Original author: Yilan, Lisa

one. Breaking the circle on the DePin track on the eve of the entry of old money

DePin is the abbreviation of Decentralized Physical Infrastructure Networks. At the end of 21, IOTEX called this track MachineFi. At the end of 2022, Messari introduced the new concept of DePIN for the first time and stated that it will be the most popular in the next ten years. One of the key crypto investment tracks. In the next ten years, we can expect incremental capital injections from traditional institutions. The involvement of traditional funds will subvert the previous preference for complete on-chain economic speculation around crypto-native applications and shift towards investment opportunities with more off-chain logic and realistic impact. DePin’s importance and investment potential in the development process of encryption fit the need to find funds for new narratives in the encryption world.

The core of the DePin concept is to use tokens to motivate users to deploy hardware devices to provide real-world goods and services or digital resources. DePIN can be understood in two parts: physical resource network and digital resource network. Physical Resource Networks (PRN) means that users provide WiFi, 5G, VPN, geospatial data, information sharing and other services through hardware distributed everywhere. ;Digital Resource Networks (DRN) is a physical infrastructure network that provides digital resources through hardware facilities, including broadband networks, storage networks, and computing power networks.

Simply put, DEPIN uses hardware to provide resources that may involve software, bandwidth, computing power, etc., to provide token incentives for real-world services that originally require centralized management, and to use more flexible and distributed node deployment to make asset-heavy services lighter. Quantify, decentralize and solve project cold start problems. In the early boot stage, DePIN adopts a spiral dynamic mechanism that allows users, providers and platforms to participate with relatively small risks. However, the participation of hardware means that the DePIN project requires sufficient up-front capital support to ensure Extensive access to hardware to establish strong network coverage. At the same time, off-chain and on-chain marketing strategies need to keep up at the same time. The full combination of these elements can lay a solid foundation for the success of a DePIN project.

two. DePin on Solana The strongest ecological and strongest narrative dual buffs

The DePins on SOL are arranged in ascending order of market capitalization as HONEY (Hivemapper), IOT (Helium IOT), Helium Mobile (Helium Mobile), HNT (Helium Network) and RNDR (Render Network), which respectively represent the specific software of the DePin sector. Applications (decentralized maps, IOT services, 5G services), Internet of Things infrastructure (decentralized wireless and 5G service platforms) and point-to-point rendering computing power matching AI platforms and other subdivided tracks. Among storage (also considered Depin) related projects, Arweave is the project that is deeply tied to the Solana ecosystem, because most of Solana’s NFTs are stored in Arweave. The following focuses on Honey, DIMO and Helium and Mobile of the Helium ecosystem.

2.1 HONEY(Hivemapper)

On Solana, Honey (Hivemapper) is a DePin track Alpha with a small market capitalization and strong investment background and project endorsement.

Hivemapper is a blockchain-based mapping network that creates a decentralized global map that rewards contributors. Contributors can collect data by installing Hivemappers driving recorder, and can earn Native Token HONEY as a reward. In Hivemappers settings, the driving recorder is equivalent to a mining machine. Integrate natively with the Hivemapper network through a seamless mobile app and put mappings on autopilot and upload automatically. By installing the Hivemapper dash cam, you can mine HONEY token rewards while driving, while collecting 4K street-level images and mapping the world.

The behavioral incentive designed by the project team is to obtain better map data. The quality, timeliness and urban density of uploaded data have become the dimensions for judging incentives and rewards. In terms of quality, the Hivemapper project created a reputation score driven by the quality of uploaded data. Users can earn higher reputation scores when their cameras mounted outside their cars capture higher quality images. At the same time, the rewards obtained by users are linked to their reputation scores. The rolling average of their reputations is higher and the rewards are higher.

Timeliness is to ensure that street information is up to date. The project party created what is called a freshness score. They essentially created a function that increases over time intervals, assuming no one collects data for an entire year, and the next person who tries and uploads new data gets a higher multiplier. This promotes timely updates of map data.

In terms of data density, the project team hopes that the map nodes are more densely distributed in certain major cities, so they have a huge bonus reward system in the selected 35 cities, giving these places higher reward weight.

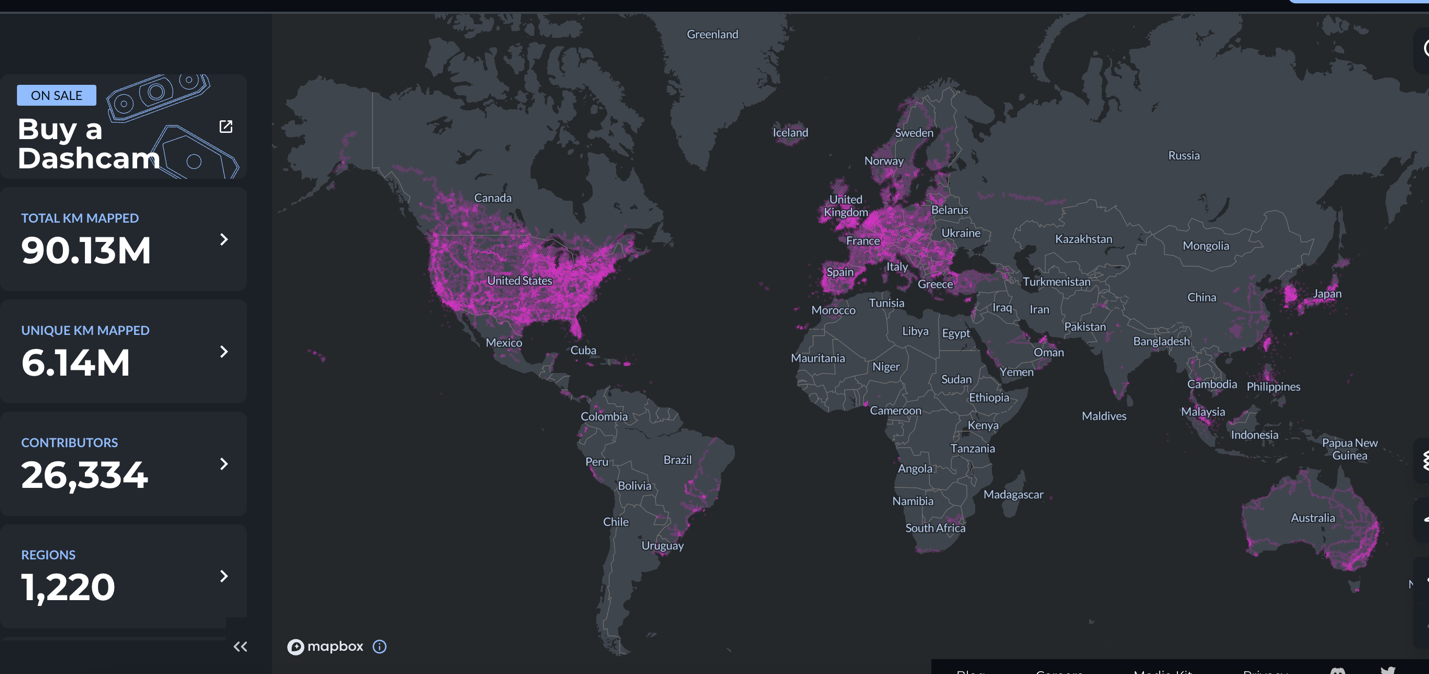

Source:Hivemapper

In terms of financing and project background, Hivemapper received US$18 million in Series A financing last year. This round of financing was led by Multicoin Capital, with participation from Craft Ventures, Solana Capital, Shine Capital, Spencer Rascoffs 75 and Sunny Ventures. The previous round was led by Spark Capital, Founder Collective and Homebrew investments. Hivemapper has raised a total of $23 million in funding. Amir Haleem, CEO and founder of Helium, joins the project’s board of directors.

In terms of token distribution, Honey’s release rules are very similar to Helium’s. The maximum supply of HONEY tokens is 10 billion, which is a fixed upper limit. The initial allocation is as follows:

The Hivemapper network begins minting and distributing 4 billion HONEY tokens as rewards to contributors. The exact number of tokens minted each week is determined by global map progress. Current circulation increases by approximately 1.6 mln Honey in 1 day.

2.2 DIMO

DIMO and Hivemapper both belong to the Drive to Earn track and are one of Hivemappers competitors.

Compared with Hivemapper, which also uses the Internet of Vehicles as its application scenario, DIMOs design is more in line with user needs. By stimulating the decentralized acquisition of driving data ownership, it facilitates C-side data collection and use (rewards car owners and satisfies automatic parking/autonomous driving). For the needs of finding parking spaces, etc., the vehicle data collected and shared by car owners can be used in more scenarios), while Hivemapper prefers B-side products (providing more detailed maps for car companies/related service providers).

The business logic behind it is that the Internet of Vehicles track is backed by a huge market of 450 billion to 700 billion US dollars in overall profits from global automotive data monetization (by 2023). DIMO links cars and drivers to tokenize car driving data, cutting into the global market. The data production and supply chain of 250 million connected cars enables users to become profit earners from driving data.

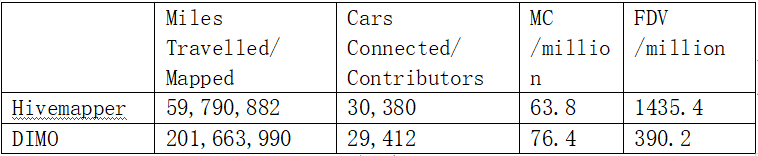

In terms of usage data, Hivemapper and DIMO are relatively close in terms of number of users, but FDV is smaller than DIMO. DIMO is an ERC-20 token on the Polygon and Ethereum blockchains. The project endorsement is slightly inferior and the ecology is not among the hot spots. Therefore, DIMO started value discovery later than Honey.

Source: LD Capital

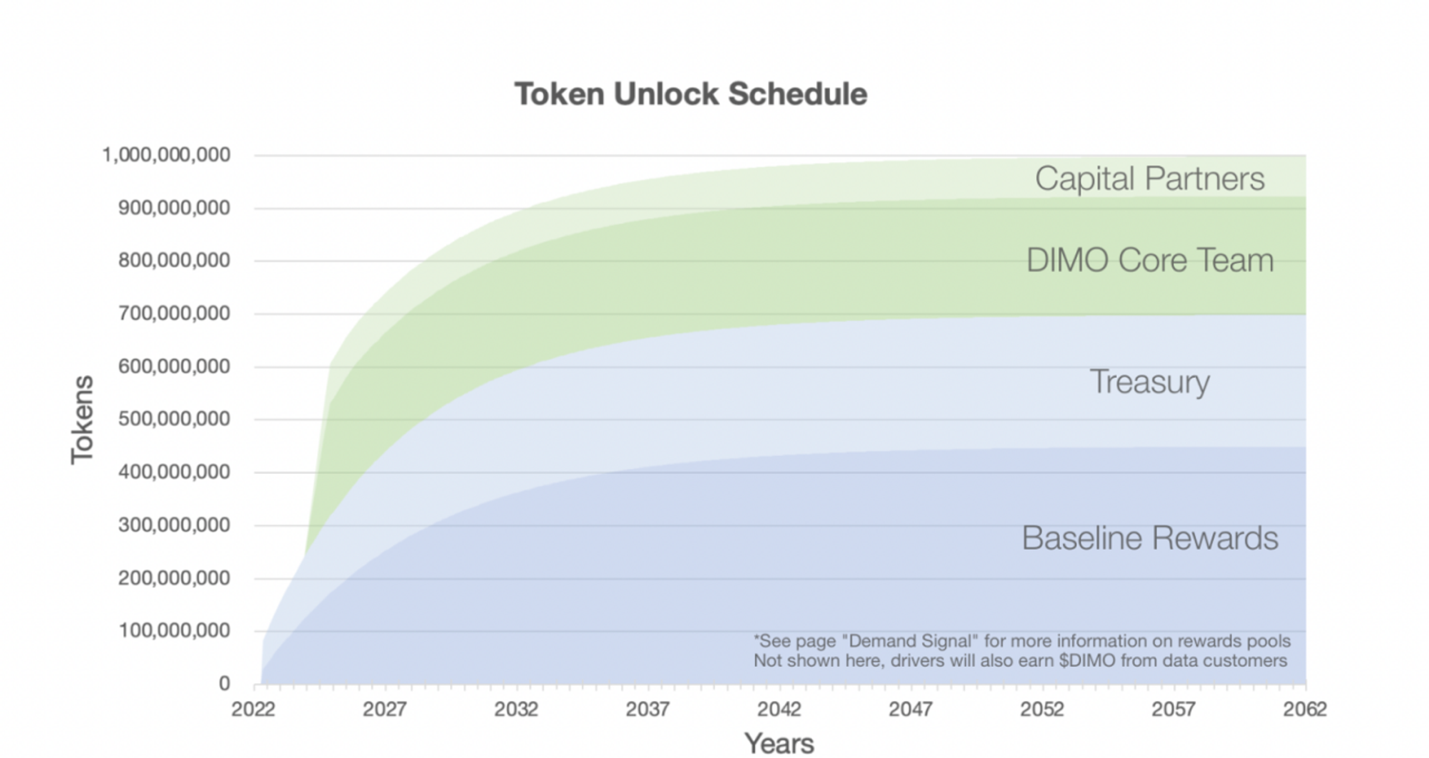

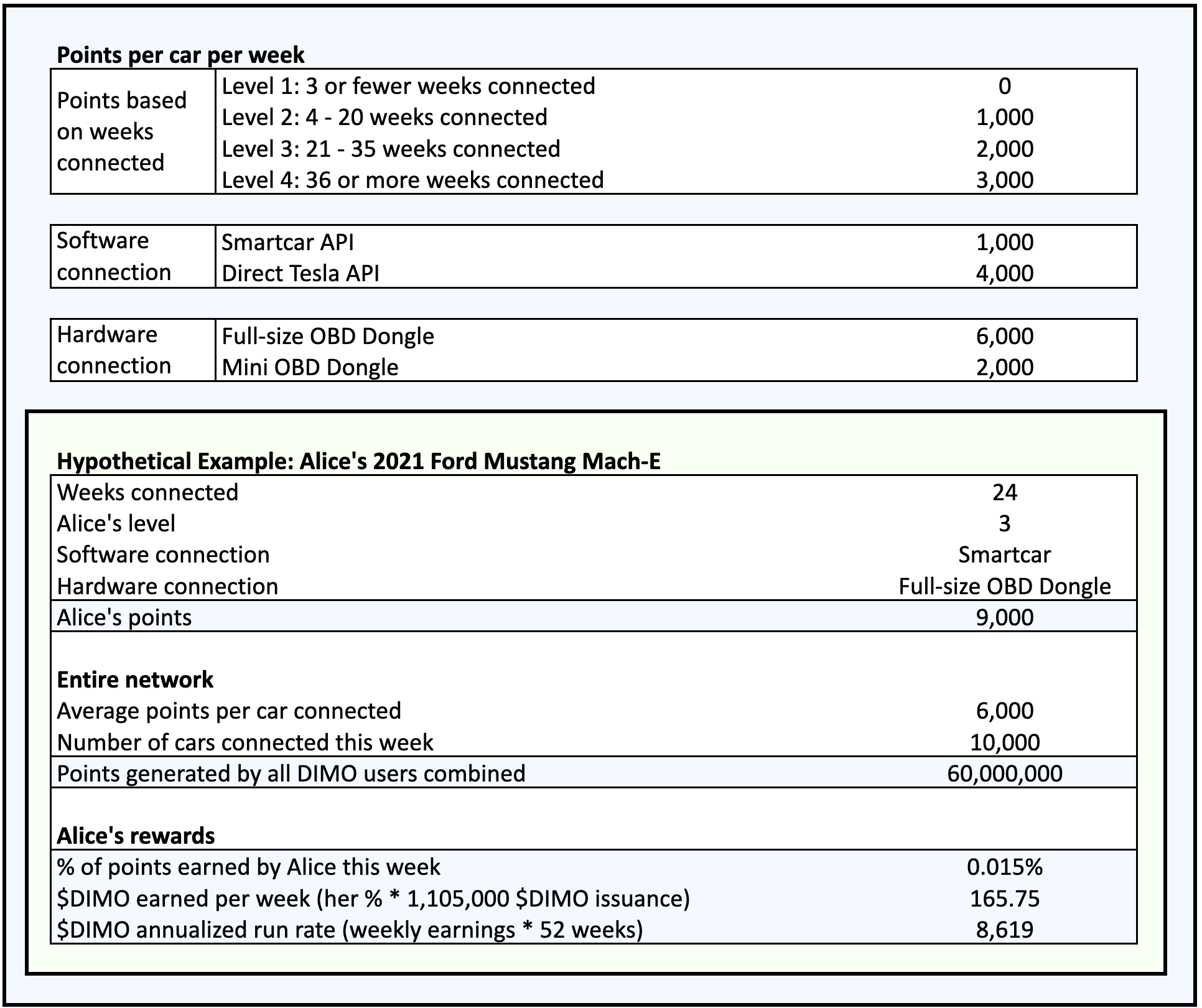

In terms of token distribution, the total supply of DIMO is 1 billion, with baseline rewards accounting for 38%. 380 million DIMO will be distributed over 40 years. In the first year, 1,105,000 DIMO will be issued to users every week. The mining rewards obtained by users are distributed according to the rules in the figure below, and the circulation is reduced by 15% every year; Dimo treasury accounts for 22%, and teams and individuals who contribute to the network may receive $DIMO in the form of bounties or grants; The team accounts for 22%, and the token allocation will be locked for two years, and then unlocked linearly every month, until all are unlocked after three years; investors account for 8%, and the token allocation will be locked for two years, and then unlocked monthly Linear unlocking until all is unlocked after three years; airdrops account for 7%;

Source:DIMO

There are currently 194 mln in circulation (including 70 mln airdropped, 57 mln already distributed by baseline rewards, and 67 mln allocated to the treasury). The initial airdrop is actually a large-scale distribution of baseline rewards (understood as mining income) (70 mln). mln), remaining 382, 491, 185 $DIMO. The pool will be distributed over 40 years, with 1,00,1050 $DIMO issued to users each week during the first year, decreasing by 15% annually. Judging from the chip structure, it is better.

2.3 Helium

Helium is a centralized wireless network project (distributed Internet of Things). Founded in 2013, it is a pioneer in the DePIN circuit. As the purest DePin project in the Solana ecosystem, Heliums ecological network is the most mature and stronger than other IOT ecosystems. With the support of Helium, its ecological project MOBILE has experienced a tenfold increase in seven days.

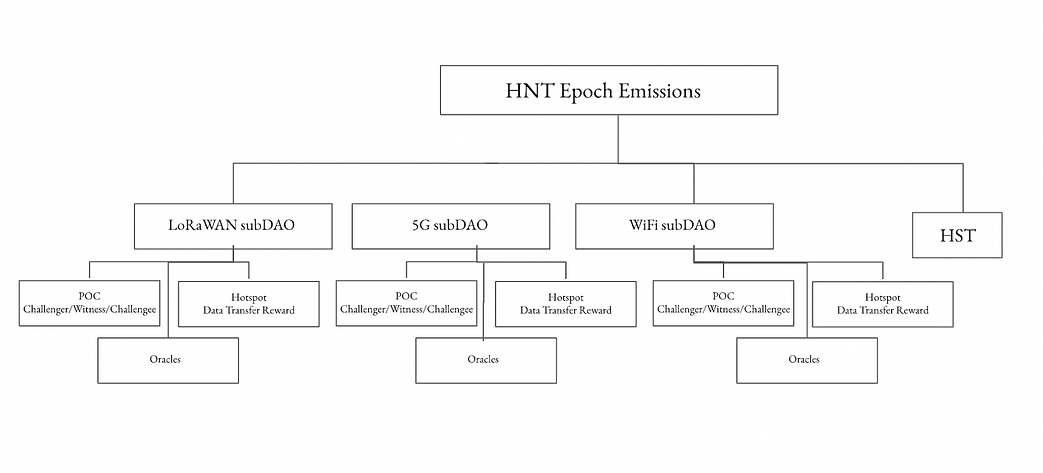

HNT is the main economic asset in the Helium ecosystem, and the only way to pay for network data transmission is to burn HNT. Judging from Heliums income, as the price of HNT has increased, reaching 9k US dollars/day, it is still in a state of insufficient demand. This may be one of the reasons why Helium vigorously promotes its sub-DAO. More sub-DAOs will promote the price of HNT. The second phase of HIP 51 implemented the Helium DAO, which oversees and maintains each sub-DAO, and as more sub-DAOs emerge (currently only IOT subDAO and 5G subDAO), there will be more competition between protocols , competing for a fixed amount of HNT produced every day (HNT currently releases a net of 1.23 million HNT per month, 40,000 per day).

Helium combines web3 technology with IoT networks to solve the problem of high financial threshold in the IoT network market (mobile operators like China Mobile China Unicom). By expanding 5G business, it aims to improve WI-FI and centralized operators inability to provide high-quality services. Efficiency covers the pain points of middle ground signals. Through everyones participation, the heavy cost of early IoT construction can be allocated to each user, thus achieving a lightweight start-up. Currently, some indoor and outdoor positioning equipment and smart farms such as Abeeway and Agulus have begun to use Helium. T-Mobile began working with Helium Mobile last year.

The Helium network and its related tokens are based on the Proof of Coverage (PoC) mechanism, which is consistent withProof of Work (PoW)There is a fundamental difference. Unlike GPU mining, which consumes a lot of energy, Helium hotspots only require as much energy as a 12-watt LED light bulb to operate. The largest cost borne by miners is the one-time cost of purchasing the hardware.

The specific process of hotspot mining is that miners purchase special LoRaWAN routers, such as Bobcat 300, place them on the roof or balcony, and then maintain the network. The miners will receive HNT tokens in return, and these tokens will Automatically appearing in Heliums App, which is connected to the miner, the PoC constantly checks whether the hotspot is actually at the location it provides and whether a wireless network is generated to cover the location.

Development status

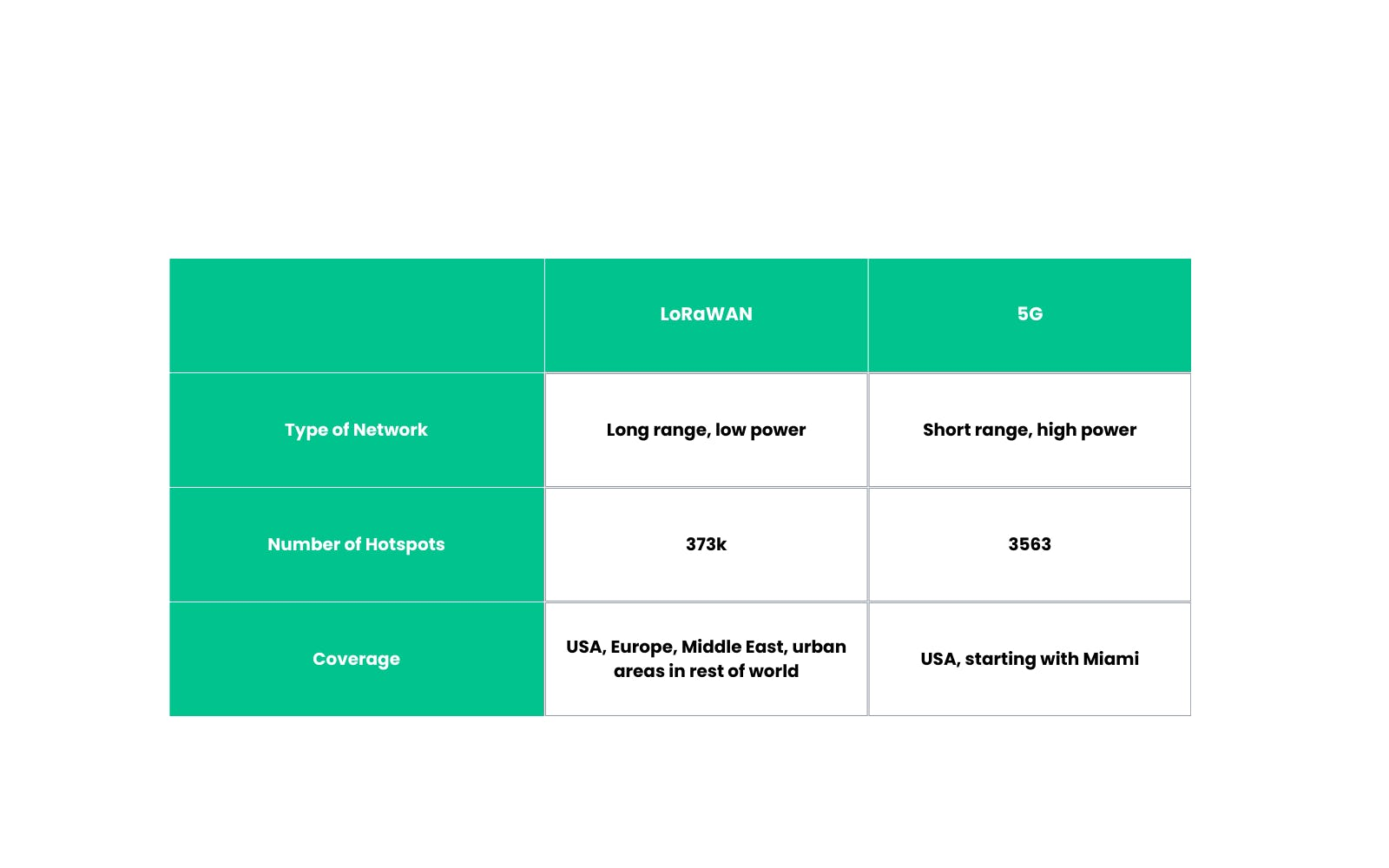

The current two sub-DAOs represent the narrowband network for IOT devices (Helium IOT) and the 5G hotspot network compatible with HNT mining machines (Helium Mobile).

Source:Swissborg

In terms of 5G, although Helium’s development is subject to the dual dilemmas of compliance and market ceilings. But the partnership between Helium Mobile and T-mobile is helping Helium Mobile truly move towards Mass adoption. The move to the high-performance public chain Solana highlights Solana becoming fertile ground for the development of the DePin project.

In terms of compliance, the allocation and licensing of frequency bands in the United States is strictly regulated by the Federal Communications Commission (FCC). T-Mobile, which has been licensed, uses the 600 MHz band to deploy 5G, and Verizon uses the 700 MHz band to deploy 5G. As a latecomer, in order to reduce deployment costs and solve compliance problems, Helium chose the CBRS GAA frequency band, which does not require authorization. Compared with the mid-band, the coverage range is slightly smaller and does not show obvious advantages compared with US operators.

In terms of the ceiling of the market, 5G is an area strictly regulated by national policies. Network operators in most countries around the world are state-owned enterprises, and only a few are private companies and have close ties with the state. Therefore, from an international market perspective, it is difficult for Helium to replicate the US 5G market experience overseas.

The strategic layout of migrating Solana began in March this year, when Helium migrated from its own Layer 1 blockchain to Solana. One of the main reasons for choosing solana is that Solanas latest state compression function can mint a large number of NFTs at a very low cost, allowing Helium to migrate to Solana at a cost of only $113 to mint nearly 1 million NFTs, saving a lot of expenses. These NFTs can serve as Heliums network credentials and verify hotspots, and can also integrate the functions of the entire ecosystem, including token gating and access rights for hotspot owners, which is very efficient and convenient. Second, there is a lot of room for cooperation with Helium in projects such as Solana Mobile Stack and the Saga mobile phone that Solana wants to launch. It can be said to be a win-win situation for Solana, which wants to make mobile phones, and Helium, which wants to develop into a 5G service provider. Third, the programming language is not popular. It is not compatible with EVM and makes it difficult for developers to enter. As a result, Helium cannot attract high-quality developers and the ecosystem does not have excellent applications. Therefore, the ecological integration with solana is the way to break the situation.

Token situation

HNT is used as Data Credits and is used in various sub-networks (income side) when users seek hot spots. Reward MOBILE/IOT (supply side) earned for deploying hotspots or transmitting data in 5 G SubDAO or IOT SubDAO can be burned and exchanged for HNT.

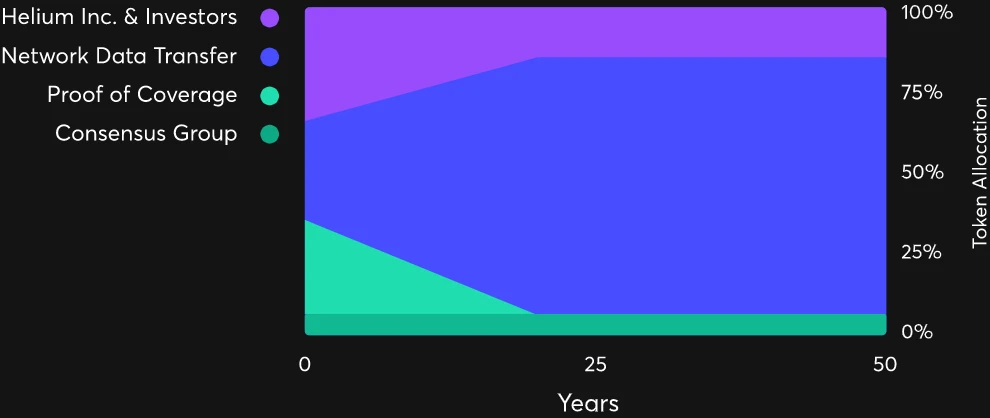

In terms of specific release allocation, 30% of the HNT released every month is used for network data transmission and is awarded to hotspots that transmit Internet of Things device data, distributed according to the data transmission ratio; 35% is used for Hotspots infrastructure rewards, mainly for hotspot owners. Mining rewards and ensuring coverage as the network grows; 35% of monthly releases are allocated to the team and investors.

Source: Helium

The actual total supply of HNT tokens is approximately 223 million, with 43 million issued in the first year and halved every two years. The price fluctuation of HNT represents project income rights and governance rights, while meeting the speculative needs of token holders. 7 ⃣️HNT inflation plan is as follows, currently generating 41,000 HNT inflation every day

HNT can be obtained by becoming a challenger, challengeee, witness, joining the consensus group, participating in network transmission, etc. (witnesses and network transmission receive the most HNT rewards). HNT meets the needs of two major players in the Helium ecosystem:

1) Hotspot hosts and operators (supply): Hosts are rewarded with network tokens like IOT or MOBILE when deploying and maintaining network coverage. These network tokens are redeemable for HNT.

2) Enterprises/Developers/Other Users (Requirements): Enterprises and developers leverage the Helium network to connect devices and build IoT applications. Data Credits are a utility token pegged to the U.S. dollar that is earned through HNT burning transactions on the network and used to pay transaction fees for wireless data transmission on the network.

However, the current revenue brought by burning HNT to Helium is not enough. Instead, equipment providers will receive more token rewards. Therefore, Helium has been lack of use in the past (the demand side, that is, the revenue is small), and the industry lacked standards in the early stage. , developers and users have been criticized for poor experience, but the promotion of Mobiles low-price esim cards seems to have opened up the dilemma of a serious lack of demand on the demand side.

2.3.1 MOBILE

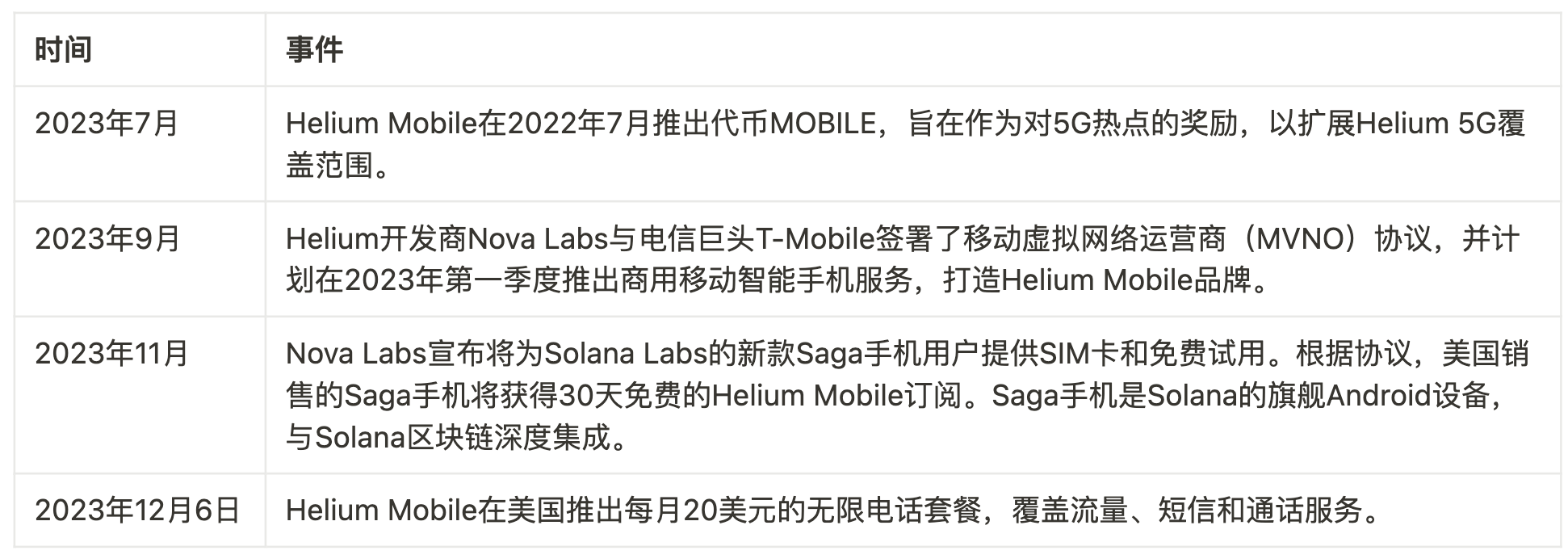

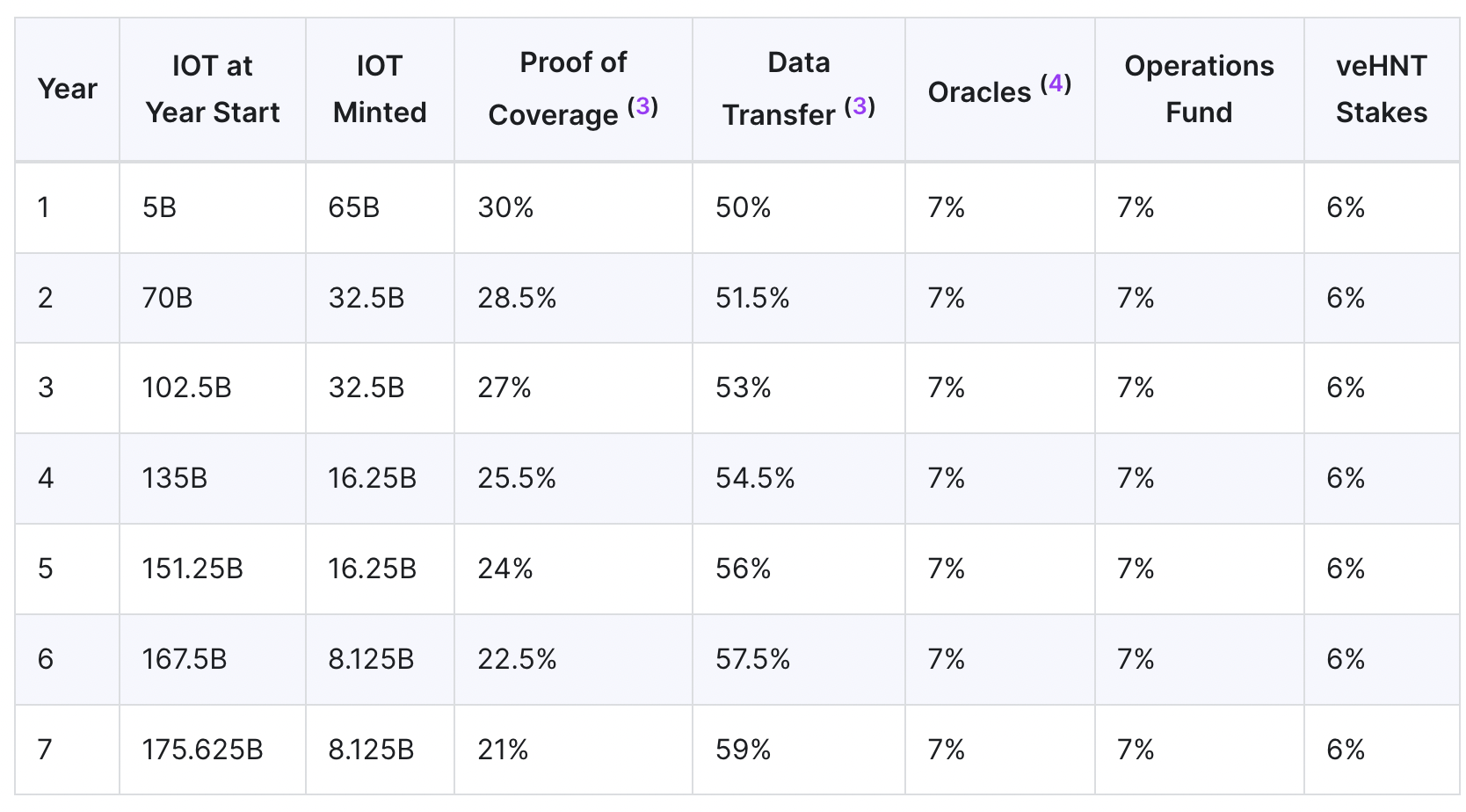

MOBILE is the protocol token of Helium Mobile Network and the governance token of Helium SubDAO, achieving governance separation. MOBILE was introduced to Helium Network through community proposal HIP-53.

Helium developer Nova Labs has previously cooperated with T-Mobile to launch commercial mobile smartphone services. It first launched a $5 monthly package in Miami. Recently, Helium Mobile launched a $20 monthly wireless phone package in the United States, and launched a new mobile phone with Solana Labs. SIM card free trial event. Ignite the Mobile market,

MOBILE tokens are mined via 5 G-CBRS and WiFi hotspots, including both data transfer proceeds and proof of coverage. Token Distribution MOBILE follows a similar minting plan as HNT, but with a maximum supply of 230, 000, 000, 000 (230 B). At the launch of the mobile network, 50 B MOBILE was pre-minted and allocated to the network operating fund managed by the Helium Foundation. A portion of this allocation is distributed to active Mobile Network hotspots during genesis. MOBILE’s first year begins on August 1, 2022, with the first tokens minted on August 12, 2022.

The issuance plan will be halved every 2 years, consistent with the HNT issuance halving.

Source: Helium

The value of the MOBILE token comes from two parts. One is that it can be redeemed for HNT through the programmatic treasury - Subdao token MOBILE can be redeemed for HNT. To achieve this, each subnet in the Helium Network is allocated a certain number of HNT pools based on the network utility score. The exchange ratio is set by the contract based on this network utility score algorithm; the second is the governance utility in subDAO. In the future, there may be more utility, such as using staking to increase hotspot proof-of-coverage participation.

The redemption price calculation of MOBILE is carried out through the following rules. All HNT rewards earned by 5G hotspots within the stipulated time are distributed into a pool, and MOBILE holders can burn their MOBILE to obtain HNT distributed proportionally in the pool. For example, if all 5G hotspots receive a total of 100 HNT, and there are 10,000 MOBILE unused, it means that 100 MOBILE can be burned to obtain 1 HNT. This structure provides a value floor for MOBILE, which can trade above its floor price based on its utility.

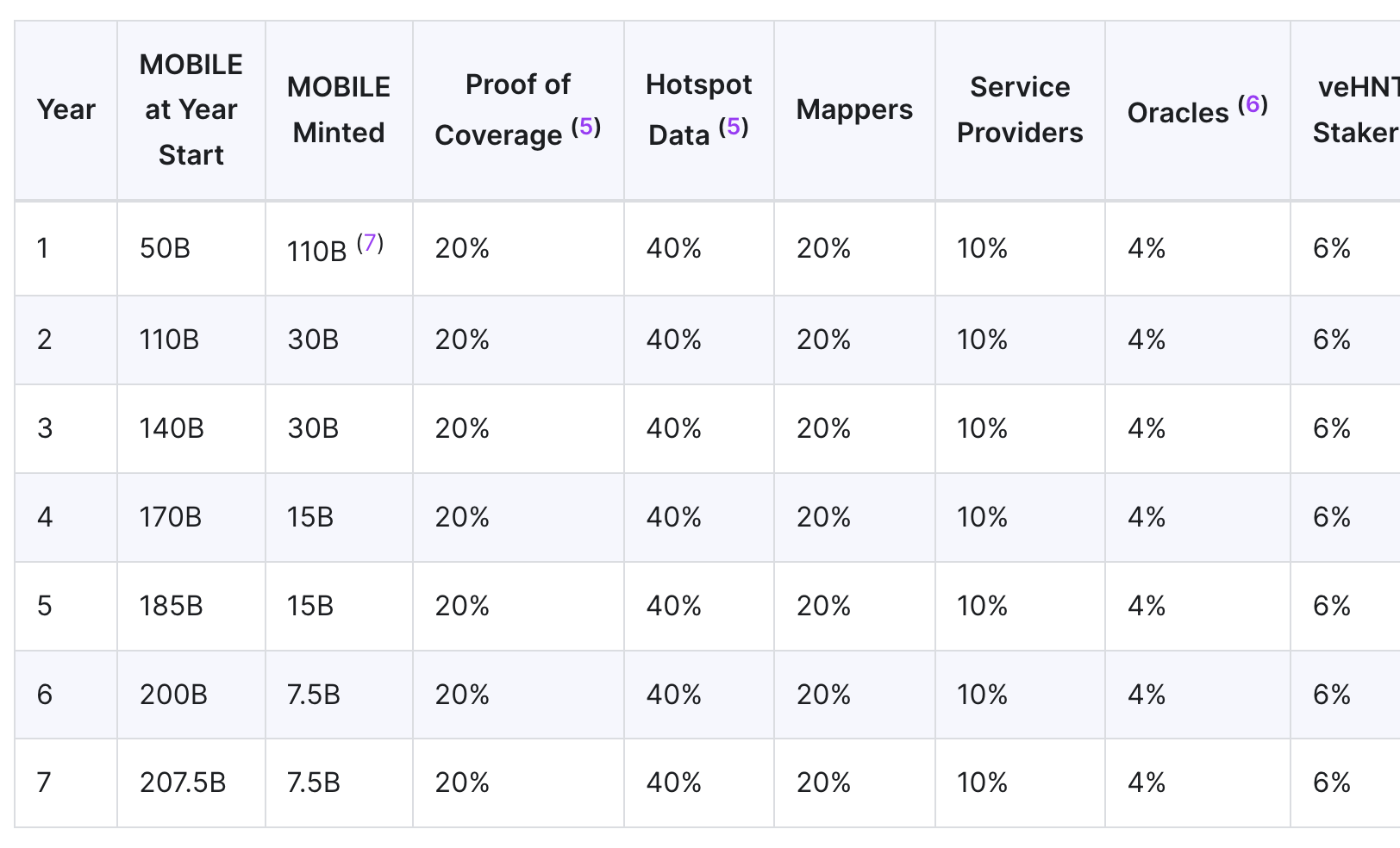

Helium Mobile’s current payback period is 209 days

Source:Depinscan

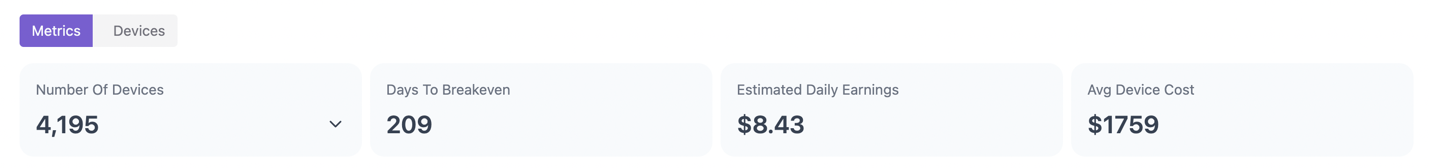

2.3.2 IOT

Helium IOT Subdao incentivizes IoT devices connected through the LoRaWAN network and balances the relationship between users and device providers. It can be understood as inheriting the use cases of the original Helium IoT part.

The current number of IOTs in circulation is 24 billion (inflation is based on the table below), which is in the early stages of chip distribution. MC 68 mln, FDV 566 mln, compared with the strong expansion of Mobile, IOT use cases have not yet been fully explored.

Source: Helium

Subdao derived from the Helium ecology is actually a continuation of the situation that HNT may face in the later stages of distribution, and is conducive to the continued development of the entire Helium ecology. After all, the main value capture is still on HNT. At the same time, Two sub-DAO tokens with significant development have been expanded to serve as narratives, which is a win-win situation for HNT, Mobile and IOT.

Helium is the IOT+ 5G network with the most financing and the most complete products and economic models. Coupled with the strategic layout of migrating Solana, the current MC/price is relatively high. As a leading project with a large market capitalization, it will still enjoy track beta, as evidenced by recent increases. The leader of the DePin track will be the Helium ecosystem. Since Mobiles chip structure is slightly better than Heliums and it is at the forefront of mass adoption, its position is also being priced.

three. What other DePin projects are worthy of attention in the secondary market?

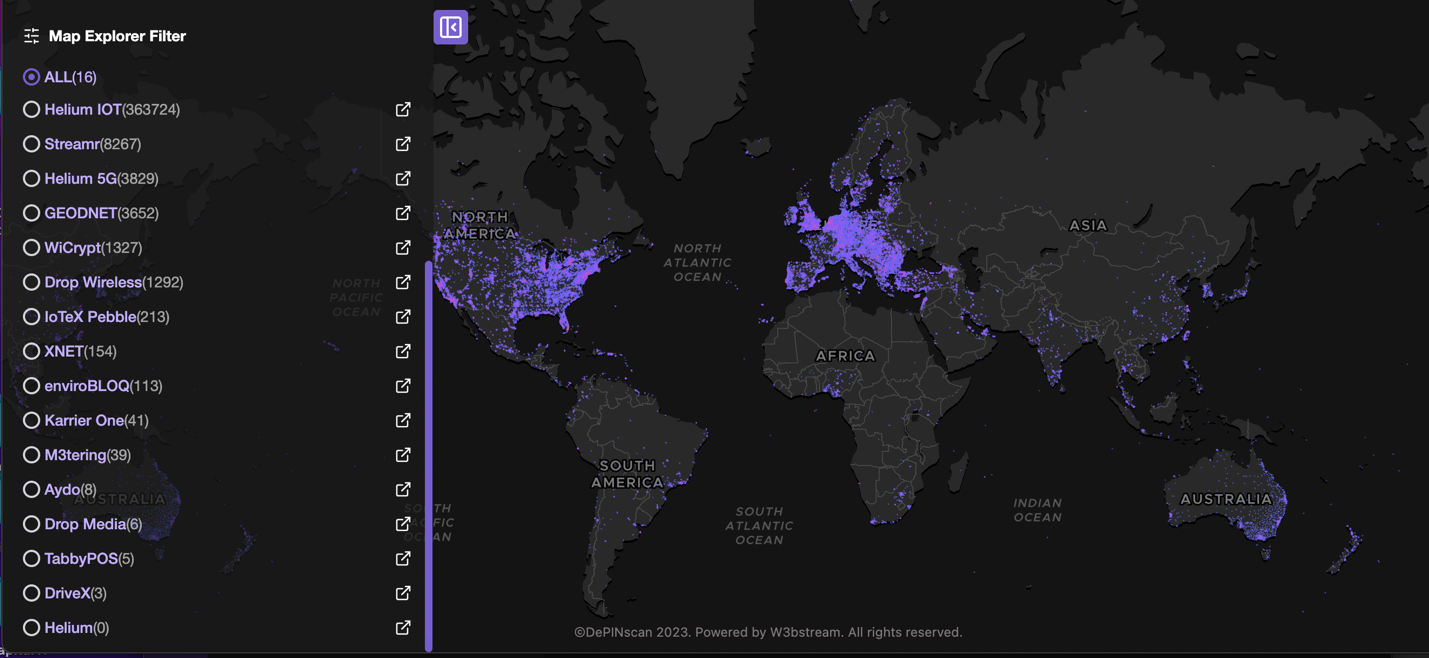

In addition to DePin on the Solana ecosystem, there are also projects with relatively mature ecological and project development in other ecosystems, including Dimo, IOTX (IOTEX), Streamr (DATA), WIFI Map (WIFI), etc. compared with Honey (Hivemapper) above. It can be seen from the hotspot distribution map provided by Depinscan that the Helium ecosystem (IOT, 5G) hotspots are the most widely distributed. Helium IOT has 363k devices deployed, Helium 5 has 38k, followed by Streamr with 83k devices deployed.

Source:DePinscan

Compared with the Helium ecosystem, the applications in the IOTEX ecosystem are not very out-of-the-box, but they have been onboarding various depin applications in an extensive manner, while Heliums sub-DAO is more of an endogenous and complete ecological construction. And with the migration of Helium to Solana, IOTEX, as L1 with a unique layered architecture, is considered to be a more pure DePin infrastructure, and its tokens also have more scenarios and use cases. At present, IOTXs MC 520 mln and FDV 523 mln have an advantage over Heliums market value. However, IOTX is an ancient project that has been fully distributed, and its incentives and ecological vitality cannot be compared with the Helium ecosystem.

In September this year, Drop Wireless (formerly Nesten) transitioned to IoTeX’s DePIN infrastructure. Drop Wireless operates a global LoRaWAN network with 1,000 nodes located in 17 countries. The companys focus extends as far as telemedicine services in India, with plans to continue extending into Africa to address significant healthcare needs. IoTeX supports Drop Wirelesss native token, launched as XRC 20 on the IoTeX chain, and facilitates decentralized data storage and transfer via W 3 bstream. This shift highlights IoTeX’s role as a DePIN hub.

Four. Summarize

In the medium term, the leader in this track must have a market value of at least 3 billion to enter the top 30. Currently, according to the market value ranking, RNDR is 1.6 billion and 48th, Helium is 1.3 billion, Theta is 1.1 billion, IOTA is 860 million, and Mobile is 550 million. There is a valuation discount across the entire track.

As the leader of DePin on Solana, HNT has a strong ecology. Although the chip structure is not as good as Mobile, it captures more value and will also benefit from the prosperity of sub-DAOs; IOTX, as the DePin infrastructure target of Ethereum Compatible, although it does not touch the market hot spots (Solana) , but it took an advantage in the subsequent Ethereum compensatory rise after the adoption of the BTC spot ETF. And the current price is relatively cheap (MC 500 mln); DIMO MC still has room for growth, and the Internet of Vehicles track also has a grand narrative space; the cooperation between Mobile and T-Mobile may bring real external revenue and is expected to lead The entire track.

The Depin track serves as a Mass Adoption channel and also links the AI sector. It is a broken track that can have a grand narrative and be selected by capital. In the next ten years, we can expect incremental capital injections from traditional institutions. The involvement of traditional funds will subvert the previous preference for complete on-chain economic speculation around crypto-native applications and shift towards investment opportunities with more off-chain logic and realistic impact. DePin’s importance and investment potential in the development process of encryption fit the need to find funds for new narratives in the encryption world.