NAVI is a one-stop liquidity protocol native to Sui. It enables users to participate in the Sui ecosystem as a liquidity provider or borrower. Liquidity providers provide assets to the market and earn passive income through yields, while borrowers have the flexibility to obtain loans across different assets. Navi focuses on providing necessary DeFi infrastructure and aims to become a key player in the rapidly growing DeFi world within the Sui ecosystem.

On the afternoon of February 4th, NAVI founder Charles was a guest on the Odaily super chat community and opened an AMA with the theme SUI Ecosystem Explodes, TVL Jumps to No. 1 NAVI Opens IDO.

Charles said: On the basis of asset security, NAVI will expand new long-tail assets to enrich the Sui ecosystem. IDO is just a starting point for us. NAVI will bring our NAVX tokens and a new economic model to the Sui will continue to work hard and give all the supporting partners a satisfactory answer.

The following is a transcript of the QA:

Odaily: NAVI has experienced explosive growth in TVL since November last year. Can you tell us about any features of its lending design?

Charles: Since November last year, the TVL of the NAVI protocol has indeed experienced rapid growth. NAVI is a protocol with particularly high capital utilization efficiency. Our current TVL is US$160 million, and US$60 million of assets have been lent. Mainly due to its unique lending design. A distinguishing feature of the NAVI protocol is its highly modular architecture, which is built on the Move language and provides a combination of flexibility and security. This design allows the NAVI protocol to easily integrate new features and assets while ensuring the protocol is robust and scalable.

Odaily: The features of NAVI’s lending module include supporting some long-tail assets, including CETUS, vSUI, etc. Are there any plans to expand the list of long-tail assets to a certain extent?

Charles:NAVI does support a range of long-tail assets such as CETUS, vSUI, haSui, which reflects our emphasis on market diversity and user needs. Suis ecology is still gradually maturing. As the leading DeFi project, we will also be particularly careful in choosing the assets to support. We perform very strict screening for each supported asset.

First of all, the size and market value of this asset need to reach a certain scale, and the currency price needs to be relatively stable. Because as collateral, excessive currency price fluctuations will lead to liquidation.

Secondly, the security of assets is also important. We will conduct careful back-checking of the project to check the security and control rights of the contract.

Regarding the plan to expand the long-tail asset list, we are actively exploring methods including but not limited to community voting to ensure that the newly added assets can not only increase the richness of our ecology, but also comply with our risk management standards. With the launch of our NAVX token, the community can participate more closely in the governance process of NAVI.

Odaily: Currently, long-tail assets do not include Boosted rewards. Will additional rewards be provided to some assets in the future as a support for other protocols?

Charles: Sui is particularly supportive of ecological DeFi projects. From August to now, NAVI has issued liquidity incentives worth more than $3 million to depositors on the protocol. At present, we still mainly incentivize blue-chip assets, but we have also begun to try to incentivize long-tail assets such as vSui. With the launch of our NAVX token, we will also use our own tokens to conduct a series of incentives. We are currently also in close contact with the Sui Foundation to see if we can incentivize these new assets in an official form.

Odaily: Can the design utility of the NAVI token be disclosed, such as lending APY Boost, protocol revenue sharing, etc.?

Charles:The functions of NAVX tokens are mainly divided into the following aspects:

community governance;

We have innovated our own DLP model based on learning from Radiant Capital. Users can then provide NAVX/Sui and NAVX/vSui liquidity on DEX, and then participate in the Boosted APY and protocol sharing activities.

Odaily: The circulation of SUI in 2024 will increase by 200% of the circulation at the beginning of the year. Is it expected that the Sui ecosystem will flourish, so users will choose to pledge SUI in large quantities?

Charles: The circulation of SUI will increase significantly after it is unlocked in 2024. I actually think this is good news. When circulation increases, token holdings will be more dispersed and currency prices will be more stable. Therefore, based on this background, we believe that LSD (Liquidity Staking Derivatives) will become a key development direction in the ecosystem. NAVI acquired the Volo LST project last month. Volo is the largest LST project on Sui, with a TVL of 16 million US dollars and more than 10,000 users.

By acquiring Volo, NAVI plans to play a key role in this trend, providing more flexible and efficient staking solutions. This will not only provide more staking options for SUI holders, but also promote the development of the entire Sui ecosystem by increasing liquidity and participation.

Odaily: A large number of unlocked SUIs are expected to be pledged, and the LSD protocol is also the focus of various ecological developments now. What strategy does NAVI plan to implement in this major event through the acquisition of Volo?

Charles:Everyone has also seen the rise of LSD in the EVM ecosystem, and more narratives and hot spots are surrounding LST LRT, such as EigenLayer and Puffer. We believe that Sui, as the L1 with the second largest TVL among all non-EVM chains, will also bring its security to other platforms through restaking. This is also a major reason for our acquisition of Volo.

Odaily: Last question: Can you introduce NAVI’s recent IDO detailed plans?

Charles:Thank you everyone for your enthusiastic support for our IDO. The oversold was completed in 10 seconds. IDO is just a starting point for us. NAVI will continue to work hard on Sui with our NAVX tokens and a new economic model, giving all supporting partners a satisfactory answer. For specific IDO and subsequent token plans, please follow us on Twitter.

Community free QA

Question 1: What are the advantages of NAVI’s lending compared to Scallop?

Charles:The biggest difference between NAVI and Scallop is fund utilization. Navi has a loan volume of $60 million, while Scallop only has a borrowing volume of about $15 million.

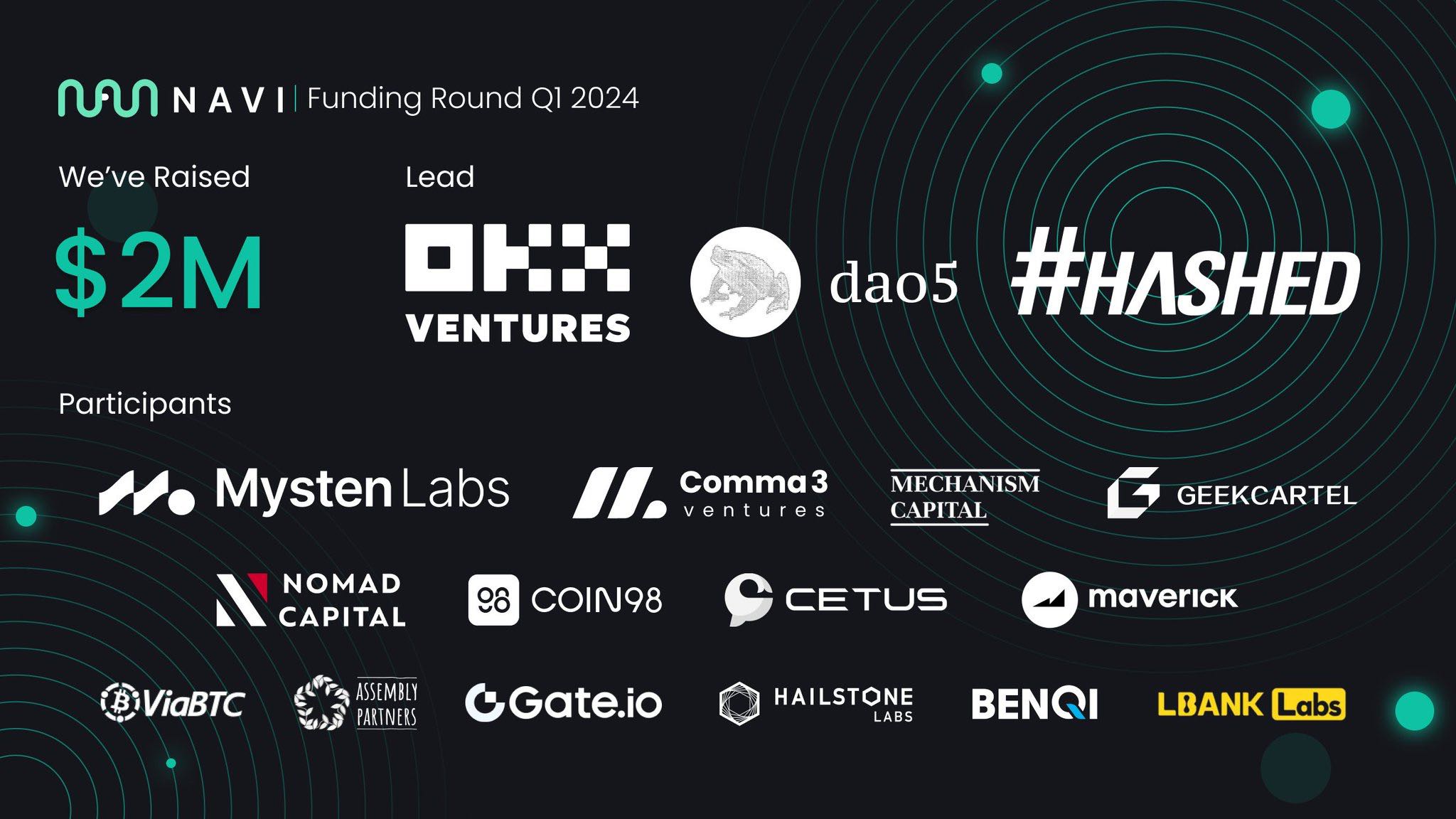

Question 2: I understand that NAVI is an activity of Sui in OKX. At the same time, NAVIs IDO information has also been forwarded by Sui officials. It can be seen that NAVIs strength is recognized by many large institutions. Could you please introduce Navis team and investors? Next, this is also an important basis for our small business to select projects.

Charles: Investment institutions can refer to the figure below:

Question 3: Are the haSUI and vSUI supported on Navi a locked SUI?

Charles: It is the SUI of liquidity staking.

Question 4: What is the relationship between NAVI and Cetus? Why do IDO on Cetus?

Charles: Cetus is the leading DEX on Sui and is also a good partner of ours. We are very happy to be able to conduct IDO on Cetus.