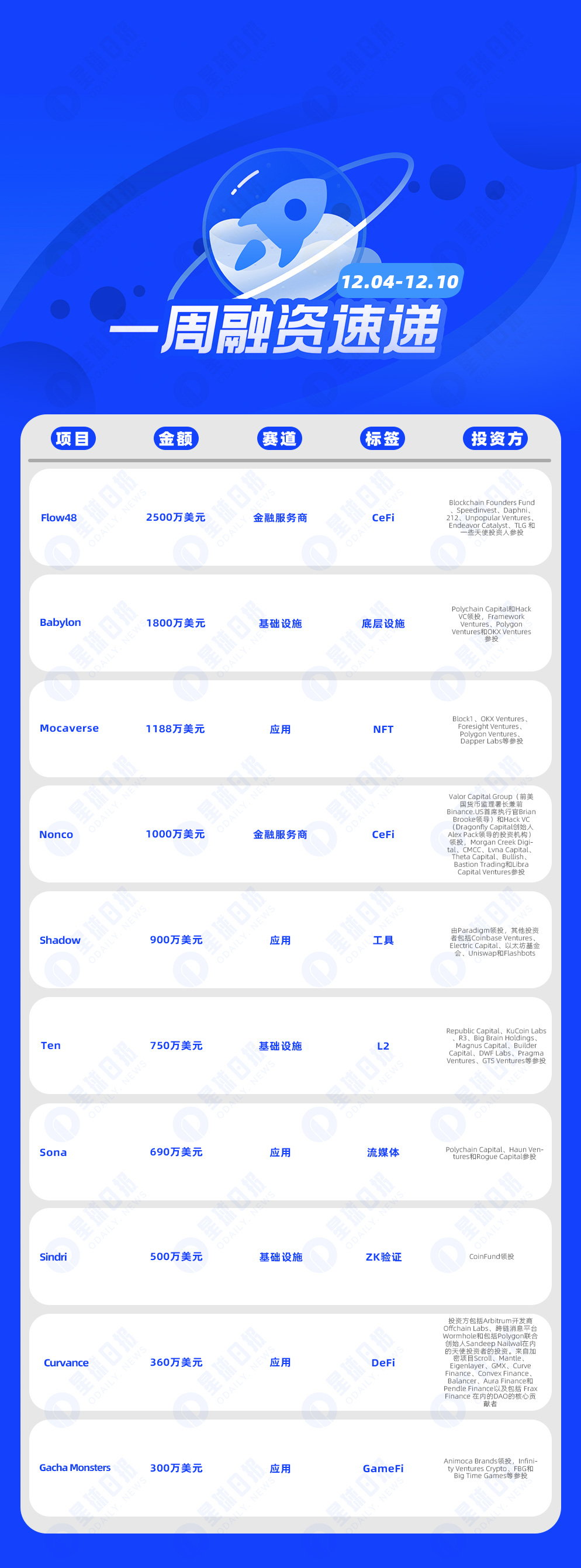

According to incomplete statistics from Odaily, a total of 16 domestic and overseas blockchain financing events were announced from December 4th to December 10th, which was a decrease from last week’s data (17 cases). The total amount of financing disclosed was approximately US$105 million. Thats a big drop from last weeks figure ($320 million).

Last week, the project that received the most investment was UAE fintech startup Flow 48 ($25 million); Bitcoin staking protocol Babylon was not far behind ($18 million).

The following are specific financing events (Note: 1. Sorted according to the announced amount; 2. Excludes fund raising and mergers and acquisitions; 3. *Represents companies in the traditional field where some of the business involves blockchain):

On December 4, UAE fintech startup Flow 48 announced the completion of a $25 million Series A round of financing, with participation from Blockchain Founders Fund, Speedinvest, Daphni, 212, Unpopular Ventures, Endeavor Catalyst, TLG and a number of angel investors.

Flow 48 provides data-driven real-time financial technology solutions and helps small and medium-sized enterprises pay attention to ESG principles. Investors may provide support in the advanced financial technology ecosystem. Blockchain Founders Funds investment portfolio includes Web3 API platform Uniblock, Web3 Domain name and TLD provider Freename, privacy protection protocol zkPas, etc.

On December 7, Bitcoin staking protocol Babylon completed $18 million in financing, led by Polychain Capital and Hack VC, with participation from Framework Ventures, Polygon Ventures and OKX Ventures. Babylon also incorporates Ordinals technology, which aims to give Bitcoin a use beyond being a store of value.

On December 8, Animoca Brands’ NFT series Mocaverse announced the completion of a second round of financing of US$11.88 million, with participation from Block 1, OKX Ventures, Foresight Ventures, Polygon Ventures, Dapper Labs and others.

So far, Mocaverse’s total financing has reached US$31.88 million. The new funds will be used to promote Mocaverse to establish a digital identity and points system for Web3 games, culture, and entertainment.

On December 9, digital asset brokerage company Nonco completed a $10 million seed round of financing, led by Valor Capital Group (led by former U.S. Comptroller of the Currency and former Binance.US CEO Brian Brooke) and Hack VC (Dragonfly Capital founder Alex Pack led the investment, with participation from Morgan Creek Digital, CMCC, Lvna Capital, Theta Capital, Bullish, Bastion Trading and Libra Capital Ventures. Brooks and Peck will join the company as board members.

Crypto data analytics platform Shadow secures $9 million in funding led by Paradigm

On December 5, the encrypted data analysis platform Shadow raised $9 million in financing, led by Paradigm. Other investors include Coinbase Ventures, Electric Capital, the Ethereum Foundation, Uniswap and Flashbots.

On December 5, according to official news, the Ethereum Layer 2 Rollup project Ten (formerly Obscuro) announced the completion of US$7.5 million in financing. Republic Capital, KuCoin Labs, R 3, Big Brain Holdings, Magnus Capital, Builder Capital, DWF Labs, Pragma Ventures, GTS Ventures and others participated in the investment.

On December 7, Web3 streaming protocol Sona completed a $6.9 million seed round of financing, with participation from Polychain Capital, Haun Ventures and Rogue Capital.

According to reports, Sona uses modules built on DeFi to provide artists with token-based streaming content, music auctions, governance rewards and other services, and distributes the income from music auctions to artists and platforms in a certain proportion.

ZK platform Sindri completes US$5 million in seed round financing, led by CoinFund

On December 7, ZK infrastructure platform Sindri completed a $5 million seed round of financing, led by CoinFund. Sindri enables developers to verify data with zero-knowledge proofs. The funding is intended to support Sindri as it scales its team and adds developers.

DeFi platform Curvance completes $3.6 million in seed round financing

On December 5, DeFi platform Curvance completed a $3.6 million seed round of financing, with investors including Arbitrum developer Offchain Labs, cross-chain messaging platform Wormhole, and angel investors including Polygon co-founder Sandeep Nailwal. Core contributors from crypto projects Scroll, Mantle, Eigenlayer, GMX, Curve Finance, Convex Finance, Balancer, Aura Finance and Pendle Finance as well as DAOs including Frax Finance.

Curvance is a full-service, full-chain money market for yield, LSDfi, tokenized treasuries, and original assets.

Gaming company Gacha Monsters raises $3 million in seed round led by Animoca Brands

On December 8, Japanese entertainment and gaming startup Gacha Monsters completed a US$3 million seed round of financing, led by Animoca Brands, with participation from Infinity Ventures Crypto, FBG and Big Time Games.

On December 5, chain game Treeverse developer Endless Clouds completed US$2.5 million in strategic financing, with founders and executives from Animoca Brands, Sky Mavis, YGG, Faze Clan, Immutable, Pudgy Penguins, Pixelmon, Pixels Online, Pixel Vault and other companies Participate in investment.

Endless Clouds will use this round of financing to continue developing the MMORPG games Treeverse and Capsule Heroes and build game IP-related content.

On December 7, Ethereum scaling platform Versatus Labs received $2.3 million in seed round financing from investors including NGC Ventures, Republic Crypto and Hyperithm. There is no leading investor in this round of financing, and it is an equity plus token guarantee round.

Blockchain fund data management service provider TISA completes £250,000 in financing

On December 6, TISA, a blockchain fund data management service provider, announced the completion of 250,000 pounds in financing. Industrial Thought participated in the investment. The TURN platform uses blockchain technology to collect and disseminate fund-related data, aiming to provide unified, transparent and efficient services. data management approach to support asset managers, distributors and financial institutions.

On December 5, CARV, a decentralized identity start-up project for gamers, has completed a new round of strategic financing, with HashKey Capital and a US$100 billion global technology company participating in the investment.

On December 5, the Pyth Data Association, a non-profit organization developed by the oracle project Pyth Network, completed financing, with participation from Castle Island Ventures, Multicoin Capital, Wintermute Ventures, Borderless Capital, CMT Digital, Bodhi Ventures, Distributed Global and Delphi Digital.

On December 7, Rhinestone, a startup dedicated to building modular account abstraction infrastructure, announced that it has completed a Pre-Seed round of financing. Investors include 1kx, Safe, Lattice, Heartcore and other companies, as well as Calvin Lui (Chief Strategy Officer of EigenLayer), Georgios Angel investors such as Vlachos (co-founder of Axelar) and Waikit Lau (Lau Ventures).