In the traditional financial market, insurance annuity products are an investment and retirement planning tool that have received widespread attention. However, in the wave of financial innovation in recent years, the digitalization and tokenization of insurance annuity products have begun to emerge. The Marquee project is promoting the construction of a new generation of insurance system and bringing new opportunities and advantages to investors through innovative insurance RWA (Real World Assets) products. This innovation is of great significance in the financial market.

1. The Importance of Insurance Annuity Products

Annuity is an insurance product by nature, a tool for people to save and manage cash. Annuities are created and sold by financial institutions. The financial institutions accept and invest personal funds, and then pay a certain amount of cash to the policyholder when the annuity is annuitized. Annuity is divided into two stages, the first is the accumulation stage before the annuitization starts, and the second is the payment stage after the annuitization starts. There are many types of annuity products, but their general characteristics are similar, that is, they provide insurance to policyholders. There are four most popular annuities: variable annuity, fixed annuity, indexed annuity, and immediate annuity. The importance of insurance annuity products in the financial field is mainly reflected in the following aspects:

1.1. Retirement planning: Insurance annuity products provide investors with a long-term stable income planning tool, ensuring that they can maintain a good standard of living after retirement and cope with long-term financial needs, such as buying houses and cars, etc.

1.2. Long-term wealth management: The asset portfolio of these products usually includes bonds, stocks and other investments, which require long-term management to support long-term expenses such as pension payments, education expenses, and large purchases.

1.3. Risk management: The diversified investment portfolio of insurance annuity products can help reduce the impact of market fluctuations on investors and provide more stable investment returns.

1.4. Asset inheritance: Insurance annuity products provide investors with more control over assets. The beneficiary can specify the method of receiving the insurance money, and can also establish an insurance trust to customize the asset inheritance plan according to the actual situation and needs. This helps avoid family property disputes and ensures that assets are properly distributed after death. It also provides an opportunity to avoid risks and avoid assets being used to pay off debts instead of being left to future generations.

In short, insurance annuity products play an important role in the financial market, not only providing investors with long-term stable retirement income, but also helping with long-term wealth management and risk management. In addition, they provide more flexibility and control over asset inheritance, helping to protect family assets and avoid potential risks. Therefore, these products have irreplaceable value in investment and retirement planning.

2. Clever integration of annuity and RWA

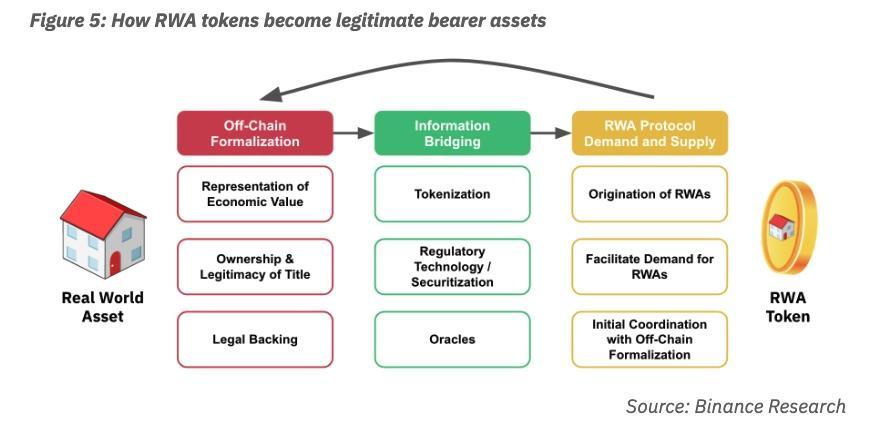

RWA (Real World Asset Tokenization) is a key financial innovation that aims to digitize and tokenize various types of assets in the real world so that they can be traded and circulated on the blockchain. The development of RWA has also attracted attention from traditional financial institutions and the crypto field, both of which are actively exploring how to introduce real-world assets to the blockchain. This trend heralds the continued digitization of financial markets and the further integration of traditional and crypto-finance sectors.

RWA can serve as an important source of real income for U-based assets in the crypto market. The potential impact of RWA’s on-chain entry on the crypto market is almost transformative. RWA can provide the crypto market with sustainable, rich types of real returns backed by traditional assets. RWA can bridge the decentralized financial system and the traditional financial system for DeFi. This means that in addition to introducing incremental funds into the crypto market, RWA can also obtain massive liquidity, broad market opportunities and the traditional financial market. Huge value capture.

The assets that can be RWA can be tangible assets or intangible assets, such as stocks, bonds, commercial real estate, cars, gold, etc. Due to the current market situation, treasury bond RWA is relatively popular, insurance annuity products and other insurance asset management industries It is also an important asset class held by people. It can also be put on the chain through RWA. The introduction of RWA has a potentially significant impact on the insurance market and the encryption field, which mainly includes:

2.1. Increase transparency: Digitizing insurance asset management assets and putting them on the chain improves product transparency. Investors can more easily track their investments and understand the status of the asset portfolio, thereby improving trust.

2.2. Improve liquidity: Digitizing insurance annuity product shares and putting them on the chain increases their liquidity, allowing investors to buy and sell shares more easily and reducing transaction costs.

2.3. Reduce management costs: Blockchain technology can reduce management costs, and smart contracts can automate many management tasks, reducing the need for manual intervention.

2.4. No centralized intermediary required: The tokenization process of insurance RWA eliminates the central intermediary in traditional transactions and achieves efficient decentralized asset storage and transfer.

2.5. Support the development of DeFi ecosystem: Insurance RWA provides more real asset support for decentralized finance (DeFi), improving the credibility and attractiveness of DeFi projects.

2.6. Introducing new asset classes: Grafting DeFi Lego on the basis of Marquee Insurance RWA can further unleash the potential of insurance RWA assets.

2.7. In the short term, Marquee’s insurance RWA is more of a one-sided demand for traditional insurance annuity products from users in the crypto world. In the future, it will be two-way. On the one hand, it can bring real-world insurance annuity products to the chain, and on the other hand, it can bring real-world insurance annuity products to the chain. On the other hand, traditional insurance annuity products can also use various technologies and advantages of blockchain to further unleash their potential.

Overall, the insurance RWA products of the Marquee project represent the future trend of financial innovation, combining insurance annuity products with blockchain technology to provide investors with more choices and flexibility, while promoting the digitization of the insurance and financial fields. Integrate with tokenization to build a new generation insurance system.

3. Income Prospects of Insurance RWA

Based on the business models of bond RWA showing various development paths, we have summarized the following business models of insurance RWA, which can bring innovation and growth opportunities to the insurance industry. The following are the main viable insurance RWA business models:

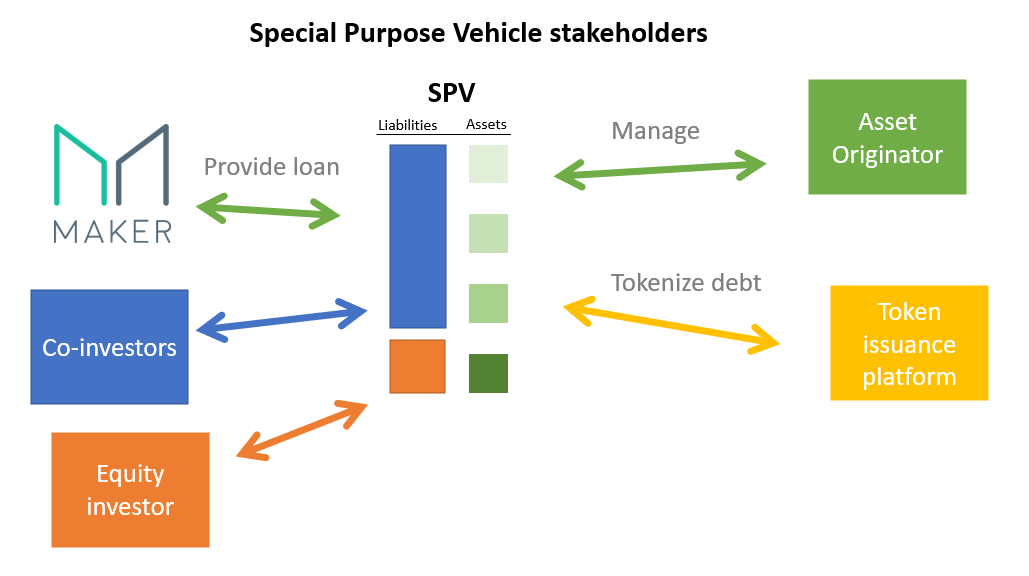

Agency model: Project parties in the agency model do not directly participate in the packaging of underlying insurance assets, nor do they provide user KYC services. Mainly attracting customers through crypto-native methods, focusing on business marketing, acquisition of funds, and expansion of ecology and application scenarios. This type requires the establishment of a fund pool to pool users funds together, and then lend the funds to a single borrower (Marquee) to purchase different types of insurance assets.

Platform model: The platform model requires the project party to provide a series of on-chain, sales and KYC services, but does not directly participate in the packaging process of insurance assets. These projects typically provide tokenization services for insurance assets and interests, on-chain verifiable information services, and user KYC services. This model is closer to the business model of the Internet platform and can help encapsulate insurance assets and rights in various traditional markets.

Infrastructure model: The infrastructure model requires the project party to provide services such as putting insurance RWA on the chain, purchasing assets, and asset management, but does not directly contact end users. The main task is to build infrastructure, digitize insurance assets and introduce them to the blockchain, and provide asset chaining and management services for other projects.

Self-operated model: The self-operated model requires the project party to find suitable insurance assets by itself, establish a business framework with external partners, manage asset risks, and tokenize assets or equity. Projects under this model are typically more complex and require more effort in legal and corporate business structures, but they also have more control and can proactively manage risks.

Hybrid model: The hybrid model project combines the above-mentioned various models, not only providing on-chain, KYC and other services, but also actively looking for insurance assets and directly providing investment opportunities to users. Projects in this model usually provide diversified services, including providing access to funds to financiers, providing encapsulated assets, providing governance and treasury management services to other protocols, and providing full-process RWA services.

As one of the most promising use cases in the current Web3 field, RWA has attracted more and more attention from the digital currency industry and the traditional financial industry. U.S. Treasury bonds are currently a relatively mature asset target in RWA. U.S. Treasury bonds are considered one of the safest investments in the world, offering fixed returns with minimal risk. By using RWA as collateral, the yield on these bonds can be increased while maintaining their low-risk profile.

The way it works is that investors buy a Treasury bond and receive an RWA that represents a portion of the bonds value. The RWA is then stored on a digital wallet or decentralized platform, providing a secure and transparent record of ownership. The investor can then use the RWA as collateral to borrow funds from a lender, potentially at a lower interest rate than a traditional loan. This approach allows investors to maximize returns on their Treasury investment while minimizing risk.

In short, the business model of insurance RWA is constantly innovating and developing, bringing more opportunities and possibilities to the insurance industry and the encryption field.

Global economic growth has slowed since 2019, primarily due to the COVID-19 pandemic, trade tensions and declining business confidence. The International Monetary Fund (IMF) predicts that global economic growth will reach 3.3% in 2023, higher than 2.7% in 2022, but still lower than the growth rate before the epidemic. The Federal Reserves continued interest rate hikes have also caused global financing costs to rise and investment returns to fall sharply. At this time, U.S. Treasury bonds, which serve as the benchmark for global risk-free interest rates, have entered the asset allocation options of most investment institutions.

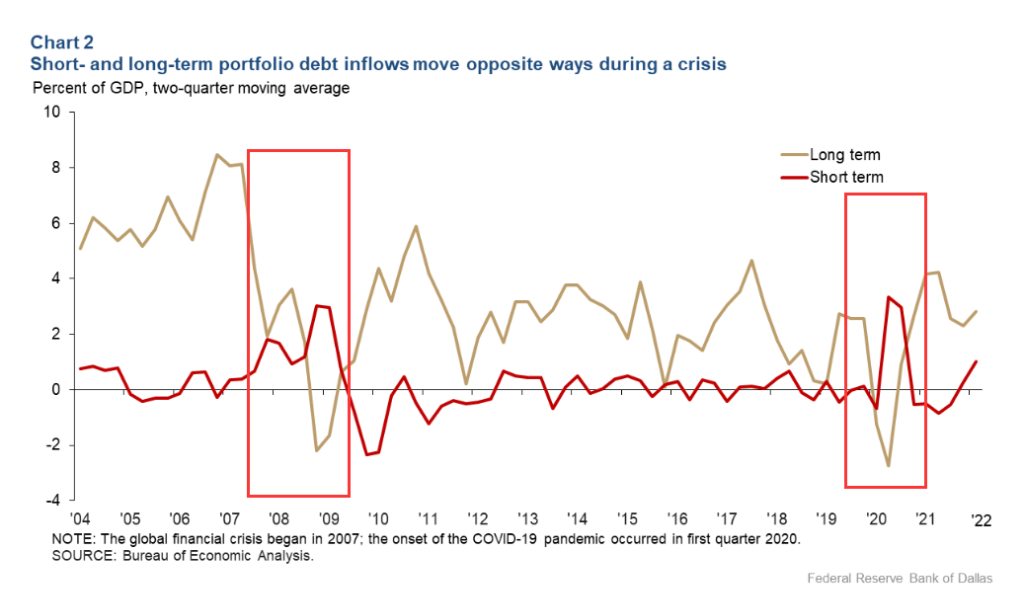

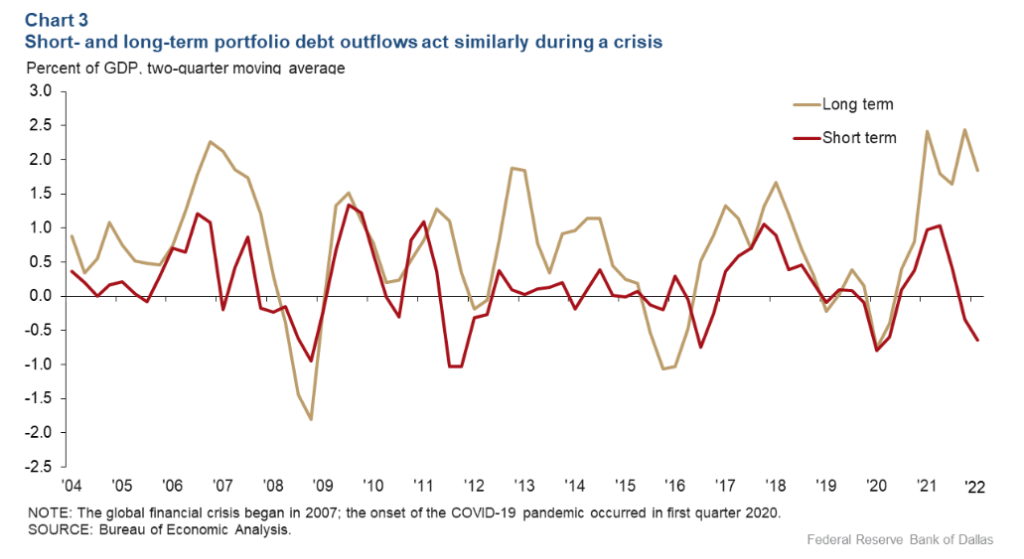

Dallas Fed economist J. Scott Davis believes that short-term U.S. Treasuries pose little liquidity or interest rate risk relative to long-term U.S. Treasuries. Only short-term U.S. Treasury bonds can be called a truly safe asset. He noted that during the 2008 financial crisis and the 2020 coronavirus pandemic, flows into long-term U.S. Treasuries fell, but flows into short-term Treasuries increased.

However, during the crisis, the trend of outflows from short-term and long-term U.S. Treasuries was almost the same, with no significant divergence.

Additionally, he pointed out that during times of economic turmoil, since the U.S. dollar is the worlds reserve currency, it tends to appreciate during crises.

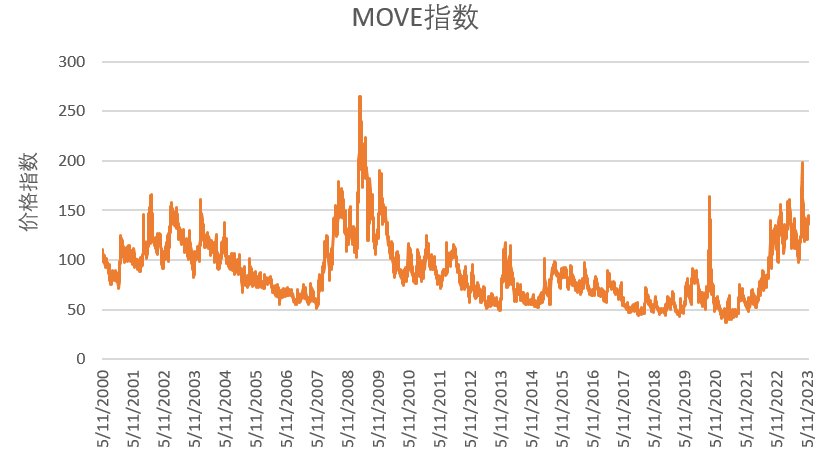

Current interest rate volatility levels in the United States are at historically high levels. The MOVE Index is a yield curve-weighted index that measures the volatility of U.S. Treasury options and is a commonly used measure of interest rate volatility. U.S. interest rate volatility has been rising steadily since mid-2021, and while it has retreated slightly from its March 2023 highs, it remains historically high.

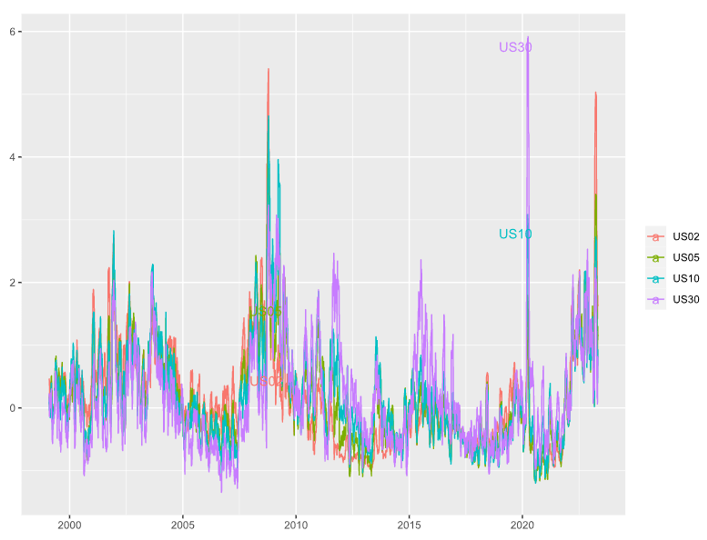

The chart below shows the normalized volatility of U.S. Treasury futures by maturity.

As you can see from the chart above, U.S. interest rate volatility is at historically high levels. Their high volatility often signals strong fixed income returns, which presents excellent opportunities for active fixed income managers.

5. The Marquee project’s future prospects for insurance RWA

In the future, insurance RWA will face a number of potential trends that will shape its future, driven by digitalization and innovation in the financial sector:

1. Regulatory compliance: As the share of insurance annuity products digitizes, regulatory compliance will become a crucial factor. Regulators will continue to adjust laws and regulations to adapt to the development of digital assets and ensure the protection of investors’ rights and interests. Therefore, insurance annuity product shares RWA need to actively comply with regulatory requirements to ensure their legal operations and protect the rights and interests of investors.

2. Investor education: Investors need more education and information to gain a deeper understanding of the potential risks and rewards of digital insurance annuity products. Financial education and information transparency will play a key role in market development, helping to increase investor trust and understanding of these new products.

3. Cooperation and integration: Cooperation and integration between Marquee and insurance companies, blockchain technology providers and financial institutions will promote the development and widespread adoption of digital insurance annuity product shares. Cross-industry cooperation helps integrate resources and improve product usability and user experience, thereby accelerating market penetration.

4. Technological innovation: As blockchain technology and smart contracts continue to develop, more technological innovations will emerge, including more secure authentication methods, improvements to smart contracts, and more efficient transaction processing. These technological innovations will improve the efficiency and usability of insurance annuity products.

5. More asset types: In the future, insurance annuity product share RWA may expand its asset range, not only limited to treasury bonds, but also include other valuable real assets and digital assets. This will provide investors with more options while also increasing the possibility of diversifying their portfolios.

6. Risk modeling and analysis: In the future, more advanced risk modeling and analysis tools may emerge to assess the risks of digital insurance annuity products. This will help investors better understand the risk exposure of their portfolios and take appropriate risk management measures.

Taken together, the emergence of insurance annuity product share RWA represents the future trend of digitalization and innovation in the financial field. These innovations are expected to provide investors with greater choice, greater transparency and lower-cost investment opportunities, while also helping to modernize and grow the entire insurance and pensions industry. To realize these potential trends, market participants need to proactively address regulatory challenges, strengthen investor education, promote cross-industry collaboration, and continuously promote technological innovation. Marquee will monitor these trends closely, respond flexibly, and actively drive innovation to ensure sustainable growth and continuous advancement in this area.

6. Underlying assets supported by Marquee Insurance RWA

Marquee Project Insurance RWAs initial supporting assets include the worlds leading insurance companies: Frances AXA, Germanys Allianz Insurance Group (ALLIANZ), Dutch International Group (ING Group), American International Group (AIG), the worlds leading insurance companies Asset management companies: BlackRock, Vanguard, and Fidelity’s share of annual insurance premium products.

First, based on its own advantages and market conditions, Marquee supports the digitization and up-chaining of the above product shares, and then sells these shares to investors (agency sales model). In this model, the insurance company is still responsible for managing the asset portfolio and paying pensions; secondly, marquee Its own page provides a digital share of insurance annuity products, allowing different institutions and investors to participate to increase the competition and diversity of the market; finally, Marquee Insurance RWA supports integration with other DeFi: a platform based on decentralized finance (DeFi) Insurance annuity product shares can be integrated, allowing investors to buy and sell these shares on decentralized exchanges, while smart contracts can automatically handle pension payments. Diverse business models will be adopted in the future, and the diversity of business models will help meet the needs of different investors.

7. Marquee’s other business needs

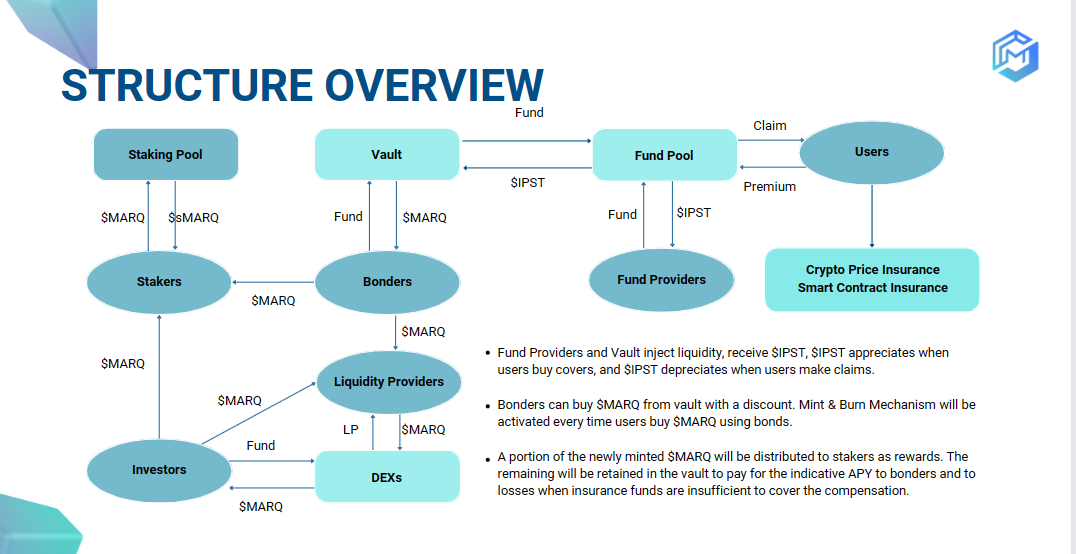

The core design of Marquee is a peer-to-pool model, with a fund pool and a Vault with a mechanism similar to (3, 3). Marquee has a strong need to bring real-world assets into the crypto world, mainly because of the macro background Real-world assets (especially U.S. debt) can provide a stable risk-free return for Marquees capital pools and vaults.

Asset management needs: Both capital pools and treasury have asset management needs. The income on the native chain mainly comes from pledge and lending activities. However, in the context of the crypto winter, the slump in on-chain activity directly led to the decline in on-chain yields. In the context of the current high yield on U.S. bonds, marquee is considering introducing U.S. bond RWA. In the new version, marquee will gradually convert stablecoin assets (with no or low returns) in the capital pool and vault into U.S. Treasury bonds. Debt RWA interest-earning assets (5% -7% risk-free return). This can ensure the safety of the capital pool and treasury assets while obtaining stable income;

Diversification of investment portfolio: The main investment strategy of the fund pool of annuity products is asset allocation. When extreme market conditions occur, the high volatility and high correlation of crypto-native assets are prone to mismatch and liquidation of assets. The soil for asset allocation strategies is poor, but The introduction of RWA assets that are less correlated and stable with crypto-native assets on the chain can effectively alleviate such problems. The investment strategy of an annuity can be diversified and build a more stable and effective investment portfolio.

8. Marquee has received investment from 7 institutions including WATERDRIP CAPITAL

Even in a bear market, Marquee still received investment from many well-known institutions due to its product advantages and technology. Marquee Co-Founder Dr. Joe said: We are very pleased to receive support from well-known institutional investors in global encryption and Web3 such as CGV. We all share a common vision and great enthusiasm and are committed to building a new generation of decentralization in the future. Financial applications and ecology. CGV’s professional investment and research advantages in the encryption and Web3 industries, as well as its diversified collaborative resources in Japan, Asia, North America and other countries, will help Marquee achieve its expected goals faster and better.