Original - Odaily

Author - Loopy

Bitcoin: “Big surge, you can’t even imagine”

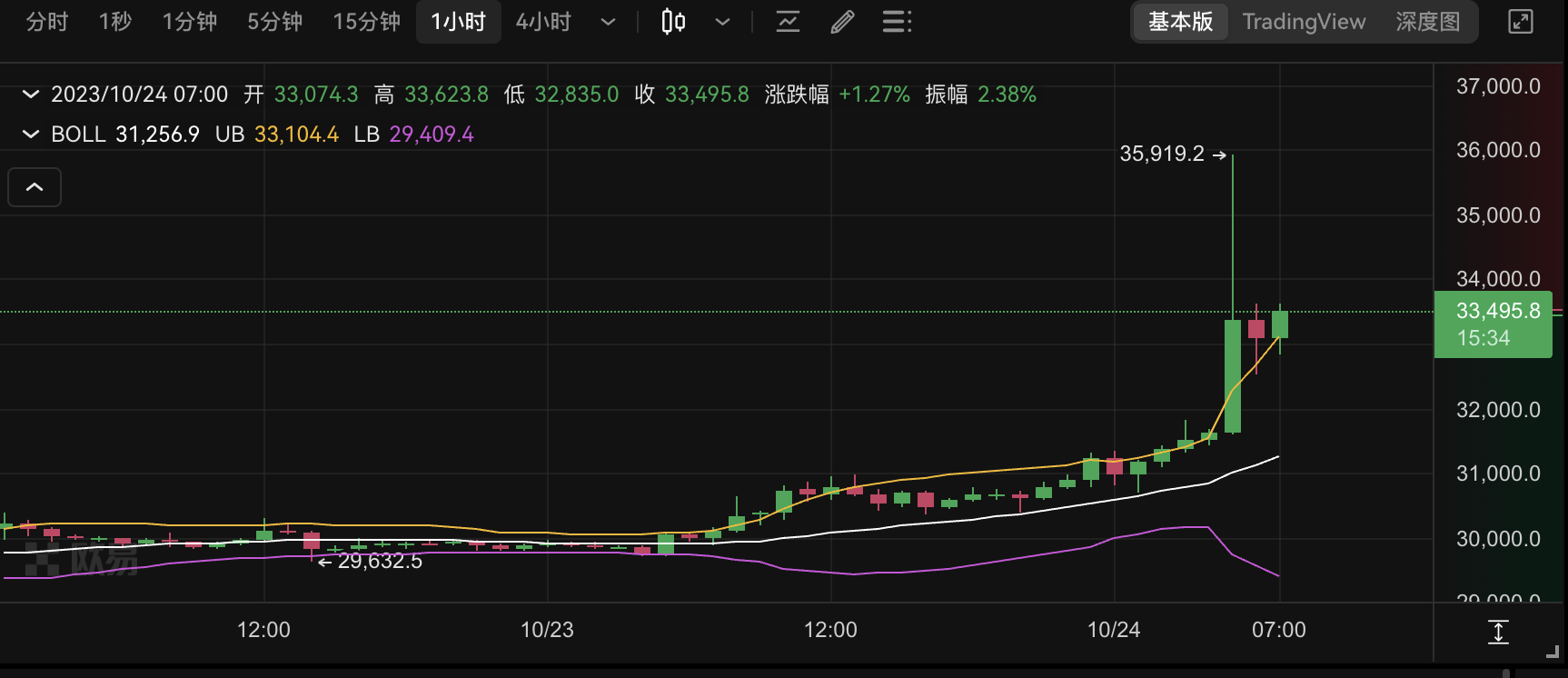

Crypto market sentiment quickly heated up as a number of developments occurred overnight in Bitcoin spot ETFs. Yesterday evening, Bitcoin experienced an extremely rare sharp rise.

Ouyi OKX market shows that BTC briefly exceeded 35,000 USDT, with the highest pin reaching 35,919 USDT, the largest increase in the day.20% . It is extremely rare for a mainstream currency to see such a huge intraday increase. Even at current prices, thats still a 24-hour gain of 11.38%.

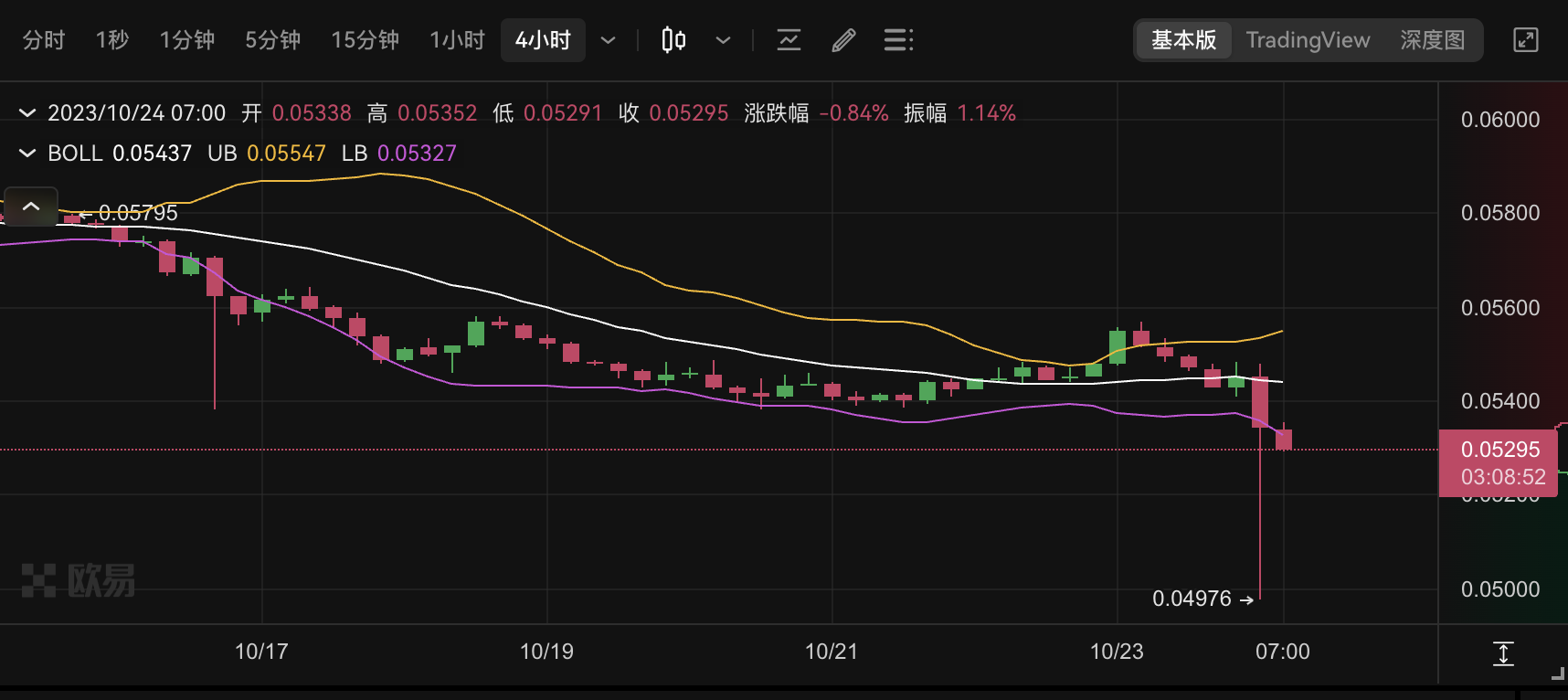

The strong increase has flattened the hourly K-line into a straight line. Driven by the big pie, the long-dormant two pie has also slightly caught up with this rise. The price of ETH briefly exceeded 1,800 US dollars, and is still hovering close to 1,800 US dollars, with a 24-hour increase of only is 6.41%.

The ETH/BTC exchange rate is still declining and has not yet shown a rebound trend.

Among the top ten tokens by market capitalization today, none has a 24-hour increase that exceeds that of BTC. Only SOL (Solana) and DOGE (DogeCoin) have experienced gains close to those of BTC, at 10.8% and 10.4% respectively.

Of course, the sudden rise of some small currencies has also occurred, especially the Bitcoin ecosystem. RIF (RSK Infrastructure Framework RIF) is currently quoted at US$0.14, with a 24-hour increase of 21%; STX (Stacks) is currently quoted at US$0.74, with a 24-hour increase of 16.3%; ORDI is currently quoted at US$5.4, with a 24-hour increase of 33%.

Affected by the upward trend of the overall market, the total market value of cryptocurrency has also grown rapidly. Coingecko data shows that the total market value of encryption currently exceeds US$1.29 trillion, up 9.8% in 24 hours. Crypto users’ trading enthusiasm has increased significantly. Today’s panic and greed index has reached 66, with a level of greed. Yesterday this figure was still 53.

In terms of derivatives trading,According to CoinglassAccording to data, in the past 24 hours, the entire network liquidated positions of US$352 million, of which short positions liquidated US$275 million. In terms of currencies, BTC liquidated its position with a liquidation of US$194 million, and ETH liquidated its liquidation of US$47 million.

BlackRock ETF: Progress clear

The current market rise is mainly stimulated by the expectation of approval of the Bitcoin spot ETF.

Yesterday evening, an S-1 amendment filed by BlackRock revealed that BlackRock has obtained a CUSIP number in preparation for the launch of a Bitcoin spot ETF.

CUSIP stands for Committee on Uniform Securities Identification Procedures. This number is also used as the U.S. Securities Uniform Identification Code.

The filing also shows BlackRock is preparing Seed Capital for a Bitcoin spot ETF. Seed Capital is the underlying asset purchased by the issuing company itself when a new ETF is launched to meet future demand for the product.

Although the adoption of CUSIP numbers and ETFs is not inevitable, the news is still regarded by the market as a major development for ETFs. The same goes for Seed Capital.

For now, BlackRock’s preparations are thorough and rapid. Although it is still unclear whether the ETF will be approved, the market generally interprets that BlackRock itself is quite confident in the approval of its ETF.

And this morning, an even more important piece of news broke out.BlackRock iShares Bitcoin Trust is listed on the DTCC under the symbol IBTC.

DTCC (Depository Trust Clearing Corporation) is an American financial services company founded in 1999. The company consists of five clearing companies and one depository institution to provide clearing and settlement services for the financial market. .

Assuming the ETF is ultimately approved and investors will move from Nasdaq to the ETF, IBTC will be used as the ticker symbol for investors to operate. This also injected strong confidence into the market, and the price of Bitcoin reached its highest point today, once approaching $36,000.

Bloomberg ETF analyst Eric Balchunas said: BlackRock has either received the green light or is just predicting and preparing for everything. We still believe that multiple ETFs will be launched together, rather than BlackRock alone being approved first.

More ETFs Still on the Way

In addition to BlackRock, other crypto ETF applications have also brought more good news to the market.

The U.S. Court of Appeals for the D.C. Circuit officially ruled on Grayscale’s lawsuit against the SEC, which requires the SEC to reconsider its application to convert Grayscale GBTC into a Bitcoin spot ETF.

The SEC now has the option of approving Grayscales application or denying it on other grounds. Grayscale spokesperson Jennifer Rosenthal issued a statement after the case closed on Monday: The Grayscale team looks forward to continuing to work constructively with the SEC on the conversion of GBTC to an ETF. GBTC is operationally ready and plans to take action on behalf of investors as soon as possible.

Grayscale’s Ethereum ETF also ushered in its own milestone moment and made significant progress.

Nate Geraci, president of The ETF Store, posted on the X platform that the U.S. Securities and Exchange Commission (SEC) has recognized Grayscale’s spot Ethereum ETF filing, which will be the process of converting ETHE into an ETF. The advent of spot ETFs will also bring more incremental funds to the market and drive the price of Bitcoin up.

However, it should be noted that this recognition only means that the SEC has accepted its application and is about to enter the formal review process. Final approval is still far away.

Singapore-based crypto financial services firm Matrixport said in a report that if BlackRock’s spot Bitcoin ETF receives approval from the U.S. Securities and Exchange Commission, the price of Bitcoin could rise to between $42,000 and $56,000. In addition, through an analysis of 15,000 U.S.-registered investment advisors, Matrixport estimates that approximately $12 billion to $24 billion worth of funds may flow into such ETFs.

Nowadays, market expectations for the adoption of ETFs are getting stronger. How long will this round of rise last? Is it a short-term rebound or the beginning of a new cycle?

Odaily would like to remind everyone that investment is risky and should be treated with caution.