RockTree OG Talks The series of roundtable talks is co-organized by Stonewood Capital and. In each issue of OG Talks, Stonewood Capital will gather pioneers in the field of Web 3.0 to bring the audience in-depth OG views and the latest information from top companies in each track.

At 21:00 on January 24, this roundtable discussion hosted by Dr. Omer Ozden, Chairman of Stonewood Capital and International Partner of Zhen Fund, started with the theme of Dialogue 2024 Infrastructure Stars. Three guests They are: Covalent (CQT) co-founder and CEO Ganesh Swami, Axelar (AXL) co-founder Georgios Vlachos, and POKT Network Foundation Director Dermot ORiorda. In this roundtable discussion, the guests discussed opportunities and related projects in the Web3.0 infrastructure track in 2024.

The following is a transcript of the roundtable conversation, condensed and compiled by Odaily.

Omer Ozden:Hello everyone, I am Omer Ozden, chairman of Stonewood Capital and international partner of ZhenFund. Stonewood Capital is an international fund and merchant bank focused on investment in crypto-native projects, especially early-stage projects. We are very concerned about the expansion and accelerated development of ourselves and investment projects, and actively communicate with exchanges, investors and the media. As a decacorn hunter in the field of crypto investment, I have always had a keen sense of the market and invested in a series of star projects with valuations of more than 1 billion or even 10 billion US dollars in the early stages, including ChainLink, The Graph, dYdX, Fantom, Maple, Pocket Network (POKT), etc. We have become the leading fund in the Web3 field and the link between the core values of the Eastern and Western cryptocurrency markets.

I’m excited to introduce you to three of the crypto infrastructure stars of 2024 – Covalent (CQT), Axelar (AXL), and Pocket Network (POKT). RockTree has invested in these three projects and is convinced that they will grow exponentially in the coming bull market. Through transaction data, we can clearly see that these projects are developing rapidly in the West. Ill explain RockTrees investment thesis for these three infrastructure projects and look ahead to how they might develop in the coming months and years.

Before I officially start, I would like to briefly introduce RockTree’s investment philosophy and how it applies to today’s three projects.RockTree focuses on the selection of project teams, the ability to succeed in projects, and analyzes the psychological characteristics of founders and teams.Every project is executed by a top team, especially today’s guests.

There are two key points to investing in: focus on the team itself and compare with similar projects.Today we only introduce the project itself and do not directly provide investment advice. We are just sharing from the perspective of RockTree’s investment philosophy.

Next, let me introduce today’s guests:

The first guest is Ganesh Swami, co-founder and CEO of Covalent (CQT). Covalent (CQT) received investment from Coinbase Ventures, 1kx, Hashed, and Binance Labs. As the leading Web3 data provider, Covalent (CQT) provides visibility into billions of Web3 data points. Ganesh has more than ten years of experience working in database technologies and marketing new products.

The second guest is Georgios Vlachos, co-founder of Axelar Network (AXL). Axelar (AXL) received investment from Polychain, Binance, and DragonFly. Prior to joining Axelar (AXL), Georgios was a member of the founding team of the Algorand blockchain and designed its consensus model. He holds a masters degree in computer science from MIT. Together with Sergey, the other founder of Axelar (AXL), he is a high-profile MIT genius in the field of Web3.

The third guest is Dermot ORiordan, Director of the POKT Network Foundation. POKT Network received investments from 1kx and Placeholder. Dermot is committed to driving the continuous development of POKT Network and has achieved impressive results. POKT’s market capitalization has been rising over the past few months, and we congratulate Dermot on this. Prior to joining the Pocket Network (POKT) Foundation, Dermot was an investment partner at Eden Block, an early-stage Web3 venture capital firm and an investor in POKT Network.

Omer Ozden:The first project introduced is Covalent (CQT). RockTree invested in Covalent (CQT) in September 2023. The reason for investing in this project can be explained to everyone through RockTree’s previous investment in The Graph (GRT). RockTree became an early investor in The Graph (GRT) in early 2020. and help promote the project in Asia. The Graph (GRT), one of RockTrees most successful investments during the last bull market, has grown to a market capitalization of $28 billion, including nearly half a year above $13 billion.

Covalent (CQT) is currently the largest indexer in Web3, with more than 225 index chains, and provides data support for related technology projects, trading parties, exchanges, and all artificial intelligence projects that appear on Web3. Although market dilution is low, on a fully diluted valuation it would be around $240 million. In Western markets, Covalent (CQT) is also showing strong growth on the CoinGecko website.

As such, RockTree still sees Covalent (CQT) as a strong prospect. Currently, Covalents (CQT) market cap remains low, below valuations in many private sales and below The Graphs public valuation, which is around $300 million, while Covalents (CQT) is trading at a fully diluted The valuation is approximately US$240 million.

Covalent(CQT)

Token name: CQT

CMC link:https://coinmarketcap.com/currencies/Covalent/#Markets

Covalent (CQT) is a leading provider of Web3 data indexes. Covalent (CQT) builds a protocol that standardizes data from more than 210 blockchains; its unified API allows developers to reuse queries across supported networks, solving the problem of inaccessible blockchain data.

As of December 2023, Covalent (CQT) supports over 210 blockchains and provides data to many cryptocurrency companies, covering a wide range of use cases including crypto-native DeFi protocols, NFT protocols, and cryptocurrencies like EY ( Large companies such as Ernst Young, Fidelity, Jump, and ConsenSys. Covalent (CQT) protects the largest and richest structured Web3 data set globally. By the end of 2024, Covalent (CQT) plans to support more than 1,000 blockchains, escorting the explosion of large-scale applications of Web3 in 2024.

Official website:https://www.covalenthq.com/

Twitter:https://twitter.com/Covalent_HQ

Chinese Telegram Group:https://t.me/Covalent_China

Omer Ozden: Ganesh, judging from the above introduction, the development of Covalent (CQT) is growing rapidly. What are the differences between Covalent (CQT) and The Graph? Also, why is Covalent (CQT) such an important driving force for the core development of Web3 and the rapid growth of AI?

Ganesh:Covalent (CQT) is similar to an execution platform, just like Bitcoin is a specific application and Ethereum is an execution platform. We are very proud to have a passionate and driven team. We know that one of the core assets of Web3 is reliable data. Without data, all applications cannot achieve the qualities of transparency, openness, and reliability that are necessary for the entire ecosystem. Our goal is to power the integration of over 200 chains and thousands of applications with efficient execution.

Omer Ozden:Next, the project introduced is Axelar (AXL). As a leading cross-chain platform, Axelar (AXL) has currently connected 56 chains, and the transaction volume on the infrastructure has reached 7 billion US dollars. We really like the founders of Axelar (AXL), who are arguably the most prominent group of high-performing performers.

RockTree has also invested in other cross-chain projects. We can see that cross-chain has become a very important application direction of Web3. Just like in the Web1 era, most networks were composed of independent intranets, such as Cern, Stanford and ARPAnet, which were then connected together to form the Internet. I believe something similar will happen soon with Web3, where all these chains will be integrated.

As of now, 25% of blockchain transactions are realized through cross-chain. Axelar has become a publicly used platform for everyone, including JPMorgan of TradFi (traditional finance) and Uniswap of DeFi (decentralized finance), etc. RockTree believes that the final valuation of Axelar (AXL) will reach a level similar to that of a Layer 1 protocol because there are already millions of projects running on it, and the ecosystem of Axelar (AXL) will be the same as we are familiar with Solana and Avalanche huge. So personally, Im very bullish and very excited about Axelars (AXL) prospects for the next 12-24 months, and even longer term 3-5 years.

Axelar(AXL)

Token name: AXL

CMC link:https://coinmarketcap.com/currencies/axelar/#Markets

Axelar (AXL) is a full-stack interoperability layer for Web3, which enables blockchain to become a new type of development platform, integrating various networks into a seamless Internet of Blockchains. Axelar (AXL) is programmable and decentralized, powered by the proof-of-stake (POS) token AXL. App users can access any digital asset or application with one click, and developers can use simple APIs and access an ecosystem of tools and service providers.

Official website:https://axelar.network/

Twitter:https://twitter.com/axelarnetwork

Chinese telegram:https://t.me/axelarchain

Omer Ozden: Georgios, how did you and your partner Sergey achieve this? If you use a specific indicator to show it, you can tell us how many applications the Axelar (AXL) project has generated so far, and share the latest progress of Axelar (AXL).

Georgios:We founded Axelar (AXL) out of our experience co-founding Algorand. Algorand is one of the hottest blockchain projects in the last bull market and one of the fastest-growing blockchains since its listing. When we created Algorand, we realized that blockchains were fragmented and siled; they were disconnected and independent ecosystems. I completely agree with Omer’s metaphor, this state of separation is like each of us having a computer but not being able to connect to the Internet to meet the needs of daily life. And Axelar (AXL) is like the Internet of blockchains. Every time a user uses Axelar (AXL), we realize cross-chain and cross-application connections through data and transactions.

This connection is reflected in our cooperation with many large financial institutions, including JP Morgan, which Omer mentioned, as well as some DApps such as Uniswap, Lido and dYdX. Recently, these applications have been integrated with Axelar (AXL). We’ve also expanded into gaming, recently announcing an integration with blockchain gaming platform Immutable. I believe that various market participants are actively integrating with Axelar (AXL), demonstrating the significant transformational value of our cross-chain technology. This also means that in the next 1-2 years, similar applications will be integrated with Axelar (AXL), and the influence of our platform technology will exceed that of general L1 platform technology.

Currently, we have over 50% integration of existing applications in our ecosystem, and we look forward to deepening the integration even further. In addition, dozens of native applications are gradually being launched online. It is difficult to give an exact number as the number of applications continues to increase every day. There are currently 3-4 token products that have achieved “permissionless” deployment through Axelar (AXL), so we don’t know the specifics. These products are not limited to a single ecosystem and are typically available on ten different blockchains, thus enabling permissionless deployment.

Omer Ozden:Finally, let’s introduce Pocket, which everyone is very familiar with. We would like to share with you the investment status of Pocket. In the early days, we viewed Pocket as a decentralized Alchemy, while Alchemy has always been viewed as a centralized RPC provider. RockTree has always adhered to the investment philosophy of decentralization, and we also expect the direction of industry development to be decentralized. Alchemy is a private token, while POKT is a public token. Alchemy’s private equity valuation has reached US$10.2 billion, and POKT’s current circulating market value is US$450 million, which is growing rapidly. Another comparable project is Chainlink. Chainlink has completed multiple investment rounds over the past 6 years and has exceeded our expectations. Judging from the comparison of offline data volume and Pockets online RPC, I am more convinced of Chainlinks attributes as a comparable project. Everyone is familiar with Chainlink’s market performance, and the current circulating market value of POKT is about 3% of Chainlink’s. Compared with the historical high point, POKT still has a lot of room for growth, although POKT is currently growing rapidly.

POKT Network

Token name: POKT

CMC:https://coinmarketcap.com/currencies/pocket-network/#Markets

POKT Network (POKT) (also known as Pocket Network) is a leading DePIN (decentralized physical infrastructure network) that provides data to applications at the lowest cost, highest uptime and high scalability connect. Today, these data connections involve multi-chain access to distributed remote procedure call (RPC) infrastructure, but may expand to serve other types of data connections in the future, including those supporting mainstream social media and open source AI LLMs (Large Language Models) Open source database.

POKT DAO is a value-driven, collaborative, open source community that builds and governs the project. Our critical digital infrastructure is built and managed by users.

The POKT Network Foundation is an entity authorized by POKT DAO and is responsible for executing the strategic vision of POKT Network.

Official website:https://www.pokt.network/

Twitter:https://x.com/poktchina?s=20

Chinese telegram:https://t.me/POKTnetworkCN

Omer Ozden: Next, Dermot, where do you think Pocket is positioned in this cycle? Also, are there any specific details about the future direction of Pocket worth sharing with us?

Dermot:I want to share some of my opinions with you. Although we are a decentralized application and platform, we also have some similarities with traditional centralized applications, mainly reflected in the following two or three points.

First of all, although we are a decentralized application, we pay great attention to three key elements: people, applications and business scenarios. Our application scenario relies heavily on blockchain technology, which is the first aspect in which we are similar to other applications.

Secondly, we still actively apply PRC (Public RPC) and bring related services to PRC. As of 2025, we will still be very concerned about this.

Third, we pay great attention to data assets and data nodes. We all know that standardized data assets are crucial to providing products and services. This is also our focus and the focus of many competitors.

Of course, we have also experienced some changes in the past 12 months, mainly including the following:

First, our transaction fees have dropped 5% over the past 12 months. Therefore, when users use our products, they will find that costs continue to decrease while service quality increases.

Second, our Relay products and services are more mature than before. Recently, some of the larger VCs that have been talking to us have seen our market and products open up to more PRCs. Let’s not close ourselves off, but let more PRCs and developers use our platform. Because our goal is to build an infrastructure to implement cross-chain services and related applications.

In addition, the third change is that we have noticed that the development and goals of the entire market are getting higher and higher, and the ambitions of the entire industry are also getting bigger and bigger. But I still call on everyone to return to this critical node of PRC. Because the essence of what we provide is a data service, we are not responsible for covering and developing all infrastructure nodes. We are more about integrating the strengths of all parties to provide more users with related information based on blockchain or even non-blockchain. application.

Omer Ozden: Ganesh, I would like to quote some words from Chinese investor Kai-fu Lee. He once said that in the era of artificial intelligence, data is as valuable as oil. As a structured data provider, Covalent has the largest structured database in Web3. I’d love to hear about specific applications of Covalent in AI and DePin (decentralized finance). Additionally, we also know that Covalent’s token, CQT, has experienced very high growth over the past 12 months. I want to ask, where do you expect the Covalent (CQT) product to be headed by the end of 2024? Can you share some specific metrics?

Ganesh:We have made exciting developments over the past few years. In addition to making great strides in the token space, the first thing I want to share with you is our achievements in application development.

First, we successfully structured data for over 200 different blockchains. This means that the data for these more than 200 chains is no longer raw data, but processed and transformed structured data that can be directly consumed and used by applications. Our goal is to quickly promote the development of various applications. Therefore, in the past few years, we have developed thousands of applications, covering enterprise-level development and applications in the Web3 field. Generally speaking, our development is horizontal rather than vertical development limited to a specific industry. We have also developed a series of applications, not just wallet applications.

Secondly, I would like to add to the horizontal development just mentioned. We have a large amount of structured data, combined with efficient data processing capabilities, we have also introduced AI models. By using AI models, AI models are combined with data for application development in DeFi, NFT, games and other industries. In other words, we’ve implemented dozens of AI-related applications over the past few years, which I’m really excited about.

At the same time, I would also like to add a very interesting and exciting point, as shown in the slideshow. First, we have paying customers from over 150 businesses, including Wormhole, Fidelity, Rainbow, and more. Their purchase of our services generates revenue for us. At the same time, we also conduct token purchases and buybacks on Uniswap, both of which bring us revenue and profits.

Omer Ozden: It is worth noting that currently we can see that the market value of the Govalent project has exceeded 5 times that of The Graph project. This shows that the project itself has made real progress in the market. If we want to realize that 100% of the projects income comes from the token itself, when will it be achieved?

Ganesh:If we want to realize that 100% of the revenue of the entire project comes from the business of the token itself, the latest realization node will be around the first quarter of 2024, and we can see the realization of this goal in a few weeks.

Also, I would like to add another aspect of the project. On the left, we list Govalent’s blockchain partners, including Scroll, Taiko, CROSS FINANCE, Movement, and more. Now, these partners, as well as the CQT token itself, can be staked within the wallet. This project began a year and a half ago with in-depth exchanges and communication with other token teams, which ultimately led to this goal. This is like the difference between different tokens"marriage", able to achieve more stable token development and alliances in the same ecosystem. It is not easy to achieve this, but after a year and a half of communication, communication and collaborative efforts, we found that mutual staking of tokens is the best way to express gratitude and willingness to cooperate to other token holders and the community.

Omer Ozden: Rocktree has invested in cross-chain projects before and done a lot of related due diligence. After completing the due diligence, we believe that compared with traditional bridges, Axelar (AXL) has gone far beyond the concept of a bridge. It is more based on blocks. Chain platform, it is a highly decentralized platform that has surpassed the general bridge products for different chains. So I want to ask you, how to ensure the security of a cross-chain platform based on blockchain infrastructure, how to provide a complete stack solution, and how to unlock different performances, including operability and programmability?

Georgios:Thank you very much for your question. Let me answer your first question. First, we noticed that over the past few years, many similar bridge applications have emerged. However, we found that these bridge technologies are still centralized in nature. They may rely on a central entity to control the bridge technology, or have a centralized manager to control the flow of funds behind it. In other words, if there is a centralized bridge between different chains, the flow of funds will become opaque and unsafe. In fact, in the past two years, we have seen almost all mature bridges suffer hacker attacks, which further strengthens our understanding that centralized bridges are not a good direction for development.

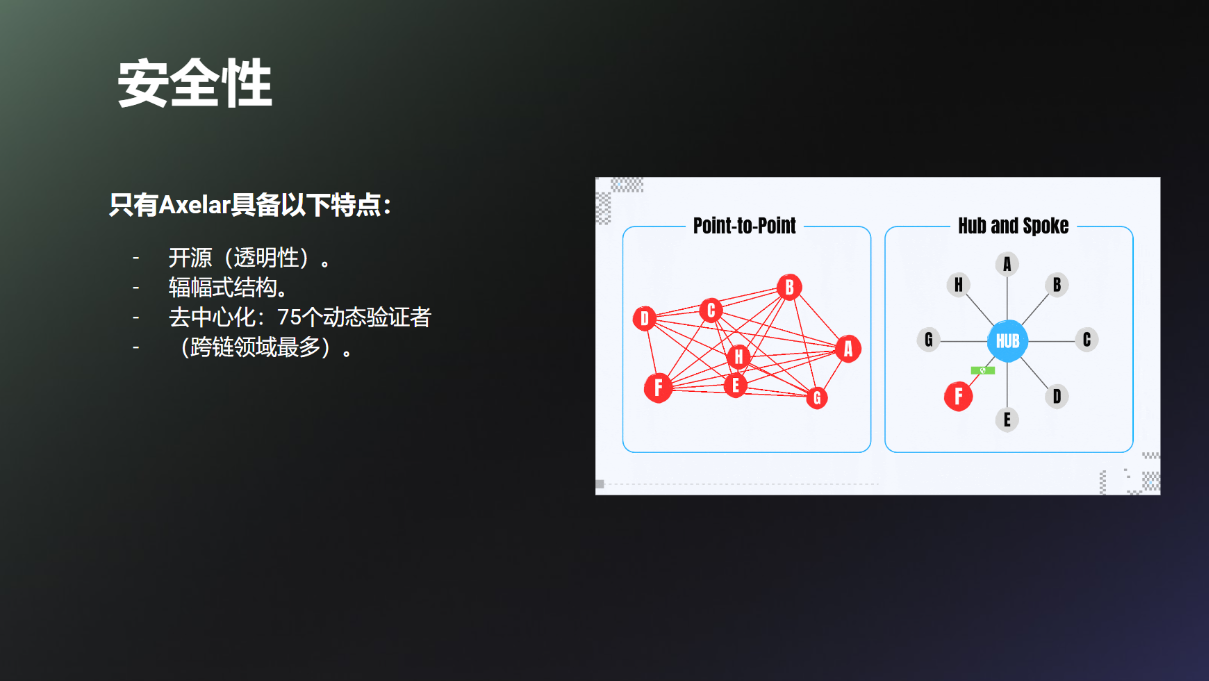

Second, we have solved existing problems in bridge technology and moved beyond the concept of traditional bridges. The Axelar (AXL) network is essentially a blockchain, and we utilize this blockchain as the platform that connects all other chains. We always insist on making the entire platform a decentralized ecosystem rather than a centralized platform. Currently, we have more than 75 validators, the selection of validators is also dynamic, and our technology and verification scheme are decentralized. We always firmly believe that centralized technology cannot replace decentralized technology.

To ensure security, we adopted three key technical points. First, we use entirely open source technology. We are the only vendor and service provider in the current market that fully adopts open source technology to ensure platform security. Secondly, the connection method we use is hub-and-spoke rather than traditional point-to-point connection. This means that after a new link is added to our platform, it can automatically connect with all other chains without the need for one-to-one repeated operations, thus saving time. Third, we implemented a dynamic validator pool, which currently has more than 75 validators. We are one of the cross-chain service providers with the most dynamic validators in the entire industry. With the support of these three technical points, we are unique in the industry compared to other competitors, which also helps us expand and develop faster.

Regarding programmability and interoperability, this is critical. Simply put, interoperability and programmability mean that after a link is connected to our platform, it can interact with more users and services, enabling more product and service design and development. Based on our research on the Internet, we found that more than 25% of transactions are implemented through cross-chains. Therefore, interoperability and programmability are very important. We’ve already attracted users that range from DeFi users like dYdX and Uniswap to traditional enterprise users like Microsoft and JP Morgan. They have used our services to achieve cross-chain programmability and interoperability.

In a cross-chain platform, high security is our primary feature. It is precisely because of our high security that we have attracted more users and enabled more chain connections. At the same time, it also attracts more users who are willing to achieve interoperability through our platform. In the industry, security, programmability, and interoperability promote and promote each other.

Omer Ozden: There has been a craze in the POKT market recently, and we want to know the reasons behind it. In addition, we also noticed that the POKT token is undergoing deflation, while traffic and customer volume are also increasing. Wed like to ask Dermot to shed some light on this.

Dermot:First, I’d like to share some perspective on why Pocket has been a big hit in the past while.

First, I found that some users in the market paid attention to Pocket again and started to get to know us again. Pocket has been undervalued for some time. However, now users are rediscovering our value and impact on their lives. As a platform based on blockchain technology, we open up the offline physical world for users, bringing cost savings and cost control to their lives. This discovery is a natural response to the fact that we truly add value to our users’ lives. Pocket was one of the early pioneers in the industry. Around 2020, there were only about 15 products in the industry and we were one of the early players.

Second, we now have a relatively mature community. As a set of infrastructure, we provide a complete API interface so that different applications can run on our infrastructure. At the same time, we also provide related data services and provide users with various incentive policies. In addition to online services, we also provide non-blockchain level services, including artificial intelligence. You may be familiar with Infura, we have worked with them in the past. In the future, we plan to expand our services and business in different markets, regions and countries, attract more potential users, and open up potential markets.

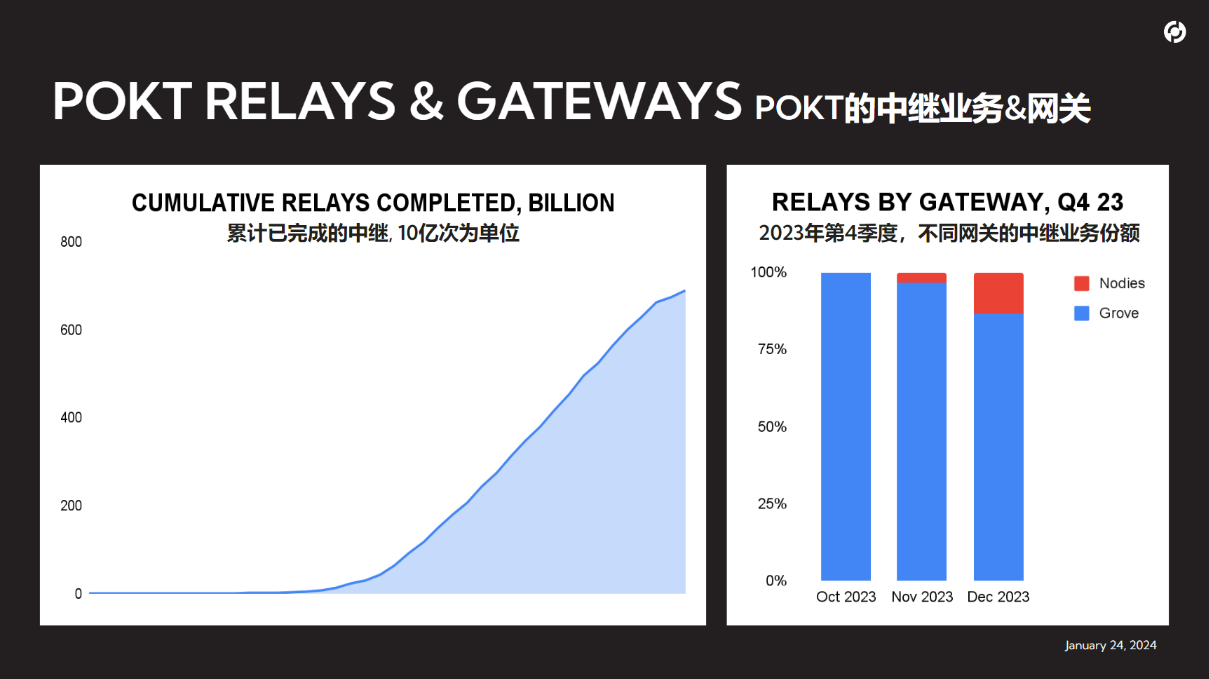

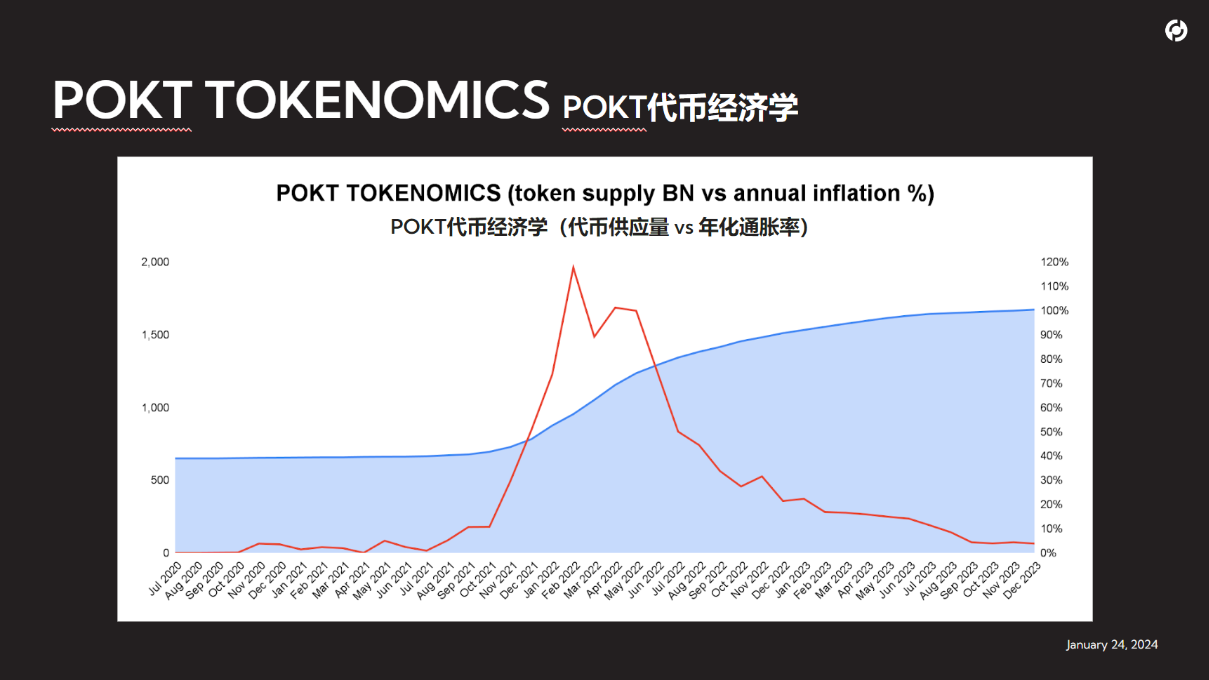

Third, we are also concerned about the issue of deflation. Recently, we have opened more gateways based on user needs. We found that as the workload increased, more Pockets needed to be burned and the staking of the nodes increased. Therefore, we need to focus on controlling inflation. In the displayed PPT, you can see the business completed by Pocket and the gateway services provided. We currently offer two key services that will support us as we grow our business in 2023. On this basis, we will also launch more businesses and services.

Omer Ozden: Before we come to the end, I would like to ask a big picture question to all the panelists. First of all, I want to know what are your big-picture expectations for your project? What do you think are the most concerning points in the development of the bull market over the next one to two years? Please answer the two questions together.

Ganesh:First, Id like to share our macro expectations for the next 12 months. We will achieve a historic breakthrough of seamless indexing of 1,000 chains. This means that there will be nowhere to hide data on the entire Web3 platform, and all data will be at your fingertips. We will build the best data economy integration and enter the best data economy era in the data era. As a developer, whether you are designing DeFi, NFT, AI applications, GameFi or SocialFi, you can get seamless data support and implementation from Govalent.

In the meantime, I also want to share some exciting data. By the end of 2023, we expect to have over 16 million users. Our vision is that no matter whether it is a bull market or a bear market in the next one to two years, as true creators, we will not be defeated by the torrent of the times.

Georgios:In fact, I very much agree with Ganesh’s statement. I completely agree with his idea and ideal of indexing thousands of blockchains. I believe that in the future, whether in the entire Web3 era or in other fields, technologies like Covalent (CQT) and our Axelar (AXL) technology will be needed. Our goal is to transform the entire industrys infrastructure over the next ten or even fifteen years. I believe that in the future, every ordinary person will be able to use these technologies, just like every ordinary person can now use Internet applications, services, products and web pages, and can use Web 3.0 technologies, products and services.

Dermot:I just heard the views of the first two guests, and I was very excited. There was a sense of unity that the heroes see the same thing. I completely agree with you. I am very optimistic about the development of cross-chain and multi-chain, and Pocket has been working hard in this direction. We have been focusing on multi-chain technology in the past few years, launching a unified API and achieving full open source in terms of application technology. In the second quarter of this year, we will also launch new protocols.

At the same time, our DAO is becoming more and more influential. I am here to appeal to any talents and partners who are interested in DAO or have relevant technologies to actively join us. Im also very focused on the data services and potential our applications and infrastructure can generate, and the industries that can have a real impact on Pocket and multi-chain development as a whole. You are very welcome to join us.

Omer Ozden:Finally, before we wrap up, I want to give you a little surprise about RockTree.RockTree will be launching a new website and brand upgrade at the end of February (after the Lunar New Year), and today we’re giving you a sneak peek.

Our new website is inspired by one of the original English-language films, Blade Runner. This movie inspired the subsequent imagination of the cyberpunk movement. Our website tells the story of the world and reality 30 years from now, which is around the time of Bitcoin’s 11th halving. We expect that most of the world will treat Web3 products the same way we treat Web2 products today, and cryptocurrencies will become Tools for daily use and widespread use at home. For example, 30 years from now we may see cryptocurrency-related ads and applications on roadside billboards, just as we see ads for banks and chewing gum today. In fact, the future has already begun to gradually integrate into our lives. We’ve already seen the GBTC ETF appear on billboards on Wall Street in New York this week, so we’re lucky to expect an even more robust cryptocurrency adoption scene over the next 30 years.

Most importantly, money will be separated from the state and become decentralized. This is RockTree’s vision for the future, and it’s a vision for the future that many of us share. On-chain and decentralized is exactly what our new website stands for, and it embodies our shared dream for the future.

Follow the following channels to get more news related to RockTree:

official website:https://rocktreecapital.com/

Official Twitter:https://twitter.com/RockTreeCapital

Telegram subscription number:https://t.me/RockTreeCapitalNews

Official public account: RockTree_Capital