The U.S. economy is off to a good start in 2024. Although the rise in CPI may lead to a delay in interest rate cuts, the openness reflected in the beautiful economic data in the United States has brought sufficient confidence to the market (especially consumers). U.S. stocks continued to reach new highs in January, and technology stocks (AI) regained market focus, but Tesla suffered its first decline in gross profit in many years; Asia-Pacific stock markets performed brilliantly, and European stock markets fluctuated steadily. The Bitcoin ETF passed as expected, but the crypto market was briefly under pressure due to Grayscale selling pressure. However, with the reduction of selling pressure, the market is now stabilizing with some rebound.

On January 5, the first important economic indicator of the new year in the United States was announced: U.S. non-farm employment increased by 216,000 in December (estimated increase of 175,000), of which private sector non-farm employment increased by 164,000 (estimated increase of 175,000). (estimated to be an increase of 130,000 people), far exceeding market expectations. A good start to the new year, which undoubtedly gave investors the first shot of blood in the new year.

However, the hot employment data also brought inflation concerns to the market. Data released by the U.S. Department of Labor on the 11th showed that the U.S. CPI rose by 3.4% year-on-year in December last year, which expanded from the 3.1% increase in the previous month, exceeding the expected 3.2%, and well above the 2% inflation target set by the Federal Reserve. . At present, although inflation has picked up, almost no one expects to continue to raise interest rates. Most market views believe that interest rates will be cut later than expected.

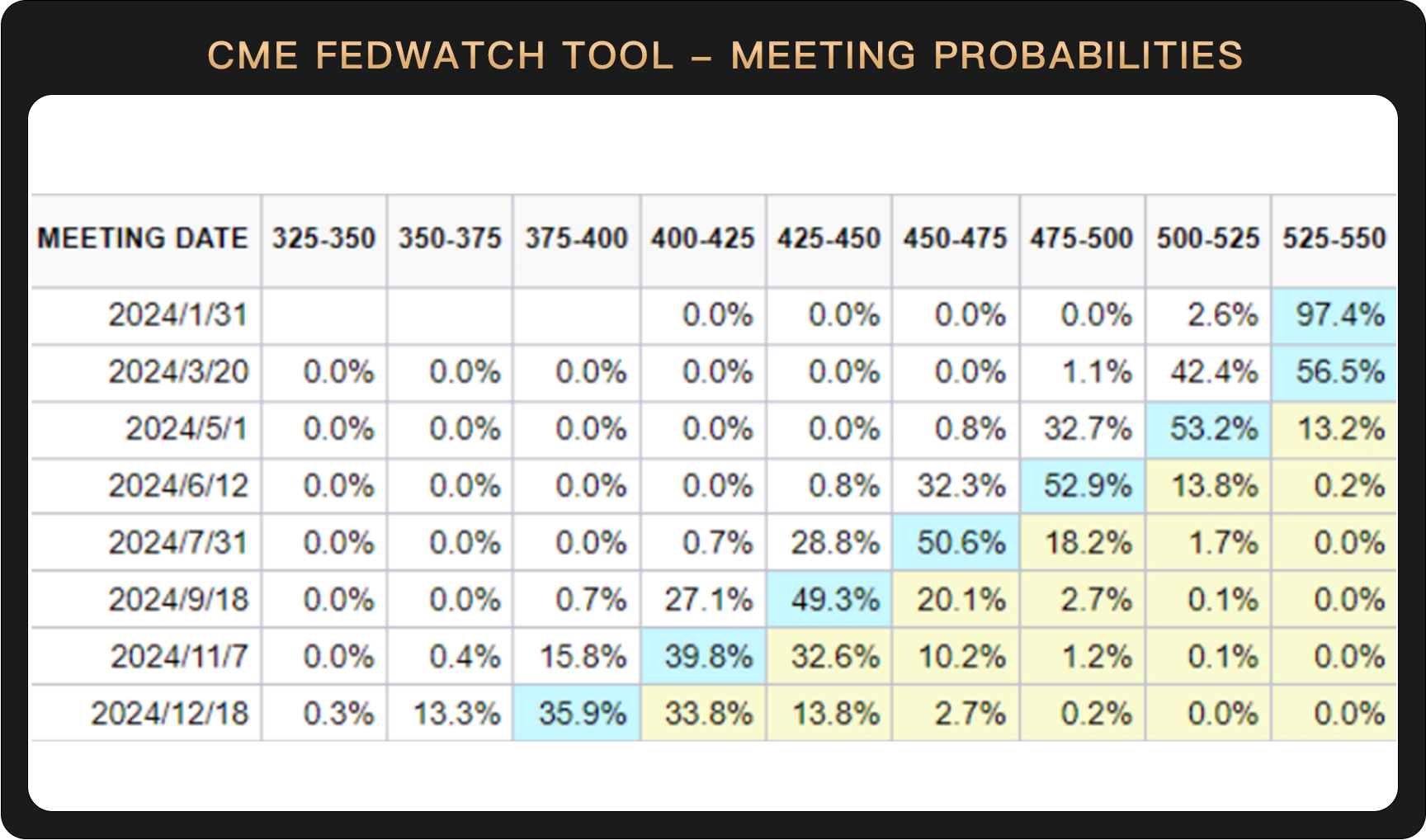

In last months CME FEDWATCH TOOL table, markets priced in a 75.6% chance of a rate cut to 5% to 5.25% at the March 20 Fed meeting. Now, however, the expected probability of a rate cut in March has dropped to 42.4%, with the market generally expecting a rate cut to be unlikely until mid-year.

In fact, it can also be seen from the trend of U.S. debt that the market is already aware of the rise in CPI. Throughout January, the U.S. ten-year Treasury bond was basically on a steady upward trend.

In fact, it can also be seen from the trend of U.S. debt that the market is already aware of the rise in CPI. Throughout January, the U.S. ten-year Treasury bond was basically on a steady upward trend.

The eye-catching non-farm payroll data and rising CPI may mean that the U.S. economy continues to remain relatively strong. As expected, the Markit manufacturing index released on January 24 also greatly exceeded market expectations: the preliminary US Markit composite PMI value in January was 52.3, higher than the expected 51. Among them, the initial value of Markits manufacturing PMI was 50.3, a new high since October 2022, which was much higher than the expected 47.6. The higher-than-expected PMI shows that both the manufacturing and service industries are showing a trend of increasing orders, and companies are in a relatively good business environment.

GDP data also exceeded market expectations, with U.S. GDP growing at an annualized quarterly rate of 3.3% in the fourth quarter, compared with expectations of 2%. So far, U.S. GDP growth has reached 2.5% for the whole year.

The state of the economy is reflected not only in the stronger-than-expected economic statistics, but also in the rise in the U.S. consumer confidence index in January. Among them, the University of Michigan’s confidence index hit a new high in a year and a half.

The Dow hit an all-time high last month, and the SP 500 followed suit this month, reaching a new all-time high, surpassing the previous high of January 4, 2022. Currently, only the Nasdaq among the three major U.S. stock indexes has not reached a new high and is only about 5% up from its new high. However, the Nasdaq 100 Index has already achieved a new high ahead of the Nasdaq.

The market focus returned to technology stocks - Nvidia and Microsoft once again hit record highs. The AI wave is a human revolution that will last for years or even decades. This is now a comprehensive consensus in the market. Looking back on 2023, the big 7 US stocks have all experienced gratifying gains, becoming the largest carrier of alpha returns in the market - Apple rose 49% for the year, Google rose 58%, Microsoft rose 58%, Amazon rose 80%, Meta rose 194%, Nvidia rose 239% and Tesla rose 101%.

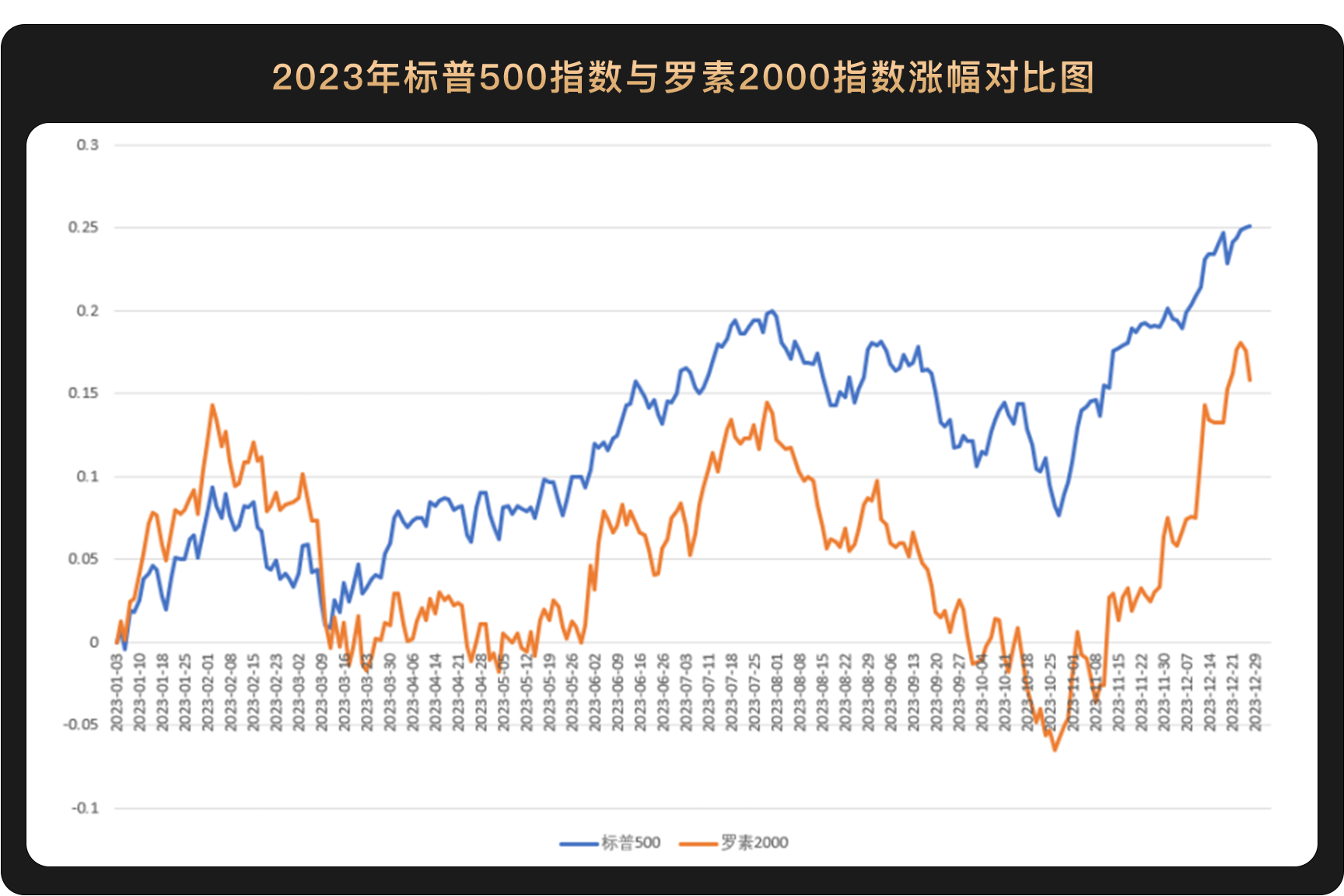

Institutional preference for large-cap stocks was a very significant market style in the U.S. stock market last year. When we compare the SP 500, a representative index of large-cap stocks, with the Russell 2000, a representative index of small-cap stocks, it can be clearly seen that large-cap stocks have a stronger trend than small-cap stocks. On the one hand, last year the market continued to live in response to the Federal Reserve’s interest rate hikes, and large-cap stocks with “outstanding performance” (especially the big 7 with clear expected support from AI) had extremely high risk-averse properties; on the other hand, as the market began to Turning to expectations of interest rate cuts, if the U.S. economy can achieve a soft landing this year and continue the prosperity at the beginning of the year, then small-cap stocks may win annual alpha. After all, the weighted price-to-earnings ratio of the Nasdaq 100 index is currently around 87% of history. Otherwise, funds may continue last years risk aversion and continue to be conservative.

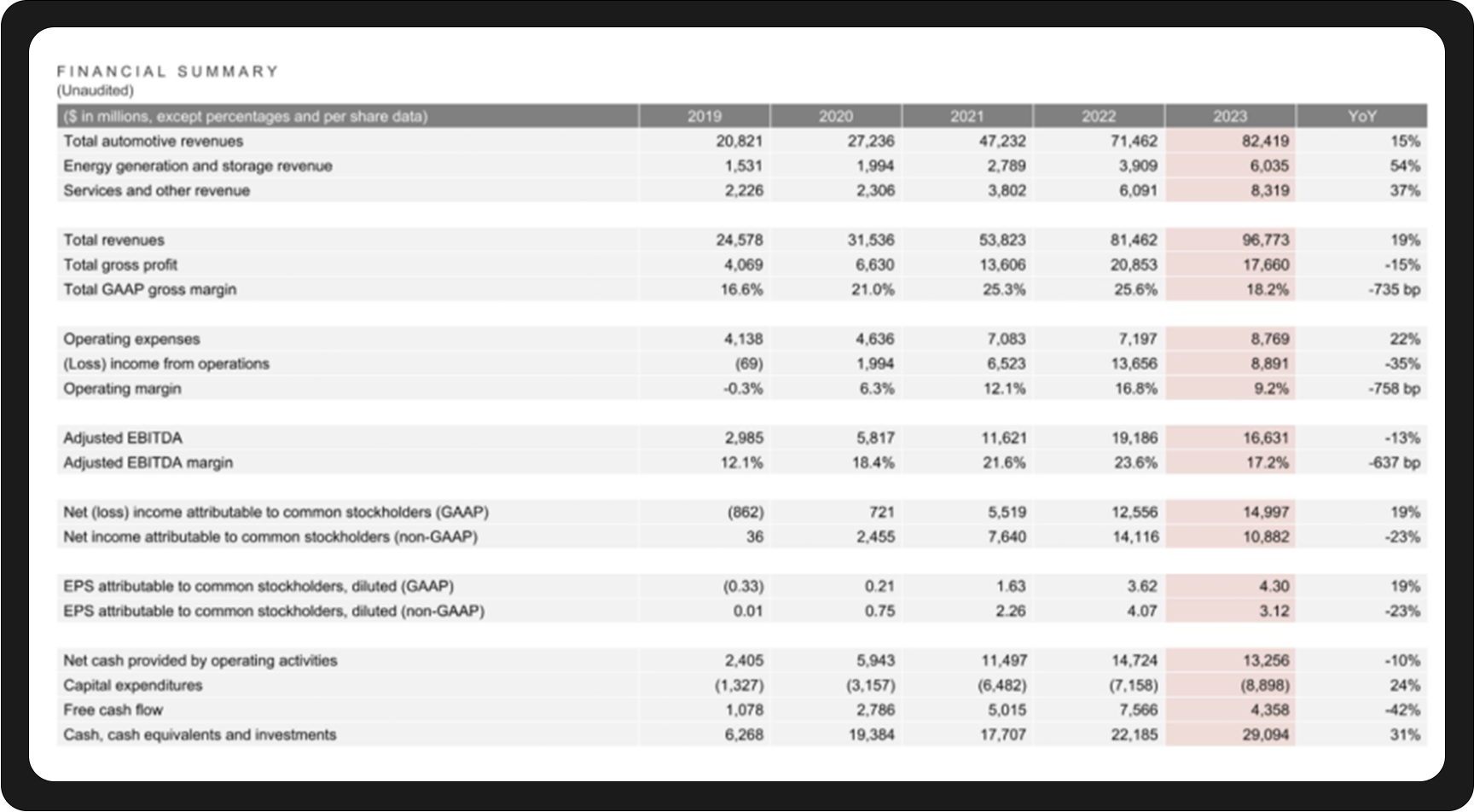

It is worth noting that although Nvidia and Microsoft have both reached record highs, Tesla has experienced a continuous decline. On January 25, it even exited a gap and opened lower, with a drop of more than 12%. The reason is straightforward - Teslas title of global electric vehicle hegemon is being taken away by the Chinese company BYD. Data released at the beginning of the month showed that Tesla delivered 484,500 vehicles in the fourth quarter, exceeding market expectations, but not as good as BYDs delivery of 526,400 pure electric vehicles in the same period. The financial report released after the market closed on the 24th illustrates the problem: Total gross profit in 2023 dropped for the first time in many years, down 15% from 2022, and cash flow also dropped by 42%.

Other markets also had positive performances in January, notably Japan and India. Mumbais Sensex 30 index reached a maximum of more than 73,400 points this month, once again hitting a record high; Japans Nikkei 225 index is approaching 37,000 points, very close to 38,957 points in 1990, striving to regain the lost thirty years; Germany DAX and French CAC 40 are currently trading sideways at a high level, and there are no obvious technical risks.

As expected, on the 11th of this month, the spot ETFs of 11 companies were collectively approved as scheduled. From this moment on, ordinary U.S. stock investors can bypass the complex wallets and exchange mechanisms of the crypto world and purchase Bitcoin assets like stocks, which will undoubtedly bring a large amount of incremental assets to the crypto market.

However, just when everyone thought Bitcoin would be bullish due to this, the crypto market fell into a bear market. In fact, the reason for the market decline is very direct-early buyers of Grayscale GBTC are selling.

Grayscale has been an important representative of buying institutions in the crypto world since its birth. It is also one of the largest crypto “big whales” and has been providing investors with compliant cryptocurrency investments in the form of trust funds for many years. channel. Initially, Grayscale provided the market with a no-threshold Bitcoin investment method in the form of private equity funds. Users can directly invest in purchasing GBTC, or transfer Bitcoin to Grayscale in exchange for an equal amount of GBTC shares (in kind). Due to the long-term premium of GBTC, this has led to the participation of many arbitrageurs, who can instantly obtain the same income as the premium by making physical investments. However, in 2014, Grayscale suspended the redemption mechanism of GBTC, resulting in investors being unable to redeem. Since then, Grayscale has been only buying but not selling.

Today, Grayscale’s GBTC has been successfully converted into an ETF, and early investors can sell their previous shares through ETFs. These early investors were eager to redeem their shares due to their huge profits and long-term inability to redeem them, resulting in huge market selling pressure. It can be seen from Grayscale’s positions that Grayscale’s large-scale reduction of positions started on the 11th.

Therefore, in a sense, the current selling pressure in the market comes from the early old money and cannot represent the crypto circles view of the market, let alone the thoughts of Bitcoin ETF investors who are new to the market in this cycle. In fact, it can also be seen from the positions that, except for Grayscale, the other Bitcoin ETFs are bargain hunting.

Since the reason for the market pressure is clear, all we need to do is estimate when the selling pressure will end. JPMorgan Chase had previously estimated that net outflows from GBTC would reach approximately $3 billion. In the latest research report of JPMorgan Chase on the 24th, it was stated that “Considering that GBTC’s net outflow has reached US$4.3 billion, we conclude that GBTC’s profit-taking stage has been basically completed, which means that its interest in Bitcoin The downward pressure should have basically ended. JPMorgan Chase believes that selling pressure has been sufficiently relieved at this time. Affected by this news, the price of Bitcoin began to stabilize around $40,000 to $41,000 and showed a certain degree of recovery.

The short-term trend of prices will be affected by various events, but the hard logic of launching a bull market - the influx of incremental funds - is obvious. ETFs provide retail investors and institutions with a more convenient way to purchase Bitcoin. Therefore, we still have great confidence in the occurrence of the 2024 bull market.

In the first month of the new year, friends in the stock market can feel the kindness of money, but friends in the currency market have experienced a less smooth start. At present, there are no obvious risks to the overall market liquidity, and the U.S. economy still maintains a promising trend. In this environment, it is only a matter of time before the currency circle recovers the decline caused by grayscale selling pressure and moves back to a new rising band. There is no doubt about the hard logic of incremental funds, so after this cold January, a warm spring will definitely usher in.

Copyright statement: If you need to reprint, please contact our assistant WeChat (WeChat ID: hir 3 po). If you reprint or clean the manuscript without permission, we will reserve the right to pursue legal responsibility.

Disclaimer: The market is risky, so investment needs to be cautious. Readers are requested to strictly abide by local laws and regulations when considering any opinions, views or conclusions in this article. The above content does not constitute any investment advice.