Original - Odaily

Author - Azuma

Crypto market sentiment continues to heat up as the approval threshold for a Bitcoin spot ETF approaches.

From last night to this morning, the market once again experienced a sharp rise. The OKX market shows that BTC briefly exceeded 45,000 USDT, reaching a maximum of 45,406.7 USDT, with a 24-hour increase of 5.66%; ETH approached 2,400 USDT, with a maximum of 2,397.76 USDT, with a 24-hour increase of 2.7%.

In addition to BTC and ETH, some Alt-coins with strong recent momentum have also continued their outstanding performance. As of the time of publication, SOL was temporarily reported at 111.57 USDT, a 24-hour increase of 7.4%; ARB was temporarily reported at 1.74 USDT, with a 24-hour increase of 9.8%; TIA It was temporarily reported at 13.85 USDT, with a 24-hour increase of 14.8%; SEI was temporarily reported as 0.7879 USDT, with a 24-hour increase of 35.19%.

Affected by the upward trend of the overall market, the total market value of cryptocurrency has also grown rapidly. CoinGecko data shows that the current total crypto market value has exceeded US$1.81 trillion, up 4.8% in 24 hours. Crypto users’ trading enthusiasm has also increased significantly. Today’s panic and greed index has reached 71, with a level of “greedy”.

In terms of derivatives trading,Coinglass Data shows that in the past 12 hours, the entire network has liquidated positions of US$111 million, most of which were short orders, amounting to US$92.9259 million. In terms of currency types, BTC liquidated positions at US$57.05 million and ETH liquidated at US$14.4 million.

ETF approval threshold approaches

Looking at the news, the most significant impact on market trends at the moment is the approval of the Bitcoin spot ETF.

As of last Friday, many ETF issuance applicants, including BlackRock, VanEck, Valkyrie, Bitwise, Fidelity, WisdomTree, Ark, and 21 Shares, have submitted the latest application documents to the regulatory agency, fully explaining the authorization requirements. Detailed arrangements for Authorized Participants (underwriters) to ensure trading liquidity after the ETF is launched.

According to the application regulations,The U.S. Securities and Exchange Commission (SEC)s final approval deadline for the above-mentioned multiple ETF applications is January 10, which also means that the SEC must make a decision on approval or rejection before January 10.

Previously, many ETF experts had predicted the time window for the SEC to make final approval. Nate Geraci, President of The ETF Store, believes that the SEC may make a decision as early as January 2 (today!); Bloomberg analyst James Seyffart believes that the SEC may issue an announcement between January 5 and January 10; Swan Bitcoin CEO Cory Klippsten predicted a time window of January 8 to January 10.

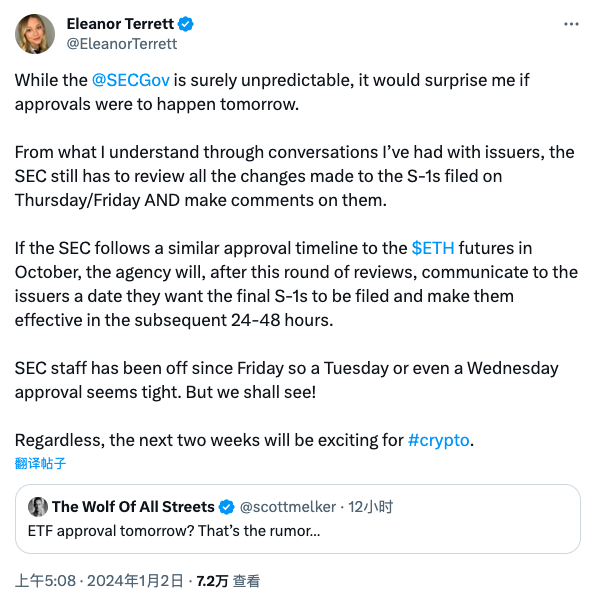

However, according to the latest report from FOX reporter Eleanor Terrett this morning, the SEC still needs time to review the updated documents on authorized participants submitted by major ETF applicants last Thursday and Friday, and needs to comment on this. Also considering that the SEC has been on New Years holiday since last Friday,It is therefore unlikely that a decision on ETFs will be made immediately after the return to work at the beginning of the week (Tuesday, Wednesday).

Odaily Note: There is news that BlackRock revealed that the SEC may make a decision over the weekend. This news is actually a false report. Another FOX reporter, Charles Gasparino, confirmed that BlackRock has been issued a silent order by the SEC and will not Leave a comment on this matter.

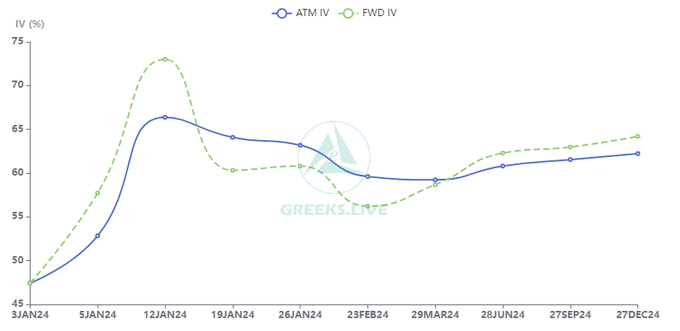

Judging from the structure of the options market, the market seems to be more inclined to Eleanors statement. Greeks.live macro researcher Adam posted on the X platform: Although there are rumors in the market that the BTC spot ETF may pass this week, the options market data shows that IV is the highest are still options expiring on January 12. The current IV of at-the-money options expiring on January 12 is close to 70%, which is significantly higher than before the holiday, and significantly higher than the average mid- and forward IV of 60%.Institutional investors still believe that the second week (that is, closer to January 10) will be the time for ETF news to land.”

yes or no? still unknown

Although judging from the current investment sentiment, the market seems to be generally positive about the approval of Bitcoin spot ETFs, but as Eleanor emphasized:“The SEC is unpredictable.”

No one knows whether the approval result will be yes or no until the SEC makes its final decision.

Last week, John Reed Stark, former director of the SECs Internet Enforcement Office, commented on the outcome of this matter based on his 20 years of personal experience at the SEC.John said that despite his personal opposition, if reports of meetings and discussions between the SEC and all ETF applicants in the past period are true, then based on his personal experience, it seems possible that the SEC will approve a spot Bitcoin ETF.

But at the same time, there are also some voices in the market who believe that the SEC will not give the green light for the time being. For example, Joy Lou, co-founder of LD Capital, said: I dont think it will happen, and the price of BTC will not fluctuate greatly.

What is the final result? Within eight days, dawn will be seen.