Just one week since BounceBit launched Early Access, the network’s total value locked (TVL) has exceeded $100 million, with more than $70 million in Bitcoin pledged. This marks BounceBit’s first Bitcoin staking chain and major A major milestone for the Bitcoin liquidity market.

This achievement is due to BounceBit’s strategic innovation on three key levels: First, it introduced a dual-token PoS mechanism that supports Bitcoin staking; Second, it integrated CeFi and DeFi to unlock diverse benefits through a unique on-chain mirroring mechanism Generate opportunities; the third is to cultivate a strong BounceBit ecosystem with the support of leading BTC ecological projects.

The first BTC pledge chain to support dual-token PoS mechanism

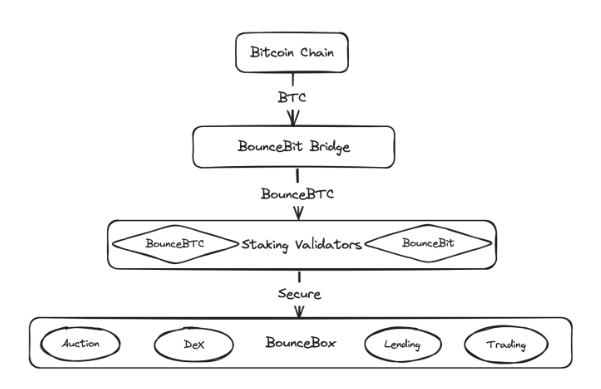

What makes BounceBit unique is that it is the first BTC staking chain to implement a dual-token Proof of Stake (PoS) mechanism. This approach not only leverages Bitcoin’s inherent security by integrating it into BounceBit’s security framework, but also introduces an innovative way to build DeFi solutions with Bitcoin liquidity at its core. BounceBit is fully compatible with EVM and can be seamlessly integrated with a large number of Dapps and smart contracts, which also enhances its practicality and versatility in the broader blockchain ecosystem.

While traditional Bitcoin ecological development work mainly focuses on building Bitcoin Layer 2 solutions, BounceBit provides another alternative to the market by adopting a Layer 1 model that supports a dual-token PoS mechanism and is driven by assets. A unique choice. BounceBits model helps achieve a more inclusive and dynamic network governance structure, allowing token holders to directly participate in the networks security and decision-making process by staking Bitcoin and BounceBit tokens. BounceBit will initially introduce diversified verification nodes, with half allocated to Bitcoin staking nodes and the other half allocated to BounceBit token nodes.

BTC is crucial to strengthening the security framework of the BounceBit network, and its bridging function is an important hub for bridging BTC between the Bitcoin network and EVM chains (such as BNB chain and Ethereum). Once bridged to BounceBit, BTC will be uniformly mapped to BounceBTC. The current market usually relies on multi-signature contracts managed by centralized team addresses for bridging operations. This solution has obvious security disadvantages; in contrast, BounceBit delegates the key role of bridging security to its verification nodes, making the bridging process The security is consistent with the security of the entire network. Similar to Restakings shared security concept, BounceBits verification nodes will assume additional responsibilities by managing bridge nodes and maintaining the verification of cross-chain messages. At the contract level, if a cross-chain transaction wants to be approved, it needs to obtain the consensus of more than 50% of the verification nodes to ensure the decentralization and security of the verification process.

CeFi+DeFi works together to find income opportunities for idle BTC

At 02:01 UTC on January 29, 2024, BounceBit launched The Water Margin event, opening early deposits of BTCB, WBTC, AUCTION, MUBI, DAII, USDT and FDUSD to users. Since then, BounceBit’s Total Value Locked (TVL) has experienced rapid growth, reaching $10 million in just 10 minutes after launch, with an average daily increase of approximately $11.5 million.

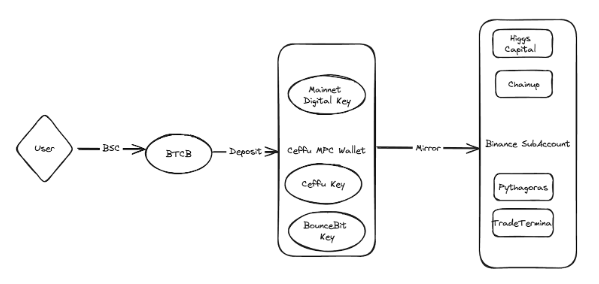

To manage the rapidly expanding TVL and solve the challenge of finding yield for idle BTC, BounceBit has integrated a transparent CeFi infrastructure with support from Mainnet Digital and Ceffu. By ensuring the security of users pledged assets through Mainnet Digitals regulated custody solution, while leveraging the on-chain traceability provided by Ceffus MirrorX, BounceBit allows users to place assets on-chain as well as on centralized exchanges ( CEX), the transaction results will be settled on the chain based on T+1.

This transparent CeFi integration is designed to avoid compliance issues while unlocking revenue-generating opportunities for BTC holders. From a user perspective, the process of generating BTC earnings on BounceBit is very simple:

First, users need to log in to their Binance account and withdraw BTC to the BNB Chain wallet address and receive BTCB on the chain.

Next, check out BounceBit’s The Water Margin event page (https://bouncebit.io/points-paradise) Deposit BTCB for early access to staking opportunities on BounceBit.

Once deposited, the BounceBit contract moves the funds to secure, regulated custody powered by Mainnet Digital and Ceffu. In exchange, users will receive LSD tokens and can choose to participate in various funding rate arbitrage strategies for BTCB on BounceBit.

Later, users will be able to transfer their LSD tokens to the BounceBit chain and convert them into BounceBTC, which will have multiple functions within the ecosystem.

Finally, BounceBTC enables users to generate revenue by participating in PoS staking on BounceBit or participating in various DeFi activities within the BounceBit ecosystem.

BounceBit has now introduced a delta neutral funding rate arbitrage strategy. This feature is only whitelist accessible and is available to users who have staked at least 1 BTCB on BounceBit. Within the first day of the feature’s launch, over 80 BTC were pledged and used for funding rate arbitrage, which is currently generating significant returns. For details on how to access this feature, check out the official guide and follow @bounce_bit on X, which is Twitter.

In addition to generating revenue through CeFi integration, BounceBit will also provide rewards for node operations that perform BTC staking. At the same time, users can also generate revenue by participating in on-chain DeFi activities in the BounceBit ecosystem and Bounce Launchpad.

BounceBits CeFi+DeFi infrastructure organically combines CeFis trustworthy transparency with dynamic DeFi activities in the on-chain ecosystem, providing users with a diverse portfolio of revenue opportunities.

Receive support from leading ecological projects and work together to build the BounceBit ecosystem

BounceBit is powered by Bounce Brand, a well-known decentralized platform built on the Bitcoin ecosystem. Bounce Brand is highly regarded for its decentralized on-chain auction protocol and premium Web3 Launchpad.

Well-known Bitcoin ecological projects such as MultiBit and BitStable are supported by Bounce Launchpad and will be an indispensable partner of the BounceBit ecosystem from the beginning. With the support of multiple leading Bitcoin ecological projects, the BounceBit ecosystem is expected to significantly improve Bitcoins smart contract capabilities and create a vibrant, revenue-focused environment.

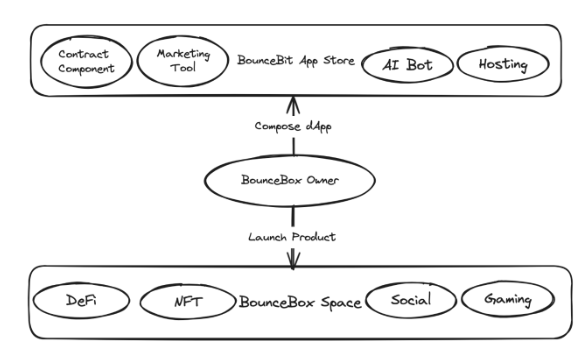

BounceBit will introduce an application store designed to simplify the creation and deployment of Dapps by providing necessary Web3 components such as DEX, IDO, and trading markets. The BounceBit app store was developed in cooperation with a third-party team and a well-known auditing agency. Its purpose is to simplify the asset issuance process while ensuring security and allow more users without programming skills to use the platform normally.

Users who publish products on BounceBit need to first obtain a BounceBox, which is an on-chain space that allows users to easily integrate and configure various components from the BounceBit app store, such as auction strategy development and bot defense, etc., thus simplifying the previous Complex processes. All of this will be done in a safe environment.

In addition, BounceBits app store services will also expand beyond DeFi to cover social, metaverse and other applications, allowing some users with greater influence in the community to interact more deeply with the community through private channels within their BounceBox . Leveraging BounceBits extensive experience in Web3 product development, BounceBit is committed to providing a comprehensive and secure environment for the deployment and management of decentralized applications and making greater contributions to the Bitcoin ecosystem.

About BounceBit

BounceBit is the first native Bitcoin staking chain. The BounceBit network is secured through staking of BTC tokens and BounceBit tokens. BounceBits PoS mechanism introduces a unique dual-token staking system by leveraging the security of native BTC with full EVM (Ethereum Virtual Machine) compatibility. By combining CeFi + DeFi, BounceBit allows BTC holders to obtain multiple benefits through native pledge verification, DeFi interaction, and the CeFi mirroring mechanism supported by Ceffu and Mainnet Digital.