Written by:@ChingChaLong 02

tutor:@Zou_Blockand@Erjiueth

Telegram Track Analysis Report (Part 1), we conduct and summarize an overview of the entire Telegram Bot track. This chapter will delve into the project to understand the current development status of Telegram trading robots and predict its future trends. In view of Banana Guns leading position on the track (total transaction volume), we hope to verify the actual market value and currency price of the Banana Gun project through a valuation model.

At the same time, given the recent activity of the Solana ecosystem, we will also explore BonkBot as a rising project that has attracted a large number of traders to participate in the meme coin trading boom on the Solana platform. As well as some future prospects for the entire Solana Telegram trading robot track at a macro level. In addition, in view of the recent craze for Bitcoin inscriptions, a Telegram robot specializing in trading BRC-20 has emerged. This article also hopes to understand its model and development.

1. Unibot

Since the launch of Unibot, the token price has risen from a low of $3.13 in May to a high of $200.45 in August. This is an almost 100-fold increase. In just two months after its release, it has earned more than $6 million in revenue. . This remarkable financial performance and rapid increase in the token value greatly increased interest in the Telegram bot space, triggering a widespread hype frenzy surrounding Telegram bots.

Users can easily issue on-chain token transaction instructions through conversational interaction with Unibot to complete various trading activities on Uniswap. This includes features such as token swaps, copy trading, limit orders, and private trading. In addition, Unibot also provides real-time Ethereum new token alert services, allowing users to conveniently add new tokens and quickly conduct sniper transactions.

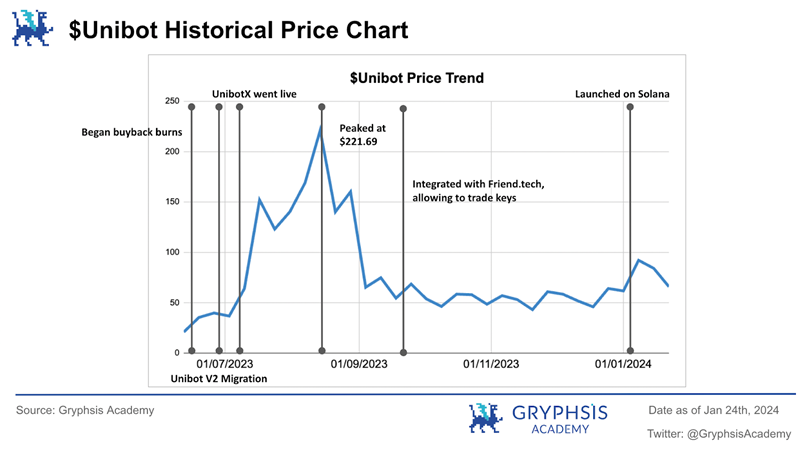

1.1 Historical event K-line chart

The Unibot project launched a token buyback program in its early stages to maintain the stability of market liquidity. However, during the Unibot V2 migration in July, the project removed the token burning function because it was found that this measure hindered the growth of liquidity. As a new strategy, the project team reissued the burned tokens, paired them with Unibot/Eth, and added them to Uniswap V2 to enhance the depth of liquidity.

At the end of the same month, Unibot launched UnibotX, which uses an order book to support trading and provide broader trading liquidity for a variety of tokens not listed on major exchanges.

Although it encountered the bear market of Telegram Bot in the later period and the token price plummeted, the project took advantage of the Friend.tech craze in September and successfully launched its keys trading function.

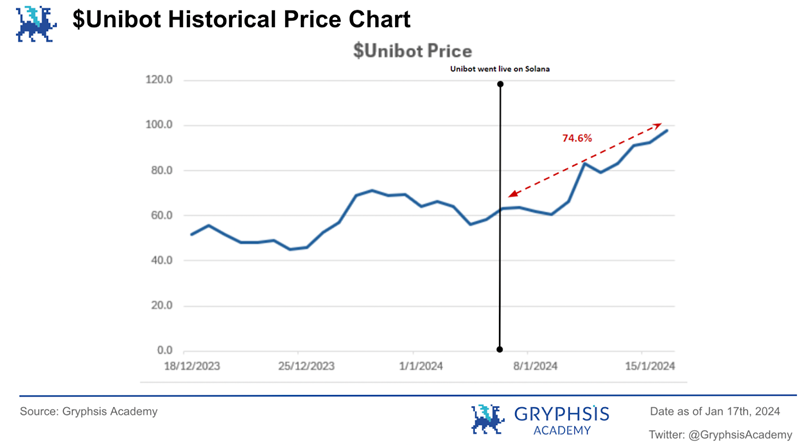

By January 2024, Unibot followed the craze of Solana meme currency and successfully expanded to the Solana platform, capturing a large amount of transaction volume.

1.2 Economic model

On May 17, 2023, the project achieved a fair launch of the token. A total of 1 million tokens were issued, and all of these tokens became fully circulated from the date of issuance.

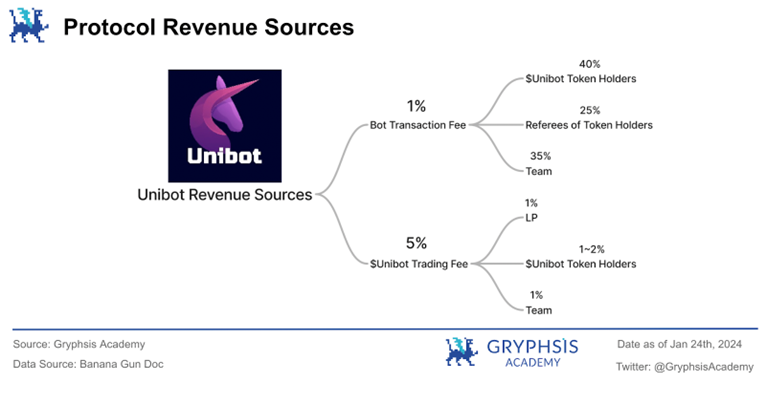

Currently, there are two main ways for Unibot to obtain income, namely the robot transaction fee (Bot Fee) and the transaction tax on the native token UNIBOT.

In the former, Unibot charges a 1% handling fee for each transaction, 40% of which is allocated to token holders; in the latter, all UNIBOT token transactions are subject to a 5% tax, and 1% of the transaction volume is allocated to token holders. There is someone, and the token holding balance needs to be greater than 50 UNIBOT to be eligible for income sharing rewards.

1.3 Future Outlook

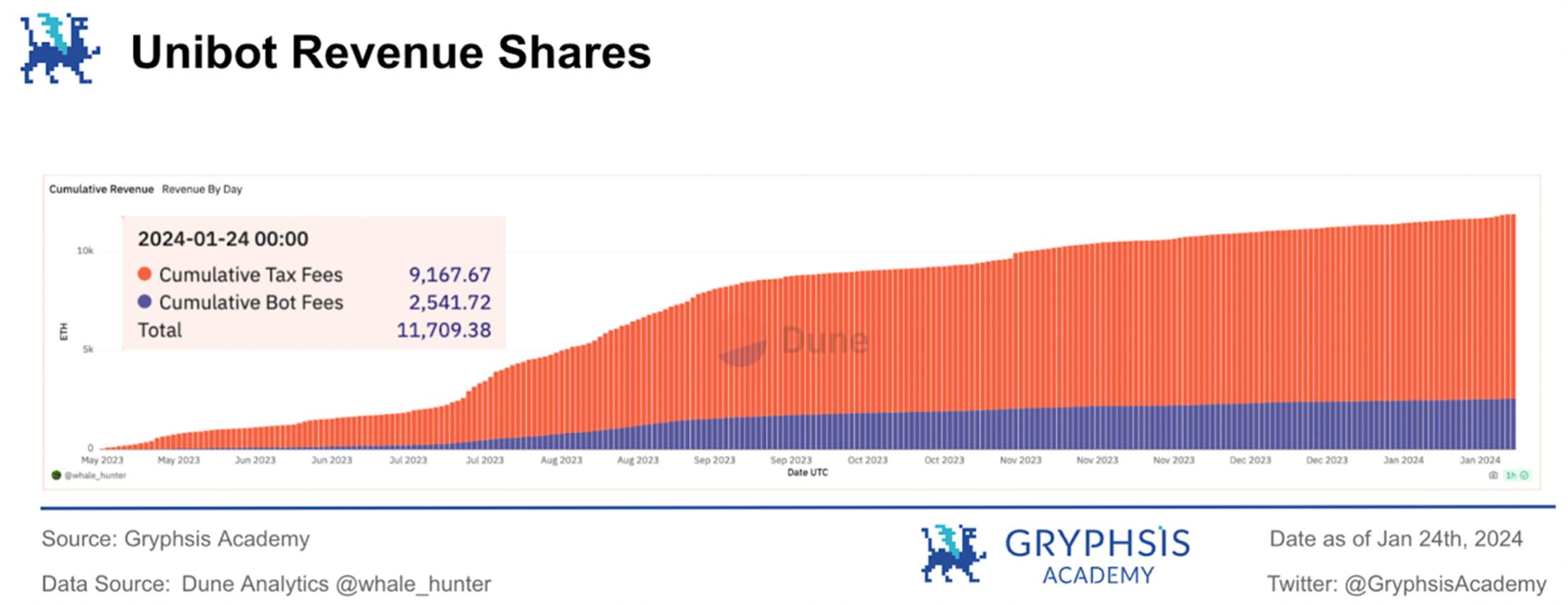

(1) Over-reliance on token transaction taxes

From current data analysis, it can be seen that approximately 80% of Unibots revenue comes from token transaction taxes. The project design requires that users pay a 5% transaction tax every time they trade $UNIBOT. Therefore, during the buying and selling process, the cumulative transaction tax borne by the user reaches 10%, becoming the main source of income for the project. However, this also hints at a potential problem: the fees a project charges through bot services may not be enough to maintain its basic income.

Taking Banana Gun as an example, the project has achieved stable revenue generated through robot services and surpassed transaction taxes, thus moving to a 0% token tax model. In the long run, the challenge for Unibot is how to capture more value through robot fees, which is, after all, the core business of the project. Over-reliance on token transaction taxes as a source of revenue is not conducive to the long-term sustainable development of the project.

(2)Unibot on Solana

Unibot also recently announced the launch of a similar Telegram Bot on the Solana platform. Making good use of its advantages as an established project, the project has the following outstanding functions:

Built-in cross-chain bridge for ETH and SOL: Basically merging the original Unibot on Ethereum with the one on Solana, becoming the first Bot project to support dual chains at the same time.

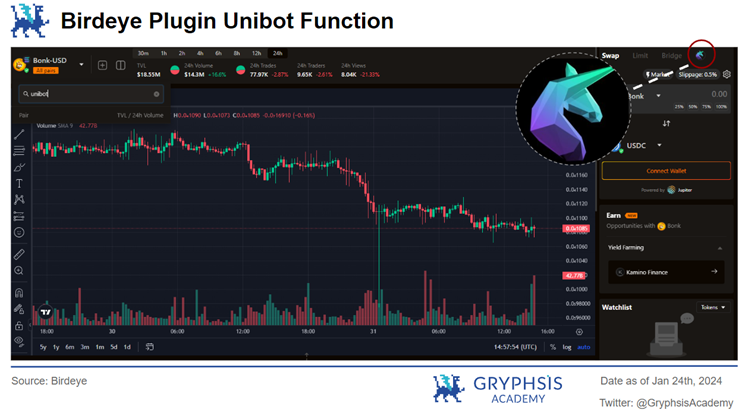

Cooperating with the transaction data aggregator platform Birdeye: It can seamlessly support all project transactions displayed on Birdeye. I personally think it is the ultimate function to improve user experience, and it is also an important turning point for UniBots future success in the Solana market.

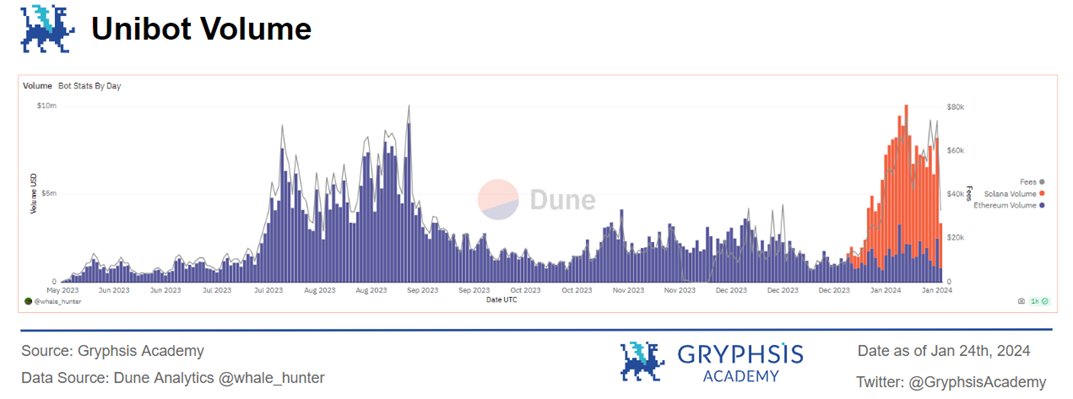

1.4 Protocol performance

The transaction volume launched on Solana has significantly outperformed Ethereum within a week, even three times higher, which is a development worth looking forward to in the long term.

The transaction volume launched on Solana has significantly outperformed Ethereum within a week, even three times higher, which is a development worth looking forward to in the long term.

2. Banana Gun

Banana Gun is one of the popular Telegram trading robots on the market. It offers two main services: trading and sniping. Through the trading function, users can securely purchase tokens that are already listed on the Ethereum blockchain. The sniping feature allows users to be the first to buy new tokens when they are released. Banana Gun went from supporting only Ethereum to recently expanding to Solana. The following are some detailed functional explanations:

First Bundle or Fail (FoF):

Aiming for the first purchase at the start of the transaction (block 0), at least 10 wallets are required to participate for it to be valid. Not available for MEV or Deadblock releases.

FoF backup:

If the FoF function is not triggered when MEV or Deadblock is released, the backup function will be purchased on the next available block and use the backup miner tip.

Slippage:

Prices are allowed to fluctuate within the 0-99% range in issuances without maximum trading limits. Setting this to 100 is equivalent to"unlimited"Slippage.

Degen mode:

Once this feature is enabled, users can purchase transactions that serve as honeypots to deter bots. If this setting is enabled, the bot will ignore the security tax setting and tokens can be purchased even if they cannot be sold.

Maximum transaction or revert (MaxTx or Revert):

Limit purchases to maximum spend. If the maximum transaction amount of the token exceeds this amount, the transaction will be reverted.

Minimum (MinToken):

Set a minimum number or percentage of tokens for purchases. If the maximum payout cannot meet this minimum, the transaction will fail.

Protection mechanism (Anti-Rug):

When taxes exceed safe settings or there are signs of fraud, try to sell tokens in advance of a potential scam.

Transfer on Blacklist:

This feature transfers tokens to a predetermined transfer wallet if the users wallet is blacklisted.

Pre-Approval:

Automatically approve tokens after front-running to sell faster.

Snipe Settings:

Allows adjusting settings for current rushes without affecting other pending or future rushes.

2.1 Historical event K-line chart

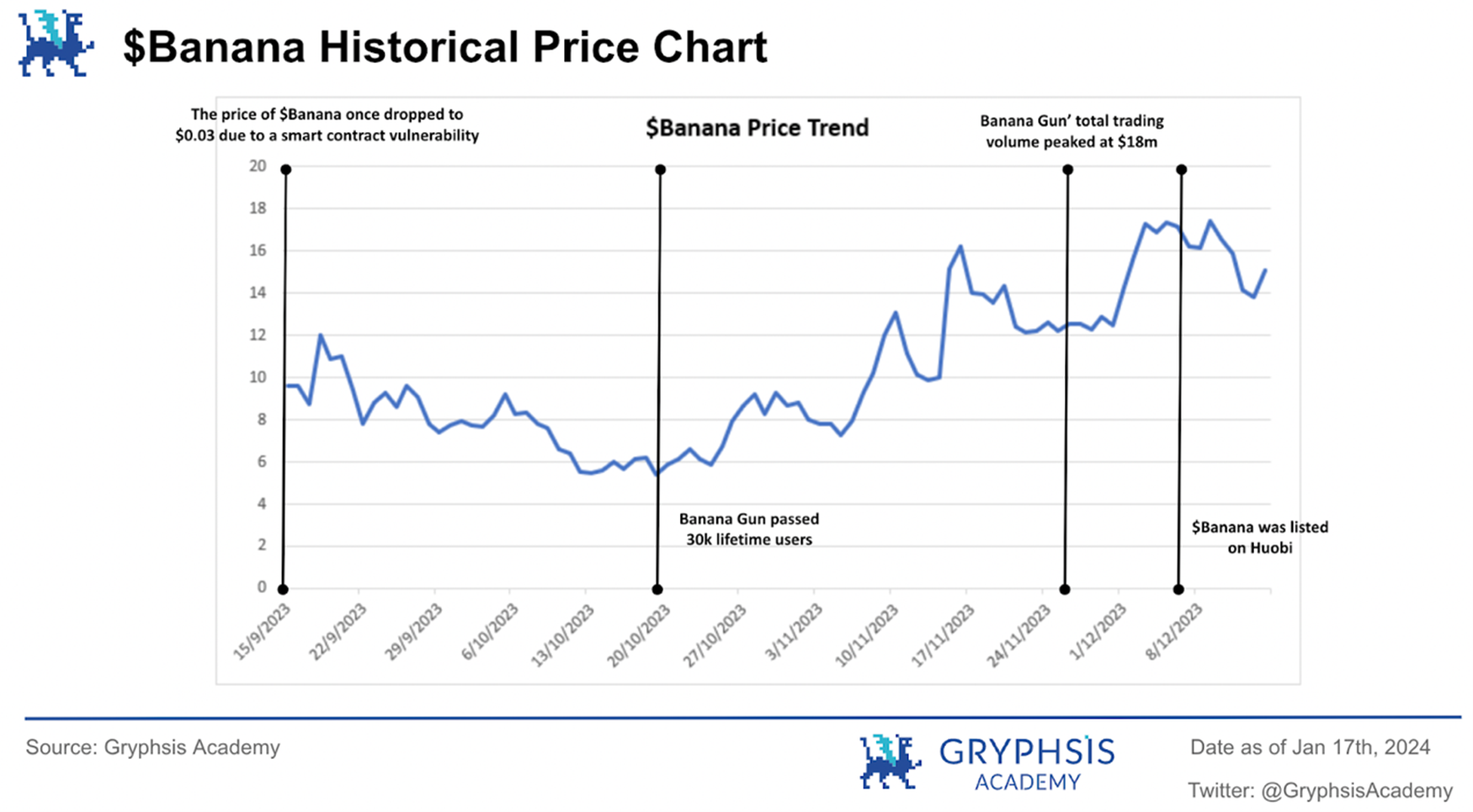

Smart Contract Vulnerability Causes Price Drop (September 11, 2023):

Hours after the airdrop was released, a vulnerability in the smart contract mistakenly allowed users to sell their assets while still allowing them to keep the tax tokens in their wallets. The price of $BANANA dropped severely to $0.03.

User milestone achieved (October 20, 2023):

As Banana Gun reaches the important milestone of 30,000 permanent users, it has also started a period of price increase in the future.

Transaction volume peaks (November 27, 2023):

The price continued to show an upward trend, and on November 27, Banana Guns daily trading volume reached a peak of $18 million, demonstrating the high activity of the project.

Launched on centralized exchange (December 5, 2023):

$BANANA is listed on Huobi.

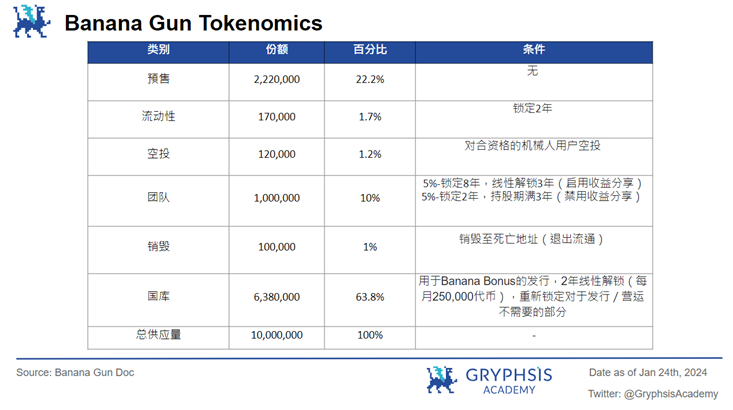

2.2 Token distribution

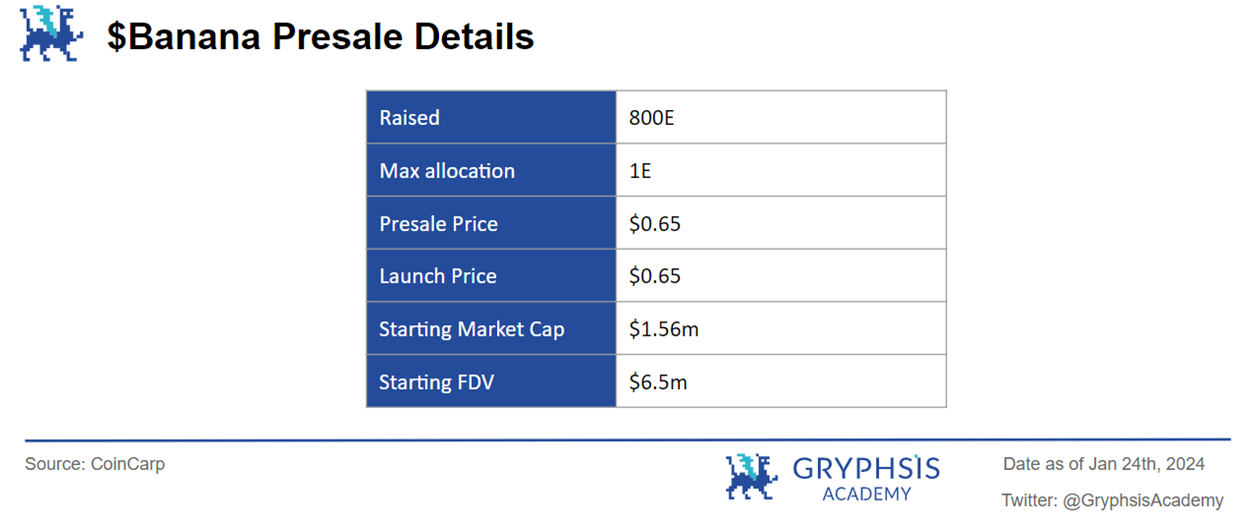

The initial issuance price of the token was $0.65, which has increased approximately 20 times since then.

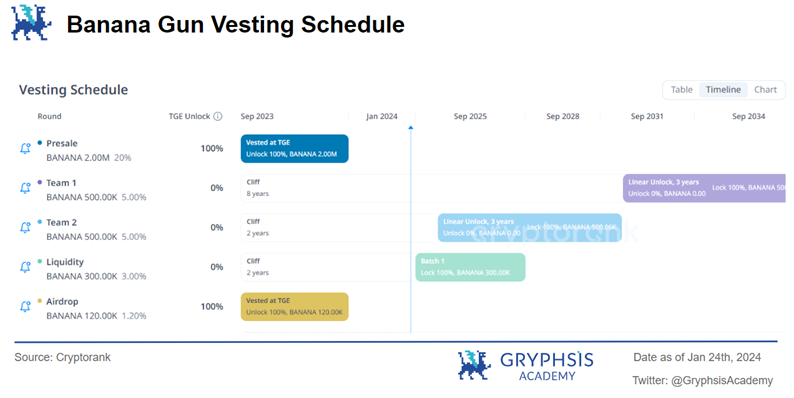

The team’s share will be unlocked in two phases, with the specific arrangements as follows: The first phase will start in 2025 and last for 3 years, accounting for 5% of the initial token supply. The second phase will start in 2031, also last for 3 years, and also account for 5% of the initial token supply.

2.3 Protocol income sources/token usage scenarios

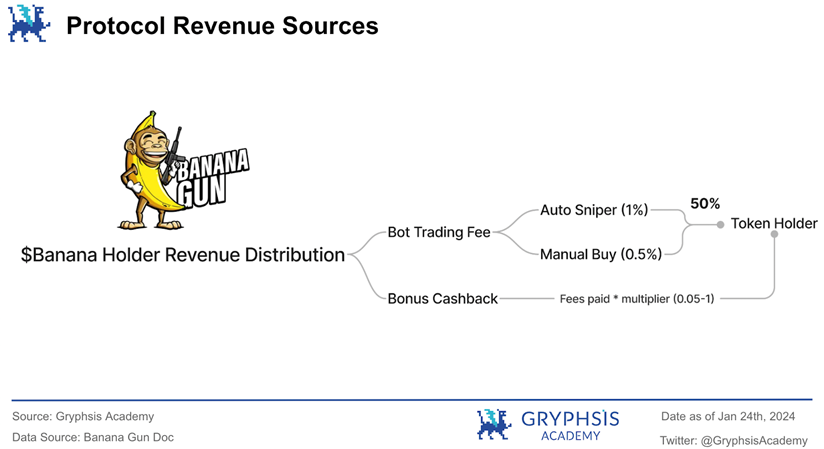

Robot trading fees:There are fees for using the robot services provided by Banana Gun.

(1) Manual purchase transactions are subject to a 0.5% fee;

(2) There is a 1% fee for automatic sniping transactions.

From all bot trading fees collected, 50% is distributed to token holders. This also provides holders with a passive income stream, incentivizing trading using the bot.

Extra cash back:Users who trade through robots are entitled to additional cash rebates.

The cash back amount is calculated using the following formula: fees paid * multiplier, where the multiplier ranges from 0.05 to 1. This means the cashback amount can be up to 100% of the fee paid, depending on a random multiplier value.

0% token tax mode:

Banana Gun recently announced a major adjustment in its fee structure, moving to a 0% token tax model. This decision was influenced by several factors. Initially, the project used token taxes as a source of revenue during the bear market, when the activity of its profitable bots was not that high. As market conditions improved and robot revenues began to steadily exceed taxes, the project re-evaluated its approach.

However, considering that the project party’s funds for token repurchase in the past mainly came from token taxes, the project party has currently suspended such repurchase activities. In the future, $BANANA token holders will play an even more critical role and will be directly involved in deciding whether to continue with the token’s deflationary strategy.

on the other hand,The abolition of token tax is seen as a strategic move to increase the attractiveness and efficiency of the project. Advantages of this new model include increased trading volume due to the absence of trading fees, reduced slippage for traders, easier integration with centralized exchanges, and broader exposure of the token. This wider exposure is expected to attract more users to the bot, creating a virtuous cycle of growth and engagement.

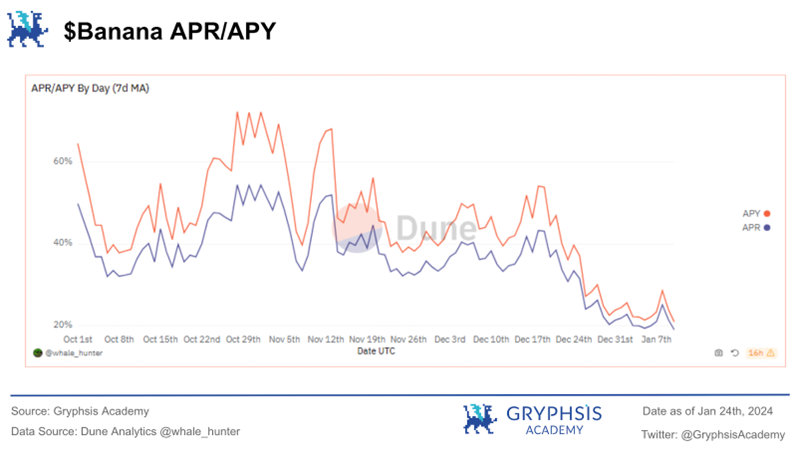

Following the announcement of this new measure, annualized returns for $BANANA holders fell to 21%, roughly one-third of the 72% peak return. However, an annualized yield of 21% is still an attractive return for token holders. Removing the token tax is expected to increase the bot’s trading volume, which in turn should increase the transaction fees generated by the bot.

This strategy is expected to provide stable and substantial annualized returns over the long term. This approach appears to balance the immediate reduction in returns with the prospect of continued, healthy returns driven by increased bot activity and broader token adoption.

2.4 Data on the chain

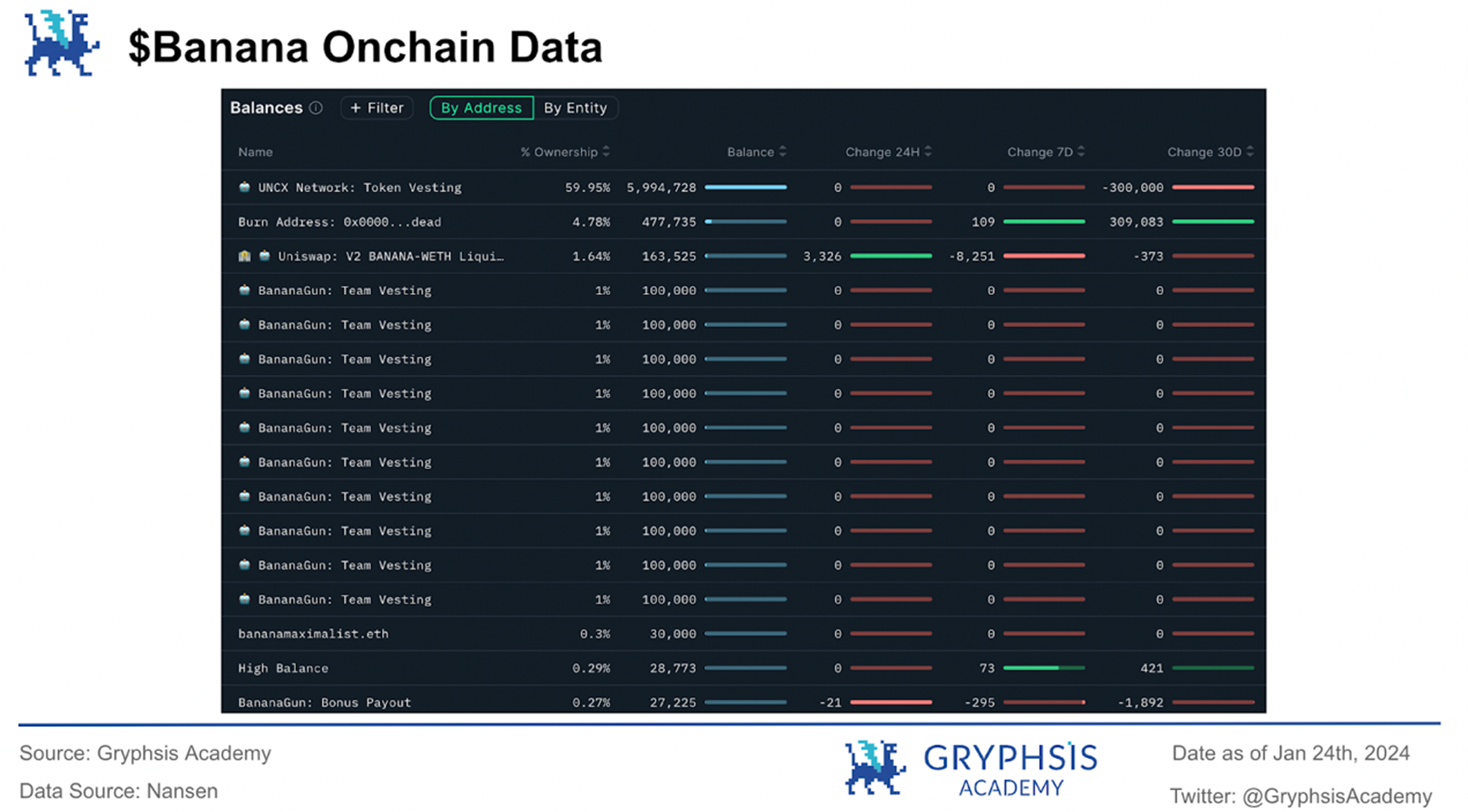

By deeply analyzing $BANANA’s on-chain data, we can gain a detailed understanding of the token’s distribution and liquidity transfers, which is critical to fully understanding the overall health of the token. On-chain data provides the distribution of token holders, transaction frequency, and liquidity trends, which are key indicators for assessing the health of any cryptocurrency. Through these data, we can more accurately judge the market acceptance of tokens, the diversity of holders, and the stability of market liquidity, thereby providing powerful data support for investment decisions.

In addition to the top ten address holders, data shows that as mentioned in Token Economics, nearly 60% of the tokens are locked in the UNCX Network, and 10% of the team tokens are also locked. It is said that more than 70% of the liquidity is still not unlocked, and you need to pay attention to the linear unlocking time in the future.

The above figure shows the token distribution of $BANANA. It can be seen that even the top ten holders each hold less than 1%, and the token is not overly centralized or subject to malicious manipulation.

Since December, the number of smart money addresses has continued to rise steadily, resulting in the total number of smart money positions rising from 56,143 to 71,327.

In contrast, the top ten holders of $UNIBOT hold a larger proportion, accounting for nearly 20% in total.

In summary, $BANANA’s token distribution shows a certain degree of dispersion and health. Although there are some locked tokens, the trend of “smart money” is also rising.

2.5 Comparable analysis

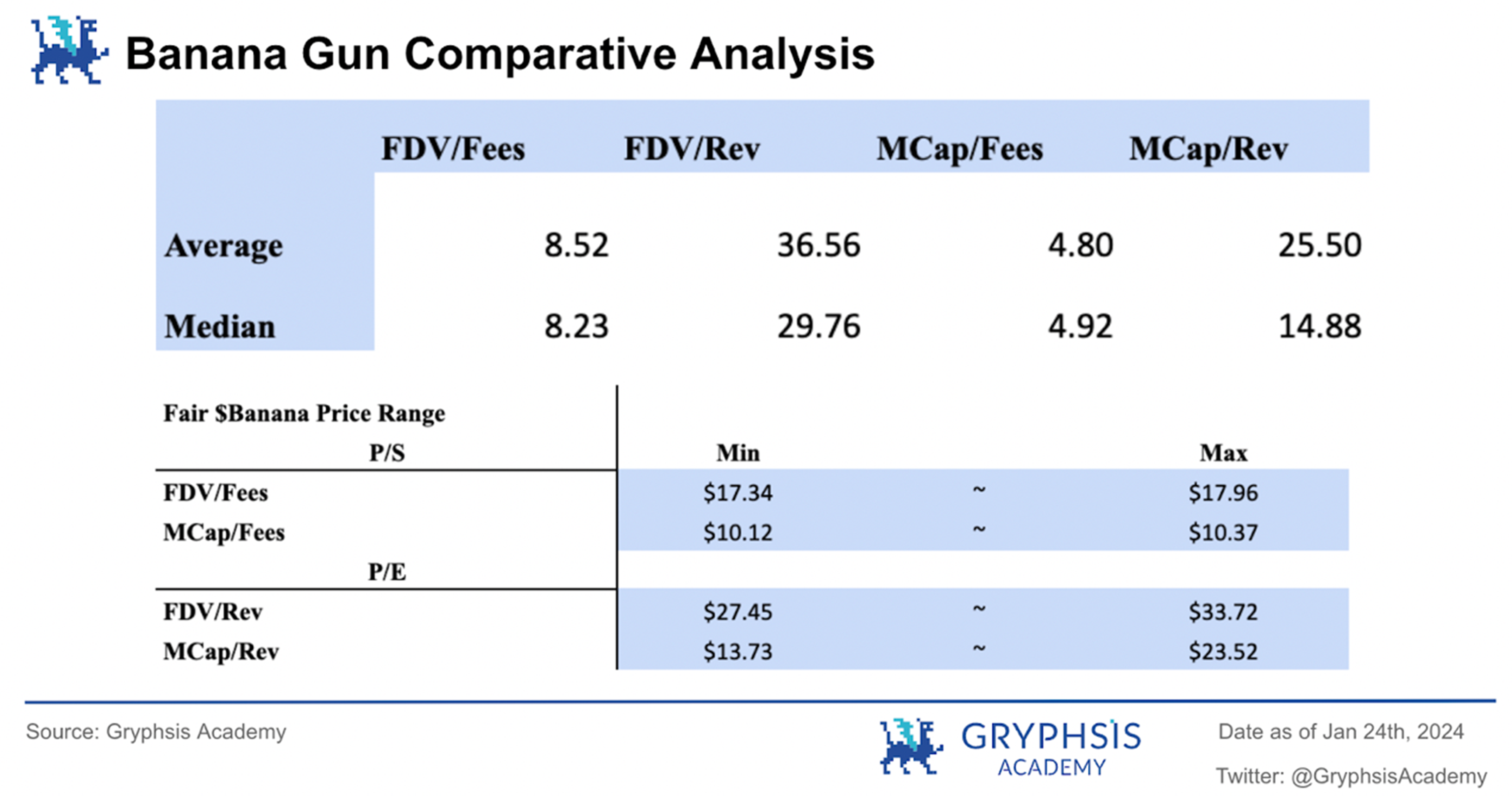

In order to more accurately estimate the reasonable price of $BANANA, we used a comparable analysis method and selected blockchain projects similar in size and nature to $BANANA for comparison. The main evaluation indicators of concern includeprice to sales ratio(Price-to-Sales) and price-to-earnings ratio (Price-to-Earnings). The selected projects include two categories: one is trading robot projects similar to $BANANA, such as Unibot and Maestro Bot; the other is decentralized exchange projects, including Uniswap, Sushiswap and Pancakeswap. Especially considering the correlation between the trading robot project and the decentralized exchange (the former is a replica of Uniswap), this increases the reliability of the comparative analysis. Through this comparison, we can more accurately assess $BANANAs market value and investment potential.

The above analysis shows the valuation of different projects based on Price-to-Earnings and Price-to-Sales ratios. Since the three trading robot projects have been operating for less than a year, their fees and revenue have been annualized for easier comparison.

In this case, Banana Guns annualized total revenue reached $21.08 million, demonstrating its excellent revenue-generating capabilities. It is particularly worth mentioning that because the project’s mechanism provides token holders with a relatively high proportion of income, the total annualized income of its token holders has also reached US$9.22 million, which is the highest among similar projects. Among them, Unibot and Sushiswap have outstanding performance.

Additionally, from a P/E perspective, Banana Gun has a low ratio relative to other similar protocol averages, suggesting that it may be undervalued by the market.

After conducting the valuation, the potential price range for $BANANA is calculated to be $10.12 to $10.37 based on the price-to-sales ratio. At the same time, based on the price-to-earnings ratio analysis, we calculated that the potential price range of $BANANA is $13.73 to $23.52.

2.6 Future Outlook

(1) Online Solana

Source: Banana Gun Twitter

Banana Gun has also launched its Telegram bot on the Solana platform, following in the footsteps of Unibot. Instead of launching SOL/ETH cross-chain services, on Solana, Banana Gun chose to use $SOL as a reward for $BANANA holders. Users can connect a Solana-enabled wallet to claim these rewards.

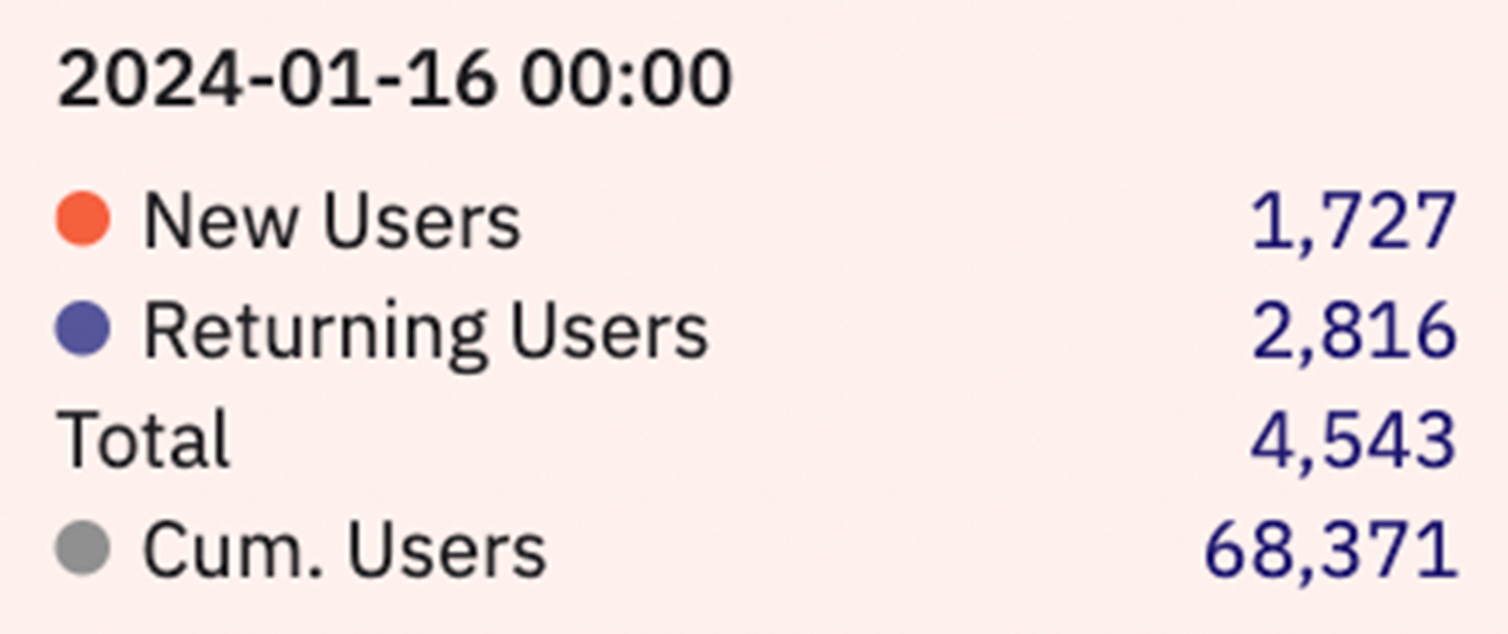

Source: Dune Analytics @whale_hunter

The above data shows that one week after the Solana platform was launched, users responded enthusiastically, attracting about 1,700 new users, and the total number of users on that day exceeded 4,000. This achievement is due to an important promotion strategy: users can earn 50% of their transaction fees in the first two weeks by recommending new users on the Solana chain.

For example, in the first week, if the trading robot earns a total fee of $400,000, of which $300,000 comes from referrals, Banana Gun will redistribute $150,000 to the referrer in the form of SOL tokens. This is a strategy used by the project team to attract new users in the early stages, and its success is also reflected in these data.

Considering the price increase of Unibot after Solana was launched, it is reasonable to expect that the value of $BANANA will also show an upward trend in the future.

Plus, offering a significant bonus to earnings within the first two weeks is certainly an attractive incentive for users holding $BANANA. This strategy is likely to have a positive catalytic effect on the price of the $BANANA token in the short term, stimulating market interest and investment enthusiasm for the token.

In this way, the trading activity of the $BANANA token may increase significantly, thereby increasing its market liquidity. This yield-plus strategy may also attract new traders to the market, further increasing the market value of $BANANA.

(2) Cooperation with DEXTools

Source: Banana Gun Twitter

The collaboration between Banana Gun and DEXTools is a significant development for Banana Gun. DEXTools, known for its efforts to make transactions less accessible to the general public, has chosen Banana Gun as its partner. This is particularly bullish for Banana Gun for several reasons:

Increase exposure and user base:

The partnership with DEXTools, which has a large user base, has significantly increased Banana Guns exposure. This may attract more users into Banana Gun’s ecosystem, potentially leading to an increase in the number of token holders and active traders.

Increase transaction volume:

By integrating Banana Guns trading functionality directly on the DEXTools platform, DEXTools users can easily trade and execute limit orders. This convenience is expected to result in higher trading volumes for Banana Gun, enhancing the token’s liquidity and market activity.

Strengthen market position:

The partnership strengthens Banana Gun’s position in the market as a reputable and technologically advanced trading option. Being chosen by a reputable platform like DEXTools highlights the quality and reliability of Banana Gun’s technology and safety features.

Price appreciation potential:

Increased usage, higher trading volume, and improved visibility may result in appreciation of the Banana Gun token price. As more traders and investors learn about and participate in Banana Gun through DEXTools, demand for the token is likely to increase.

3. BONKBot

BONKbot is a Telegram trading robot based on the Solana network, which allows users to conduct transactions in the easiest and fastest way. The token used by the project is $BONK, which was originally released on Christmas 2022 as a free airdrop to the Solana community. Since then, $BONK’s adoption has grown exponentially, with uses spanning DeFi, gaming, payments, and more. As an official partner of the $BONK community, BONKbot provides users with a series of features:

Minimum position value:

In the users portfolio, it is possible to set the minimum position value displayed. Tokens below this threshold will be hidden. This feature is particularly useful when you do not wish to sell certain tokens, even if the investment fails (commonly known as being trapped). Click to edit.

Automatic buy:

When the user pastes the token address, the system will immediately execute the purchase operation, eliminating the need for confirmation.

Button configuration:

Users can customize the buy and sell buttons on the dashboard. When buying or selling tokens, just click on each button to edit.

Slippage configuration:

You can customize slippage settings for buy and sell. Slippage is the difference between the transaction price and the execution price, and proper configuration can help you better control transaction costs. Click to edit.

MEV protection features:

BONKbot teamed up with Jito Labs to provide users with advanced MEV protection features, which can accelerate transactions by default and defend against front-loaded transaction attacks. MEV protection provides two modes for users to choose from:

Turbo mode: In this mode, transactions are sent through Jito to ensure front-end transaction protection at the fastest speed. If normal transfer speeds are faster, MEV protection will not be enabled for the transaction.

Secure mode: This mode guarantees transaction protection under all circumstances, even if it means transaction speed may be slowed down. Users can speed up transactions by increasing the bribe amount.

When users enable the MEV protection function, they can choose the above mode and decide the priority level of the transaction: medium, high or very high. For advanced users who want more granular control, BONKBot also offers the option to customize transaction priorities.

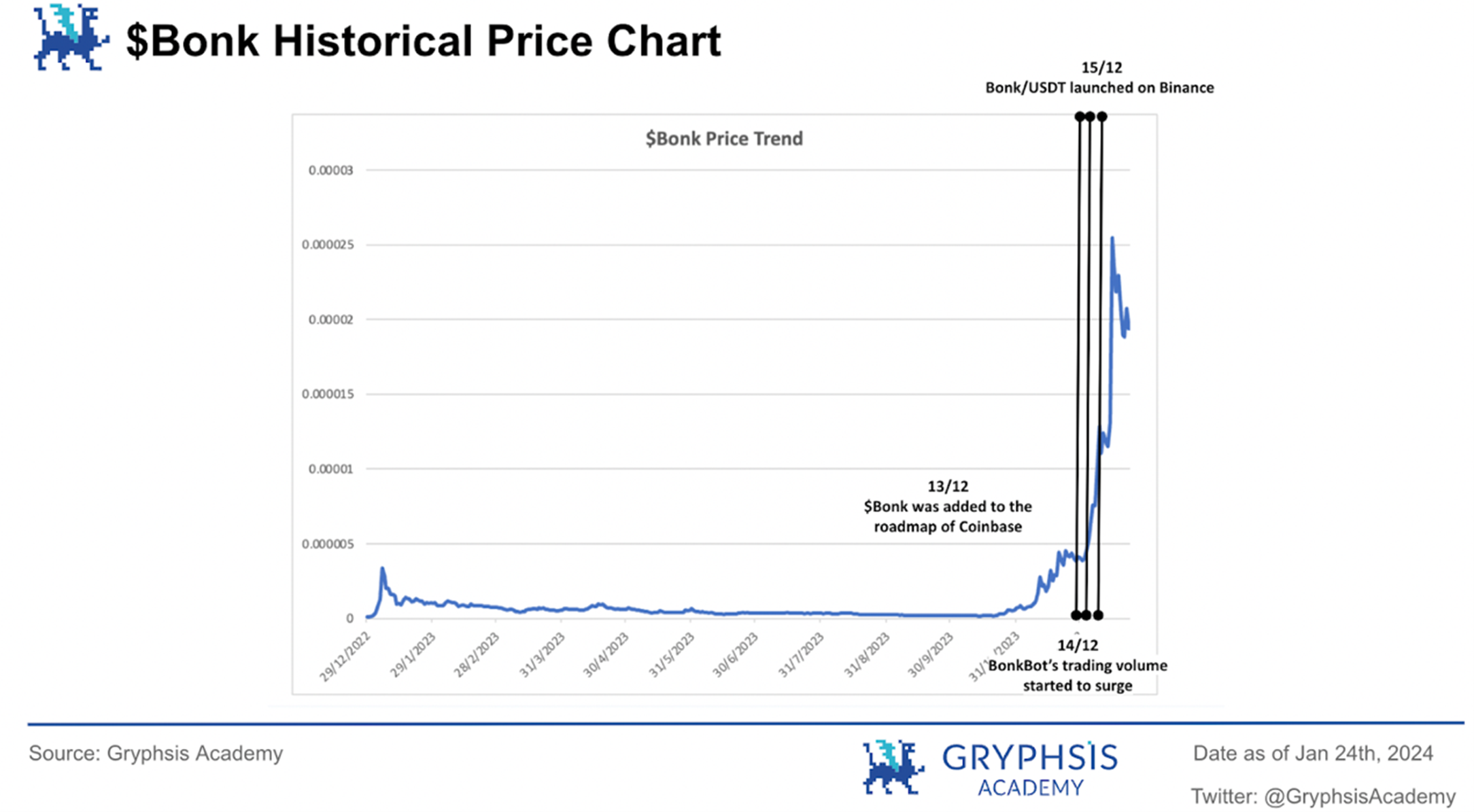

3.1 Historical event K-line chart

$Bonk was initially airdropped to Solana community members as a meme coin and has since been adopted by multiple projects. However, its significant price increase is mainly due to the recognition and adoption of centralized exchanges. Two large trading platforms, Coinbase and Binance, have successively mentioned and listed it, which has greatly promoted the development of the Bonk ecosystem and led to wider adoption.

Taking BONKBot as an example, it chose to use $Bonk as the main token of its trading platform, and adopted a mechanism to use transaction fees for token repurchase and destruction, which not only enhanced the utility of $Bonk, but also increased its value Provided support. In this way, trading activities not only support the operation of BONKBot, but also indirectly promote the healthy cycle of the $Bonk economic model.

3.2 Economic model

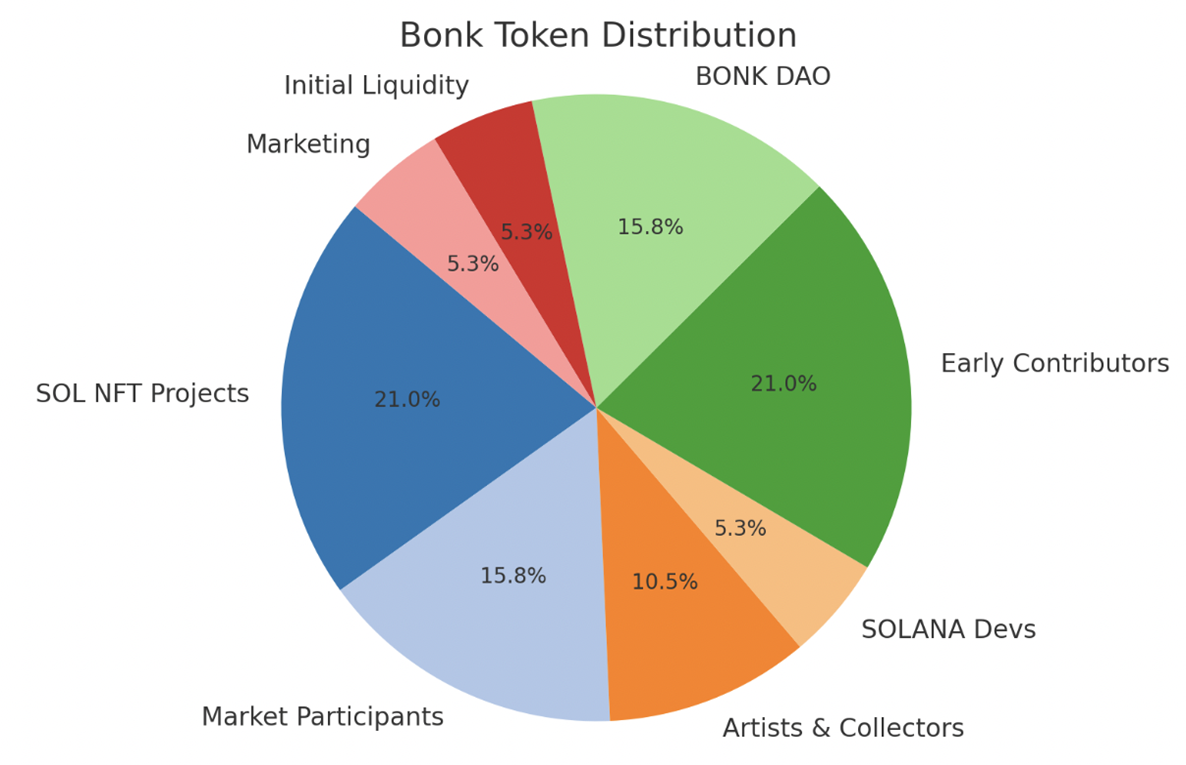

Source: Bonk Whitepaper

The above is the token distribution of $Bonk, and BONKBot, as a project that rewards $Bonk, will use 1% of the transaction fee for the following purposes:

Source: BONKbot Documentation

30% goes to the team behind BONKbot

20% is used to pay referral fees

10% for immediate destruction of $BONK

10% for Bonk community contribution

10% to cover infrastructure costs and future development

10% belongs to BonkDAO multi-signature wallet

10% goes to fund BonkLabs

3.3 Protocol performance

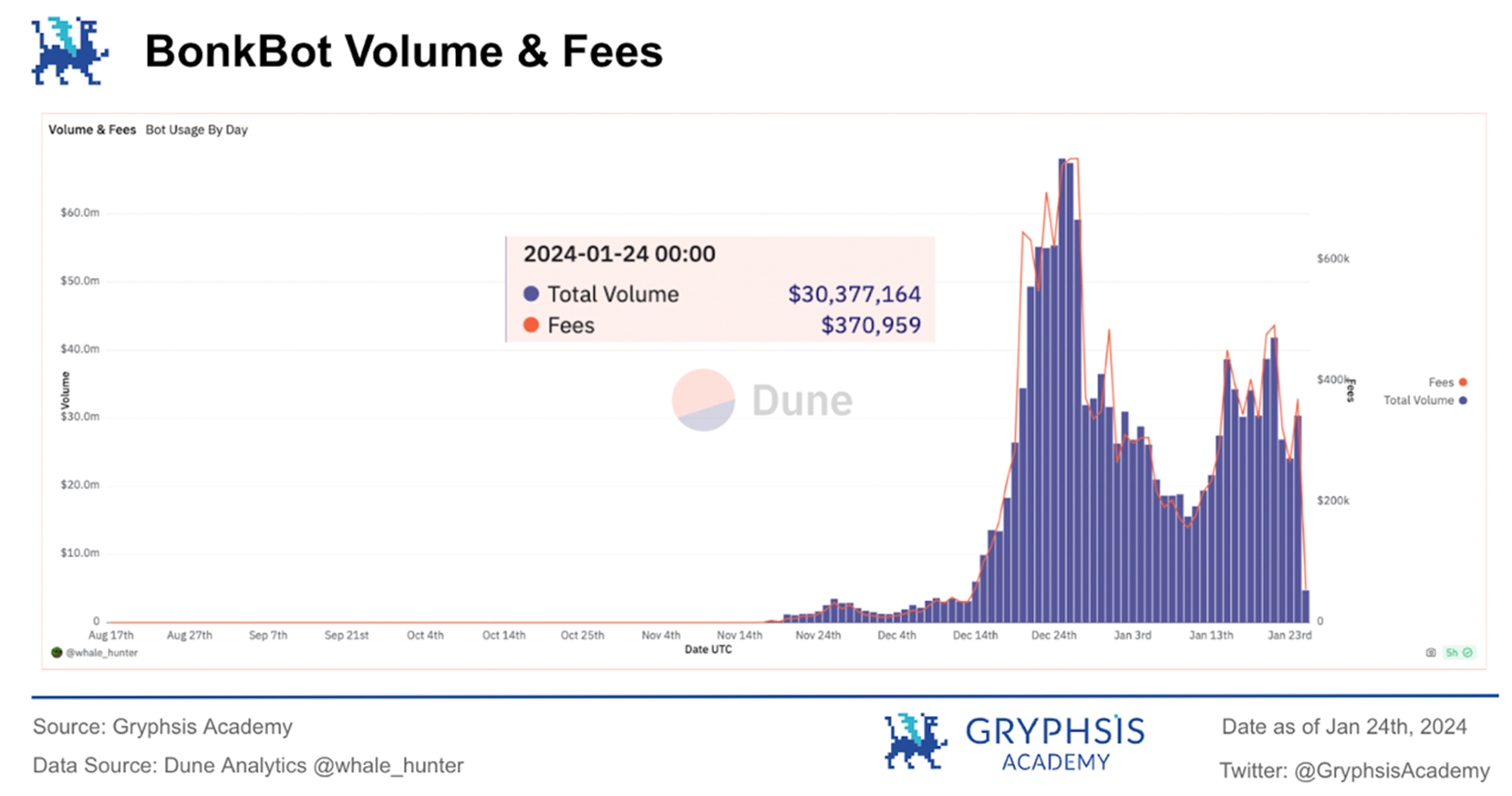

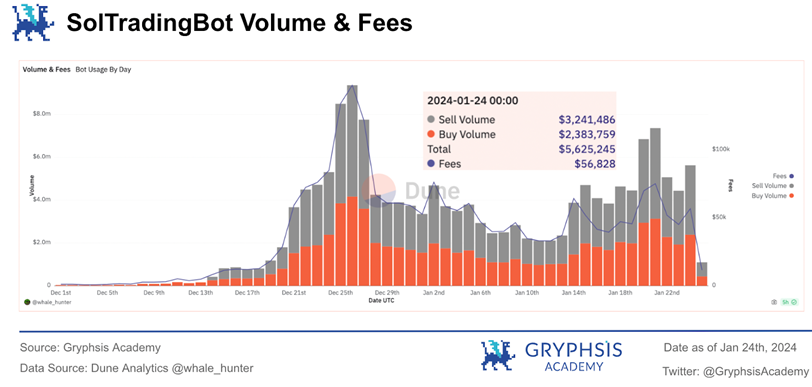

The protocols transaction volume and transaction revenue have also increased significantly with BONKBots hype on meme coins, with single-day revenue reaching a high of 750K US dollars, which has declined recently.

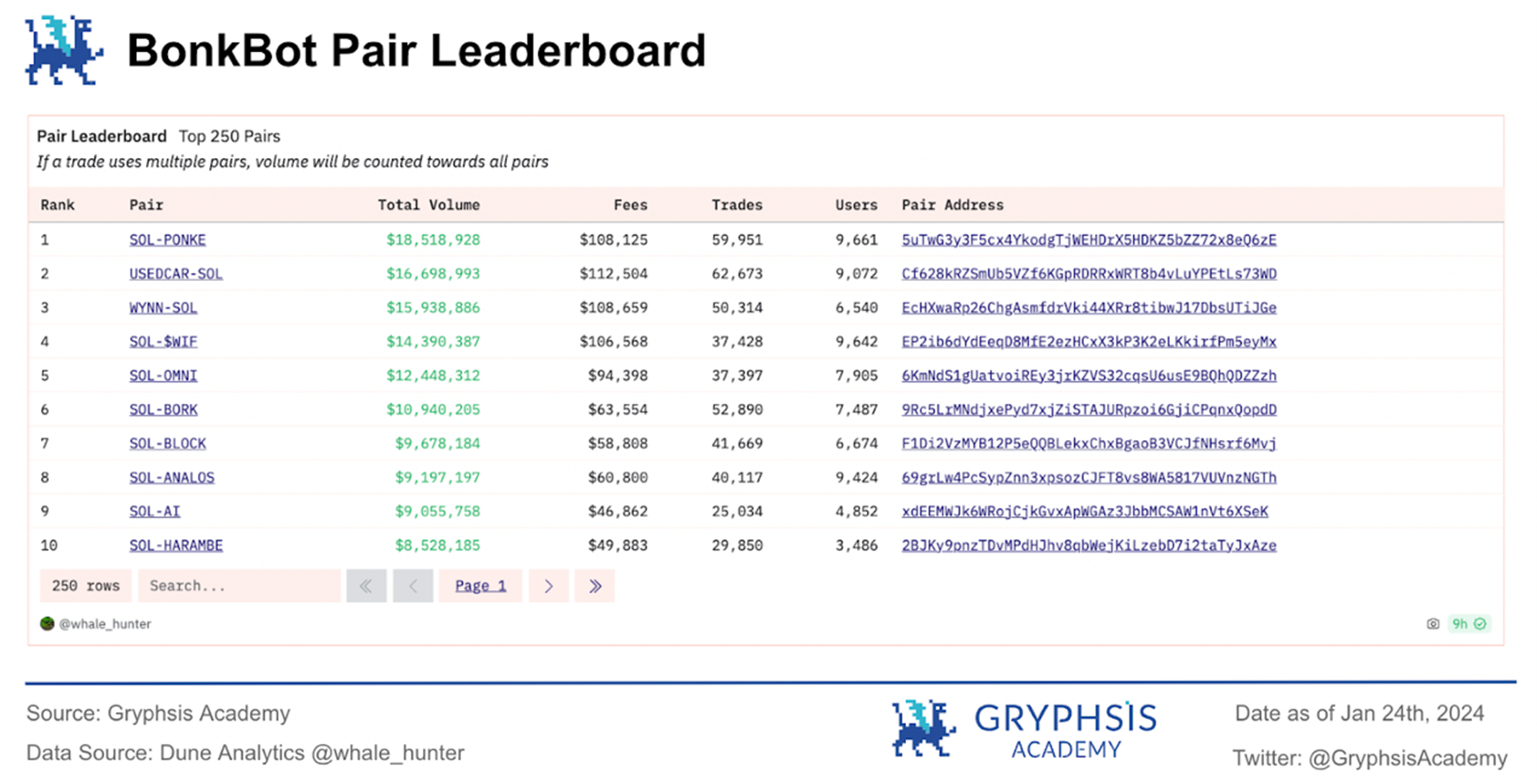

The main trading configurations on BONKBot are SOL/PONKE, SOL/USEDCAR, SOL/OMNI, SOL/$WIF, SOL/BORK. Meme coins belonging to various types.

3.4 Future prospects

(1) The craze of Solana ecological meme currency

The thriving memecoin culture within the Solana ecosystem can largely be attributed to the influence and style of Solana founder Anatoly Yakovenko. A key moment that marked Solanas embrace of meme coins was when Yakovenko appeared at the Solana Breakpoint event, wearing a costume representing Silly Dragon and expressing a friendly greeting to the meme coin community. This gesture highlights Solana’s welcoming attitude towards memecoins and promotes an environment in which they can thrive.

Following this incident, $Silly, one of the leading meme coins on Solana, along with $Bonk, gradually evolved into an important aspect of Solana community culture. As long as this culture persists, tools like BONKBot, which facilitate quick and easy acquisition of tokens, will remain extremely valuable.

This is especially true for speculative traders who are attracted to high-risk, high-reward memecoin trading. The Solana market also has some new meme coins such as $WIZ, PONKE, etc. The practicality of BONKBot in this case perfectly matches the speculative and dynamic nature of the meme coin market in the Solana ecosystem.

(2) Drive DEX Raydium on Solana

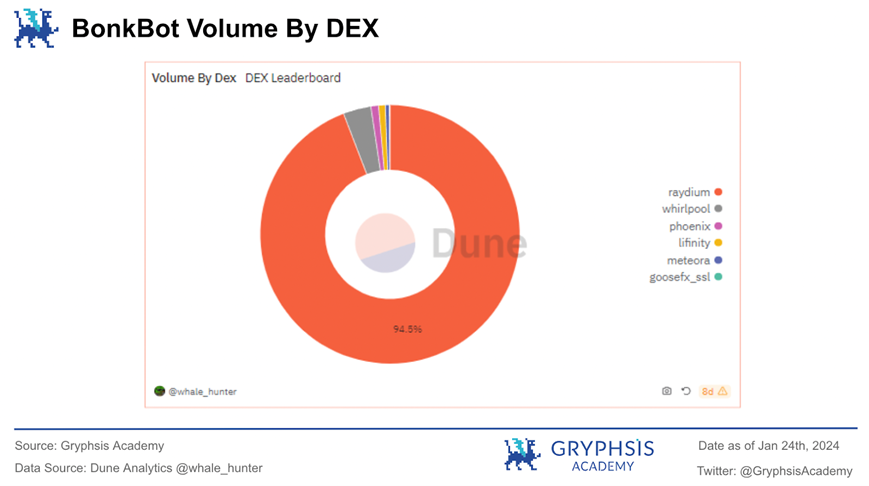

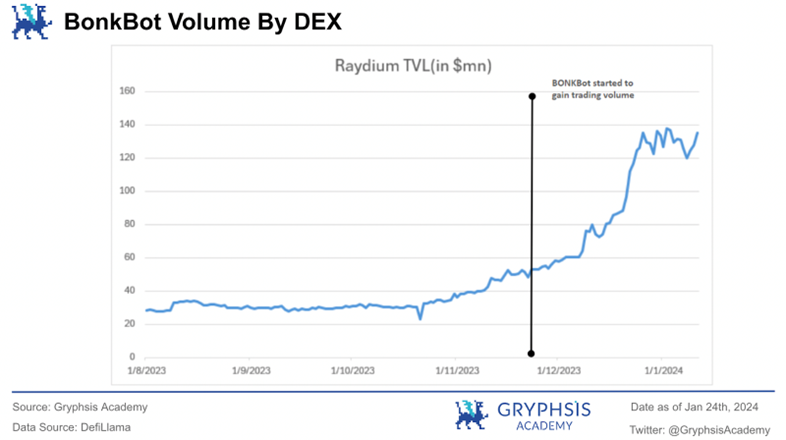

BONKBot has become a key catalyst for Raydium, as evidenced by the fact that approximately 95% of BONKBot transactions occur through Raydiums Swap feature. This correlation is further illustrated by data showing that Raydium lock-up has increased significantly in line with BONKBot’s increasing trading volume, highlighting the central role BONKBot plays in driving activity on Raydium.

In addition, any major updates to Raydium, such as adding new trading pairs, will directly benefit the development and usefulness of BONKBot. These enhancements to the Raydium platform may expand BONKBots trading capabilities and efficiency, further strengthening its importance in the ecosystem. The mutually beneficial relationship between BONKBot and Raydium demonstrates that the growth and evolution of one will fuel the growth of the other, creating a mutually beneficial dynamic that supports the growth and vitality of both parties in the Solana ecosystem.

4. SolTradingBot

SolTradingBot is another imitator similar to BONKBot. It generally adopts the gameplay of Telegram Bot, but it has some special functions, such as:

SolTradingBot is another imitator similar to BONKBot. It generally adopts the gameplay of Telegram Bot, but it has some special functions, such as:

DEX integration:

Integration with major DEXs: SolTradingBot has integrated with Jupiter, Orca, and Raydium, three of Solana’s leading decentralized exchanges.

Enhanced liquidity access: Users can access the extensive liquidity pools of these DEXs to efficiently execute transactions at the best prices.

Diverse Token Opportunities: Offers a wide range of trading options from established cryptocurrencies to emerging projects.

Multi-DEX strategy: enables users to leverage the unique advantages of each DEX platform to optimize trading.

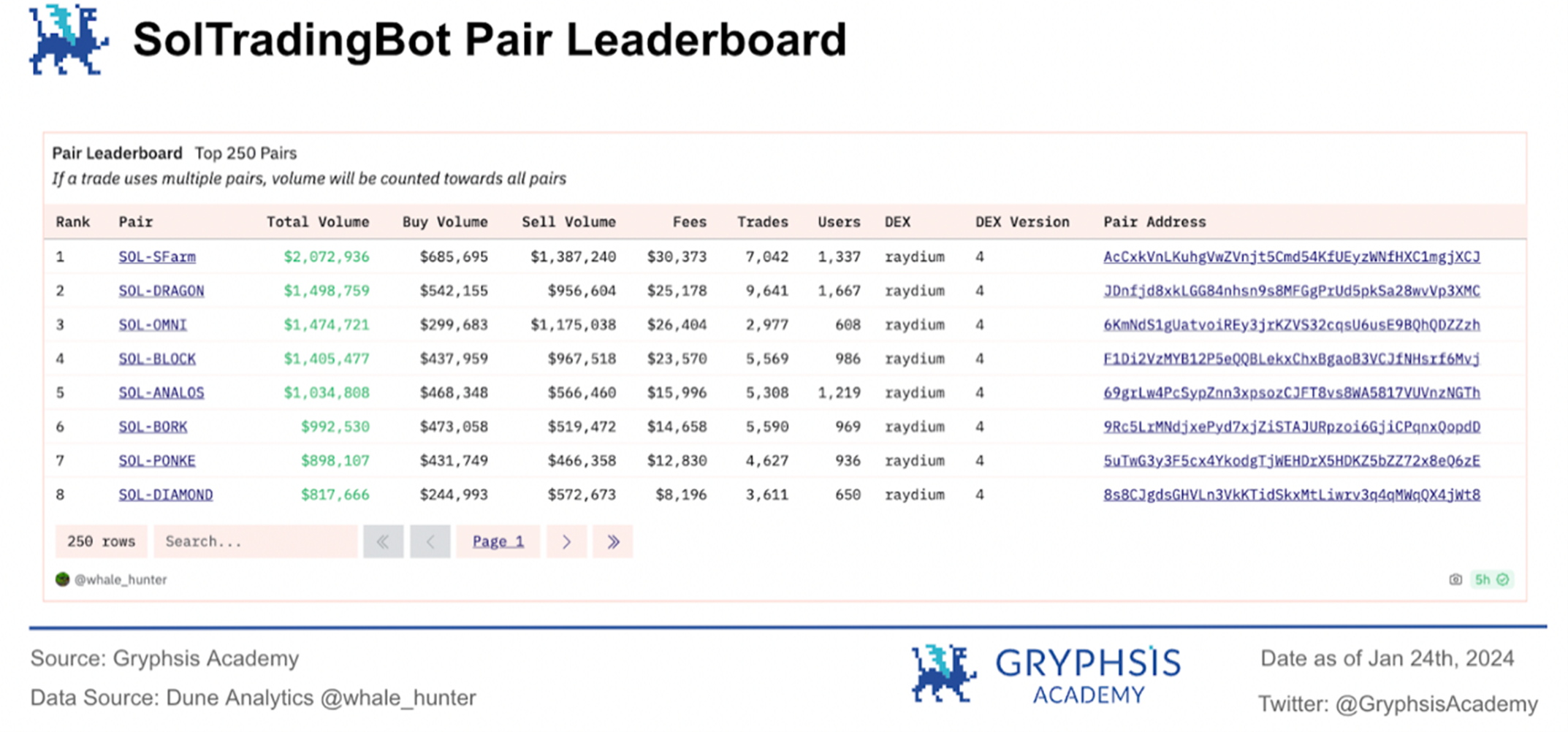

4.1 Protocol performance

As a rising star, the project was only launched in December, but it happened to catch up with the peak of speculation about the Solana meme coin. In less than a month, by December 26, its trading volume had surpassed UniBot and Banana Gun.

The tokens with the highest trading volume also include some popular meme coins, such as SOL/SFAR, SOL/OMNI, SOL/BORK, SOL/PONKE, etc.

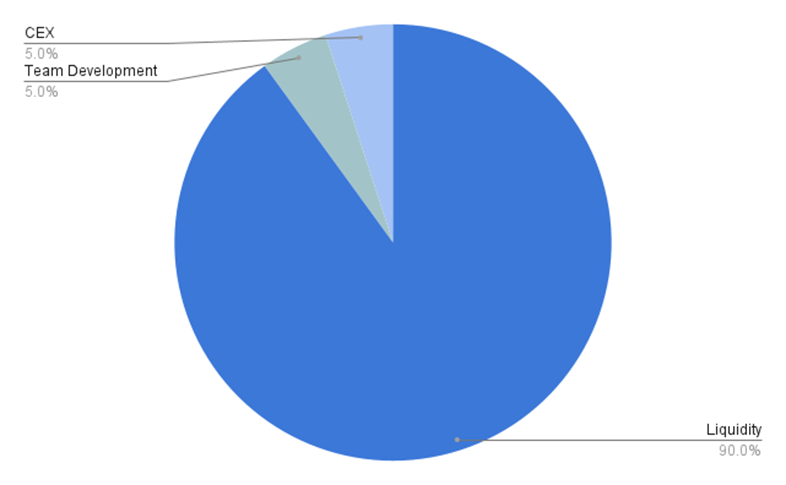

4.2 Economic model

Data Source: SolTradingBot Doc

There is currently only some very preliminary information about the token distribution. The data indicates that the tokens are primarily allocated for liquidity funding.

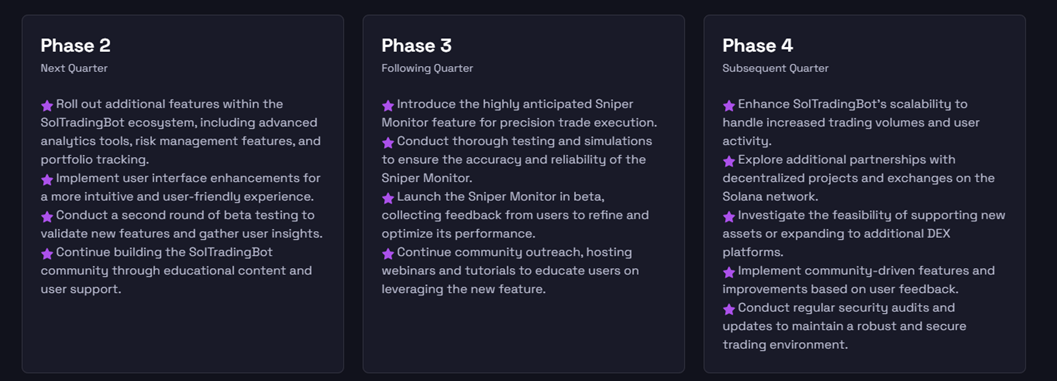

4.3 Future prospects

(1) Clear roadmap

Although the functionality of SolTradingBot has not yet reached its most complete state, the project team has formulated a clear roadmap and plans to complete it at different stages in 2024. For a Telegram Bot project that already has a place in the market, continuing to improve the user experience will undoubtedly help it seize a larger market share in the future.

Source: SolTradingBot Website

Here are a few milestones that are considered critical:

Comprehensive ecosystem:The launch of additional features such as advanced analytics, risk management and portfolio tracking illustrates a move towards creating more powerful trading tools.

Innovative features:The introduction of the Sniper Monitor feature for precise trade execution may set SolTradingBot apart from its competitors, providing traders with a unique tool to enhance their trading decisions.

Strategic partnership:Exploring further partnerships within the Solana ecosystem could lead to additional availability and integrations, expanding the bots reach and capabilities.

Platform evolution:Research supports new assets and potential expansion to more DEX platforms.

(2) SolanaTradingBot’s foothold

The author believes that in terms of the functions of Telegram Bot, the various projects are generally similar, so there is no need for two almost identical projects. Especially in the Solana ecosystem, this will be an area that many projects want to enter or establish in the future. Although SolTradingBot got off to a good start in its first month, it needed to figure out its market positioning. Considering that the project was launched relatively late, it may face the risk of being swallowed up by BONKBot if the future roadmap is not realized.

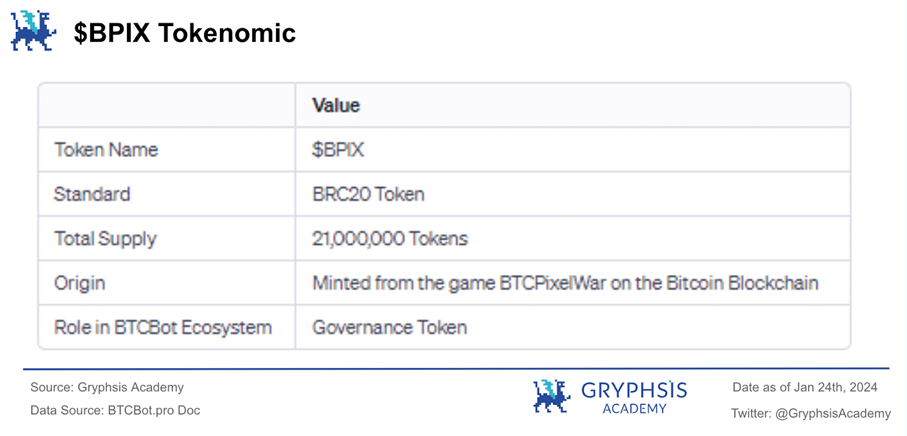

5. BTCBot.pro

Solona and ETH use the account model, and BTC uses the UTXO model. This difference in underlying data structure leads to huge differences in its related assets and ecology. In this section, we focus on the functional innovation of BTCBot.pro and its possible impact on users and the industry.

BTCBot.pro is the Telegram Sniper Bot product of the BTC ecosystem. The product was launched on December 23, 2023. It currently focuses on engraving and trading BRC-20 tokens, and has launched some practical functions to solve the problems currently faced by the BTC field.

Since the BTC ecology is very different from the ETH EVM and Solana ecology, and its overall design logic is also very different, the BRC 20 field is currently divided into a primary market and a secondary market. The primary market is different from the primary market in the usual sense. , the primary market of the BTC ecosystem refers to the issuance of BRC 20 tokens, and the secondary market refers to the transaction of BRC 20.

5.1 BRC 20 primary market

Challenge 1: Delayed block confirmation

After submitting the inscription confirmation of batch inscriptions, you will often face a sharp increase in transaction fees, resulting in the transaction not being confirmed on the blockchain in time, and the user may not receive the tokens after the minting is completed.

Corresponding solution: BTCBot.pro’s AutoBoost

BTCBot.pro solves this problem by automatically monitoring and promoting transactions. It is able to identify inscribed transactions that are unconfirmed for the next block and bundle them together for promotion.

This multi-stage bundling method greatly increases the probability that these transactions will be confirmed in the next block, with a success rate of up to 99%, and also brings the following good benefits:

Adapt to changing transaction fee prices

Blockchain confirmation of guaranteed inscriptions

Ensure users receive their tokens promptly

Challenge 2: No refunds

Although users can protect their chances of successful inscription by paying high transaction fees, there is no mechanism for users to receive refunds if tokens are not received due to delayed confirmation. In terms of consequences, users paid high transaction fees but failed to successfully obtain inscriptions.

Corresponding solution: automatic fuel recovery

BTCBot.pro automatically analyzes transactions in new blocks. If the users minting process is not complete, it will continue to advance up to 20 inscriptions. If the process has ended, BTCBot.pro will stop and refund the user automatically. This eliminates the worry of losing transaction fees if the inscription is unsuccessful. In summary, there are the following benefits:

Effectively manage transaction fees

Relieving users of the burden of bearing high transaction fees for unsuccessful inscriptions

BTCBot.pros AutoBoost and automatic fuel restoration together provide a comprehensive solution to the problems faced when inscribing in the Bitcoin Ordinals ecosystem. These solutions not only enhance the chances of confirmation, but also ensure that users receive their tokens and manage gas costs efficiently, thus optimizing the user experience.

Challenge 3: Data monitoring

The time when high-quality projects in the BRC 20 field start to mint is uncertain. It is impossible for users to stare at the computer screen all the time to update. Therefore, the monitoring function is set up. After the user sets the number of currency holders, progress, number of transactions and other information, these setting information must be met. A message will pop up, and the user can choose to submit the mint number of sheets for new creation.

Corresponding solution: Automatically create a new Sniper

After the user sets the parameters such as the number of currency holders, progress, number of transactions, number of engravings, etc., if the automatic renewal function is turned on, if the account balance is sufficient, the currency will be automatically renewed according to the set parameters.

5.2 BRC 20 secondary market

Except for a few BRC 20 listed on centralized exchanges, most BRC 20 token transactions require the use of trading markets on platforms such as OKX and Unisat. Although the current BTC inscription field is said to be FT (fungible token), the transaction experience is very similar to NFT (non-fungible token). Due to the particularity of the mechanism, the price and quantity of each order are different, but the taker can only take one order at a time and cannot split the transaction in time.

Whether it is the Unisat or OKX trading market, the buyer must eat the sellers price limit and a limited number of pending orders before the transaction can be completed. This has led to poor liquidity in the entire BRC 20 decentralized trading field, the inability to place limit buy orders, and the inability to introduce market makers. BTCBot.pro is trying to solve the liquidity problem in the BRC 20 field.

BRC 20 sell order function

Before BRC 20 tokens are listed for sale on trading platforms such as OKX or Unisat, they need to do a step of mint work. For example, if you want to sell 2000 $abcd (a certain BRC 20 token), you need to first convert 2000 $abcd into an inscription, and then Set a price for this inscription, hang it on the trading platform and wait for the order to be taken. There is no handling fee for placing a limit sell order. All the user has to pay is mint gas fee.

On BTCBot.pro, when users use the limit sell function, they can place orders on Unisat, OKX and other platforms at the same time without increasing any cost. The same inscription can be placed in two places, which will increase the probability of selling orders being completed.

BRC 20 limit buy order function

This is the first time that the limit buy order function has been proposed in the BRC 20 field. Its buying function has the following four characteristics:

zero cost

After setting the price and purchase amount, users can modify or cancel the limit buy order at any time without any gas fees. Like the sell order function, the buy order function is also applicable to Unisat, OKX and other trading markets. Currently, the Unisat buy order function has been launched.

Slippage control

When the price of a certain token falls back to the buy order range set by the user, the transaction will be triggered. However, the BTC Gas Fee when the order is completed will affect the comprehensive price of the token.

For example, the number of tokens in a certain order is 100, each price is 1 USD, but the transaction currently requires a gas fee of 9 USD, BTCBot.pro will automatically calculate the comprehensive cost as: (100+ 9) ÷ 100 = 1.09 USD, this At that time, the trading slippage was 9%.

If the users slippage is set to 10%, then the sell order will be triggered to be automatically completed; if the user sets the slippage to 5%, the transaction will not be triggered, which can avoid the increase in the comprehensive cost of token purchase. The greater the number of tokens in a certain order, the smaller the transaction slippage will be.

The slippage setting mentioned here is unique to the BTC ecosystem and is different from the slippage experienced by users using the AMM mechanism in Uniswap.

Because under the AMM mechanism, what affects slippage is the size of the Liquidity Pool, and what affects slippage in the current BRC 20 field is the BTC transaction Gas Fee. Through slippage settings, users can filter out the orders they really need and effectively control comprehensive costs.

Handicap management

Most of BRC 20s current trading platforms cannot use the limit buy order function. Therefore, institutional participants such as market makers or project parties cannot manage the market well and can only manage it with market orders.

This greatly affects the activity and depth of transactions. The limit buy order function can solve this problem, and project parties or market makers can manage the orders on BTCBot.

Automatic matching

In BTCBot.pro, you can see the current amount and quantity of limit buy orders. Token holders (sellers) can observe the order thickness and choose the price at which to sell, while buyers can obtain lower-cost chips through bidding (similar to Bid). In BTCBot.pro, buyers and sellers can automatically conduct matching transactions.

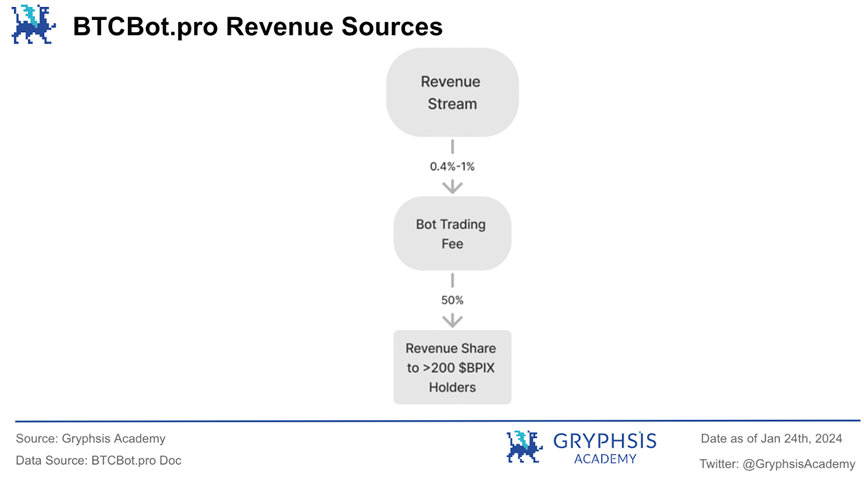

economic model

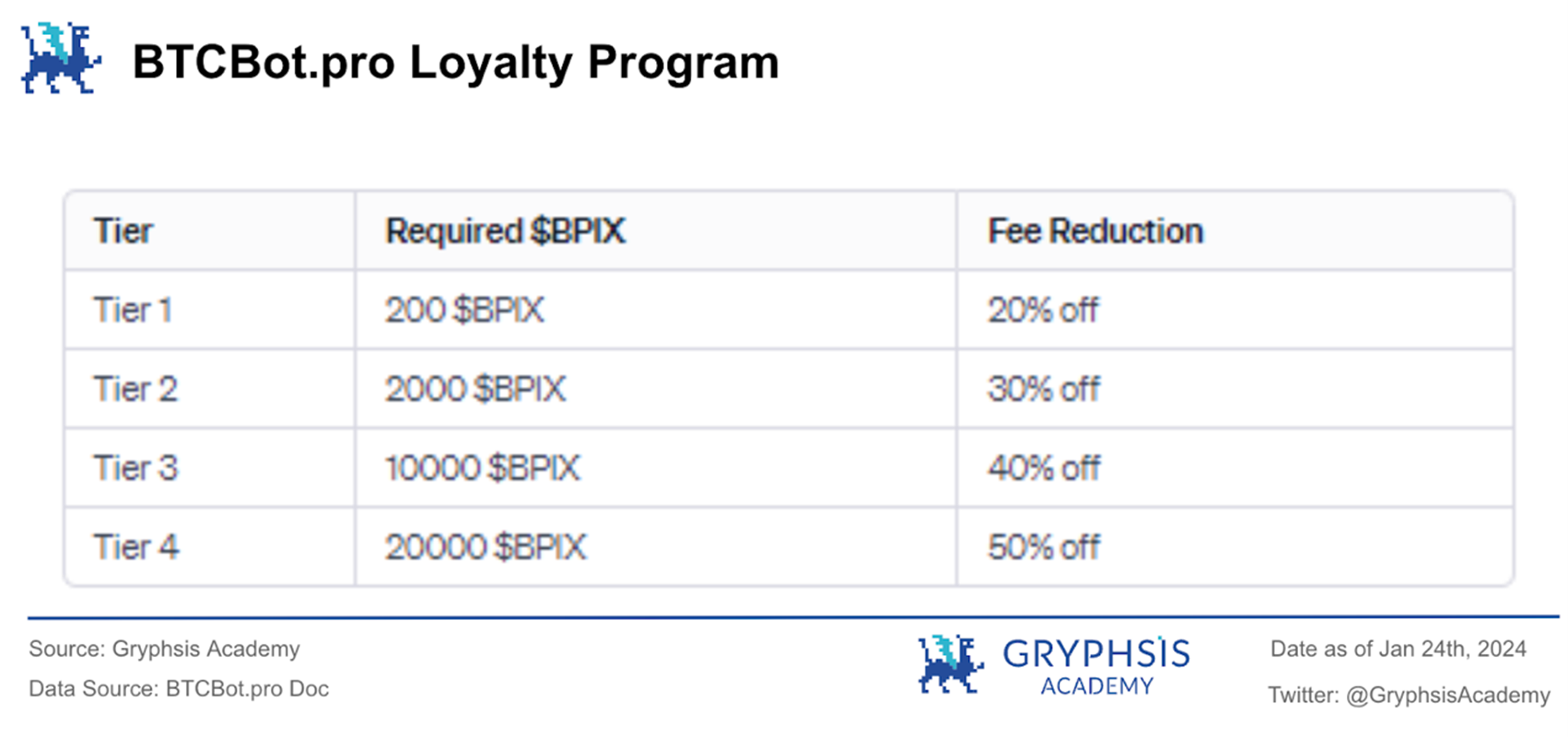

The main source of revenue for the project is transaction fees, which range from 0.4% to 1% based on tier rewards and discounts from referral programs.

Tier rewards reduce fees by up to 50%.

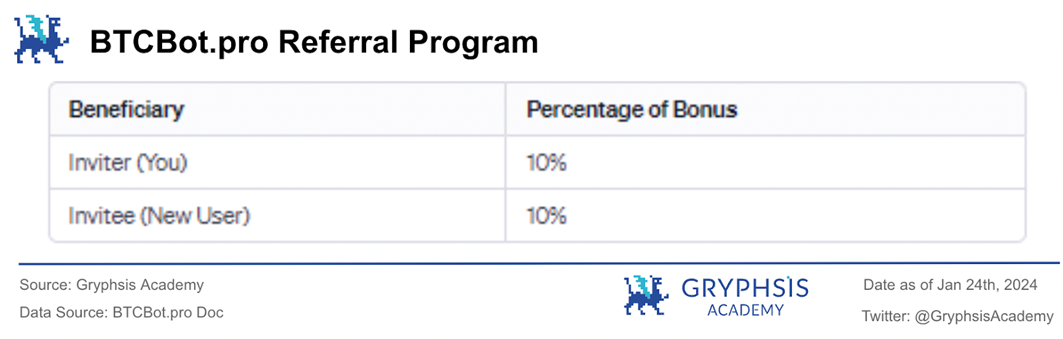

The referral program allows inviters to receive a 10% fee reduction when new users use their referral code.

This represents a minimum fee reduction of 60%.

50% of trading fees will be distributed to holders holding 200 $BPIX or more.

5.3 Future prospects

(1) The impact of Nakamoto upgrade and Bitcoin halving

The inscription market is expected to remain popular until Bitcoin undergoes the Nakamoto upgrade and the upcoming halving event. This gives trading platforms like BTCBot.pro huge room for growth, especially in terms of attracting new users and increasing trading volume.

(2) Development of order book function

BTCBot.pro’s roadmap states that its goal is to implement order book trading functions in Telegram Bot. This move will not only facilitate users to trade, but will also significantly increase liquidity in the BRC 20 token field.

By implementing this feature, BTCBot.pro is expected to gain more competitive advantages in the market, especially in terms of user experience and transaction efficiency. In addition, the addition of order book trading functionality will make the platform more attractive and attract more users and investors to participate. As liquidity increases, BTCBot.pro may also become a pioneer in the BRC 20 field and further consolidate its market position.

Finally, the development of this feature will need to consider the convenience of the user interface, the security of transactions, and the stability of the system to ensure a high-quality service experience.

(3) Development of Copytrading functions

The launch of smart money monitoring and follow-up functions mentioned in the project will be key. These features can not only increase the appeal of the platform, but also provide novel gameplay in the Brc-20 market, attracting more professional investors and daily users.

(4) Support for more protocols

The most popular protocol in the BTC ecosystem currently is BRC 20, butARC 20 , SRC 20, Runes and other standards are also constantly developing, and the NFT field is also constantly advancing. The development of the BTC second-layer network has also been attracting the attention of BTC OG and developers, and more types of assets are following up with more protocol standards. This is also the focus of BTCBot.pro’s future efforts.

6. Summary

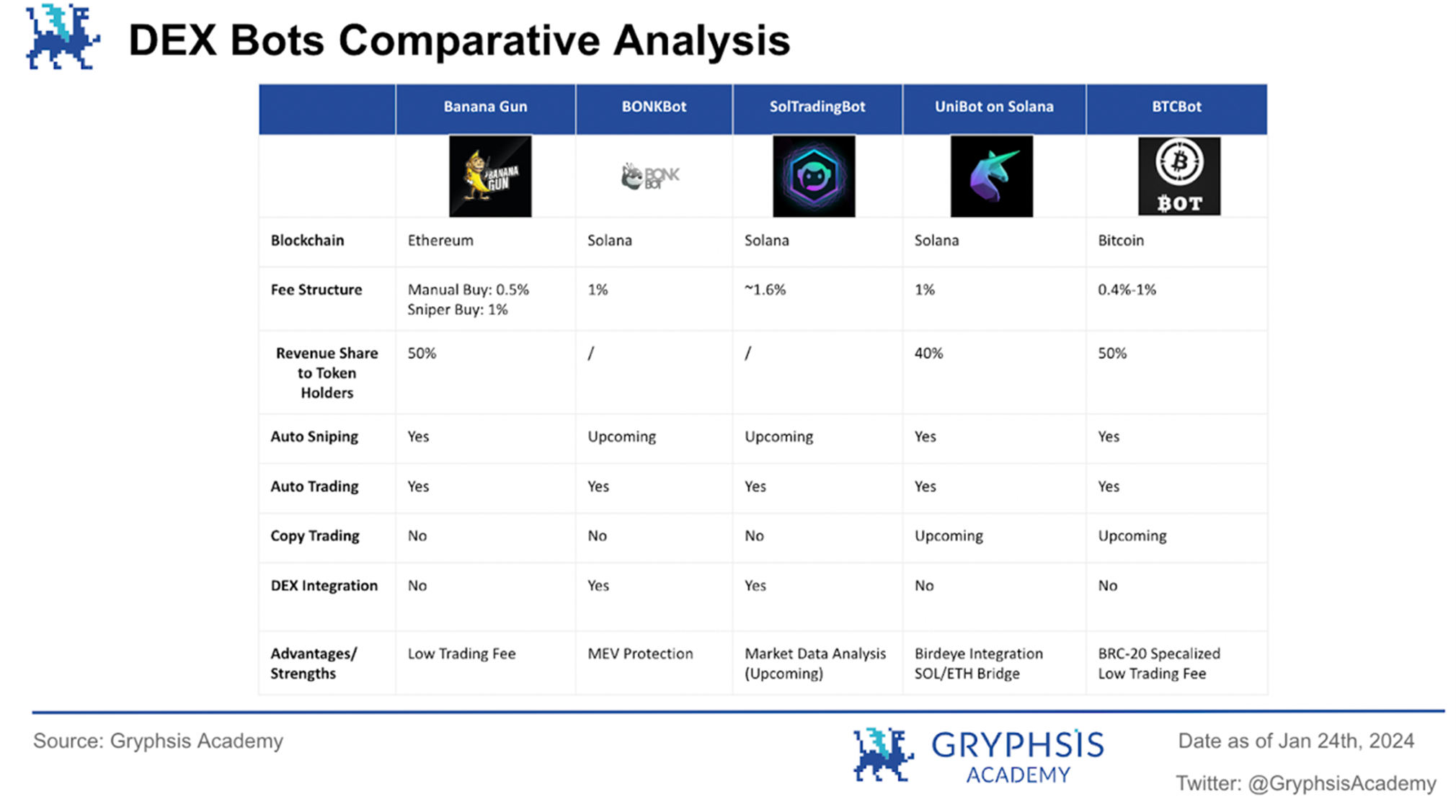

Although each Telegram Bot project has a different positioning and targets different blockchains and markets, we still want to examine each project by comparing some Telegram Bot performance standards.

6.1 Fee structure

In terms of fee structure, BTCBot.pro offers more flexible options and discounts on trading fees based on more work, more gain, making it one of the most cost-effective options. In comparison, Banana Guns manual trade also offers an affordable option at 0.5%.

For example, if a user trades 20 ETH worth on Banana Gun and the trade breaks even (i.e. 20 ETH each for buy and sell), they will be charged a fee based on the total transaction volume. On UniBot or Bonk Bot, users need to pay 0.2 ETH respectively when buying and selling, for a total fee of 0.4 ETH. On Banana Gun, whether buying or selling, you only need to pay 0.05 ETH each time, and only 0.1 ETH in total. In comparison, SolTradingBots 1.6% trading fee makes a more significant difference when buying and selling.

This significant difference in fee structure highlights the huge competitive advantage of Banana Gun and BTCBot.pro for cost-effective users. Considering that traders are likely to make multiple trades over a long period of time, this difference in fees can potentially save users a lot of money over time, which is the main reason why they are more popular than other options.

6.2 Blockchain technology

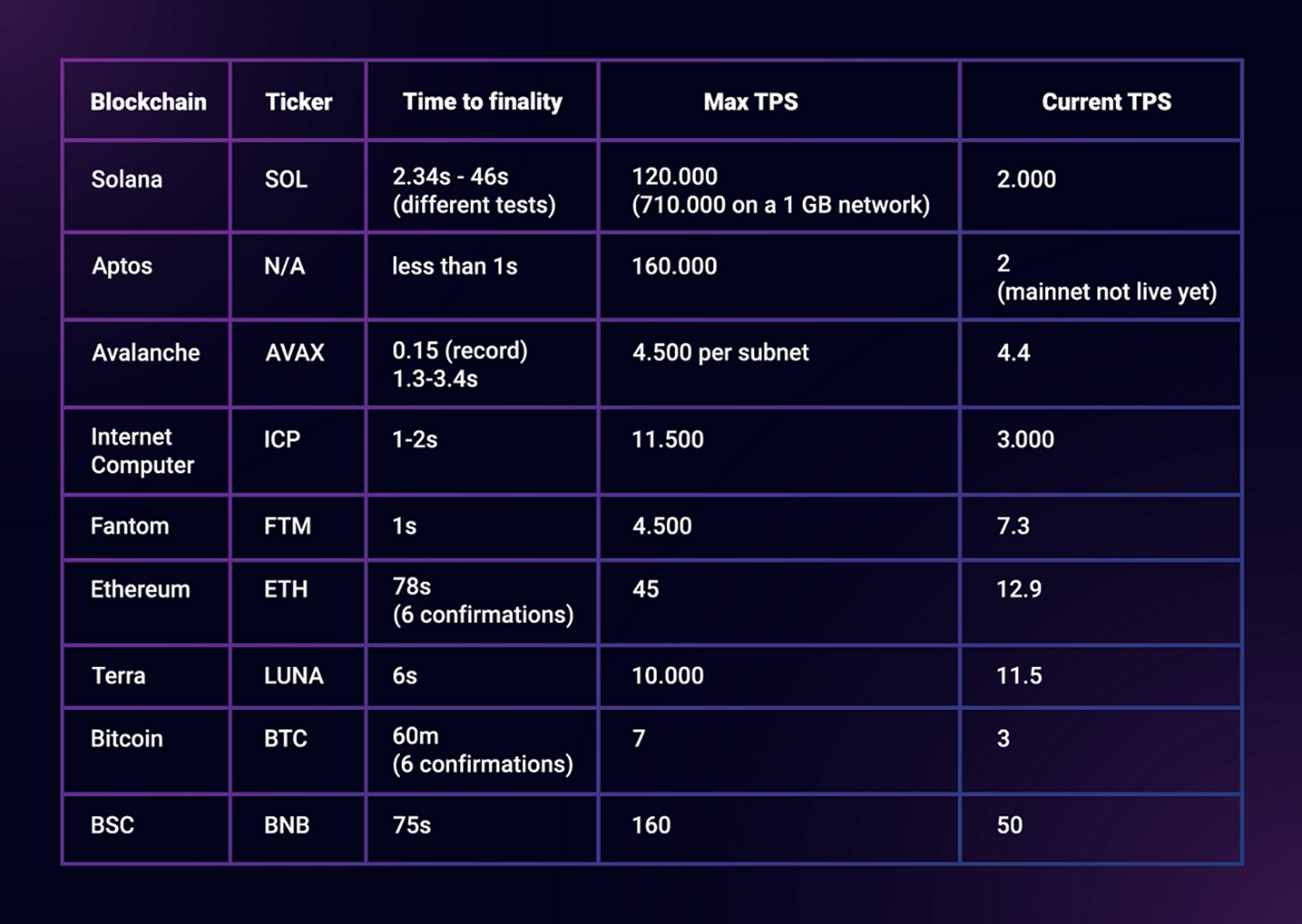

As mentioned above, the Solana blockchain has become a popular Telegram Bot center recently. The key reason is that Solana is known for its high throughput (high transaction speed per second, TPS) and can handle a large number of small asset transactions, which makes There is greater liquidity and turnover of funds. This is a significant advantage for those users who use trading robots for high-frequency trading.

Source: Medium @Pontem Network

Compared with Ethereum-based Banana Gun, the high TPS provided by Solana is not only suitable for investors with large trading volumes, but also particularly suitable for retail investors with smaller funds. Due to the high gas fees of the Ethereum network, Solanas low transaction fee structure allows small investors to conduct more frequent transactions without having to worry about high fees, thereby capturing market value more effectively.

Therefore, using these advantages of Solana can attract a wider user base, especially retail investors who are interested in high-frequency and hot transactions, further improving its market competitiveness and attractiveness.

6.3 Integration of decentralized exchanges

By integrating robots with decentralized exchanges, liquidity can be significantly improved and slippage reduced, ensuring accurate execution of robot functions. For example, this combination can ensure that limit orders set by the robot can more accurately capture market prices.

The Telegram Bot field is still in its infancy, with a market capitalization of approximately $337 million. Compared with the related field of decentralized exchanges, its market value is as high as US$15.52 billion, which is nearly 50 times the market value of Telegram Bot. As the market matures and combined with Telegrams huge user base, the development potential of Telegram Bot is extremely broad.

[Statement] This report is produced by@GryphsisAcademystudents@ChingChaLong 02 , in tutor@Zou_Blockand@ErjiuethOriginal works completed under the guidance of. The authors are solely responsible for all content, which does not necessarily reflect the views of Gryphsis Academy, nor the views of the organization that commissioned the report. Editorial content and decisions are not influenced by readers. Please be aware that the author may own the cryptocurrencies mentioned in this report. This document is for informational purposes only and should not be relied upon for investment decisions. It is strongly recommended that you conduct your own research and consult with an unbiased financial, tax or legal advisor before making any investment decisions. Remember, the past performance of any asset does not guarantee future returns.