Original - Odaily

Author - Hao Fangzhou

Editor - Mandy

today,Hong Kong Police Arrest JPEX for Promoting Internet Celebrity Lin Zuo, or related to the turmoil of the crypto exchange JPEX, the police searched Lin Zuo’s office in the Entertainment Building in Central. The case is now being handed over to the Commercial Crime Bureau for follow-up.

Who is Lin Zuo? How many unlicensed exchanges are there in Hong Kong represented by JPEX? Why is the market strategy of the regular army in Hong Kong unacclimated? How many ordinary investors in Hong Kong will actually register and use trading? So, why is the pace of compliance accelerating, but the market is similar to the chaotic currency circle atmosphere of the previous era 5 years ago? Where will Hong Kongs Web3 eventually go...

Now, let’s start with Odaily’s case of borrowing JPEX one by one.

Sir, I wont bother you with our affairs in Kowloon City.

Two flowers bloom, one on each side.

September 13,The Hong Kong Securities Regulatory Commission issued an announcement and noticed a virtual asset trading platform called JPEX,Actively promote the platform’s services and products to the Hong Kong public through social media influencers and over-the-counter virtual asset currency exchangers. The SFC clarified that none of the entities under the JPEX Group have been licensed by the SFC, and have not applied for a license from the SFC to operate a virtual asset trading platform in Hong Kong.

Convention and Exhibition↔Beside the overpass in Wan Chai, street advertising of JPEX and its public chain

According to Ming Pao, some users pointed out,JPEX has limited the withdrawal limit to 1,000 USDT and changed the withdrawal fee to 999 USDT., that is, retail investors can only withdraw up to 1 USDT.

Pictures circulated in the community

14th,JPEX issued a response and special announcement to the Hong Kong Securities Regulatory Commission’s statement, stating that it has adjusted the USDT withdrawal fee, and established a task force to adjust the future development direction and await further guidance from the China Securities Regulatory Commission.

Although the announcement stated that if users have urgent currency withdrawal needs, they can arrange to withdraw coins as soon as possible by filling in the form. However, community users reported that after filling in the form, they were asked to submit documents such as identity documents and income certificates. Community staff recommended not to submit documents such as proof of identity and income to JPEX. Submitted information may be used for illegal purposes.

15th,Bitrace says, the JPEX address suffered serious fund pollution. More than 190 million risky USDT flowed into a hot wallet recharge address, and the related address was marked as a black and gray product risk type.

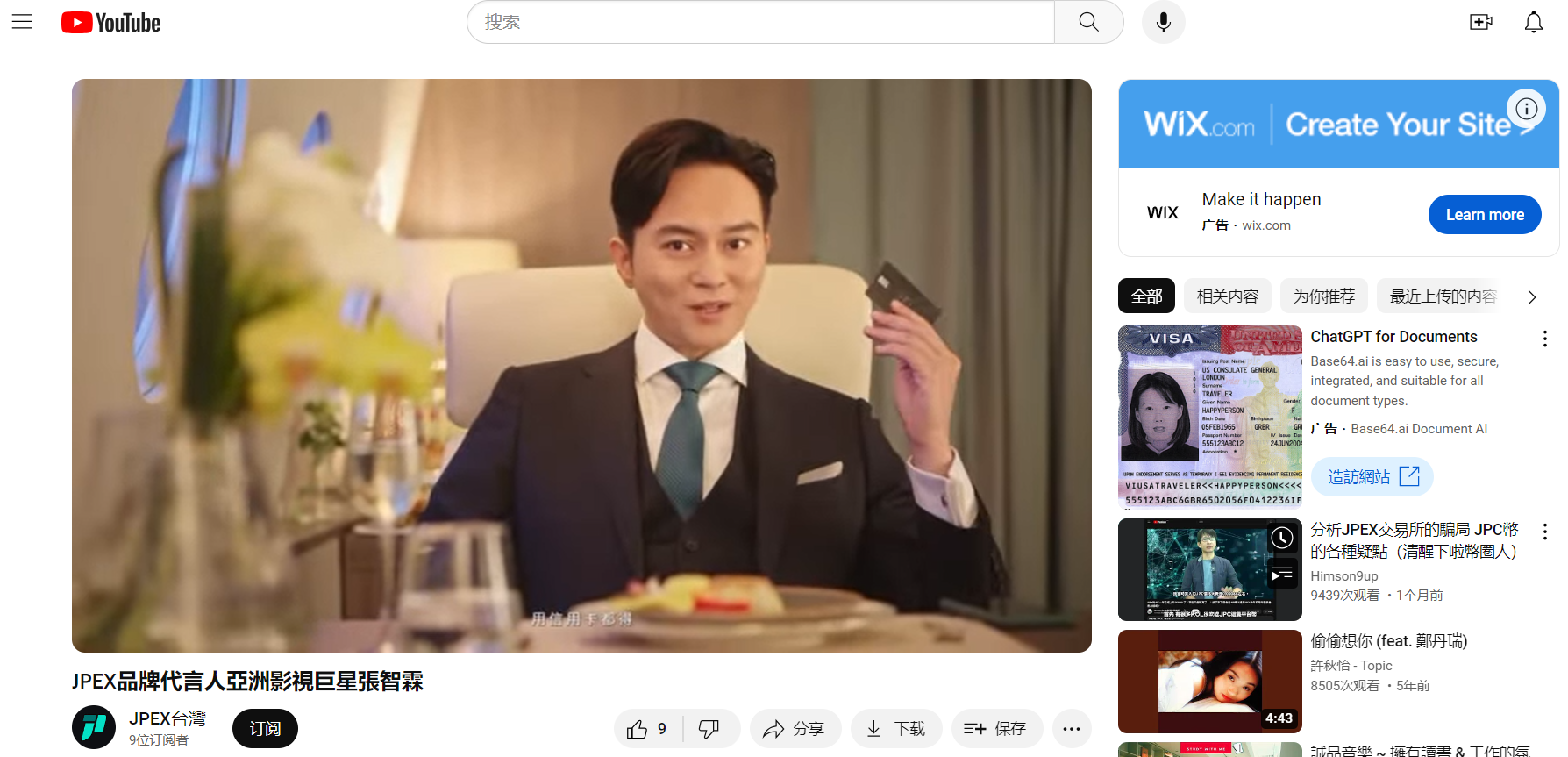

On the same day, Zhang Zhilin’s agent responded:I just noticed that Julian Cheung’s portrait is being used by JPEX, deeply helpless, Zhang Zhilin received an invitation to shoot an advertisement before. At that time, JPEX told them that it was registered overseas and provided proof, so they arranged to shoot in March last year. However, in May last year, they learned that JPEX was under supervision of the China Securities Regulatory Commission and notified JPEX in writing. , Zhangs portrait is not allowed to be used for any advertising before obtaining a license in Hong Kong. They indicated they would reserve the right to pursue JPEX.

JPEX’s Youtube Channel

According to anotherMing Pao, since the China Securities Regulatory Commission issued a warning statement the day before yesterday,Internet celebrities and over-the-counter currency exchange shops (OTC) are gradually “cutting their seats” with JPEXAmong them, JPEX partner Lin Zuo announced on his social media page that he would stop promoting any unlicensed exchanges in Hong Kong from yesterday, and his OTC has also suspended operations. He described that he had also suffered heavy losses and was not feeling better; many people have promoted Internet celebrities of JPEX, including Coin Master Huang Chengjie who was arrested for throwing money in Sham Shui Po in 2018, have removed JPEX-related videos from social platforms and stated on Instagram that in order to comply with laws and regulations and the requirements of the Securities Regulatory Commission, they will not publicly promote and Mention any exchange that has not applied for a license in Hong Kong.

In August, at a large exhibition, Lin Zuozheng gave a speech on the topic of cryptocurrency investment.

16th,Commissioner of Police Siu Chak-yi of the Hong Kong Special Administrative Region responded to the JPEX fraud and Cyberport data leakage case, he said that the police received a referral from the Securities and Futures Commission the day before yesterday. Because it may involve elements of fraud, the Commercial and Crime Investigation Bureau is now following up. As of 3 pm yesterday, 83 people had reported the case, involving approximately HK$34 million. As for the Cyberport leak case, Xiao Zeyi said that he received a report from Cyberport in August and has actively maintained communication with Cyberport in the past month. The relevant cases are still under investigation.

Regarding this JPEX issue,Hong Kong Wen Wei PoCommented that JPEX’s overwhelming publicity attracted a large number of investors, but the China Securities Regulatory Commission did not intervene early, and was questioned as one of the reasons for the geometric increase in the number of victims.

In fact, JPEX is far from the only one that has been overwhelmingly publicized.

Getting on the bus entering the port from Shenzhen Bay, the distant view outside the window is the Liyue Port-like merchant ships loaded with containers docking and setting off, and the close-up view is the CSOP Bitcoin/Ethereum Futures ETF billboard that flashes by from time to time. All the way from reality to fiction, it hints at the changes in the theme of international financial center.

When we arrived in Tsim Sha Tsui, several crypto education academies were located in the Golden Corner and Silver Edge of the neighborhood. On the scrolling screen were the logos of Bitcoin and Ethereum and the handsome PR photos of several investment mentors of the week.

Arriving at the Hong Kong Computer and Communication Festival 2023 at the Convention and Exhibition Center, a large number of local Web3 teams brought Eurasian models to the battle, cheering people on, engaging people in interactive games, and giving away gifts (from plush dolls to USDT).

Photographers, old and young, are fighting each other to create the beauty economy

The Hong Kong media writing style with the stereotype of exaggeration, yin and yang, pun, rhyme has also been transmitted to the promotional copy of Web3 companies. Words such as guaranteed, highest, sure to win, guaranteed profit... appear frequently(Mainland media practitioners who adhere to advertising laws are shocked)。

Hong Kong, which entered the attention economy decades ago, is well versed in the advantages of appearance-oriented and live video broadcasting in the 2C media path. It may co-brand with Internet celebrities or cultivate a more next-door personal IP.(Not only companies in the Web3 field such as OTC merchants and encryption education studios, but also clinics and cram schools on the streets of Hong Kong often use the direct names of doctors and teachers as prefixes.)

As a cultural symbol of Hong Kong, Miss Hong Kong must talk about her views on AI this year.

Returning to the usage growth strategy of “unlicensed representative” JPEX, Odaily found that,Cooperating with local OTC merchants to attract new customers, placing advertisements in densely populated areas, and asking celebrity influencers to recommend and increase credit are some of the few “right choices”.

The problems exposed after the incident are of course far more than improper publicity.

Chan Chun-ying, a member of the financial sector of the Hong Kong Legislative Council, said,The China Securities Regulatory Commission has been monitoring the issue of unlicensed operations, but the China Securities Regulatory Commission must collect evidence to prove that the platform has business operations before it can intervene.Since the platform is unlicensed, it is not under the supervision of the China Securities Regulatory Commission, and customers cannot receive compensation if it goes bankrupt. Therefore, the JPEX case can only be handed over to the police for investigation in the direction of fraud.

Learning from this experience, the SFC will alert investors online if it discovers that unlicensed trading platforms are selling advertisements in the future, and investors should also check the SFCs list of licensed trading platforms before making investments.

(Hong Kong’s crypto-finance is still within the Kowloon Walled City. Sir, of course, you have to manage the territories outside the city. You have autonomy over small matters in the city, and you have to make notes before intervening in major matters. The thin line connecting the two sets of rules and maintaining balance is hidden in In the dust and smoke.)

17th,JPEX releases announcement: Due to third-party market makers restricting the platform’s liquidity and in compliance with policy guidelines, the platform will delist all transactions on the financial management page. At that time, users will not be able to place any new financial management orders, and existing financial management orders in progress will be maintained until the end of the product in order to receive benefits. JPEX will recover liquidity from third-party market makers as soon as possible and gradually adjust currency withdrawal fees to normal levels.

A crypto blogger on Youtube gave a lengthy analysis of the risk points of JPEX, mentioning marketing, platform currency, financial management sectors, etc. (Youtube is also the powerhouse of Web3 information in Traditional District)

Latest news on September 18,Hong Kong police said the number of people reporting the case on JPEX has exceeded 1,000 and arrested another internet celebrity, Chen Yi(Suspected of conspiracy to commit fraud), the police went to Chen Yi’s “CYOTC” cryptocurrency exchange shop in Wing On Plaza in Tsim Sha Tsui East to search and arrest him.

The second Lin Zuo was arrested, and the first case of illegal crypto trading in Hong Kong is still unfolding

Behind Victoria Harbor, the Gatsbys mingling with each other

Less than 900 meters from Lam’s office is the Hong Kong Maritime Museum at Pier 8 in Central.

Since the Hong Kong Web3 Carnival in early April, the area has been frequently requisitioned by Web3 events of all sizes, and some chartered boats from high-end private bureaus have also set off since then, circling in the night of Victoria Harbor.

The launching ceremony of HashKey Exchange was held here, and the attendees in the front row stood upright in their clothes.

On August 28, Hong Kong Web3 Compliance Representative HashKey ExchangeOfficially opening BTC/USD and ETH/USD trading pairs to retail investors。

Weng Xiaoqi, chief operating officer of HashKey Group, said at the event, HashKey Exchange is currently only open to users in 16 regions that meet regulatory requirements, and is cautious about users usage conditions. The review will be based on the applicants identity document, deposit and withdrawal bank card, and IP location.

HashKey Exchange has now launched a trial version of the web page and APP, and is expected to launch the official version in September.The specific schedule will be determined after communicating with partners and regulators.. Regarding the question of only USD trading pairs are currently open, Weng Xiaoqi said that HKD against BTC and ETH trading pairs will be open within a week or two.

During the media interview session, Weng Xiaoqi’s words caught Odaily’s attention – “In the beginning, retail investors can purchase BTC and ETH, and willLimit investment in virtual assets to no more than 30% of total assets.When asked how to determine 30% of total assets, HashKey said, If retail investors invest more than 30% of total assets in virtual assets on the platform, a risk warning will appear and investment will be restricted. However, the platform cannot truly verify the users total assets and can only rely on the users own provision.

Not talking about Hong Kong, for regulatory implementation in various countries, it is difficult to confirm the “innocence” of investment quotas, asset proportions, and funding sources. This is also the main reason why OTC merchants rarely have “license qualifications”.

andHong Kong’s licensing system for virtual asset trading platform operators is a “dual license” system. In addition to the licensing system applicable to “security tokens” under the Securities and Futures Ordinance, there is another licensing system applicable to “non-security tokens” under the Anti-Money Laundering Ordinance.

Currently, several virtual asset trading platforms, including OSL Exchange and HashKey Exchange, are applying for the second type of license, but no license has been approved yet. The Hong Kong Securities and Futures Commission has previously stated that the terms and characteristics of virtual assets may evolve over time, and the definition standards of security tokens and non-security tokens may also change. Therefore, in order to ensure compliance, virtual asset platforms should hold Dual license plates.

Under the current Hong Kong compliant encryption trading system, HashKey, a regular representative, has also made many efforts in addition to KYC.For example, 98% of the digital assets on the platform are stored in independent cold wallet systems; KPMG, PwC, and Ernst Young respectively conduct external independent audits, group internal audits, and code audits for HashKey Exchange; and cooperate with Chainalysis to ensure the security of the crypto assets themselves and compliance; cooperates with AON Insurance (Aon Insurance) to underwrite user assets, with the first-stage insured amount being approximately US$500 million; cooperates with a number of commercial banks to provide users with legal currency deposit and withdrawal services, Be the first to support US dollar transactions; currently only accept bank card transactions, not credit cards;Actively communicate with regulatory agencies to promote stablecoin supervision, and explore whether a certain degree of contract trading and pledge products can be approved; given that the Securities Regulatory Commission has not approved the provision of margins and derivatives at present, when regulatory approval is given in the future, related products will be graded and various products will be launched to different types of users...

On August 31, Weng Xiaoqi said that it is expected that only 5-8 exchanges will eventually successfully obtain Hong Kong virtual asset exchange licenses, and 80% of those applying for licenses are expected to withdraw.

(You must feel the harshness, this is a completely different world from JPEX)

It is reported that in order to diversify the platform’s retail channels, HashKey is currently negotiating with approximately five local brokerage firms in Hong Kong to establish terms related to its crypto trading services. This could attract tens of millions of users who trade Hong Kong stocks on these platforms.Hong Kong drifters from the Mainland, even if they have not obtained Hong Kong permanent resident status, are eligible to open an account on HashKey Exchange as long as they have obtained a Hong Kong resident identity card and can provide proof of address of their permanent residence in Hong Kong and Hong Kong bank account information.

Weng Xiaoqi also said,HashKey has high hopes for its retail service: We hope to increase the number of registered users to between 500,000 and 1 million by the end of this year. We also expect the market to be more bullish next year. If that is the case, we aim to serve 10 million users by 2025.

So what is the recent performance of such a new platform in Hong Kong that is rising and gaining customers vigorously?

As ofSeptember 18, Coingecko dataShowing that HashKey Exchange has a 24-hour trading volume of $481, 381.

Want to enter the competition? First understand who is giving the order and blowing the whistle

The story ends at this point.

we discover,The two types of encryption companies that attract new users in Hong Kong and welcome Web2 and traditional financial users to Web3 show clear stratification.:

HashKey and OSL, which are closest to compliance, and trading platforms such as OKX and BitgetX, which are rushing to obtain licenses, are T 0-level regular troops that adhere to strict customer contact disciplines and focus on institutional cooperation with huge amounts of funds; a large number of them use encryption education and OTC (Lin Zuomen) is the entry point of private companies and studios, stragglers, working together with moms and uncles, consolidating the bottom of the pyramid of Web3 in Hong Kong.

And the spire is suspended in the air.

Another obvious fact is thatHong Kong Web3 only has finance(Trading platform + OTC), there is no technology development or non-financial applications, and I have never seen any L1, L2, DeFi, NFT, or DAO. Behind this appearance is the genetic expression of Hong Kongs century-old development.

In June this year, Odaily came into contact with a group of Chinese Web3 entrepreneurs in Vietnam. When asked How do you view Hong Kong’s favorable policies and whether you will participate in them? At that time, Brother E (pseudonym) just smiled and said, Its hard to believe the follow-up support (from the Hong Kong government). As a person in the currency circle who was driven out five years ago, it would be better to live anywhere in Southeast Asia. Just in case one day What if you are not allowed to do it?

Big C (pseudonym), who has worked in the hardware and disk circles in Shenzhen, also lacks interest in Hong Kong: “The cost of doing anything is so high. It’s the same amount of work, but developers in India and Vietnam are so easy to use. (Southeast Asia) ) The cryptocurrency penetration rate here is high, retail investors yearn for wealth, and they communicate closely, so it is easy to develop a user base (for projects).”

This group of loose and reckless Chinese serial entrepreneurs are sharp in information, flexible in thinking, and experienced. They never need the guidance of any Moses and rarely wear suits to attend meetings like the New Money people. They make their own decisions. After considering the pros and cons of all parties, we actively rush to the promised land flowing with milk and honey, just like the Great Mining Migration a few years ago. It’s just that “Canaan” in their eyesNot Hong Kong or Singapore。

Xiao Z (pseudonym), a student studying Hong Kong Chinese and having worked as an intern in Web3 and traditional Internet industries for many years, said: I will most likely work on the Internet for a few years after graduation. Web3 is highly uncertain, and they are all in the coin circle. , getting rich doesn’t necessarily depend on work.”

Xiao Z also has his own opinions on the landing posture of Hong Kong Web3. The people you (Simplified Chinese) media come into contact with are still those in the old currency circle in Shanghai, Beijing, and Hangzhou. They cant speak Cantonese well, and those in high positions Traditional financial giants and low-level retail investors are beyond your reach.”

On September 14, V God spoke in Singapore and said that although Hong Kong has shifted towards a cryptocurrency-friendly stance since the end of last year,Cryptocurrency projects should consider the stability of its friendly policies when setting up offices in Hong Kong, For me, the sustainability of Hong Kongs encryption-friendly policies is a key variable, and it is difficult for me personally to judge this issue. It is very challenging for local regulation to convince people that encryption-friendly policies are sustainable.

15th,Hong Kong Legislative Council member Ng Kit-chuang responded on the X platform: I respect his right to speak, but at the same time I think he does not understand and understand the situation in Hong Kong. I now sincerely invite Mr. Vitalik to come to Hong Kong to understand the situation. I am willing to coordinate with relevant institutions and enterprises to share the situation in Hong Kong with him. Hong Kong is A special administrative region with complete procedures for formulating policies and laws. Under one country, two systems, Hong Kong has legislative power. As a member of the Legislative Council of the Hong Kong Special Administrative Region, I would like to share with you that every policy or law in Hong Kong has to go through a period of development. Discussions include government policy writing, public consultation, discussions in multiple committees of the Legislative Council and discussions at the General Assembly, etc., so I hope Vitalik understands the actual situation. The country and Hong Kong do not have the complicated situation Vitalik said. The central government has always expressed support for the development of one country, two systems in Hong Kong. Therefore, Hong Kong has room to formulate policies on virtual assets and welcomes global compliance companies to develop in Hong Kong.

Wu Jiezhuang finally said: Hong Kongs policies and laws will not change overnight. All relevant strategies and regulations have gone through major social consensus and complete procedures. Therefore, I can tell Mr. Vitalik that Hong Kongs policies are very stable.”

Zooming out, looking at this years macro situation, on the one hand, mainland interest rates are falling, while U.S. bond yields continue to rise, and Hong Kong dollar-denominated financial products (which have been pegged to the U.S. dollar for 30 years) have high returns - water is flowing out; On the one hand, the Hong Kong government continues to optimize talent attraction policies, such as further relaxing the entry plan for talented and highly talented people, etc. - people are going south.

Some people say that chaos is not an abyss, but a ladder.

So, are you ready to climb up the ladder? Do you see the way forward clearly?