1. Frax Finance background introduction

Frax Finance is a DeFi protocol that offers three stablecoins and staking derivatives (FRAX, FPI, frxETH) for earning income, providing liquidity and staking in DeFi. The protocol uses innovative sub-protocols and native governance tokens (FXS, FPIS) to ensure price stability and user governance. It is a major player in the global cryptocurrency market with over $800 million in value locked and was founded by Sam Kazemian.

Three Stablecoins

FRAX — Core Stablecoin

Anchored with the US dollar (USD), FRAX aims to maintain a value ratio of 1:1, that is, every US$1 of FRAX is equivalent to US$1 of USD.

(CR*USDC + ( 1-CR)*FXS)

The protocol uses a combination of on-chain assets and algorithmic mechanisms to ensure this anchoring. If the price of FRAX deviates from $1, the system intervenes by adjusting the collateral ratio to bring the value back into balance. Therefore, FRAX, while providing cryptocurrency benefits like decentralization and transparency, also plays a role in reducing high price volatility, making it a safe stablecoin for yielding in DeFi.

On February 23, 2023, the hybrid algorithmic stablecoin protocol Frax Finance’s proposal to shift the algorithmic stablecoin FRAX to a fully mortgaged mechanism was approved by the community vote. The mortgage rate will be set to 100% and the stablecoin reserve will be increased to eliminate algorithmic elements. , as of now, the market value of FRAX is approximately US$1 billion.

FPI — a new stablecoin linked to CPI

Frax Price Index (FPI) is the second stablecoin of the Frax financial ecosystem. FPI is the first stablecoin pegged to a basket of real-world consumer goods defined by the U.S. CPI-U average. The FPI stablecoin aims to keep its price consistent with the prices of all items in the CPI basket, thereby maintaining its purchasing power through an on-chain stabilization mechanism. This is like a stablecoin that hedges against inflation because it does not lose purchasing power as fiat currencies depreciate in value.

FPI has its own governance token, Frax Price Index Share (FPIS), which is entitled to receive revenue from the protocol. Like the FRAX stablecoin, all FPI assets and market operations are on-chain and use AMO contracts.

frxETH — Stablecoin loosely pegged to ETH

In the Frax Finance ecosystem, Ethereum (ETH) exists under the names frxETH and sfrxETH and is a liquid staking derivative. frxETH is a stablecoin designed to reflect the value of ETH 1:1, with a target range of 0.9900 to 1.01 ETH for 1 frxETH. Whenever ETH is contributed to the system, it is minted in equal amounts.

Meanwhile, sfrxETH is a yield variant of frxETH. Users can exchange their frxETH for sfrxETH to obtain fixed investment rewards. As these rewards accumulate, more frxETH will be minted and added to the vault. Therefore, sfrxETH holders own a share of a growing pool of frxETH, much like systems like Aaves aUSDC or Compounds cUSDC.

three applications

Fraxswap

Fraxswap is the first constant product automated market maker with built-in Time Weighted Average Market Maker (TWAMM), which enables long-term block trades without trust. It is completely permissionless and the core AMM is based on Uniswap V2.

Fraxlend

Fraxlend is a lending platform that allows anyone to create a market between a pair of ERC-20 tokens. Any token of a Chainlink data stream can be lent to borrowers or used as collateral. Each lending pair is an independent, permissionless market where anyone can create and participate in lending activities. Lenders can deposit ERC-20 assets into this lending pair and receive ftoken with a yield rate. As interest is earned, the amount of the underlying asset that can be redeemed by the ftoken increases.

*Lending AMO is the same as the current mainstream lending market (eg. Aave/Compound). But you need to pay attention to the utilization rate in the pool.

Additionally, Fraxlend supports the ability to create custom term sheets for the over-the-counter debt market. Fraxlend loan pairs can be created with the following features: maturity, restricted borrowers and lenders, underfunded loans, and limited liquidation.

Fraxferry

Fraxferry is a permissionless, non-custodial and secure cross-chain bridge for transferring natively issued Frax protocol tokens across many blockchains without the need for bridges or third-party applications. Funds will arrive within 24 to 48 hours.

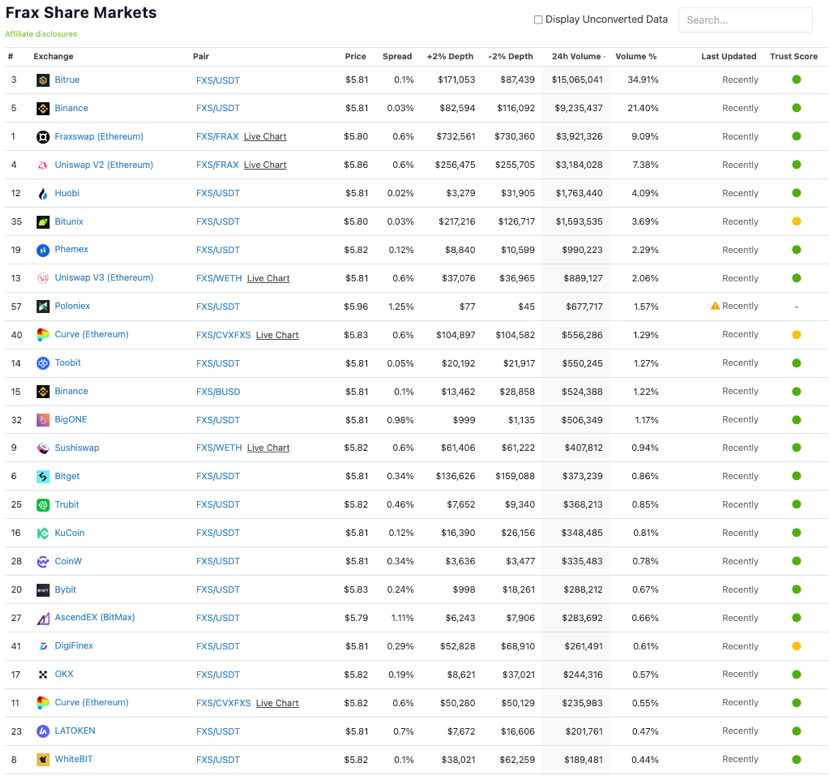

2. FRAX Trading Market

Frax tokens can be traded on all major exchanges, as shown below.

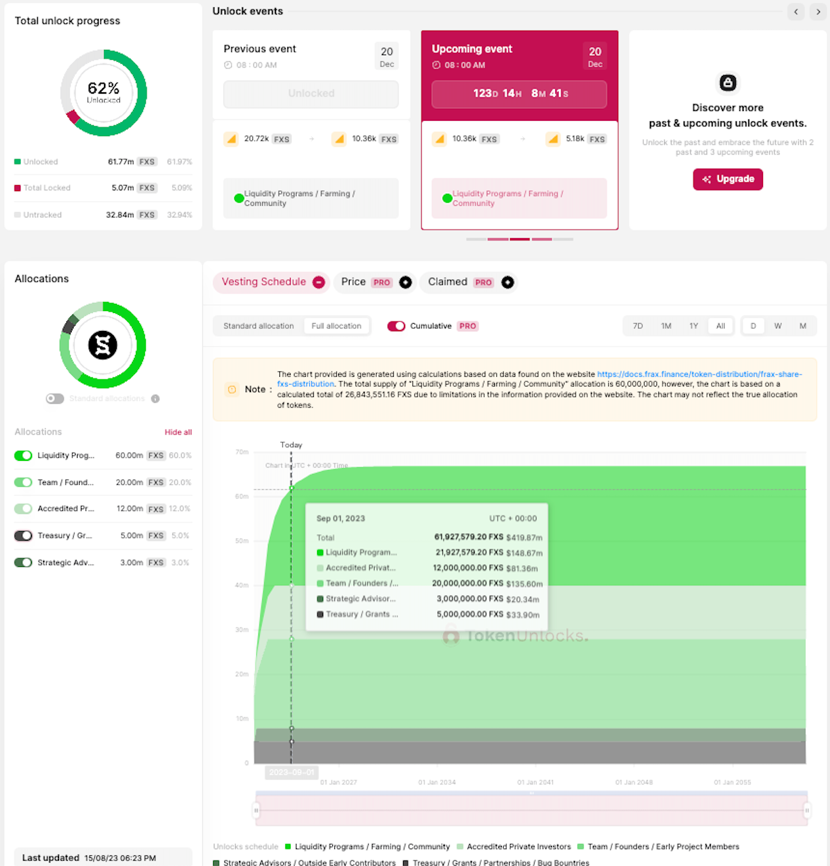

3. Tokenomics

Frax Finance adopts a dual-token model, using USDC and its governance token Frax Share (FXS) to partially support its stablecoin Frax (FRAX) with a variable collateral ratio [5]. Here are Frax’s token economics:

Frax is a crypto-collateralized stablecoin pegged to the U.S. dollar[ 1 ][ 6 ].

Frax’s collateralization rate is variable, meaning the amount of collateral backing the stablecoin can change based on market conditions [5].

Frax Share (FXS) is the protocol’s governance and value accumulation token [4][5].

The distribution of FXS tokens is as follows [2]:

60% – Liquidity Plan/Farm/Community – Naturally halved every 12 months through metering and governance.

3% — Strategic Advisor/External Early Contributor — 36 months of advisory tokens for strategic legal, technical, and business work to drive adoption of the Frax Protocol. Tokens are distributed equally over 3 years.

12% — Accredited Private Investors — 2% unlocks at launch, 5% vests in first 6 months, 5% vests in 1 year, 6 month cliff period.

Frax Share (FXS) can be exchanged for Frax (FRAX) or for fractional collateral backing Frax [3].

Frax Finances token economics are designed to incentivize holders to maintain the stability of Frax. Holders can earn rewards by investing their FRAX tokens into liquidity pools[1].

Quote:

[ 1 ] https://sometimes-interesting.com/frax-frax-and-tokenomics-an-overview-of-the-frax-token/

[2] https://docs.frax.finance/token-distribution/frax-share-fxs-distribution

[3] https://messari.io/report/frax-a-fractional-algorithmic-stablecoin

[4] https://albaronventures.com/frax-finance-analysis/

[5] https://coinmarketcap.com/alexandria/article/what-is-frax-finance-features-tokenomics-and-price-prediction[6]https://frax.finance

4. Investment institutions

Famous investment institutions participating in the investment include Dragonfly Capital, Mechanism Capital, Electric Capital, Robot Ventures and ParaFi Capital, etc., all of which are in the field of institutional investment. Important players. Notable individual investors include recognized project founders in the DeFi space, such as Aave’s Stani Kulechov, Synthetix’s Kain Warwick and Bancor’s Aya Eyal Herzog. In addition, there are investments from centralized exchange (CEX) backgrounds, including well-known companies such as Crypto.com, and Balaji Srinivasan, former chief technology officer of Coinbase and partner of A16Z.

5. Team introduction

One of the founders, Sam Hamidi-Kazemian, has a programming background and graduated from UCLA. In December 2014, he founded Everipedia in partnership with fellow UCLA alumnus Theodor Forselius. The result of this entrepreneurial project is a unique online encyclopedia that combines wiki-style collaboration with blockchain technology. Over time, Everipedia gradually developed into one of the most famous DApps on the EOS platform, and Sam served as president.

FRAX.finance’s journey began in 2019, with initial support from Stephen Moore, Donald Trump’s senior economic adviser. While Stephen Moore was initially instrumental in promoting FRAX during 2019, he ultimately distanced himself from the project.

Another co-founder, Travis Moore, also graduated from UCLA and started his entrepreneurial journey in a biological laboratory after graduation. He then entered the corporate world, holding various positions at insurance company Anthem. In 2015, Sam Kazemian and Theodor Forselius invited him to join Everipedia as Chief Technology Officer (CTO), and his life path intersected with the founders of Everipedia together. Later, when Sam launched the FRAX project, Travis Moore continued his entrepreneurial journey as a co-founder and retained the position of CTO.

Jason Huan is co-founder and a 2021 graduate of UCLA with a bachelors degree in computer science. He established a blockchain community at UCLA in 2017 and even contributed to the school’s first blockchain course as a teaching assistant. While interning at blockchain company WhiteBlock, he wrote numerous reviews on various blockchain platforms. Jason Huan joined the FRAX project in June 2020 and currently serves as Development Director.

Quote:

[ 1 ] https://pitchbook.com/profiles/company/462109-69

[2]https://frax.finance

[3]https://messari.io/dao/frax-finance-governance

[4]https://iq.wiki/wiki/frax-finance

6. Transaction data

About Frax Share (FXS Token)

24-hour trading volume: $34, 093, 794

Current circulating supply: 73, 354, 242 FXS

Total supply: 99, 681, 496 FXS

7. Reasons for recommendation

1. Core team status:

To learn more about the team, see the previous chapters. Overall, the team is small but professionally assigned, and product development and improvement is extremely fast. Sam Kazemian is a leader in external and community engagement, actively engaging with users in relevant communities and podcasts.

Quote:

[ 1 ] https://www.countere.com/home/sam-kazemian-frax-interview

[2]https://twitter.com/samkazemian/status/1664737658797686784

[3]https://twitter.com/samkazemian/status/1561042961315467264

[4]https://youtube.com/watch?v=RRfNuTA_ZEM

[5]https://twitter.com/samkazemian/status/1681718947866120192

2. Recent developments

In June 2023, Frax Finance announced plans to launch its own second-layer scaling solution, Fraxchain, by the end of the year. The news boosted the price of Frax Share (FXS).

In July 2023, Frax Finance released a monthly report that included updates on various projects. One of the updates is about Liquid Staking tokens, and Flywheel has published a complete guide covering these tokens.

In August 2023, Frax Finance released another monthly report that included various updates. One of the updates is regarding Staked Frax ETH (sfrxETH), which comprehensively covers all relevant factors.

The Frax Finance team has been focused on developing its platform and expanding the reach of its product range.

Quote:

[ 1 ] https://www.ccn.com/analysis/frax-share-fxs-price-prediction/

[2]https://fraxfinancecommunity.medium.com/frax-finance-monthly-report-29-july-2023-ffca1da825e4

[3]https://fraxfinancecommunity.medium.com/frax-finance-monthly-report-30-august-2023-68 add 8 e 46 2b e

3. Track prospects

To date, Frax Finance has established a significant user base and business presence. It has become more than a single currency agreement. Instead, it is forming a DeFi ecosystem centered on the stablecoin FRAX, supported by key features such as LSD (frxETH), and its coverage is also expanded to include elements such as DEX (FRAXSwap) and lending (FRAXLend).

The initial advantage of Frax Finance lies in its efficient monetary mechanism and adaptive monetary policy based on the AMO module. Today, its product lineup covers lending, swaps, stablecoins and LSD. These products are quite innovative in the DeFi space and may give the project a lasting competitive advantage.

All in all, Frax is an all-encompassing DeFi platform with a strong ecosystem, a unique stablecoin model, innovative features, and a strong commitment to security and efficiency. All these aspects make it an important player in the DeFi space. Looking ahead to the upcoming LSDFi season, we may see Frax reach unprecedented heights.

4. Expected revenue

Stablecoin Perspective: As of now, the market value of FRAX has remained around US$1 billion, which is less than a quarter of the market value of DAI. Likewise, MKR has a total market capitalization of approximately $1 billion.

LSD Perspective: Lido Finance holds approximately $14.3 billion in Ethereum tracking volume, while Frax Finance holds approximately $445 million. In terms of market capitalization, LDO is currently valued at approximately $2 billion.

From this perspective, Frax Finances potential to compete with LSD should match or exceed Lido Finance. Currently, frxETHs growth trajectory is closely related to stETHs split. Given that frxETHs growth remains stable and strong, it is likely to gradually eat into Lido Finances market share.

When it comes to the stablecoin landscape, Frax Finance’s potential ceiling is determined by two key factors. First, the established trading volume of FRAX has remained at a level of around US$1 billion for the past year. Second, it is directly tied to the amount of crvUSD minted via frxETH as collateral. In just one month since its launch, crvUSD’s trading volume has exceeded $55 million. In addition, the usage of frxETH as collateral closely follows wstETH, almost evenly.

If we compare the pioneering projects in these two areas, their total market capitalization potential is as high as US$3 billion. Currently, FXS has a market capitalization of $670 million, which means its potential for growth is approximately 4.5 times its current value.

*One important point to consider is that high yields on frxETH may have a ripple effect. Since its inception, frxETH’s returns have been better than Lido’s stETH.

Protocol adoption and increased revenue form a virtuous cycle. If frxETHs yield exceeds that of stETH, then more people may choose to deposit ETH into Frax. Especially after Lido launches the withdrawal function, the expanding frxETH share will generate more protocol revenue. These profits will flow to veFXS punters, thereby increasing veFXS staking returns. Since FXS may be in short supply, this may cause prices to rise.

Frax Finances core strength lies in its comprehensive narrative on LSD and stablecoins. Frax Finance partners with Curve to tap liquidity-liberating opportunities in the multi-billion dollar LSD market, a strategic move with great promise. In addition to taking advantage of the increased LSD profits, it is also possible to shape a new stablecoin landscape by utilizing crvUSD and the native stablecoin FRAX. This strategic approach could pave the way for a new perspective on post-stabilization monetary agreements.