original:A BTC ETF is a watershed moment》

Author: Cryptojoe

Compiled by: Odaily How about

The Bitcoin ETF is an important milestone moment because it can quickly meet (traditional) market expectations for demand without requiring a long wait. A Bitcoin ETF will attract interest from a variety of investors, particularly institutions such as family offices, private banks and hedge funds, as it provides a compliant way to gain exposure to spot Bitcoin on a global basis. If there is demand for billions of dollars in the market, this will have a significant impact on Bitcoin prices. Institutions offering ETFs will also be incentivized to sell as much of the product as possible. Overall, the Bitcoin ETF marks an important turning point with profound consequences for the entire market.

The following was posted on X (Twitter) by Cryptojoe and compiled by Odaily.

Why a Bitcoin ETF is a watershed moment

ETF Approval->ETF Trading

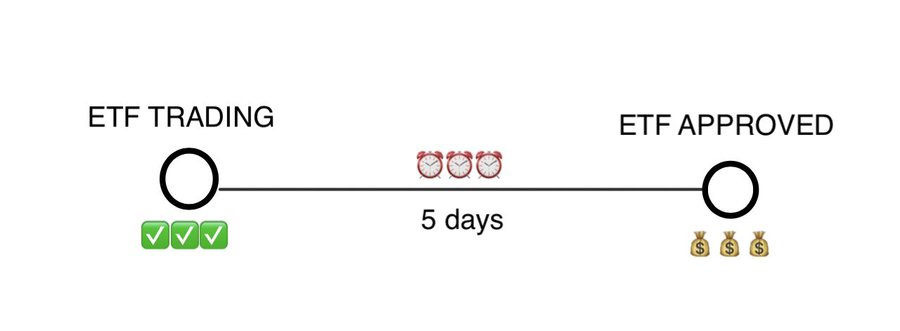

Taking the ETH futures ETF as an example, you can see how quickly ETF instruments can start trading.

In this case, only 5 days passed between approval and official transaction. Why?

Because there is not a long time between anticipated demand and its realization. Assuming the gap is a few months, then it is more likely that the market is selling news.

demand conundrum

But none of that matters if no one buys the ETF. So who will buy it? Why?

golden mode

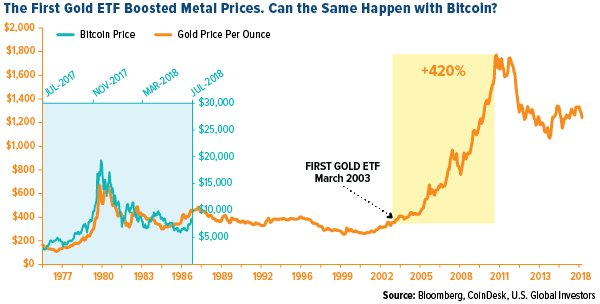

Only two ETFs in history have reached $1 billion in size in their first 3 trading days:

Gold (2004)

Bitcoin Futures (2021)

After the gold spot ETF was launched in 2004, gold rose 500% over the next 5 years. The data illustrates just how important spot ETFs are.

2. Why is a Bitcoin spot ETF a breakthrough?

Because it provides meaningful exposure to spot Bitcoin globally in a compliant manner. From KYC to custody to regulation, there are huge barriers to entry, blocking hundreds of billions of dollars in funding. How many types of investors are there?

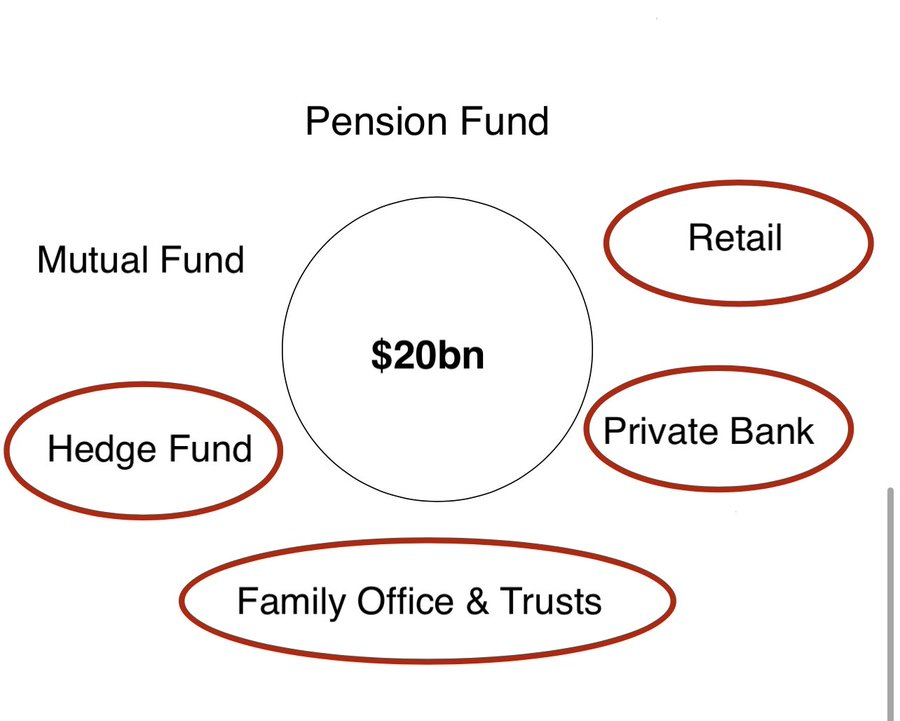

For example, family offices, private banks, and hedge funds, their most ideal product is Bitcoin ETF.

I estimate among the investor community below that the market size is probably between $10-20 billion.

What happens if there is $10 billion in demand in the spot market? At current trading depth, it would take approximately $100 million to increase the Bitcoin spot market by 10%.

However, ETF inflows may take some time, subject to the following factors:

halved

Credit Tightening -> Quantitative Easing

Geopolitical uncertainty.

However, from my personal perspective I can clearly see the impact an ETF could have on the price of Bitcoin.

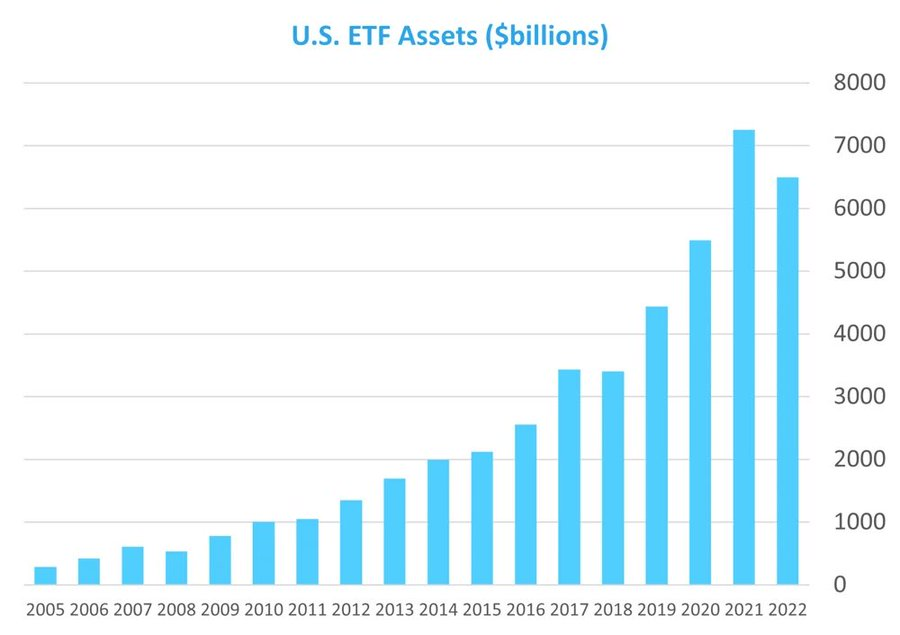

Fees are King: Incentivizing Institutions to Sell ETH

The ETF provider has an incentive to sell as much of the ETF as possible. ETF fee revenue will exceed $100 billion in 2022, with an average expense ratio of 0.37%. Total ETF assets under management are about $7 trillion.