Original Author: Alfred, LD Capital

Since July this year, the price of UNIBOT has been rapidly increasing. According to data from coingecko, the price of UNIBOT has increased from the lowest point of $2.46 in May to the highest point of $236.98 in August, nearly 100 times growth, leading a wave of Telegram bots craze. Currently, the price of UNIBOT has fallen to around $100, and the prices of other assets have also fallen from their highs. Whether these bots projects are just a short-lived trend or will evolve into a new track and have another outbreak is a topic of discussion. This article will summarize by analyzing three representative projects of different types of bots.

1. What are "Crypto" bots?

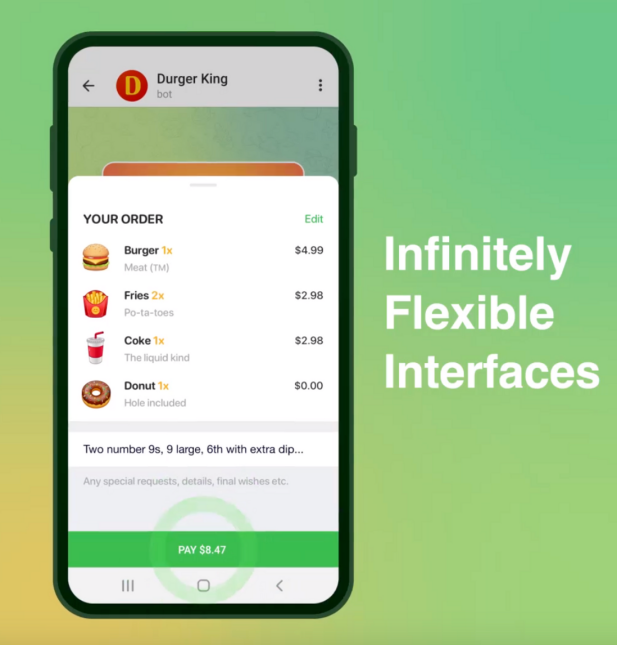

In fact, Telegram bots are not a new concept. Telegram bots are small applications running inside Telegram. Users can interact with bots through flexible interfaces, which can support almost any type of task or service, such as replacing entire websites, receiving payments, creating custom tools, creating games, and establishing social networks.

Source: telegram official (*the following is a food ordering mini-program developed based on telegram)

Thanks to Telegram's open-source framework, since the birth of the crypto market, various bots based on Telegram have gradually emerged. For example, news bots that push important messages, bots that track changes in large holder addresses or token indicators, and bots that provide alerts. In the past, these bots mainly served users for free or charged subscription fees.

Currently, in addition to Telegram-based bots, there are also many bot-type dapps based on platforms such as Discord, Twitter, or directly on the web. The characteristics of these bots are that they solve the needs of the crypto industry in an automated manner and integrate the characteristics of the crypto market. For example, they design specific token economics. Therefore, with the rapid development of bots recently, the author of this article temporarily prefers to call them "crypto" bots. This article categorizes "crypto" bots into three main types: trading bots, specialized tool bots (bots that solve specific problems other than trading), and GPT and AI bots. It will dissect a representative project from each category.

2. Trading bot - Unibot

Unibot is a trading tool bot based on Telegram. Users can communicate with the bot through Telegram and complete on-chain token trading activities on Uniswap in the form of conversations. Activities include token trading, limit orders, copy-trading, sniper trading, and privacy trading. According to official information, the bot's trading speed is 6 times faster than Uniswap. Additionally, Unibot has a lucrative profit-sharing mechanism that has driven token prices to increase by hundreds of times.

Other projects of this type include Maestro (*token not available yet), Banana Gun, Wagie Bot, Boltbot, NitroBot, 0x Sniper, Dexbot, and more.

1. Core Features

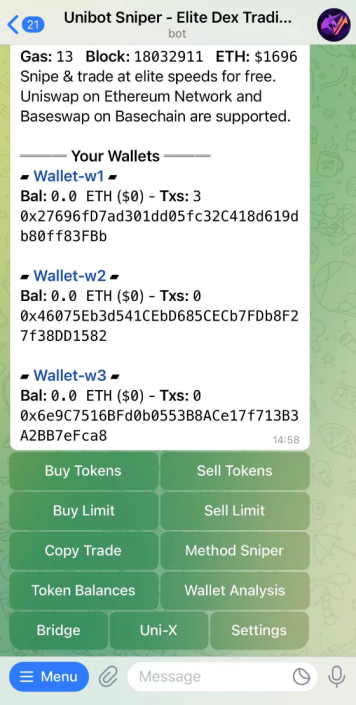

(1) Main Menu and Basic Trading

When using it for the first time, visit the Unibot Telegram channel and click "start." Unibot will generate three wallets and display the main menu. To start trading, send at least 0.01 ETH to the wallet address. The main menu includes all the functions provided by Unibot, which can be accessed by clicking and chatting.

Source: unibot

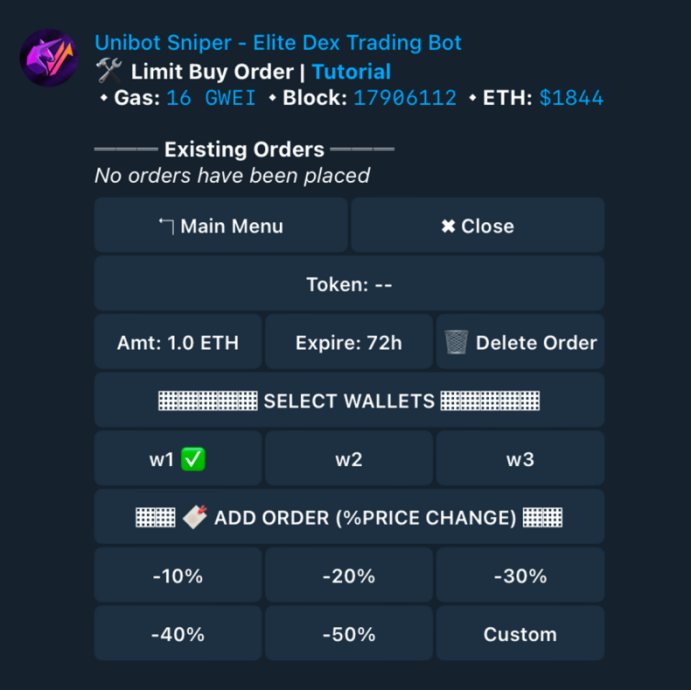

(2) Limit Order Trading

Limit order trading is implemented through chat conversation, after customizing token contract address, purchase quantity, wallet selection, limit order duration, limit order percentage, etc., the deployment will be completed.

Source: Unibot Official

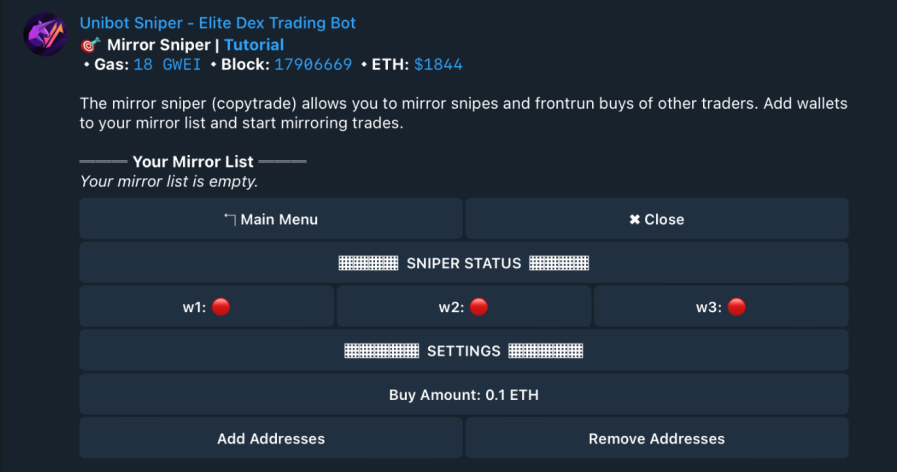

(3) Mirror Trading

You can select professional traders and replicate their trades automatically. First, choose the wallet you want to enable mirror trading for. Second, set the maximum purchase amount of ETH for each mirrored trade. Third, add or remove addresses. You can input one or multiple ETH addresses separated by commas.

Source: Unibot Official

(4) Method Sniper

This feature allows the bot to automatically purchase the newly issued coin. First, select the wallet you want to enable Method Sniper. Second, enter the address of the token you want to sniper. Third, set the maximum amount of ETH to be used for a single sniper and the highest Gas price you are willing to pay. Fourth, set the relevant functions for token operations, such as enabling trading, adding liquidity, and starting transactions. Fifth, set the maximum number of tokens you are willing to purchase and the number of blocks to wait before buying. Sixth, add to the snipe list to start. Unibot also provides an ERC-20 token deployment scanner (*unibotscanner) to quickly search for and view new tokens.

Source: Unibot Official

(5) Sell Protection

Enable Fail Guard to avoid loss of gas fees. With Fail Guard enabled, transactions will be simulated before being broadcasted to the network to ensure they do not result in execution errors. The purpose of Fail Guard is to prevent wasting gas when sending transactions that are expected to fail. This setting adds some delay to your transactions as simulation must be completed before execution.

(6) Private Transactions

Enable private node transactions to prevent them from being visible on etherscan until the transaction is completed, avoiding sandwich attacks. Sandwich attacks are a popular front-running technique in DeFi, where attackers find a pending victim transaction and perform transactions before and after it in order to exploit price or liquidity vulnerabilities.

Later, the offender attempted to trap the victim by manipulating their transactions. For example, if the attacker noticed that the victim's pending assets, X, were being used to trade asset Y, they would purchase asset Y before the victim. The attacker knows that the victim's transaction will increase the price of the asset, so they plan to buy asset Y at a lower price and make the victim buy it at a higher price, and finally sell the asset at a higher price. However, private node transactions can prevent such attacks.

Source: Unibot Official

2. Token Economics

The project had a fair launch, with 100% of the token supply added to liquidity at launch. The total supply is 1 million, fully circulating and non-dilutive.

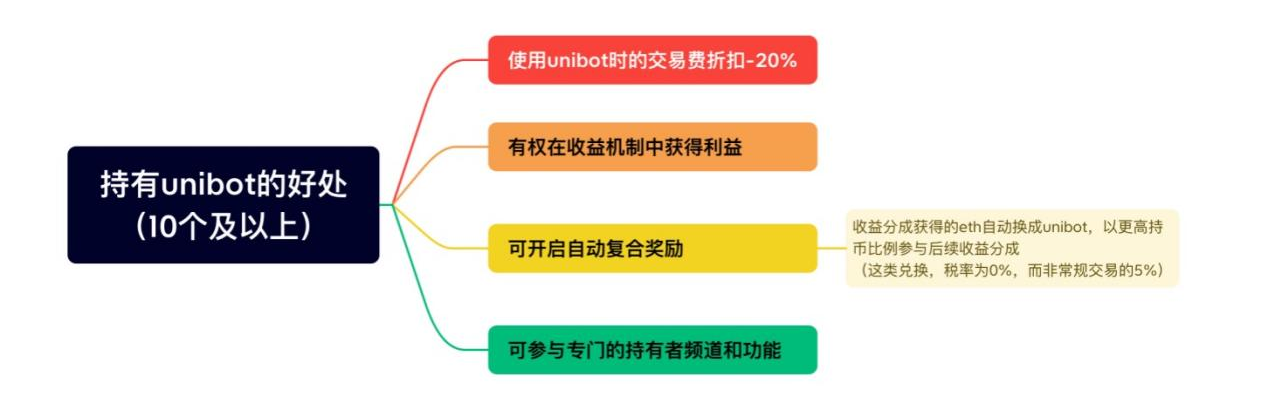

Why buy UNIBOT? Holding UNIBOT comes with a series of benefits, such as trading discounts by using the product, earning others' profits from the entire platform and referrals. Due to these benefits, Unibot users and investors are motivated to buy and hold as much UNIBOT as possible. This process increases the overall platform's total earnings and raises the token price, attracting more people to participate.

Source: LD Captial

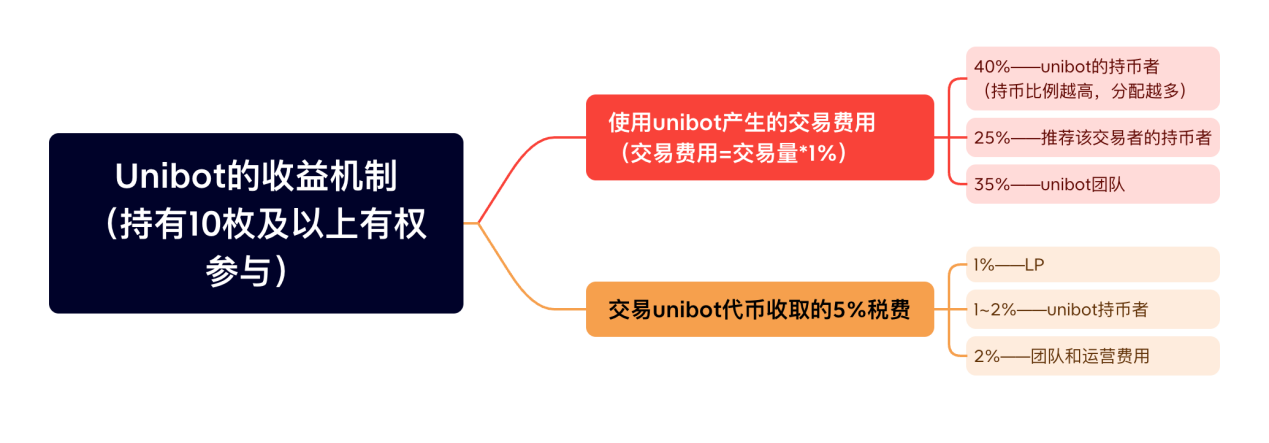

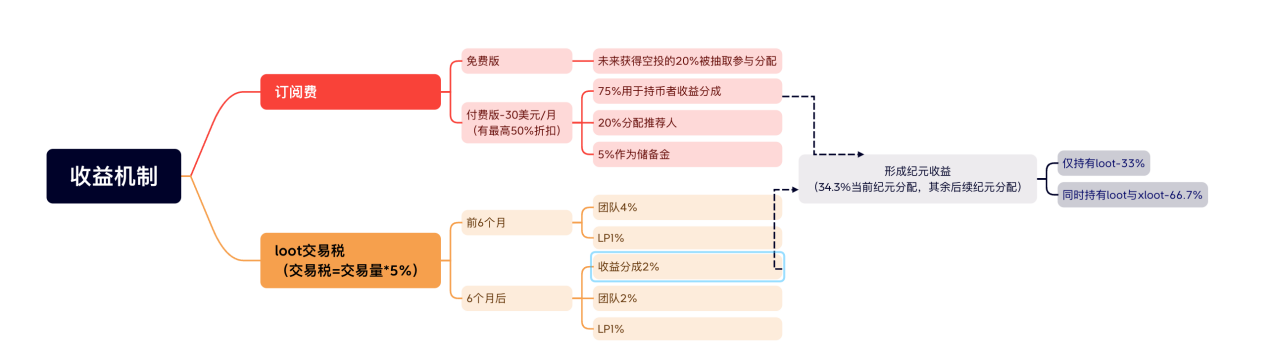

The specific profit mechanism of UNIBOT is as follows: there are two main parts of the charges, one is the subscription fee for using the bot product, and the other is the transaction tax for buying and selling tokens. The fee distribution will give a higher proportion to token holders, giving tokens a certain intrinsic value and promoting token holding. The referral mechanism also incentivizes token holders to invite more new users to join the Unibot platform with a 25% revenue sharing ratio.

Source: LD Captial

The introduction of the attractive token economics design by UNIBOT is a key factor in the project's popularity. Token holders can earn profits from the UNIBOT profit sharing mechanism and the increase in token price. The path to achieving this is to accumulate more tokens and refer more people to use and trade. In order to sustain this positive spiral, the project needs to ensure two things: continuously iterate and operate the product to ensure that there are users actively using the platform and new users joining, otherwise it will become a "meme" coin; and have decent market making and marketing capabilities to make the token trading volume and price attractive.

3. Data Performance

Currently, the total market value of the entire Crypto bots sector is only about $200 million. UNIBOT has an MC (Market Capitalization) and FDV (Fully Diluted Valuation) of $100 million, accounting for 50% of the total market value of the sector, indicating its leading position in sector development. The top ten holding addresses account for about 18% of the total supply, indicating a highly dispersed chip distribution. The token price has grown nearly 100 times from its lowest point of $2.46 in May to a peak of $236.98 in August, leading a wave of interest in Telegram bots.

Source: coingecko

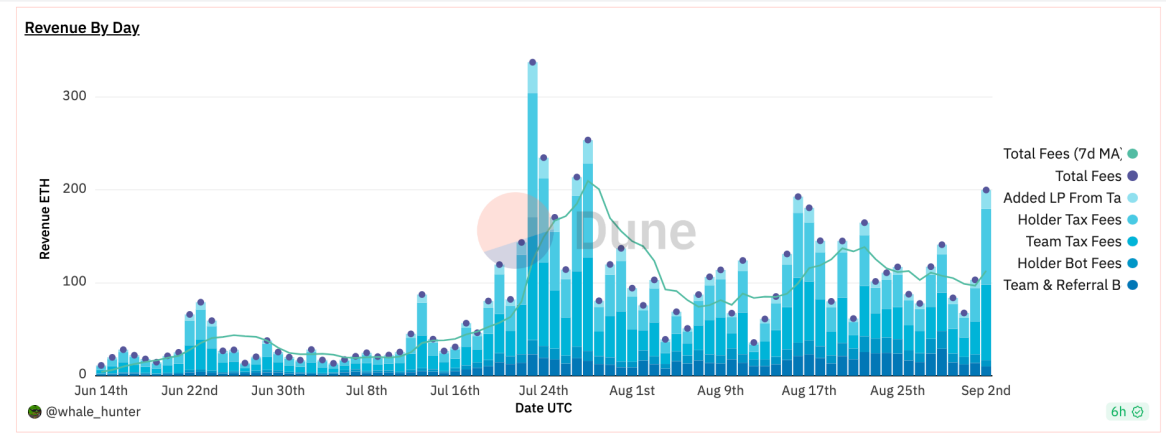

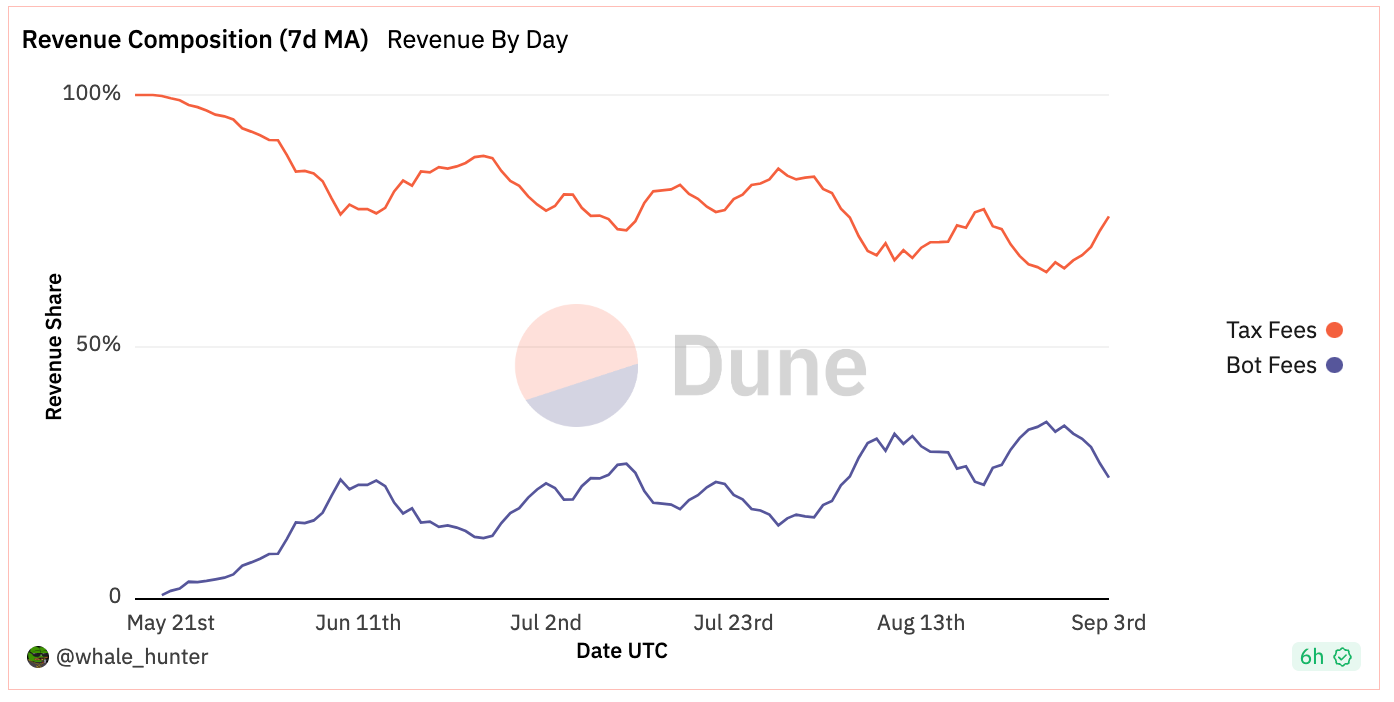

In the revenue model, the highest daily revenue was 337.54 ETH on July 23rd. After a decline from the peak, the daily revenue has returned to the range of 100 - 200 ETH recently. The total cumulative revenue is 7649 ETH. EPS is 42.51 USD, and the recent P/E has dropped from above 3 to 1.85, indicating an increase in investment value. In terms of revenue composition, Taxfees accounts for 79.93%, while Botfees accounts for 20.07%. The overall proportion is still relatively low, with room for further optimization.

Source: Dune

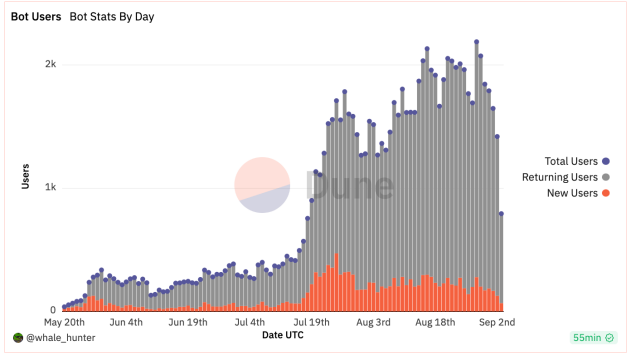

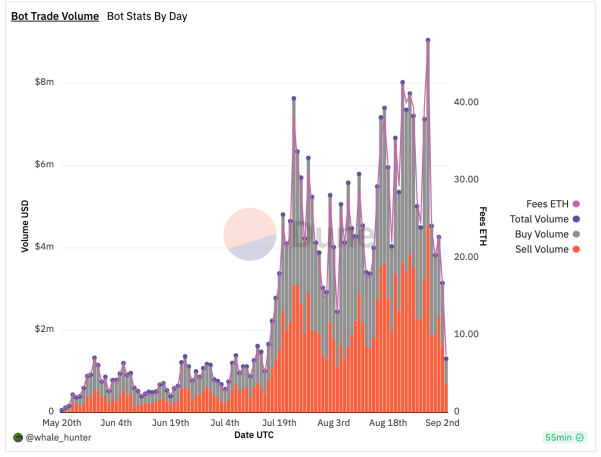

UNIBOT has a cumulative trading volume exceeding 290 million USD, with 428,000 transactions. The average daily trading volume is around 4 million USD, showing good performance recently. The number of bot users is 143,500, with 1,808 active users in the past 7 days. The number of daily users is around 1,000, and the number of new users per day is around 100. As a leading project in the bots category, the number of daily users is relatively lower compared to other leading projects in different categories. If there is a significant and stable increase, the token price may surpass the previous high.

Source: Dune

4. Project Features

(1) First introduced an attractive profit mechanism, which is the core driver of the token price surge: Unibot was not the first to offer automated trading robot functionality, nor did it have the most users. Maestro was the trading bot with the most users in the past. However, Unibot has the most effective tokenomics design, attracting a large number of users to hold and share the profits, and inviting more users to participate. The relationship of interest binding and distribution is the core driver of quickly increasing the token price.

(2) It provides the core functions that bots need to solve, to some extent improving the efficiency of dex usage: The copy trading and new coin sniper functions introduced by Unibot indeed require automated operation to be efficiently realized. In the past, these functions were mostly completed by professional quantitative traders. Through bots like Unibot, individuals can also realize them, giving some advantages of using Dex over Cex.

(3) It has the most stable and reliable architecture and is the only one that can protect the safety of investors' assets in all situations. It is suitable for both beginners and experienced users.

(3) As a leading project, there is further room for improvement in terms of security and reducing user barriers: Market investors generally have concerns about the security of trading bots, as the private keys will be automatically accessed by the bots. How to prove the security and decentralization to users is crucial for such bots to attract substantial funds. Moreover, many bots are based on high-traffic platforms such as Telegram and Discord, which are expected to easily attract users from beyond the crypto market. However, the current usage of trading bot products is based on simple clicks, inputs, and conversations to deploy functionalities, rather than intuitive front-end interfaces that allow users to quickly understand. Users need to have clear trading logic and experience to quickly get started. Currently, bots are considered as an enhancement for experts rather than a barrier reduction for novices.(4) The income is considerable, with obvious first-mover advantages, and there is more opportunity to sustain the business model: Current trading bots are incorporating token economics similar to the UNIBOT profit mechanism, which can lead to rapid price spirals. However, in order to maintain long-term success, it requires the combination of product capabilities, market-making capabilities, and marketing and operational capabilities. Currently, the user base, activity level, and bot fee ratio of leading projects like UNIBOT are not high, and the data for many other projects is even more tepid. UNIBOT has taken first-mover advantages and high revenue, which provides more opportunities for continued efforts in product and operations to achieve long-term development. For example, the recently released Unibot X provides a more intuitive front-end interface and better user experience.

Three, Segmented Tool - Lootbot

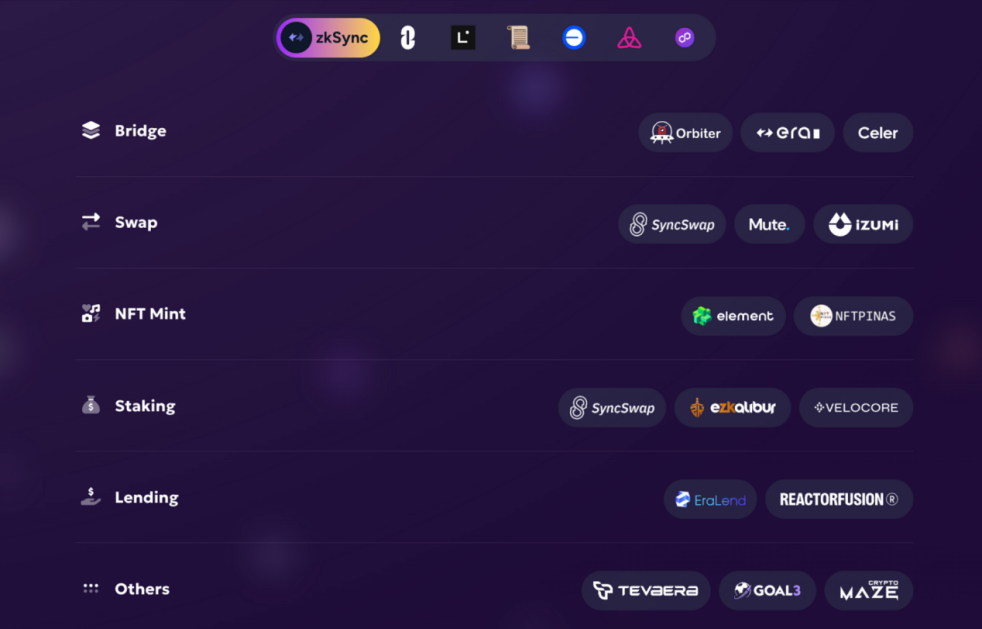

Lootbot is a bot that focuses on executing potential airdrop interactions. It is used on the Telegram platform and serves as a simplified front-end for multiple chains, deploying and automating on-chain interaction behaviors through conversations. It can provideSave a lot of time and effort on highly repetitive work, and design anti-witch mechanisms to achieve efficient airdrops. Currently, it mainly supports the actual interactions of Zksync and Linea, and will further enrich the interaction support for other chains such as Layerzero, Scoll, Base, etc. The possible interactions include bridge, swap, NFT mint, etc.

Source: Lootbot Official

Other subcategory tool bots include Collab.Land (community management), Bridge Bot (cross-chain), WallyBot (wallet analysis), NeoBot (cryptocurrency analysis and tracking), TokenBot (community trading tool).

1. Core Features

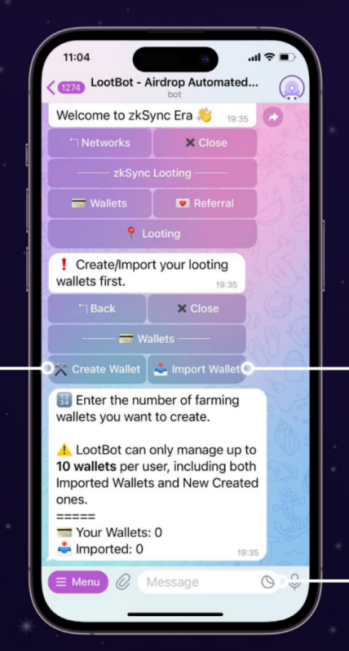

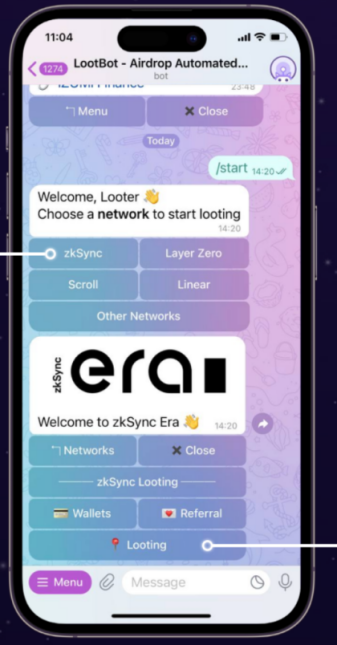

(1) Wallet Deployment and Network Selection

First, you can create up to 10 wallets for airdrop task interaction. Second, after creating a wallet, provide at least 0.1 ETH funds for each wallet on the Ethereum mainnet (*recommended to transfer from a centralized exchange to avoid front-running). Third, perform fund bridging to bridge your funds from the Ethereum mainnet to the selected chain to start looting.

Source: Official Lootbot

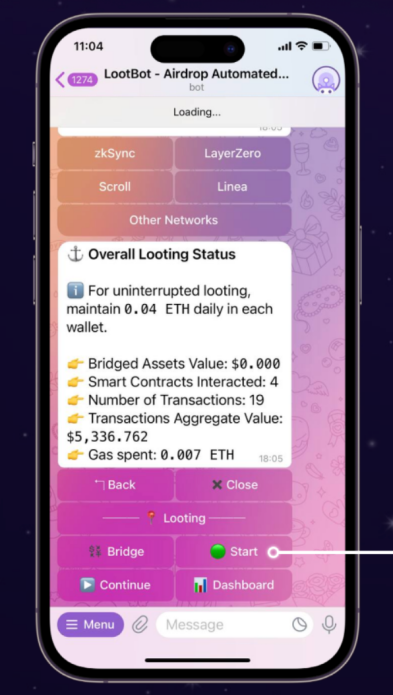

(2) Automated Airdrops

Once the loot starts, task interactions will be automated by the bot, saving users a lot of time and effort in repetitive work. Airdrop tasks are generally triggered once a week, and lootbot will choose the lowest cost time to execute the airdrop route. The airdrop tasks will be suggested by Lootbot's advisors, and the team will select which tasks and routes can be passed. Users can view the corresponding interaction data of the wallet after loot starts.

Source: Lootbot Official

(3) Integrated Trading

In addition to looting, Lootbot also integrates trading functionality, allowing you to trade all ERC-20 tokens directly on Telegram through Lootbot. Unlike the airdrop wallet, the trading wallet can create a maximum of 3 wallets.

(4) Anti-Witch Detection

To prevent witch attacks and represent real on-chain interactions, Lootbot provides different planning routes to maximize your chances of qualifying for airdrops. Lootbot uses random strategies, hides on-chain activities, hides fund flows, and automatically mixes funds on centralized exchanges (CEX) to avoid being identified as a witch.

2. Roadmap

Lootbot is still an early-stage project. It conducted fundraising and development in the second quarter of this year, and launched the official version and LOOT token in the third quarter. This year, Lootbot will integrate more chains and protocols, perform more automated tasks, and focus on recommended marketing.

Source: Official Lootbot

3. Token Economics

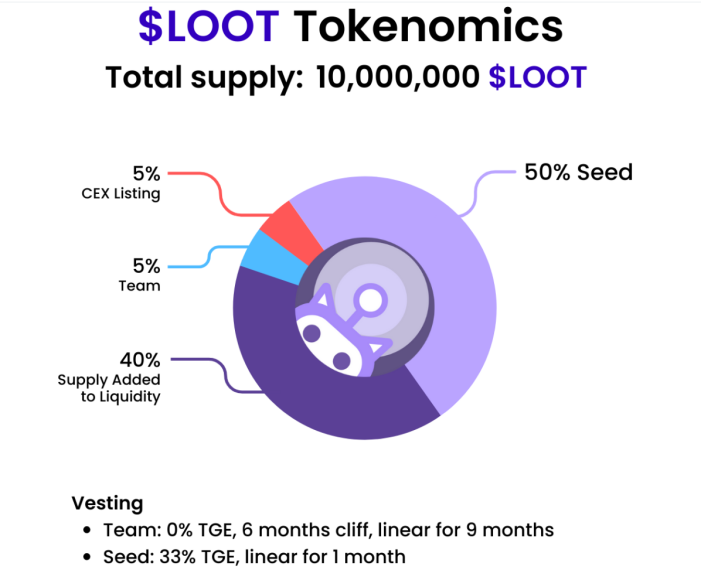

The total supply of LOOT tokens is 10 million, with 50% sold to seed investors, 40% allocated for liquidity, 5% allocated for the team, and 5% listed on cex. The team portion has a TGE ratio of 0, with a cliff unlocking after 6 months and a linear unlocking after 9 months; the seed portion has a TGE ratio of 33%, with a linear unlocking after 1 month.

Source: Lootbot Official

Why use LOOT and hold LOOT? Similar to UNIBOT, holding LOOT allows you to enjoy your own subscription discounts and participate in profit-sharing mechanisms, earning income from others' product payments.

Source: LD Capital

What is the profit-sharing mechanism of LOOT? The cost of LOOT comes from two parts: the subscription fee used by Lootbot every month, and the transaction tax of LOOT tokens. 75% of the subscription fee is allocated to holders, and 2% of the transaction tax starts to participate in profit sharing six months after the product goes online. Lootbot introduces the concept of "epochal income," and the income to be shared will be aggregated into epochal income. 33% is allocated to holders who only own LOOT, and 66.7% is allocated to holders who own both LOOT and XLOOT. All epochal income will not be distributed in one epoch (* 24 hours), but will be distributed in subsequent epochs. According to the project party's idea, this method aims to create a more stable and consistent reward distribution, reducing the impact of fluctuations that may occur when sharing income in a single instance.

Source: LD Capital

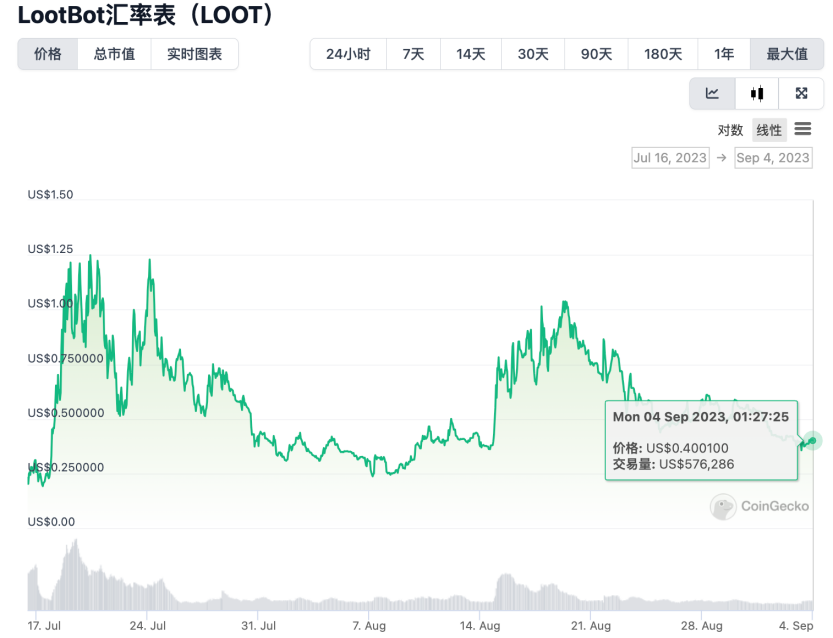

The current circulation of LOOT token is 8.7 million, accounting for 87% of the total supply. MC is 3.48 million, FD V4 is 0.0 million, and ATL appeared at $0.19 on July 17th. ATH appeared at $1.3 on July 20th. The top ten holding addresses account for approximately 36% of the total supply.

Source: coingecko

4. Project Features

(1) It also introduces a revenue mechanism similar to Unibot, but the source and distribution method of revenue are different. The coin price driving force is weaker than UNIBOT: similar to Unibot, revenue comes from service fees and token transaction taxes. However, Unibot's service fee is deducted from each transaction, so every transaction will generate immediate revenue. Lootbot's service fee is a subscription fee, which is not paid by free version users but compensated with future airdrop shares. This part of the revenue is uncertain in the long term. Paid version users pay a monthly fee, which is relatively weaker in terms of timing and frequency of revenue distribution. The distribution method requires linear distribution over multiple epochs, extending the time dimension of revenue. This may weaken its ability to drive rapid price increases compared to UNIBOT. However, due to the different types of bot products and operations, the distribution method of Lootbot may be more suitable for itself in the long run.

(2) Airdrops greatly rely on the use of bot tools, and Lootbot has entered the niche airdrop tool market and become a leading project in this field. There are many trading and Defi bots, but very few personal users use airdrop bots. Airdrop tasks are often highly mechanized and repetitive. Without bot usage, personal users need to spend a lot of time and effort on continuous repetition and have weak parallel capabilities. In the future, the development of the airdrop market will lead to an increasing need for more professional bot tools. Lootbot has taken the lead in this subset and has the potential to become a widely adopted airdrop tool.

The income is highly uncertain, and the bot provided for individual users can largely meet the needs of individuals. 4. GPT and AI-ChainGPT ChainGPT is an advanced artificial intelligence model and tool designed specifically for blockchain technology and encryption-related topics. Its features include: blockchain and encryption information, no-code smart contract generator, smart contract auditor, artificial intelligence NFT generation, ChainGPT (first-layer blockchain) virtual machine, etc. In addition, ChainGPT's SDK and API services can be integrated into existing applications.

Source: Chaingpt Official Website

There are also All In (*AI trading), Image Generation AI (*AI-generated NFT), NexAI (a series of AI tools), BlackSmith (AI analysis), TrackerPepeBot (AI analysis and contract security testing), and more.

1. Core Features

(1) ChainGPT Chatbot: A conversational AI assistant that solves blockchain technology and cryptocurrency problems through dialogue, such as codeless smart contract programming, debugging, market analysis, guidance, and trading. It is suitable for individuals, developers, and companies in the cryptocurrency market. It can be used on multiple platforms such as Telegram, Discord, and Web.

(2) AI News: Provides AI-driven news service that scans the internet every 60 minutes and automatically generates news articles in the field of blockchain and cryptocurrency. The service aims to provide users with the latest and accurate information about the industry's trends and developments.

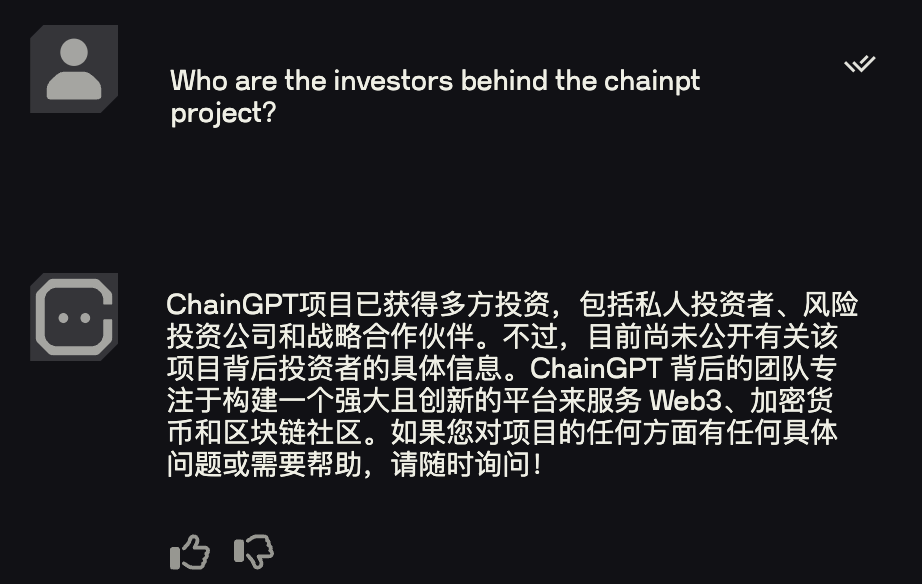

The ChainGPT team was established in 2022 and is composed of experienced developers, blockchain engineers, and artificial intelligence engineers. Ilan Rakhmanov, the CEO and founder of ChainGPT, is a renowned blockchain and artificial intelligence engineer, and Dr. Adnan Tariq, an award-winning blockchain and artificial intelligence engineer, leads the development team. The team is engaged in the planning and design of complex Al models, and showcases the research results of artificial intelligence to large tech companies and entrepreneurs. In 2022, the team created a chatbot based on chaingpt and published a research paper (*v1.0 white paper). On August 25, 2023, chaingpt announced that it had received $350,000 in funding from Google and support from Google Cloud resources, which will be used for the processing and enhancement of the ChainGPT AI model. ChainGPT claims to have received investment from multiple parties, including private investors, venture capital firms, and strategic partners. However, specific information about the investors behind the project has not yet been publicly disclosed.

Source: ChainGPT

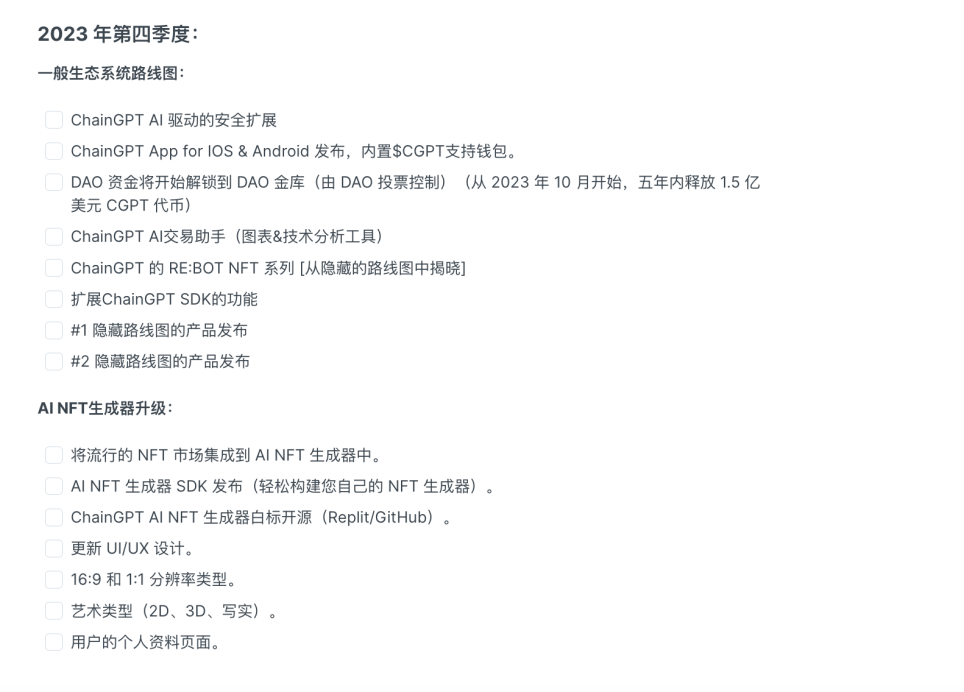

In the first three quarters of 2023,ChainGPT has released the Beta and official versions of ChainGPT chatbot,DevAssist browser extension,Stake & Farming DApp,ChainGPT News,ios and Android chatbot applications,Telegram/Discord/Slack Al Robots as well as the token CGPT.

In the fourth quarter of 2023, improvements will continue to be made to the artificial intelligence model and new features will be added. These include ChainGPT AI Trading Assistant,ChainGPT app versions for ios and Android with an embedded CGPT wallet, and upgrades to the AI NFT generator.

Source: ChainGPT Official

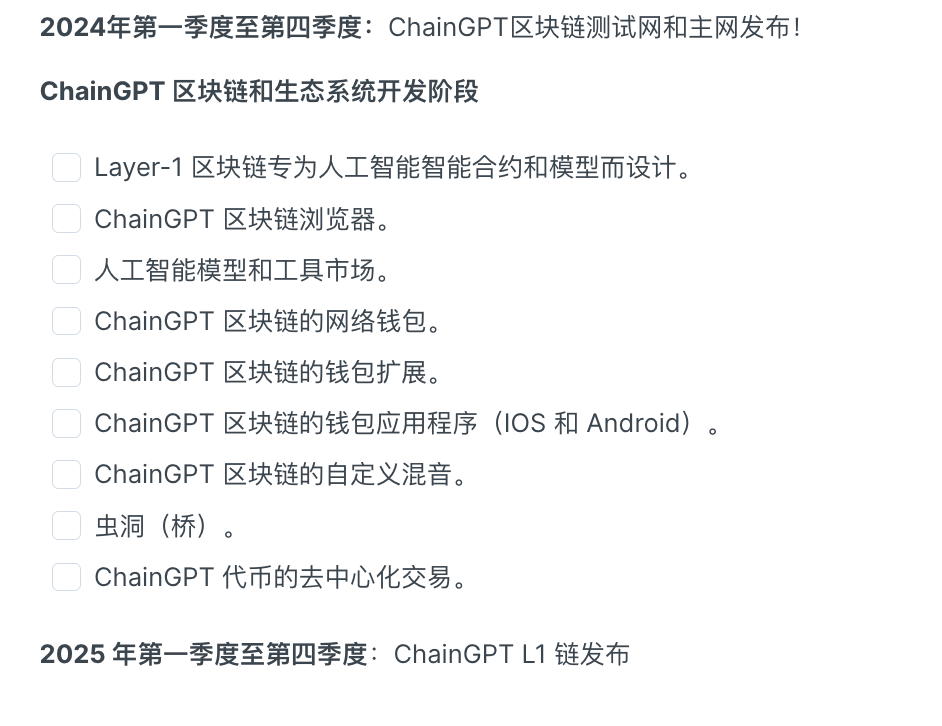

By 2024, the ChainGPT team will start focusing on building and launching the ChainGPT testnet and mainnet, creating a one-layer and two-layer network suitable for AI smart contracts and models.

Source: ChainGPT Official

3. Token Economics

The total supply of tokens CGPT is 1 billion, with the following allocation: private sale a-11.4%; private sale b-4.5%; public-9%; liquidity-20%; team-9%; development-4%; consulting-3%; dao-9%; reserve 9.85%; marketing-9%; kol-6.25%; liquidity mining-5%. The current real-time supply is 129,024,329 tokens, representing a token release ratio of 12.9% (*including LP).

CGPT tokens have four main use cases:

(1) Consumed and used in specific functionalities: accessing ChainGPT AI models, advanced artificial intelligence models designed specifically for the cryptocurrency and blockchain fields, providing users with assistance in contract writing, concept interpretation, answering questions, and market analysis, etc.

(2) Destruction Mechanism: cgpt has a burning mechanism, which automatically consumes half of the cost or income generated by ChainGPT tools and utilities. This reduces the overall supply of CGPT and increases its scarcity. Currently burned 1,294,904 (*about 0.12%).

(3) Staking: Staking allows token holders to lock their tokens and contribute to the security and stability of the network in exchange for rewards or certain benefits within the ecosystem. In the case of ChainGPT, staking allows token holders to access AI models and prioritize access to their services. They can also gain governance rights over Dao and upgrade their membership level in ChainGPT Pad (*Bronze, Silver, Gold, Diamond) to gain greater participation rights in Launchpad.

(4) Liquidity Provision: Token holders can earn rewards by providing liquidity to the ecosystem. In the case of ChainGPT, token holders can provide liquidity to the CGPT token on decentralized exchanges and receive rewards in CGPT tokens.

Currently, the CGPT market cap is $6.52 million and FDV is $50.54 million. The token price has gradually fallen to a new low level after a wave of increase in April this year, ATH bsp;Appears on 4.29 day for 0.297 USD, ATL appears on 9.3 day for 0.0492 USD.

4. Project Features

(1) ChainGPT combines bot with AI technology and provides many efficient tools: for example, users can solve blockchain technology and cryptocurrency problems specifically through ChainGPT chatbots; through the smart contract generator and auditor, users can generate and review the required smart contracts without much programming knowledge; and through the NFT AI generator, users can generate and deploy their NFTs on the blockchain within 30-60 seconds.

(2) ChainGPT has built a comprehensive product matrix, which, once successfully implemented, could form a closed loop and create competitive barriers. ChainGPT has developed many AI tools applicable to cryptocurrency and can form a closed loop. For example, developers can use ChainGPT for development and publish on ChainGPT Pad. Users can participate in initial offers by holding CGPT, conduct intelligent transactions using ChainGPT, browse news, and consult GPT for blockchain and cryptocurrency questions. ChainGPT is also developing an independent chain (Layer 1 and Layer 2), which, once successfully implemented, will have strong competitive barriers. However, the time and difficulty of implementation are also significant challenges.

5. Summary and Reflection

By dissecting various cutting-edge projects of crypto bots, it is found that crypto bots effectively address some pain points of cryptocurrency users, such as copy trading, sniper trading of new coins, automated airdrop interactions, AI-generated smart contracts or NFTs. Without relevant bots, individual users would find it difficult to gain technological advantages. With the rise in popularity of this round of unibot, both investors and users have paid attention to various types of bots, and new projects have emerged rapidly in a month or two, each with its own highlights. Driven by real demand, crypto bots will evolve into a completely new track.

Currently, the market value of the entire track is still relatively small, at about $200 million, leaving plenty of room for growth compared to other mature tracks. The long-term development factors rely on: product iteration to lower barriers and provide better interactive experiences, better asset security and decentralization, and more user accumulation.

In summary, projects that solve user pain points are bound to have long-term development. The token economics of current bots have also opened up new ideas for empowering funds and coin prices. Paying attention to new products and iterations will have the opportunity to capture the rise of a new round of market trends.