Original author: CapitalismLab

There are endless Eigenlayer LRTs out there. Which one should you choose to get the most benefit? What strategy is best for my needs? Eigenlayer will briefly open LST deposits on February 5th, it’s time to make a decision!

This article will comprehensively compare various LRTs, analyze the characteristics of each major project, and provide seven distinctive strategies to help you create unlimited possibilities with the limited ETH in your hands.

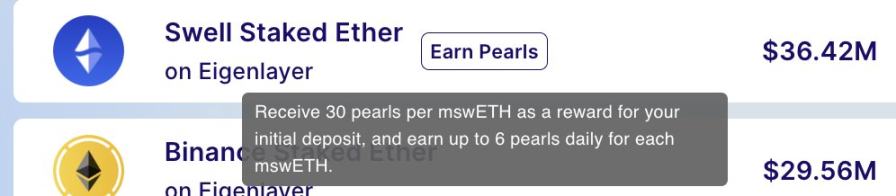

1. Eat three things out of one fish: swETH+ Eigenpie

Deposit swETH to Eigenpie:

Eigenpie points correspond to 10% of the total amount airdrop + 24% IDO 3 million US dollars FDV - Swell pearls correspond to 7% of the total amount airdrop;

Airdrop of Eigenlayer points;

You can win two of the Big Six at once, and both sides can get full benefits. In the future, mswETH can continue to earn more profits by using Pendle or other platforms. The feature of this strategy is the ultimate points for one fish to eat more.

It should be noted that Eigenpie is a fleet mode, the larger the fleet, the higher the increase.

2. Follow Binance: Puffer+stETH

Puffer Finance has received double investment from Binance Labs and Eigenlayer. The community generally believes that the expectations for listing on Binance are high, and TVL is currently growing rapidly.

Puffer mainly focuses on Anti-Slash LRT. There are also some technical features that need special attention. Because Puffer Mainnet has not yet been launched, the current pre-mainnet activity only supports stETH. However, stETH has a high probability of touching the 33% upper limit of a single LST set by Eigenlayer, which means Unit ETH can only obtain fewer Eigenlayer points.

Therefore, the focus of this strategy is to play Puffer on Binance, but there may be certain disadvantages in obtaining Eigenlayer points.

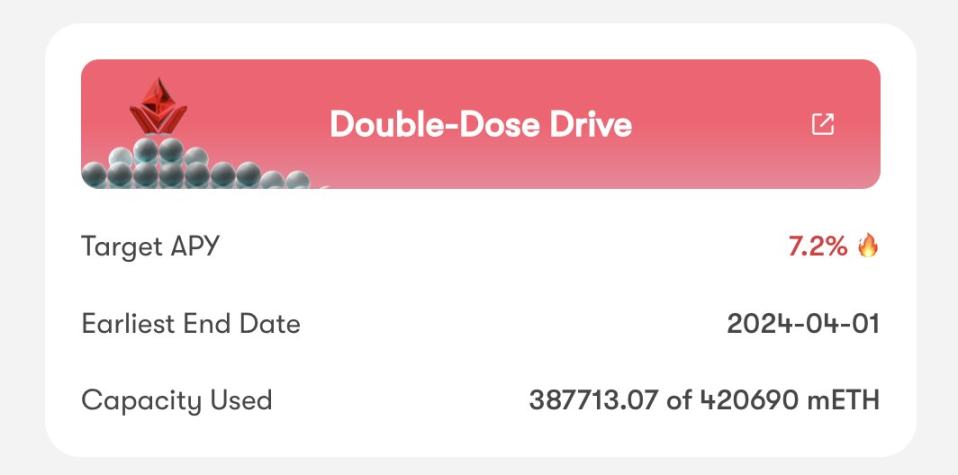

3. Surprisingly honest: mETH+Eigenpie

Subsidized by Mantles treasury, mETHs 7.2% APR is more than twice that of other LSTs and will last until April 1st. The basic income is high, plus

Eigenpie has many benefits and high ceilings.

Therefore, the characteristic of this strategy is that it can be surprisingly upright, and it can not only obtain deterministic high returns, but also benefit from LRTs surprises.

For mETH, you can go to Mantle’s official website Mint. If you reach the upper limit, you can also try to use stETH on NativeX to exchange without slippage. It should be noted that Eigenpie is a fleet mode, the larger the fleet, the higher the increase.

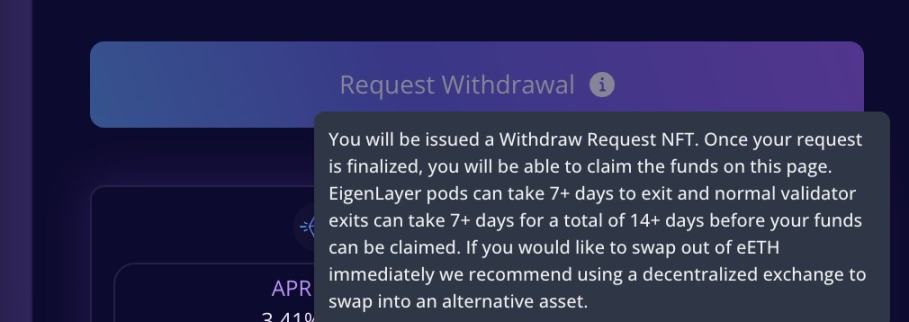

4. Leave a way out: EtherFi

Compared with other projects that generally only support DEX Swap back to ETH, EtherFi is currently the only one that supports unstake. Users can not only return ETH through DEX Swap, but also unstake 1:1 to redeem ETH. The waiting time may be 7+ days to 14+ days. .

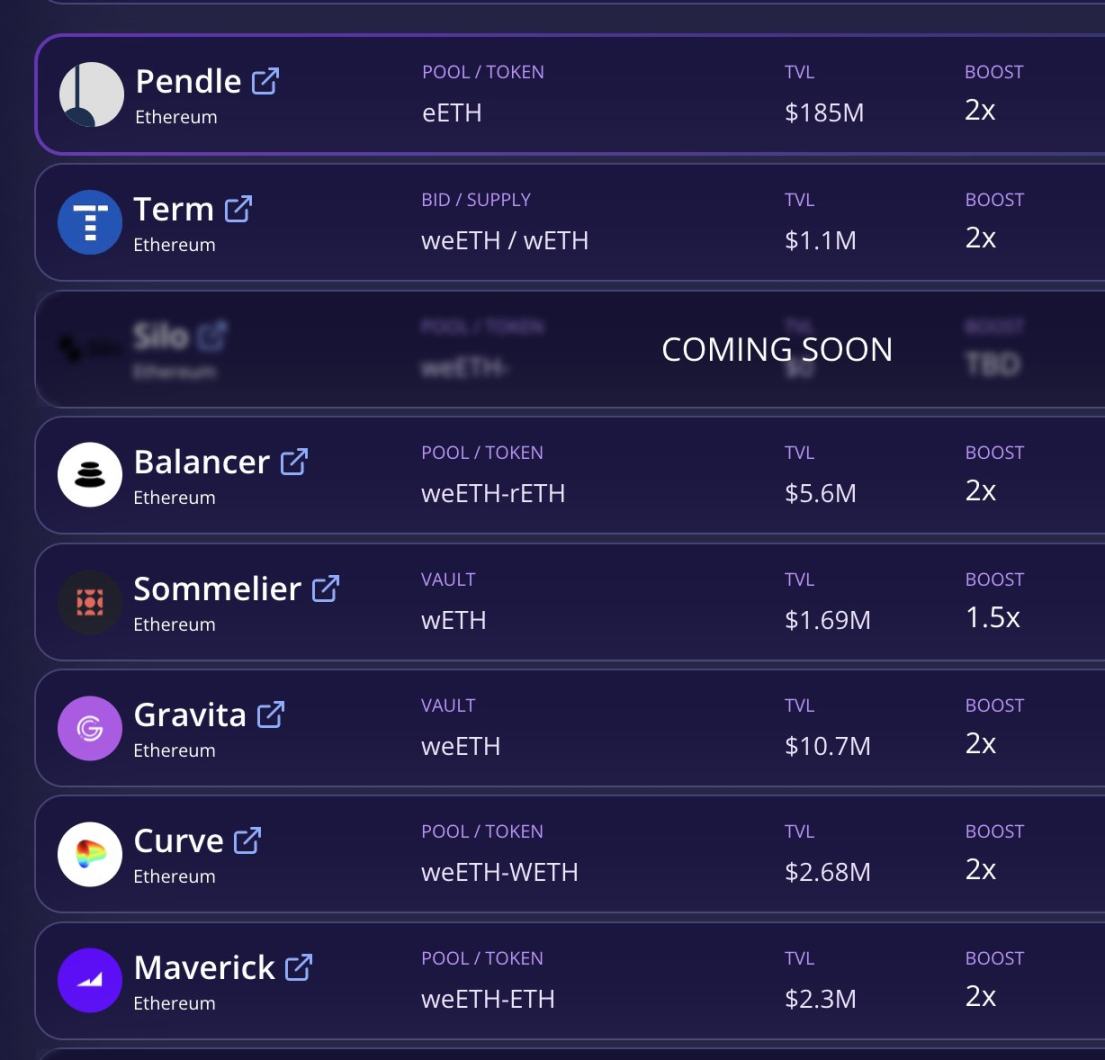

In addition, EtherFi can currently earn double points when combined on DeFi such as Pendle, as well as the incentives of these DeFi itself.

EtherFi has been relatively ambiguous about airdrops before, and the projects own airdrop income is highly uncertain. Therefore, this strategy is characterized by users with higher liquidity needs and lower depeg loss tolerance, and users who have higher liquidity requirements than LRT airdrops. Users who care about the Eigenlayer airdrop can exit at a low loss when they need liquidity.

EtherFi is also holding a MegaWeek event this week. You can get 5 times the EtherFi one-time deposit points by depositing using the invitation link, and you can also participate in sharing the additional reward of 1M Eigenlayer points.

5. Lock in profits (Pendle buys PT) or 6. Small stakes gambling (Pendle buys YT)

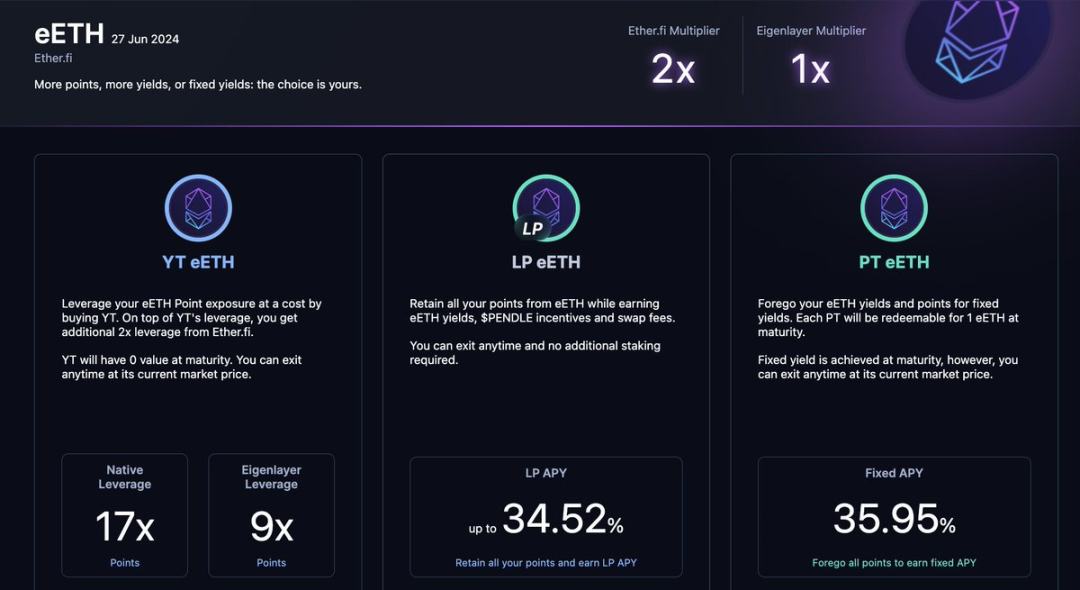

Pendle launches LRTExclusive page. It can be seen that for every 1 YT eETH, you can get 17 eETH of EtherFi points and 9 eETH of Eigenlayer points, and the PT fixed interest rate is 36%.

That is to say, if you buy PT, it means giving up all points income and staking income, and you can obtain 36% APY on eETH until the expiration date of June 27.

If you buy YT, it is equivalent to opening a 10x leverage to mine points. If the final income from these points is less than 36% APY, then you will return your capital. If it is greater than 36% APY, you will make money. For the specific calculation formula, seehere。

Currently, EtherFi/KelpDAO/Renzo are all listed on Pendle, but the rules are different. It is recommended to fully understand before operating.

7. Bold operation: buy and lock vlPNP/vlEQB and vote to earn points as bribes

Currently, due to the large number of listings to Pendle, various companies have also given bribe points to Penpie and Equilibria.

How to tell if its worth it? Voting is once a week, so you can calculate how many points you can get per day for 1 PNP/EQB, and then look at how many points you can get per day for 1 ETH, and you will have an idea. According to previous calculations by various experts, the efficiency is generally more than ten times to dozens of times.

However, please note that this vote can only obtain LRT points, not Eigenlayer points. The mechanism is complex and involves large losses and liquidity risks. It is not recommended for people who are not familiar with Pendle and Convex flywheel gameplay.

Summarize

Market situation:

EtherFi / KelpDAO / Puffer / Renzo / Eigenpie / Swell six giant pattern;

stETH has a high probability of hitting the single 33% upper limit set by Eigenlayer and will earn fewer points;

Features of each project:

Eigenpie: The best benefits, the highest income certainty and ceiling;

Puffer: has the best background and the highest expectations for listing on Binance;

EtherFi: The largest scale, the best liquidity, and already supports unstake;

KelpDAO: second in scale, launched by LST team Stader;

Renzo: Supported by Chinese capital such as OKX/SevenX, Native LST;

Swell: LST+LRT, which can be combined with Eigenpie to form triple points mining;

At present, the six companies either have well-known investors or are originally launched by well-known and proven teams, so anyone who is interested can test the waters, but there may still be pitfalls.

Seven distinctive strategies:

1. One fish, three eats: swETH+Eigenpie, swell+Eigenpie+Eigenlayer triple points;

2. Following Binance: Puffer has received dual investment from Binance Labs and Eigenlayer, and the community generally believes that the expectations for listing on Binance are high;

3. Surprisingly conservative: mETH+Eigenpie, mETH 7.2% APR is more than twice that of other LSTs, the basic income is high, Eigenpie has many benefits and a high ceiling;

4. Leave an exit path: EtherFi supports unstake, and large amounts of funds can be exited smoothly with low losses;

5. Lock in income: Pendle buys PT, gives up points and enjoys fixed high income;

6. Small-amount gaming: Pendle buys YT, which is equivalent to increasing leverage gaming points by more than ten times;

7. Bold operation: buy and lock vlPNP/vlEQB and vote to earn points as bribes;