Banks have long been embracing new technologies, introducing features such as digital banking and chip cards. Charles and Elliscope took a different approach to creating NAVI Protocol, leveraging their technical expertise and experience to focus on the banking sector.

“The company culture is centered around kindness and openness, and we believe NAVI can become a Web3 bank for Web2 users,” Elliscope said. The founders chose the name NAVI, which means friendly, to reflect the kindness and openness of the company culture.

NAVIs founders have worked at companies like Apple and LinkedIn and are deeply influenced by Silicon Valley innovation, working with top engineers from around the world to develop technology that serves millions of people around the world. In evaluating Sui as a potential platform for NAVI, they recognized how Sui was built with the same eye for innovation and scalability.

Suis founders come from similar backgrounds and have built networks from the ground up to support enterprise-scale applications. Features such as Suis object-oriented programming model go well beyond the account-based models of other blockchains, providing experienced developers with an operational approach similar to that used in the infrastructure of leading technology companies in Silicon Valley.

Design with users in mind

At its core, NAVI supports lending on Sui. The protocol allows people to deposit tokens, which will grow at a fixed interest rate. At the same time, people can also pay interest rates to borrow tokens. Borrowers often hope to use these borrowed tokens to obtain higher yields. NAVI has a unified pool of loans and collateral to maximize its capital efficiency.

We drew inspiration for the NAVI design from the traditional financial institution model of operating loan and deposit products, which has proven to be very effective historically. By combining this approach with the use of blockchain technology, Combining flexibility and innovation, we have been able to create a protocol that is both user-friendly and efficient.”

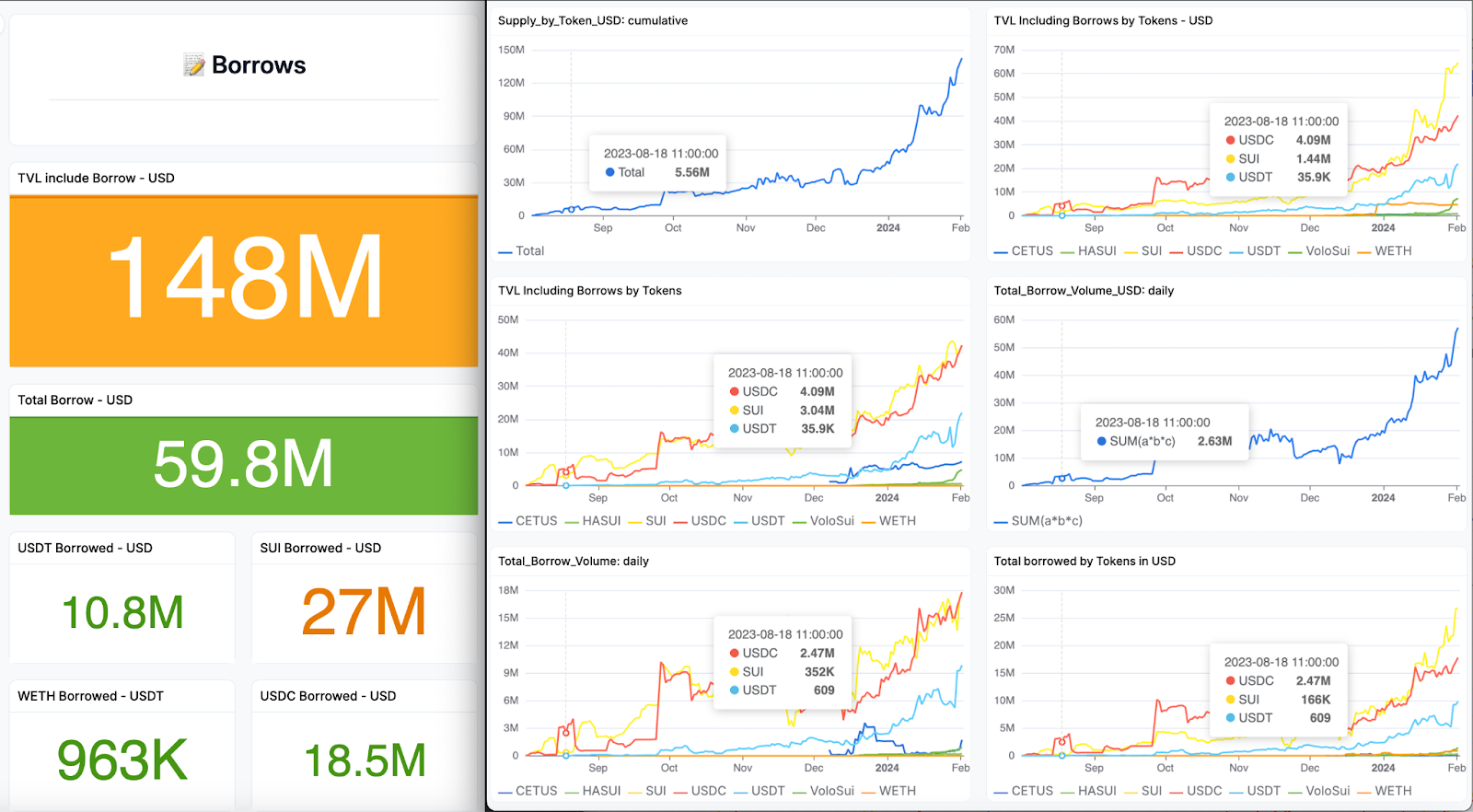

The chart shows NAVI’s DeFi growth on Sui. By various indicators, NAVI’s growth is considerable, proving its good performance in serving DeFi users on Sui.

NAVI’s performance has been outstanding and has consistently ranked at the top of DeFiLlama’s Sui protocol rankings. The total value locked is up to $150 million, with $60 million in borrowed assets.

In addition to the efficiency of the protocol, NAVIs success lies in its user interface. The data below clearly shows each user’s token supply and borrowed amount on the protocol, as well as corresponding health indicators. With Notifi, users can receive updates via their preferred communication channel if health indicators prompt the need for account adjustments. The dashboard also lists a list of tokens, including SUI, USDC, and WETH, along with their yields, while providing a simple Supply button for one-click borrowing and lending.

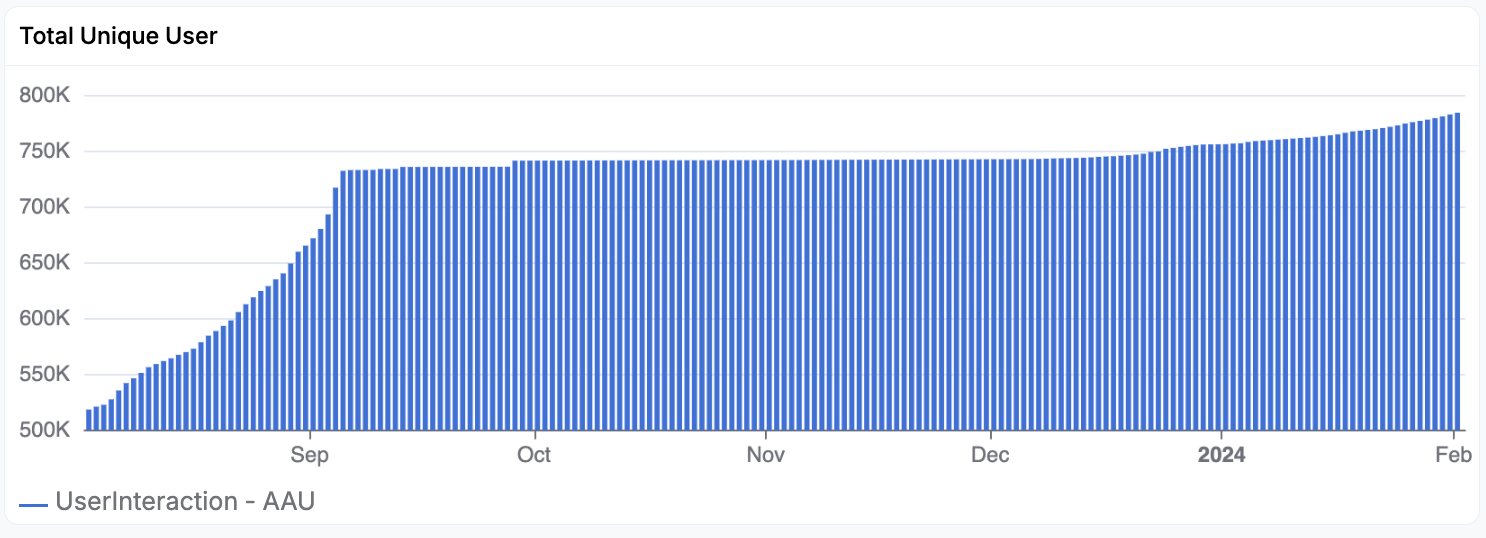

The chart shows the growth in user numbers over time, with NAVI growing its user base to nearly 800,000 in less than a year.

Other tabs in the interface allow users to view the NAVI market ranked by token supply, use the bridging and swapping features, and view the top users. This gamification feature includes categories such as NAVI’s point rating, supply amount, borrow amount, and overall activity.

says Ivan, Marketing Director at NAVI. “We have collaborated with well-known brands in the Web3 industry, such as OKX, Bitget Wallet, Zealy and Galxe, etc. to conduct various activities.”

DeFi asset security and user experience

DeFi protocols must excel in security to protect users and maintain reputation. A key factor that attracted NAVI founders to Sui was that Sui adopted an object-centric data architecture, making it more resistant to risks such as vulnerabilities than account-based blockchains.

“All assets and tokens are watched and monitored,” Charles said, “This avoids common attack patterns on EVM chains, such as re-entrancy attacks or double-spend issues.”

This design paradigm allows for greater control over how objects are interacted with and accessed, effectively mitigating a wide range of attack vectors. The granularity of control extends to specifying who can interact with objects, under what conditions, and through what methods Unlike traditional account-based systems that rely on more generic security measures, Suis object-centric approach enables developers to tailor security policies directly to the individual characteristics of each digital asset. said Haoran, core smart contract developer at NAVI.

NAVI emphasizes user experience to ensure that customer-initiated DeFi activities can be completed quickly and successfully. Users of Web2-based financial applications expect that their operations do not consume too much time. Therefore, when these users open an account with NAVI, they need to find a similarly fast and smooth experience.

Sui supports this experience through a consensus mechanism that processes transactions faster than other blockchains. When someone uses NAVI for DeFi, their transaction is finalized in less than a second and settlement is completed within seconds. And due to Sui’s scalability, these times do not increase as transaction volume increases, allowing NAVI to support transaction surges.

future outlook

DeepBook is Sui’s first native liquidity layer and plays an important role in NAVI’s future plans. NAVI integrates with DeepBook for liquidation, ensuring it can withstand changes in the market. The liquidity support provided by DeepBook enables NAVI to find new options for users, including trading and flash loans.

With their experience at leading technology companies, coupled with their passion for Web3 and decentralization, NAVI’s founders are well-positioned to take advantage of Sui’s architecture and capabilities. NAVIs success has shown that they are on the right track.