Original author:@0x markyzl

Mentor:@CryptoScott_ETH

TL;DR

API 3 is an innovative first-party oracle project that focuses on enabling data providers to run their own oracles, ensuring direct delivery of data to blockchain applications without intermediaries, enhancing data integrity, and addressing critical trust issues. API 3 ensures the quality standards of data providers through management and monitoring, replacing providers that fail to meet the standards, while reducing user reliance on trust.

By deploying first-party oracles and decentralized APIs (dAPIs) using Airnode technology, API 3 facilitates a more direct, secure, and efficient connection between data providers and blockchain networks. This mechanism alleviates potential issues with traditional third-party oracles, ensuring higher security, transparency, efficiency, and reducing data transmission costs and potential risk points.

The combination of OEV Network and ZK-Rollup brings greater competitiveness to API 3 and significant progress to the dApp and oracle space. This solution captures MEV and channels its value back into the protocol ecosystem, unleashing new value streams for stakeholders and promoting a more balanced and financially sustainable ecosystem.

API 3 has a carefully designed, unique, and powerful token economic model. Its tokens are fully empowered by the burning mechanism and the one-year lock-up of staking rewards to combat inflation, and by the dynamic APR to incentivize staking. More importantly, the design of its economic model incorporates the operational and risk factors of the protocol itself, bringing a self-regulating mechanism of negative feedback loop that enables stakeholders and governors to quickly reach consensus on governance decisions surrounding the long-term development of the project, thereby enhancing the stability of the protocol by suppressing excessive risk and ultimately creating a positive feedback loop for the development of the protocol, benefiting multiple parties in the long run.

With innovative first-party oracle methods, a strong focus on data reliability and security, a fully decentralized governance model with DAO, and a broader application scope in data provisioning, the future of API 3 will not be limited to providing oracle price feeding services as an intermediary component, but has the potential to become the infrastructure for on-chain ecosystems and diverse dApp development, providing possibilities for on-chain development for more API applications ubiquitous in our real life, while continuously promoting ecosystem innovation by setting new standards for the oracle race.

Introduction

In the evolving Web3.0 ecosystem, decentralized applications (dApps) are experiencing rapid growth, and their increasing value highlights their potential while expanding the demand for integration of real-world data sets, making decentralized oracles one of the most important components in on-chain ecosystems. However, a major challenge still exists: how to seamlessly and securely integrate off-chain data into the blockchain ecosystem. Against this backdrop, API 3 emerges as a solution to this challenge, aiming to fundamentally change the data interface between the off-chain and on-chain environments.

1. Project Overview

API 3 was launched in December 2020 as a pioneering first-party oracle project that aims to bring most APIs customized for centralized applications into the decentralized world of Web3.0 without imposing significant burdens on API providers or dApp developers.

Unlike traditional third-party oracle networks, API 3 focuses on first-party data providers. Its infrastructure is built around decentralized API (dAPI) and uses serverless oracle node technology called Airnode, allowing API providers to directly connect their data to dApp projects without relying on third-party intermediaries for data aggregation and relay that are common in traditional oracle networks. Essentially, dAPI is compatible with blockchain technology, enabling cross-chain integration and providing a cross-platform oracle solution.

The governance model of API 3 is based on a decentralized autonomous organization (DAO), giving decision-making power to token holders, ensuring a transparent and community-driven ecosystem. It is reasonable to expect that the innovative framework of API 3 has the potential to meet the crucial needs of the blockchain industry for decentralized and trustworthy data sources. It could set a new standard for the oracle race and on-chain data integration, establishing a more interconnected and efficient decentralized future.

1.1 Team Background

https://www.linkedin.com/in/heikki-v%C3%A4nttinen-83a 86380/? originalSubdomain=pt

Heikki Vanttinen, co-founder of API 3, has accumulated rich work experience in various fields, particularly in blockchain technology and smart contract development. Heikki, as the founder and CEO of CLC Group, has focused on achieving seamless integration between smart contracts and the real world, demonstrating excellent abilities across disciplines such as business development, decentralized application development, and research. Moreover, his entrepreneurial experience and market sales experience showcase his leadership and business insights in cross-functional team management, business expansion, and new market development.

https://www.linkedin.com/in/burak-benligiray-b3055715b/

Burak Benligiray, co-founder of API 3 and head of the core technical team, holds a Ph.D. in Electrical and Electronic Engineering and has served as a research assistant in university, exploring various technology fields. Burak has extensive experience and impressive technical skills in technical innovation and research, demonstrating deep expertise in blockchain technology and smart contracts, and is committed to building a decentralized and trust-minimized system.

1.2 Financing Situation

According to Crunchbase data, on November 12, 2020, API 3 raised a $3 million seed round led by Placeholder. In this round of financing, a total of 13 institutions, including Pantera Capital, Accomplice, CoinFund, Digital Currency Group, Hashed, and Solidity Ventures, participated in the investment.

At the same time, in the token public sale event held in December 2020, API 3 raised a total of $23 million.

1.3 Important Developments

On January 29, 2021, it announced a partnership with Polkadot Layer 2 protocol Plasm Network to introduce Airnode-supported APIs and data oracles in the Polkadot ecosystem.

On April 20, 2021, it was announced that a 10-year partnership with the Open Banking project will be established to allow the use of APIs, enabling developers to build applications and services around financial institutions and develop blockchain solutions.

On June 3, 2021, a partnership with the encrypted credit data company Credmark was reached, launching a decentralized risk model platform for scoring decentralized financial projects.

On March 25, 2022, a partnership with the Ethereum Layer 2 scaling solution Metis was announced, providing a Web 3 API directory for developers on Metis and providing price feeds for the Metis ecosystem.

On May 4, 2022, a partnership with the Australian National University was announced to launch a quantum random number generator QRNG for smart contracts, ensuring unpredictable randomness.

On January 29, 2024, the ZK-Rollup platform OEV Network was launched, increasing the revenue of DeFi protocols through capturing and utilizing valuable methods extracted by oracles, ensuring instant income for dApps and enhancing security, transparency, and accountability through on-chain auctions.

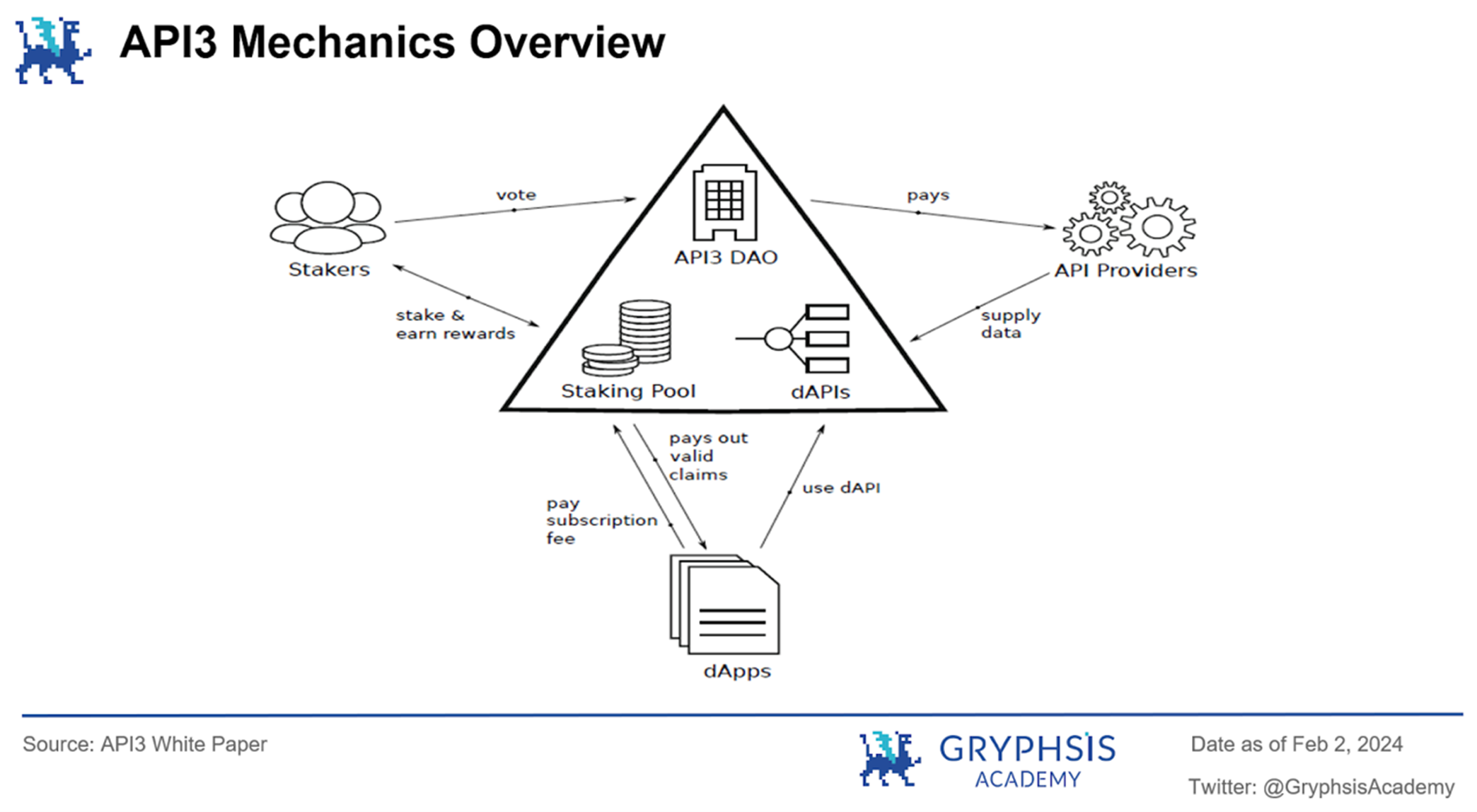

2. Project Implementation Mechanism

The overall mechanism of API 3 is shown in the diagram above. API 3 acts as a decentralized autonomous organization (DAO) platform that connects various parties together. API providers earn income by providing data, dApps pay subscription fees to enjoy the data services provided by dAPIs, and if users of a dApp find issues with dAPI data, they can submit claims. Token stakers will be rewarded and have voting rights in the API 3 DAO through the staking mechanism. The specific mechanism will be detailed in the following sections.

The overall mechanism of API 3 is shown in the diagram above. API 3 acts as a decentralized autonomous organization (DAO) platform that connects various parties together. API providers earn income by providing data, dApps pay subscription fees to enjoy the data services provided by dAPIs, and if users of a dApp find issues with dAPI data, they can submit claims. Token stakers will be rewarded and have voting rights in the API 3 DAO through the staking mechanism. The specific mechanism will be detailed in the following sections.

2.1 From API to dAPI

In Web 2.0, APIs act as critical bridges for data exchange between various digital platforms, enabling seamless communication of software applications and supporting the functionalities of modern digital services in our lives. For example, when we use a ticket booking website to book a flight, the website typically relies on APIs to retrieve real-time pricing and availability from various airlines' databases.

While the concept of dAPI extends the application mode of traditional APIs to the decentralized domain. Unlike traditional APIs that rely on centralized servers and third-party intermediaries, dAPI can provide direct data feeds from data providers to users without the need for any intermediaries.

dAPI of API 3 is built on top of Airnode, an oracle supporting tool, which allows API providers to directly connect their data sources to the blockchain network, enabling dApps to access real-world data in a secure and trustless manner. API 3 offers two types of data interface services for developers: hosted dAPI and self-funded dAPI, catering to different potential use cases. Additionally, API 3 balances flexibility and security by adopting a multi-signature wallet and governance protocol to manage changes to its dAPI configurations.

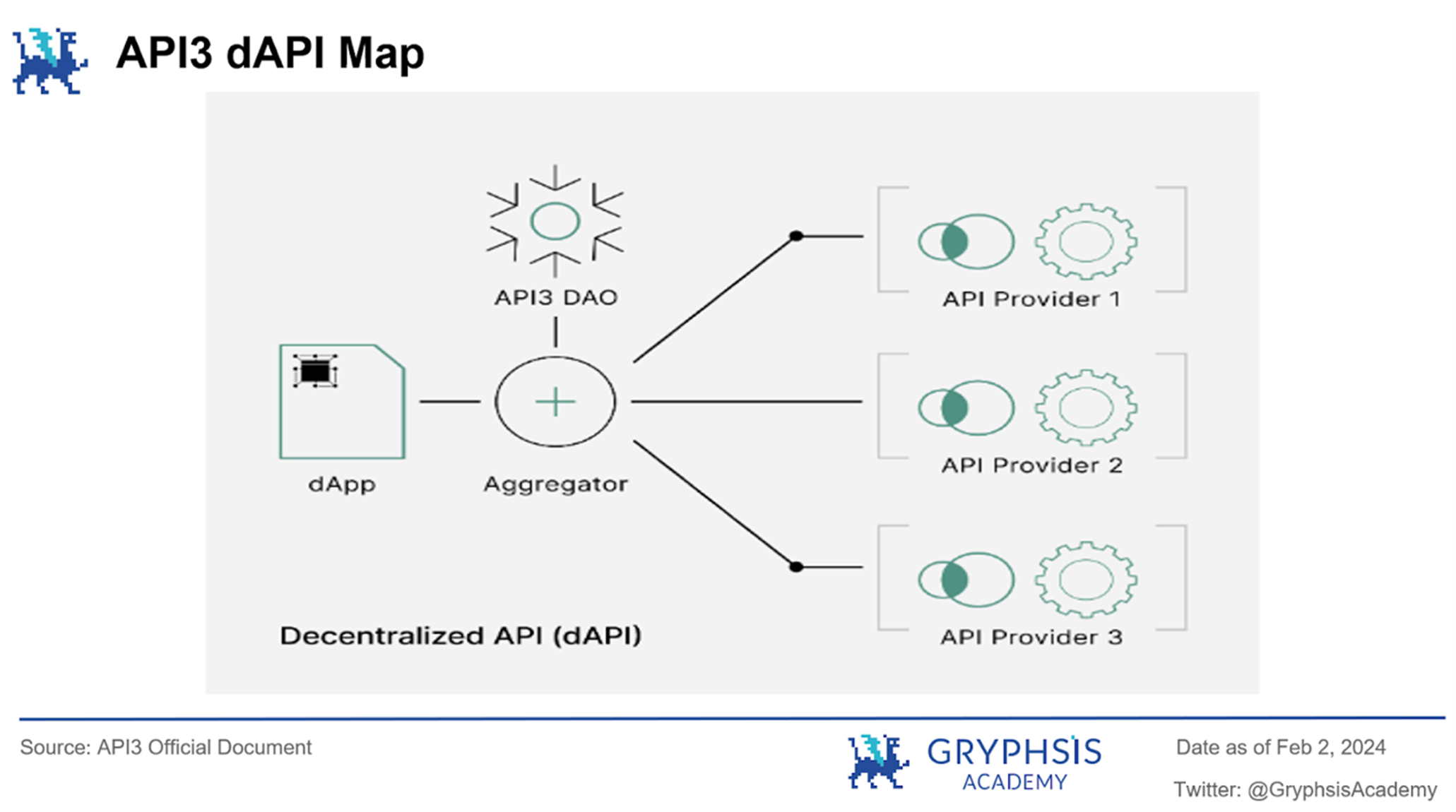

In the hosted dAPI model, multiple first-party oracles are aggregated to provide more reliable and stable data sources using the median function. This is suitable for production environments with high requirements for data quality and stability. Under the hosted dAPI model, users need to pay fees to API 3 to use the service, which covers operational and management costs.

The specific mechanism is illustrated in the diagram above. API providers first send data to a single aggregator, which processes and integrates data from different sources to ensure reliable and consistent information for dApps. dApps can retrieve processed data by calling dAPI and provide services based on this data. API 3 DAO supervises the entire process through voting and other governance mechanisms to ensure transparency and security of the system.

On the other hand, self-funded dAPI allows users to bear the costs and provides data through a single first-party oracle. This approach provides developers with more flexibility and autonomy, allowing them to experiment and use data interfaces at lower costs. It is particularly suitable for early-stage projects or cost-sensitive applications. Under this model, users need to provide funding for the operation of the self-funded dAPI, which will be used to cover on-chain transaction fees and ensure timely data updates.

API 3's innovation in dAPI mode may signify a paradigm shift in the data consumption model in a decentralized environment, as it not only reduces the latency, costs, and potential failure points associated with third-party intermediaries but also enhances the security and reliability of data. It represents an important step forward in seeking fully decentralized and efficient data solutions in Web3.0. At the same time, the concept of dAPI allows API 3 to extend beyond price feed services and provide potential decentralized implementations and support for ubiquitous API applications in our lives.

2.2 Core Technology of API 3 - Airnode

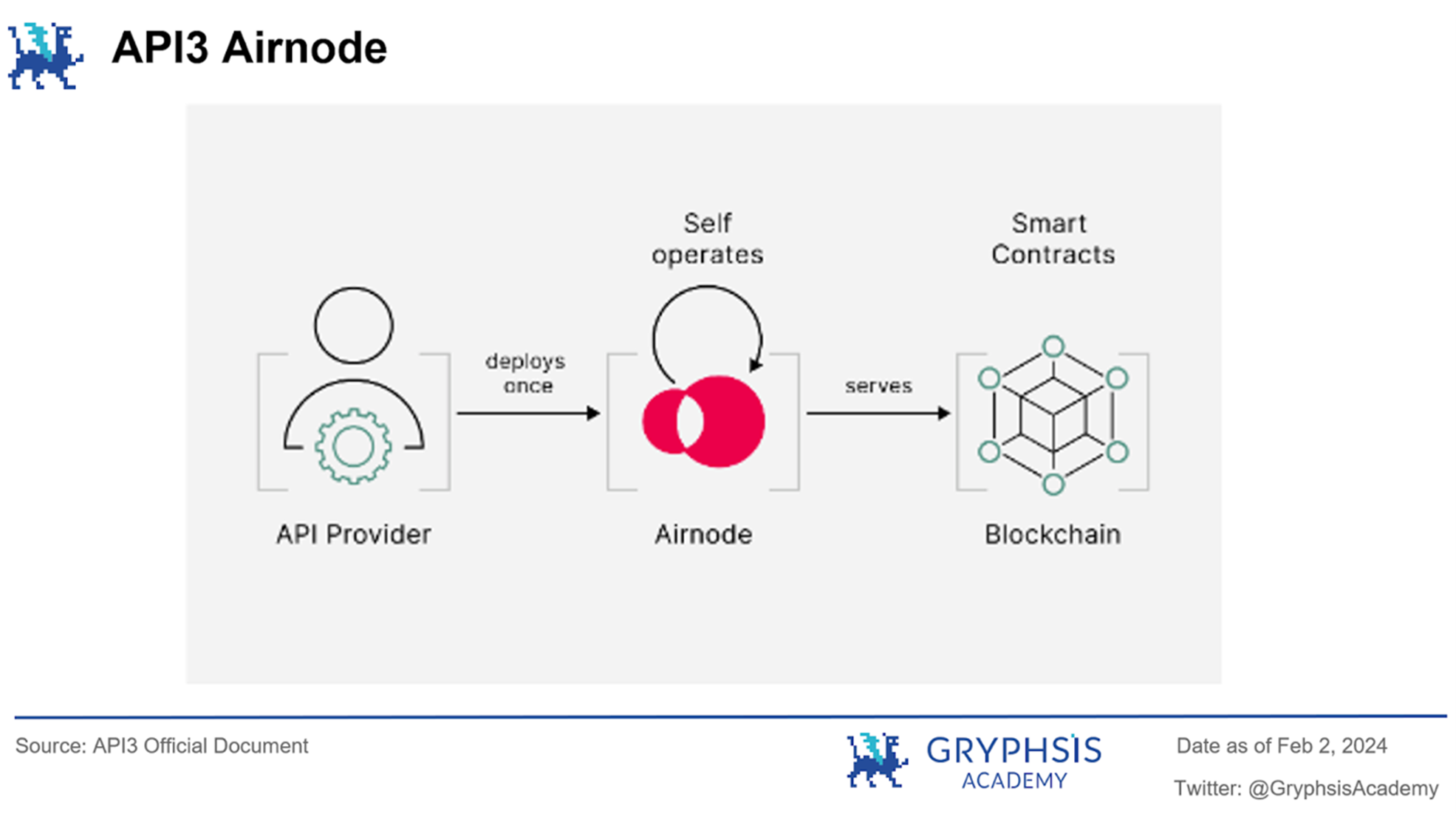

Airnode is the core component of API 3 that enables API providers to transform their APIs into dAPIs, establishing a direct communication bridge between off-chain APIs and on-chain smart contracts, facilitating seamless flow of real-world data into the blockchain ecosystem.

Specifically, Airnode is a serverless oracle node that emphasizes decentralization and security in its architecture. The node is easy for API providers to deploy and maintain while remaining highly scalable. Unlike traditional oracles that typically require complex setup and intermediary services, Airnode's design enables API providers to directly become first-party oracles without the need for third-party involvement, ensuring data integrity and security.

Furthermore, a major advantage of Airnode is its simplified API integration process. This enables API providers to set up and operate with minimal blockchain knowledge and costs. This feature simplifies the process of API providers becoming first-party oracle nodes, promoting frictionless adoption of blockchain technology, encouraging wider participation of data providers in the decentralized data market.

Therefore, essentially, the design of Airnode has evolved beyond just being an oracle solution, but rather as a fundamental component in building a decentralized, secure, and user-centric data ecosystem. Through Airnode technology, API 3 aims to address common challenges faced by traditional oracle services such as transparency, trust, and efficiency, thus paving the way for stronger and more reliable dAPP development.

2.3 OEV Network - Capturing Value, Nourishing the Ecosystem

In the cryptocurrency space, Miner Extractable Value (MEV) has always been an important concept, where block producers (such as miners or validators) can manipulate blocks through transaction ordering, insertion, or replacement, and earn extra profits. On-Chain Extractable Value (OEV), on the other hand, can be seen as a subset of MEV.

Recently, API 3 announced the launch of the ZK-Rollup platform OEV Network, which is a custom ZK-Rollup network built with Polygon CDK. It captures all OEV generated by dAPPs that utilize API 3 to mitigate the common issue of value leakage in current DeFi operations. Moreover, the adoption of rollups makes the entire process transparent and verifiable, enhancing decentralization and trustlessness, thereby boosting user confidence and participation.

Firstly, we can understand what OEV is through an example. Imagine we are participating in an auction where everyone's bids are visible, and the auctioneer can choose to consider the order of bids. This creates an opportunity for the auctioneer to strategically place certain bids that benefit themselves or others, allowing them to earn additional income. When oracles update or push data to the blockchain, even minor differences in timing or data accuracy can create opportunities for "suppliers" to capture potential value, such as front-running, arbitrage, or liquidation.

The OEV Network developed by API 3 aims to make this process more systematic and democratic. Operating as a dedicated order flow auction platform, the OEV Network captures the value generated by oracles during the data update process and redistributes this value to DeFi protocols and their users. This process is executed through auctions, where the highest bidder wins the right to update the data source, and the fees paid for this purpose are shared with the dAPPs that utilize API 3 data sources.

By capturing OEV, API 3 introduces a novel source of revenue for dApps, strengthening the economic model for API providers and dApp projects. In this model, the winning bidder needs to pay an additional 10% fee on top of their bid, with half of it serving as revenue for API 3 and the other half being allocated to the oracle providers. This way of distributing captured OEV to API providers will incentivize their direct participation in building the Web3.0 ecosystem, nurturing a fairer and more transparent data ecosystem. Additionally, the mechanism of on-chain auction feeding rights creates a decentralized and secure environment, promoting a more equitable data ownership model and mitigating risks associated with centralized data feeds.

It is worth mentioning that Sandeep Nailwal, co-founder of Polygon, has praised API 3's innovative solution for value extraction from oracles and considered it an important breakthrough for the DeFi ecosystem.

In summary, API 3's OEV network has brought significant progress to the dApp and oracle domains, addressing critical inefficiency issues and unlocking new value flows for participants. It has the potential to create a more balanced and financially sustainable ecosystem for data providers and users in the future.

3. Protocol Revenue Sources

According to the whitepaper, API 3's protocol revenue sources mainly include subscription fees paid by dApps, extractable value from oracles (OEV), and service coverage fees. The uses of the protocol revenue include but are not limited to supporting ongoing project development, enhancing network security, operational costs, staking rewards, and rewarding potential stakeholders within the ecosystem. API 3 governs the project through DAO and decides the allocation of its resources to ensure project sustainability and stable growth.

4. Token Economic Model

4.1 Basic Information

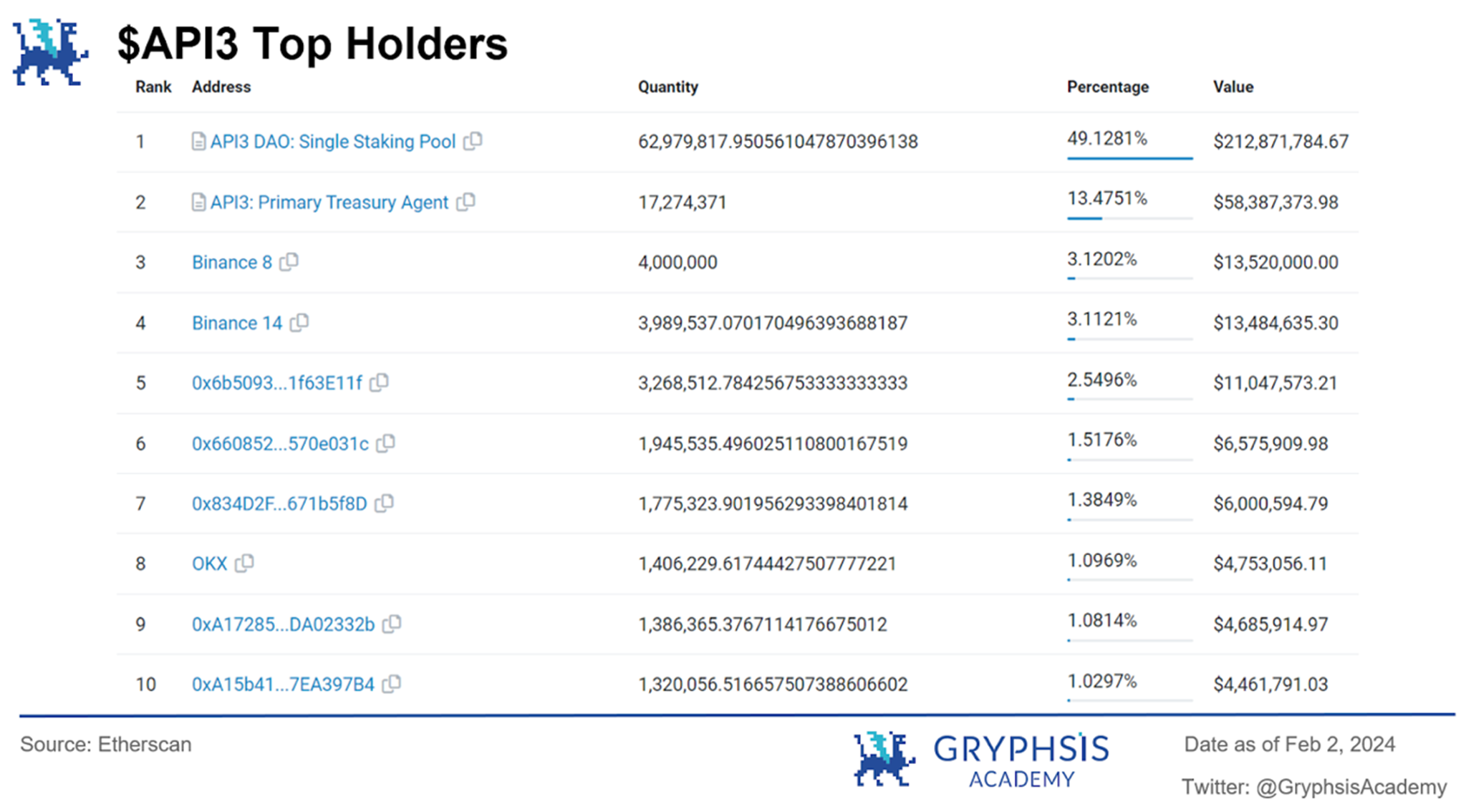

According to Etherscan data, the current maximum total supply of $API 3 token is approximately 128 million, with a circulating supply of about 103 million. The non-circulating portion consists of minted reward tokens obtained by token stakers, which will be unlocked after one year from the reward date.

As shown in the figure, the largest holding address of $API 3 token is the staking pool of $API 3, and the second largest address is its treasury. The sum of the two accounts for 62.6% of the total token circulation. In addition, exchanges like Binance and OKX are also major holders of $API 3. Therefore, the actual circulating supply of $API 3 in the market is not large, to some extent avoiding the occurrence of severe selling pressure.

Overall, API 3 adopts a combination of staking, collateralization, and governance in its token economic model. Its purpose is to incentivize participation, protect the network, and drive project growth by ensuring that token holders can influence the trajectory of the project, effectively manage resources, and participate in the expansion of the ecosystem. By combining the three utilities to build a sound token system, true decentralization of governance and operational activities is achieved.

4.2 Staking Mechanism

The staking mechanism is the most important core component of the API 3 token economic model, aiming to align the incentives of stakeholders with the long-term success of the project. By staking $API 3 tokens, holders can receive newly minted tokens (awarded weekly) as staking rewards and gain governance voting rights in API 3 DAO. At the same time, the staked tokens will also be used as collateral and be compensated to users in the event of dAPI failure.

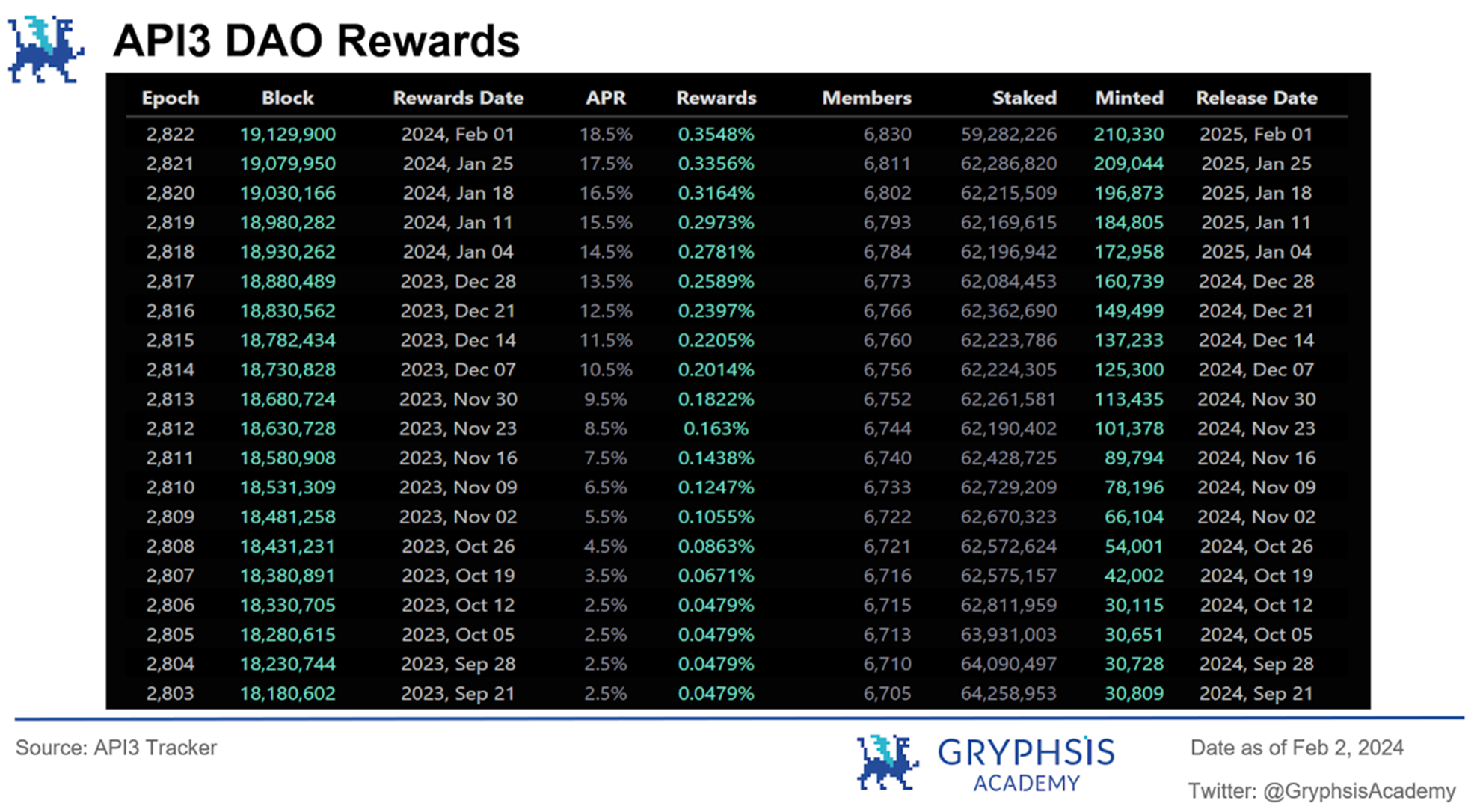

In order to ensure service continuity, product quality, and decentralized governance, API 3 has set a "staking target" and always aims for a specific percentage of the total token supply to be staked. The current staking target for API 3 is 64,097,566 tokens, and the current actual staked amount has not yet reached the target. Therefore, as shown in the chart, API 3 DAO will increase the APR by 1% on each upcoming reward date to incentivize more holders to stake tokens until the staking target is reached or the APR is increased to 75%.

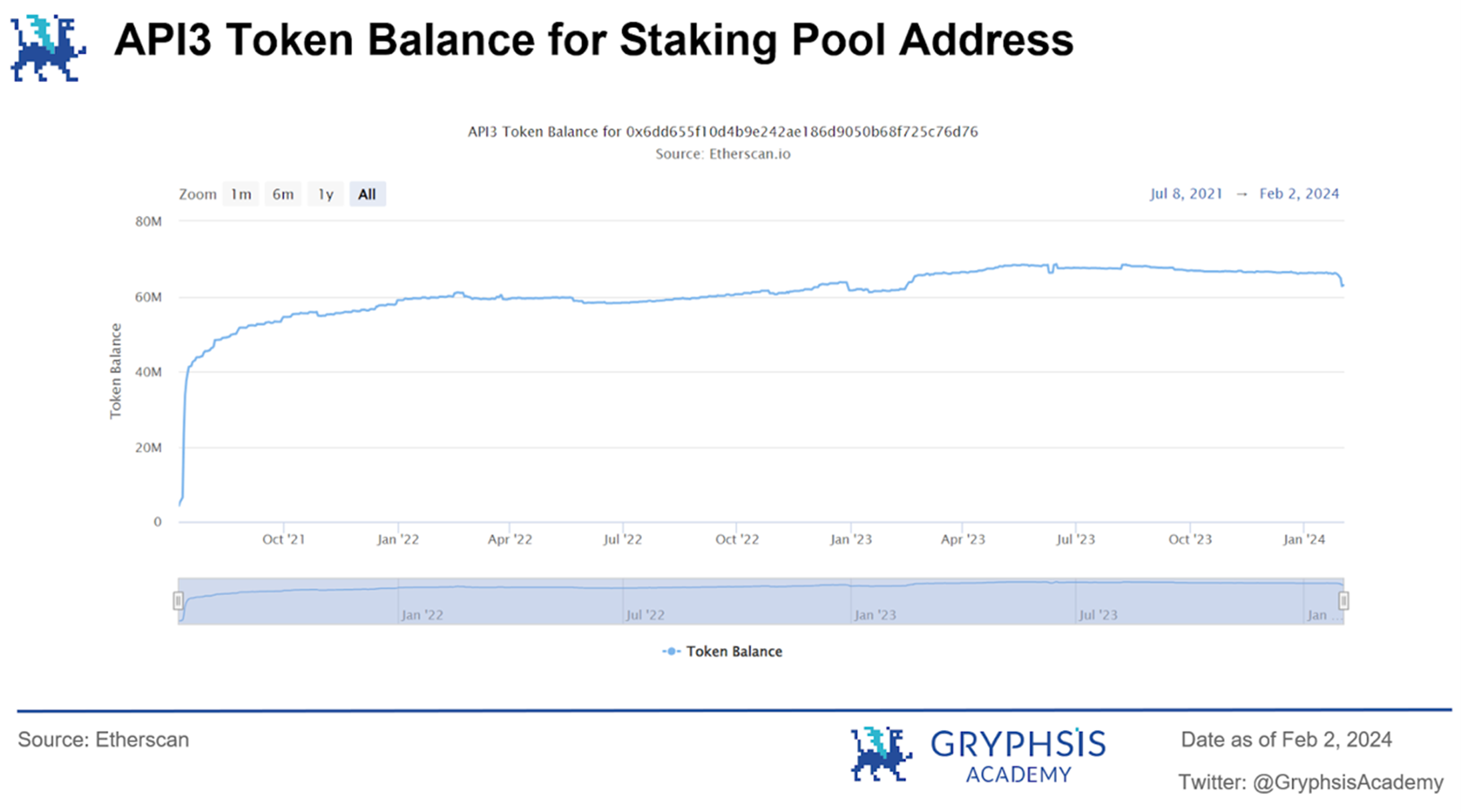

Since the token rewards received by stakers are minted, theoretically this could cause token inflation. To strike a balance, API 3 has designed a deflationary mechanism to address this issue. Firstly, as shown in the chart above, the minted token rewards will be unlocked one year after the reward date, which encourages participants to hold and stake tokens for the long term instead of short-term speculation.

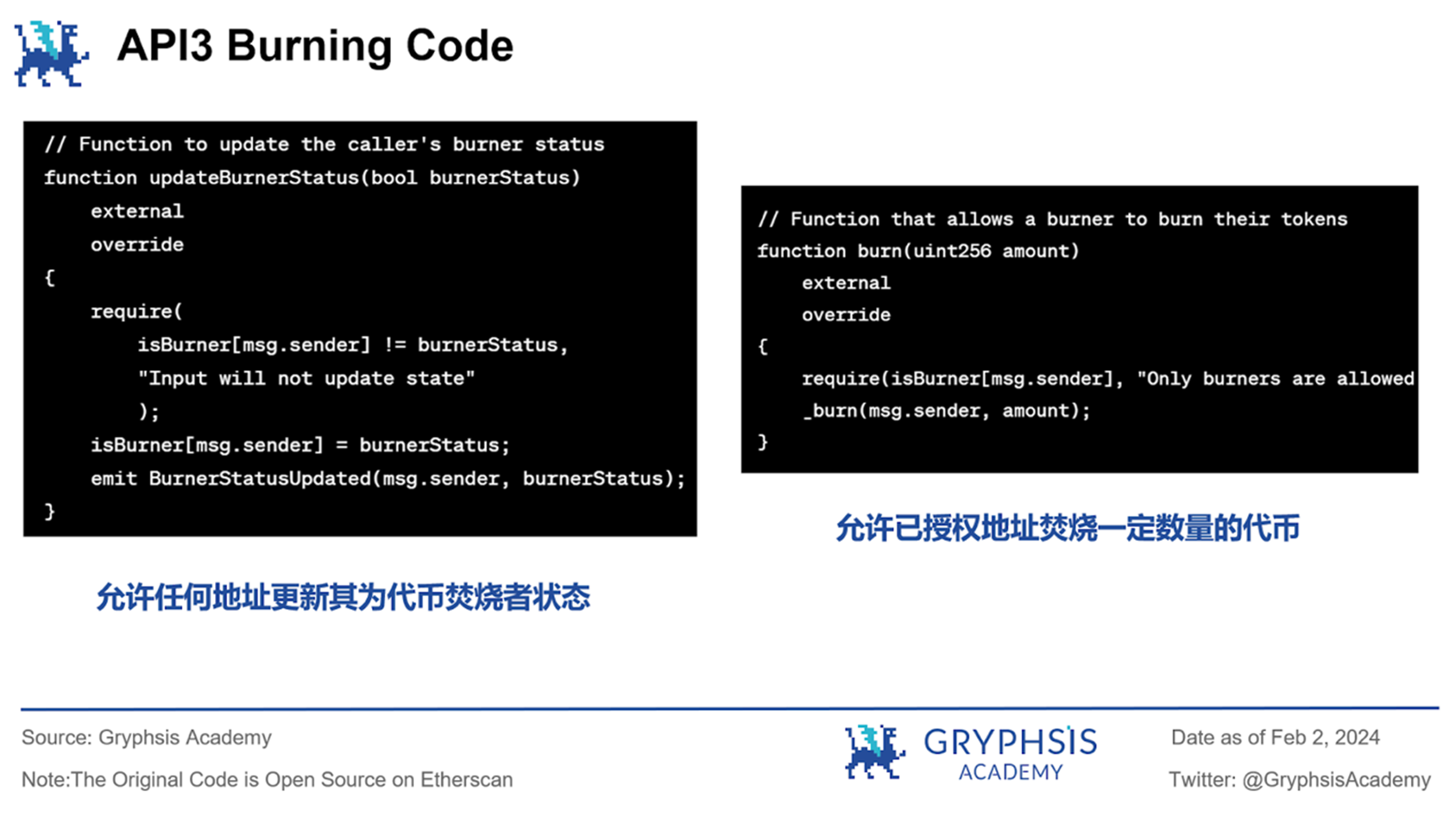

Secondly, API 3 DAO will require users of dAPI to burn or lock $API 3 tokens for a specific period of time in order to access data services. As shown in the chart above, by reviewing the open-source code of API 3, we found that it allows any address to independently decide whether to enable or disable their burning permission and can burn a specific amount of tokens by calling the Burn function. This approach partially offsets the inflation caused by new token minting, effectively reducing the market supply pressure of $API 3, benefiting all token holders, and enhancing the staking confidence of long-term investors and participants.

And by looking at the past pledge situation of $API 3, we also found that since 2021, the amount of tokens pledged has been in a stable state without drastic fluctuations. Even in the recent case of a substantial increase in the price of $API 3 tokens, the overall pledge amount remains stable and there is no large-scale selling, which indirectly proves the effectiveness of the API 3 pledge mechanism.

4.3 Collateral Mechanism

The collateral mechanism of API 3 can be considered as an on-chain oracle service insurance product, which is achieved by providing quantifiable security, and this security is reflected in the form of service coverage.

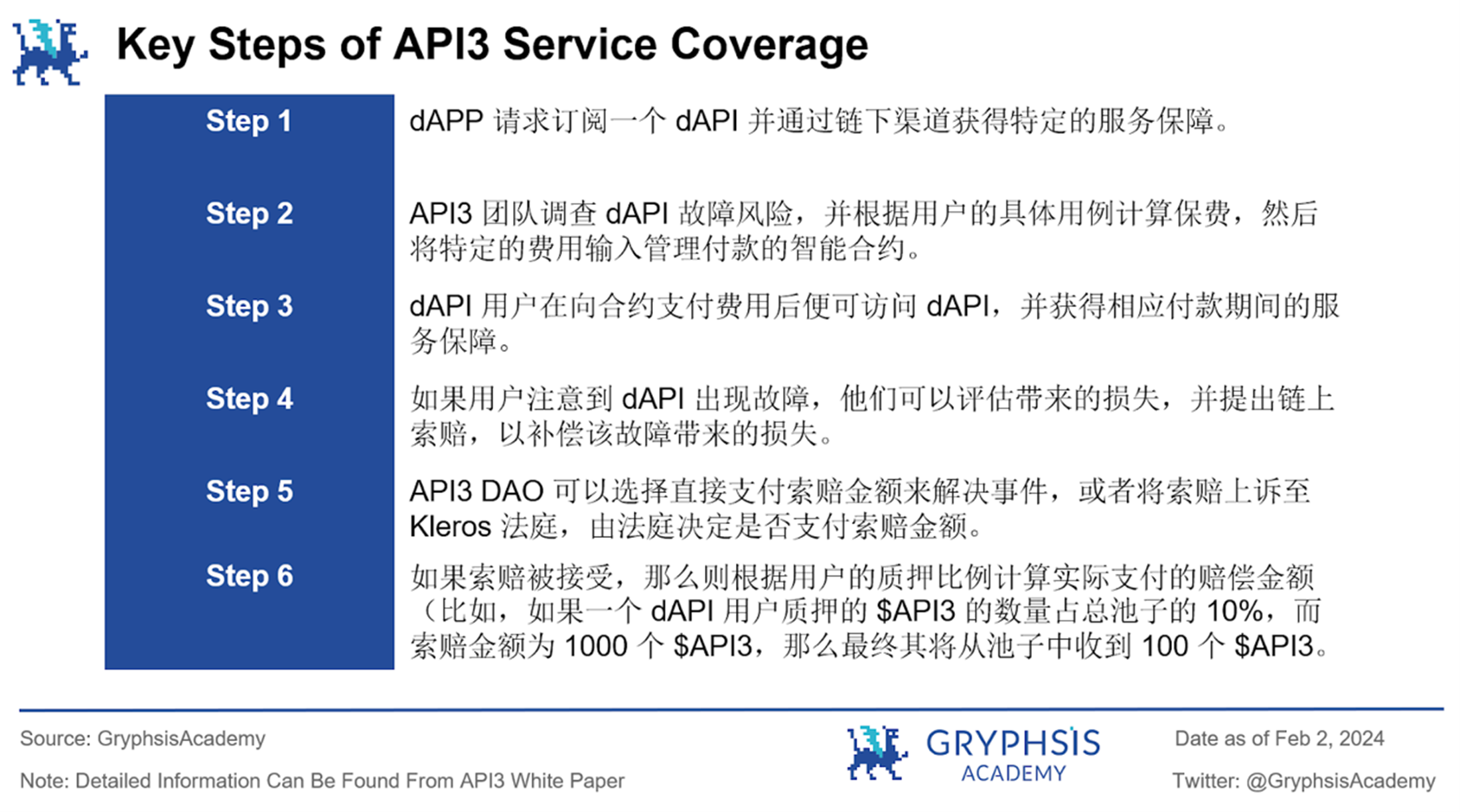

The entire process can be summarized as the following key steps:

Essentially, this process is similar to purchasing an insurance policy, but it does not require any traditional insurance policies. Once the protocol confirms that the dAPI function has failed, the user will receive compensation from the pledge pool. At the same time, API 3 also supports multiple types of cryptocurrencies (such as ETH), indicating the diversification of its services and collateral mechanisms.

More importantly, the collateral model design of API 3 brings about a negative feedback loop and a self-adjusting mechanism to avoid the system's excessive expansion and potential self-destruction. Specifically, as the API 3 DAO expands and increases new dAPI users, the risk of overload leading to dAPI failure and triggering compensation also increases. Therefore, the potential compensation demand provides motivation for the API 3 DAO to not excessively increase the workload in the governance process, ensuring that API 3 does not take unnecessary risks for short-term benefits. This approach helps to encourage and promote responsible and stable growth of the API 3 DAO and its sustainability.

Through this approach, the incentives for dAPI users and other token stakers become aligned as they both have a common goal of avoiding system failures. Stakers are motivated to oversee and maintain the healthy operation of dAPI due to the potential insurance payouts, while users benefit from the stability and reliability of the system. Additionally, the requirement for claimants of service guarantees to stake tokens increases the cost of filing a claim, reducing the probability of false or abusive claims. This mechanism prevents the misuse of the system by individuals who might exploit the guarantee mechanism for personal gain instead of the system's health. Ultimately, the regulation mechanism of negative feedback loops will help suppress drastic fluctuations in token value. Stability is crucial in attracting long-term investors and users in token economics. By restraining excessive risks and failure rates, this loop contributes to establishing confidence in $API 3 tokens as a long-term store of value.

4.4 Governance Mechanism

In the API 3 DAO, the only way to obtain governance voting rights is by staking $API 3 tokens. Therefore, the governance party bears all the risks and rewards of API 3. As mentioned earlier, if governance participants do not actively engage, resulting in a large number of claim incidents, they will suffer losses, and the tokens they staked will be reintroduced to the market and purchased by new governance parties. Conversely, if governance is conducted properly, the supply of $API 3 tokens in the market will decrease accordingly, potentially leading to an increase in token price due to scarcity, allowing governance participants to gain more profits. This approach allows API 3 DAO to continuously improve itself and recover from failures, achieving true decentralization.

4.5 Token Economic Model Summary

Overall, the tokenomic model of API 3 is a carefully designed complex model. The API 3 token serves multiple purposes and needs, such as staking, collateral, insurance pool, governance voting, and accessing dAPI services. It combats the potential inflation issue of the token by setting reward lock-up periods and implementing token burning mechanisms, thereby reducing selling pressure. Importantly, its economic model integrates the API 3 token with the operation and risk of the project itself, as well as the value (supply) of the token. In this context, governance rights no longer remain a trivial option but become the most important tool for incentivizing participants, encouraging token stakers to actively engage in governance to mitigate their own risks. This way, API 3 establishes a close connection between the long-term development of the project and its stakeholders, ensuring the project's stability and significantly promoting true decentralization.

5. Market Analysis and Competitive Landscape

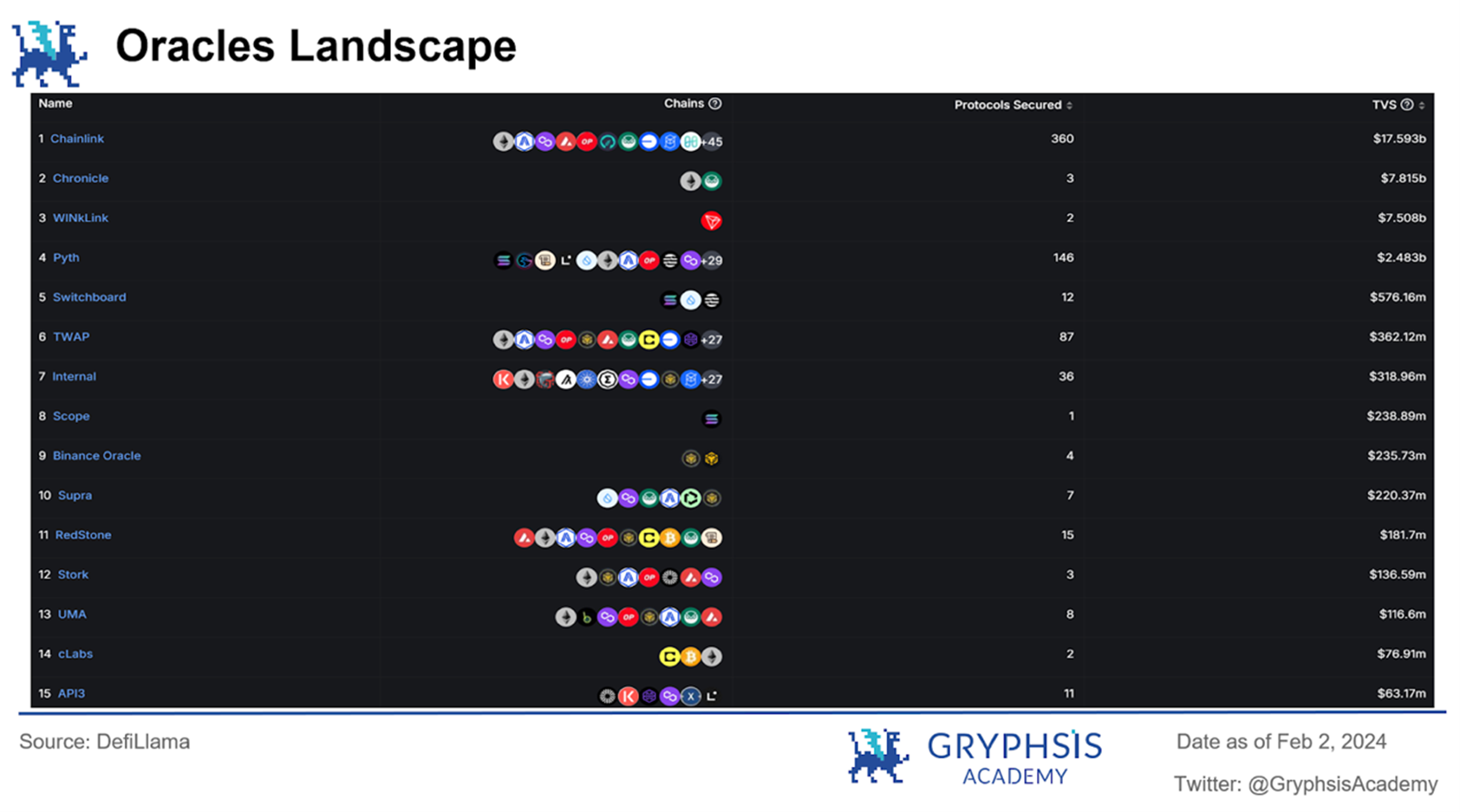

In recent years, the oracle market has experienced significant growth and development due to its unique technical capabilities and wide range of applications. According to CoinGecko data, the total market capitalization of the oracle market has exceeded 13 billion USD. As an essential component of blockchain technology, oracles bridge the information gap between the crypto world and the real world, providing a means for smart contracts to access external data.

Throughout the years, Chainlink has been the absolute leader in the oracle race. According to DefiLlama data, Chainlink currently serves over 50 different networks and 360 protocols, with a Total Value Secured (TVS) of over $17 billion, far surpassing its competitors in terms of market value. However, this market dominance does not mean there are no challenges or competitors. For example, API 3 positions itself as a first-party oracle solution, emphasizing direct data feed from data providers to blockchains, aiming to reduce dependencies and potential failure points associated with third-party oracles like Chainlink, while providing greater advantages in data accuracy and latency.

5.1 Why We Need to Pay Attention to First-Party Oracles

In August 2020, nine Chainlink node operators were attacked. Since Chainlink nodes operate by responding to smart contracts' requests, retrieving and verifying real-world data, and then delivering the data to smart contracts, this process requires paying gas fees on the Ethereum network to execute these operations. The attacker initiated the attack by sending a large number of seemingly valid price feed requests to Chainlink nodes, causing node operators to suddenly face significant Ethereum gas fees. The attacker then hedged gas price fluctuations by minting $Chi tokens, which were being used as gas tokens at the time by 1inch. After minting, the attacker sold these tokens for $ETH, effectively draining $ETH from the node wallets and resulting in a loss of approximately 700 $ETH.

Although Chainlink took timely remedial measures after this incident and continuously strives to improve its protocol to enhance network security and reliability, considering the significant importance of oracles to the on-chain ecosystem, oracle-related risks will continue to be an important factor that we cannot ignore in the long term. For example, Mango Markets and Bonq DAO both suffered significant losses due to oracle attacks. In fact, these attackers exploited the mechanism of third-party oracles to carry out these attacks. In contrast, first-party oracles bring different solutions.

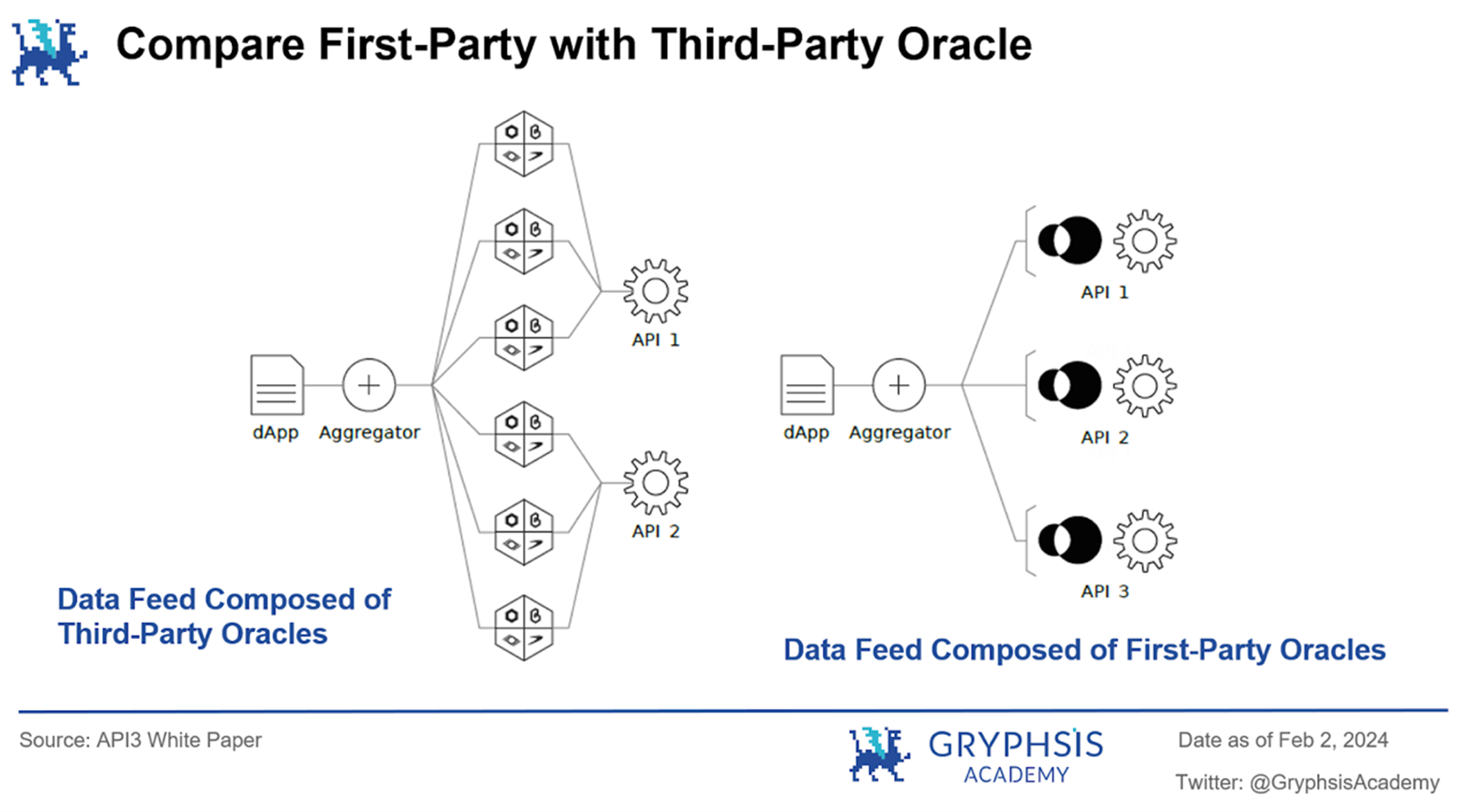

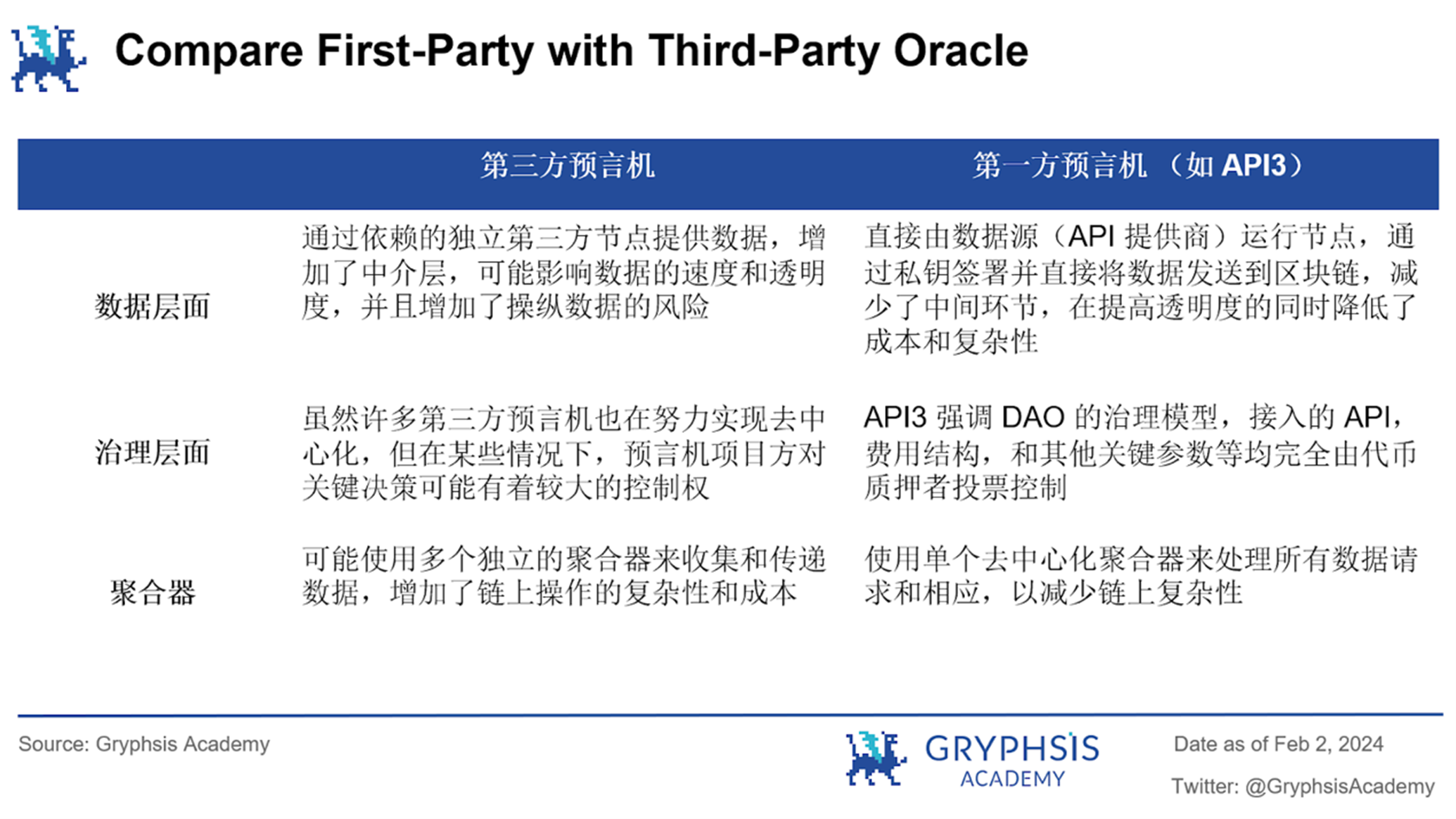

Traditional third-party oracles are nodes hosted by third-party intermediaries, which need to aggregate external data and input it into smart contracts. This mechanism not only requires data consumers to trust data providers but also intermediaries, introducing additional layers of trust and potential costs, and may raise concerns about centralized failure points, data manipulation risks, transparency, trust, and so on. For example, to incentivize third-party nodes to provide reliable services, third-party oracles typically require middleman costs to incentivize honest behavior, which is not present in the first-party oracle model. In addition, the mechanism of third-party oracles may not be considered truly decentralized in some respects. In contrast, as a first-party oracle, API 3 allows API providers to operate oracle nodes themselves, providing a more decentralized and cost-effective way with improved data reliability and integrity.

5.2 Competition of first-party oracles

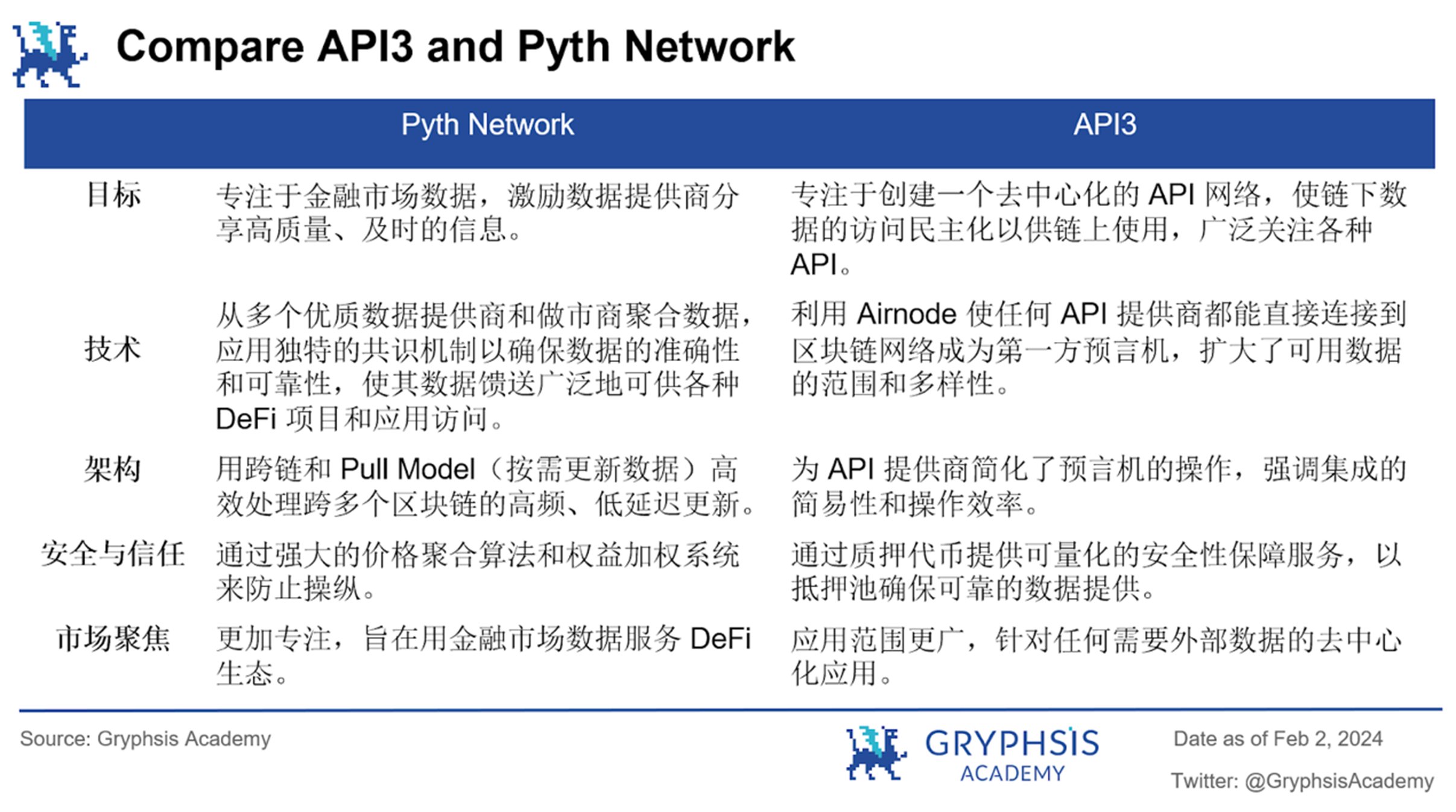

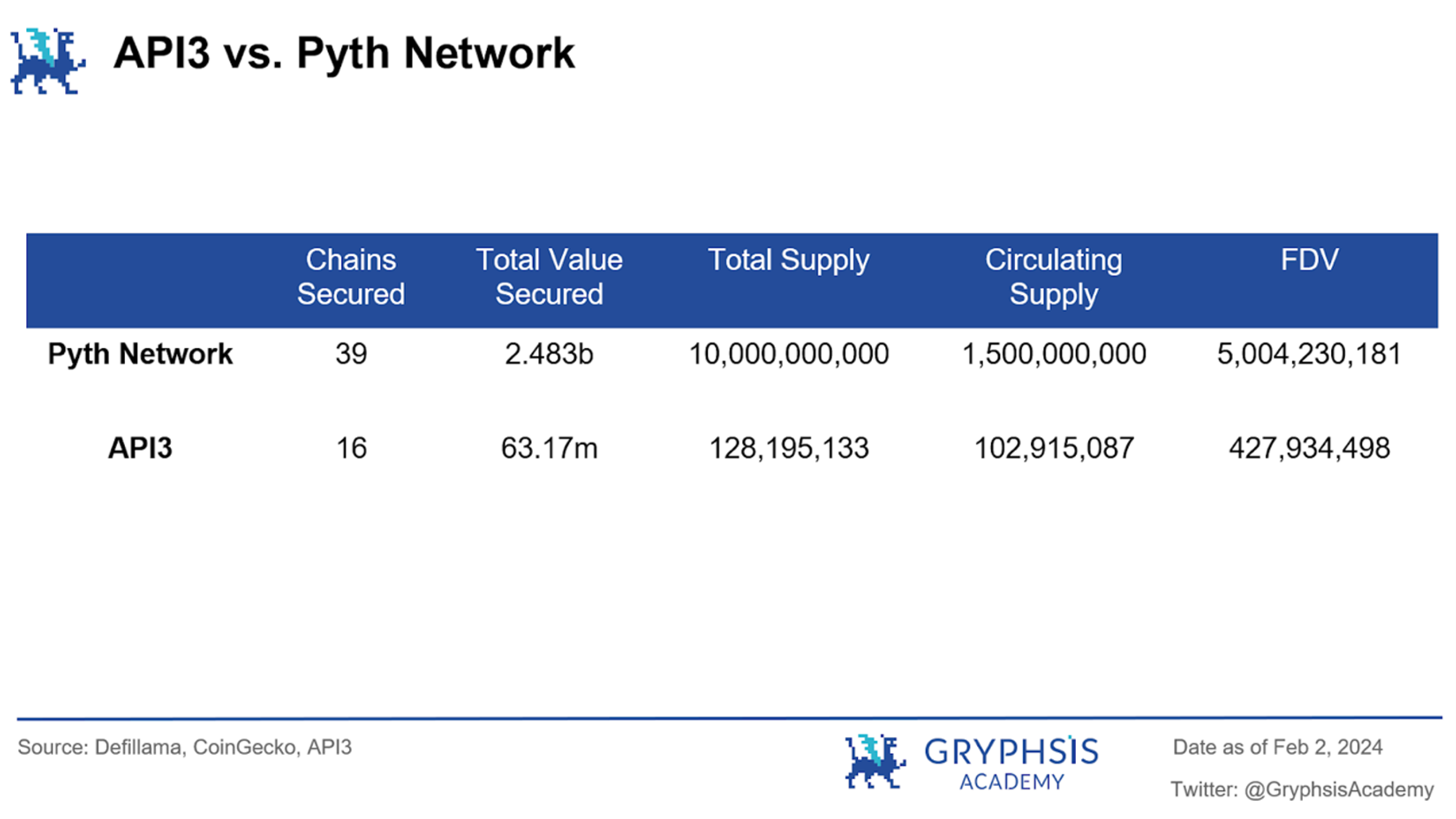

When it comes to first-party oracles, it is impossible not to mention the recently popular Pyth Network protocol. Next, we will analyze API 3 and Pyth Network through a comparative approach.

It is easy to see that both projects have made important contributions to the Web3.0 ecosystem by addressing the key demand for reliable and decentralized data sources. The main advantages of API 3 include: a wider range of data applications, a fully decentralized DAO governance model, low operational difficulty, cost-effectiveness, high transparency, and a more robust token economic model.

From these data, we can see that Pyth Network has a greater advantage in terms of current integrated depth and coverage scope. However, this does not mean that API 3 lacks competitiveness. The current fewer integrated protocols allow API 3 to focus on providing high-quality services and deepening its presence on the blockchain it serves. In the future, as blockchain technology continues to develop and more application scenarios emerge, API 3 can expand its market share by increasing integration links, protocol support, and value guarantee. Additionally, API 3's current smaller market size may make it more flexible and able to quickly adapt to market changes and user demands, bringing greater growth and expansion opportunities. In the future, we expect API 3 to enhance its position in the industry through innovation and optimization.

Therefore, we still have reasons to be optimistic about the development prospects of API 3. Combining the previously mentioned OEV Network, when the architecture of dAPI is combined with OEV Network and ZK-Rollup, and governed by a fully decentralized DAO, we can see that the future of API 3 may not only be as an intermediate component providing oracle services but also have the potential to become the infrastructure for on-chain ecosystems and dApp project development, even with the potential to disrupt the market currently dominated by third-party oracles.

5.3 Risks

Although API 3 brings strong expectations with its various advantages, any blockchain project faces a series of unique risks, and API 3's main risks may include the following:

Adoption: The future success of API 3 largely depends on the adoption by API providers and their integration with blockchain projects. If API 3 fails to attract enough interest or achieve the expected adoption rate, it may have a negative impact on the project's success and the value of its tokens.

Provider Loss: If, for any reason, a large number of API providers stop their services or choose not to adopt API 3, it may limit the diversity and quality of available data, potentially affecting the utility of the API 3 network.

Security Vulnerabilities: Like any blockchain project, API 3 may be susceptible to potential security vulnerabilities in its protocol, smart contracts, or Airnode technology. Any security vulnerabilities or exploits can lead to loss of funds or data and weaken user trust in the platform.

Competition Landscape: The competition in the oracle field is extremely fierce, and established players like Chainlink already have a considerable market share. The concept and design of API 3 are very innovative, but this does not guarantee the project's long-term success. Therefore, API 3 still needs to stand out and prove its value proposition to overcome competitive pressures.

Therefore, apart from its innovative approach and mechanisms, the success of API 3 will also depend on technical execution, market adoption, competitive differentiation, regulatory environment, and other factors. Like all investments in the cryptocurrency field, before making investment decisions, we should thoroughly understand the advantages and risks involved in the project itself.

6. Conclusion

In summary, API 3 brings a pioneering approach to the oracle field by directly connecting data providers and blockchain networks through first-party oracles and dAPIs. It enhances security, transparency, and efficiency while reducing the risks associated with data tampering and the costs associated with data feeds. Additionally, API 3 has a well-designed and powerful token economic model that allows smart contract platforms to leverage dAPIs in a truly decentralized and trust-minimized manner to build meaningful dApps through a DAO governance model. With the launch of its OEV Network, we have reason to expect that API 3 will be adopted by more blockchain networks and dApp protocols in the future, and have the opportunity to become an infrastructure for the development and innovation of decentralized applications.

References

https://etherscan.io/token/0x0b38210ea11411557c13457D4dA7dC6ea731B88a

https://docs.api3.org/explore/

https://www.theblock.co/post/76986/chainlink-nodes-attack-eth

https://www.wublock123.com/index.php?m=content&c=index&a=show&catid=47&id=23865

[Statement] This report is an original work completed by the student @0x markyzl of @GryphsisAcademy under the guidance of mentor @CryptoScott_ETH. The author is solely responsible for all content contained herein. The content does not necessarily reflect the views of Gryphsis Academy or the organization commissioning the report. Editorial content and decisions are not influenced by readers. Please be aware that the author may have investments in cryptocurrencies mentioned in this report. This document is for informational purposes only and should not be used as a basis for investment decisions. It is strongly recommended that you conduct your own research and consult with an impartial financial, tax, or legal advisor before making any investment decisions. Please remember that past performance of any asset is not indicative of future returns.