1. Risk: Logical and profit problems of safe sharing

In essence, the Eigenlayer project is the matryoshka doll project of the Ethereum ecosystem. Assuming that according to this safe sharing logic, infinite matryoshka dolls can be theoretically created, and it has a highly similar structure to the root cause of the 2008 subprime mortgage crisis. This is also an important reason why Buterin is worried about the risk of re-pledge. In other words, the re-pledge protocol relies on the underlying consensus of Ethereum in the event of major losses. This impact will be transmitted to the layer 1 network, thus triggering a normative conflict in the layer 1 network itself. , which is the so-called consensus overload problem. In the words of the financial world, excessive leverage on the consensus itself may lead to the collapse of the consensus itself.

The matryoshka properties of Eigenlayer cannot be denied, but on the basis of limited matryoshka dolls, this is indeed not only a way to improve the efficiency of asset operation on Ethereum, but also moderately extends the security consensus on the Ethereum main chain, which is indeed very It is conducive to the prosperity of the Ethereum ecosystem itself. As far as the nature of the project is concerned, it provides SaaS services, although some people call it RaaS. If we look forward to the future of the encryption world, one obvious trend is that public chain competition has entered the Spring and Autumn Period and the Warring States Period. Multiple chains are shining, Daaps are emerging one after another, and the few high-level security consensuses in the encryption world have become popular. This is the stage for projects like Eigenlayer. From this perspective, its positive significance outweighs the potential dangers.

From a risk perspective, the biggest potential risk of the Eigenlayer project is the logical difficulty of the concept of safe sharing itself. Those who have the ability to ensure security do not need to share, but those who need to share are extremely unsafe and are likely to be hit by thunderstorms. Therefore, from a business model perspective, Eigenlayer still has a long way to go, especially for re-stakers. Without high returns or airdrops, it is basically impossible to engage in re-staking. Will it be able to make stable profits in the future? There is a question mark, but at least in the short term, with the support of top investment institutions and concepts, there is no problem with market value expectations. In the long run, Eigenlayers model is likely to work, especially in a world where modularity is becoming increasingly popular. This fast, convenient, and low-cost deployment method is a very imaginative narrative.

2. How to play: List of potential projects

(1) Re-pledge project

●Eigenlayer pledge:

Official website:https://app.eigenlayer.xyz/

Specific methods: There are currently 9 types of LRT provided, among which LIDOs stETH and Swells swETH have larger TVLs, and exiting requires a 7-day wait. In addition, native staking is also provided. As mentioned above, this is aimed at large users with Ethereum verification nodes and is not suitable for ordinary players.

Income: In addition to re-staking income, you can also earn points. The number of points may be the basis for subsequent airdrops. Points calculation not only depends on the amount of pledge, but also on time. The example given on the official website is: a user who pledges 1 stETH for 10 days can get 240 points. The calculation formula is: 1 ETH××10 days×24 hours/day.

●swell network pledge:

Official website:https://app.swellnetwork.io

How to play the project: One is swETH Liquid Staking. You can pledge ETH on the official website to get swETH, and then go to eigenlayer for re-staking. One is rswETH Liquid Restaking, that is, you can get rswETH by staking ETH on Swell, and you can directly complete the re-staking.

Income: Staking income, Eigenlayer points, SWELL points/tokens

●Kelp DAO

Official website:https://kelpdao.xyz/restake/

How to play: The Restaking project made by Stader Lab, the main mode is Liquid-LSD Restaking, that is, you can deposit stETH in lido to get rsETH, which cannot be redeemed yet.

Income: pledge income + eigenlayer points + kelp points

●Puffer finance

Official website:https://puffer.fi

Project progress: Binance Labs (announced on January 30), Brevan Howard Digital, Jump Crypto and Lightspeed Faction, and investment from the founders of Eigenlayer. The project owner is Jason Vranek, a former chainlink engineer with a strong technical background. In addition, OGs such as Mr. Block and Shenyu participated in the seed round. Very worthy of attention.

Project model: Judging from the current news, it is mainly based on native staking. It is expected to launch a dual-token model. The details have not been disclosed.

●Renzo

Official website:https://app.renzoprotocol.com/restake

How to play: Currently TV L1 is 60 M, pledge ETH to get ezETH, which cannot be redeemed yet. 24 years of rapid TVL growth.

Income: Staking income + eigenlayer points + Renzo points (points based on holding hours)

●etherfi

Official website:https://app.ether.fi/

How to play: The current TVL is 532.7 M. You can pledge ETH to get eETH, which can be redeemed in 14 days.

Income: Staking income + eigenlayer points + ether points (pledged ETH* 1000* number of pledge days)

● eigenpie

https://www.eigenlayer.magpiexyz.io/restake

This project will be described in detail in another article

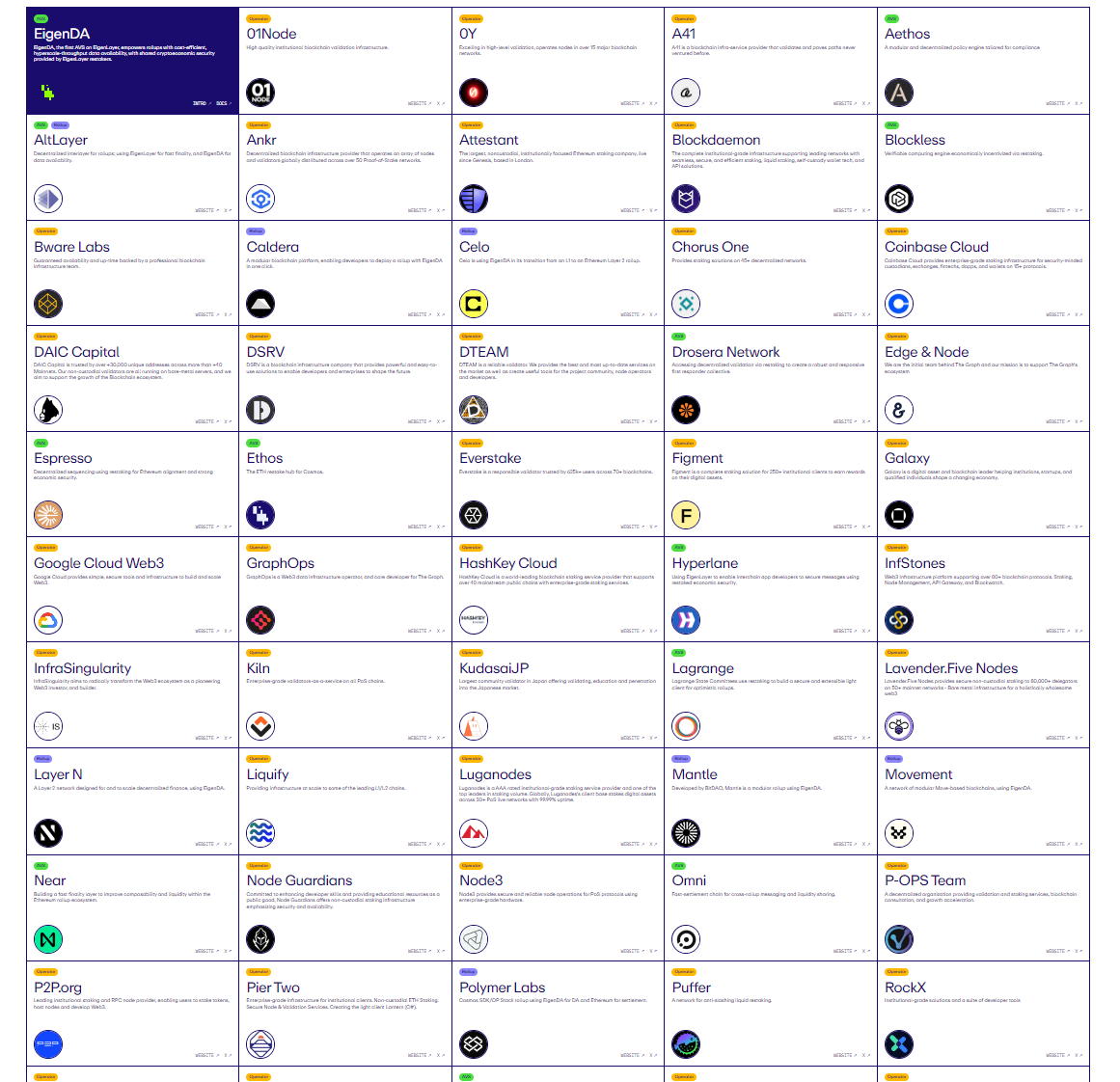

(2) Ecological projects: Altlayer and other ecological potential projects

In the current Eigenlayer ecosystem, the recent ALTlayer (AVS and roll-up service) has been stealing the show, and the rise in currency prices has quickly ignited other projects in the Eigenlayer ecosystem.

In the Eigenlayer ecosystem, the main categories are divided into three categories: AVS, Roll-up and Operator.

Introduction to key projects

●EigenDA: Data Availability Layer (DA)

Main introduction: The first official AVS service launched by eigenlayer, Restakers can entrust their rights and interests to node operators that perform verification tasks for EigenDA in exchange for service payments, and Rollups can also publish data to EigenDA.

Other ecologically similar projects: AltLayer, Celo, Mantle, Movement, Caldera, Layer N, Polymer Labs

●Witness Chain: Witness chain

Main introduction: middleware, witness chain uses eigenlayer to build a decentralized monitoring network, providing provable monitoring of AVS services for OP rollup.

●Lagrange: cross-chain bridge

Main introduction: Cross-chain infrastructure, mainly used for cross-chain state verification, verifying and confirming the proposal block state transition of optimistic rollup, and generating zero-knowledge state proof. Currently it is compatible with EVM, and will be further compatible with non-EVM chains in the future, such as Solana, sui, etc.

●Espresso: decentralized sorter

Main progress: Seed round of 32 million US dollars, the project is mainly to build a privacy public chain; the project team was deeply involved in infringement and ethics scandals in the early stage. Later, it was converted into a decentralized sequencer, mainly to provide a modular Sequencer shared component for Rollups, which can quickly implement one-click chain issuing.

●Omni: L1 blockchain,https://omni.network/

Major progress: It has received 18 M in financing, with investments from coinbase, jumpcapital, Polygon, Pantera Capital, etc. You can currently earn points through its test network on the Omni Overdrive Launch Supporter in the Galxe platform.

●layerN: Modular L2, https://www.layern.com/

Major progress: In September 2023, it received US$5 million in investment jointly led by Founders Fund and dao 5, and has received 3 rounds of financing so far. The public testnet was launched in February and is available for experience.

●Polyhedra Network ZKP track, cross-chain bridge

Major progress: A total of 25 million US dollars in financing, including Binance Labs, Polychain Capital, ABCDE Labs, OKX and other well-known institutions. It is currently possible to passchainlist.orgParticipate in early test coins or participate in