Why are the world’s largest banks and financial market infrastructure exploring tokenization? Because on-chain finance can provide the global financial system with a more convenient, more efficient, and more convenient operation method. As the standard messaging network connecting more than 11,000 banks, Swift has successfully proven its ability to connect multiple Blockchain, the secure and scalable way. DTCC is the world’s largest securities settlement system, processing more than $2,000 trillion in transactions annually, and it is actively working with Chainlink to bring capital onto the chain. In addition, Australia and New Zealand Banking Group (ANZ), Australias leading bank with an asset management scale of more than US$1 trillion, also uses Chainlink CCIP to conduct cross-currency and cross-chain purchases of tokenized assets.

The future of finance is on the chain. There may be hundreds of public and private blockchains supporting trillions of dollars worth of tokenized real-world assets (RWAs), including tokenized financial instruments and other assets such as real estate, commodities, and art. .

To realize the full benefits of on-chain finance, tokenized RWAs need to meet the following three key capabilities:

Have enough real world information

Achieve secure cross-chain transmission

No matter which chain an asset is moved to, it must be connected to off-chain data

As a decentralized computing platform that has secured over $8.8 trillion in transaction value, Chainlink is the only fully functional platform that can meet the three key requirements of tokenized RWAs while maintaining the high security required by institutions.

Key Point 1: Enrich RWAs with real-world information

Chainlink’s data services power the on-chain economy with encrypted facts

Tokenized RWAs require more than just minting tokens to represent the corresponding assets. One of the main benefits of digital assets is that they serve as a programmable information carrier. All information and logic of the carrier can be customized according to the interactive needs of banks, various protocols, and customers regarding the asset, including proof of reserves, Corporate business automation, identity data, proactive risk management, settlement requirements and daily net asset value (NAV).

Since the mid-1970s, when the industry shifted from paper to electronic assets, there hasn’t been any meaningful innovation in the way markets interact with these assets. Typically, these traditional static assets are identifiers in databases, which users can collect and view through Bloomberg terminals (information asymmetry), and risk management is done passively, such as through central bank support or clearinghouse.

With blockchain technology and Chainlink services, we have the opportunity to eliminate information asymmetry and create assets with active risk management capabilities. We can combine all disparate information and processes into a single asset.

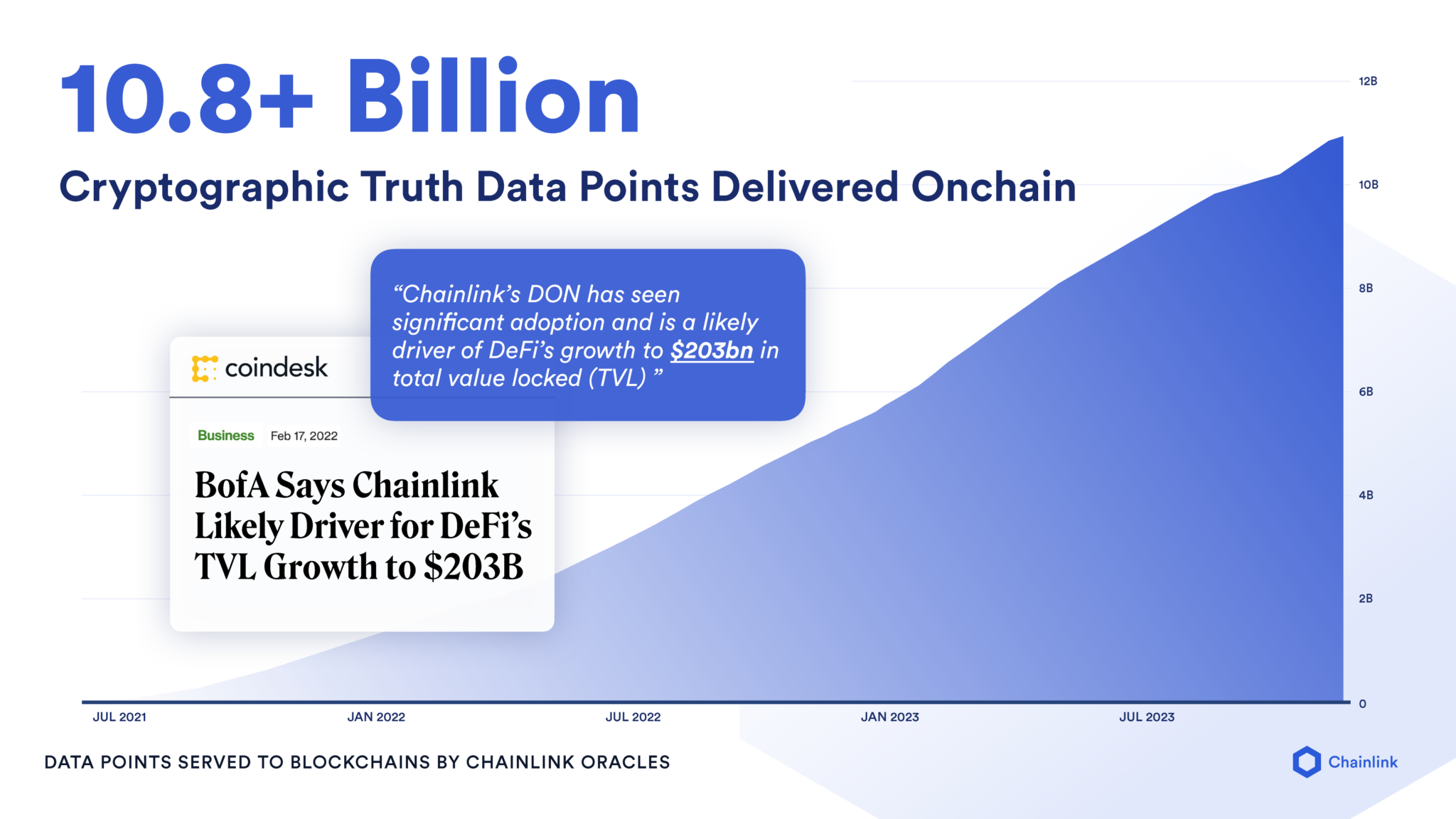

Chainlink services bring 10.8 billion data points on-chain, serving as the industry standard to inject a wealth of information into RWAs with all types of off-chain data. Some of these services include:

Reserve certificate——Autonomous, reliable and timely verification, enabling consumers, monetary authorities, asset issuers and on-chain applications to view cross-chain or off-chain reserves of tokenized RWAs. Provides greater transparency and can implement circuit breakers to protect users when there is a discrepancy between the value of off-chain assets and the value of on-chain tokenized assets.

Authentication--In order for banks, asset managers and their clients to trade with each other in a regulatory-compliant manner, the identities of counterparties and asset owners need to be established. DECO is a privacy-preserving oracle protocol in development that leverages zero-knowledge technology to enable institutions and individuals to prove the origin and verify ownership of tokenized RWAs without revealing personal information to third parties.

Chainlink Data Streams——Support on-chain markets through secure and decentralized financial market data sources around commodities, stocks, foreign exchange, indices, economic data, corporate financial reports, cryptographic tokens, and more.

Chainlink Functions——Any off-chain events or data can be synced or published on-chain, such as long-term settlement instructions, corporate actions, proxy voting, ESG data, dividends and interest, and daily NAV.

Key Point 2: Empowering liquidity through cross-chain operability

Chainlink CCIP bridges originally fragmented markets and liquidity

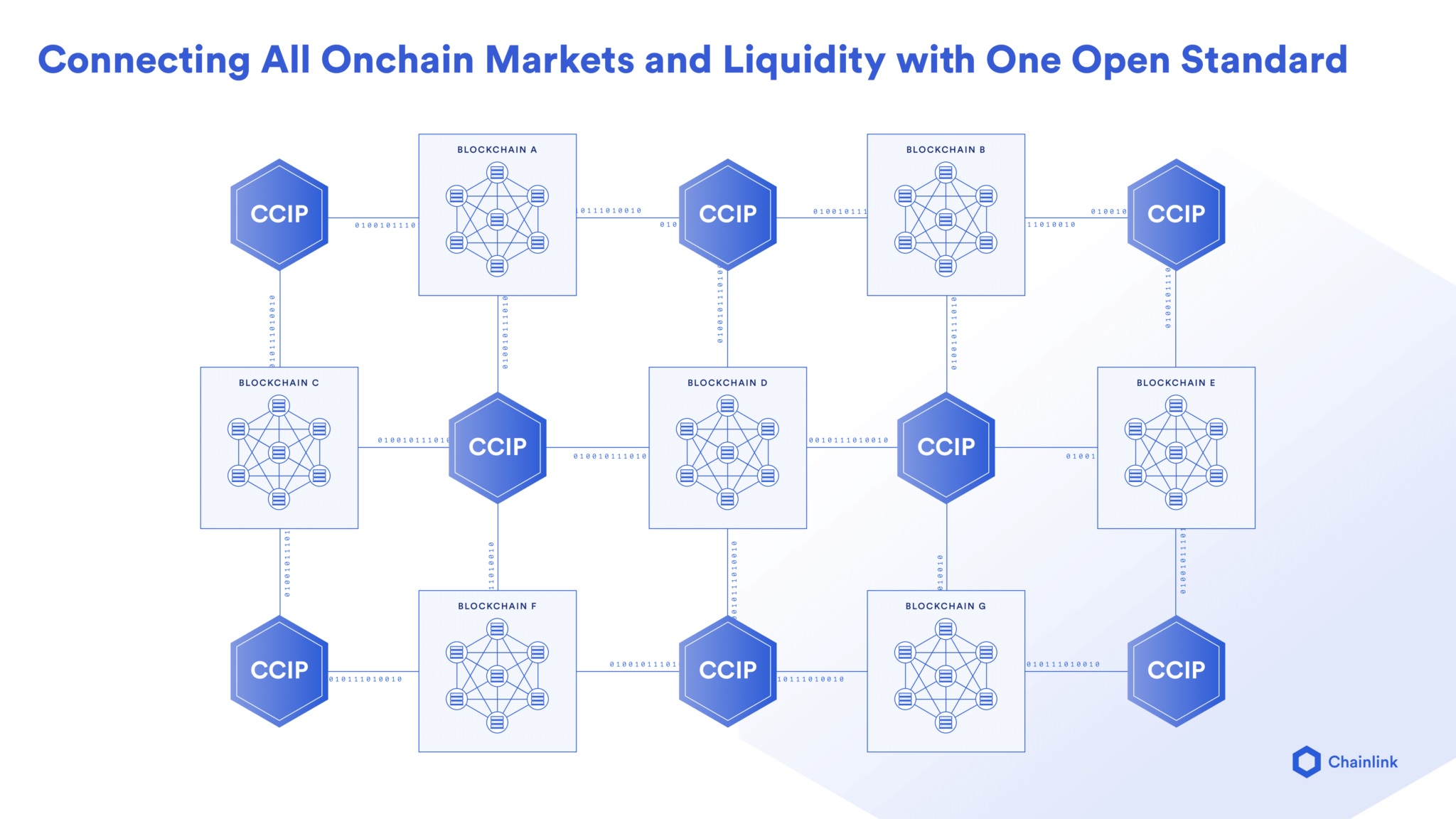

Banks, financial market infrastructures and Web3 protocols are increasingly aware that there will be hundreds or even thousands of different blockchain networks in the future, especially the possibility of an increasing number of networks targeting specific asset classes and different country and region needs. situation. Without secure blockchain interoperability standards, many fragmented liquidity silos will be created, hindering the growth of new on-chain markets.

As a blockchain interoperability standard, Chainlink Cross-Chain Interoperability Protocol (CCIP) will play a role similar to TCP/IP. However, instead of connecting the worlds information, CCIP enables smart contracts to securely transfer value on public and private blockchain networks, creating an Internet of contracts where value can be automatically exchanged when certain conditions are met.

CCIP provides a single integrated gateway to connect backend infrastructure to blockchain networks, which is important for institutions because this way they can save time, cut costs, reduce risk and roll out faster New product. Rather than directly integrating with each individual chain, institutions only need CCIP as an abstraction layer that connects and spans all chains.

CCIP operates with the highest level of cross-chain security and is the only solution that meets the stringent security standards of the capital market. This is part of the reason why Swift and ANZ chose to cooperate with Chainlink and use CCIP for cross-chain tokenized asset settlement. As a universal blockchain interoperability standard, CCIP enables RWAs to flow seamlessly between blockchains, thereby expanding accessibility and deepening global market liquidity.

“Just like key protocols such as TCP/IP reshaped the early decentralized Internet into the globally unified Internet we know and use today, we want to use CCIP to combine the decentralized public blockchain and the growing bank chain ecosystem, Connected to become a unified internet of contracts.” —Sergey Nazarov, Co-Founder of Chainlink

Key point 3: Continuously update data when RWAs move on the chain to ensure complete and accurate records (the Golden Record)

Chainlink is the only platform that can securely provide key on-chain data points to any on-chain environment that RWAs are transferred to.

Chainlink is the only platform that can securely provide key on-chain data points to any on-chain environment that RWAs are transferred to.

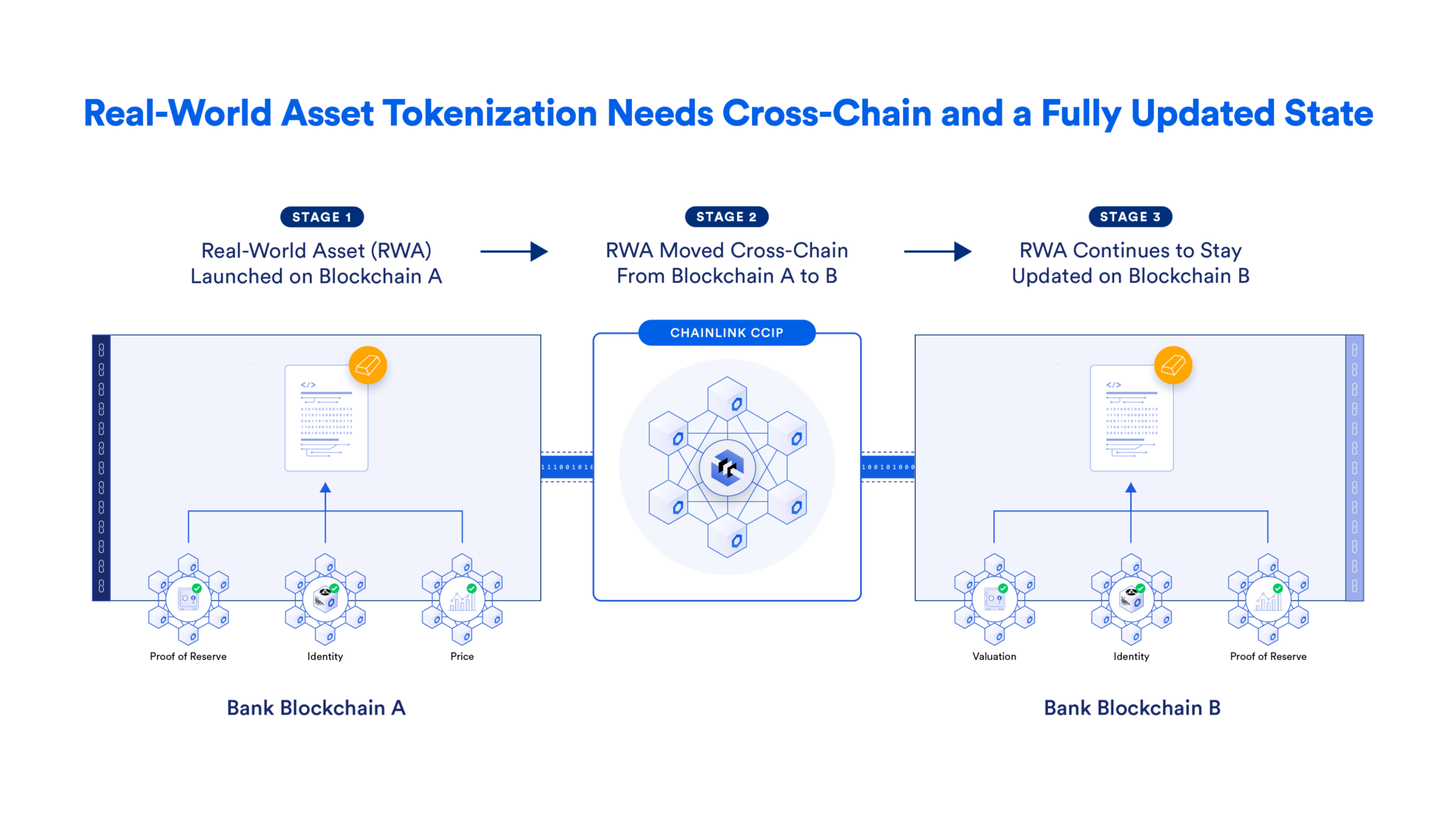

When assets circulate in the financial system, it is crucial to the completeness and accuracy of information records (the Golden Record) to keep the asset-related information intact and ensure that its status is up-to-date - using a single data point and provide all material information about the property completely and accurately. During the 2008 global financial crisis, we witnessed the consequences of a system that separated core financial data from financial instruments. Thousands of mortgages are aggregated into mortgage-backed securities (MBS), and buyers blindly trust the risk ratings assigned to individual loans by rating agencies. Without easy access to core financial information, many people fail to check credit scores, mortgage rates, payment histories and other critical information, or evaluate the models used by rating agencies (which incorrectly assume that property prices do not fall simultaneously across the country) .

On-chain finance can solve this problem for global markets, but it first requires a secure blockchain interoperability standard. When RWAs move across chains, key data points such as price, identity, and reserve value still need to be kept up to date. Therefore, we need a secure solution that provides off-chain and cross-chain connectivity to various blockchains.

Chainlink is the only platform to solve this problem, providing supporting services that cover connecting off-chain data and cross-chain interoperability, while providing the high security guarantees institutions require. As a blockchain-agnostic platform, Chainlink enables RWAs to stay connected to all necessary off-chain data regardless of which chain they are on, through services such as Proof of Reserves, Chainlink Functions, and Data Streams. At the same time, CCIP enables the safe transfer of RWAs between blockchains, and asset issuers and holders can rest assured that during the asset transfer process, on-chain data will be completely and accurately recorded.

For example, Hong Kong-based financial institution ARTA TechFin is using Chainlink’s industry-standard decentralized computing platform to unlock key capabilities for the company’s tokenized fund. Specifically, Tokenized Funds are integrating Chainlink Proof of Reserves to provide customers with on-chain proof of reserves, Chainlink CCIP to enable cross-chain interoperability, and Chainlink Data Feeds to continuously publish tokenized funds on the chain hourly net asset value (NAV), ensuring data transparency.

Another example is that tokenized MBS leveraging Chainlink can contain thousands of tokenized mortgage loans that can be minted via different banks on their own chains. As tokenized mortgages move cross-chain into on-chain MBS contracts, Chainlink can help ensure that the core financial data used by each tokenized mortgage is continuously updated (while still protecting individual privacy). Bank customers can easily create their own models to assess risk using all important financial data before purchasing tokenized MBS. Essentially, Chainlink keeps track of assets as they move across blockchains.

“On-chain finance has the potential to prevent a recurrence of the financial crisis like 2008. If all core information is contained in tokenized RWAs and can be easily accessed on-chain, everyone can become Michael Burry.” - Chainlink Co-founder, Sergey Nazarov

A universal standard to support the transfer of programmable tokenized assets

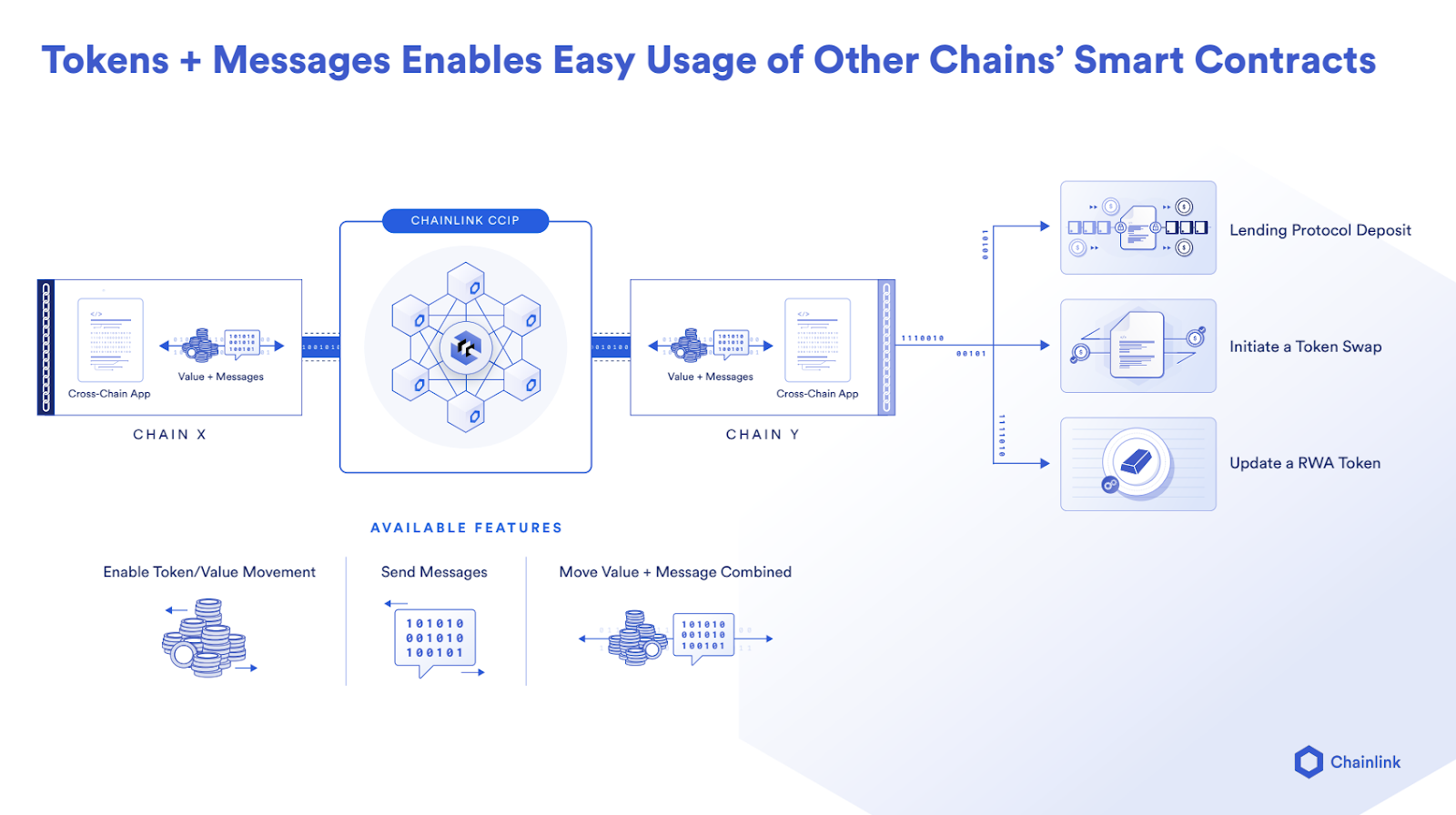

CCIP combines assets with information about them

By enabling arbitrary data, tokens, and instructions to be securely cross-chain, CCIP enables cross-chain programmable tokenized asset transfers (i.e., moving asset platform to obtain loans). Additionally, regardless of which chain the tokenized assets are minted on, banks and asset managers can use CCIP to interact with tokenized RWA across the entire on-chain economy through existing backend infrastructure or a single Web3 wallet.

ANZ proved that CCIP can allow their customers to complete the purchase of tokenized assets through a single transaction, even if the assets are on different chains and settled in different currencies. Behind the scenes, CCIP helps convert a stablecoin backed by the local currency (NZ$DC) into another stablecoin (A$DC), then moves the stablecoin from the source chain to the target chain, purchases the tokenized asset, and sends it back Client wallet on the source chain. CCIP removes all the complexity of advanced financial transactions that might otherwise take days, require manual input from multiple parties, and expose the buyer to counterparty risk.

Enabling data and value assets to flow together between markets and institutions is an important step forward for the global financial system, which previously required information and value assets to flow separately and exist in dispersed islands. The gap from a system where transactions settle at T+1 with counterparty risk to an on-chain economy with near-instant settlement and deterministic cryptographic guarantees points the way forward.

Chainlink is already the leading platform for tokenized RWAs, providing support for products such as TrueUSD stablecoins and tokenized gold products Pax Gold. Now, as world-leading institutions like Swift and DTCC explore how CCIP can connect to their systems, CCIP is becoming the universal blockchain interoperability standard, underpinning tokenized RWAs in the on-chain economy.

For more information, visit chain.link, subscribe to the Chainlink newsletter, and follow us on Twitter, YouTube, and Reddit.