1. Key points of the report

1.1 Core investment logic

Covalent is a leading project on a rapid development track, with various business data in a rapid growth stage and revenue data increasing. In terms of income level, Covalent has an income several times greater than that of The Graph, the current leading project on the track, and seems to have achieved a better PMF (Product Market Fit). However, because its income stream has not yet been uploaded to the chain, market investors There may be a large awareness gap about this.

In terms of new business, the Ethereum Wayback Machine it is developing is a long-term blob DA (blob is a new data storage structure after the upgrade of Ethereum EIP 4844, which stores data that does not require permanent chain storage) solution , which is also in line with the current market hot spots.

In terms of team, the founding team has professional resume and entrepreneurial background that matches the track. Investors also basically include various industry parties at the top of the industry, including public chain foundations, leading exchanges, major customers, etc.

1.2 Main risks

1. If other centralized blockchain data service organizations with a larger number of users, such as Alchemy, Infura, Quicknode, etc., start from RPC and move into the downstream data indexing service track and provide similar data indexing services, they may have a negative impact on Covalents Market share and pricing are squeezed. For example, Alchemy completed its acquisition of data indexing platform Satsuma in September 2023.

2. Data index is a relatively unpopular track with little awareness among public investors. At present, it still does not attract the attention of investors. This trend may continue in the absence of hot events on the track.

1.3 Valuation

Compared with The Graph, the leading project in the same track, the valuation is more attractive.

2.Basic situation of the project

2.1 Business positioning

Covalent provides a Blockchain Indexer service, which provides a unified set of blockchain data APIs that allow developers to query across multiple blockchains.

Before describing the data indexing service, it is necessary to give a brief explanation of its upstream services - blockchain node and blockchain RPC.

Blockchain node:

Blockchain nodes are the basic elements that make up the blockchain network. Each node stores a complete copy of the blockchain (or in some cases, a partial copy, such as a light node). Nodes synchronize and verify all transactions and blocks through the consensus mechanism to ensure the data consistency and security of the network.

Blockchain RPC:

RPC is a service interface that allows external clients to interact with blockchain nodes. It is a middle layer that provides a standardized set of commands or function calls, allowing developers to perform operations such as reading data, sending transactions, executing smart contract functions, etc.

Blockchain index:

Blockchain index is a data service based on blockchain nodes and RPC. It reads data from blockchain nodes through RPC, then processes and organizes the data to create an efficient query database. This way, users and applications can quickly retrieve the information they need without having to make complex queries directly from the blockchain node.

Briefly, the relationship between nodes, RPC and indexing services is: the blockchain node is the source of data, the RPC service is the channel to access these data, and the indexing service is the data processing plant, optimizing the retrieval and use of data.

In the blockchain data indexing track, there are existing centralized service providers, such as@Bitquery_io,@etherscan,@Moralis Web3,@blockvisionhqetc., there are also decentralized service providers, the most famous of which is The Graph.

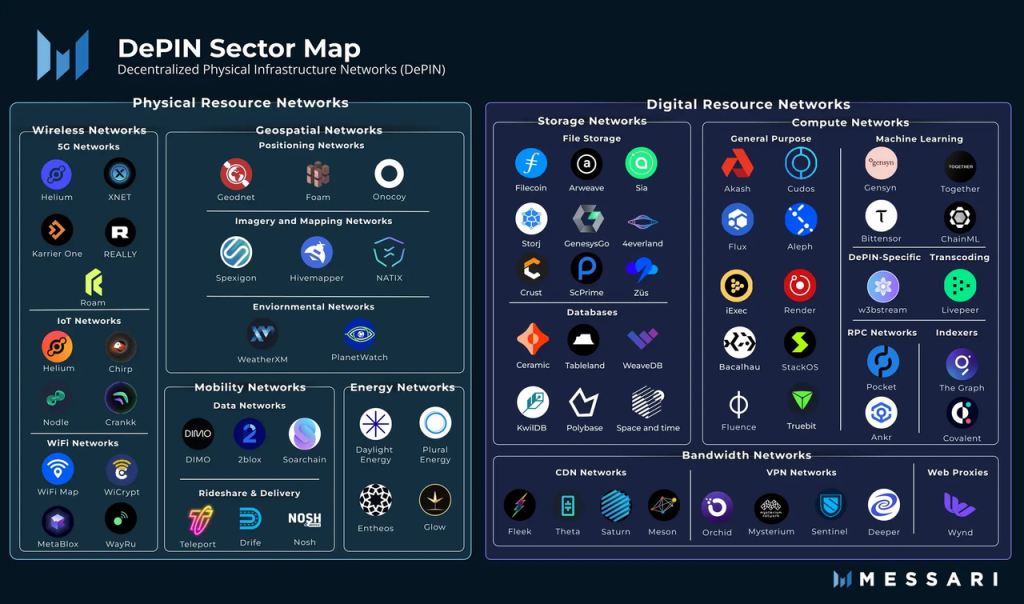

In addition, in the Depin track Mapping released by Messari in 2023, data index is also included in the scope of Depin and classified under Depins Digital Resource Network category, of which The Graph and Covalent both appear in the figure as representative projects. .

Image source: Messari

2.1.1 User groups

Covalents customers are mainly B-side, including Dapp projects, such as various Defi, as well as many centralized encryption companies, such as Consensys (investment board), CoinGecko (asset quotes), Rotki (tax tools), NFTX (NFT) Curation), and Rainbow (crypto wallet), etc.

2.1.2 Value proposition

The economic scale of the blockchain world is growing exponentially: more ecosystems, more L1s, and more Rollups.

More users and economic activity means more transactions and more data, all of which is stored distributedly by blockchain nodes. On the one hand, this means that the data is decentralized, open and accessible, but it also means that the data is complex, large and inefficient to read. The data size of the Ethereum blockchain alone has exceeded 1 TB, and the data is facing Reading and parsing scalability issue.

The situation becomes more complicated when applications (such as wallets, NFT marketplaces, or more complex web3 products) require data from multiple blockchains, and those blockchains have different output formats. Covalent built a protocol that standardizes data from various blockchains, the Unified API. This unified API allows users and dApps to obtain all on-chain data in a structured way that they can integrate into existing products without having to do tedious data processing themselves.

Image source: Covalent documentation

The indexing layer of the blockchain should be flexible to the greatest extent possible to accommodate the diversity of products and services that will be launched on the market in the coming years, and should be trust-reducing to the greatest extent possible. Covalent’s value proposition for data indexing includes:

Data is verifiable. Enables trustless data verification through cryptographic proofs, enabling Covalent to allow anyone to enter the network as a block specimen (a new data structure package based on the original on-chain data) producer, and through staking and slashing ) mechanism incentivizes them to stay honest, thereby achieving decentralization of the infrastructure.

Scalability. Covalent is a plug-and-play solution for new EVM blockchains and appchains that takes less than a week to get started. For non-EVM blockchains, simply follow the block sample standard to extract data from the chain client.

Data composability. Covalents standardized data model allows developers to wrap, mix, and fork data just like assets, regardless of the data chain.

No-code solution. The no-code capabilities of Covalents Unified API provide solutions for analysts, developers, and other non-technical users working at the visualization level. Users can create something similar to a pivot table on the base layer data to obtain information such as 24-hour transaction volume, NFT historical floor prices, and aggregated wallet token balances across the network.

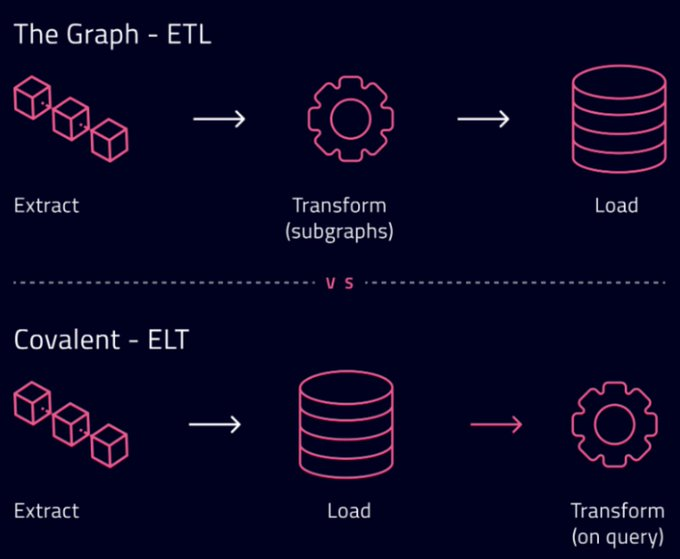

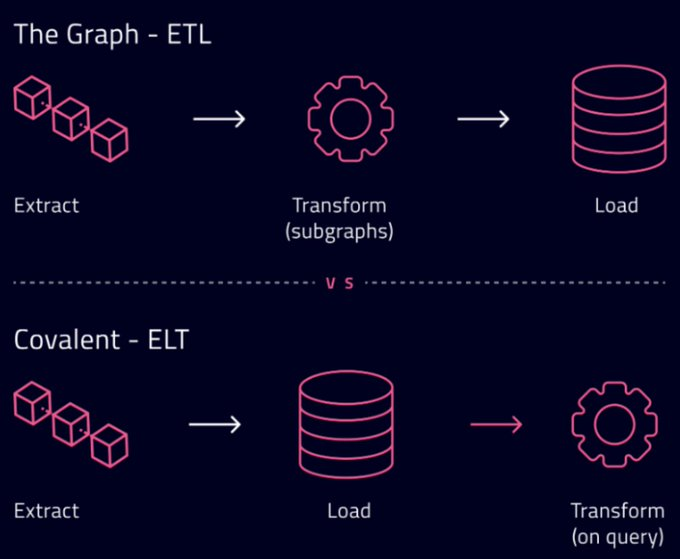

flexibility. Covalent follows an extract-load-transform (ELT) data integration model, with its network extracting data from the blockchain and loading it into a data warehouse. This is then transformed as needed by the client to provide the required data when queried. In contrast, Graphs subgraph-based indexer follows an extract-transform-load pattern, where extracted data is first transformed into a use-case-specific subgraph, which is less flexible.

Image source: Covalent documentation

2.2 Business logic

2.2.1 Product mechanism

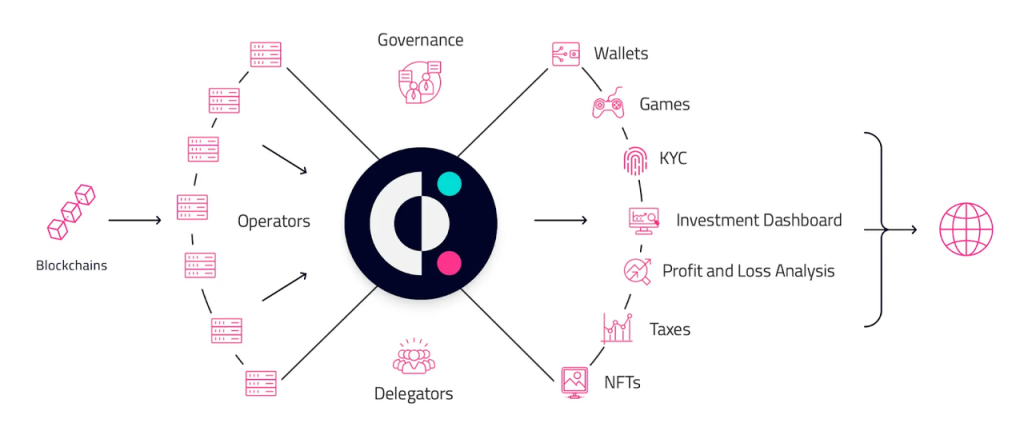

Covalents current core product is the Unified API, which transfers data between two modules: client and server. Through the API, the server can control its system and respond to client requests. Users (such as application developers or analytics companies) pull data from the API, while data providers (mostly Covalent itself at the moment, but will open up to third parties later) retain ownership. Although many companies have built server-side infrastructure to provide access to blockchain data, most companies self-built server-side is limited to the RPC layer, often only obtaining the raw underlying blockchain data of the target chain.

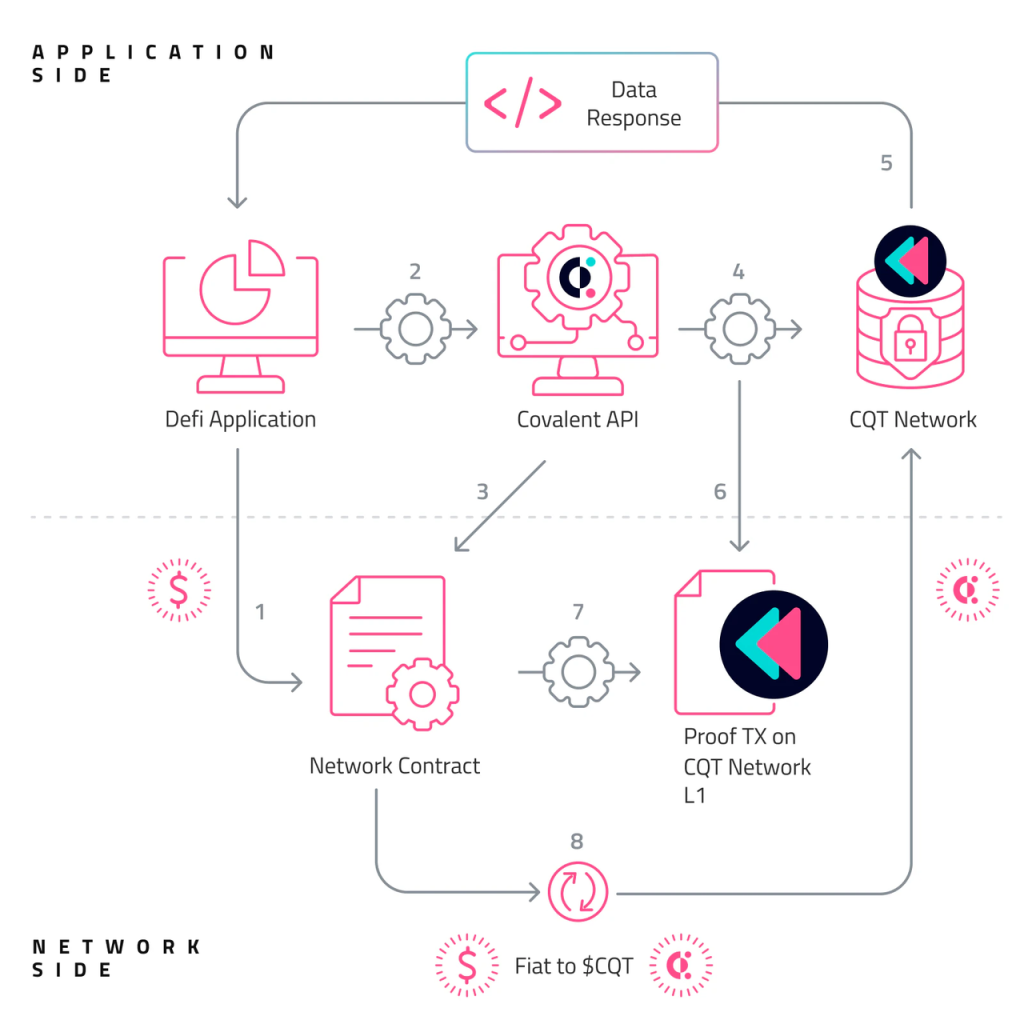

Covalent’s business process, image source:Covalent: A Unified API for Retrieving Blockchain Data

The so-called basic blockchain data refers to information that can be directly queried from the blockchain through RPC. In contrast, more in-depth data analysis, such as complex queries, data correlation analysis, historical data trend analysis, etc., usually requires more advanced data processing and indexing services, namely the services provided by Covalent and Graph.

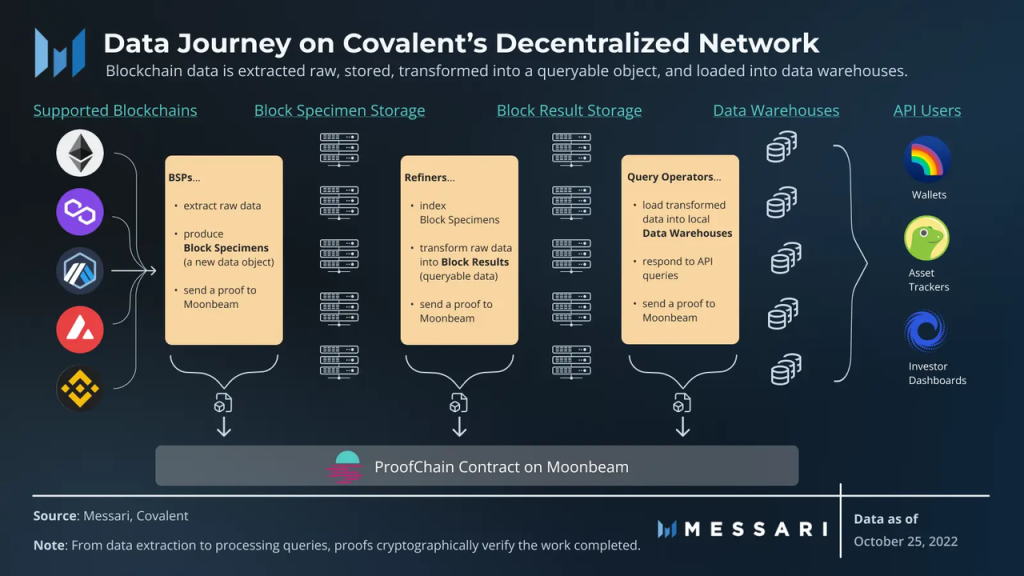

Covalents protocol goes deeper than traditional approaches: it extracts data from various blockchains, uploads that data into a storage instance*, indexes and transforms the stored data objects, and loads the data into a local data warehouse, For API users to query. Throughout the process, it sends proofs to the Moonbeam network to verify the work completed at each step. In short, Covalent cryptographically secures and standardizes all extracted blockchain data, allowing developers to query from any chain in a unified way, hence the name Unified API.

Storage instance: Data instance, which includes database software and related memory structures and background processes. A database server can run multiple instances, each managing its own data and processes.

Based on the unified API, in order to facilitate customer integration and display on the product side, Covalent has also launched corresponding toolkits.

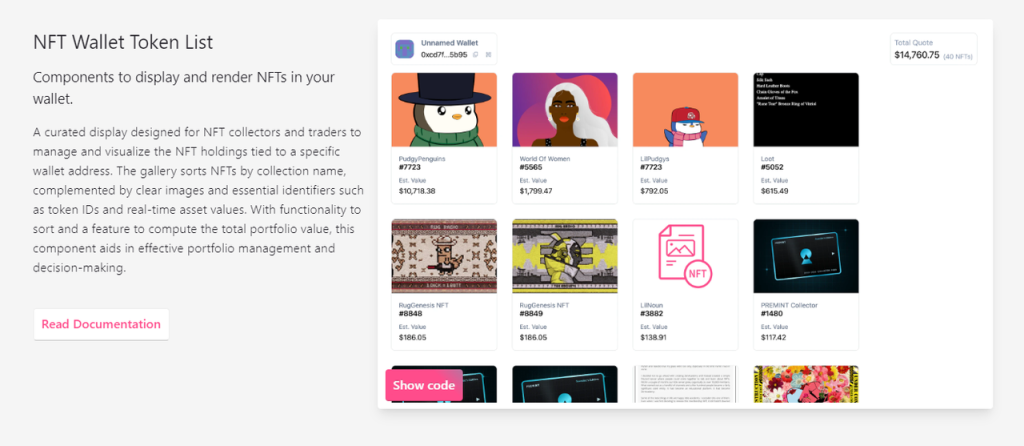

GoldRush

GoldRush is an open source modular blockchain browser and toolkit provided by Covalent, which can be integrated with various Dapps and Web3 applications.

Case scenario:

NFT marketplaces like Blur or NFTx. Every NFT transaction on the platform can be linked to a block explorer like Etherscan for query. This will take users away from your platform, interrupt the user experience, and the blockchain browser will be ineffective for many mass users. Its too technical to understand.

Web3 games face the same challenge: users should not have to stop mid-game to verify and check transactions on a block explorer. Many in-game transactions are unique and complex, and block explorers are unable to capture these details or present them in a correct, intuitive way.

In a similar scenario, as a Blur or web3 game developer, you can directly integrate Covalents GoldRush module into your own application to display various data and provide interaction in a way with a better user experience.

Image source: https://www.covalenthq.com/products/goldrush/?component=NFTWalletTokenListView

After roughly explaining the industrial mechanism of Covalent, lets take a look at how it is integrated into the token mechanism.

2.2.2 Decentralized design

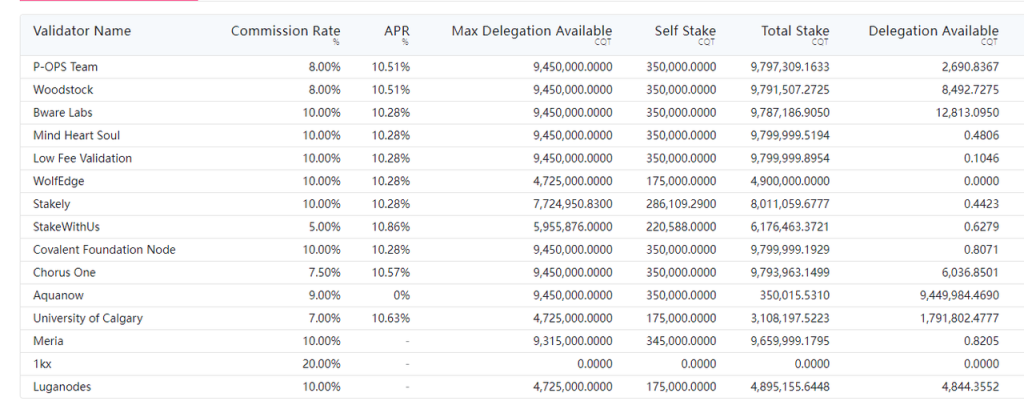

Covalent’s decentralized network will have multiple network participants, called “operators.” Currently, only 2 network operator roles are active, namely Block Specimen Producer (BSP) and Refiner. As of December 2023, Covalent has 15 BSPs, including Chorus One, Woodstock, StakeWithUs, and 1kx, among others.

BSP extracts the original blockchain data and creates a data object called Block Specimen. The BSP standard promises to make blockchain data composable and reusable outside of the execution environment. The BSP then uploads the block sample to the storage instance, creates a hash (or proof) that stores the block sample, and publishes the proof to Covalent’s ProofChain smart contract on Moonbeam. Once the proof is posted to Moonbeam, other network nodes can verify the work of the BSP.

The proof and data storage solution based on Moonbeam is only temporary. In the future, Covalent will launch its own L1 for accounting and migrate the pledge of CQT tokens to Ethereum. The migration is expected to start at the end of February this year.

There are 4 set roles for Covalent decentralized data index network operators, namely:

Block-Specimen Producer (BSP), is now online. When BPS uploads blockchain raw data to a storage instance, they can choose to run the instance locally, or pay a storage operator to run it. Storage operators should increase attestation data availability via IPFS loading and local storage. The following is the situation of BSP pledgers. The current pledge APR is 10% +.

https://www.covalenthq.com/staking/#/

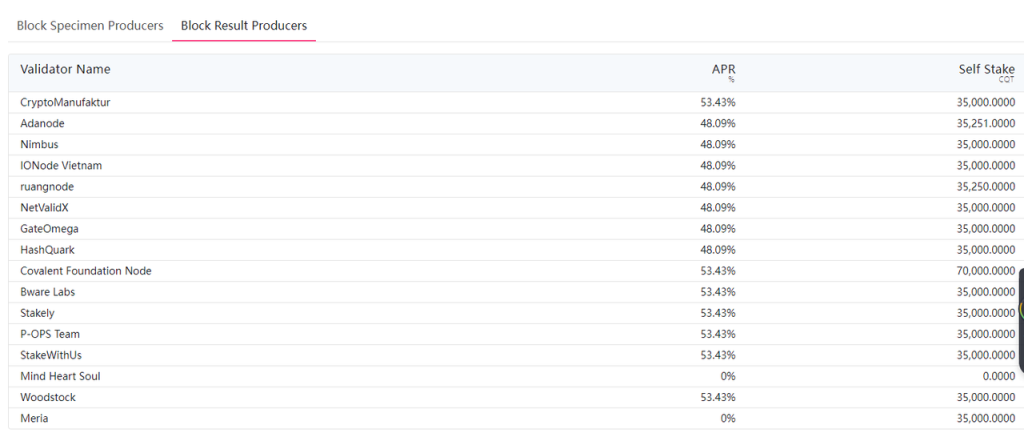

Refiner, which is now online, takes the block sample (Block Specimen) from the storage instance, converts the original data into a queryable data object, called the block result (Block Result), and publishes a proof of the verification work. The following is the list of Refiner’s stakers:

https://www.covalenthq.com/staking/#/

Query Operator, which loads transformed data into local data warehouses before responding to API queries.

Delegator, each network operator is compensated for performing their duties after the Delegator confirms each attestation for a specific period. Prior to payment, a set of Delegators are randomly selected from the network operators overall set to serve as Delegators for the audited period.

The current operators are all in whitelist roles set by the Covalent Foundation, and will gradually be opened to more applicants:

All the above operators work together in a distributed and censorship-resistant mode to realize data storage, classification processing, response to queries and responsibility supervision. In the final network form, each role has a corresponding token incentive mechanism.

2.2.3 Other businesses

Ethereum Wayback Machine(EWM)

After the implementation of Ethereums improvement proposal EIP 4844, the new data structure blob will be introduced. Blob data is mainly used to store data that does not need to be permanently retained on the blockchain and needs to be spread through the network in a short period of time. of information data. for example:

Batch transaction data: For applications that need to process large volumes of transactions (for example, a CEX exchange batch processing withdrawals), blob data can contain information about these batches of transactions so that they can be processed efficiently as a whole.

Zero-knowledge proofs: Complex cryptographic proofs, such as zk-SNARKs, may require the transmission of large amounts of auxiliary data. Blob data can be used to store auxiliary information for these proofs so that the proofs can be verified without taking up too much space on the main chain.

Off-chain state: For some scaling solutions, such as state channels or sidechains, it may be necessary to periodically commit snapshots or proofs of off-chain state to the Ethereum main chain. Blob data can be used to contain data for these states.

Large datasets: For decentralized applications (DApps) that need to process large datasets, such as decentralized social media platforms or data marketplaces, blob data can be used to store user-generated content or other large datasets.

Bulk signing information: In some cases, a large number of signatures may need to be verified, such as in multi-party signing or bulk authorization operations. Blob data can contain this signature information.

Blob is a kind of data temporarily stored on the Ethereum network. Whether and how long to save it is decided by the node itself, and this constitutes the long-term data availability problem of blob data.

Covalents Ethereum Wayback Machine is an open source solution launched to solve long-term data availability. Its purpose is to provide decentralized, cryptographically secure historical data for demanders of blob data. We can understand it as a DA solution.

As for the specific technical mechanism of the Ethereum backtracking machine, due to space limitations, the author will not elaborate here. All we need to know is that the Ethereum backtrace machine also leverages Covalent’s network and data indexing mechanisms to ensure the accessibility and usability of historical blockchain data. By using the Ethereum backtrace machine, anyone can reconstruct a comprehensive representation of the blockchain and create a database with a normalized schema based on it.

More information about the Ethereum wayback machine can be found at https://www.covalenthq.com/blog/the-ethereum-wayback-machine/.

The product is currently under development and has not yet been officially launched.

It is worth mentioning that Ethstorage, a project also targeting blob decentralized storage, received $7 million in investment in a seed round in July 2023 with a valuation of $100 million.

Based on the above explanation of product mechanism and decentralized design, we can summarize Covalent’s business model at this point.

2.2.4 Business model

Covalents business model comes from the demand side paying fees for data needs (which will be done through Covalent in the early stage), and the fees will be paid to network operators, who need to pledge the project token CQT to provide services. The specific process is as follows:

When individuals call the API, they are paid in a U.S. dollar-denominated stablecoin, such as USDC. The contract will then use these USDC to purchase CQT on the secondary market, driving demand for the token. CQT is then distributed to the nodes wallet as a reward for responding to API queries.

Applications/developers deposit stablecoin assets into the Covalent protocol’s smart contracts.

The application queries the Covalent API.

Before sending the corresponding inquiry request to the operator, a check is made whether there are sufficient funds in the recharge account.

Query requests are sent to the query operator to fulfill the request.

The required data is sent back to the application.

The Moonbeam ledger records what data is being used, which operators are fulfilling requests and their cost.

Reconciliation will be completed between the balance between the network contract, CQT and the work performed.

USD funds are deducted from the developers recharge account and exchanged for CQT through the market purchase mechanism, and then settled with the validators unsettled balance.

The greater the profit of the network, the more operators want to enter the network, the greater the demand for CQT pledge, and the amount of pledge and payment will form buying pressure on CQT tokens. Of course, operators sell CQT and exchange it for stable currency, which is also Selling pressure will form on CQT.

Obviously, Covalents business situation is determined by external data indexing needs. The more developers and institutions that demand data, the better its business development will be.

Note that the above business switch of distributing revenue streams to purchase CQT to operators has not yet been turned on. However, according to official statements, the switch will be turned on in the near future and the process will be demonstrated on the chain. At that time, the repurchase will be conducted on Sushiswap, where CQT’s current liquidity is mainly located, to facilitate user supervision.

So, where is Covalents business today? We start with the analysis from the number of chains it supports, user data, pricing and charging, and customer situations.

2.3 Business situation

2.3.1 Number of blockchains supported by the indexing service

Covalent currently provides comprehensive historical transaction data for more than 211 chains.

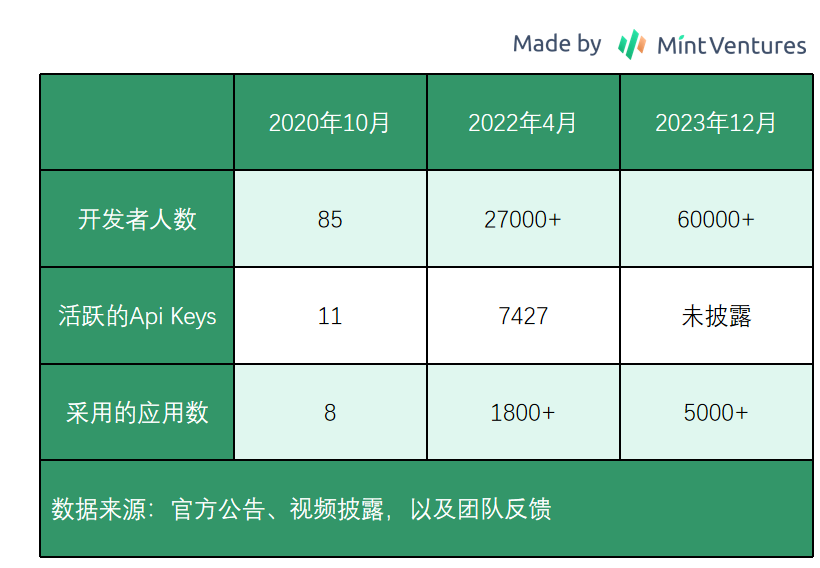

2.3.2 Number of users

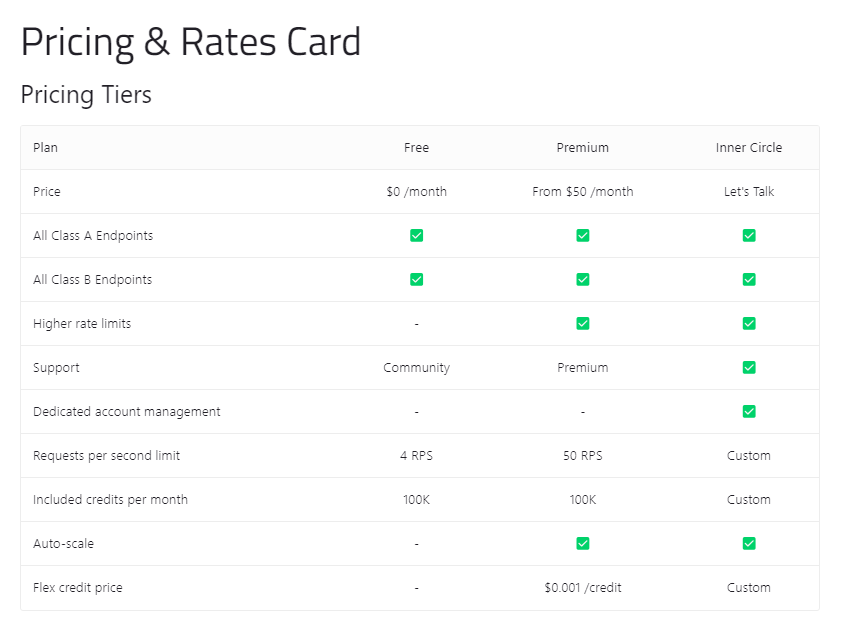

2.3.3 Charges

1. Pricing

According to the price list provided by Covalent, the minimum consumption unit of the platform is credits, and different query behaviors correspond to different amounts of credits.

Image source: https://www.covalenthq.com/docs/unified-api/catalog/

Take a small wallet project as an example to calculate its one-month indexing service consumption:

This wallet supports three chains: Ethereum, Polygon, and Optimism. The corresponding daily activity data is as follows:

Ethereum ( 7, 000 daily active users)

Polygon ( 3, 000 daily active users)

Optimism ( 1, 000 daily active users)

The application uses the balances_v2 endpoint to provide data to the user, consuming 1 credit per balance call.

The corresponding consumption is 11,000 credits/day and 330,000 credits/month.

Assuming that he is a premium member, the corresponding consumption is: Premium Member 50 $ per month + (330000-100000) * 0.001 $ = 230 $/month.

2. Revenue in 2023 and comparison with Graph

Regarding the overall revenue of Covalent in 2023, the author verified with the official team, and the data fed back by the other party are as follows:

Covalents revenue from data indexing in 2023 will be US$600,000. 2023 is also the first year that Covalent officially started commercialization. Its initial revenue in January was still 0

The number of paying users is 150+, among which institutions and project parties are the main paying users.

Estimated revenue growth of 100% in 2024

As for The Graph, the leading project in the decentralized data indexing track, its annual revenue in the past three months has only been US$100,000+.

Data source: https://thegraph.com/explorer/network?chain=mainnet

In addition, the team stated that Covalent’s revenue business flow data will be online in the next few weeks, and users will be able to see Covalent’s revenue flow at that time.

2.3.4 Customer situation

Covalent’s customer base is mainly B-side, and its main customer categories include:

Wallets and dashboards: Popular wallets and dashboards like Rainbow and Zerion use the Covalent API to aggregate historical balances and profits for DeFi and NFT assets for their users.

Market data: Dashboards like CoinGecko can show price trends, liquidity, and asset ROI.

Cross-chain projects: Cross-chain liquidity aggregators such as Li Finance are used to access different networks to obtain asset price information.

Crypto tax: Portfolio trackers like Rotki can pull historical balance and pricing data across chains in tax reports.

Defi: Such as Aave, Balancer, Paraswap, Curve, Lido, Frax, Yearn, etc. integrate user data from different chains.

CEX: In order to comply with tax regulations, the exchange will extract users’ historical transaction data to generate reports.

Traditional financial and custodian institutions: Fidelity, the world’s largest wealth management institution, Ernst Young, one of the Big Four accounting firms, and Jump Crypto.

AI training and decision-making: Provide on-chain data for AI models of projects such as Nomis.cc (multi-chain identity and reputation protocol), Network 3 (distributed computing protocol), and other projects to help large models with training and decision-making.

Other Internet services: For example, some financial websites, these applications want to display cryptographic functions such as NFT and DeFi positions on different networks. These customers will be able to take advantage of Web3 without investing in additional infrastructure (i.e. running nodes, writing smart contracts). Instead, they will be able to access on-chain data using SQL.

Analysts: Covalent’s no-code solution reduces friction for analysts building complex dashboards and conducting downstream analysis for compliance, risk or tax. In Analyst Mode, all requests and responses become an Excel-like experience that can be exported to CSV and Tableau.

In addition, the parent company of Metamask, Infura, Linea@ConsensysAlso a client of Covalent.

In addition to Covalents direct sales channels, Covalent has begun to cooperate with other upstream RPC service providers such as Chainstack, QuickNode, and Infura since last year to provide data indexing services to their users through the channels of these partners. Currently, only users generated through the Infura channel The payment amount has already reached the 6-digit level.

2.3.5 Business flywheel

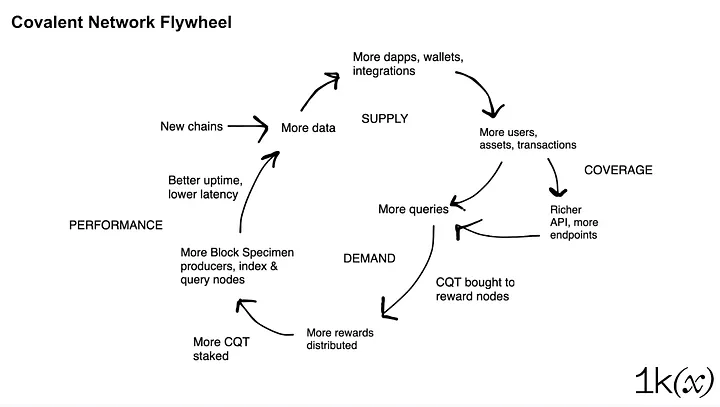

Image source: https://medium.com/1kx network/indexing-the-universe-of-blockchains-with-covalent-7 a 968678 3d c 1

In a report written by 1KX, Covalent’s investment institution, 1KX envisioned a self-reinforcing flywheel for Covalent’s business development, which is simply: low latency, rich data index → more B-side customers, dapps, wallets Integrated with institutions → More C-side user requests → Larger index volume and rich indexing requirements → More CQT repurchase and distribution rewards → More network nodes and CQT pledge → Better and richer data services and low latency.

2.4 Team, financing and partners

2.4.1 Founder and Team

Covalent is founded and led by Ganesh Swami and Levi Aul.

Ganesh, a man trained in physics with over 10 years of experience in data analysis, listed his first company on the New York Stock Exchange and is also a professional on Mount Everest. Levi established the first Bitcoin exchange in Canada and was a member of the IBM team that built CouchDB. The team is currently expected to number around 40-60 people, including network architects, data scientists and software engineers.

Overall, the background and experience of the team founders are very consistent with the current project, and they also have a good entrepreneurial success background.

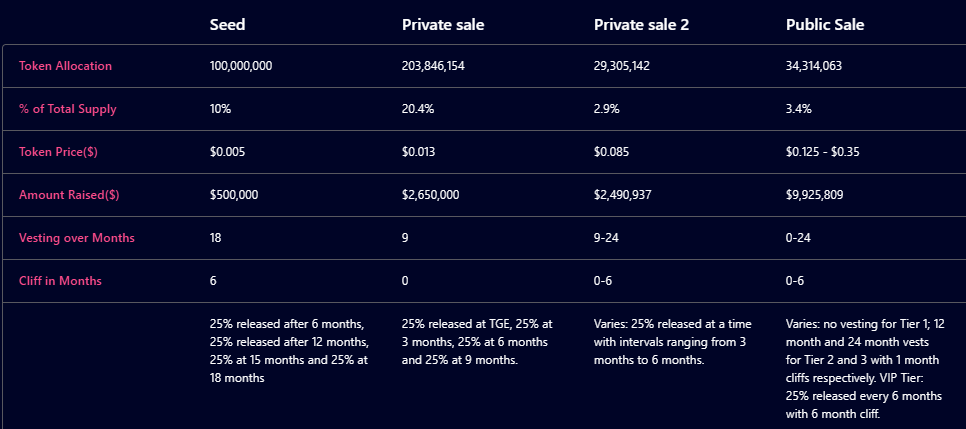

2.4.2 Financing situation

The project has conducted a total of 4 rounds of financing, with a total financing amount of approximately US$15.5 million.

Image source: https://www.covalenthq.com/token/

Image source: rootdata

The investors are also very luxurious, basically bringing together various top Web3 institutions, including Hashed, Dephi Digital, etc., among which the two leading exchanges Binance and Coinbase have investments.

However, the project side’s latest round of financing was in May 2021, and more than 2 years have passed so far.

2.4.3 Important partners

In addition to various public chains and customers being important partners, Infura officially announced its partnership with Covalent at the Istanbul Decentralized RPC Summit in November 2023. Others include Microsoft, Tencent, Pokt network and other institutions .

Through the partnership, infura will integrate Covalent’s API into Infura’s existing suite of services, ensuring developers have a seamless and efficient experience, removing barriers to entry and accelerating development cycles.

2.5 Summary of the basic situation of the project

Overall, Covalent is a leading project on a rapid development track, with its various business data in a rapidly rising stage and its revenue data increasing. In terms of income level, Covalent has an income several times greater than that of The Graph, the current leading project on the track, and seems to have achieved a better PMF (Product Market Fit). However, because its income stream has not yet been uploaded to the chain, market investors There may be a large awareness gap about this.

In terms of new business, the Ethereum Wayback Machine it is developing as a long-term blob DA solution is also in line with the current market hot spots.

In terms of team, the founding team has professional resume and entrepreneurial background that matches the track. Investors also basically include various industry parties at the top of the industry, including public chain foundations, leading exchanges, major customers, etc.

3. Token model

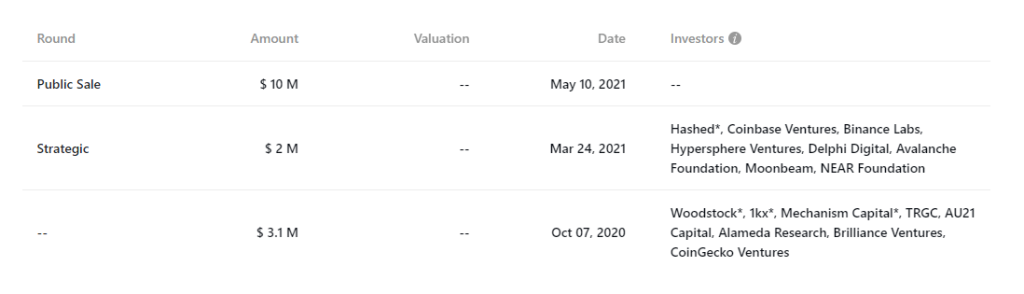

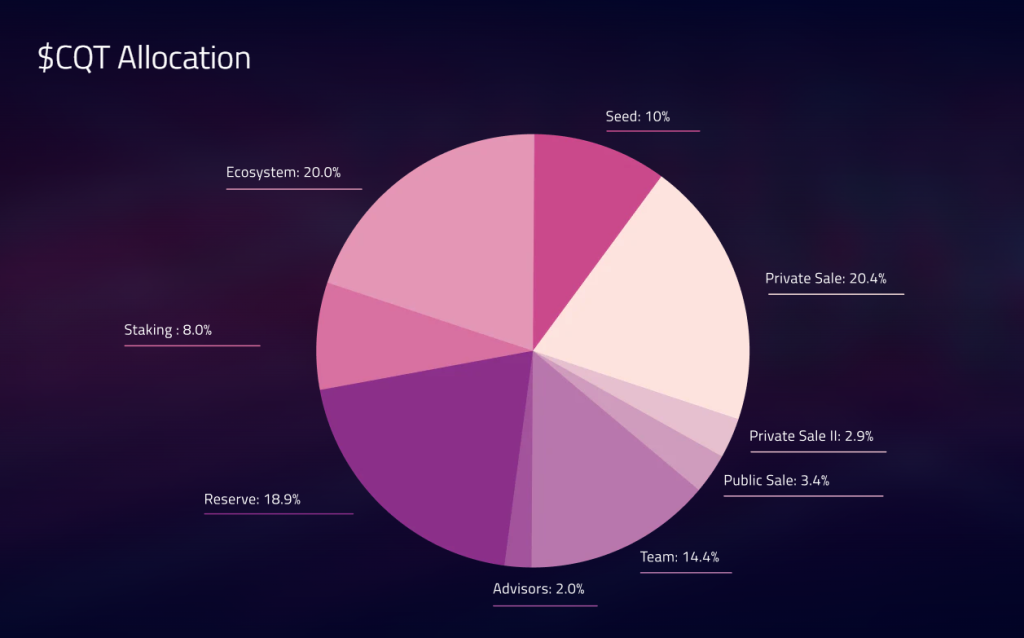

3.1 Total amount and distribution of tokens

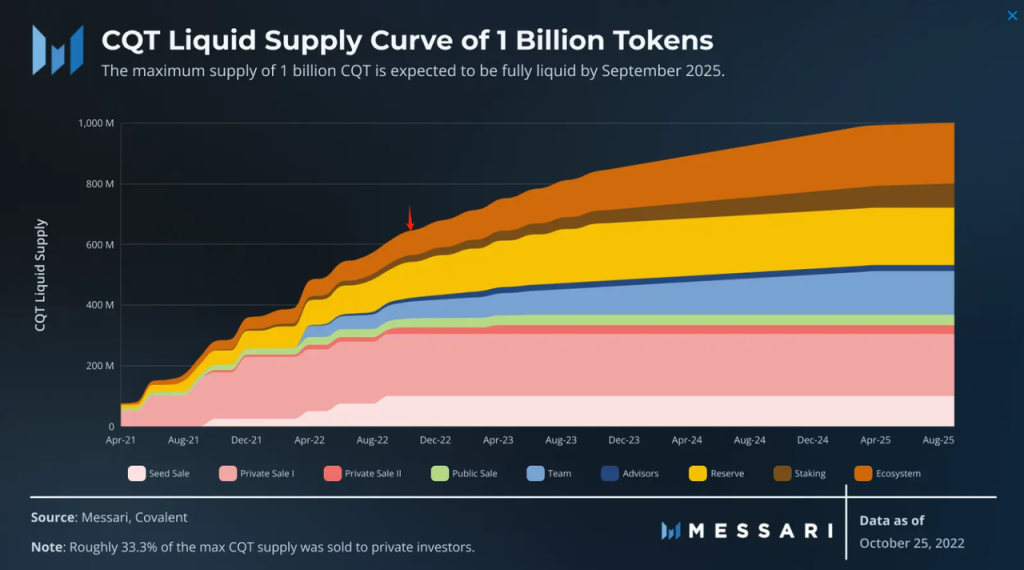

The total number of Covalent tokens is 1 billion, and the specific distribution method is as follows:

Token sale: 33.4%

Teams and consultants: 16.4%

Reserve: 18.9%

Staking reward: 8%

Ecology: 20%

The current token circulation rate is 62.5% and is at the following release position:

Data source: https://messari.io/report/covalent-a-unified-api-for-retrieving-blockchain-data

3.2 Token use cases and requirements

Governance: Token holders vote on proposals that change system parameters, such as new data sources, specific geographies, and data modeling requirements.

Staking and Verification: $CQT is a staking asset. Validators earn fees by ensuring the integrity of network data. Token holders can delegate to validators and earn rewards by participating in the security mechanism.

Economic settlement within the system: paying users pay stablecoins to purchase data services, and the stablecoins will be exchanged for CQT from the market and distributed to pledged and functioning network operators

Staking rewards: Staking CQT itself will also receive staking incentives, but this part of the income only lasts for 4 years and is used to activate early network participants. The cost of long-term network operation will be maintained by payments generated by users’ real needs.

Overall, the economic model design of the token is reasonable, especially taking into account the payment and budget preferences of enterprise customers: enterprise customers do not want to hold a volatile token on their balance sheet, namely CQT .

4. Market and competitor situation

4.1 Market stratification

There are many participants and levels in the on-chain data market, and we need to classify them.

Among them, service providers that provide basic and native on-chain data based on RPC, centralized representatives include Infura, Alchemy, Quicknode, etc., and decentralized RPC service providers include Pocket network. In fact, they are the upstream of Covalent, Covalent Network The operators also obtain the original data on the chain from them.

Covalent belongs to the index layer of data, that is, the processing and re-output layer after obtaining the data. In the competition of this layer, there are@Bitquery_io,@etherscan,@Moralis Web3,@blockvisionhqWaiting for opponents, but they are all centralized, and the decentralized indexing service provider that introduced tokens is The Graph.

The relative value of the decentralized data index layer is that it provides greater censorship resistance, openness, and verifiability of data sources and construction methods. The distributed working method also makes the system less prone to single points of failure.

4.2 Competitor comparison

Compared with The Graph, the main differences of Covalent are:

1. Different data processing methods

Covalent follows the extract-load-transform (ELT) data integration paradigm, where the network extracts data from the blockchain and loads it into a data warehouse. The client then transforms it as needed to support the required data when queried. In contrast, subgraph-based indexers (Graphs) follow an extract-transform-load paradigm, where extracted data is first transformed into a use-case-specific subgraph.

Specifically, the benefits are:

Flexibly handle changes in downstream demand. Since the data is non-destructively normalized (extract-load) before querying (transformation), users can obtain different types of analytical data simply by changing the query. If the protocols smart contracts are upgraded, Covalent users only need to re-query the comprehensive dataset, rather than modifying and re-indexing subgraphs as would be the case under the ETL paradigm.

Flexibly handle changes in upstream demand. As blockchains become more heterogeneous, the Block Specimen standard ensures that Covalent’s unified API can be directly queried, even for chains with different transaction receipt formats and non-EVM chains. In the ETL paradigm, customers would need to rewrite subgraphs for chains like EVMOS or Solana, but on Covalent, patching these chains to the Block Specimen specification is a one-time fix.

Lower operating costs for customers. With Covalents ELT-based approach, customers costs come primarily from analysts and IT operations staff writing queries, rather than developers building and maintaining subgraphs. Covalent eliminates redundant data engineering work, allowing teams to focus on analytics, helping them make smarter business decisions.

Able to handle queries that require data from the entire chain. This is why Covalent is so popular among portfolio trackers and tax reporting apps. The fact that all data is available through a unified API makes Covalent suitable for machine learning endeavors such as address classification and clustering. With this, developers can also build a range of data-driven applications using the API as a single point of integration.

Realize true chain-independent data consumption. Covalent’s block sample producers will become full node operators of the source blockchain, and they will extract and normalize on-chain data before publishing it to storage nodes. Query nodes read data from storage nodes in response to external API requests. This means customers can use the same query on the data in a very different form than its original form, which is a powerful feature for dapps to become cross-chain local.

2. Differences in needs of user objects

Applications that use Covalent tend to require highly general, broadly applicable data, and they tend not to require the highly specialized, diverse datasets that developers of subgraphs like Graph build. Applications in areas such as wallets, NFT markets, and tax services are more likely to use the official data API launched by Covalent. At the same time, if your application relies on segment and scenario data, you might be tempted to use The Graph.

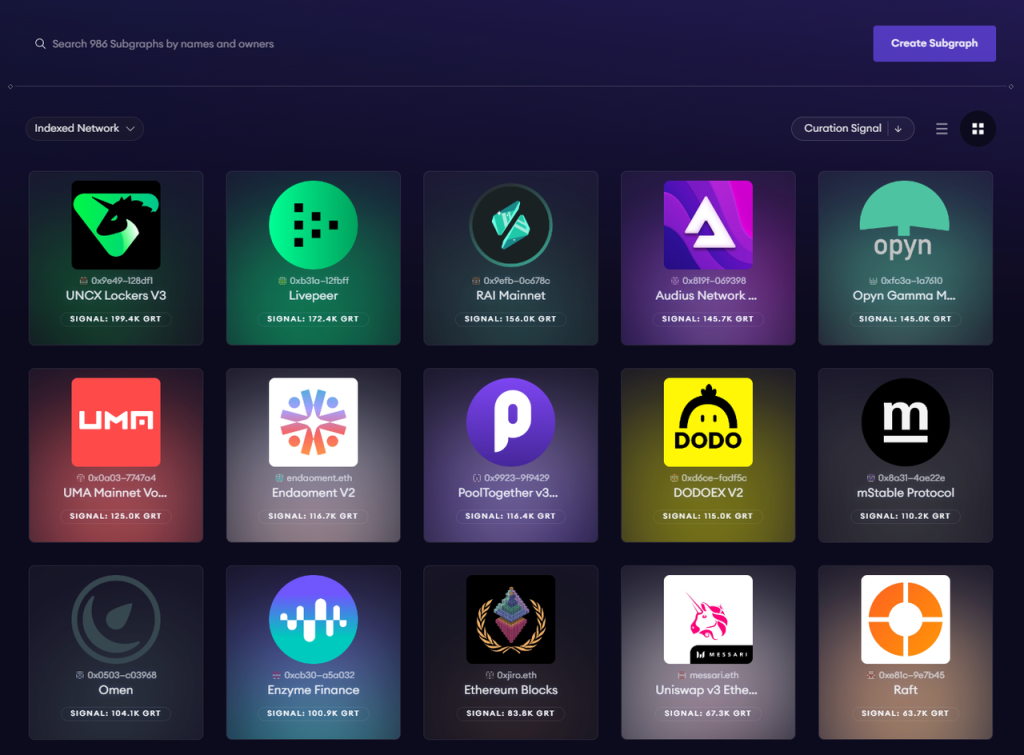

3. Ecology

Image source: https://thegraph.com/explorer?chain=mainnet

Number of subgraphs: The Graph’s third-party self-built subgraphs are much more than Covalent’s third-party C endpoints. The number of subgraphs supported by The Graph on the two arb+eth chains has reached 1500+, while Covalent’s There are only a dozen, which is related to the fact that it has just started opening third-party endpoints (similar to sub-pictures).

Number of networks: Covalent supports 200+ chains, while The Graph supports 10+, which is a big difference. However, all major business chains have been covered.

5.Valuation

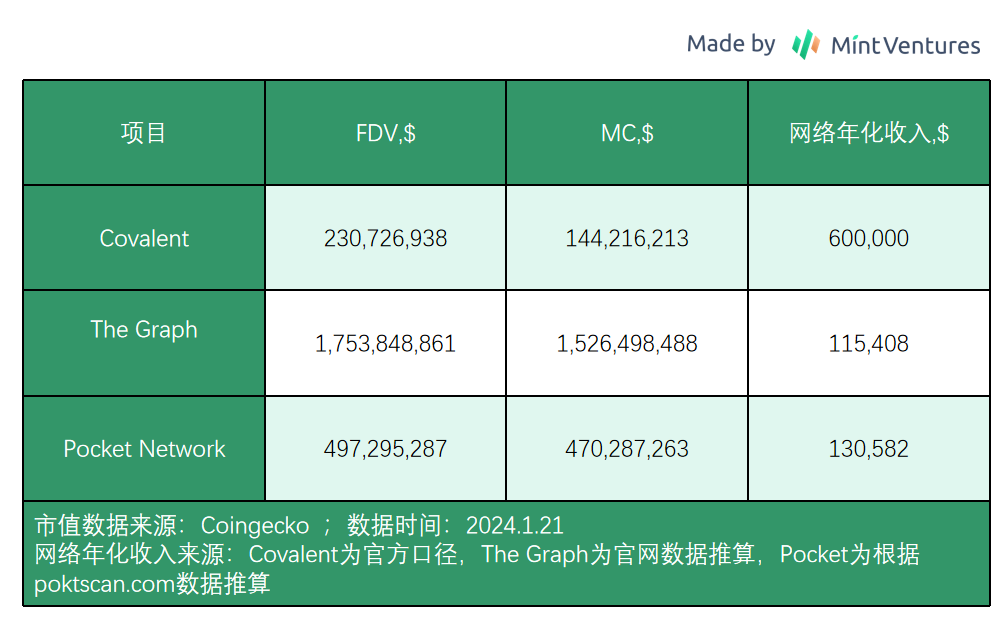

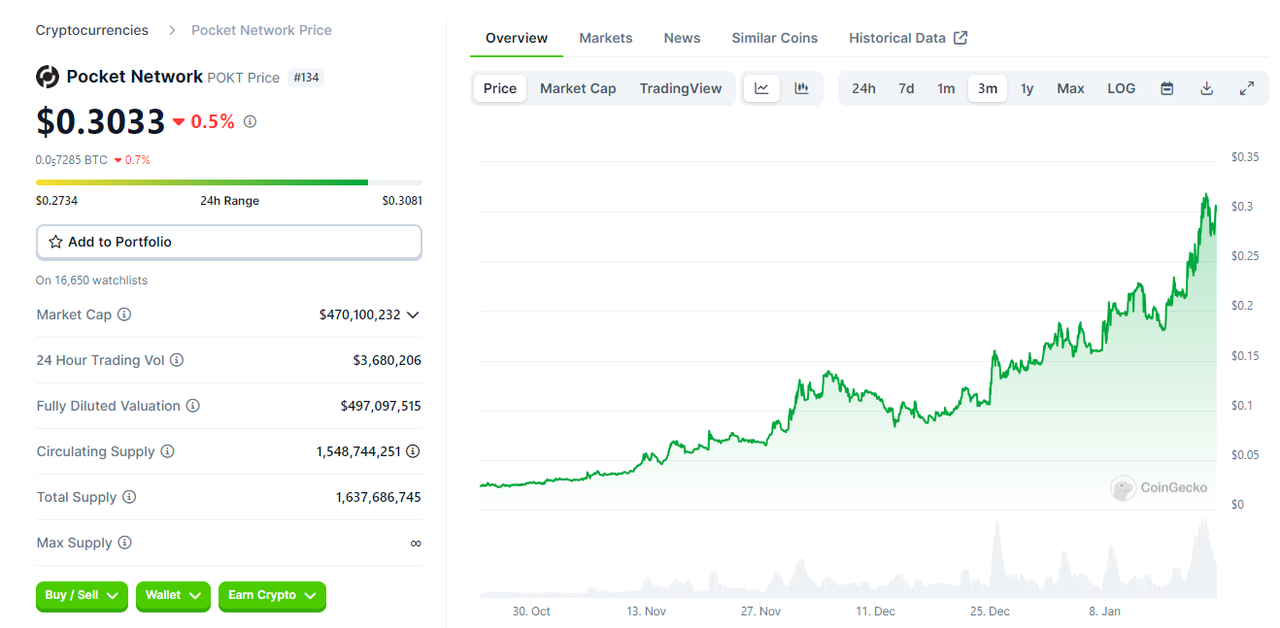

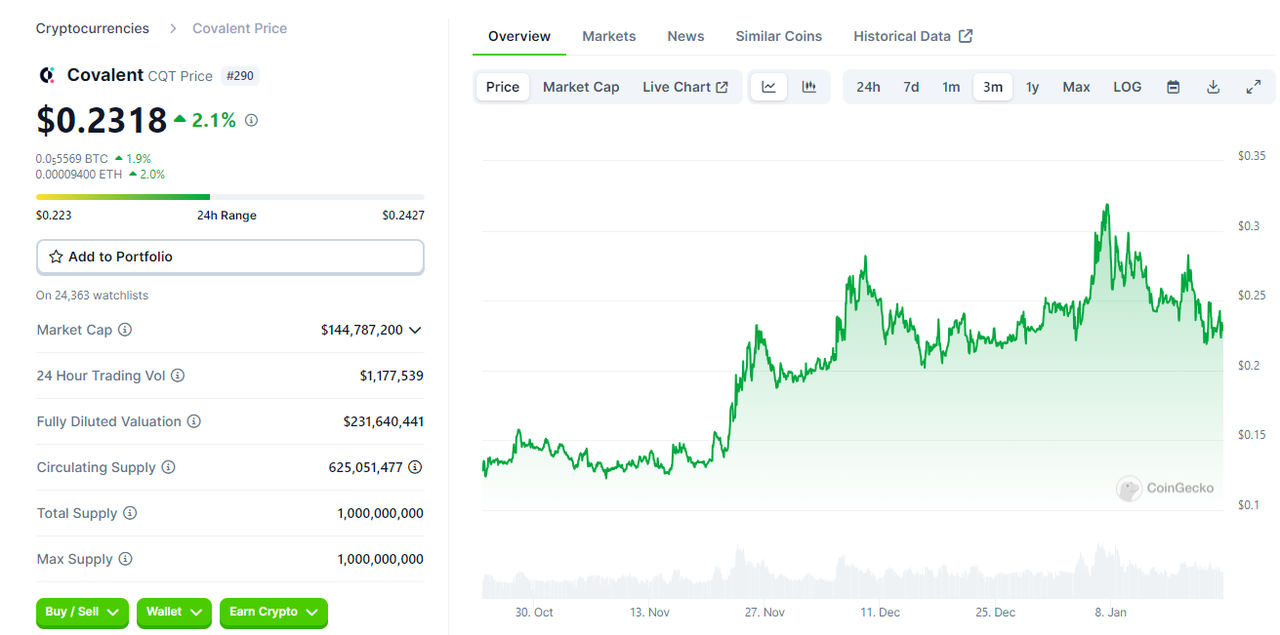

In terms of valuation, the author mainly uses comparative valuation and selects two decentralized data service projects that are in the same track as Covalent for comparison. They are The Graph and Pocket Network.

Among them, The Graph is a direct competitor of Covalent, and its valuation is of high reference. As a decentralized RPC service project, and the upstream of Covalent in the same industry, Pokt’s valuation is also of certain reference.

From a valuation perspective, Covalent still has a FDV valuation gap of nearly 7 times from The Graph. When we take into account the fact that Covalent’s annualized revenue is nearly 6 times that of The Graph, this valuation seems very Tempting.

Compared with Pocket Network, Covalent’s revenue level is higher, but its valuation is lower, but it is basically at the same order of magnitude valuation—that is, at the level of several hundred million dollars. However, Pokt has achieved a nearly 12-fold increase in the past 3 months, completing an astonishing round of value discovery.

CQT has only risen by about 80% in the past three months. It is more following the rebound of the market and has not yet received the attention of a large amount of funds.

6.Risk

Regarding Covalent, the author believes that there are two main risks worthy of attention:

1. If other centralized blockchain data service organizations with a larger number of users, such as Alchemy, Infura, Quicknode, etc., start from RPC and move into the downstream data indexing service track and provide similar data indexing services, they may have a negative impact on Covalents Market share and pricing are squeezed. For example, Alchemy completed its acquisition of data indexing platform Satsuma in September 2023.

2. Data indexing is a relatively unpopular track with little awareness among public investors. At present, it still has not attracted the attention of investors. This trend may continue in the absence of hot narratives in the track.

7. References and Acknowledgments

This article would like to thank Leo and Bruce from the Pocket Network community for their review and comments.

Messari:Covalent: A Unified API for Retrieving Blockchain Data

1KX:Indexing the universe of blockchains with Covalent

The Graph data dashboard: https://thegraph.com/explorer/network?chain=mainnet

Pocket Network data dashboard: https://poktscan.com/