1. Why is EigenLayer gaining popularity again?

With the passage of the Bitcoin spot ETF, Ethereums positive effects have emerged: with the expectation of the adoption of the Ethereum spot EFT and the Cancun upgrade, Ethereum, which has been languishing for a long time, has burst out with new vitality.

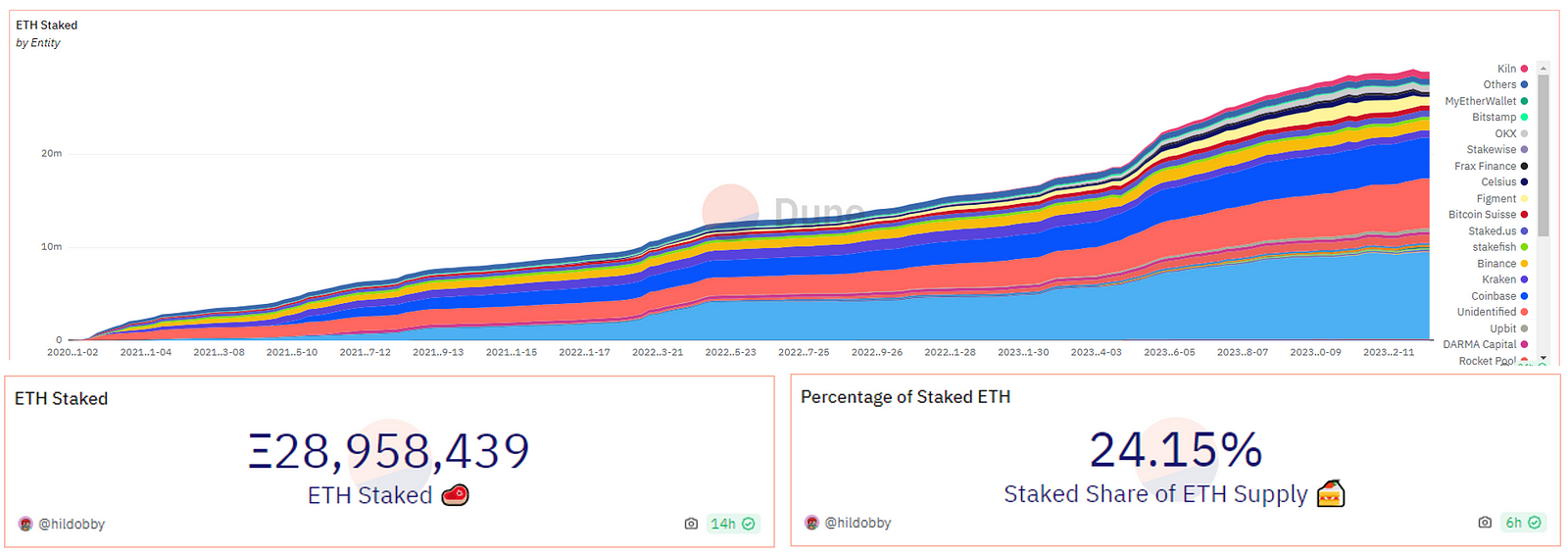

The amount of Ethereum pledged continues to increase, and the need for re-pledge has become increasingly prominent. EigenLayer allows users to re-pledge ETH, lsdETH (liquidity pledged ETH) and LP Token in other side chains, oracles, middleware, etc., as nodes and receive verification rewards, so that third-party projects can enjoy the security of the ETH main network , ETH pledgers can also get more benefits, achieving a win-win situation.

Data source: https://dune.com/hildobby/eth2-staking

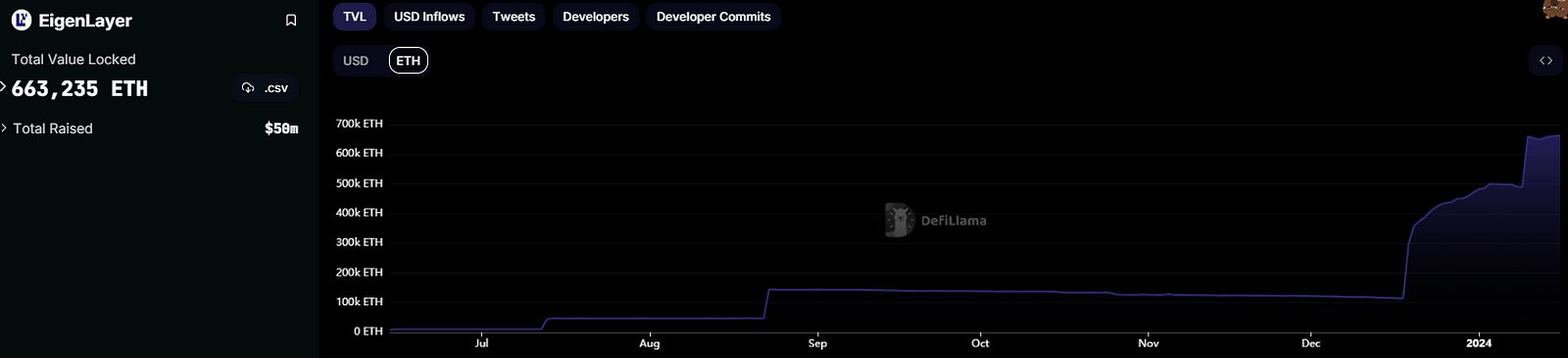

The trend of re-pledge has become the focus of the Ethereum ecosystem as EigenLayer increased the LST mortgage amount. In just one month, EigenLayer absorbed more than 500,000 Ethereum, with a TVL of over 1.6 billion US dollars, ranking 12th on the Ethereum chain. top-level protocols.

Data source: https://defillama.com/protocol/EigenLayer?denomination=ETH

Recently, EigenLayer announced that it will provide re-pledge services for the Cosmos sub-chain, which is of great significance to both Ethereum and Cosmos. EigenLayer provides re-pledge services for Cosmos sub-chains, allowing Cosmos to obtain the security of Ethereum, and also opens up a new world of incremental returns for Ethereum stakers.

The picture shows EigenLayer Universe, source: https://x.com/eli5_defi/status/1746550169183846503?s=20

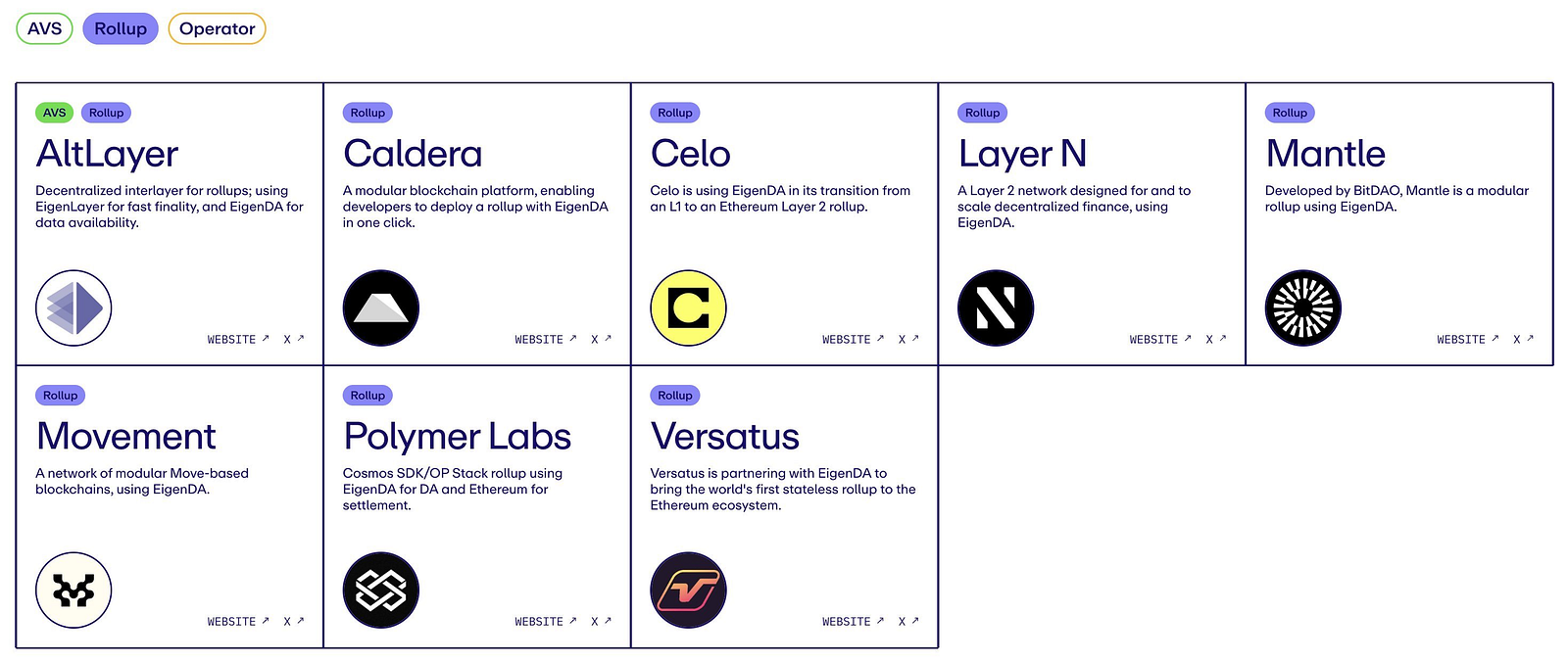

EigenDA, the first AVS to use EigenLayer verification service, is also about to go online. The narrative of its DA service has also become a topic of market attention with the skyrocketing price of Celestia’s token TIA.

The picture shows EigenDA’s partners, source: https://x.com/eigen_da/status/1731674794347860449?s=20

For more information about EigenLayer, please refer to this issue:Research Report|EigenLayer: Strengthening the security of Ethereum and inspiring a new era of staking

2. What are the potential projects on the re-pledge track?

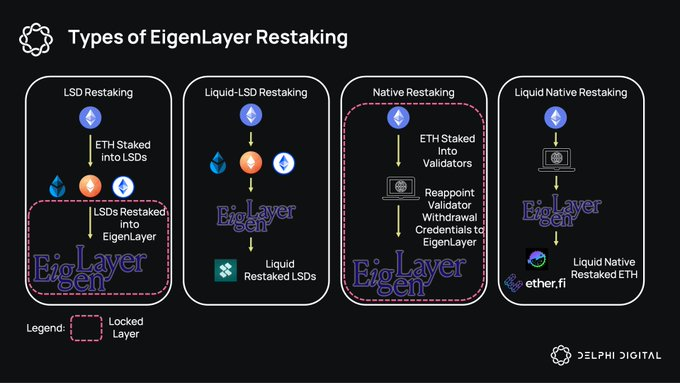

The re-staking track is not only EigenLayer, there are also many opportunities for derivative projects under the Restaking narrative. Let’s briefly introduce the four types of Restaking:

LSD Restaking: Deposit the LST (stETH, cbETH, etc.) you get after depositing into the LSD protocol into EigenLayer and then stake it.

Liquid-LSD Restaking: Through LRD protocols such as Kelp DAO, LST is entrusted to the LRD protocol, and the protocol deposits it into EigenLayer and then pledges it, and the user gets the mortgage certificate token Liquid Restaking Token (LRT).

Native Restaking: Native liquid staking means that the verifier uses the EigenPod smart contract to redirect the verifiers withdrawal certificate to EigenLayer.

Liquid Native Restaking: Native liquid restaking refers to projects such as etherf.fi or Puffer Finance that provide small-amount ETH node services, and provide the ETH in the node to EigenLayer for re-staking.

Image from: Delphi Digital, source: https://x.com/Delphi_Digital/status/1740463277099151482?s=20

Below are statistics of five re-pledge projects with unissued coins for your reference. These five projects can earn EigenLayer points while earning points for their respective projects.

Kelp DAO

Kelp DAO is a Restaking project made by Stader Lab, an LSD project that supports multi-chain. It belongs to the Liquid-LSD Restaking type mentioned above. It is currently open to deposit Lido’s stETH and Stader’s ETHx, two LST tokens. However, due to the current The EigenLayer LST quota is full, so deposits are currently suspended.

Although Stader Lab has issued tokens, Kelp DAO has launched a points system. As its sub-project, Kelp DAO should still launch its own tokens. And we can look forward to the linkage effect between SD (Stader Lab’s token) and Kelp DAO.

Swell

Swell is a well-established LSD protocol. It recently announced that it will enter the field of Liquid Restaking and is a Liquid Native Restaking type product. After adding the re-pledge function, users can deposit ETH and exchange rswETH, so Swell will no longer be restricted by the EigenLayer LST quota.

Since Swell has not issued any tokens yet and has airdrop expectations, its LST token swETH is valued by airdrop hunters and is currently the second-ranked pledged asset in EigenLayer. In the past, LSD could earn points, and you can also earn points by participating in re-staking.

ether.fi

Ether.fi is a Liquid Native Restaking type product and has received US$5.3 million in seed round financing from BitMEX founder Arthur Hayes. Unlike Lido, ether.fi uses a decentralized, non-custodial approach to implement ETH. pledge, and announced the provision of re-pledge services. Since it is a native ETH re-pledge, it is not affected by the EigenLayer LST limit and can still be deposited, and its mortgage certificate token eETH (wrapped token weETH) is currently one of the few with liquidity. LRT Collateral Receipt Token.

Renzo

Renzo is also a Liquid Native Restaking type product and will not be restricted by the EigenLayer LST deposit limit. Deposits are still possible. However, it should be noted that the ETH deposited in Renzo is currently not open for redemption, and the mortgage certificate ezETH cannot be transferred, and it will be locked in the short term.

On January 16, Renzo announced the completion of a US$3 million seed round of financing. The security is guaranteed, and compared with similar protocols, the lock-up amount is smaller, and it currently appears to be more cost-effective.

It should be noted that because of the form of reward points for new players and the unannounced team background, as well as the fact that redemption is not open, it has been questioned and distrusted by some users.

Puffer Finance

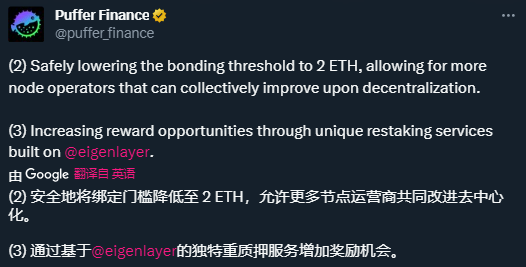

Puffer Finance is an anti-slash liquidity staking protocol, which is similar to ether.fi. It is also a Liquid Native Restaking type product and is not open for staking at the moment. Puffer Finance has received a seed round of financing led by Jump Crypto, with a total of US$6.15 million in financing at an undisclosed valuation.

EigenLayer has a 32 ETH threshold requirement for general Ethereum re-pledge nodes, which can be reached before AVS can be run.

Puffers re-pledge function is to lower this threshold below 2 ETH in an attempt to attract small nodes.

3. Find a new way, how to use Pendle to participate in re-staking?

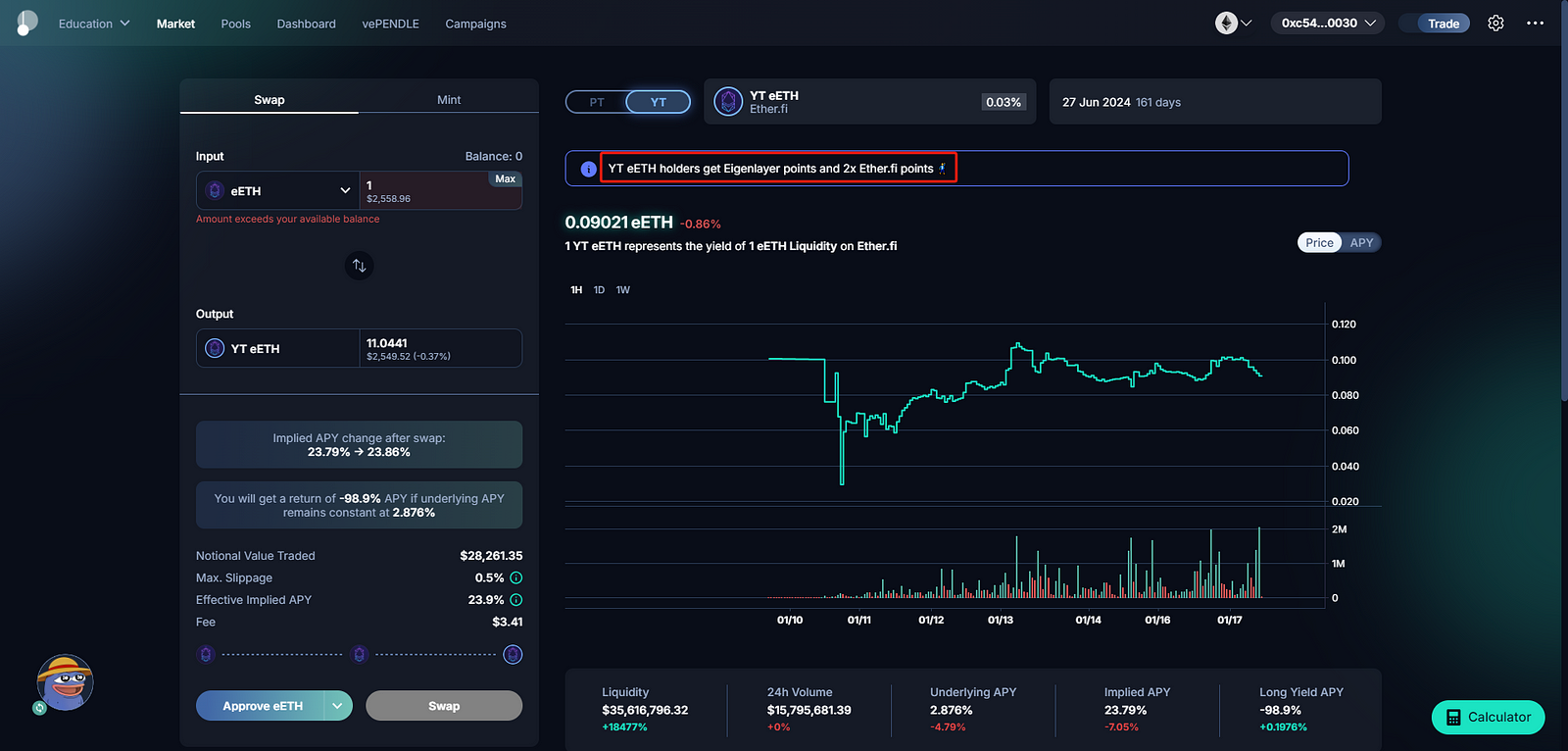

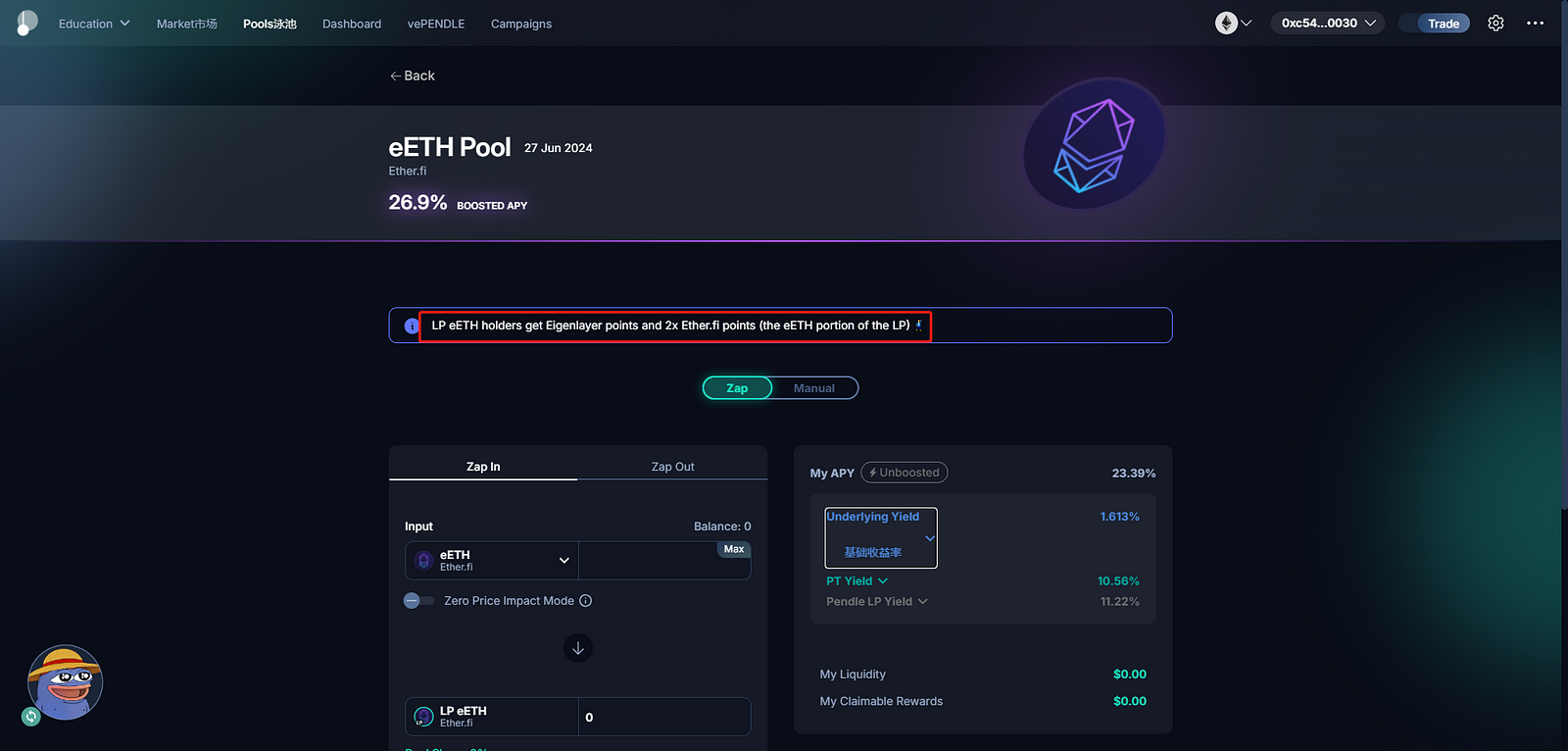

Pendle is a decentralized interest rate trading market that provides transactions of PT (Principal Token) and YT (Yield Token). We can use YT transactions in Pendle to accelerate the acquisition of ether.fi and EigenLayer points.

Go to Pendles YT-eETH exchange and buy YT-eETH. By holding YT-eETH, you can receive staking income, double ether.fi points, EigenLayer points, and Pendle trading rewards. Currently, 1 eETH can buy approximately 11 YT-eETH, which is equivalent to 11 times the leverage.

The benefits look attractive, right? But after understanding the price mechanism of YT, you will know that the price of YT gradually decreases as the expiration date approaches. This is essentially exchanging time for pledge income and points.

Of course, you can also obtain the above rewards in a lower-risk form such as group LP. However, there are also disadvantages, such as being susceptible to impermanent losses and relatively low efficiency in obtaining points.

Tip: If you don’t know much about Pendle, please learn the relevant knowledge before operating it. This article cannot explain it in too much detail due to space limitations.

4. Risks of re-pledge that cannot be ignored

Re-staking, as an emerging concept in the crypto space, is coming to prominence, providing stakers with more opportunities to join different networks and increase their returns. EigenLayer calls itself the “Airbnb of decentralized trust,” underscoring the appeal of the opportunity. However, re-hypothecation is not without risks, and it introduces a series of potential issues that deserve careful consideration.

1. Risk of fines: The risk of losing staked ETH increases due to malicious activities.

2. Centralization risk: If too many stakers move to EigenLayer or other protocols, it may cause systemic risks to Ethereum.

3. Contract risks: There may be risks in the smart contracts of each agreement.

4. Multi-level risk superposition: This is the key issue of re-pledge. It combines the existing pledge risk with additional risks to form multi-level risks.

5. Summary

The ETH/BTC exchange rate has rebounded strongly after the adoption of the Bitcoin spot ETF. With the blessing of the Cancun upgrade and the Ethereum spot ETF, the Ethereum ecosystem will also rebound. The next main theme of the Ethereum ecosystem is the L2 sector, which is directly beneficial to the Cancun upgrade, and the other is the re-staking ecosystem of EigenLayer.

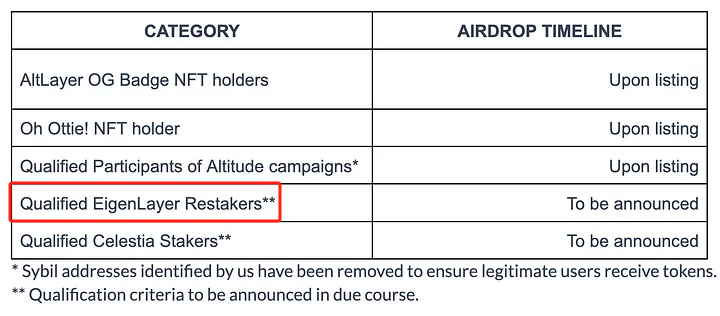

Using the projects mentioned today to participate in re-staking is undoubtedly the most cost-effective option. As long as you participate in staking, you can eat two or three of the same fish. It should be noted that the recent airdrop rules of Altlayer mentioned that airdrops will be given to EigenLayer stakers, but it is still unknown whether pledges to protocols such as Kelp DAO and Renzo can be penetrated and recognized as EigenLayer stakers.

Image source: https://blog.altlayer.io/altlayers-alt-token-launch-f49bf8ac2556

Of course, we must also realize that the constant re-hypothecation of nesting dolls is essentially speculative leverage created for liquidity. While bringing higher returns, it also amplifies risks. No matter which layer of the protocol has a contract problem, user assets will be damaged.

Glossary

Restaking: Restaking involves staking liquidity-staking tokens, enhancing security while allowing stakers to receive rewards from services provided by middleware applications.

AVS (Actively Validated Services): Active verification service, any system that requires its own distributed verification semantics for verification, such as side chains, data availability layers, new virtual machines, keeper networks, oracle networks, bridges, threshold encryption schemes and Trusted execution environment.

LSD (Liquid Staking Derivatives): Liquid pledged derivatives refer to the receipt tokens obtained after pledging tokens, which is equivalent to the certificate of deposit after depositing in the bank.

LST (Liquid Staking Token): Liquid pledged token, representing tokens pledged on the POS (Proof of Stake) blockchain, such as Lidos stETH, Coinbases cbETH, etc.

LRT (Liquid Restaking Token): Liquid re-pledge token. LST is pledged again to obtain LRT.

Related project websites

EigenLayer:https://www.EigenLayer.xyz/

Kelp Dao:https://www.kelpdao.xyz/

ether.fi:https://www.ether.fi/

Puffer Finance:https://www.puffer.fi/

Pendle:https://www.pendle.finance/