Original - Odaily

Author - Azuma

As the final “judgment” day for the Bitcoin spot ETF on January 10 approaches, cryptocurrency market sentiment continues to heat up.

From last night to this morning, BTC once again experienced a sharp rise. Ouyi OKX market display,BTC briefly exceeded 47,000 USDT, reaching a maximum of 47,300 USDT, setting a new high in 22 months.. As of the time of publication, BTC was temporarily trading at 46582.6 USDT, a 24-hour increase of 6.5%.

Mainstream alt-coins are also generally rising, and the increase is basically at the same rate as BTC. As of the publication of this article, ETH is temporarily reported at 2303.55 USDT, a 24-hour increase of 4.56%; SOL is temporarily reported at 96.54 USDT, a 24-hour increase of 8.03%; OP is temporarily reported at 3.36 USDT, a 24-hour increase of 8.25%; ARB is temporarily reported at 1.79 USDT, a 24-hour increase of 6% ; TIA is temporarily trading at 14.85 USDT, with a 24-hour increase of 5.16%.

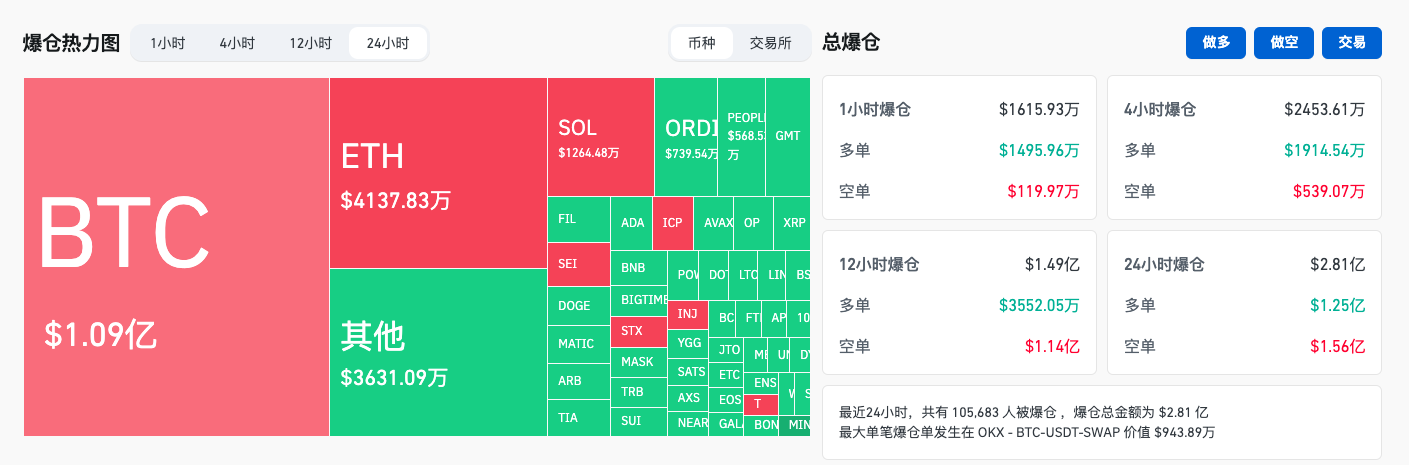

Goinglass data shows,In the past 24 hours, the entire network was liquidated to US$281 million, including US$125 million for long orders and US$156 million for short orders.; In terms of currencies, BTC liquidated positions at US$109 million and ETH liquidated at US$41.3783 million.

ETF’s decisive moment is coming

According to the ETF application regulations, January 10th is the deadline for the U.S. Securities and Exchange Commission (SEC) to approve the Ark/21 Shares Bitcoin spot ETF application, which also means that the SEC must approval or approval before January 10th. Refuse to make a decision, and according to disclosures from many people familiar with the matter,The SEC intends to take this opportunity to make a unified decision on all Bitcoin spot ETF applications.

21:00 in Beijing last night (8:00 on January 8, Eastern Time) was the deadline for the SEC to require major Bitcoin spot ETF applicants to submit updated versions of documents.

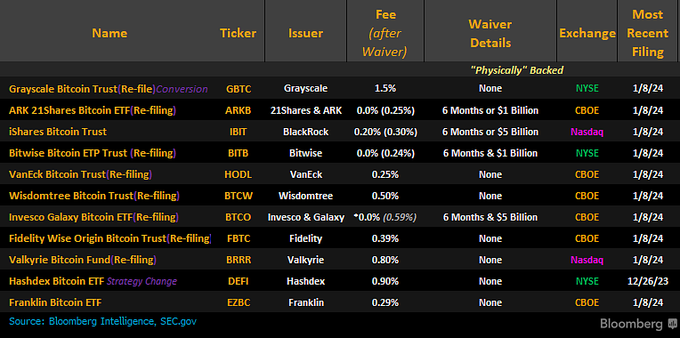

In the end, in addition to Hashdex, all other ETF applicants such as Grayscale, Ark/21Shares, Blackrock, BitWise, VanEck, WisdomTree, Invesco, Fidelity, Valkyrie, and Franklin have submitted their applications. Updated S-1 file (S-3 file in grayscale case).

In the application documents, major ETF applicants detailed the rate standards set for their own products, including BlackRock, Fidelity, Ark and other ETF applicants, whose rate standards are all lower than 0.3%. This is The rate is even lower than the handling rate for directly purchasing BTC in some CEX or DEX.

For details, see:48 Hours Before ETF Decision: Here Are These Real-Time Developments You Need to Watch.

According to the SEC approval process previously disclosed,The SEC will next vote on the 19 b-4 documents and S-1 (S-3) documents submitted by major applicants and relevant exchanges. If both documents are passed, the Bitcoin spot ETF will be officially approved. Trading can be opened as early as the next working day.

Approval or rejection, thats a question

as described above,At present, the only factor affecting whether the Bitcoin spot ETF is passed is the attitude of the SEC members who are qualified to vote (a total of 5 people including Gary Gensler), at the moment, we can only make guesses based on some of the SEC members statements and review actions, but how to interpret it specifically depends on everyones opinion.

From last night to this morning, there are two things that deserve more attention.

First, SEC Chairman Gary Gensler issued an article on the X platform reminding the investment risks of cryptocurrency.In this regard, conservatives believe that Gensler is obviously expressing his opposition, but radicals believe that this is a symptom that the ETF is about to be approved, and Gensler is reminding investors to stay rational when participating in ETFs.

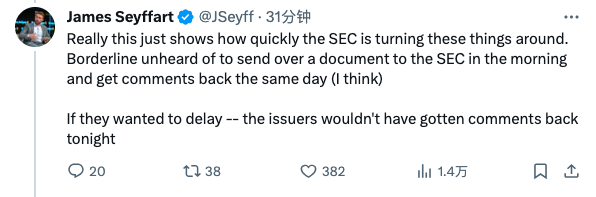

Second, this morning (the evening of January 8, Eastern Time), the SEC made additional comments on the S-1 (S-3) documents just submitted by major ETF applicants.

Digital Chamber founder and CEO Perianne believes this is a signal of delayed approval; however, Bloomberg ETF analyst James Seyffart does not think so. Seyffart mentioned that the SEC received the document in the morning local time and made a comment in the evening. This speed is almost unheard of in the SECs history, and if the SEC doesnt want to pass it, they dont have to do it.

All in all, there are still differences in the current market’s prediction of the “success or failure” of ETFs. What will be the final result? Within two days, the results will be announced.