Original author: Delphi Digital

Original compilation: DAOSquare

Introduction

2023 will go down as one of the most important years in Bitcoin history. Bitcoin Ordinals opens up a whole new concept and submarket of Bitcoin. Bitcoin L2, sidechains, and scaling solutions have renewed interest among market participants. The traditional financial market has begun to regard BTC as a serious and effective asset class. A total of more than a dozen spot BTC ETF applications were submitted in 2023, and many ETFs were approved in early 2024. Most importantly, however, BTC appears to be climbing out of one of the worst bear markets the crypto market has ever experienced. BTC has withstood the storm of Luna, FTX, Voyager, and Celsius collapses and is even stronger than before, such as the market attention, ecological vitality, and new technologies we have seen. All in all, the current state of Bitcoin is exciting.

This report will focus on several key trends and areas where we believe Bitcoin will shine in 2023. Readers should not view this report as an exhaustive list of every Bitcoin development in 2023, as there are too many things to count and track. There are thousands of people working towards their own vision of Bitcoin. Whether it’s BTC micropayments via the Lightning Network, Inscription Market, Bitcoin sidechains, or working to introduce BTC to other chains, Bitcoin’s development levels in 2023 have reached fever pitch. The sclerotic Bitcoin we saw in 2021 and 2022 appears to be a thing of the past.

Bitcoin Network

The first area we want to focus on is how exactly Bitcoin works as a network. Crypto enthusiasts could be forgiven if we sometimes forget that Bitcoin is much more than the price of BTC. Bitcoin is the largest decentralized currency network in the world, so it is important to closely monitor the health of the network. In a way, buying BTC is a bet for the Bitcoin network to attract more users and capital. Without growth, Bitcoin will fail. Thankfully, in 2023, almost everything about the Bitcoin network is starting to fall into place.

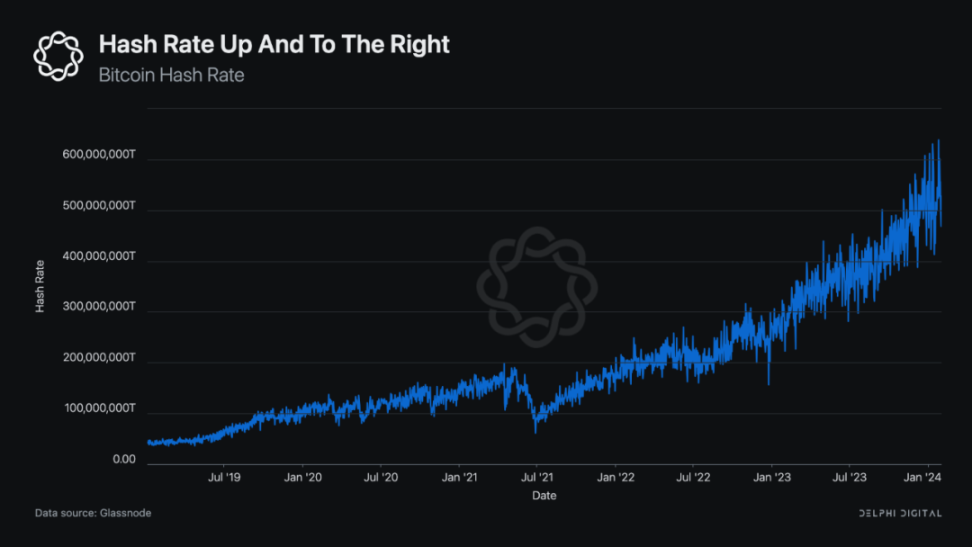

The computing power in 2023 is astonishing. Due to BTCs relatively poor price performance in 2022, we were surprised to see hashrate continue to breach all-time highs until 2023. Bitcoin’s hash rate has doubled since the beginning of 2022, and its hash rate is worth watching for two reasons:

It represents the security level of Bitcoin. Generally speaking, the higher the hashrate, the more secure Bitcoin is (assuming the hashes are coming from new miners, not just all existing miners).

A higher hashrate indicates miners’ confidence in the network. If mining is not profitable or the period of profitability is too long, we expect the hash rate to fall.

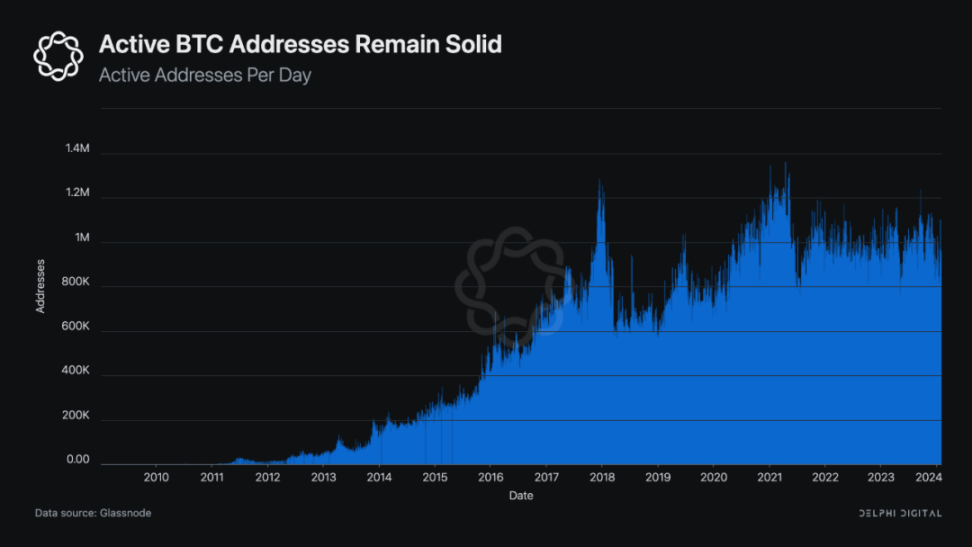

The number of active BTC addresses has dropped significantly in 2021 from a peak of 1.15 M addresses. As BTC prices stagnated, more than 300,000 users disappeared in a matter of weeks. Even reaching the new ATH in November 2021 did not bring back the lost users. Active BTC addresses remained unchanged throughout 2022. But in 2023, we see a growing trend in active BTC addresses. However, entering 2024, the growth trend seems to have stalled, with active addresses stabilizing at around 1M.

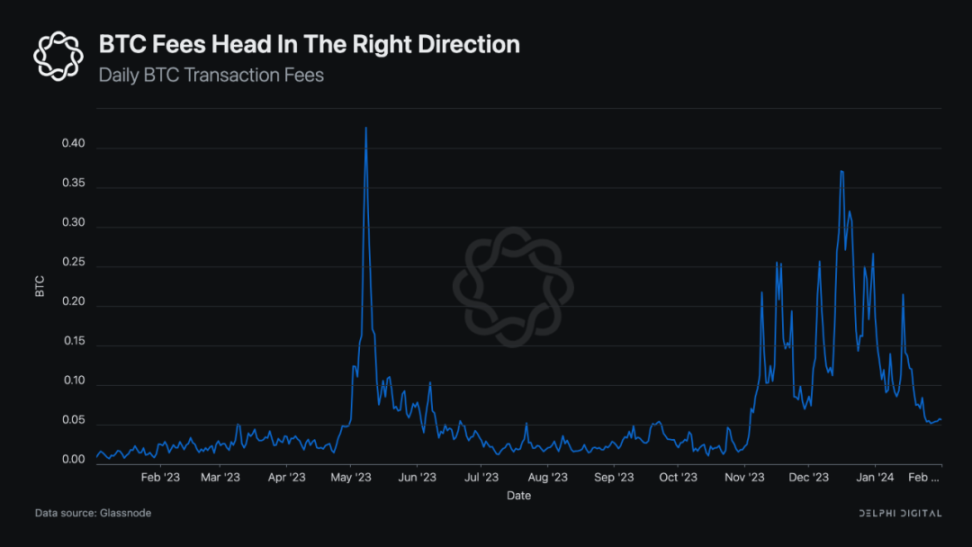

In 2023, we saw Bicoins fee income improve. Bitcoin has a problem. The problem is that at some point in the future, Bitcoin’s fees will replace its block rewards to continue paying miners to protect the network. Unfortunately, Bitcoin’s fee revenue has historically been too low to replace block rewards. But 2023 brings some new hope for solving this challenge.

Inscription and the new demand for block space have had a huge impact on Bitcoin. First, we saw a huge spike in fees at the start of the year. After the initial spike, fee levels calmed down, but fees are still rising significantly.

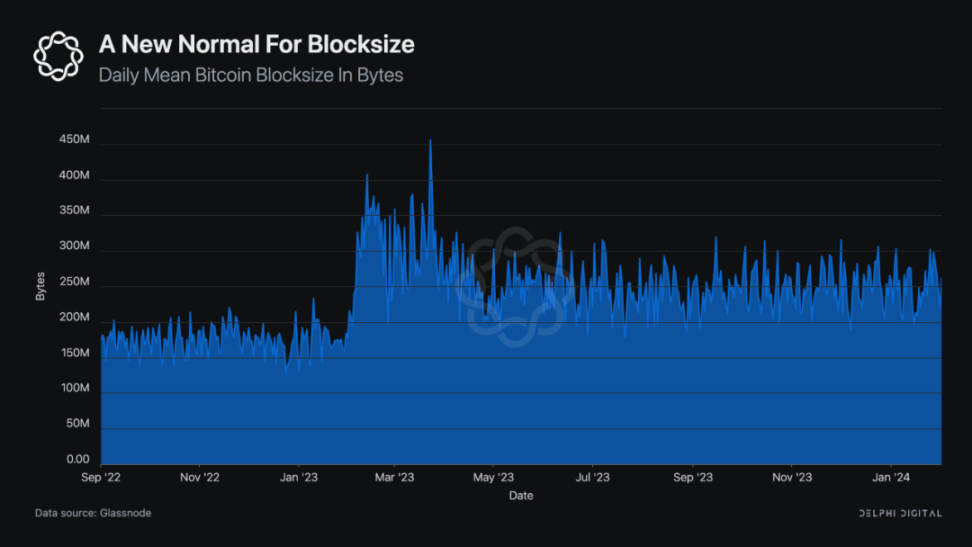

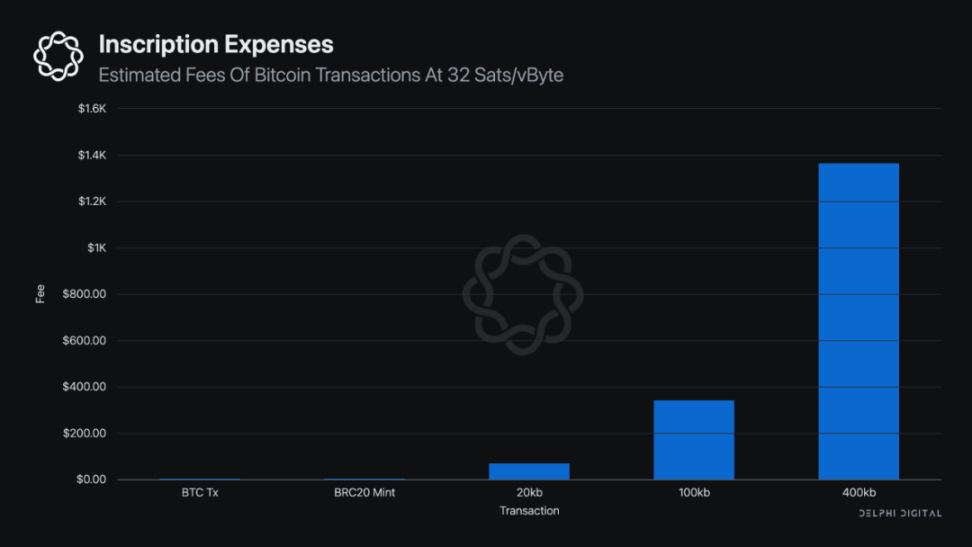

A major development that will help solve Bitcoins fee challenges is Inscription. We’ll discuss them in detail later, but fundamentally, Inscriptions allow users to store any arbitrary data on the Bitcoin network. Just like regular transactions, users have to pay a fee to burn data. This small technological development led to an explosion in demand for Bitcoin block space. In early 2023, people inscribed data on thousands of Sats. Then people figured out how to create a simple token using the inscription standard BRC 20, which led to more demand for block space. The demand for storing data on Bitcoin is so great that the average block size will almost double in 2023.

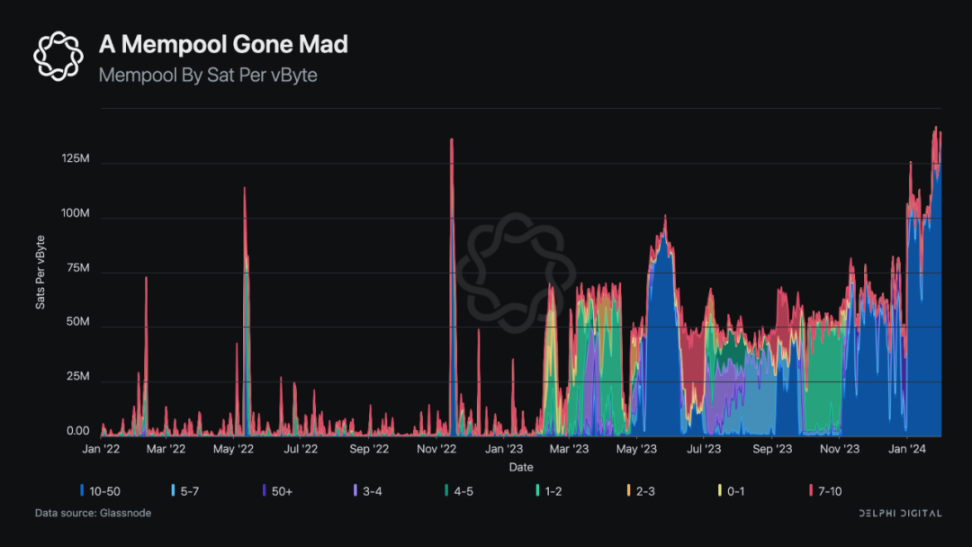

We can easily see the demand for block space in the Bitcoin memory pool. Starting in the first quarter of 2023, Bitcoin’s mempool exploded. The memory pool is suddenly clogged with thousands of transactions trying to put their inscriptions on Stats. Fees briefly dropped again when bots killed users ability to create BRC 20 (more on that later), but the mempool has become congested again. For struggling miners, a congested mempool may be a godsend, but those trading small amounts are frustrated by it. For some, the chain is almost unusable.

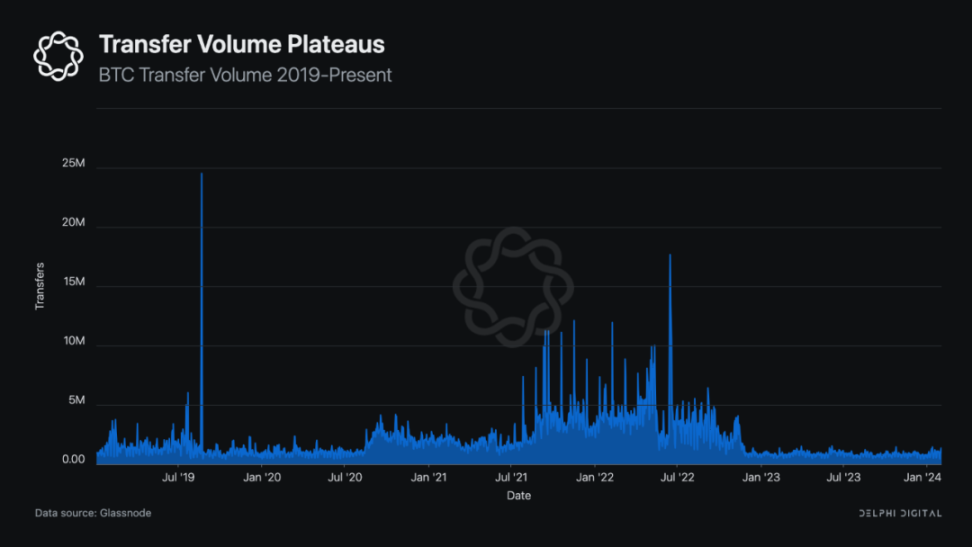

The sudden drop in those small BTC transfers caused by the popularity of Inscription seems to be the reason why we saw the collapse of BTC trading volume after the popularity of Inscription. Bitcoin’s transaction volume, which measures the total number of successful BTC transfers on the chain, has dropped to levels not seen since 2020, and it looks like the downward trend will continue.

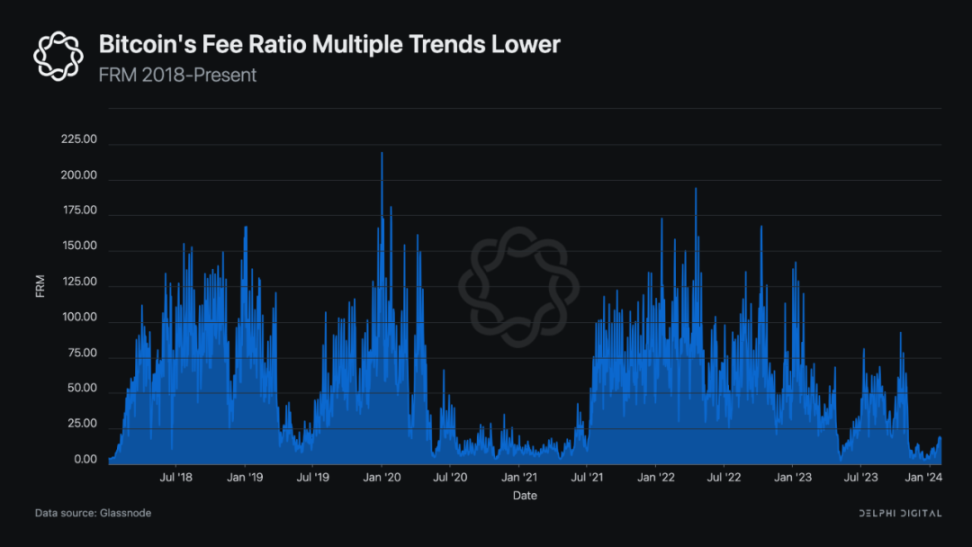

The increase in inscription demand and fees has resulted in Bitcoin’s FRM being at its lowest level in a period. FRM, or fee ratio multiple, measures the fee multiple a chain would need to replace its block rewards. The lower the FRM, the better. In 2022, Bitcoins FRM hovers between 40x and 120x, which means that Bitcoin will need 40x to 120x fees to replace block rewards. The proliferation of inscriptions has begun to bring this number down. In 2023, FRM plummeted from 80x to between 12x and 40x, closer to Bitcoins levels between 2020 and 2021. Lower FRM levels are more promising, and if you are a long-term Bitcoin believer, you want to see this downward trend continue.

Bitcoin’s network statistics paint a vivid picture, largely dependent on large adoption scale. Bitcoin seems to be moving beyond HODL memes and into scenarios we regularly use. When Kewen first entered the market, we predicted the scene you see today. Demand for Bitcoins block space has created new sources of fees and users for the chain. Thanks in part to new fee sources, the network is as busy and as secure as ever. Despite some naysayers, engraving has proven to be a boon to the entire Bitcoin network by 2023.

However, we think it is important to note that FRM remains high between 12x and 40x. Bitcoin still faces challenges surrounding its security model and what it will do when block rewards end. But the inscription is a step in the right direction. If the Bitcoin community can find more sources of fees, Bitcoins future will be promising.

Bitcoin entity

Despite being one of the most decentralized cryptocurrencies, large entities and institutions still have a huge influence on it. In order to fully understand Bitcoin, we need to analyze the behavior of some BTC whales.

exchange

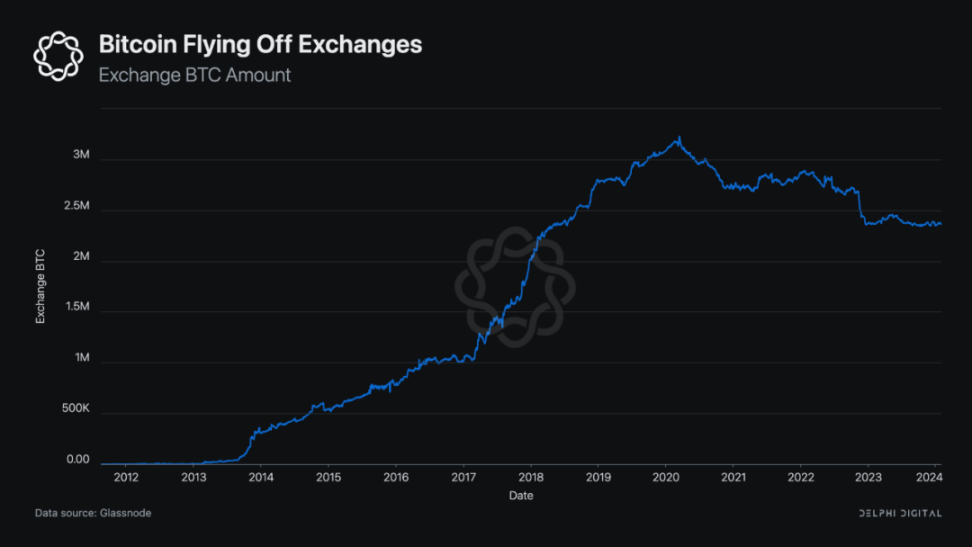

One of the most common metrics that analysts like to discuss is exchange BTC balances. The reason is simple: since almost all BTC trading occurs on centralized exchanges, less BTC on exchanges means less BTC is available for purchase, leading to a supply shortage and potentially an increase in BTC prices. At this point, 2023 continues a trend that started during the COVID-19 collapse of 2020. That said, BTC has been flying off exchanges. BTC on exchanges is at levels we haven’t seen since 2018, at just over 2 million.

There have been rumors that exchanges have rehypothecated BTC. After the FTX implosion, BTC will likely continue to fly off exchanges as BTC holders become increasingly reluctant to trust centralized entities. The Ordinals explosion may also play a role in this trend.

miner

Next, we will focus on miners in the physical journey of Bitcoin. Bitcoin miners are a fundamental part of the Bitcoin ecosystem. Without industrial-scale mining, Bitcoin would be significantly less secure. But security doesn’t come cheap. The network pays miners security fees in BTC. Because of this, miners rely on BTC to operate, which may be a source of BTC selling pressure. Not only that, but miners’ behavioral reactions also indicate their market stance, which could signal belief in a downward trend if a massive sell-off occurs. If miners choose to continue holding BTC, it indicates that they believe the price is likely to rise.

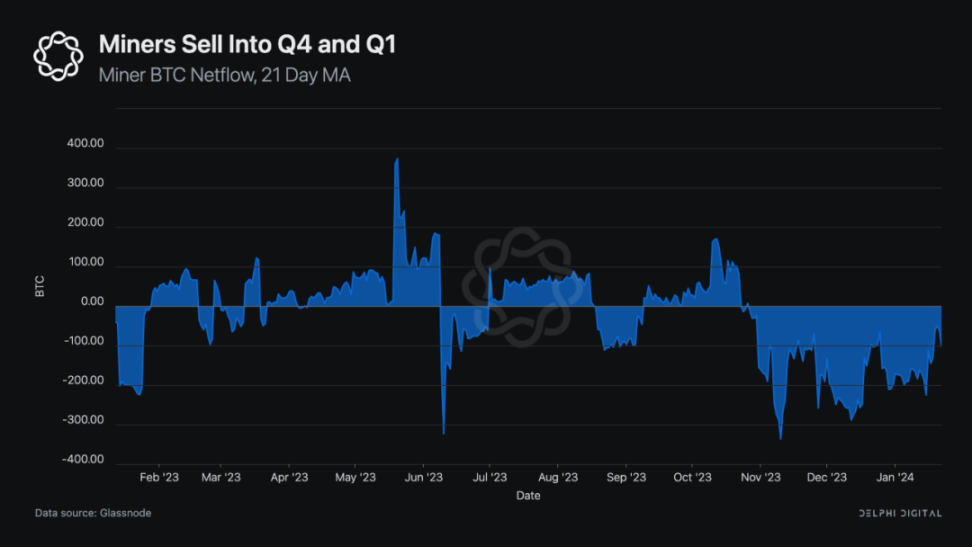

In 2023, miners generally held more BTC than sold, although not by much. During the collapse of FTX, miners sold large amounts of BTC, but starting in 2023, they started hoarding BTC again (although they continued to sell in Q4 2023 and Q1 2024).

Several large mining companies are publicly traded, and any analysis of the state of BTC mining should focus on these companies. If mining companies suffer heavy losses, Bitcoins security will be compromised by the shutdown.

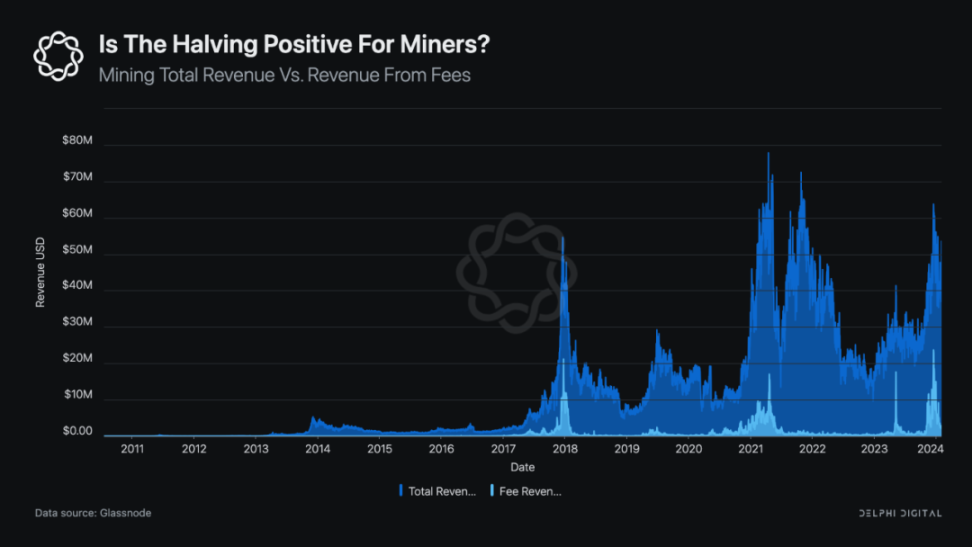

Regarding the performance and life cycle of miners, the most important thing to look at is their income. BTC miners income consists of two separate sources: block rewards and fees. As we are sure readers know, Satoshi Nakamoto programmed Bitcoin to reward miners with what we call block rewards. However, approximately every four years, the block reward is halved. Block reward reductions are often viewed as an important positive catalyst. However, miners may be a little scared about the next halving.

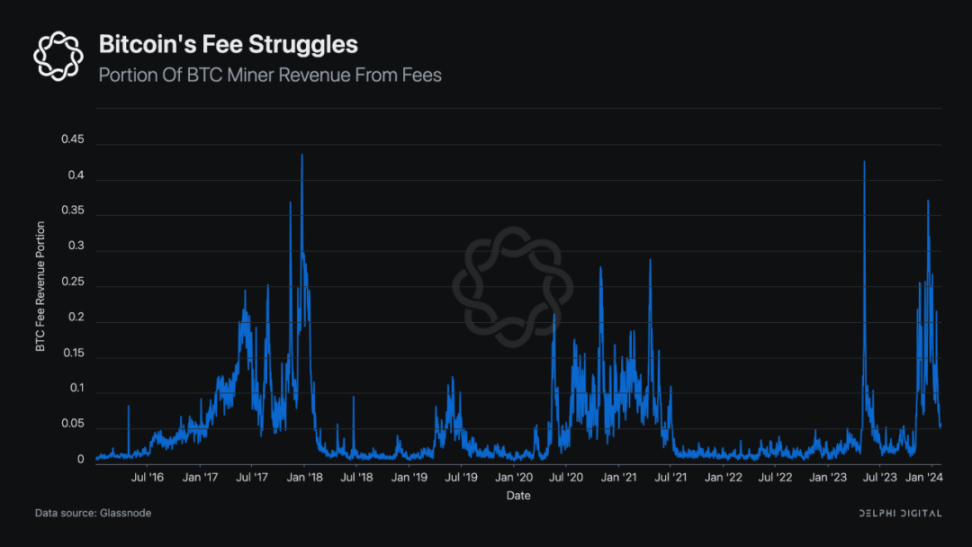

The majority of BTC miners income has always come from Bitcoin block rewards. Looking back at 2016, we saw that the revenue miners received from fees was often a fraction of the block reward. Fees sometimes account for less than 1% of miners’ revenue, and since 2016 have rarely exceeded 10%. The fees generated by Inscription may bring some hope to miners, but it is still doubtful whether Inscription can fundamentally solve Bitcoins fee problem.

Unless the price of BTC rises significantly, miners income will take a serious hit. Bitcoin has not yet generated enough fees to replace the roughly 450 BTC per day loss that the halving will bring. Since the last halving, Bitcoin has only been able to generate around 50 BTC per day through fees on average, which is 1/9 of what miners lost during the halving. From a very practical perspective, the halving will cut miners’ income in half.

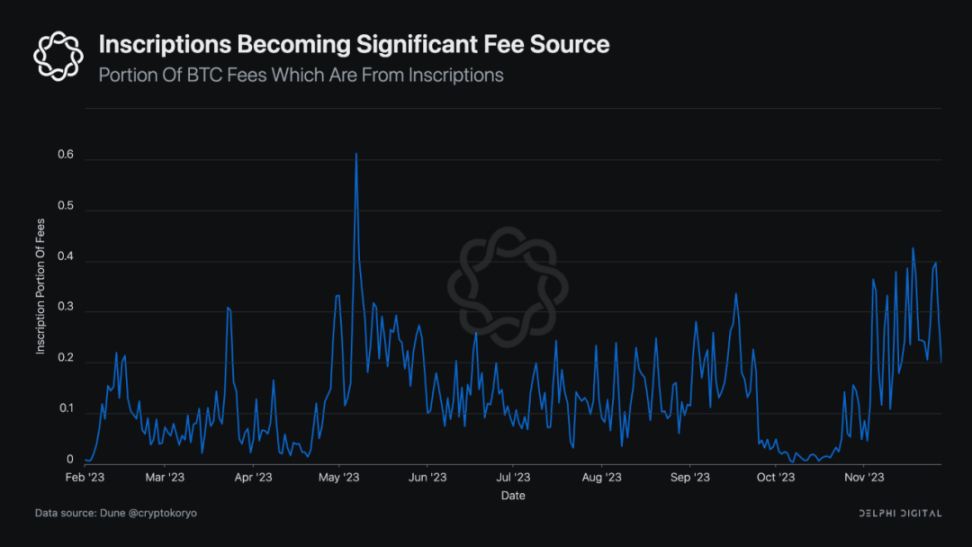

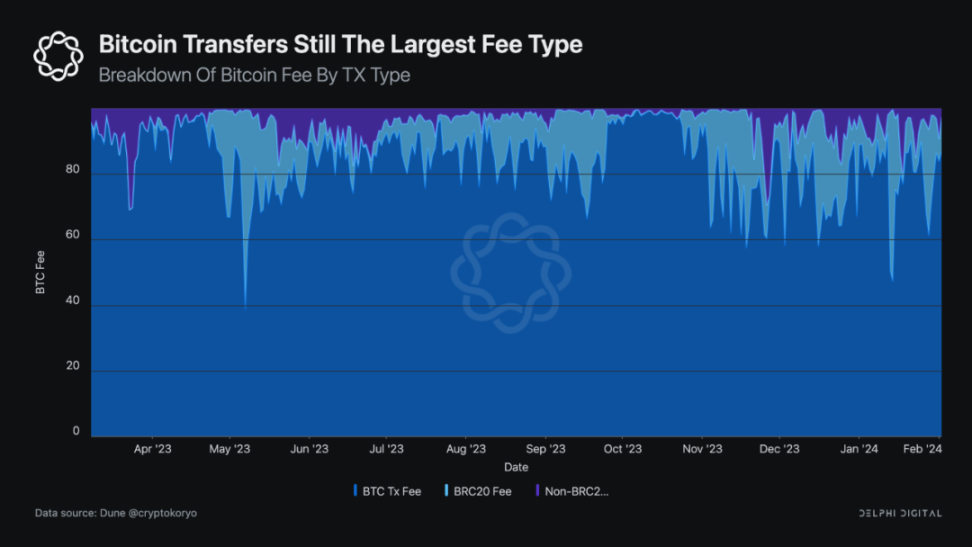

Interestingly, the halving makes Inscription even more important to Bitcoin’s long-term success. With block rewards halving around April 2024 and fees making up a larger portion of miner revenue than before, Inscription will be more important than ever as a new and important source of fees for Bitcoin. Since its rise in February 2023, Inscription has become an important part of Bitcoins fee structure. On average, inscriptions alone account for around 13% of Bitcoin fees. In some feverish times the inscription may even account for more than a quarter of the cost. At one point in 2023, Inscription even accounted for 60% of Bitcoin fees.

In light of the Bitcoin block reward halving, the fees generated by Inscription will become even more important to miners hoping to stay afloat. To this end, we expect miners to become strong advocates of the thriving Inscription ecosystem.

Institutions and ETFs

There are new Bitcoin entities worthy of our attention in 2023: traditional institutions. 2023 is a booming year for Bitcoin. No longer just labels for anarchists, liberals, degenerates and rebels. Respected, reputable companies are lining up to bring BTC to traditional markets for the first time in its history. For the first time, serious investors consider BTC to be a reasonable asset.

In 2023, we see significant developments between Bitcoin and institutions, and we recommend that people stay informed about these developments. We’ll detail the approval of BTC ETFs and how they’re performing in this week’s Market Note for Pro subscribers.

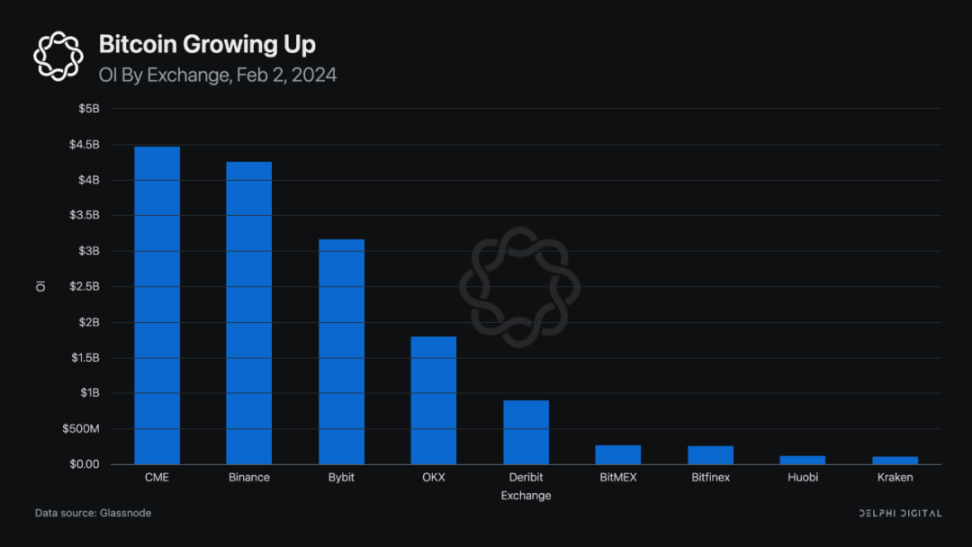

For those who already hold spot BTC or other crypto assets, a BTC ETF may not seem like a big deal. However, spot BTC ETF trading on traditional stock exchanges could have a significant impact on Bitcoin. The first impact is that spot ETFs are a strong signal that BTC and other crypto asset markets are an important asset class. Before the advent of spot ETFs, cryptoassets were in a gray state. Many investors consider them a legitimate asset class, but many dont. Warren Buffett calls BTC “rat poison.” A spot BTC ETF managed by a reputable firm like VanEck or Blackrock is a strong signal that BTC has moved from being an important asset class in grandparents’ 401K households to being a significant asset class. Interestingly, CME surpassed Binance in OI, which is another signal that the market is paying more attention to this asset class.

Second, and more importantly to most people, spot BTC ETFs open the door to large amounts of capital. As we mentioned, many capital allocators are unable to invest in BTC. Rules and regulations may prevent them from trading with crypto asset exchanges, and existing custody solutions may not be suitable. However, spot ETFs, managed by reputable companies and traded on well-regulated stock exchanges, open the door to just about everyone. Investors can purchase ETFs through banks, financial apps, company 401K, etc. Spot BTC ETFs place BTC firmly into the mainstream and open up huge liquidity pools for it.

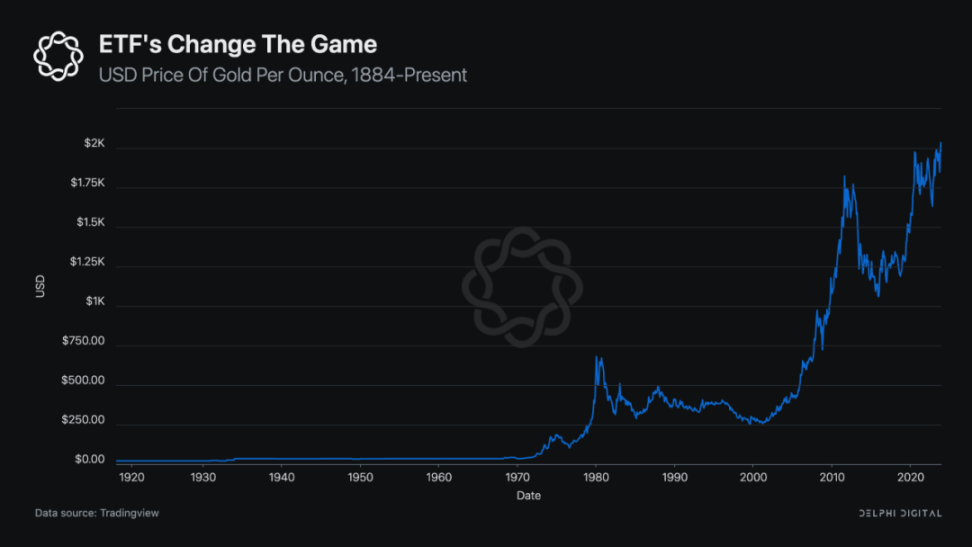

Heres a good example of what spot ETFs mean for Bitcoin, namely the performance of gold prices after the listing of spot gold ETFs. The first gold ETF entered the market in 2003, when gold was trading at around $650 an ounce. Gold ETFs have opened the door for a massive influx of capital, with gold now trading at $2,000 an ounce, a more than three-fold increase. A spot BTC ETF could have the same impact on the price of BTC, which is why people are watching the process closely.

The evolution of Bitcoin

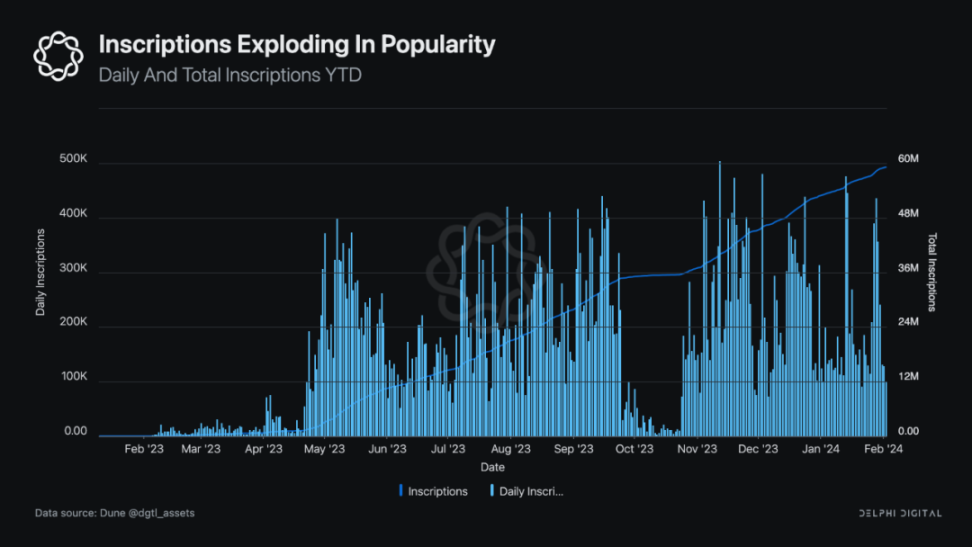

One of the most interesting things happening in Bitcoin in 2023 is the development and release of inscription technology on the Bitcoin network by Casey Rodarmor. Inscription uses Toproot to allow users to store any data on the Bitcoin network and bind or engrave the data on a specific Sat. Users can transfer data simply by sending it to a new address. Once launched, the market quickly embraced inscriptions, and in early 2023, we saw a large number of users flocking to the Bitcoin network to create inscriptions. As of the release of this report, there are more than 59 M inscriptions on the Bitcoin network.

Early inscription market

The inscription craze petered out after reaching a few key psychological numbers: 1 K, 10 K, 100 K and 1 M. The number of inscriptions now exceeds 59M, so this psychological effect is now less important. Some market participants still believe that the earliest inscriptions will command a premium. Some collectibles were an early hit, such as Bitcoin Punks, a replica of CryptoPunks that the team had inscribed between 89 and 34,399. But the enthusiasm for these early inscriptions has been replaced by the BRC 20s. Having said that, these early inscriptions always have their place. They may become collectibles or digital artifacts in the future, especially if the inscriptions increase in importance to Bitcoin or become more popular in the future.

To this end, one should note that Bitcoins Ordinal market has had some notable successes. The famous New York auction house Sothebys recently completed the Bitcoin Shroom auction. The three items sold for between $101 and $241, three to five times Sothebys estimate. Others of note include Taproot Wizards, OCM (the first collection to use recursion), and Ordinal Maxi Biz. Taproot Wizards, in particular, seems attractive because they are capitalizing on Bitcoins early meme. Regardless, the Ordinal Market has become an exciting place for collectors, and it’s an area that NFT enthusiasts should keep an eye on, even if BRC 20’s venture capital overshadows it.

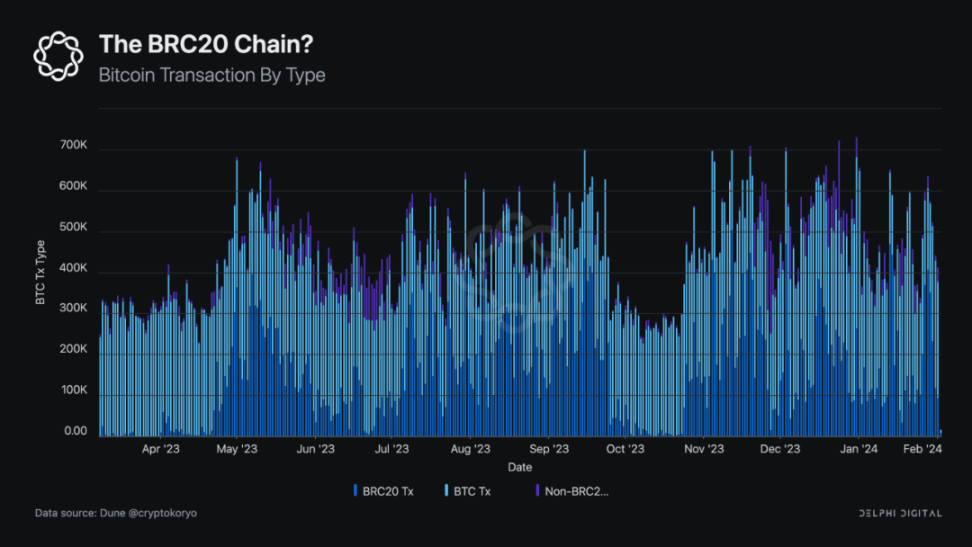

BRC 20 chain?

Inscriptions emerged when anonymous Twitter developer Domo pushed for a simple token standard using Bitcoin Inscriptions. This simple Token method is called BRC 20, which has created a sub-industry with a market capitalization of $1B and has become the absolute main battleground of Inscription.

The BRC 20 is super easy. They are JSON text files that are embedded into sats by the user and are used to describe the following three Token functions: deploy, mint and transfer. Initially, users deploy tokens by burning the token parameters on sat, including the four-letter token symbol, token amount, and minting amount. Other users can then mint Tokens within the scope specified in that inscription. For example, if a user deploys a Token with a supply of 10 K and a minting parameter of 1000, the first 10 inscriptions will mint the entire supply. The transfer token is a simple text inscription specifying the token symbol, quantity and receiving address. These simple features have now spawned a multi-billion dollar industry.

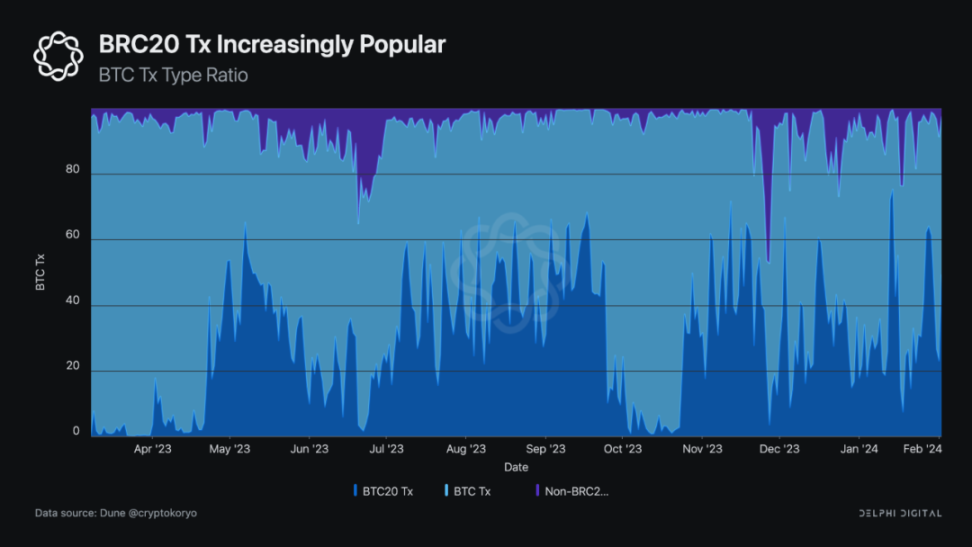

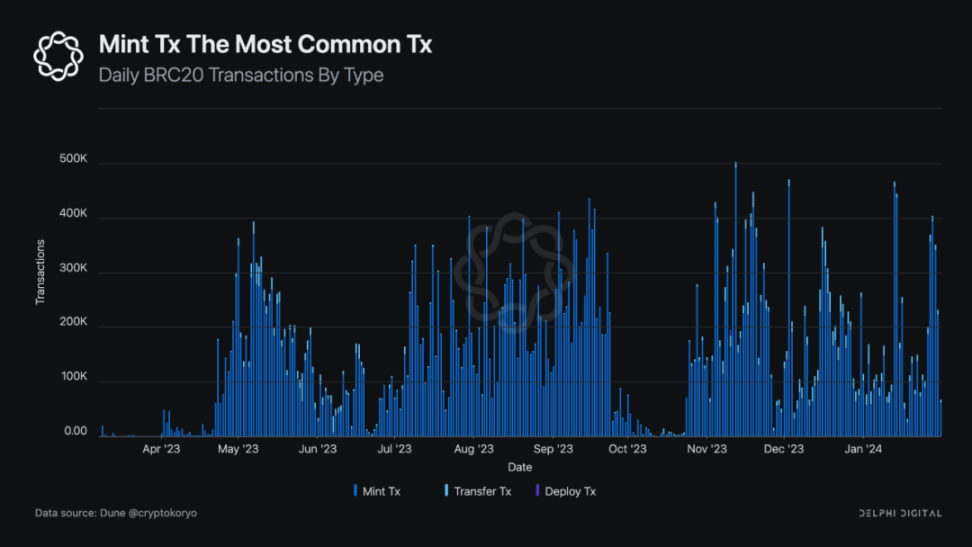

While it’s hard to overstate the extent to which BRC 20 surpasses other inscription markets, which aren’t even in the same league, as you can see from the chart above, the number of BRC 20 transactions does far exceed that of other types of inscription transactions. At one point, the number of BRC 20 inscriptions even exceeded regular BTC transactions.

For a brief period in late 2023, the BRC 20 craze seemed to be over. New BRC 20 minting and deployment transactions are zero. However, the reason is not that the market doesn’t want BRC 20. Instead someone was skeptical of BRC 20 and created a bot to pre-run any BRC 20 deployment transaction and set the total supply to 1. The bot essentially shut down all new BRC 20 castings, nearly killing the market. But eventually, the bot ran out of BTC transaction fees and the BRC 20 market returned to the same level as before.

cost issue

As we mentioned in our previous article, Bitcoin miners and its security are suffering from the lack of fees. BRC 20 is an important new fee source for Bitcoin. But as I believe readers can surmise from the chart above, one should not think that the BRC 20 fee is a panacea to Bitcoin’s fee challenges. While BRC 20 and Ordinal fees still make up only a small portion of Bitcoin’s fee structure, they are growing.

Unfortunately, BRC 20s and Ordinals may cause overall BTC trading volume to decline. As we mentioned before, large demand has pushed the fee floor higher, which has pushed small transactions out of the equation. As a result, BTC’s transaction volume has stabilized, even as the mempool has exploded with high-value transactions.

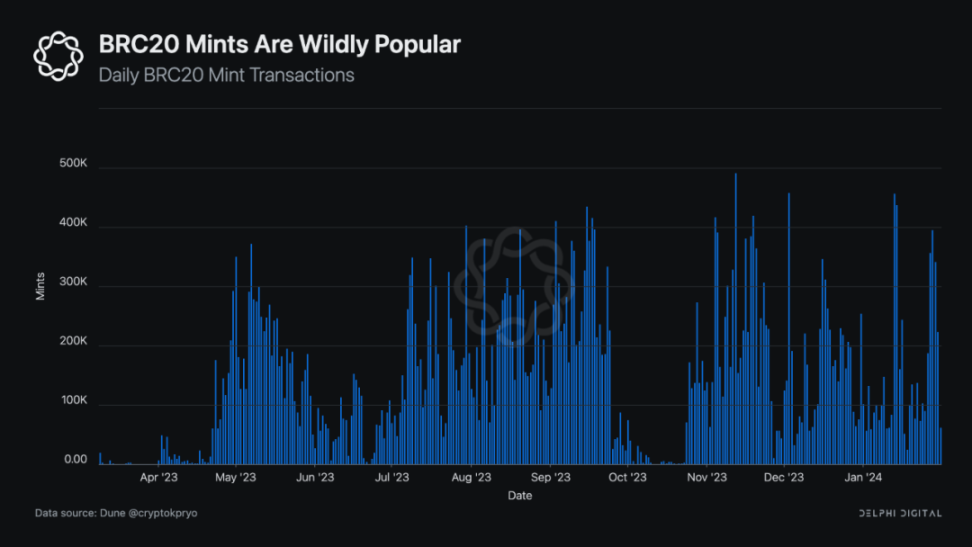

BRC-20 indicator

The BRC 20 market has been an interesting one in 2023. More than 56,000 BRC-20 tokens have been deployed. However, since only one deployment transaction is required per BRC 20 token, the number of deployments exceeds the minting and transfer transactions. Minting transactions, in particular, make up a huge portion of the BRC 20 market, which is no surprise. Generally, minting is completely free except for transaction fees. When someone deploys a token, they specify the amount that users can mint in a transaction. For example, $ORDI allows a minting limit of 1000 per user. The nature of this minting process means that whenever a new token comes onto the market, people rush to mint it because its free. Of course, since casting is the most popular type of trade, they account for the majority of fees.

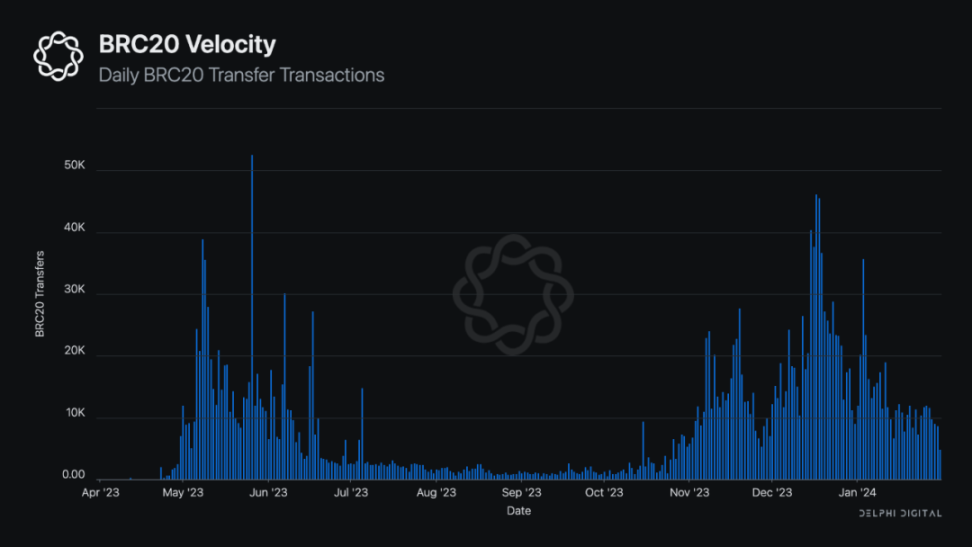

Since minting is essentially free, transfer transactions are the best barometer of BRC 20 market activity. BRC 20 transfer tx are crucial to track as they represent a certain level of buying and selling transactions. Until now, the BRC 20 market functions like an auction, so if one wants to buy or sell them, transfer transactions will occur. Transfers become an indicator of trading volume and activity. With the arrival of the first mini bull market, transfers surged, with daily transactions often exceeding 10K. BRC 20 trading volume disappeared in June but began to recover in November.

However, the amount of transfers indicates that BRC 20 is still a smaller market, with participants focused on minting and holding tokens. Minting transactions are approximately 10 times larger than transfer transactions. Those minting tokens seem more interested in holding them than selling them quickly.

New term: $ORDI’s dominance

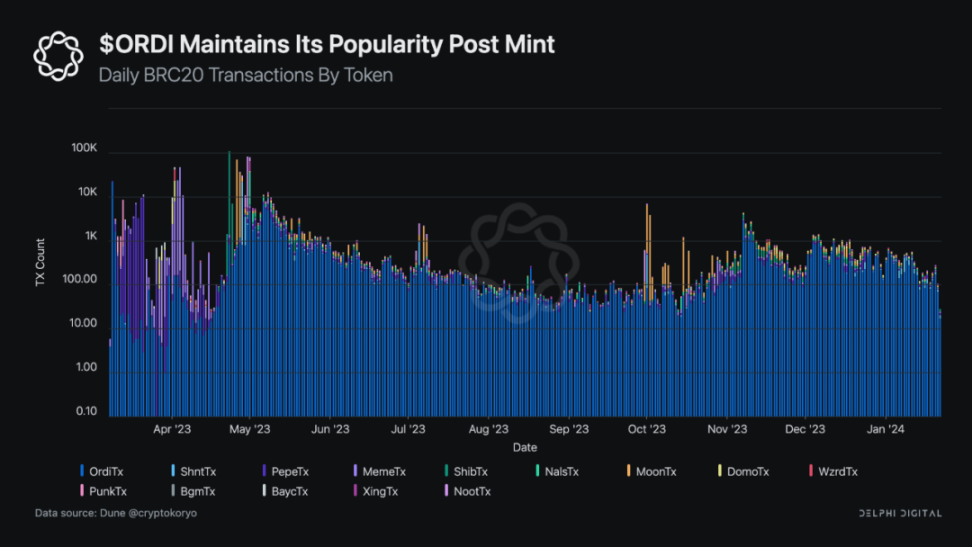

Although Bitcoin currently has thousands of tokens or even more if we include various non-BRC 20 standards, ORDI still dominates the market. Due to the specific nature of BRC 20 transactions, it is difficult to find the exact reference. With the exception of ORDI, most BRC 20 is traded through auctions on markets such as Unisat. The auction mechanism creates a strange situation where if we extrapolate its market value from a few auction sales, we might get very inaccurate numbers. Therefore, some websites claim that the BRC 20 market is an incredible $11.2 trillion, or we see tokens with market caps in the hundreds of millions with no trading volume. Thankfully, by trading ORDI on Binance and OKX we can get a more accurate market cap of ORDI, which currently stands at $1.3B. However, the market is definitely bigger than ORDI. Other popular BRC 20 are still mainly traded through auctions, such as SATS, MEME, DOMO, etc. We need to take these into consideration. Unfortunately, however, viewing them through the lens of market cap is inaccurate. So we can get an idea of $ORDIs importance to the BRC 20 market by looking at top trades, rather than market cap.

One of the trends in the BRC 20 market is that someone will release a new Token and people will rush to mint it. But once minting ends, trading collapses and no one trades it. There are 56K BRC 20 tokens with almost no trading volume after the initial minting rush. These dead tokens are not important. So when we look at transactions, we see that $ORDI is one of the few tokens that has maintained trading volume after minting. We can also look at cost as another barometer of popularity. There have been 140 K $ORDI transactions and approximately 23 BTC have been paid for this single token. The next comparable token is $MEME, where we saw 114K transactions, but the fee was only around 4.8 BTC. The difference between the two is that $MEME transfers quickly disappeared after the initial minting boom.

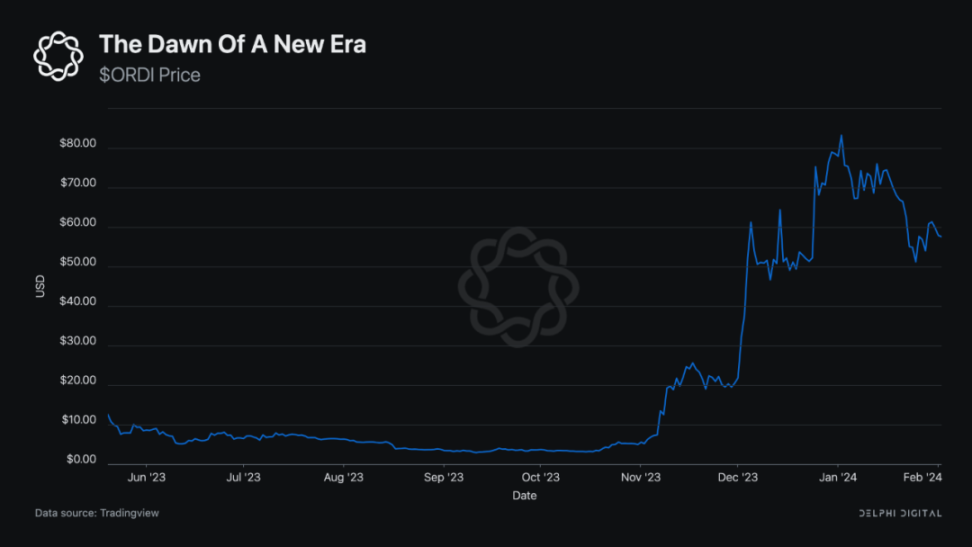

$ORDI’s popularity also means it is the first BRC 20 to be listed on CEX. CEX listing is usually a good sign for a token as it signals an endorsement, as well as better liquidity. After being listed on Binance, $ORDI started a legendary new ATH. In October, $ORDI was trading at around $4. At the time of writing, $ORDI has reached an all-time high of $82. For Token, the impressive impression seems to have no effect except meme effect and collectible value.

The performance of $ORDI is strong support for BRC 20 from the market. CEXs generally don’t care about technology, they care more about fees. With $ORDI demonstrating demand for BRC 20 trading, it seems likely that more CEXs will be listing BRC 20. Only time will tell whether the new scene will be more $ORDI listed on other CEXs, or more BRC 20 listed on exchanges like OKX and Binance. But it looks like its coming.

Ordinals market

Exchanges and markets are areas that offer some opportunities for BRC 20 and Ordinal inscriptions. BRC 20 and Inscription have proven popular and exchanges and markets can make money. The competition we see with ERC 20 trading and various DEXs and CEXs will likely happen on BRC 20, with the winner taking the spoils.

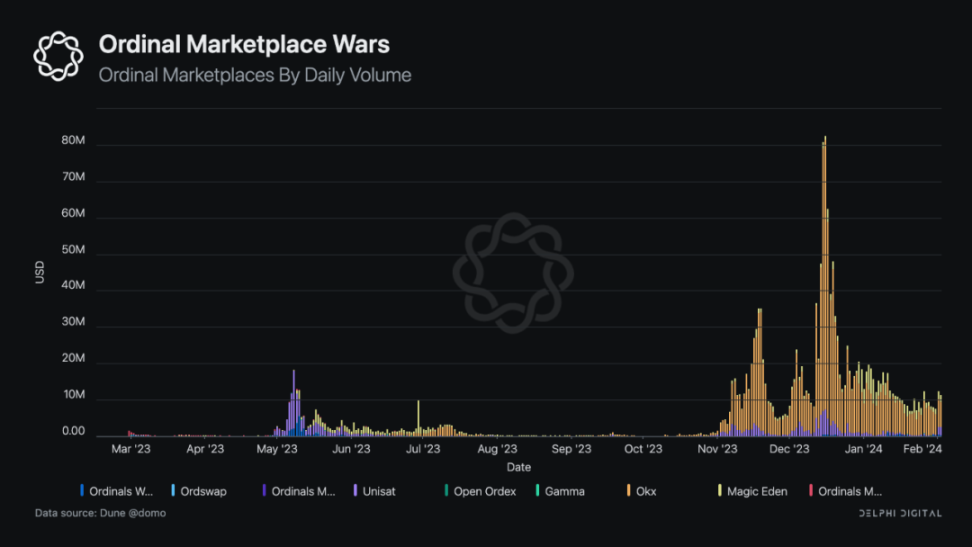

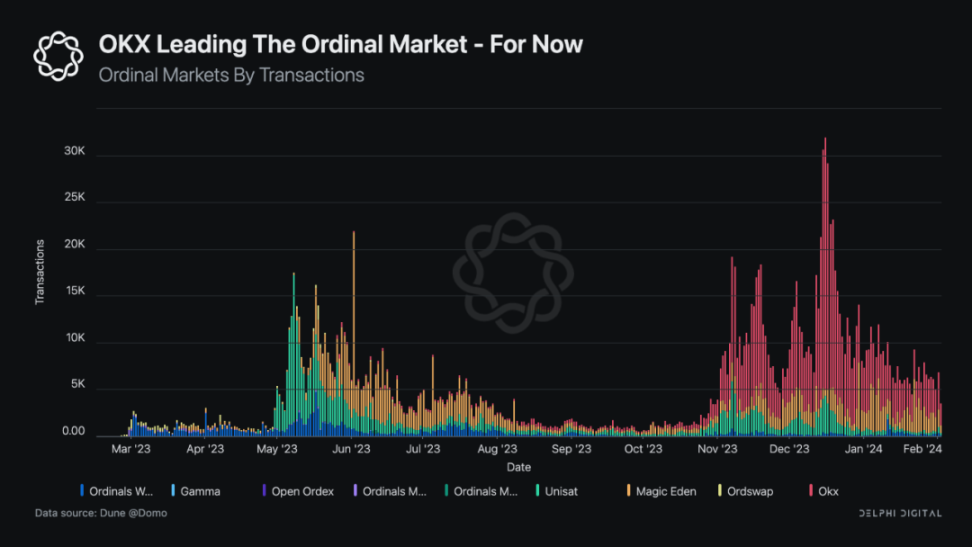

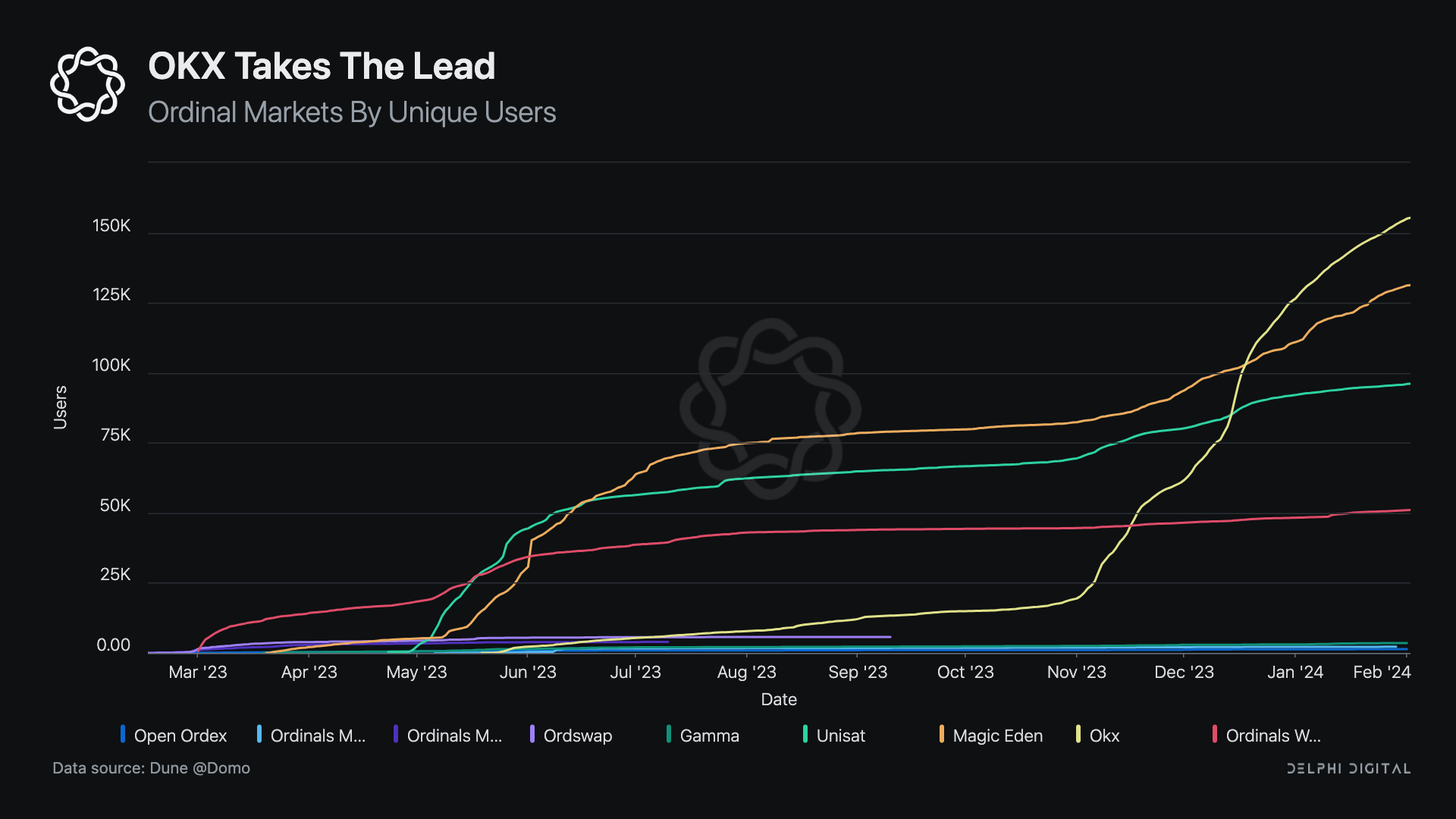

So, who is winning the Ordinal market war? Its too early to tell. Early Ordinal players used Discord OTC to exchange these items. However, some platforms such as Ordinals Wallet, Ordswap and Open Ordex are quickly filling this gap with viable platforms. New entrants such as Unisat, Magic Eden and OKX have overtaken the early market. OKX has been hugely popular in this space, but with Binance’s recent entry into the BRC 20 market, we suspect this landscape will change. OKX dominates the BRC 20 market in terms of trading volume and size so far.

One area where OKX really outperforms its competitors is in new user acquisition. OKX’s lead may change if Binance releases some data, but OKX has currently brought a large number of users to the market. What we see is an explosion of new users transacting, which then quickly levels off. Often, users flock to new exchanges, but once the novelty wears off, there is little new growth. However, OKX has always been an outlier in this regard, and they are attracting users to join the BRC 20 ecosystem by leaps and bounds. Of course, bootstrapping users through CEX is always more accessible than Magic Eden or Unisat, which require a wallet. For now, though, OKX is growing by leaps and bounds, and of course, Binance has the potential to change that.

Of course, there is room for more than one exchange in the market. In particular, the prospect of DEX still awaits the emergence of an ambitious project. So, who will build the first BRC 20 Uniswap?

cultural issues

It should be noted that BRC 20 and Ordinals are not without controversy. Bitcoin and its believers are very skeptical about new additions to the Bitcoin core protocol. They are more resistant to any action that changes the vision of Bitcoin as the world’s hardest currency and makes it impure with something new, and Ordinals and BRC 20 are no exception.

Many Bitcoin believers believe that Ordinal and BRC 20 are garbage, harmful to the chain, and deviate from the original intention of Bitcoin. However, despite their misgivings, Bitcoin is a neutral, permissionless platform, and since it is decentralized, shutting down Ordinals would be nearly impossible without spending years convincing everyone that they are bad for the chain. Given that the market for Ordinals has rapidly expanded to over $1 billion, closing Ordinals and BRC 20 seems unlikely. Additionally, miners may become strong advocates of the technology because the halving is coming and they need the new fees these new things bring to make up for lost revenue.

Regardless, we expect Ordinals to remain controversial and some Bitcoin believers to continue to hate them. However, because their incentives and markets are so strong, they are likely to continue to exist. While drafting this report, the U.S. government added Inscription to their national vulnerability database on the grounds that it was a vulnerability because Ordinals circumvented data carrier restrictions by obfuscating the data into code. Being in the database doesnt mean the market will immediately consider them, but it makes their future more uncertain.

Additionally, Ordinals sparked a more relevant cultural debate for Bitcoin that, in retrospect, may be as monumental as the block size wars from 2015 to 2017. Ordinals have reignited interest and conflict in the changes and developments of Bitcoin. The debate surrounding Ordinals involves Bitcoins core premise. For example, is Bitcoin only used for BTC transactions? Does Bitcoin’s permissionless nature mean that users can use it in any way they want? Who decides how people use it? Is it reasonable to cut some use cases and prioritize others? There are no simple answers to these questions, and anyones answers simply reflect someones values and opinions about Bitcoin, rather than the basic truth of the blockchain. Bitcoin believers are unlikely to resolve this debate anytime soon, and we expect it to continue into 2025.

DeFi and scaling

Bitcoin DeFi

To gain insight into the current state and challenges of Bitcoin DeFi, we’ll link to our December ZetaChain report. If you are interested in this specific area of Bitcoin, be sure to read this section.

Lightning Network

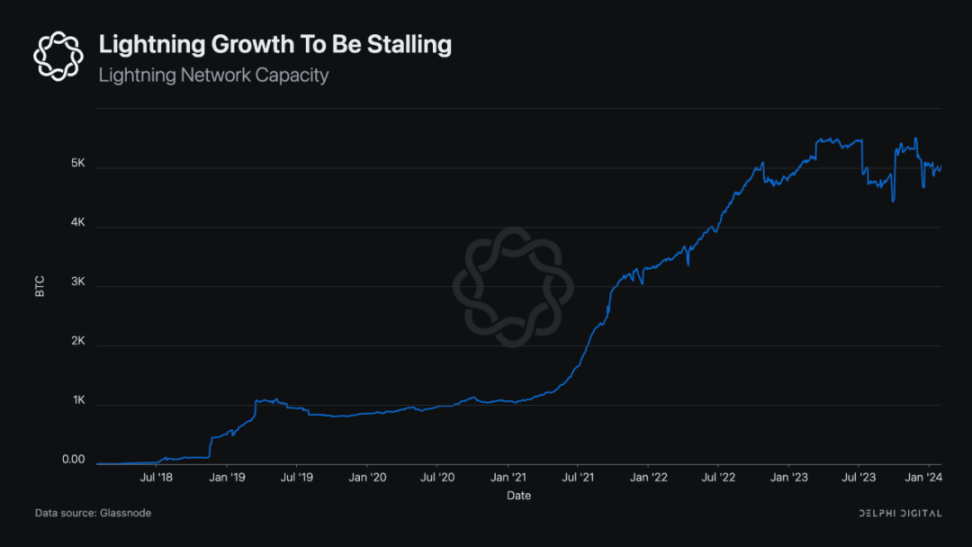

Lightning Network adoption stalled in 2023 as the narrative of Bitcoin as a neutral payments rail faded and never truly materialized. Spending sats or BTC is a bit painful due to tax laws, conversions and volatility, especially in a world with decent payment channels like Visa, Mastercard, EFT, USDT on Tron, physical cash or countless other methods. True, the Lightning Network attempted to alleviate the challenges of BTC payment usage with TARO and the Lightning Network stablecoin, but compared to other methods it never really took off. The Lightning Network has always been a good product, but it has struggled to find use cases.

As Ordinals and BRC 20 drive up fees, the Lightning Network may find its product market in basic BTC transactions rather than as a payment channel. The Lightning Network can easily handle smaller BTC transactions and could become the technology that allows BTC and Ordinal enthusiasts to coexist relatively peacefully.

As the Lightning Network may become the key for Bitcoin to maintain its normal ecosystem and low-cost transactions, we are curious about where the Lightning Network is after a year of Ordinals and how it will change by the end of 2024. To this end, 2023 is a neutral year for the Lightning Network.

The Lightning Network managed to maintain its overall size in 2023. The Lightning Network works by allowing users to create off-chain channels to transfer BTC without settling on the main chain. Once the channel is closed, the Lightning Network settles the transaction on-chain. Users must allocate a certain amount of BTC to the channel, thereby providing transmission capacity to the Lightning Network. Lightning Network capacity (the number of BTC in a channel available for transactions) has remained relatively stable in 2023, which is a good sign for the network.

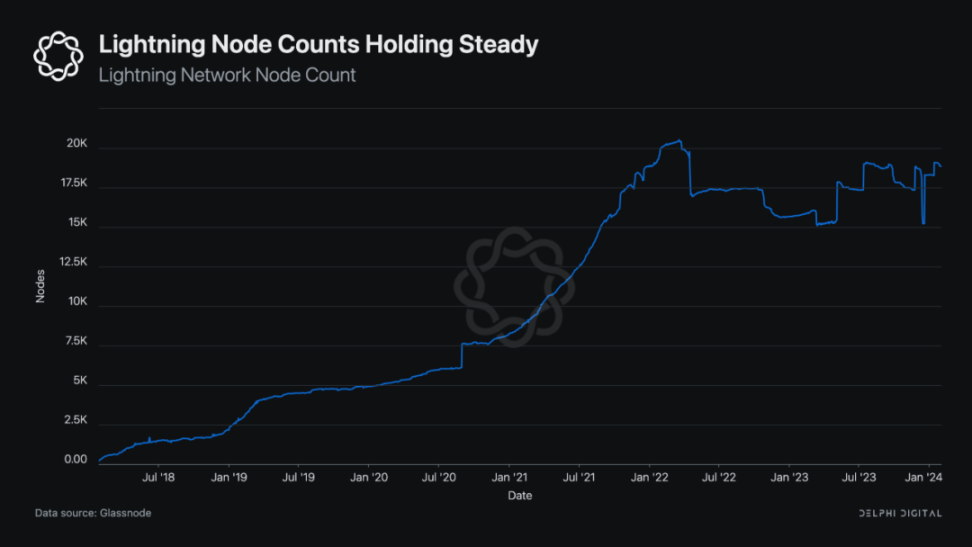

Second, the number of Lightning Network nodes running Lightning channels has begun to rebound from the lows in 2023. The more nodes there are, the more decentralized and secure the Lightning Network is. Based on these statistics, the Lightning are set to have a big year.

Bitcoin Rollup and more

Bitcoin Rollup has attracted a lot of market attention and capital influx recently. Today we saw the release of Citrea, a Chainway-incubated zk-rollup that uses BitVM. We will see more announcements and developments like this, which we will delve further into in 2024.

Secondly, the return of interest in Bitcoin expansion in 2023 has brought about the re-emergence of the Bitcoin Drivechain proposal. Basically, Drivechains will allow people to temporarily lock their BTC on the main chain and then release it to a sidechain. Like other sidechains, Drivechain can provide users with low-cost payment transactions or smart contracts. Several experimental Drivechain projects are already underway, such as Zside (which brings privacy properties to BTC transactions) and ETHside (an Ethereum sidechain clone).

Bitcoin Outlook 2024

Ordinals have shaken Bitcoin to its core. The Ordinal encryption field started from scratch at the beginning of this year. Starting from the humble act of allowing users to store any data on Bitcoin sat and burn PFP and Bitcoin artifacts on the chain, the Ordinal ecosystem has grown to a scale worth more than 1 billion US dollars. CEX and market support, popular token standards, and new technology protocols. However, not everyone is excited. Many Bitcoin believers view Ordinals and BRC 20 as loopholes and bullshit. Skeptics would rather have developers tinker with Ordinal technology and everything surrounding it. The community is still grappling with the controversy surrounding Ordinals, and we think it may continue into 2024, and possibly even into 2025.

Perhaps more important for Bitcoin is the ETF application submitted by the institution to the SEC in 2023. No less than 12 well-known companies applied to the U.S. Securities and Exchange Commission for permission to offer spot BTC ETFs to traditional markets, and were approved in the first quarter of 2024. These ETFs provide access to a large number of new capital inflows and market participants. Not bad for an asset that was once freely available and started its life on some small cryptography forum.

2023 is a big year for Bitcoin, and 2024 seems poised to continue these positive trends. We look forward to seeing where it goes.