1. Introduction

Launched in late 2021, Berachain is an EVM-compatible L1 focused on DeFi, built on the Cosmos SDK, and adopts a Proof of Liquidity (PoL, Proof of Liquidity) consensus mechanism.

Development History

Berachain is a meme chain that originated from Smoking Bears NFT, which can be traced back to the Bong Bears series of NFTs launched in August 2021. Afterwards, the NFT rebase released new collections of Boo Bears, Baby Bears, Band Bears and Bit Bears.

After experiencing the bulls and bears in the currency circle, the core members of the Berachain team deeply feel that liquidity is of great significance to DeFi. Compared with decentralization, scalability, security and interoperability, liquidity is the foundation of all this. The team decided to design their own L1 public chain based on the advantages of once successful Defi projects and avoid their shortcomings, so Berachain was born. Subsequently, the Berachain team designed the verification mechanism of Proof of Liquidity, which also indirectly laid the foundation for Berachain’s three-token model.

On November 28, 2023, Berachain started internal testing.

On January 11, 2024, the day the Bitcoin spot ETF was approved, the Berachain public test network Artio was officially announced. According to official news, more than 30 native protocols are under development, and other network protocols such as Pendle, Redacted, Sudoswap, Abracadabra, etc. are also planned to be deployed on the Berachain test network and main network.

According to rumors, Berachain will be launched on the mainnet in Q2 2024.

Financing situation

On April 20, 2023, Berachain received US$42 million in financing led by Polychain, with participating institutions including Hack VC, OKX Ventures, etc., with a valuation of US$420 million.

Team background

Berachain was established by an anonymous team. The co-founders are Smokey the Bera, Papa Bear, Homme Bera and Dev Bear. The recently joined Vice President of Engineering Baloo the Bera (former engineering director of Mysten Labs), other team members are unknown. Most of the project team members are early people who came into contact with and invested in encryption around 2015, and have a deep understanding and research on the development of DeFi and public chains. Although it is an anonymous team, its ability to obtain US$42 million in financing shows that it has rich connections and resources in the encryption field.

2. Mechanism Interpretation

According to Lianchuang Smokey the Bera, Berachain was built to solve the problem of on-chain liquidity. If a chain loses liquidity, it will soon become a ghost town. This is the conclusion reached by the Berachain team after experiencing DeFi Summer.

Lets take a look at how Berachain solves the liquidity problem on the chain through clever design.

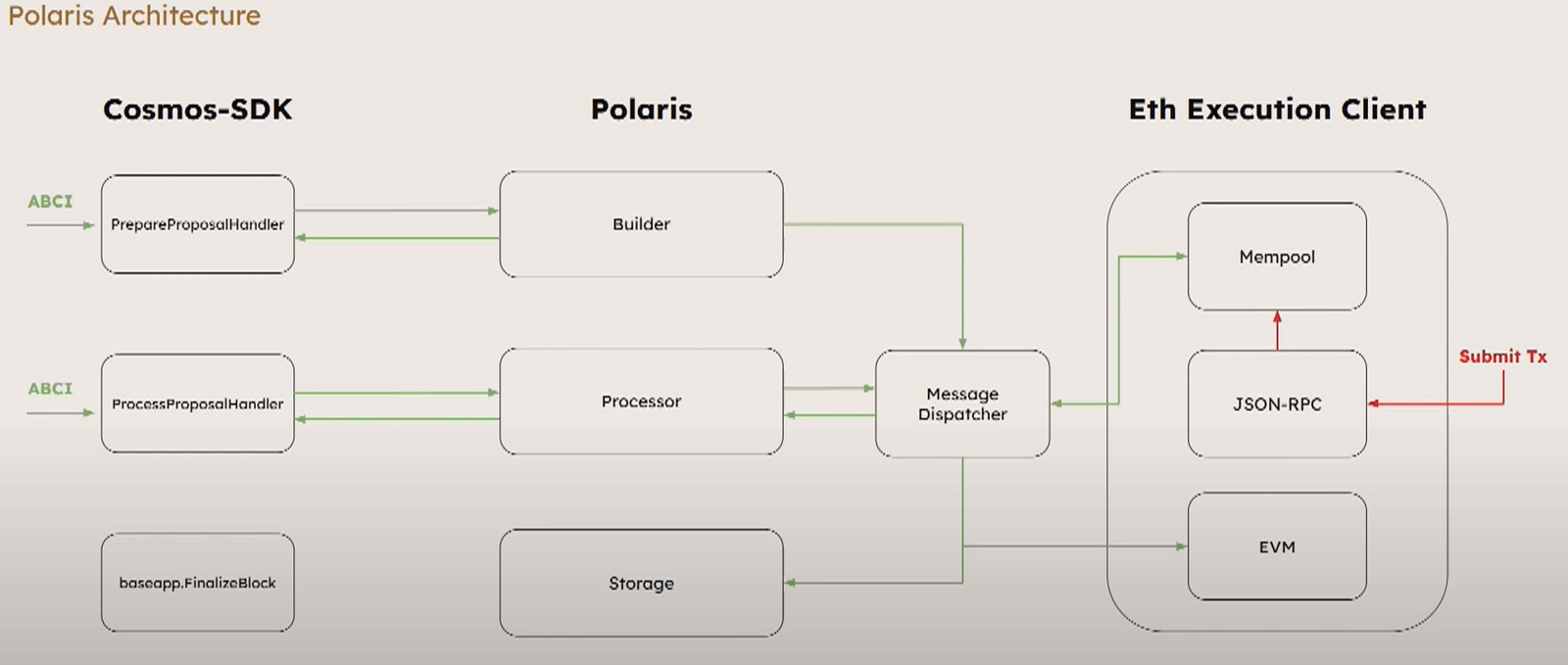

Polaris EVM

Berachain is built on Polaris EVM, its underlying operating system for EVM built on top of the Cosmos SDK. Polaris uses messaging to connect EVM and Cosmos SDK, separating block construction, processing, and storage from execution. Polaris EVM also provides developers with state precompilation and the creation of custom modules, which developers can use to create more efficient and powerful smart contracts.

What are the advantages of using the Polaris EVM framework?

1) Ethereum is developer friendly

Berachain is compatible with EVM and is friendly to Ethereum developers, making it easier to attract developers from other EVM chains.

2) Strong cross-chain interoperability

As a Cosmos sub-chain, Berachain naturally cannot do without the support of IBC. As the most powerful cross-chain communication protocol, IBC eliminates obstacles for liquidity from other networks to flow into Berachain.

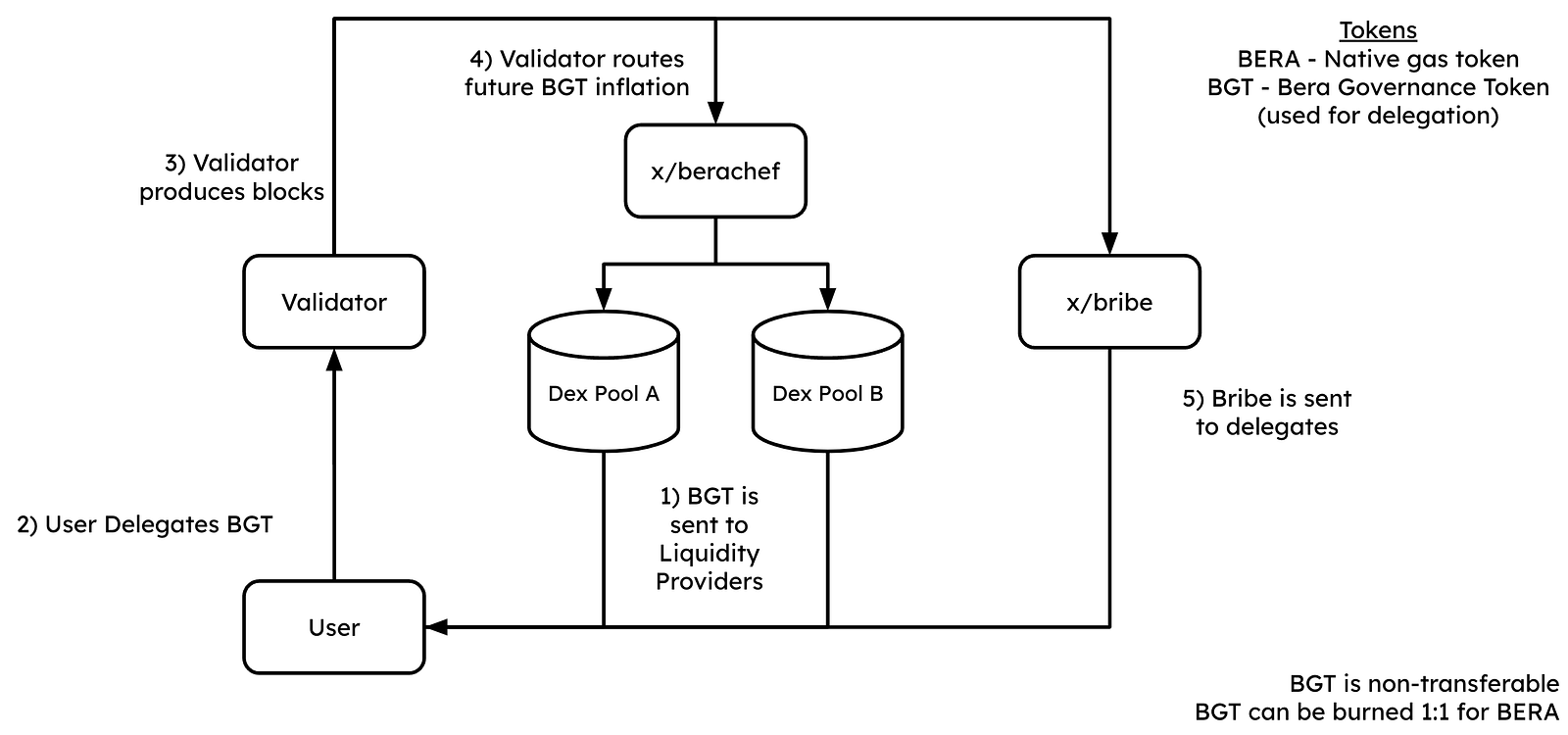

PoL proof mechanism

Using the PoL mechanism to introduce some mainstream asset liquidity into Berachain is the teams direction to solve the liquidity problem.

The PoL proof mechanism is shown in the figure above:

1) Users provide liquidity to the BEX (Berachain native DEX) pool to obtain BGT, which is a governance token. The detailed introduction of BGT is in the Three Token Model section;

2) The user entrusts BGT to the verifier, and the verifier generates blocks based on the BGT proportional weight entrusted by the user;

3) The principal and the verifier receive rewards (BERA and HONEY) from the chain in turn;

4) Validators can vote on the inflation of BGT in any liquidity pool;

5) Bribes are distributed from validators to their delegators.

What are the advantages of PoL compared to PoS?

1) Incentivizes liquidity and improves security

The only way to earn the governance token BGT on Berachain is to provide liquidity to BEX. Not all tokens can be pledged, which enhances security and incentivizes liquidity. The traditional PoS mechanism to improve on-chain security may lead to a reduction in liquidity.

2) Inflation is more decentralized

For PoS public chains like Ethereum, the only way to increase token issuance is to release it to ETH pledgers. In the PoL mechanism, BGT will not be allocated directly to validators, but to the liquidity providers of some assets, so that additional tokens will not be released only to holders of a single token. The new token inflation is fairer than the traditional PoS network and solves the equity concentration problem of the PoS mechanism.

3) Coordinates the relationship between asset issuance protocols and verifiers

The PoL mechanism incentivizes protocols and validators to cooperate in order to

Allow validators to control the flow of BGT and incentivize the protocol to issue liquidity pools of assets

Let the protocol help validators gain more governance rights by bribing BGT holders

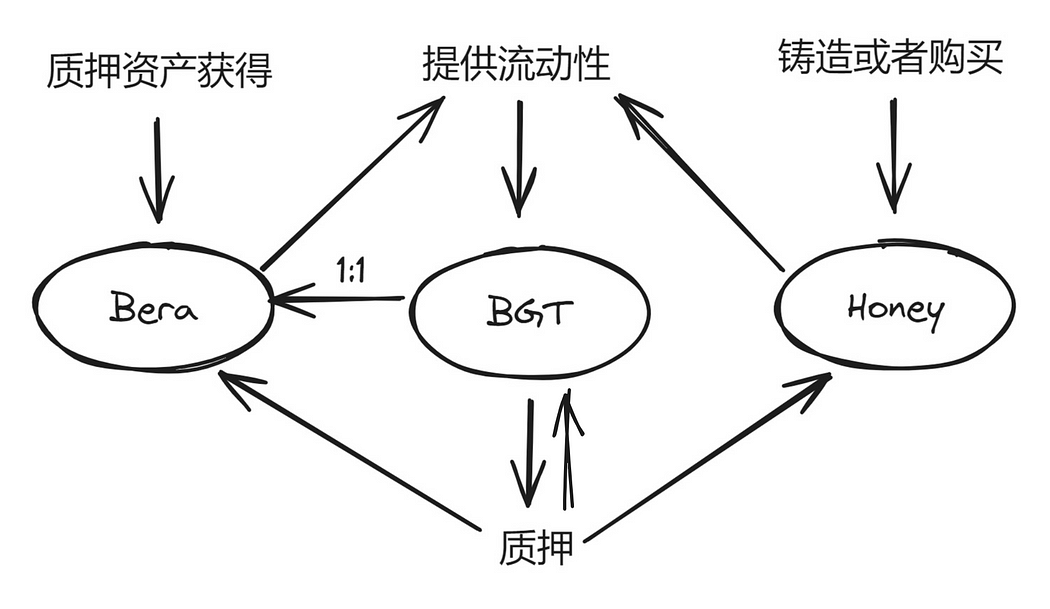

Three Token Model

Berachains three tokens are BGT (Governance Token), BERA (Gas Token) and HONEY (Stable Coin).

BGT: Governance token, non-transferable, can only be obtained through LPs that provide part of their assets on BEX.

BERA: Gas Token, rewarded or verified by BGT 1: 1 one-way burning.

HONEY: The native over-collateralized USD stablecoin is the distribution medium for protocol income.

Operation mode

Users provide liquidity (BERA, HONEY or other trading pairs) on Berachain and obtain BGT rewards

You can earn BERA + HONEY by entrusting BGT governance rights to verification nodes.

This three-token model builds liquidity more systematically, in which

The governance token (BGT) is separated from the on-chain Gas token (BERA)

The only way to obtain BGT is to provide liquidity to BEX

This means that Berachains pledge supports mainstream assets on other chains. Unlike the PoS public chain, pledge rewards can only be obtained by pledging a specific token. Berachain users have more diverse assets that can be pledged to obtain BGT, further stimulating liquidity. .

Berachains three-token model draws on the experience and lessons of many DeFi projects. For example, the decentralization of governance rights borrowed from Curve, stimulating asset issuers’ competition for governance rights; Honey borrowed from Terra’s native stablecoin concept to add more liquidity to the protocol.

3. List of important ecological projects

the honey jar

The honey jar is the entrance to the Berachain ecosystem and occupies a considerable voice in the community. It is responsible for educating users, ecological project incubation and publicity, and cooperation and matchmaking of various projects. Its web page is made into a computer desktop style, and information related to Berachain is placed in each software.

Currently the honey jar has launched Honey Comb NFT, but has not promised any specific empowerment. However, Honey Comb NFT, as an NFT project of the Berachain core community, brings together the benefits of multiple projects. Holding this NFT will have the opportunity to receive benefits such as airdrops, whitelists, APY improvements, and free NFT casting, all of which come from the Berachain ecosystem. cooperation agreement.

Also noteworthy is the project mentioned on Twitter by the honey jar and its founder Jani.

Beradrome

Beradrome is a DEX and Restaking liquidity market on Berachain, with ve (3, 3) token economics, built-in bribery, voting and other mechanisms. The team launched an NFT series called Tour de Berance a year ago, which is often nicknamed Beras on Bikes. And the team made it clear that holding this series of NFTs will enjoy rebase rights when Berachain is launched, and is expected to receive airdrops of BERO or hiBERO tokens in the future. Not only that, Tour de Berance holders have received oWIG airdrops from another project launched by the project party on the Base chain.

Beradoge

Beradoge (BDOGE) is a high-profile Meme project on Berachain. The project has two NFT series, namely Beradoge Gen 1 and the recently minted Mibidiots. According to the project team, holding these two series of NFTs will be awarded a lot of useless things or a lot of BDOGE. In addition, there are rumors that BDOGE may also be airdropped to NFT holders of other Berachain projects.

Sudoswap

Sudoswap is a full-chain NFT AMM liquidity market that received a $12.5 million private placement round at the end of 2022. Its innovation focusing on liquidity coincides with the central idea of Berachain, and it has also announced early that it will deploy the protocol after the Berachain mainnet is launched. After Berachain is officially launched, Sudoswap is expected to support the bridging of blue-chip NFTs, bridge many NFTs on the main network to Berachain and provide incentives, and Sudoswap is the first group to announce that it will join Berachains NFT market.

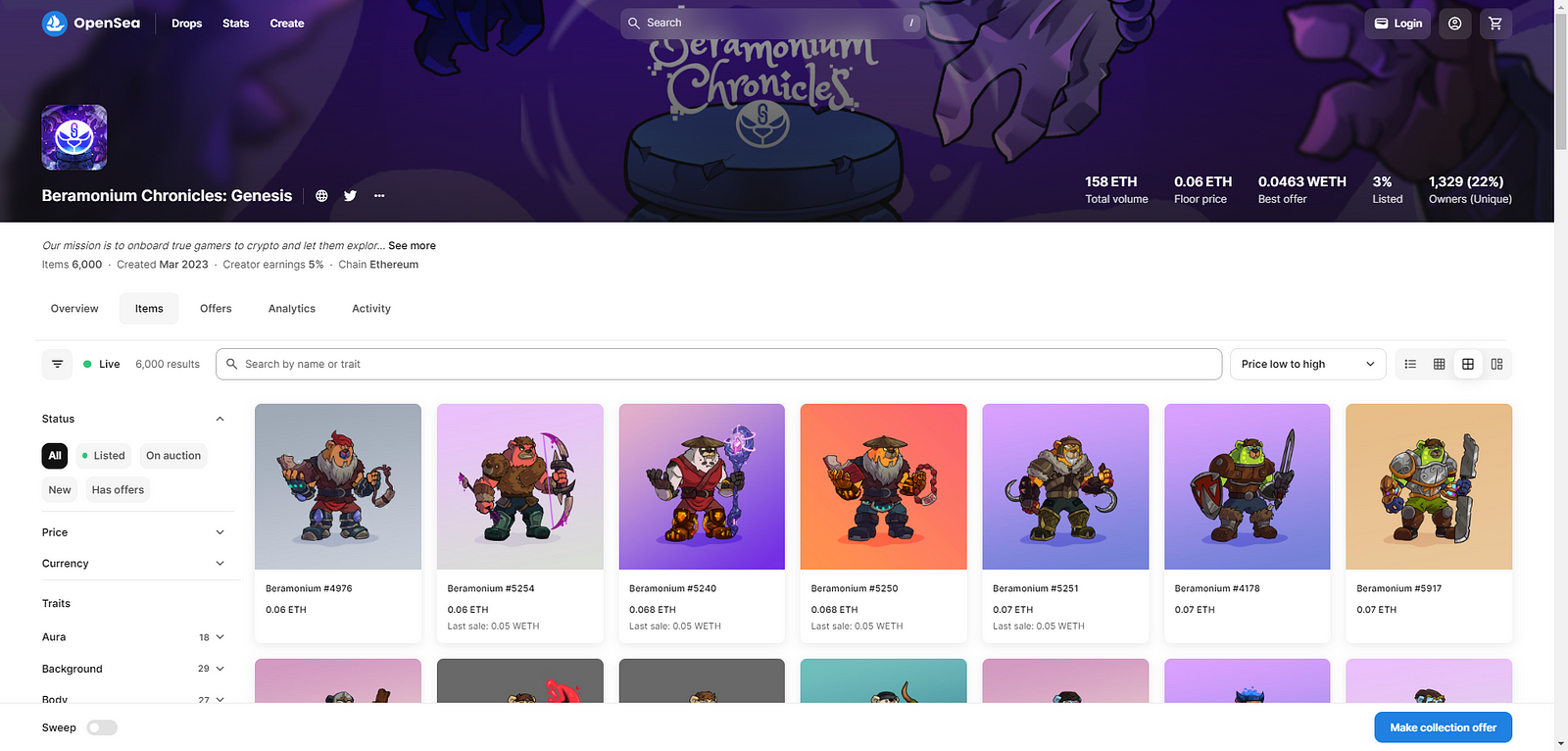

Beramonium

Beramonium is a blockchain game from Berachain, and they released an idle role-playing game called Gemhunters. In this game, players can have their Beramium Genesis beras perform tasks to obtain gems, which can be exchanged for NFTs from other well-known Berachain projects, such as Honey Combs, Beradoges, etc. The minting price of this NFT is 0.045 ETH.

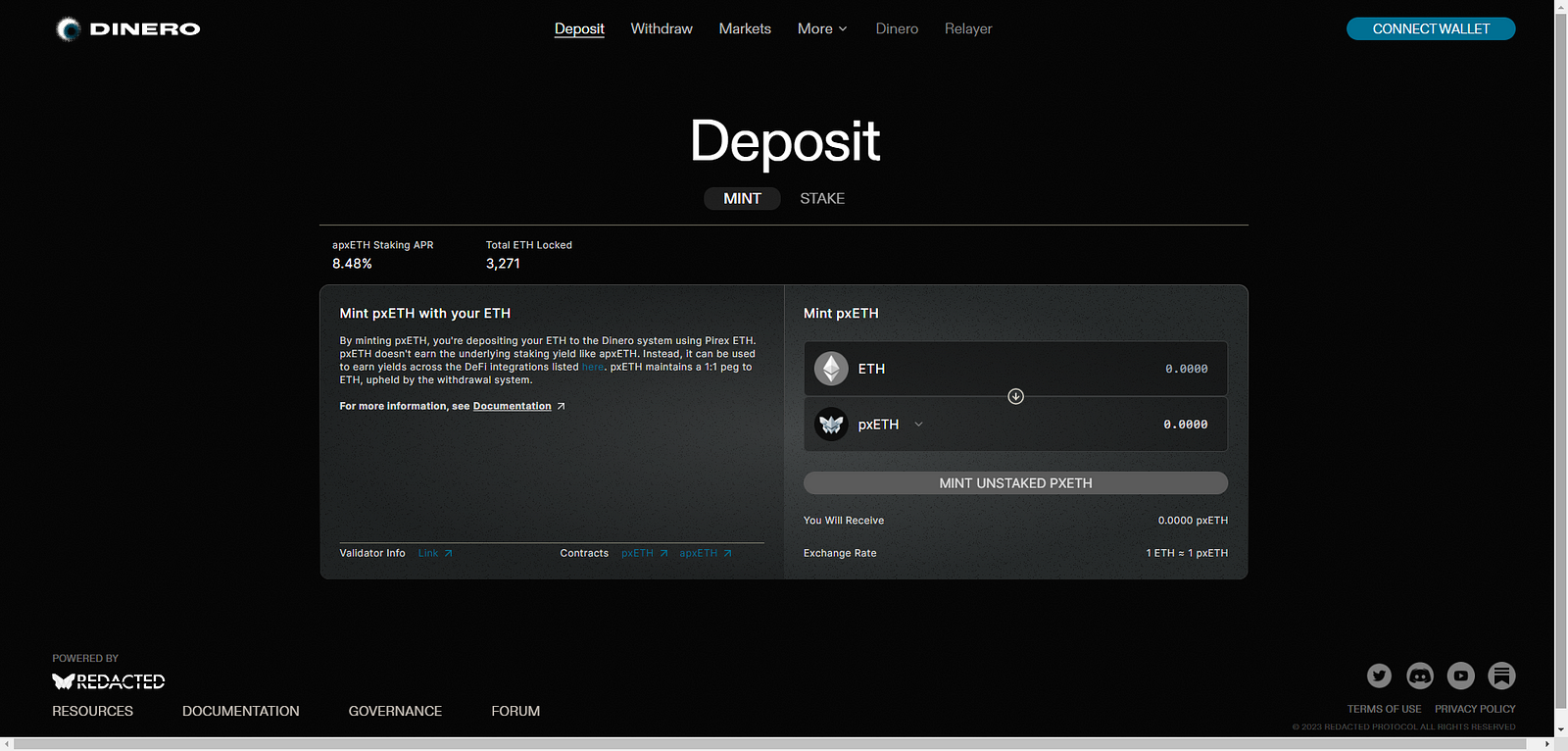

Redacted Cartel

Redacted Cartel is a Defi income protocol incubated by the New Order team. It has multiple sub-products, covering bribery market transactions and LSD liquidity staking. It has also announced earlier that it will deploy new projects on Berachain, but there are currently no more details. message. Berachain has a built-in voting bribery mechanism, so it can be expected that ecological projects such as Redacted Cartel that earn bribes from Defi will be expected to show their talents on Berachain.

Ecological project summary link:https://docs.google.com/spreadsheets/d/1tLOrxMnws6NX-0JMAIKH1ULFmjDYv2 LVvYG 8 Lb v2 kpU/edit#gid= 659852632

Summarize

Berachains unique three-token economic model separates gas and gov to maximize liquidity, avoid damaging the rights and interests of active users who actively participate in the network (such as users who contribute a large amount of transactions and gas), and solve the problem of staking participation in governance. Conflict with liquidity. Therefore, we are very optimistic that Berachain will lead DeFi innovation and create a DeFi protocol with high liquidity and high capital efficiency.

At the same time, as the number of users increases and fee income increases, Berachain will further attract more users and ecological projects to settle in. Together with the Berachain governance reward mechanism, it will form a positive flywheel.

But we must also remain rational. Whether Berachain will be as we expected, we still need to pay attention to the future development of the project (the development of the project itself, the growth of the ecosystem, the security of the protocol, etc.).

Reference article

1.《Berachain: The Evolution from Meme to Mainstream that Could Revolutionize DeFi Liquidity》

2.《Bullish on Berachain Part I: The Future of MemeFi》

6.Interpretation: Core Features and Potential of Berachain

7.Exploration of New Public Chains: Berachains Technology, Community and Ecological Projects

9.PoL + Three Tokens + Growth Flywheel? Detailed explanation of the new public chain Berachain》

Disclaimer: All contents on this website may involve project risk matters and are for science and reference purposes only and do not constitute any investment advice. Please treat it rationally, establish a correct investment philosophy, and increase your awareness of risk prevention. It is recommended to comprehensively consider various relevant factors, including but not limited to personal purchasing purpose and risk tolerance, before interacting and holding.

Copyright notice: The copyright of the quoted information belongs to the original media and author. Without the consent of Jian Shu J Club, other media, websites or individuals are not allowed to reprint the articles on this site. Jian Shu J Club reserves the right to pursue legal liability for the above-mentioned acts.