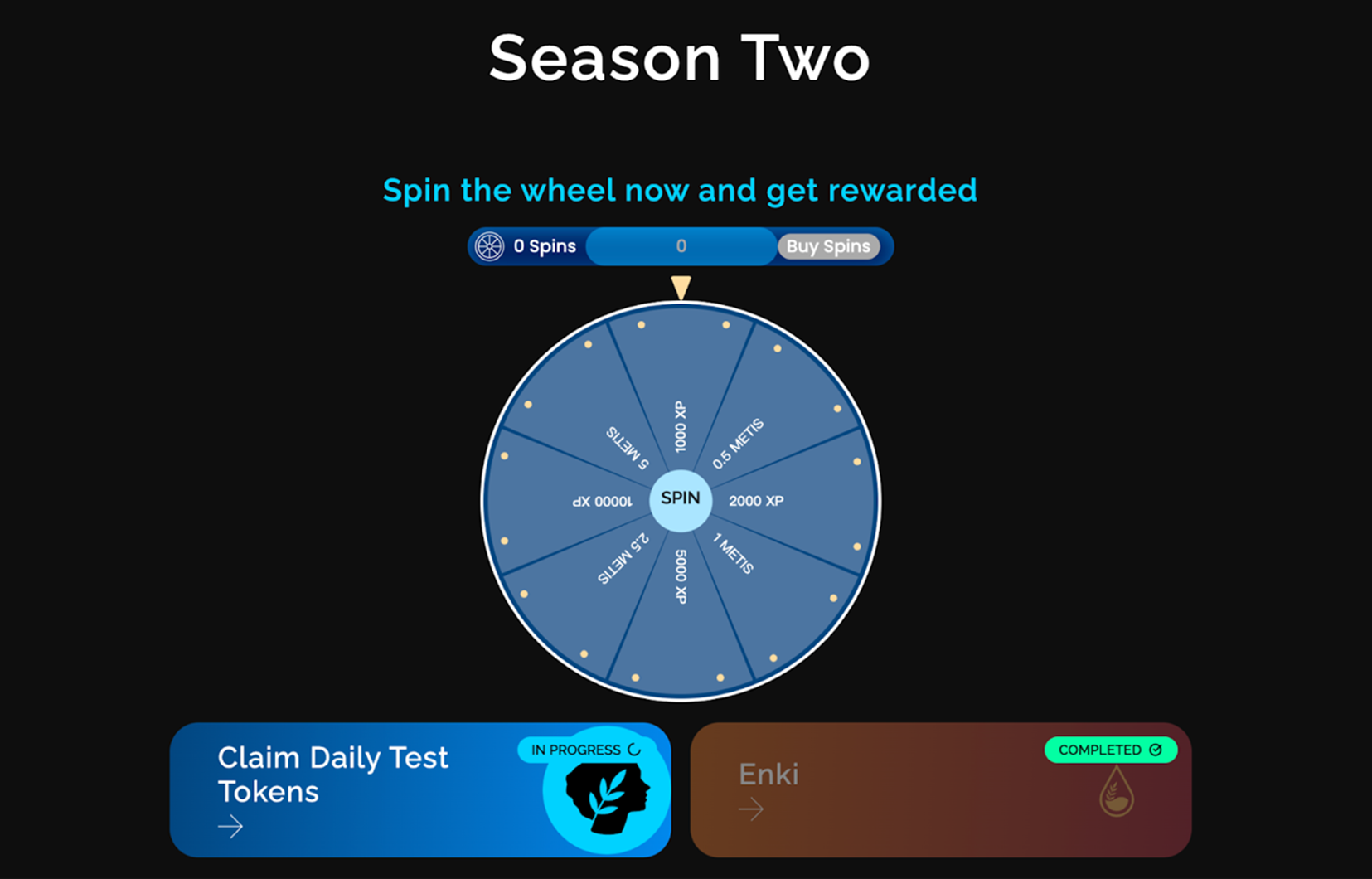

Currently, ENKI is deployed on the Metis Sepolia Testnet and is participating in the second phase of the Metis decentralized sequencer community testing.

On January 16th, Metis officially launched Community Testing on the Sepolia testnet, allowing users to test the POS Sequencer pool by exploring various Dapps and earn corresponding Testing Points rewards. Each Dapp corresponds to a different points pool, and each action has a different points ratio. Participants can participate and earn points by receiving testnet $METIS at no cost.

In Season 1, participating ecosystem projects include Hummus Exchange, League.Tech, Tethys Finance, Midas Games, and Netswap; whereas in this Season 2, it only includes ENKI.

Source: https://decentralize.metis.io/#szn2

By claiming test coins $METIS, you can Mint&Stake on the ENKI website to earn points, or claim test coins $ENKI for staking and rewards.

Source: Medium

The official ENKI Fantasy Genesis Plan was launched on February 8th, with an early phased release of 10% (1 M) of $ENKI tokens as incentives.

The entire activity will be divided into two phases:

Phase 1 - Pre-launch and Testnet

Community Participation and Trivia Tasks: Allocation of 25,000 $ENKI (0.25% of the total supply).

Participation in Testnet Activities: Allocation of 25,000 $ENKI (0.25% of the total supply).

Testnet Bug Bounty and Marketing Cooperation: Allocation of 100,000 $ENKI (1% of the total supply).

Ecosystem partner airdrop: Distribute 100,000 $ENKI (1% of the total supply) to reward loyal users in the Metis ecosystem community.

All users participating in the above activity will be eligible to mint an early supporter NFT on the Metis mainnet after the first phase ends. This NFT will serve as proof for claiming the airdrop later on.

Phase 2 - Post-launch on Metis Mainnet

Metis staking airdrop: Distribute 200,000 $ENKI (2% of the total supply) to users staking Metis in the ENKI protocol, based on their staking proportion.

Invitation staking activity: Allocate 400,000 $ENKI (4% of the total supply).

Users holding $eMetis or $seMetis are eligible to participate in this activity, where they will be able to mint a special inviter NFT and obtain a unique invitation code. Users staking with this invitation code will increase the airdrop points for the inviter's NFT, given that each invitee contributes at least 0.1 $METIS to the staking pool to help increase points for the inviter.

The calculation rule for points is as follows: Points = 100 * total number of invitees + 200 * total staked amount by invitees. After the activity ends, airdrop tokens will be distributed based on the proportion of airdrop points. The inviter NFT will also serve as proof for claiming the airdrop.

ENKI liquidity incentive: Distribute 150,000 $ENKI (1.5% of the total supply).

ENKI is the most important step for Metis to achieve decentralized orderers, lowering the staking threshold to reach ordinary users and benefit individual investors, enabling the entire community to participate in network construction and enjoy profits.

2.2 Artemis

2.2.1 Basic Introduction

Artemis Finance is a liquidity staking protocol designed for the Metis decentralized sorter pool. Users can stake their $METIS tokens on Artemis and receive the liquidity token $artMETIS, which automatically accumulates income and can be used for interactions on the Metis chain.

2.2.2 Token Economics

1) Distribution Mechanism

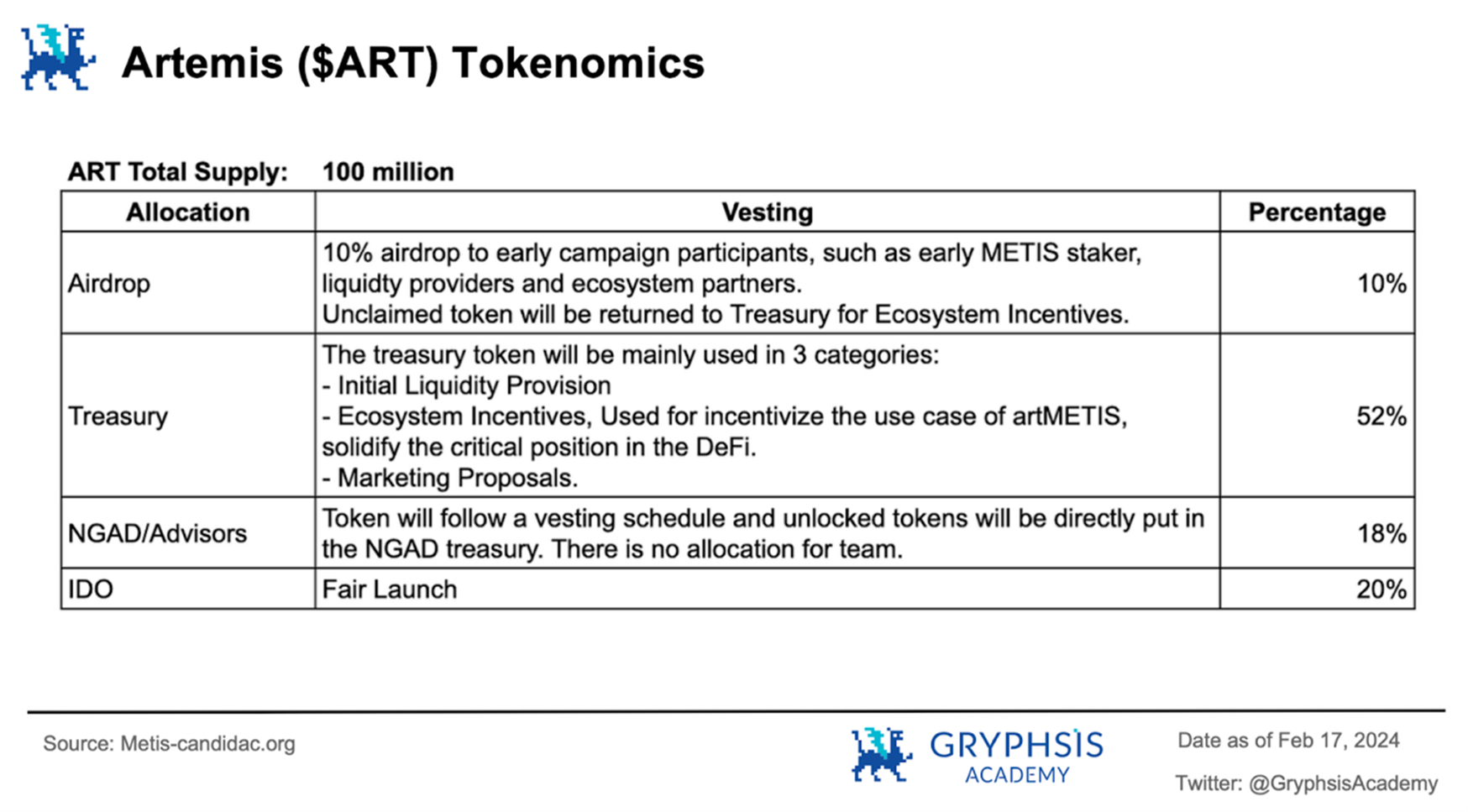

The native token of the Artemis protocol is $ART, with a total supply of 100 M. The initial allocation plan is as follows:

Airdrop (10%, 10 M): Early participants such as $METIS stakers, liquidity providers, and ecosystem partners.

Treasury (52%, 52 M): Treasury funds primarily used for initial liquidity provision, $artMETIS incentivization, market collaboration proposals, etc.

NGDAO/Advisors (18%, 18 M): Locked in the DAO, the team itself does not hold shares.

IDO (20%, 20 M): Conducted through a Fair Launch.

2) Value Capture

Artemis allocates 10% of the tokens to early participants such as $METIS stakers, allowing $METIS staking to receive multiple rewards, similar to the role of a golden shovel, enjoying the incentives of other projects in the ecosystem, further stimulating staking motivation. In addition, a portion of the shares is used to expand the use cases of $artMETIS, thereby increasing the utility and application scenarios of the assets.

The profits that holders of $ART can enjoy are currently undisclosed.

Artemis is expected to launch a series of activities, including collaborations with DeFi projects, liquidity providers, and yield optimization platforms, to increase liquidity and expand the use cases of $artMETIS:

Launch $artMETIS/$METIS pool on DEXes and provide liquidity mining incentives;

List $artMETIS on Pendle and enable yield trading;

Include $artMETIS as eligible collateral for lending protocols;

Aims to attract more participation in $METIS staking while allowing users to use $artMETIS in a diverse DeFi ecosystem and earn profits. Like ENKI, Artemis provides $METIS holders with an opportunity to simplify participation in decentralized sequencing and earn profits.

3. Summary

We can foresee a positive cycle brought by the development of the LSD protocol by Metis: the LSD protocol lowers the staking threshold and allows ordinary users to enjoy multiple benefits, incentivizing more users to participate in staking; the staking rate of $METIS increases, promoting the decentralized implementation of the network, sharing traditional Layer 2 MEV revenue with the community, reducing user costs, and maintaining user profits; forming unique network characteristics to attract more users to participate in the network.

As the utility token for network usage, the rising network usage will bring more consumption demands, leading to the appreciation of the token; as the fastest and most profitable investment method for token holders, LSD will attract more users; the abundant user traffic inspires more derivative tracks such as LSDfi, Re-Staking, etc., enabling assets to generate profits while enjoying liquidity, thus activating the entire DeFi ecosystem.

References

[1]https://medium.com/@ENKIProtocol/understanding-enki-an-essential-faq-before-testnet-launch-57ab3f2e6a22

[2]https://pro.nansen.ai/eth2-deposit-contract

[3]https://medium.com/@GryphsisAcademy/diving-into-lsd-the-growth-potential-and-strategic-opportunities-bcea5c10cdc6

【Disclaimer】This report is an original work completed by a student, @auggest_crypto, under the guidance of @CryptoScott_ETH at Gryphsis Academy. The author is solely responsible for all content and it does not necessarily reflect the views of Gryphsis Academy or the organization commissioning the report. Editorial content and decisions are not influenced by readers. Please be aware that the author may own the cryptocurrencies mentioned in this report. This document is for informational purposes only and should not be used as a basis for investment decisions. It is strongly recommended that you conduct your own research and consult independent financial, tax, or legal advisors before making any investment decisions. Remember that past performance of any asset does not guarantee future returns.