Original author: ASXN

Compiled by: Odaily Azuma

Editors note:

On September 25, the artificial intelligence company Anthropic announced that it would receive up to US$4 billion in investment from Amazon. This equity investment takes into account that FTX had invested US$500 million as the lead investor in Anthropic’s Series B financing. The expectation of appreciation is also regarded by many FTX creditors as the best hope for getting back their principal.

The following is a detailed analysis of the current value and potential appreciation of this equity investment by Boutique Digital Asset analyst ASXN. The content was compiled by Odaily.

FTX and its related groups have been very active in the field of venture capital, and data show that it has invested billions of dollars in more than 130 companies.

Among FTXs hundreds of investments, the most noteworthy investment today is undoubtedly the Series B lead investment in Anthropic. At that time, FTXs investment amounted to US$500 million. As Anthropic continues to stir up troubles in the primary market, its rising valuation has naturally given FTX creditors new expectations.

First, heres some basic information about Anthropic. This is an artificial intelligence company founded by former employees of OpenAI. It developed Claude, an artificial intelligence chat application similar to ChatGPT, and is now widely regarded as OpenAIs biggest competitor.

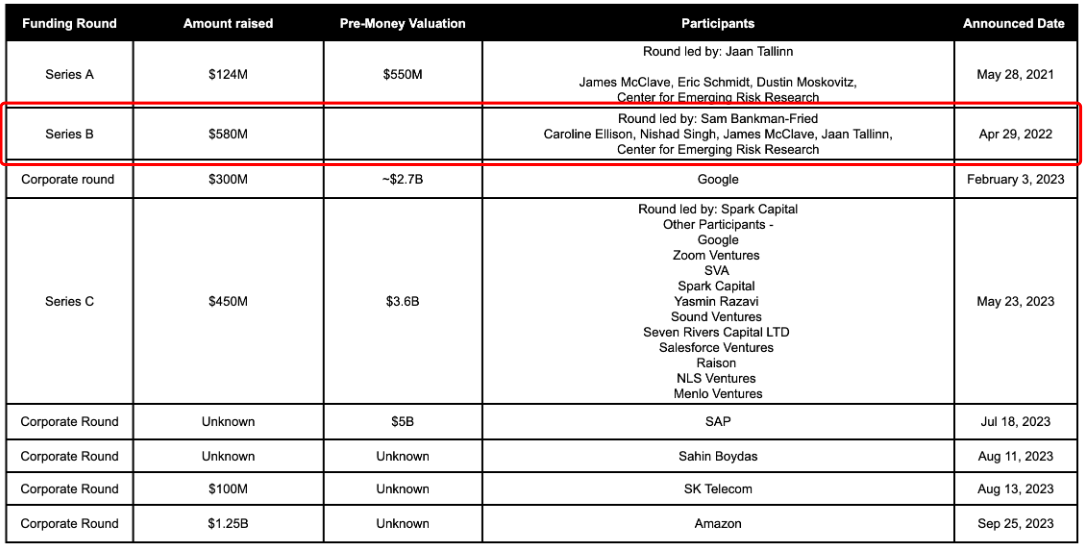

Since its founding, Anthropic has received billions of dollars in venture funding through multiple rounds of funding.

April 2022,Anthropic completed a $580 million Series B round, in which FTX invested a total of $500 million, including SBF himself as the lead investor, as well as participation from senior executives such as FTX co-chief engineer Nishad Singh and former Alameda CEO Caroline Ellison.

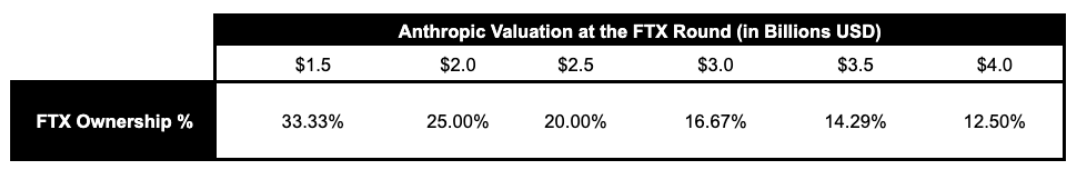

However, the valuation of this round of financing was not disclosed, so we are unable to learn the specific transaction price and shareholding ratio of FTX. However, we can infer one or two from the subsequent Series C financing.

In May 2023, Spark Capital led Anthropics $580 million Series C financing. TechCrunch reported that the valuation of this round of financing is approximately US$4.1 billion. Considering that the AI concept shows no signs of ebbing during this cycle, this also means that the valuation during the Series B financing will most likely not exceed US$4.1 billion.

It can be inferred from this thatFTXs shareholding ratio in Anthropic is likely to exceed 10%. Based on different specific valuation figures, we estimate that FTXs corresponding shareholding ratio should be between 12.5% and 33.33%.

Another piece of evidence regarding FTX’s shareholding ratio is Google’s investment in Anthropic. Google invested US$300 million in Anthropic in February 2023. The Verge and other media reported that the transaction was in exchange for 10% of Anthropics equity.

Since FTX entered the market earlier and made a larger investment, its shareholding ratio should be larger than that of Google。

Back to the latest news, Anthropic recently received another huge funding boost from Amazon. According to TechCrunch’s public interviews with both parties, the investment will be immediately implemented at US$1.25 billion, and the total subsequent investment is expected to be as high as US$4 billion.

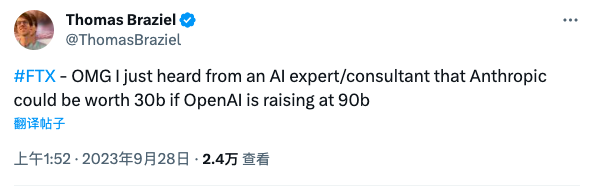

Although the valuation of this round of financing has also not been disclosed, the capital market has made relevant speculation based on another incident at the same time.

On September 27, the Wall Street Journal reported that OpenAI, another major artificial intelligence giant, was negotiating with potential investors for the sale of shares at a valuation of US$90 billion. Considering the competition between OpenAI and Anthropic,There are rumors that the markets latest valuation of Anthropic has reached $30 billion.

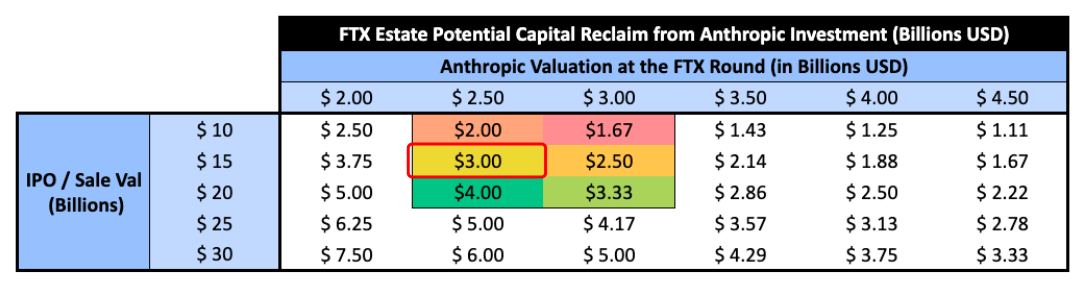

We adopt a more conservative calculation method,Assuming that Anthropics valuation was US$2.5 billion when FTX invested, the current valuation is US$15 billion, and FTXs shareholding ratio is 20% (the three data are basically compromise values), the corresponding equity value has been as high as to US$3 billion.

Now, lets answer the question of FTXs own debt.

When FTX filed for bankruptcy, its asset gap was approximately US$9 billion. However, information submitted by FTX in May stated that approximately US$7 billion in liquidity has been recovered to date, leaving a hole of US$2 billion. If liquidity issues are not taken into account (including the real liquidity issues of the assets held by FTX and the restrictions on the realization of Anthropics equity), it seems that Anthropics equity value is enough to cover...

Perhaps there are still other non-transparent issues, but in any case, for the creditors who were deeply affected by the FTX incident, Anthropic’s increase in valuation is definitely a positive change, and it brings benefits to the victims who are still suffering from the long wait. Come greater expectations.

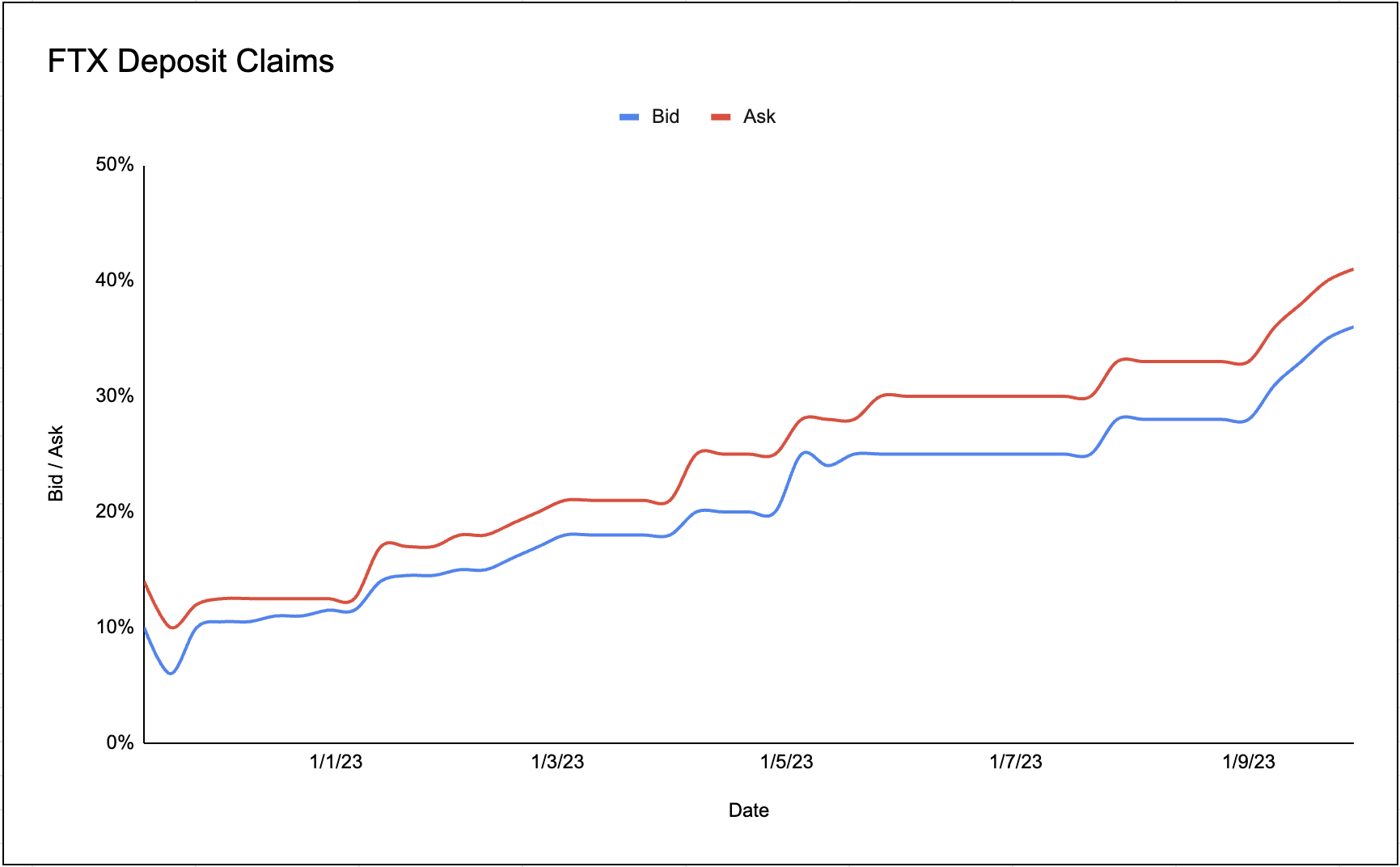

This has also been reflected in the secondary market for FTX claims, where todays expected loss ratio has risen to 35% - 40%, which is a new high since the collapse of FTX.

Finally, the editor would like to insert an old news item.

In June this year, people familiar with the matter revealed that Perella Weinberg, the investment bank responsible for handling the FTX bankruptcy case, has been considering selling FTX’s stake in Anthropic and has been investigating potential bidders for several months, but in the end Still chose to give up.

Looking at it now, this decision may change the fate of FTX and thousands of creditors.