Original author: DrJinglee (X: @ordjingle)

Editors note: Recently, the Ordinals/BRC 20 track has been hot, causing the Fee on the BTC chain to continue to be high. X KOL DrJinglee (X: @ordjingle) published an article discussing the narrative of Ordinals and the security budget of Bitcoin. Odaily compiled it as follows:

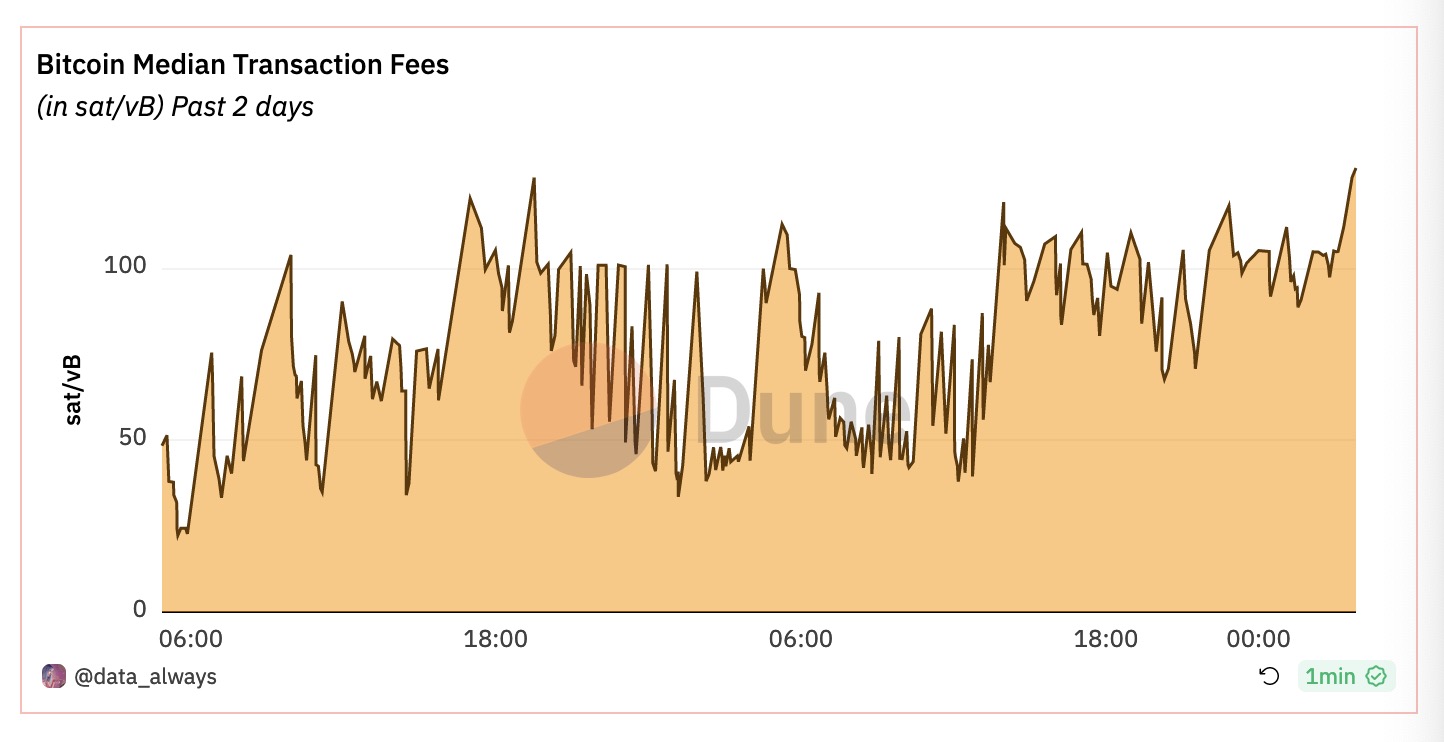

Figure 1

In the past two days, the fee on the BTC chain has continued to rise, and now it is around 150 sats/byte. It must be emphasized that there is no GAS on BTC, only FEE.

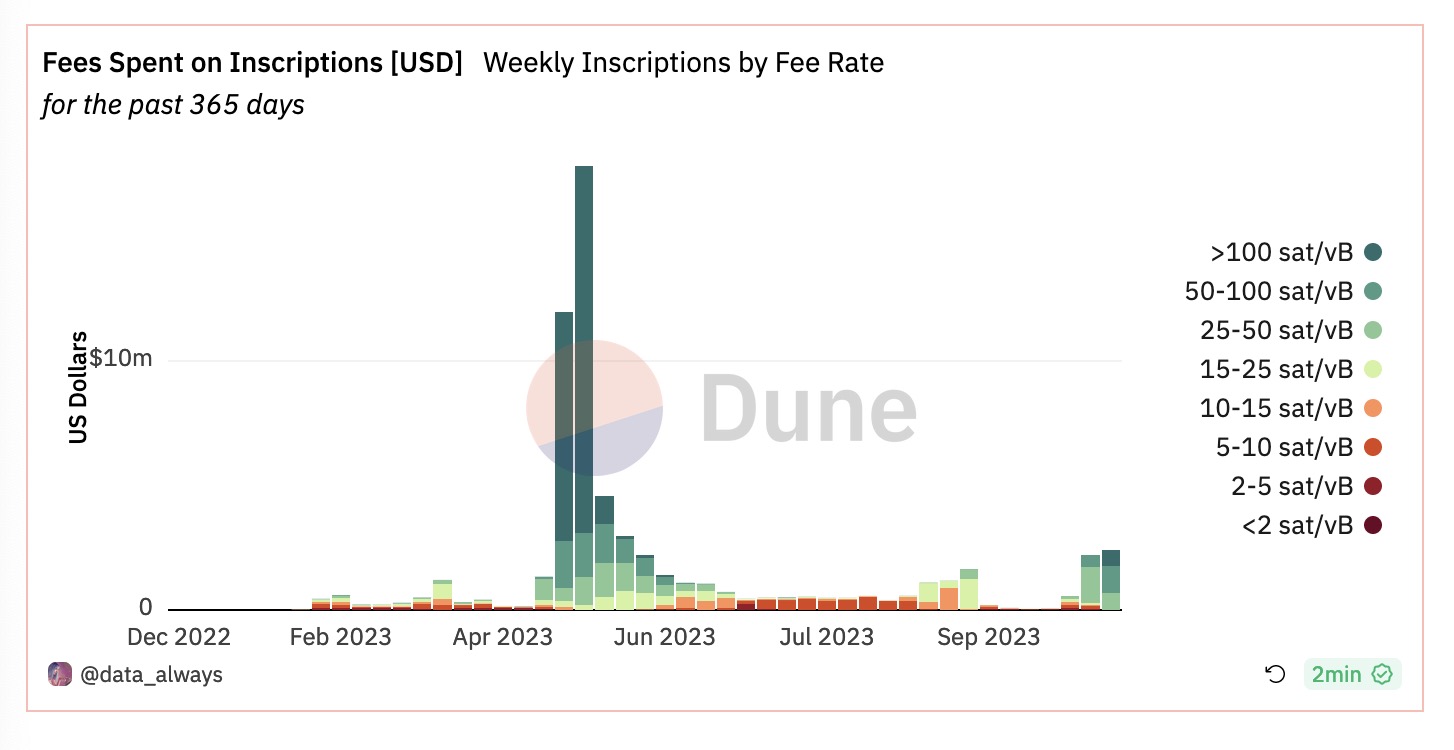

Figure II

It is obvious from Figure 2 that the FEE on the BTC chain has picked up significantly in the past two weeks, but the height of the Fee generated by on-chain activities this time is still very different from the height generated in May.

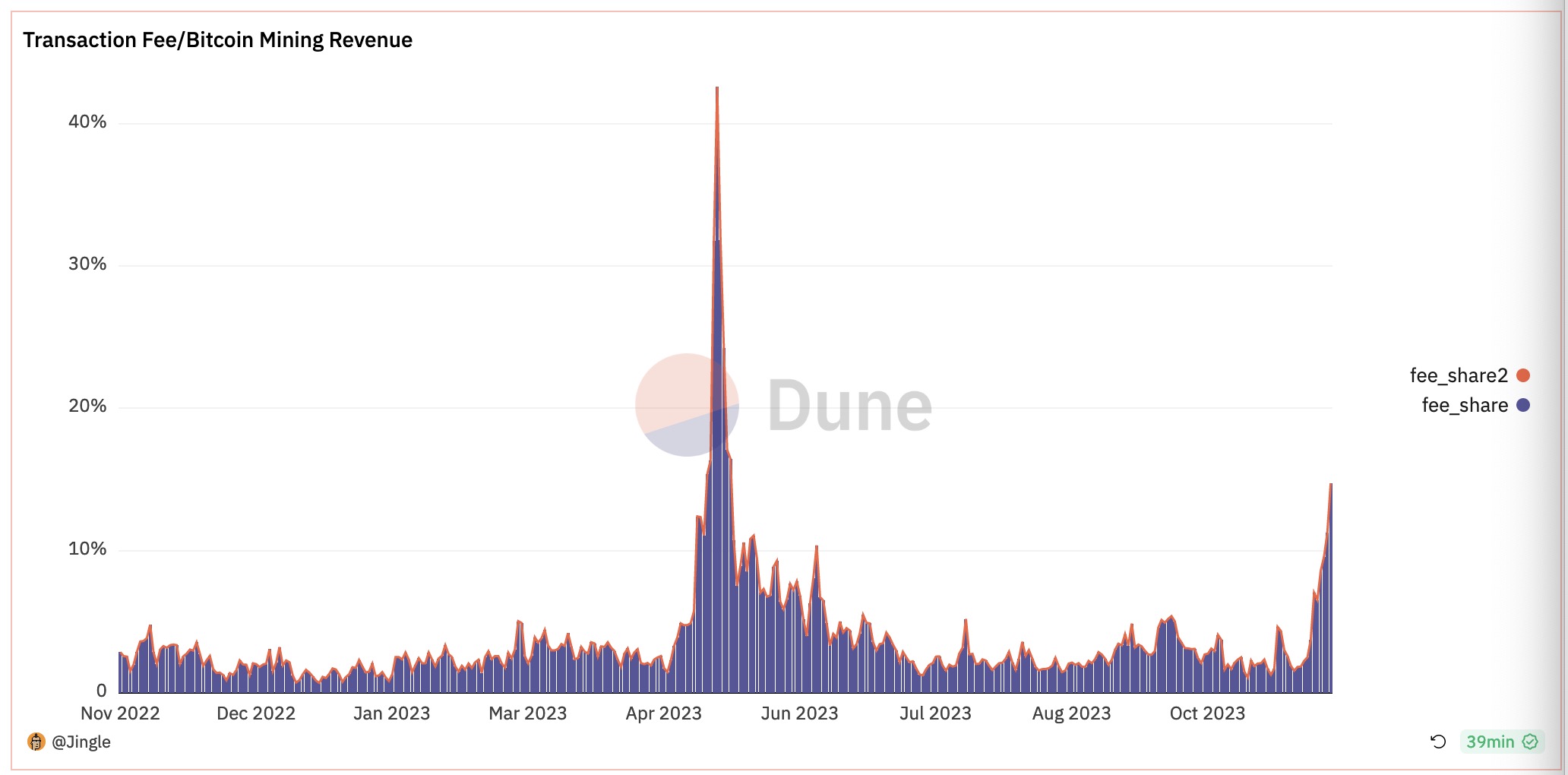

Figure 3

Figure 3 is a tracking indicator that tests the contribution of Ordinals or generalized Layer 1 to the security budget. Assuming that ordinary transaction transfers remain roughly unchanged, we can see that the increase in transaction fees caused by the Layer 1 protocol has reached a maximum of the entire current About 40% of coinbase, that is, after the future halving, can generally fill the gap in this part.

In recent days, gas has basically continued to be around 100, accounting for about 10% -15%. This level can reach the 20% -30% level of coinbase after the halving, thus increasing miners income and maintaining BTC security. The budgets claims dont seem particularly outrageous at the moment. It’s just that everyone has to be patient, which is equivalent to charging BTC users a security tax based on the principle of who uses who pays?

Because of the popularity of Ordinals/BRC 20, FEE has been raised, forcing some users who are eager to complete transactions to use high rates.

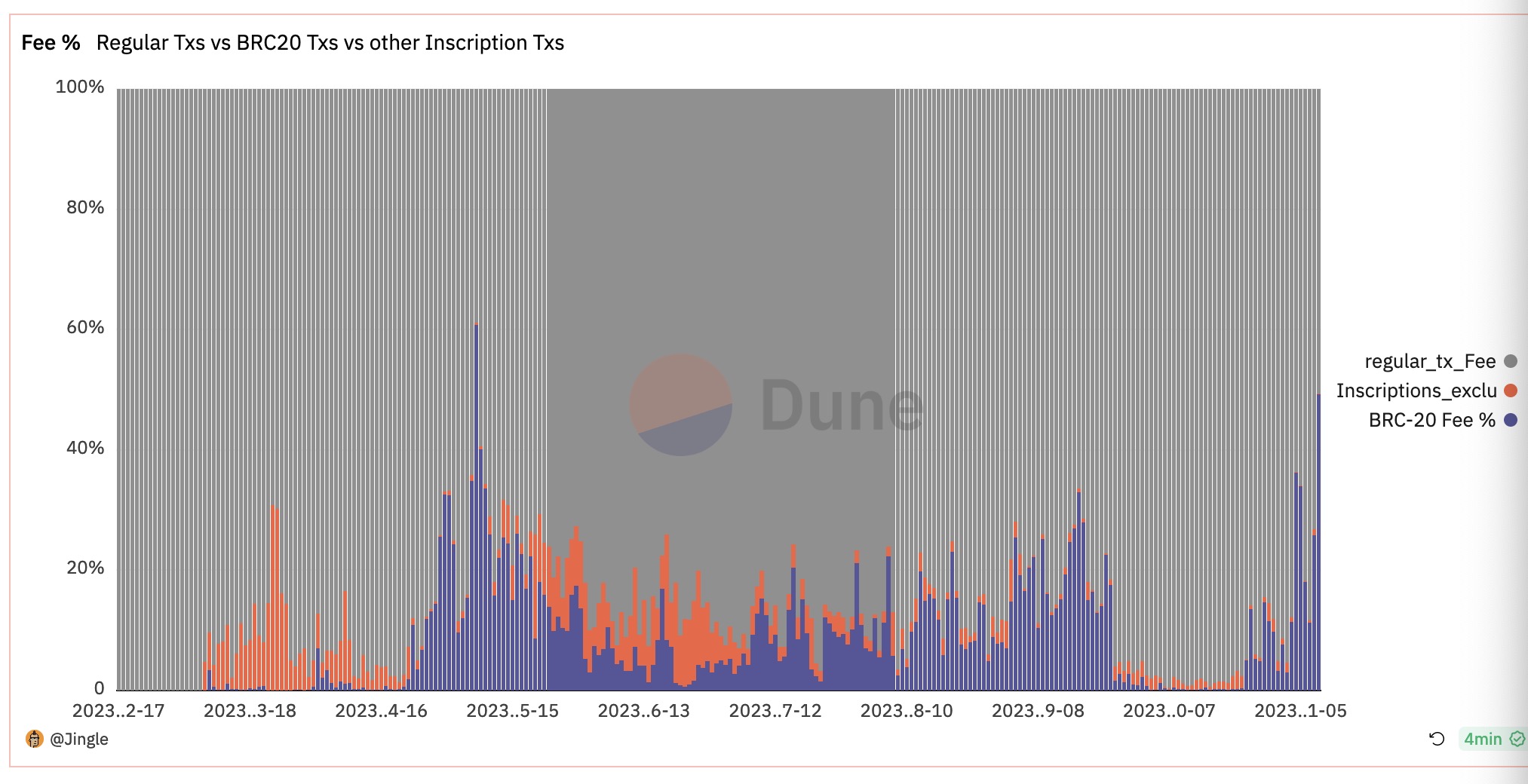

Figure 4

Figure 4 shows the composition of recent BTC transaction fees. You can see that the BRC 20 fee has reached about half of the entire transaction fee in recent days (Figure 4). The other half is ordinary transactions.

in conclusion

Without Ordinals/BRC 20, the ratio of BTC transaction fees and miner revenue to Coinbase is roughly around 1-3%, raising concerns about security budgets after future halvings;

During the outbreak of Ordinals/BRC 20, transaction fees increased, reaching a maximum of 40%, and when the fee was around 100, it could increase by about 15-20%. The increase in transaction fees is due to the front-running mechanism of BRC 20, which drives the overall fee to increase, thus increasing the transaction costs of some rigid users; users passively need to pay high rates to complete transactions as quickly as possible;

BRC 20 also contributes more and more to transaction fees, and its peak value can account for half of all transaction fees.

Judging from the data, the continued popularity of Ordinals/BRC 20 can greatly make up for miners’ income, thereby alleviating people’s concerns about security budgets. The popularity of BRC 20 has levied a security tax in disguised form on users who just need BTC transactions, which has also become a source of increasing miners income. You can learn the basic knowledge about Bitcoin halving and security budget by yourself.