Original author - Bloomberg CryptoMichael P. Regan & Anna Irrera

Compile - Odaily 0xAyA

As Sam Bankman-Fried’s case heads to trial, many cryptocurrency players remain in survival mode.

Sara Feenan ventured out of finance in 2017 and entered the brave new world of crypto.

Feenan, who has spent the past few years working at a blockchain technology company and the Binance exchange, is excited to be part of a movement that promises to transform and improve just about everything. She even named her dog after the inventor of Bitcoin. Then, amid the turmoil of 2022, the FTX exchange suffered a stunning bankruptcy in November. As the ripple effects of the ensuing months continued, Feenan, whose most recent job was at a startup, found herself out of a job, after which she left the cryptocurrency industry.

“I was a little disappointed,” said Feenan, who now works at a non-crypto fintech startup in London. “Things like FTX are a little annoying. If you tell people you work in cryptocurrency and this just happens, it’s hard to tell that people here aren’t scamming people for a living.”

While a cloud of doubt and suspicion has hung over the nascent asset class from its inception, it may not have been as thick as it has been in the past few months since the downfall of FTX and its enigmatic leader, Sam Bankman-Fried. That cloud of suspicion and suspicion is unlikely to dissipate anytime soon as SBF is indicted next week as the man responsible for one of the largest financial frauds in US history - even though he has pleaded not guilty to a range of charges against him.

Of course, nothing affects market sentiment more than price. Although Bitcoin has rebounded about 60% this year and is trading around $27,000, it is still well below the record of $69,000 set in November 2021 and has been stuck in a trading range for much of the time. A market that was once worth nearly $3 trillion now only has about $1 trillion left. The dream of Bitcoin or any other cryptocurrency token becoming a true alternative currency remains just a dream.

Trading has dried up, and once-hot corners of the market like NFTs now look like the digital tulips critics have always said they were. According to data from researchers at dappGambl, 95% of the collection of more than 73, 000 NFTs are essentially worthless. Citing data from The Block, the researchers said weekly NFT transaction value in July was around $80 million, just 3% of the August 2021 peak. Remember the much-hyped Dapper Labs NFT project NBA Top Shot? It converts basketball highlights into tradable tokens, some of which sold for more than $200,000 in 2021. There are hundreds of these tokens sitting around for sale right now, with asking prices as low as $1.

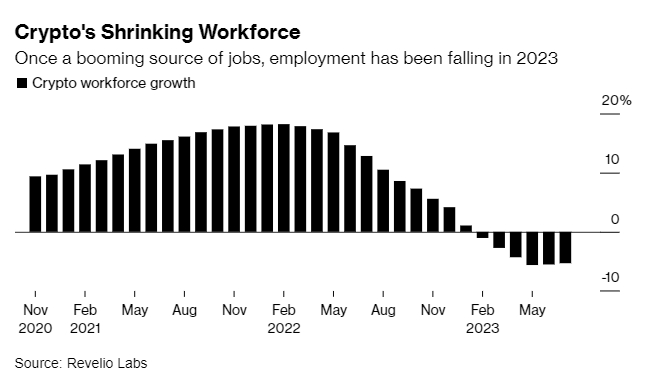

Crucially, the previously loose pockets of the venture capital community have tightened significantly. Venture capital deals targeting cryptocurrency and blockchain projects totaled about $7.3 billion this year through September 19, according to Pitchbook, equivalent to a quarter of the total for all of 2021 and 2022. And jobs in the industry are declining. While the cryptocurrency industry’s workforce grew at more than 18% in early 2022, employment opportunities have been declining throughout the year, with the most recent decline exceeding 5%, according to Revelio Labs, based on data from 35 large companies.

“Honestly, it’s really painful,” said Nico Cordeiro, chief investment officer at crypto hedge fund Strix Leviathan. Due to market conditions, revenue is negligible. You cant attract new investors because no one is investing in this space. Players in this industry are in survival mode: keep operations going as long as possible until money starts flowing back into the space.

Strix Leviathan had used FTXs offshore exchange to trade perpetual cryptocurrency futures that were not available on U.S. exchanges, but funds are now locked up in the bankrupt exchange through a major brokerage. The company has halted perpetual futures trading over concerns that there is no safe place to trade, as FTX’s main rival Binance also comes under increasing regulatory scrutiny.

It’s been a tough road for those who have successfully launched cryptocurrency-related businesses in the post-FTX era. Hilal Diab launched his company Market Mapper, a platform that provides traders with blockchain analytics, in January in Tel Aviv, Israel. But he soon ran into trouble, unable to find a major online advertising platform willing to accept his business. He said that when he tried to sign up on Mailchimp to publish Market Mapper’s newsletter, the company told them to find another service provider because it didn’t want to be associated with the cryptocurrency industry. Even his friends and family are wary of it.

“As soon as I tell people my startup is about cryptocurrency, they get nervous. That’s the first reaction I get,” he said. There are also investors who are very skeptical about giving us money, especially after what happened with FTX. Theyre afraid of getting sued.

These lawsuits and various other cases have been piling up in the wake of the FTX bankruptcy and last year’s cryptocurrency crash. In addition to FTX’s own bankruptcy and Bankman-Fried’s impending criminal case, cryptocurrency firms Genesis Global, Celsius Network, Voyager Digital, Three Arrows Capital, and BlockFi Inc. are all involved in bankruptcies and related legal proceedings. Three Arrows co-founder Su Zhu was detained in Singapore on Friday and faces potential jail time along with co-founder Kyle Davies after they refused to cooperate with a liquidators investigation into the bankrupt hedge fund.

Meanwhile, Coinbase Global Inc. is battling the U.S. Securities and Exchange Commission (SEC) over charges that many of the cryptocurrencies traded on its exchange are unregistered securities, while also relentlessly lobbying Congress and making progress overseas.

Meanwhile, Binance has been caught up in enforcement actions by the Commodity Futures Trading Commission (CFTC) and SEC. Even Bankman-Fried’s parents are involved in a lawsuit seeking to recover funds they received from FTX.

Surprisingly, however, the courts are also a rare source of optimism, which may well help cryptocurrency prices find a footing, according to Georgetown University finance professor Reena Aggarwal. She cited an appeals court ruling last month that overturned the SEC’s decision to block Grayscale Investment LLC’s proposed spot Bitcoin exchange-traded fund, as well as another judge’s ruling that Ripple Labs’ XRP token Not considered securities when sold to the general public.

“The SEC has been trying to enforce and say cryptocurrency is the Wild West and we need to regulate, but the courts have pushed back,” she said. In a sense, this gives the industry new life.

Indeed, as BlackRock Inc., Fidelity, Franklin Templeton and others look to finally approve their spot Bitcoin ETFs, traditional Wall Street firms are busy aiming to With blockchain projects converting traditional assets into digital tokens, the future of crypto innovation has arguably never been closer to compliance.

As for London-based cryptocurrency exile Feenan, whose dog Toshi is named after Satoshi Nakamoto, the mysterious inventor of Bitcoin, she isn’t ready to give up on the digital asset industry forever.

“Cryptocurrencies can go from esoteric to very silly in a very short period of time,” she said.

“If an interesting project comes along and I think it will help move things forward, I’ll come back.”